Global Money Transfer Services Market By Type (Inward Money Transfer, Outward Money Transfer), By Channel (Banks, Money Transfer Operators), And By End User (Personal, Small Businesses), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033.

-

36088

-

April 2023

-

120

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

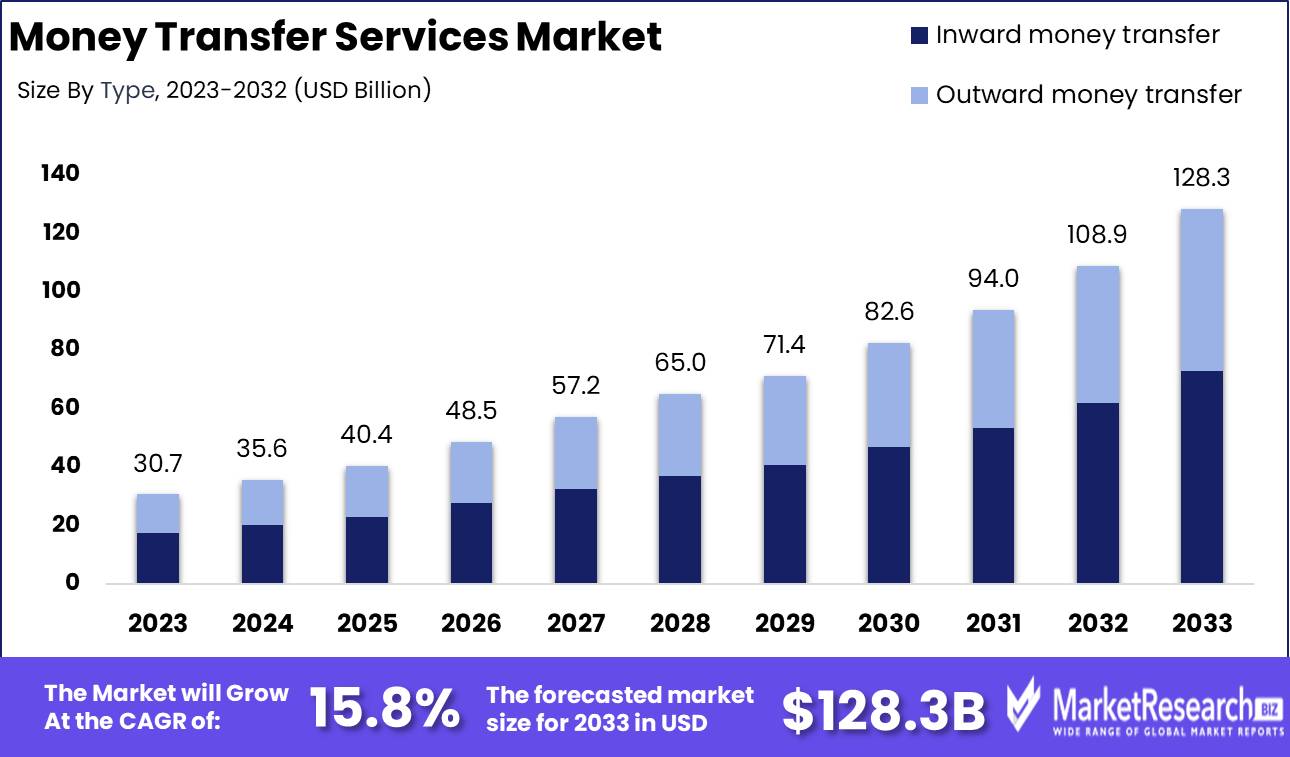

Global Money Transfer Services Market size is expected to be worth around USD 128.3 Bn by 2033 from USD 30,7 Bn in 2022, growing at a CAGR of 15.8% during the forecast period from 2023 to 2032.

Money transfer services are methods and platforms for sending money from one person to another. These services transfer money between people inside the country or internationally. Money transfer services are provided by banks, financial institutions, online payment systems, and other companies which do money transfers. Some most popular money transfer services include wire transfers, PayPal, Venmo, and check services. These services' costs and transmission times can differ depending on the provider and the amount.

The Money Transfer Services Market is set for significant transformation and growth, driven by robust technological advancements and shifting global demographics. A recent study by Juniper Research underscores this dynamic trajectory, projecting a 41% increase in the value of digital money transfer and remittances transactions by 2028, reaching an impressive $4.5 trillion. This escalation is indicative of a broader trend in financial services where digital solutions are increasingly pivotal.

In a strategic move that reflects the sector's consolidation trends, the acquisition of Australian paytech Till Payments by Canadian giant Nuvei for AUD 47 million underscores a growing appetite for enhancing technological capabilities and expanding market reach. This transaction, valued at approximately $30.5 million, mirrors the industry's rapid evolution and the strategic endeavors of key players to fortify their positions in a competitive landscape.

Furthermore, collaborations such as the one between Western Union and Thunes in 2023, aimed at streamlining international money transfers, highlight the industry's focus on improving transaction efficiency and customer experience. These partnerships are crucial in a market where speed and reliability are paramount.

The sector's expansion is also fueled by broader socioeconomic factors. Globalization and the rise of international workforces necessitate more efficient cross-border financial interactions, while demographic shifts promote a heightened need for versatile money transfer solutions. Additionally, the increasing penetration of smartphones and the acceptance of digital transactions are pivotal in driving demand within this market.

These developments collectively suggest a market that is not only growing but also becoming increasingly sophisticated and customer-centric. Companies that invest in technology, expand through strategic acquisitions, and leverage partnerships will likely emerge as leaders in this evolving landscape, shaping the future of money transfers in an increasingly interconnected world.

Market Scope

Type Analysis

Inward money transfers Segment Held the Highest Share

Money transfer services are divided into types such as inward money transfer and outward digital money transfer. The Inward money transfer is the transfer of money to a country or region from a different location using different digital channels. This type of transfer is mainly used by people who work in different countries and want to send money back home to their families. The other type is outward money transfer is the type of transfer of money from one country to another country using various digital channels. This type of money transfer is mainly used for businesses that need to make payments or make any purchases in another country or any region.

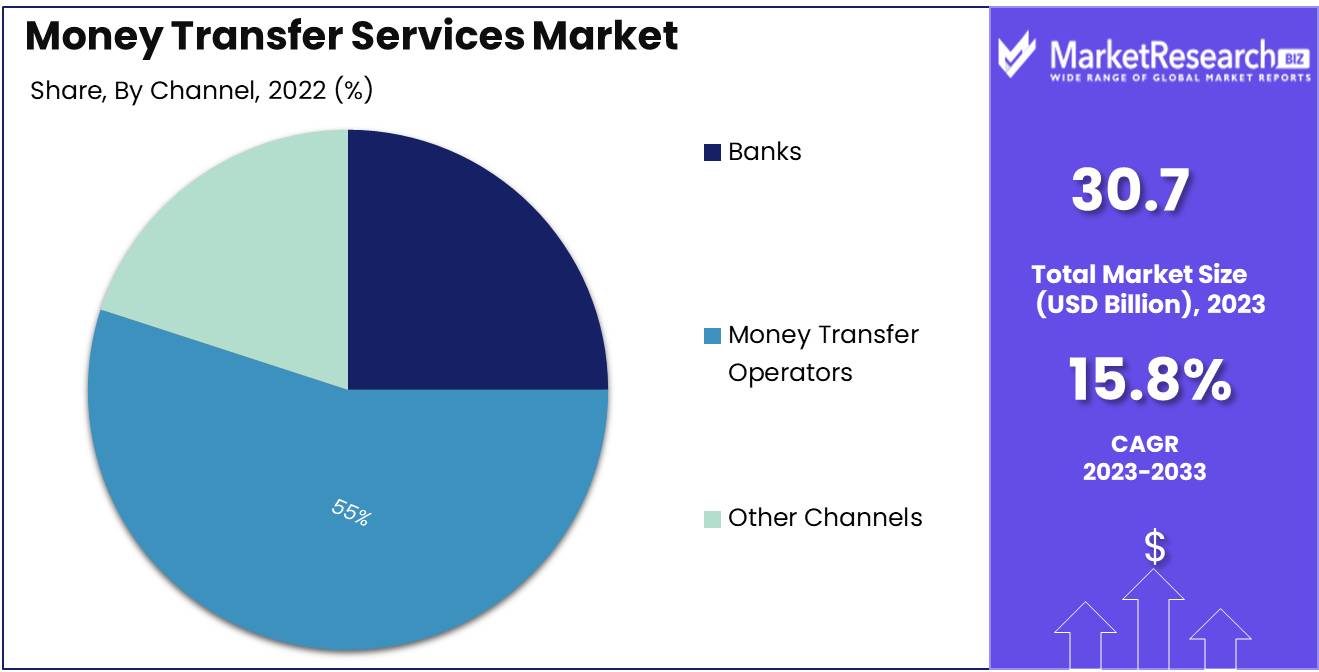

Channel Analysis

Money Transfer Operators Segment Dominate The Market During The Forecast Period.

The money transfer services market is distributed into two primary channels for money transfer banks and money transfer operators. Banks have usually been the primary channel for money transfers, given that wire transfer services to their clients. Wire transfers are electrical transfers of money from one bank account to another. The Banks also deal with services such as automated payment house transfers, which are used for frequent payments, direct deposit of paychecks, and other electronic payments. The MTOs are non-bank financial organizations that study providing money transfer services. They deal with a wide range of services, containing cash-to-cash transfers, bank transfers, and mobile money transfers. The MTOs are often used by persons who do not have entree to traditional banking services, such as immigrants or people living in country areas.

End-User Analysis

Personal End Users Segment Will Drive the Market's Overall Growth.

The global money transfer segment of the market contains persons who need to transfer money for personal causes, such as paying bills, sending money to friends or family members, or making purchases. Personal end users normally trust money transfer services that give low fees, fast transactions, and accessibility. Small businesses also need money transfer services to pay vendors, suppliers, employees, and other business-related costs. They frequently need more standard services that can handle large transactions, offer lesser fees and improved exchange rates, and mix with accounting and other business organizations.

Key Market Segments

By Type

- Inward money transfer

- Outward money transfer

By Channel

- Banks

- Money Transfer Operators

- Other Channels

By End User

- Personal

- Small Businesses

- Other End-Users

Market Dynamics

Drivers

Increase the Globalization and New Technical Launches Results in the Growth of the Market.

As companies become more worldwide spread and people move to changed countries for work or learning, the need for money transfers has improved. The introduction of novel technologies, such as mobile devices and the internet, has prepared it easier and more suitable for people to transfer money. Digital platforms and mobile applications have made it possible to transfer money fast, and these technologies are driving the growth of the money transfer market.

Restraints

Lack of verification and payment amount Issues Limits the Growth of the Market.

Governments or financial organizations may force bounds on the maximum amount of money that can be moved in a single transaction or within a definite time structure. This is typically done to prevent money laundering. Financial institutions may be essential to confirm the identity of their customers before allowing them to transfer money. This can include inviting personal info, such as a government-issued ID, a passport, or a utility bill. The purpose of these verification supplies is to prevent fake activity and confirm that the money being transferred is not related to criminal activity.

Trends

Mobile Reliable, Block Chain Money Transfer Methods to Drive the Market’s Growth

One of the main trends in the money-transferring market is the increase in mobile payments. With the general acceptance of smartphones and the development of mobile banking apps, customers are ever more using their mobile devices to make payments and transfer money. Blockchain-based payments have increased adhesion in recent years as a more safe and clear alternative to traditional payment methods. Blockchain technology secures and spread out transactions that are reduced to fraud and hacking.

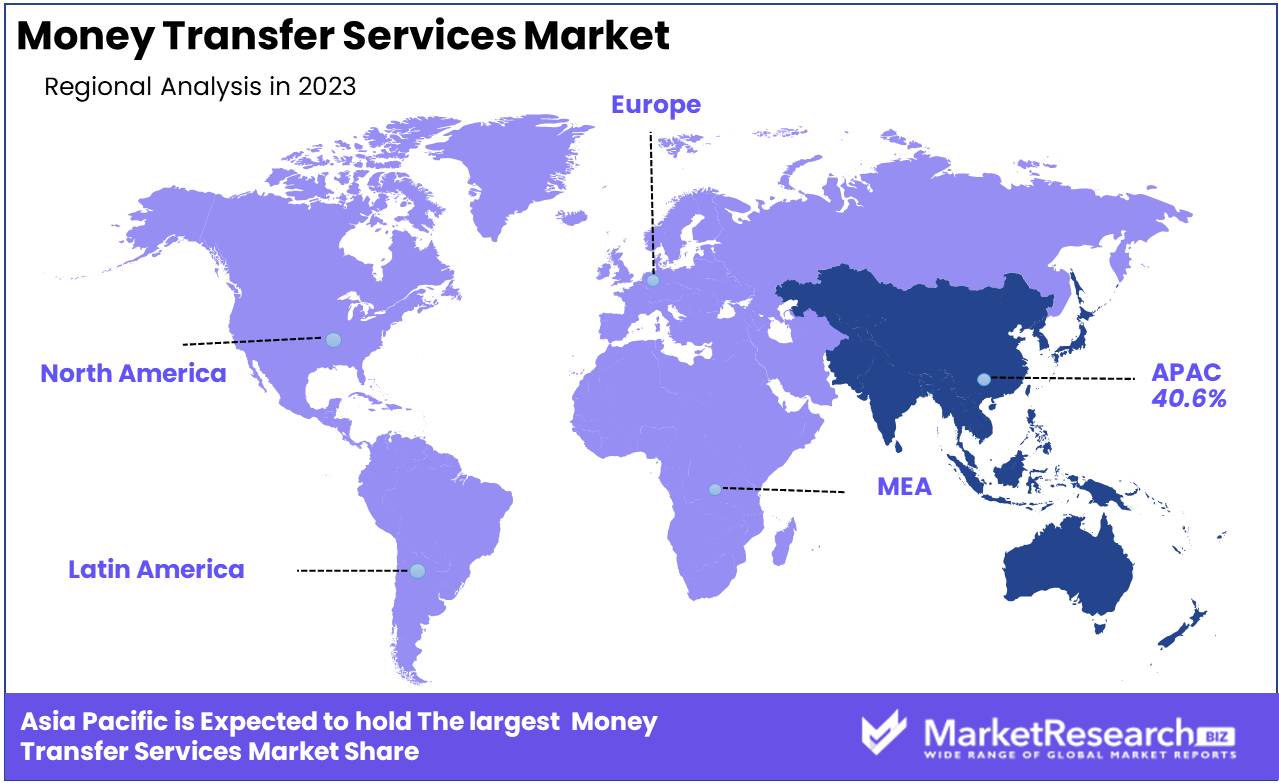

Regional Analysis

Asia-Pacific Dominates the Market During the Forecast Period.

As per the regional analysis, the global money transfer market was dominated by Asia-Pacific in 2023 with a 40.6% revenue share and is expected to see development at the highest rate due to the rising number of immigrants and growing acceptance of digital remittance due to fast advancing technologies, developing customer expectations, and an exchanging regulatory background. The Region of North America is growing rapidly due to traditional banks and financial organizations, along with online payment platforms such as PayPal and Venmo.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

The global money-transferring market is a major player accepting various plans, such as product invention, corporations, research & development advantages, mergers& achievements, joint strategic projects, and geographical growth, to support their position in the market. The Money transfer software achieves the transfer of money among businesses along with between businesses and their clients. Money transfer software and transfers are mostly used by B2B clients and money professionals to make costs online.

Many players in the market are aiming to support transactions in many languages, states, and currencies. For Example, On August 2021, WorldRemit Ltd. propelled its money transfer services in Malaysia, allowing users to send money from Malaysia, also to 50 other countries, as well as the U.S. and the U.K., and more than 130 destinations.

Listed below are some of the most prominent market players in the global money transfer services market.

Market Key Players

- Bank of America

- TransferWise Ltd.

- XOOM

- Western Union Holdings Inc.

- JPMorgan Chase & Co.

- Citigroup Inc.

- MoneyGram International Inc.

- RIA Financial Services Ltd.

- UAE Exchange

- Wells Fargo

- Other Key Players

Key Industry developments

Report Scope

Report Features Description Market Value (2023) US$ 30.7 Bn Forecast Revenue (2033) US$ 128.3 Bn CAGR (2023-2033) 15.8 % Base Year for Estimation 2023 Historic Period 2017-2023 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Therapeutic Radiopharmaceuticals and Diagnostic Radiopharmaceuticals; By Application- Cardiology, Neurology, Oncology, and Other Applications; By End-User- Diagnostic Centers, Hospitals & Clinics, and Other End-Users. Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Lantheus Medical Imaging, Inc., Cardinal Health, Nordion Inc., Curium, Bayer AG, Norgine B.V., Medtronic, Inc., Jubilant Pharmova Limited, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bank of America

- TransferWise Ltd.

- XOOM

- Western Union Holdings Inc.

- JPMorgan Chase & Co.

- Citigroup Inc.

- MoneyGram International Inc.

- RIA Financial Services Ltd.

- UAE Exchange

- Wells Fargo

- Other Key Players