More Electric Aircraft Market Report By Aircraft Type (Fixed-wing Aircraft, Rotary-wing Aircraft), By System Type (Power Generation, Power Distribution, Power Conversion), By Component Type (Electric Actuators, Electric Motors, Electric Power Systems, Energy Storage Devices [Batteries, Supercapacitors], Power Electronics, Others), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48991

-

July 2024

-

325

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

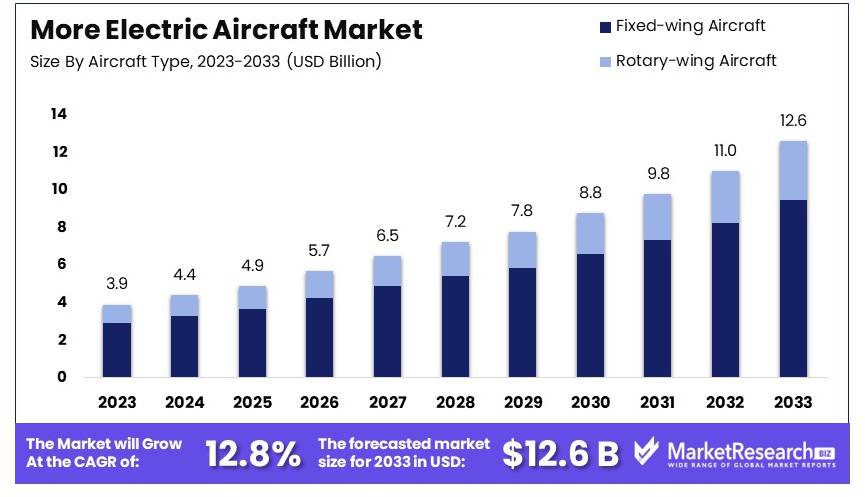

The Global More Electric Aircraft Market size is expected to be worth around USD 12.6 Billion by 2033, from USD 3.9 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033.

The More Electric Aircraft (MEA) market focuses on aircraft that use electrical power for various systems traditionally driven by mechanical, hydraulic, or pneumatic means. This shift aims to enhance efficiency, reduce weight, and minimize environmental impact. MEA systems include electrical actuation, environmental control, power generation, and distribution.

Advancements in battery technology, power electronics, and electric motors drive market growth. Regulatory bodies are also pushing for greener aviation solutions, further propelling the MEA market. Major players in the aerospace industry are investing in MEA technologies to meet future sustainability goals and improve operational efficiency.

The More Electric Aircraft (MEA) market is poised for significant growth, driven by advances in electric power generation and increased emphasis on sustainability in aviation. The shift towards more electric systems in aircraft is a response to the rising demand for efficient, environmentally friendly alternatives to traditional aircraft designs. This trend aligns with the broader increase in global power generation, which rose by 2.3% in 2022, maintaining a consistent growth trajectory observed over the past decade.

The expansion of the MEA market can be attributed to several key factors. Notably, the aviation industry's commitment to reducing carbon emissions and improving fuel efficiency is a primary driver. The adoption of electric systems reduces dependency on hydraulic and pneumatic systems, leading to lighter, more efficient aircraft. This transition supports the industry's sustainability goals and enhances operational efficiency.

Regional growth patterns in power generation further underscore the potential for the MEA market. In 2022, China experienced a 3.7% increase in power generation, while India saw a remarkable 9.7% rise. The United States also contributed with a 3.2% increase, alongside Indonesia and Saudi Arabia, which reported growth rates of 7.9% and 5.9%, respectively. These regions are pivotal in the global aviation market, and their robust growth in power generation capacity supports the infrastructure necessary for the widespread adoption of MEA technologies.

The More Electric Aircraft market is on a growth trajectory, bolstered by advancements in electric power generation and regional economic expansions. The industry's shift towards electric systems is not only a response to environmental imperatives but also a strategic move to enhance efficiency and sustainability in aviation operations.

Key Takeaways

- Market Value: The More Electric Aircraft Market was valued at USD 3.9 billion in 2023, and is expected to reach USD 12.6 billion by 2033, with a CAGR of 12.8%.

- Aircraft Type Analysis: Fixed-wing Aircraft with 75%; Significant due to their dominant use in commercial and military aviation.

- System Type Analysis: Power Generation held 40%; Crucial for enhancing fuel efficiency and reducing emissions.

- Component Type Analysis: Electric Actuators dominating with 35%; Vital for improving aircraft performance and reducing maintenance costs.

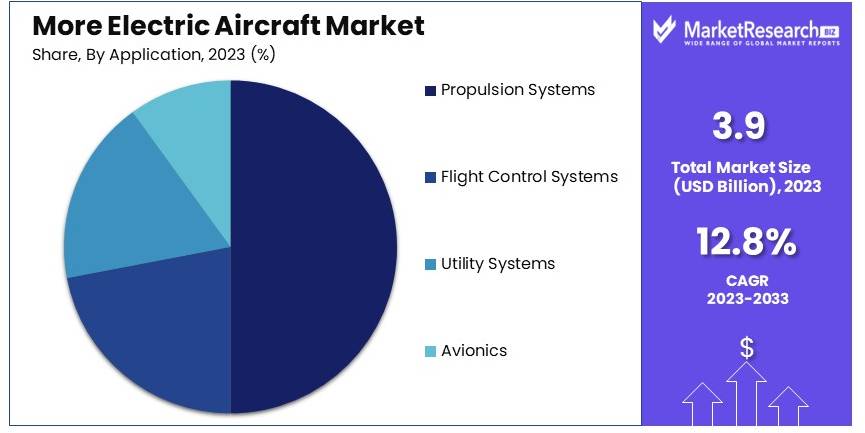

- Application Analysis: Propulsion Systems with 50%; Essential for the development of more efficient and environmentally friendly aircraft.

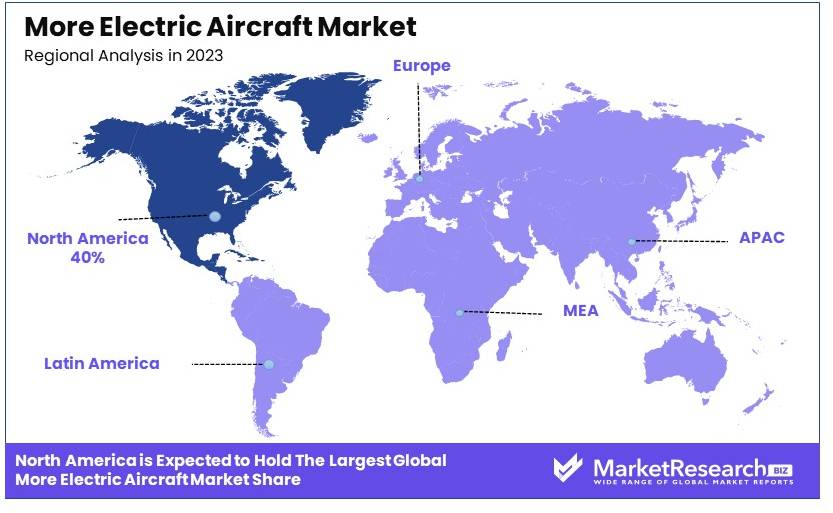

- Dominant Region: North America ~40%; Leading in technological advancements and adoption of electric aircraft.

- High Growth Region: Asia Pacific ~35%; Rapidly growing aviation market with increasing investments in electric aircraft.

- Analyst Viewpoint: The market shows strong growth potential driven by environmental regulations and technological advancements, with high competition among key players.

- Growth Opportunities: Key players can leverage advancements in battery technology and partnerships with aviation companies to stand out.

Driving Factors

Increasing Demand for Fuel-Efficient and Environmentally Friendly Aircraft Drives Market Growth

The aviation industry is under immense pressure to reduce its carbon footprint and comply with stringent emission regulations. More electric aircraft (MEA) offer a solution by leveraging electric power for various systems, resulting in improved fuel efficiency and lower emissions. For example, the Boeing 787 Dreamliner incorporates more electric systems, leading to significant fuel savings and reduced environmental impact.

By replacing traditional hydraulic and pneumatic systems with electric alternatives, the Boeing 787 has achieved a 20% improvement in fuel efficiency compared to older aircraft models. This shift not only meets regulatory requirements but also aligns with the growing demand for sustainable aviation solutions from both consumers and governments. Additionally, the push for greener aviation is supported by global initiatives such as the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which further accelerates the adoption of MEA. The combination of regulatory pressure, consumer demand, and technological advancements in electric systems significantly contributes to the growth of the More Electric Aircraft Market.

Advancements in Electrical Power Generation and Distribution Systems Drive Market Growth

Technological advancements in electrical power generation and distribution systems have enabled the integration of more electric systems in aircraft. The development of high-power density generators, advanced power electronics, and efficient power distribution architectures have made MEA designs more feasible and reliable. Companies like Honeywell and Safran are actively developing innovative electrical power solutions for the aerospace industry. For instance, Honeywell's new generation of high-power density generators offers improved efficiency and power output, crucial for supporting the electrical demands of modern aircraft systems.

These advancements reduce the reliance on traditional mechanical systems, enhancing the overall efficiency and reliability of aircraft operations. Furthermore, the continuous improvements in power electronics, such as wide-bandgap semiconductors, allow for more efficient power conversion and distribution, leading to lighter and more compact system designs. This technological progress not only enhances the performance of MEA but also reduces operational costs and improves the overall sustainability of aircraft, thus driving market growth.

Improved Aircraft Performance and Reduced Maintenance Costs Drive Market Growth

MEA designs offer improved aircraft performance by eliminating mechanical components and reducing overall weight. Electric systems are often more reliable and require less maintenance compared to their hydraulic and pneumatic counterparts. This translates into lower operating costs for airlines and increased aircraft availability. For instance, the Airbus A350 XWB incorporates an advanced electrical architecture, leading to reduced maintenance requirements and improved dispatch reliability.

The reduction in mechanical components not only decreases the aircraft's weight, enhancing fuel efficiency, but also minimizes the likelihood of mechanical failures, thereby improving safety and reliability. Airlines benefit from the reduced need for maintenance, which lowers operating costs and increases the availability of aircraft for flights, enhancing profitability. The shift towards MEA is supported by the industry's focus on improving operational efficiency and reducing lifecycle costs. This trend, combined with the continuous advancements in electrical systems, significantly contributes to the growth of the More Electric Aircraft Market by providing a compelling value proposition for airlines and aircraft manufacturers alike.

Restraining Factors

High Initial Investment and Certification Costs Restrain Market Growth

Transitioning to More Electric Aircraft (MEA) designs requires significant upfront investments in research, development, and certification processes. The aerospace industry has stringent safety standards, and obtaining certifications for new electrical systems can be lengthy and costly. For example, certifying a new electrical system can cost millions of dollars and take several years. This financial burden is particularly challenging for smaller aircraft manufacturers, who may lack the resources to invest in such extensive development and certification processes.

The high initial costs can deter companies from adopting MEA technology, limiting market growth. Additionally, the need for specialized testing facilities and expertise further escalates expenses, making it difficult for many manufacturers to justify the transition. These high costs and lengthy processes slow down the overall adoption rate of MEA, posing a significant barrier to market expansion.

Concerns Over Power Density and Weight Limitations Restrain Market Growth

While electrical systems offer advantages, they also face challenges related to power density and weight limitations. Achieving the required power levels while maintaining weight constraints is a significant hurdle, especially for larger aircraft. For instance, developing high-density energy storage solutions that are lightweight yet powerful enough for aircraft applications remains a complex and costly endeavor.

This challenge often necessitates the use of advanced lightweight materials, which can further increase costs. These technological constraints can slow down the development and adoption of MEA, as manufacturers strive to balance performance, weight, and cost. The need for continuous innovation in materials and energy storage solutions adds to the complexity and expense, making it difficult for the industry to scale MEA technologies quickly. Consequently, these power density and weight limitations present substantial obstacles to the widespread adoption and growth of the More Electric Aircraft Market.

Aircraft Type Analysis

Fixed-wing Aircraft dominates with 75% due to its widespread use in commercial aviation and advanced technological integration.

The Fixed-wing Aircraft segment is the dominant sub-segment in the More Electric Aircraft Market, accounting for approximately 75% of the market share. This dominance is primarily due to the widespread use of fixed-wing aircraft in commercial aviation. Fixed-wing aircraft, such as commercial jets and cargo planes, are the backbone of the global aviation industry. These aircraft benefit significantly from the integration of more electric systems, which enhance fuel efficiency, reduce emissions, and lower operating costs. For instance, the Boeing 787 Dreamliner and Airbus A350 are prime examples of fixed-wing aircraft that have adopted more electric technologies, leading to significant improvements in performance and sustainability.

The commercial aviation sector's continuous growth fuels the demand for fixed-wing aircraft. The International Air Transport Association (IATA) predicts that the global passenger numbers will reach 8.2 billion by 2037, driving the need for more efficient and environmentally friendly aircraft. Additionally, the increasing focus on reducing carbon emissions and adhering to stringent environmental regulations further boosts the adoption of more electric systems in fixed-wing aircraft.

In contrast, the Rotary-wing Aircraft segment, which includes helicopters and other vertical take-off and landing (VTOL) aircraft, represents a smaller portion of the market. Although rotary-wing aircraft also benefit from more electric technologies, their adoption is slower due to the unique challenges they face, such as power density and weight limitations. However, advancements in electric propulsion and energy storage technologies are gradually enhancing the feasibility of more electric systems in rotary-wing aircraft, contributing to their incremental growth.

System Type Analysis

Power Generation dominates with 40% due to its crucial role in enabling more electric systems in aircraft.

The Power Generation segment is the leading sub-segment within the System Type category, accounting for 40% of the market. This dominance is attributed to the critical role of power generation systems in enabling more aircraft electric systems. High-power density generators and advanced power electronics are essential for producing and managing the electrical power required by modern aircraft systems. Companies like Honeywell and Safran are at the forefront of developing innovative power generation solutions that improve efficiency and reliability.

Power generation systems are pivotal in supporting various aircraft functions, from propulsion to utility systems. The shift towards more electric systems reduces reliance on traditional mechanical and hydraulic systems, enhancing overall aircraft efficiency. The continuous development of high-power density generators and advanced electrical architectures supports the growth of this segment.

Other segments, such as Power Distribution and Power Conversion, also play significant roles in the more electric aircraft ecosystem. Power distribution systems ensure efficient and reliable delivery of electrical power throughout the aircraft, while power conversion systems adapt the generated power to suit different electrical loads. These segments contribute to the overall efficiency and reliability of more electric aircraft, supporting the broader market growth.

Component Type Analysis

Electric Actuators dominate with 35% due to their efficiency and reliability in replacing hydraulic systems.

Electric Actuators are the dominant sub-segment within the Component Type category, representing 35% of the market. These components replace traditional hydraulic actuators, offering improved efficiency, reliability, and reduced maintenance requirements. Electric actuators are used in various aircraft systems, including flight control, landing gear, and utility systems. Their adoption is driven by the need to reduce weight, enhance fuel efficiency, and improve overall aircraft performance.

The use of electric actuators in modern aircraft like the Airbus A350 XWB highlights their importance in more electric aircraft designs. These actuators contribute to reduced maintenance costs and increased aircraft availability, making them a preferred choice for manufacturers and operators.

Other components, such as Electric Motors, Electric Power Systems, Energy Storage Devices (Batteries, Supercapacitors), and Power Electronics, also play crucial roles in the more electric aircraft ecosystem. These components are essential for generating, storing, and managing electrical power, ensuring the efficient operation of various aircraft systems. The continuous advancements in these technologies support the overall growth and adoption of more electric aircraft.

Application Analysis

Propulsion Systems dominate with 50% due to their critical impact on fuel efficiency and emissions reduction.

Propulsion Systems are the dominant sub-segment within the Application category, accounting for 50% of the market. The integration of more electric propulsion systems is crucial for improving fuel efficiency and reducing emissions. Electric propulsion systems offer significant advantages over traditional aircraft engines, including lower fuel consumption, reduced environmental impact, and enhanced performance. The development of hybrid-electric and fully electric propulsion systems by companies like Rolls-Royce and Siemens underscores the importance of this segment.

The focus on sustainable aviation and the need to comply with stringent emission regulations drive the adoption of more electric propulsion systems. These systems are expected to play a pivotal role in the future of aviation, supporting the industry's goal of achieving carbon-neutral growth.

Other applications, such as Flight Control Systems, Utility Systems (Hydraulic and Pneumatic Replacement), and Avionics, also contribute to the growth of the more electric aircraft market. Flight control systems benefit from the integration of electric actuators and advanced power electronics, enhancing performance and reliability. Utility systems, such as hydraulic and pneumatic replacements, reduce weight and maintenance requirements, further improving aircraft efficiency. Avionics systems, which manage and monitor various aircraft functions, also benefit from the increased reliability and efficiency of more electric systems. Together, these applications drive the overall growth and adoption of more electric aircraft.

Key Market Segments

By Aircraft Type

- Fixed-wing Aircraft

- Rotary-wing Aircraft

By System Type

- Power Generation

- Power Distribution

- Power Conversion

By Component Type

- Electric Actuators

- Electric Motors

- Electric Power Systems

- Energy Storage Devices (Batteries, Supercapacitors)

- Power Electronics

- Others

By Application

- Propulsion Systems

- Flight Control Systems

- Utility Systems (Hydraulic and Pneumatic Replacement)

- Avionics

Growth Opportunities

Development of Hybrid-Electric and Fully Electric Aircraft Offers Growth Opportunity

The growing interest in hybrid-electric and fully electric aircraft presents a significant growth opportunity for the More Electric Aircraft (MEA) market. These aircraft rely heavily on electrical systems for propulsion and auxiliary functions, driving the demand for advanced electrical power generation, distribution, and management systems. Companies like Zunum Aero and Eviation are pioneering efforts in developing hybrid and fully electric aircraft.

For example, Eviation's Alice, a fully electric commuter aircraft, demonstrates the potential for substantial reductions in operating costs and emissions. As the aviation industry seeks to reduce its environmental impact, the adoption of hybrid and fully electric aircraft is expected to increase. This shift not only supports sustainability goals but also drives technological advancements in the MEA market, providing new opportunities for growth and innovation.

Emergence of Urban Air Mobility and Unmanned Aerial Vehicles Offers Growth Opportunity

The urban air mobility (UAM) market, which includes electric vertical take-off and landing (eVTOL) aircraft and unmanned aerial vehicles (UAVs), is gaining traction. These aircraft are designed with a high degree of electrification, creating a demand for lightweight, efficient, and reliable electrical systems. Companies like Joby Aviation and Archer Aviation are at the forefront of developing eVTOL aircraft for urban air mobility applications.

The UAM market is projected to reach USD 1.5 trillion by 2040, driven by the need for efficient and sustainable urban transportation solutions. The increasing focus on reducing urban congestion and lowering emissions further propels the growth of this segment. The development of eVTOL and UAV technologies not only enhances the MEA market but also introduces new applications and services, expanding the market's potential.

Trending Factors

Increasing Focus on Sustainability and Decarbonization in the Aviation Industry Are Trending Factors

The aviation industry is under mounting pressure to reduce its carbon footprint and embrace sustainable practices. More electric aircraft, along with the development of alternative propulsion systems like hydrogen fuel cells and electric batteries, are seen as key enablers for achieving decarbonization goals.

Regulatory bodies and industry initiatives are driving the adoption of more environmentally friendly technologies, creating opportunities for MEA solutions. The International Air Transport Association (IATA) aims for net-zero carbon emissions by 2050, pushing the industry towards sustainable innovations. This increasing focus on sustainability drives the demand for more electric aircraft and related technologies, making it a significant trending factor in the market.

Advancements in Energy Storage and Distribution Technologies Are Trending Factors

Ongoing research and development in energy storage technologies, such as lithium-ion batteries and supercapacitors, are enabling more efficient and lightweight electrical systems for aircraft. Additionally, advancements in power distribution and management systems are improving the reliability and performance of MEA designs.

Companies like EnerDel and Saft are leading players in developing advanced energy storage solutions for the aerospace industry. For instance, lithium-ion battery technology has seen significant improvements in energy density and cycle life, making it a viable option for aircraft applications. These advancements enhance the feasibility and attractiveness of more electric aircraft, driving market growth and positioning energy storage and distribution technologies as key trending factors.

Regional Analysis

North America Dominates with 40% Market Share

North America leads the More Electric Aircraft (MEA) market, accounting for 40% of the market share. This dominance is driven by significant investments in aerospace technology and the presence of major aircraft manufacturers like Boeing and Lockheed Martin. The region's advanced infrastructure for research and development and strong government support for green aviation initiatives further propel market growth.

North America's robust aerospace industry, coupled with stringent environmental regulations, accelerates the adoption of MEA technologies. The region's focus on reducing carbon emissions and improving fuel efficiency aligns with the global push for sustainable aviation, fostering innovation and development in the MEA sector.

North America's market presence is expected to grow, supported by continuous advancements in electric aircraft technologies and increasing investments in sustainable aviation solutions. The region's leadership in aerospace innovation will likely maintain its dominant position, driving further growth and technological progress in the MEA market.

Regional Market Shares and Growth Rates

Europe: Europe holds a 30% market share, driven by strong environmental regulations and significant investments in green aviation technologies. The presence of leading aircraft manufacturers like Airbus and a robust R&D infrastructure support market growth.

Asia Pacific: Asia Pacific accounts for 20% of the market, with rapid growth expected due to increasing demand for air travel and substantial investments in aerospace innovation. Countries like China and Japan are key players in adopting and developing MEA technologies.

Middle East & Africa: This region holds a 5% market share, with growth driven by investments in aviation infrastructure and the adoption of sustainable aviation practices. The focus on modernizing air fleets and expanding aviation capabilities supports MEA market development.

Latin America: Latin America represents 5% of the market, with potential growth fueled by increasing air traffic and efforts to modernize the aviation sector. Investments in sustainable aviation technologies are expected to drive future market expansion in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The More Electric Aircraft (MEA) market is driven by key players such as Airbus SE, The Boeing Company, Rolls-Royce Holdings plc, and others. These companies leverage advanced technologies to enhance aircraft efficiency, reduce emissions, and lower operational costs.

Airbus SE and The Boeing Company are the leaders in the MEA market. Their strong R&D capabilities and extensive product portfolios position them strategically. They focus on developing innovative electric systems and components, significantly influencing market trends.

Rolls-Royce Holdings plc and General Electric Company are pivotal in engine technology and electric power systems. Their advanced propulsion systems and strong market presence make them crucial players in the MEA market.

Safran S.A. and Raytheon Technologies Corporation are key contributors with their expertise in electrical and electronic systems. They provide essential components and systems that support the MEA's operational efficiency.

Honeywell International Inc. and Thales Group enhance the market with their avionics and electrical systems. Their innovative solutions improve aircraft performance and safety, impacting the market positively.

Meggitt PLC and BAE Systems plc focus on electrical systems and components, contributing to the MEA's development. Their strategic positioning strengthens their market influence.

Elbit Systems Ltd. and Leonardo S.p.A. bring unique expertise in avionics and electronic warfare systems. Their contributions support the growth of the MEA market.

Northrop Grumman Corporation and Embraer S.A. also play significant roles. Northrop Grumman's defense solutions and Embraer's regional aircraft innovations enhance the market landscape.

In conclusion, these companies drive the More Electric Aircraft market with their advanced technologies, strategic positioning, and market influence. Their continuous innovations and contributions shape the future of the MEA market.

Market Key Players

- Airbus SE

- The Boeing Company

- Rolls-Royce Holdings plc

- Safran S.A.

- Raytheon Technologies Corporation

- General Electric Company

- Honeywell International Inc.

- Thales Group

- Meggitt PLC

- BAE Systems plc

- United Technologies Corporation

- Elbit Systems Ltd.

- Embraer S.A.

- Leonardo S.p.A.

- Northrop Grumman Corporation

Recent Developments

- June 2023: MIT aeroengineers announced the development of a 1-megawatt electric motor designed to power commercial airliners. This motor is expected to significantly reduce carbon emissions and enhance the efficiency of electric aircraft, marking a critical step towards fully electric commercial flights, which are more sustainable and environmentally friendly.

- April 2024: Diamond Aircraft, in collaboration with Lufthansa Aviation Training, successfully tested the eDA40 electric aircraft at Dübendorf Airport in Switzerland. This test was conducted to integrate electric aircraft into flight training programs, promoting sustainable aviation practices and reducing the carbon footprint of pilot training. The successful performance of the eDA40 in a professional training environment represents a significant milestone for electric aviation.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 12.6 Billion CAGR (2024-2033) 12.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Aircraft Type (Fixed-wing Aircraft, Rotary-wing Aircraft), By System Type (Power Generation, Power Distribution, Power Conversion), By Component Type (Electric Actuators, Electric Motors, Electric Power Systems, Energy Storage Devices [Batteries, Supercapacitors], Power Electronics, Others), By Application (Propulsion Systems, Flight Control Systems, Utility Systems [Hydraulic and Pneumatic Replacement], Avionics) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Airbus SE, The Boeing Company, Rolls-Royce Holdings plc, Safran S.A., Raytheon Technologies Corporation, General Electric Company, Honeywell International Inc., Thales Group, Meggitt PLC, BAE Systems plc, United Technologies Corporation, Elbit Systems Ltd., Embraer S.A., Leonardo S.p.A., Northrop Grumman Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Airbus SE

- The Boeing Company

- Rolls-Royce Holdings plc

- Safran S.A.

- Raytheon Technologies Corporation

- General Electric Company

- Honeywell International Inc.

- Thales Group

- Meggitt PLC

- BAE Systems plc

- United Technologies Corporation

- Elbit Systems Ltd.

- Embraer S.A.

- Leonardo S.p.A.

- Northrop Grumman Corporation