Millets Market By Product(Pearl Millet, Finger Millet, Others), By End-Use (Ready to Eat, Direct Consumption, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

15951

-

Jul 2023

-

154

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

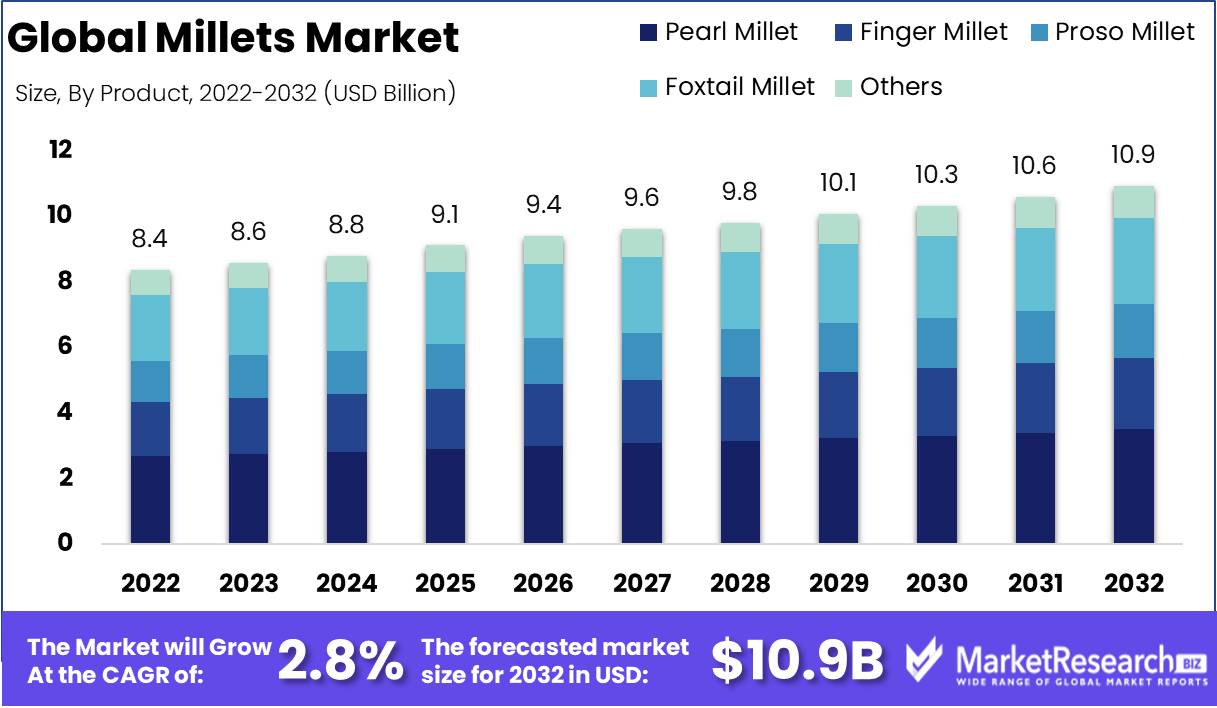

Millets Market size is expected to be worth around USD 10.9 Bn by 2032 from USD 8.4 Bn in 2022, growing at a CAGR of 2.8% during the forecast period from 2023 to 2032.

Millets, the diminutive yet tenacious grasses that have adorned our cultivated lands for millennia, are a testimony to their unflinching resilience in the face of varying climatic conditions. These modest grains, renowned for their tenacity, contain an abundance of health benefits that have captivated the affections of many.

Millets have carved out a niche for themselves in the wellness industry, from their commendable ability to manage diabetes and lower cholesterol levels to their outstanding contribution to digestion and cardiac health. Within the vast expanse of the millets, market are numerous alluring varieties, such as the delicate foxtail millet, the tenacious finger millet, the resplendent pearl millet, and the regal sorghum.

A symphony of health benefits that pirouettes on the tongue can be experienced when consuming millets. These cereals offer a treasure trove of essential nutrients, minerals, vitamins, and antioxidants thanks to their gluten-free nature and low-calorie content. A guardian deity for the digestive system, dietary fiber is concealed within their unassuming hulls.

Notably, millets have a low glycemic index, which makes them a delicious addition to the diet of diabetics. Beyond their health benefits, millets stand out as an inexpensive and easily cultivated alternative to conventional grains, flourishing even in the harshest environments, thereby beckoning all to embrace their wild allure.

In recent years, the world of millets has undergone a fascinating transformation as innovation and tradition have intertwined. A multitude of millet-based products has proliferated, including heavenly bread, tantalizing noodles, resplendent linguine, and delectable cookies.

Driving factors

A Rising Trend in Global Agriculture

Due to agricultural factors that are undergoing transformation, the millets market is experiencing positive growth. Millets, which are nutrient-dense small-seeded cereals, have benefited from the instability of rice production. Increasing health consciousness and the transition toward online accessibility have contributed to the growth of the market. In addition, the demand for organic rice has boosted the market for millets, as organic cultivation techniques are widely used. Government regulations, including subsidies and marketing, have also positively affected the market.

The millets market will be further revolutionized by technological advancements and innovations in processing and packaging. However, competition from crops such as quinoa and oats and shifting consumer preferences may present obstacles. Despite this, the millets market is anticipated to expand as consumers pursue healthier and more sustainable food options.

Accessibility and Health Drive Growth

The millets market is expanding due to increased consumer health consciousness and increased accessibility. The demand for natural alternatives to processed foods has been met by the increased accessibility of millets thanks to online platforms. In addition, the increasing demand for organic rice has bolstered the millets market due to their reduced reliance on chemical fertilizers and pesticides.

Government policies and programs that encourage millet cultivation and consumption have further stimulated market growth. In India, millets have been incorporated into the National Food Security Act, and 2023 has been designated as the International Year of Millets by the United Nations. These initiatives emphasize the significance of millets and their capacity to enhance global food security.

Technological Advancements

By increasing productivity and quality, emerging technologies are reshaping the millets market. It is anticipated that advances in crop breeding, mechanization, and precision cultivation will make millets more competitive with other crops. These innovations have the potential to revolutionize millet production and increase its consumer appeal. In addition, advancements in food processing and packaging are likely to make millet-based products more appealing, thereby propelling market growth.

Obstacles and Prospective Disruptors

While the millets market is promising, it encounters competition from crops like quinoa and oats. These options offer comparable nutritional benefits and versatility, which will appeal to consumers seeking variety. In addition, shifting consumer preferences, such as the rise of plant-based diets and alternative proteins, may shift away from millets. To sustain growth, the millets market must address these potential market-disrupting factors by accentuating distinctive qualities and adapting to shifting consumer preferences.

Restraining Factors

High product costs hinder Millets' market expansion

Due to an increasing trend among consumers toward healthier eating practices, the millets market has experienced growth over the past few years. However, the market still confronts a number of obstacles, most notably the availability of substitutes, high product costs, and limited shelf life. This article will discuss the impact of these factors on the growth of the millets market.

Limited shelf life inhibits market expansion

The limited shelf life of the product is another factor that hinders the growth of the millets market. Compared to other grains, millets are highly perishable and have a limited shelf life. This restricts the ability of producers to stockpile or store significant quantities of millets for an extended period of time, resulting in supply issues. Additionally, the limited shelf life makes transportation and distribution more difficult, resulting in increased costs for producers and suppliers.

Product Type Analysis

In recent years, there has been a significant increase in the demand for millets, a group of highly nutritious grains that have been traditionally consumed throughout the globe. Pearl Millets have emerged as the dominant segment among the various varieties of millets on the global millets market.

Pearl Millets, also known as Bajra, is a grain that is gluten-free and abundant in protein, fiber, and essential nutrients. This cereal grain is cultivated primarily in India, Africa, and some Asian regions. Pearl Millets are utilized in a variety of foods, including bread, porridge, and nibbles.

The adoption of the Pearl Millets Segment on the global millets market has been driven by economic growth in developing nations. The rising income levels and altering dietary preferences of consumers in these nations have led to an increase in demand for nutritious and healthy food products such as Pearl Millets.

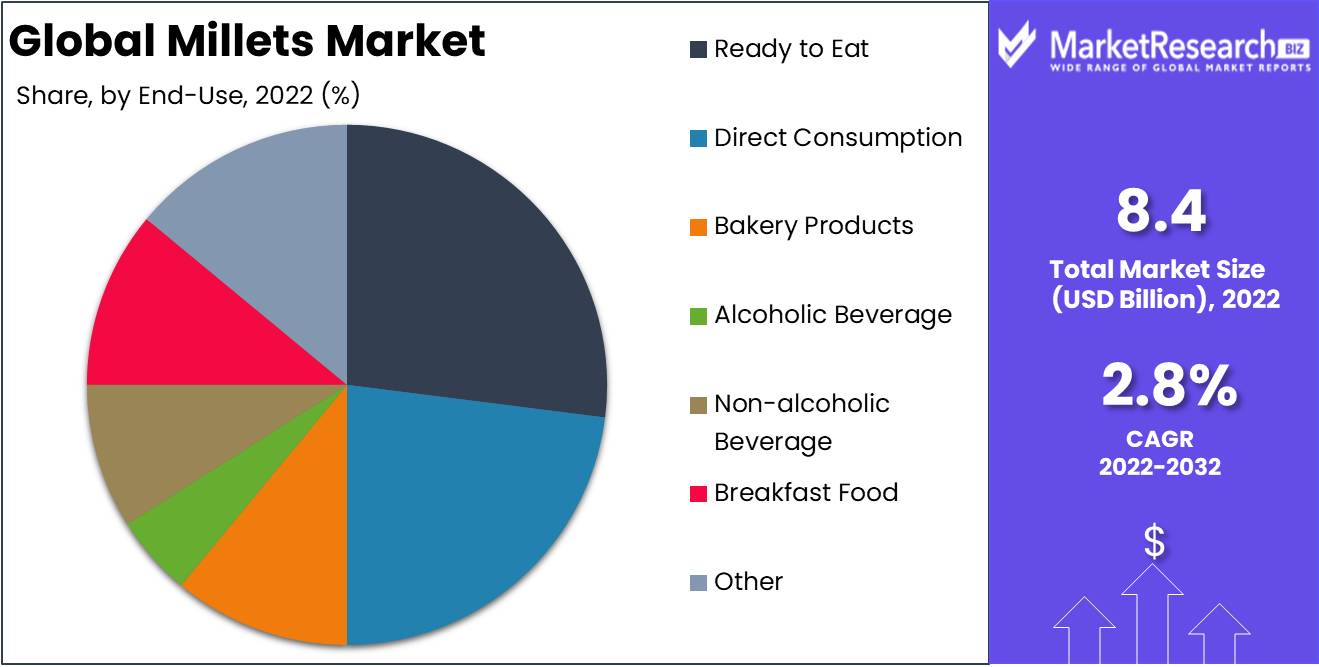

End-Use Analysis

The Ready to Eat Segment has emerged as the dominant segment among the various end-use segments in the global millets market. The Ready to Eat millet products are a healthy and convenient option for consumers seeking fast and simple meals.

The Ready to Eat millet products include breakfast cereals, munchies, and baked goods made with millet. These items are typically pre-cooked and ready for immediate consumption or minimal preparation.

The adoption of the Ready to Eat Segment in the global millet market has been propelled by the economic growth of emerging economies. The increasing urbanization and altering lifestyles of consumers in these nations have led to an increase in demand for convenient and nutritious food options, such as Ready to Eat millet products.

Key Market Segments

By Product

- Pearl Millet

- Finger Millet

- Proso Millet

- Foxtail Millet

- Others

By End-Use

- Ready to Eat

- Direct Consumption

- Bakery Products

- Alcoholic Beverage

- Non-alcoholic Beverage

- Breakfast Food

- Fodder

- Other

Growth Opportunity

Rise in Unsustainability of Rice and Wheat Production

For centuries, the production of rice and wheat has been the foundation of many cultures, including India. Nonetheless, rice and wheat production is becoming increasingly unsustainable due to a number of factors. First, rice and wheat production consumes enormous quantities of water, a resource that is already scarce in many regions. Second, the use of chemical fertilizers and pesticides has caused soil degradation and contributed to the rise in global pollution levels.

Diabetes, Obesity, and Cardiovascular Disorders are Prevented by Millets.

Millets have been demonstrated to prevent diabetes, obesity, and cardiovascular disease. Millets have a low glycemic index, meaning they release glucose slowly into circulation, thereby reducing the risk of developing diabetes. In addition, millets are high in fiber, which causes people to feel full quickly, thereby preventing the overeating that can contribute to obesity. Magnesium, potassium, and fiber are essential for cardiac health, and millets contain high levels of these nutrients.

Millets Have High Protein and Mineral Content

Millets have a high protein and mineral content, making them an essential element of any healthy diet. Millets contain more fiber, minerals such as iron, zinc, and phosphorus, and B vitamins than other grains. Additionally, millet is gluten-free, making it an ideal grain for people with celiac disease or gluten sensitivity. Additionally, millet is readily digestible, making it an ideal food for infants and people with digestive issues.

Latest Trends

Contains Calcium, Iron, and fiber for Healthy Growth

The first major trend shaping the millets market is their nutritional value. Millets are rich in various minerals and vitamins, such as calcium, iron, and fiber, which aid in healthy growth and development, especially in infants. The calcium in millet helps in the growth and maintenance of bones and teeth, while iron helps in the formation of hemoglobin, the protein in red blood cells that carries oxygen throughout the body. Additionally, the fiber in millet aids in digestion, keeping the gut healthy.

Rich in Vitamins A and B, Iron, Phosphorus, Magnesium, and Manganese

Another major trend that is shaping the millets market is their versatility. The millets are an excellent source of many essential vitamins, such as vitamins A and B. Vitamin A is essential for good vision, immune system, and skin health, while the B vitamins are essential for energy production and maintaining red blood cells. Millets are also rich in other minerals like phosphorus, magnesium, and manganese, which play an essential role in building strong bones and maintaining healthy muscles and tissues.

More Protein Than Rice

Millets are known to have higher protein content than other cereals such as rice, which has made them a popular choice for the health-conscious population, fitness enthusiasts, and athletes. The high protein content in millets helps in building and repairing tissues, including muscles.

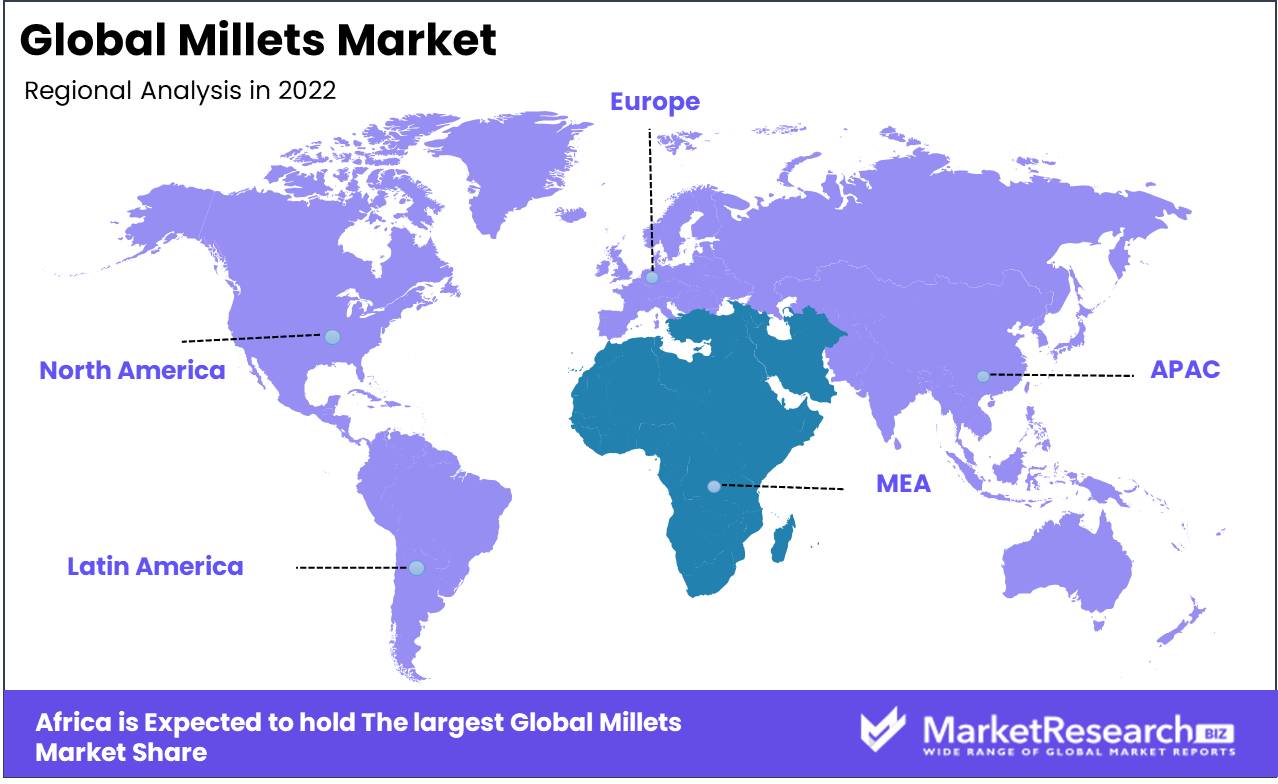

Regional Analysis

The Millet Market is Predominated by Africa. Currently, millet is witnessing a renaissance as a nutritious and healthy grain. This micronutrient powerhouse is rich in vitamins, minerals, and antioxidants and has a low glycemic index, making it an ideal food for diabetics. Africa is the region with the highest production and consumption of this wonder grain among the top millet producers in the world.

The top 10 millet-producing countries in the world, according to the Food and Agriculture Organization (FAO), are all in Africa. Nigeria topped the list, producing more than 7.5 million tonnes of millet in 2019. Sudan, Niger, Mali, Burkina Faso, and Chad are additional significant producers. These nations account for more than 80 percent of global millet production.

Although many African nations export millet, the vast majority of it is consumed domestically. In fact, millet is a staple food in many African diets, especially in the Sahel region, where it frequently serves as the primary source of calories. Due to its high protein content, it is a suitable food for vegetarians and those who live in areas with limited access to livestock.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Millets are a highly nutritive grain that is acquiring popularity among consumers who prioritize their health. Millets are becoming an essential part of healthful diets as a result of their gluten-free nature, high fiber content, and high nutrient value. Consequently, the demand for millet on the market is growing, as is the competition among the major participants.

Companies such as Nestle SA, General Mills Inc., and Kellogg Company are some of the main players in the millets market. These businesses are all multinational food corporations with a substantial market presence in multiple nations. They are producing a variety of millet-based foods and beverages, including cereals, munchies, and beverages. In addition, a number of lesser businesses have emerged and are competing in the market to meet the growing demand for organic and non-GMO millets.

The Indian government, which has launched initiatives to promote the cultivation and consumption of millets, is another significant participant in the millets market. To assist rural farmers, the government offers incentives to millet producers, provides training programs to improve their techniques, and permits the sale of millet-based products through the Public Distribution System.

Top Key Players in the Millets Market

- Archer Daniels Midland Company

- Cargill, Inc.

- Bayer Crop Science AG

- Wise Seed Company, Inc.

- I. DuPont De Nemours and Company

- Brett-Young Seeds Limited

- Ernst Conservation Seeds

- Roundstone Native Seed Company

- Glanbia Nutritionals Inc.

Recent Development

- In February 2022, Wholesome Food, a prominent player in the Indian millet market, announced an investment of more than USD 7 million to expand its already impressive selection of millet-based products. The funds will be used to fuel the brand's aggressive expansion strategy, which includes the introduction of new products and the consolidation of its market presence. This decision is anticipated to strengthen Wholsum Food's position in the extremely competitive millet market.

- In April 2022, the government of Orissa approved the second phase of the 'Odisha Millet Mission,' a program designed to encourage millet cultivation in the state. With an estimated investment of more than USD 340 million over the next six years, the initiative seeks to establish a millet value chain in the region that is self-sufficient. Offering incentives to farmers, promoting scientific millet farming practices, and educating consumers about the health advantages of millet-based products, the mission has already helped transform the local economy.

- In November 2022, The Indian millet market received some thrilling news, when the government formulated a five-year strategic plan to promote millet on the international market. The plan includes numerous initiatives, including the organization of international trade fairs, the formation of a global millet research consortium, and the promotion of millet as a climate-friendly, sustainable crop to international consumers.

Report Scope

Report Features Description Market Value (2022) USD 8.35 Bn Forecast Revenue (2032) USD 11 Bn CAGR (2023-2032) 2.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Pearl Millet, Finger Millet, Others), By End-Use (Ready to Eat, Direct Consumption, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, Cargill, Inc., Bayer Crop Science AG, Wise Seed Company, Inc., I. DuPont De Nemours and Company, Brett-Young Seeds Limited, Ernst Conservation Seeds, Roundstone Native Seed Company, Glanbia Nutritionals Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Archer Daniels Midland Company

- Cargill, Inc.

- Bayer Crop Science AG

- Wise Seed Company, Inc.

- I. DuPont De Nemours and Company

- Brett-Young Seeds Limited

- Ernst Conservation Seeds

- Roundstone Native Seed Company

- Glanbia Nutritionals Inc.