Mosquito Repellent Market By Product Type(Spray/Aerosol, Cream and Oil, Coils), By Ingredient Type(Chemically Derived, Citronella Oil, DEET, Picaridin, IR3535), By Distribution Channel(Retail Store, Hypermarket/Supermarket, Online Sales Channel), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4361

-

July 2023

-

150

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

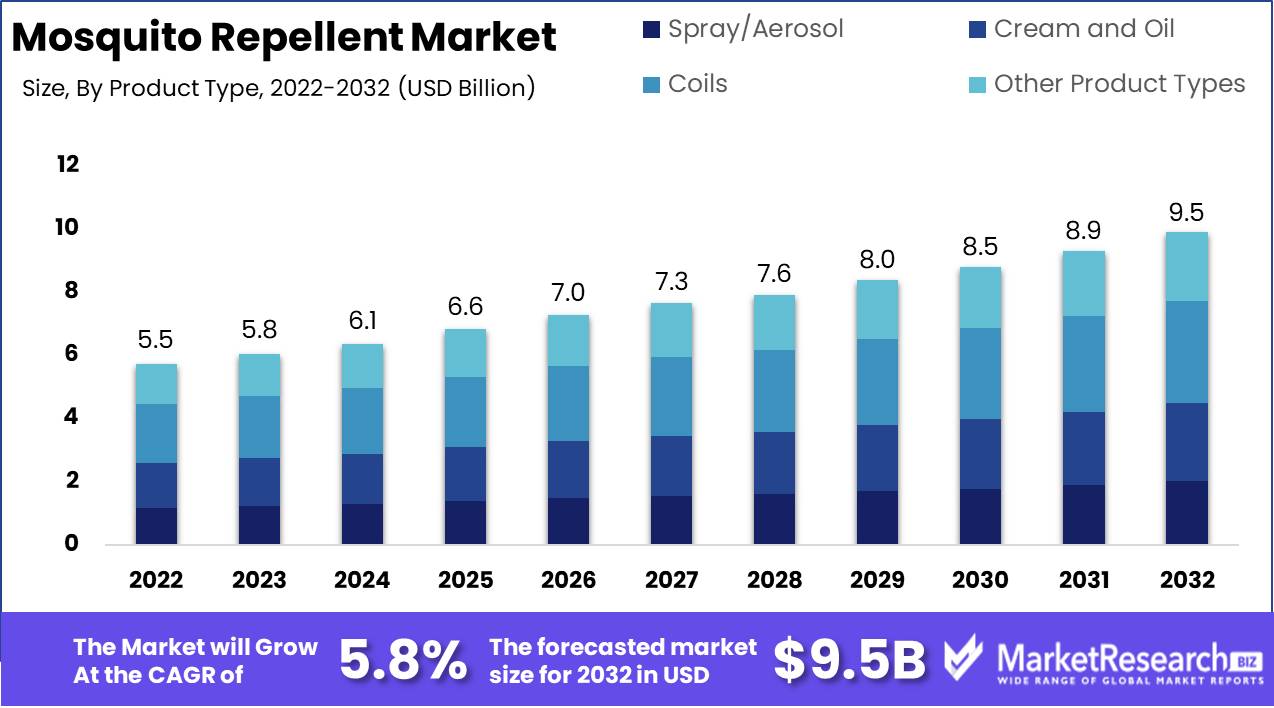

The Mosquito Repellent Market size is expected to be worth around USD 9.5 Bn by 2032 from USD 5.5 Bn in 2022, growing at a CAGR of 5.8% during the forecast period from 2023 to 2032.

The mosquito repellent market products is a highly nuanced and multifaceted industry that involves a plethora of technologies and products designed to combat mosquito-borne diseases. These diseases, including dengue fever, malaria, and Zika virus, are a significant cause of morbidity and mortality worldwide, with children and pregnant women being the most vulnerable.

The mosquito repellent market comprises a wide array of products that utilize diverse mechanisms to repel and eliminate mosquitoes. These products include sprays, creams, patches, and electronic devices that are used in households, commercial spaces, and government institutions for mosquito control. The growth of this market is primarily driven by a range of factors, including increasing urbanization, rising awareness about mosquito-borne diseases, and the need for safe and effective mosquito control solutions.

The use of mosquito repellent products is essential in preventing the spread of mosquito-borne diseases. Households use mosquito repellent sprays and creams to safeguard themselves and their families from mosquito bites. In contrast, mosquito repellent patches and bands are preferred by children who can wear them while playing outdoors. The commercial sector, including hotels, resorts, and hospitals, also employs mosquito repellent products to prevent mosquito-borne diseases.

The mosquito repellent market has undergone several notable innovations in recent years. For instance, mosquito repellent patches and bands have become increasingly popular due to their convenience and ease of use. These products contain natural ingredients such as citronella oil and have a long-lasting effect. Additionally, electronic mosquito repellent devices that emit ultrasonic sound waves to repel mosquitoes have also gained popularity. These devices are safe to use and do not emit harmful gases or chemicals.

The mosquito repellent market has attracted significant investments from various industries, including healthcare, consumer goods, and agriculture. Companies such as Reckitt Benckiser Group, SC Johnson, and Godrej Consumer Products have heavily invested in mosquito repellent products and have incorporated them into their product portfolios. Furthermore, companies have developed innovative technologies such as nanotechnology and natural formulations to enhance the efficacy of mosquito repellent products.

The global warming phenomenon has contributed to the growth of the mosquito repellent market, as rising temperatures increase mosquito breeding rates. Additionally, the increasing international tourism has elevated the need for mosquito control solutions in tourist destinations. The major drivers of this market include the need for safe and effective mosquito control solutions, increasing urbanization, and rising awareness about mosquito-borne diseases.

Driving factors

Increasing Prevalence of Diseases Spread by Mosquitoes

The escalating prevalence of mosquito-borne diseases such as dengue fever, malaria, and the Zika virus is one of the driving forces behind the thriving mosquito repellent markets. These diseases, which pose a substantial risk to public health, are particularly prevalent in regions with mild and humid climates. Consequently, the demand for mosquito repellents that deter mosquito attacks and reduce the risk of contracting these diseases has increased.

Expanding Urbanisation

The escalating rate of urbanization has led to a commensurate increase in the number of potential mosquito breeding grounds, such as stagnant water sources, which contribute to the spread of mosquito-borne diseases. As more people migrate to urban areas, the need for effective mosquito control measures to prevent the spread of these diseases increases. Consequently, the demand for mosquito repellent products has increased, particularly in densely populated urban areas.

Enhanced Understanding of Personal Health and Hygiene

As consumers become more health-conscious, they seek out more methods to protect themselves from mosquito-borne diseases. The growing awareness of personal health and hygiene has been crucial to the expansion of the mosquito repellent market. To ensure the well-being of themselves and their families, consumers are pursuing products that are secure, effective, and user-friendly and are prepared to make substantial investments in high-quality mosquito repellent products.

Boosting Discretionary Incomes

Individuals' rising disposable incomes have made mosquito repellent products more accessible to a broader market. This has increased the demand for high-quality mosquito repellent products, and more people can now afford to purchase them. This trend is particularly evident in emergent economies, where rising disposable incomes and a greater awareness of health and hygiene have led to an increase in demand for mosquito-repellent products.

Development of the Tourism Sector

The expansion of the tourism industry has contributed significantly to the demand for mosquito-repellent products. As more people travel to regions with dense mosquito populations, effective mosquito control measures are required to prevent the spread of mosquito-borne diseases. This has resulted in a growing demand for safe and effective mosquito repellent products of the highest quality, especially in tourist destinations.

Restraining Factors

Government regulations, Consumer consciousness, as well as More

There are a number of restraining factors in the mosquito repellent market that pose a threat to the development and success of the industry. These factors include government regulations on chemicals used in mosquito repellents, growing awareness about the harmful effects of specialty chemical-based repellents on human health, the availability of alternative natural and organic mosquito repellents, the low disposable income of consumers in developing countries, and competition from other insect repellent products like citronella candles and electronic mosquito traps.

Chemicals used in mosquito repellents are regulated by the government

The use of chemicals in mosquito repellents is becoming increasingly restricted by governments due to health and environmental concerns. Some nations have prohibited the use of certain chemicals in mosquito repellents, while others have imposed restrictions on the quantity of chemicals that can be used. Such regulations make it difficult for manufacturers to locate effective chemical constituents for their products, thereby affecting the repellents' quality and efficacy.

Raising Awareness of the Dangerous Effects of Chemical-Based Insect Repellents on Human Health

Some of the compounds used in mosquito repellents are detrimental to human health, according to studies. In extreme circumstances, some of these chemicals can lead to malignancy. As a result, consumers are becoming more cognizant of the potential dangers associated with the use of chemical-based repellents and are transitioning towards natural and organic alternatives.

Availability of Natural and Organic Alternative Mosquito Repellents

As consumer awareness of the detrimental effects of chemicals increases, the demand for natural and organic mosquito repellents rises. These mosquito repellents contain natural constituents such as citronella, lemon eucalyptus, and lavender. Although these repellents do not provide instantaneous relief or protection like chemical-based products, they are still a viable option for consumers who place a premium on safety and health.

Low Consumer Disposable Income in Developing Nations

In developing nations where mosquito-borne diseases pose a high risk, the majority of the population has a low disposable income. This means they are less likely to invest in costly mosquito repellents or alternative solutions such as mosquito nets. As a result, there is a substantial demand for inexpensive mosquito repellents, posing a challenge for manufacturers who must strike a balance between affordability, quality, and efficacy.

Covid-19 Impact on Mosquito Repellent Market

The COVID-19 pandemic has caused significant changes in consumer behaviour, including an increase in the demand for mosquito repellents. Multiple nations experienced lockdowns, resulting in fewer outdoor activities and less mosquito exposure. In addition, many individuals labored financially, resulting in a decline in discretionary income for non-essential items such as mosquito repellents.

Due to these factors, the global mosquito repellent markets experienced a decline in demand. However, the demand decline was not the only factor influencing the market.

Due to the COVID-19 pandemic, supply chains in several nations, including the insecticide and mosquito repellent industry, were disrupted. The problem was exacerbated by logistics and transportation restrictions, which made it difficult for businesses to acquire basic materials.

The insufficiency of basic materials, such as methyl parathion, deet, and allethrin, resulted in a decline in the manufacturing capacity of companies that produce mosquito repellents. To make up for the lack of basic materials, some manufacturers have turned to alternative solutions, such as plant-based mosquito repellents, in order to meet consumer demand.

Since the emergence of the COVID-19 pandemic, the mosquito repellent markets have witnessed a number of shifts. Companies on the market have adopted a variety of strategies to accommodate the new norm.

Others have expanded their offerings to include plant-based or DEET-free mosquito repellents. Some companies have focused on developing new, innovative mosquito repellent products that cater to consumer requirements, while others have expanded their offerings to include plant-based or DEET-free mosquito repellents. Several companies have increased their online presence and digital marketing strategies to enhance their market position.

In addition, businesses have begun investing in cutting-edge technologies to enhance the effectiveness of their production processes. This includes the use of automated machines to accelerate production and reduce labour costs. Companies can satisfy the demand for mosquito repellents even during the prime season by implementing these measures.

Product Type Analysis

Coil Segment dominates the mosquito repellent market. This is due to the widespread use of mosquito coils in many countries, particularly Asia, where mosquitoes pose a significant threat due to the potentially fatal diseases they transport, such as malaria and dengue fever. The traditional method of repelling mosquitoes, the use of mosquito coils, has acquired popularity due to its affordability and simplicity of use.

The adoption of the Coil Segment is driven by economic growth in emerging markets. As these economies expand, there is a growing demand for affordable and effective mosquito repellents. This requirement is flawlessly met by the Coil Segment, which is inexpensive and readily available.

Due to their simplicity of use, portability, and affordability, consumers favour mosquito coils as their preferable mosquito repellent. Due to their long-lasting effectiveness, which allows users to remain protected from mosquito attacks throughout the night, mosquito coils are also preferred over other types of repellents.

Ingredient Type Analysis

The mosquito repellent market is dominated by the Chemically Derived Repellents segment. This segment consists of synthetic chemical-based products, such as DEET, picaridin, and IR3535. The effectiveness of these compounds in repelling mosquitoes and other biting insects has been demonstrated.

Economic development in emerging economies is driving the adoption of the Chemically Derived Repellents Segment. As these economies expand, so does the demand for long-lasting mosquito repellents that are effective. This has led to the popularity of repellents derived from chemicals, which are highly effective and inexpensive.

Consumers who seek highly effective, long-lasting mosquito repellents prefer the Chemically Derived Repellents segment. These items are also popular due to their affordability and usability. In addition, consumers are increasingly concerned about the hazards posed by mosquito-borne diseases such as malaria and dengue fever, which has led to an increase in demand for repellents derived from chemicals.

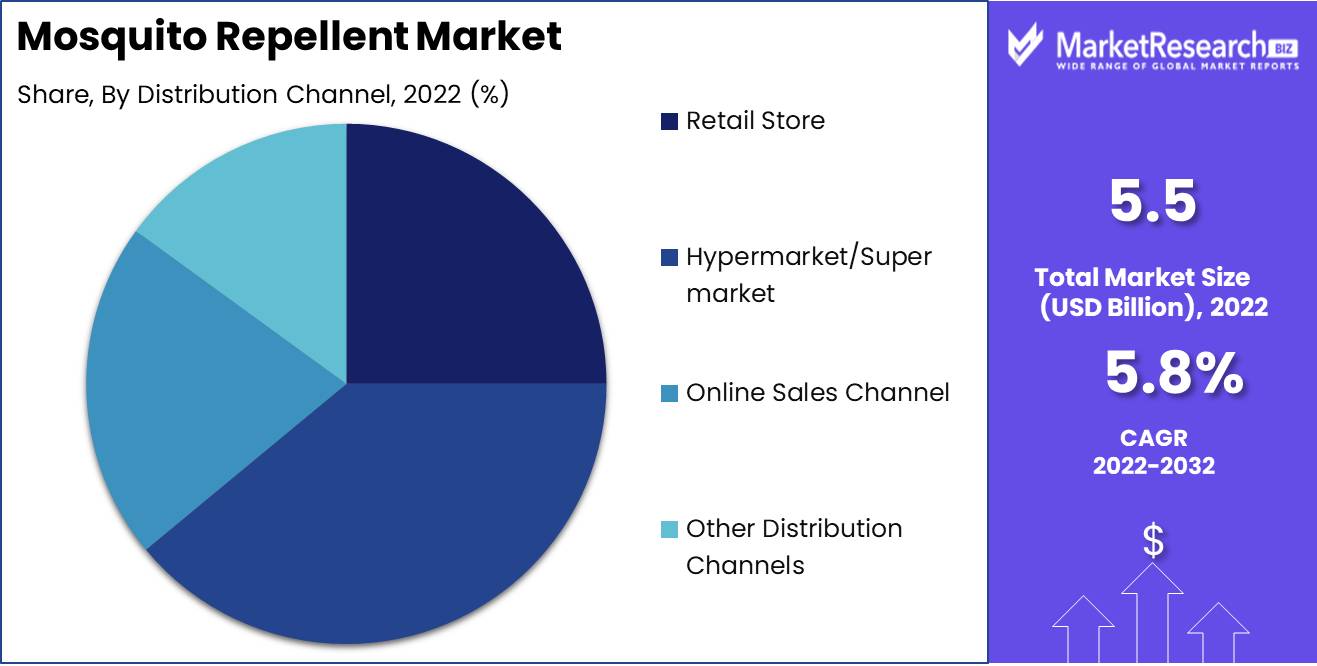

Distribution Channels Analysis

The mosquito repellent market is dominated by the Hypermarket/Supermarket Segment. Customers can choose from a wide range of mosquito repellents on the market, including coils, mists, lotions, and cosmetics. Because they are readily accessible and offer a variety of products at reasonable prices, supermarkets are the most expedient distribution channel for customers seeking to purchase mosquito repellents.

The adoption of the Supermarkets Segment is driven by economic growth in developing nations. As these economies expand, supermarkets become more prevalent and accessible, making them the most expedient place for consumers to buy mosquito repellents.

Consumers prefer purchasing mosquito repellents from supermarkets due to the availability of convenience and variety. Moreover, supermarkets enable consumers to readily compare prices and products, enabling them to make informed purchasing decisions.

In the coming years, the Supermarkets Segment in the Mosquito Repellent Market is anticipated to experience the highest growth rate. This growth is a result of the convenience and affordability offered by supermarkets in emerging economies, which are becoming more accessible. As supermarkets continue to proliferate, they will remain the dominant mosquito repellent distribution channel.

Key Market Segments

By Product Type

- Spray/Aerosol

- Cream and Oil

- Coils

- Other Product Types

By Ingredient Type

- Chemically Derived

- Citronella Oil

- DEET

- Picaridin

- IR3535

- Other Ingredient Type

By Distribution Channel

- Retail Store

- Hypermarket/Supermarket

- Online Sales Channel

- Other Distribution Channels

Growth Opportunity

Increasing Product Offering

One of the most effective ways for businesses to enter into the expanding mosquito repellent market is by diversifying their product offerings. When it comes to mosquito repellents, there is no paucity of product categories, including mists, lotions, coils, mats, and electronic repellent devices. By providing a variety of products, businesses are able to target diverse consumer segments and satisfy their specific requirements. Additionally, offering eco-friendly and child-friendly products can be a market advantage and point of differentiation.

Geographical Growth

Geographic expansion is a significant opportunity for businesses to enter the mosquito repellent market. The increasing prevalence of mosquito-borne diseases has increased the demand for mosquito repellents. Consequently, businesses can expand their presence in emerging markets and countries where mosquito-borne diseases are prevalent. In addition, resorts and vacation destinations present a substantial market opportunity for mosquito repellents.

Online Sales Channels

The proliferation of e-commerce platforms and digital marketing has made online sales channels a highly profitable business opportunity. By leveraging e-commerce platforms and employing digital marketing strategies, businesses are able to reach a larger consumer base, maintain a competitive advantage, and increase customer engagement. Before commencing online sales and marketing strategies, businesses should consider optimizing their websites for search engines and social media marketing to increase traffic and visibility.

Alliances and Collaborations

In order to reach potential consumers in the mosquito repellent market, partnerships and collaborations are crucial. Companies can form strategic alliances with hospitals, government agencies, tourism boards, and similar entities to obtain valuable insights, leverage their expertise, and expand their reach within specific market segments. Collaboration with third-party suppliers, retailers, or distributors can also result in increased sales and market penetration.

Research and development (R&D) investment

Research and development (R&D) investments can be a game-changer for businesses seeking to distinguish themselves from the competition. The emphasis of research and development in the mosquito repellent market is on developing innovative and effective products with enhanced formulations and safer constituents, as well as addressing consumer concerns about the environmental impact of mosquito repellents.

Latest Trends

Climate Alteration and Rising Temperatures

As global temperatures continue to rise, it is crucial to recognize that mosquitoes' adaptability increases proportionally. The global threat posed by mosquito-borne diseases continues to increase, and increasing temperatures only exacerbate the situation. As a consequence, there is an increasing demand for mosquito repellents that provide long-lasting protection against these parasites.

Demand for Natural and Organic Products Is Growing

A heightened interest in natural and organic solutions has resulted from an increased awareness of the detrimental effects of synthetic compounds used in mosquito repellents. This trend reflects the growing preference of consumers for health-conscious products that offer eco-friendly and sustainable pest control solutions. In response to this trend, market leaders in mosquito repellents have incorporated natural constituents such as citronella, eucalyptus, and lemongrass into their repellent formulations.

Insufficient Public Health Campaigns

A lack of education and awareness about mosquito-borne diseases is the consequence of ineffective public health campaigns. As a result, the demand for mosquito repellents is increasing, as consumers place a greater emphasis on personal protection against mosquito-borne diseases. The expansion of the Internet of Things presents opportunities for businesses to develop innovative solutions, such as app-controlled mosquito repellents, that inform and educate consumers about the perils of mosquito-borne diseases and offer effective protection.

Increase in International Commerce and Trade

Increased international trade and commerce are advantageous to the global mosquito repellent market. The rise in tourism and international travel from regions with a high risk of mosquito-borne diseases is contributing to the increase in demand for effective mosquito repellents. Manufacturers are working to provide innovative travel solutions, such as portable and long-lasting repellent formulations packaged in travel-friendly containers.

Invention and Technological Progress

The mosquito repellent market is propelled by formulation innovations and technological advancements. Manufacturers continue to develop new and enhanced products to meet consumers' expanding demands for efficiency, safety, and sustainability. Companies have developed repellent bands and patches that provide long-lasting protection and are simple to use for outdoor activities like hiking, camping, and picnicking.

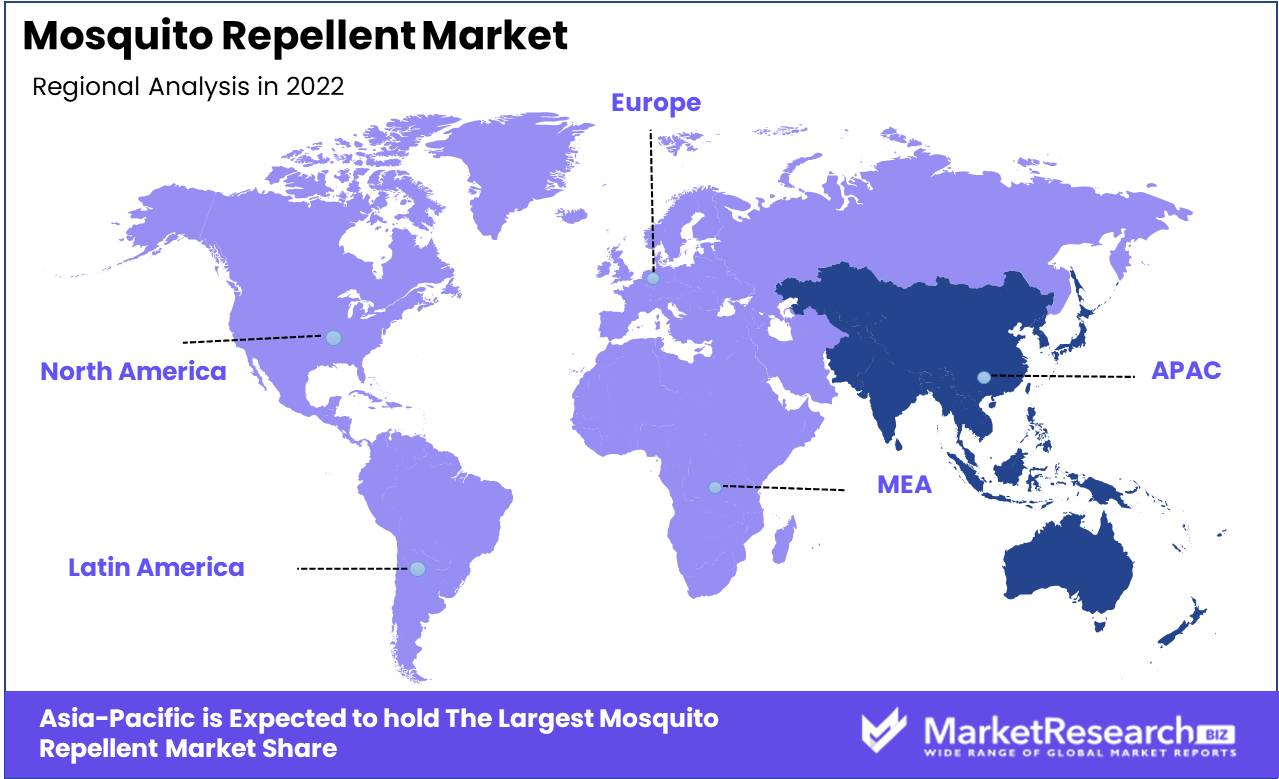

Regional Analysis

Asia-Pacific is the fastest-growing market segment for mosquito repellents.

Asia-Pacific is home to a large rural population where diseases transmitted by mosquitoes are prevalent. Consequently, this region has a high demand for mosquito repellents. Climate, geography, and lifestyle also contribute to the prevalence of mosquitoes in the Asia-Pacific region.

This region's awareness of diseases transmitted by mosquitoes has increased significantly in recent years. As a preventative measure, the rise of diseases such as Zika, Dengue, and Chikungunya has increased the demand for mosquito repellents. Governments throughout this region have also promoted the use of mosquito repellents to prevent the spread of these diseases.

Asia-Pacific manufacturers have responded swiftly to the increasing demand for mosquito repellents. Numerous companies have introduced mosquito repellents containing natural and technologically advanced compounds that are effective and safe to use. Moreover, manufacturers have introduced products designed specifically for various age groups to meet the diverse requirements of consumers.

The development of e-commerce platforms and online retailing has made mosquito repellents more accessible to consumers. In Asia Pacific, consumers are more likely to purchase mosquito repellents online due to the convenience of online purchasing. In addition, as a result of the COVID-19 pandemic compelling more consumers to remain indoors, the online sale of mosquito repellents has increased significantly.

In Asia-Pacific, environmental protection and sustainability initiatives have acquired momentum. When purchasing mosquito repellents, many consumers in this region seek environmentally friendly options. As a result, manufacturers have developed products with natural and eco-friendly ingredients and packaging.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Share & Key Players Analysis

SC Johnson is a market leader in mosquito repellents, with a product portfolio that includes OFF!, Raid, and Baygon. Its products, which include perfumes, moisturizers, and candles, are distributed in over 110 countries worldwide.

Reckitt Benckiser is a multinational corporation that manufactures a vast array of consumer products. It carries the mosquito repellent brands Mortein, Autan, and Soffell. These products are marketed in over sixty countries and provide protection from various mosquito species.

Spectrum Brands is a diversified manufacturer of consumer goods that offers high-quality mosquito repellents under the Cutter and Repel labels. Its products, which are sold in the United States and Canada, include perfumes, moisturizers, and bracelets.

Godrej is a market leader in India's mosquito repellent industry, with an extensive product line that includes Good Knight, Hit, and Jet. Its products provide protection against various varieties of mosquitoes and are distributed throughout India.

3M is a multinational corporation that manufactures a vast array of products, including mosquito repellents. Ultrathon, the company's trademark, provides long-lasting protection from mosquitoes, fleas, and other irritating insects. It sells its products in both the United States and Canada.

Top Key Players in Mosquito Repellent Market

- Reckitt Benckiser Group Plc

- Avon Products Inc.

- S. C. Johnson & Son Inc

- Energizer Holdings Inc. (Spectrum Brands Holdings Inc.)

- Godrej Consumer Products Ltd

- Dabur

- Jyothy Laboratories Ltd.

- Coghlan’s Ltd

- Plascore Inc.

- Enesis Group

- Sawyer Products Inc.

Recent Development

In September 2020, PelGar International, a UK-based company specialising in pest control products, introduced Cimetrol Super RFU, a new water-based aerosol designed to repel winged and crawling insects. The product is a combination of synthetic and natural pyrethroids and is administered as an aerosol. It is possible to apply Cimetrol Super RFU to firm surfaces, fissures, crevices, and even mattresses, which distinguishes it from other mosquito repellents.

In January 2020, the Brazilian multinational cosmetics company Natura &Co acquired Avon Products Inc. to form the fourth-largest beauty company in the globe. Combining brands such as Avon, Natura, The Body Shop, and Aesop, the acquisition enables Natura &Co to increase its global market presence.

The purpose of the acquisition is to bolster Natura &Co's position in the consumer market and expand its market share. With Avon's expansive distribution network and large customer base, Natura &Co is poised to become a significant beauty industry participant.

In August 2019 Henkel AG & Co. KGaA, a market leader in insect repellents, invested USD 130 million in its production facility to increase output. In addition to establishing a new bottling station for its products, the company intends to expand its product offering.

Report Scope:

Report Features Description Market Value (2022) USD 5.5 Bn Forecast Revenue (2032) USD 9.5 Bn CAGR (2023-2032) 5.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Spray/Aerosol, Cream and Oil, Coils), By Ingredient Type(Chemically Derived, Citronella Oil, DEET, Picaridin, IR3535), By Distribution Channel(Retail Store, Hypermarket/Supermarket, Online Sales Channel) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Reckitt Benckiser Group Plc, Avon Products Inc., S. C. Johnson & Son Inc, Energizer Holdings Inc. (Spectrum Brands Holdings Inc.), Godrej Consumer Products Ltd, Dabur, Jyothy Laboratories Ltd., Coghlan’s Ltd, Plascore Inc., Enesis Group, Sawyer Products Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Reckitt Benckiser Group Plc

- Avon Products Inc.

- S. C. Johnson & Son Inc

- Energizer Holdings Inc. (Spectrum Brands Holdings Inc.)

- Godrej Consumer Products Ltd

- Dabur

- Jyothy Laboratories Ltd.

- Coghlan’s Ltd

- Plascore Inc.

- Enesis Group

- Sawyer Products Inc.