Military Satellite Market By Orbit Type (Geosynchronous Earth Orbit (GEO), Low Earth Orbit (LEO)), By Type (Nano-micro, Small, Medium, Heavy), By Application, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2023-2032

-

41741

-

Oct 2023

-

186

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

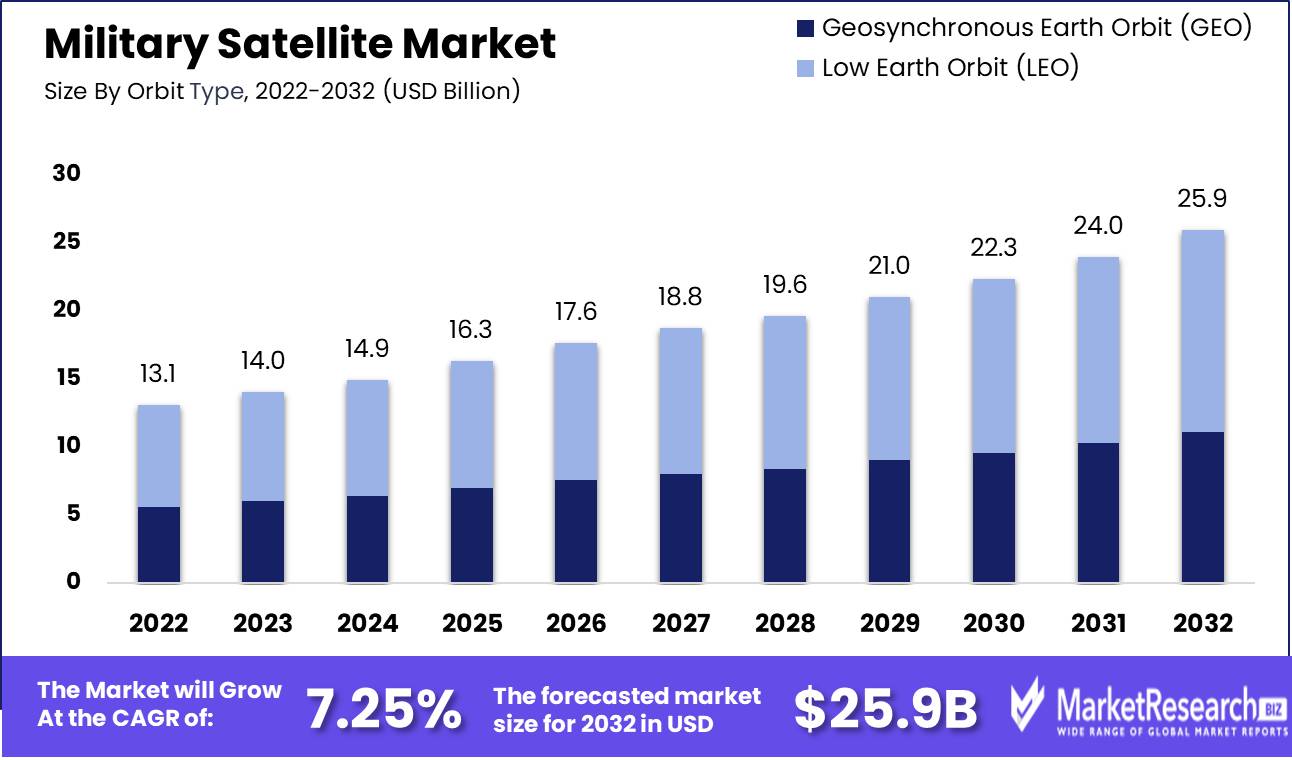

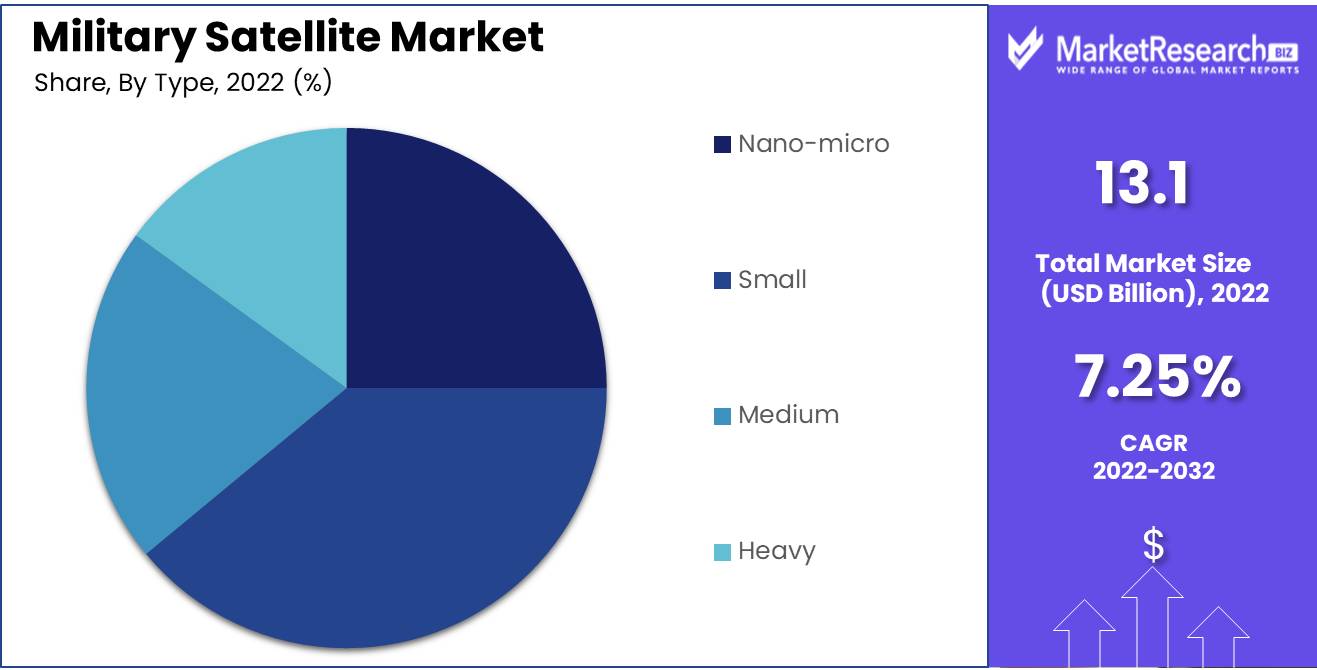

The global military satellite market size was estimated at USD 13.1 billion in 2022 and it is expected to hit around USD 25.9 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 7.25% during the forecast period 2023 to 2032.

The military satellite market is a rapidly growing sector in the aerospace and defense industry. Military satellites are used for a variety of purposes, including communication, intelligence gathering, and navigation. They play a critical role in modern warfare, enabling military forces to communicate and coordinate their operations across vast distances.

Recent advances in medical imaging demonstrate its growing relevance and integration into wider technological environments. In September 2023, Russian Space Forces unveiled the Kosmos-2549 reconnaissance satellite. While not directly related to medical imaging applications, its launch demonstrates how space technology and healthcare applications are converging; satellites are increasingly employed to expand global healthcare access, monitor epidemics, and provide remote telemedicine services.

Ukraine launched the "Brave1" portal in April 2023, to encourage public-private innovation and the incorporation of technology into military infrastructure. Although initially created for military use, its emphasis on innovation and technological advancements are inextricably linked with medical imaging trends; military satellites often play an integral role in providing medical imaging as part of disaster response initiatives or supporting telemedicine and telehealth initiatives.

Defense Innovation Unit (DIU) issued a request in August 2023 for their Victus Haze mission, requiring an agile satellite launch within 24 hours' notice. This development highlights the burgeoning need for agile satellite deployment, real-time diagnostic imaging for real-time diagnoses, and telemedicine needs require urgently deployed imaging capabilities as quickly as possible for real-time diagnosis or telemedicine applications; rapidly deployed imaging capabilities are crucial when dealing with public health crises such as natural disasters or pandemics.

Military satellite markets are experiencing exponential growth due to rising demands for communication and surveillance within military sectors. Trends toward small satellites with high throughput capabilities as well as the development of innovative technologies are likely to bolster market expansion over the coming years.

Driving Factors

Demand for real-time information and communication has skyrocketed in recent years.

Military satellite sales are expected to experience steady growth over the coming years due to various driving forces. One reason is an increasing need for real-time data and communication among military personnel. Technology has only compounded military operations' complexity, making timely information critical. Military satellites provide this critical service by offering up-to-date situation updates, intelligence gathering capabilities and command and control features.

Secure and reliable communication

Military satellites play an integral part in providing secure communications channels that are difficult to jam or intercept compared with more conventional forms of communication, providing military forces with an edge against cyber attacks or electronic warfare in combat environments.

Increased investments in space-based technologies

Investment from countries around the globe has fuelled an explosion in military satellite market growth. Many nations have recently launched military satellites and more are likely to do so over time in an effort to strengthen their military and gain strategic advantages against competitors. This trend should continue as nations look for ways to bolster both their military capabilities as well as gain strategic advantages against adversaries.

Restraining Factors

High costs associated with development.

While the military satellite market is expected to experience growth over the coming years, several factors could prevent its success. One such factor is cost; developing and launching military satellites requires significant financial commitment from countries. A single satellite alone could cost billions to construct and launch.

Increased competition from other technologies

Another factor restraining military satellite market expansion is increased competition from other technologies. UAVs have become an increasingly popular alternative, offering similar capabilities as military satellites while being much cheaper and more flexible solutions.

The growing threat of cyber attacks

Cyber attacks remain a growing threat for military satellite technology markets. As more military operations rely on satellite technology, there is an increased risk that its systems could be breached or disrupted by hackers or cybercriminals and lead to serious ramifications for national security and possibly leading to decreased trust for satellite tech in general.

Risk of geopolitical tensions

Geopolitical tensions pose another risk to the military satellite market. As nations become more competitive and territorial, they may become less willing to share satellite technology between nations, leading to some being left behind with regards to satellite technology - this could have serious repercussions for national security implications.

Orbit Type Analysis

The military satellite market can be divided into two orbital segments: geosynchronous Earth orbit (GEO) and low Earth orbit (LEO). LEO satellites currently dominate this segment.

LEO satellites operate at altitudes below 2,000 km, completing orbits in short time frames for frequent coverage and revisiting of locations on Earth. Their lower altitude also requires less energy for launch and operation compared with GEO satellites, making LEO the go-to orbit for many military applications such as reconnaissance, surveillance, and communications.

GEO satellites orbit at an altitude of 35,786km above the equator, matching Earth's rotation while staying over fixed areas. While GEO constellations may be suitable for weather monitoring applications due to their lower cost and limited coverage area, their higher costs and limited reach have limited their adoption as military space satellites compared with LEO counterparts - LEO has established itself as an uncontested market leader since 2013.

Type Analysis

The military satellite market can be divided into four distinct types, known as nano-micro satellites, small satellites, medium satellites and heavy satellites. Small satellites have quickly become the market leaders with the highest market share, due to their compact size and reduced launch costs; militaries around the globe prefer these compact satellites for rapid deployment and more agile response to emerging threats.

Medium and heavy satellites with their larger payloads and capabilities remain vital to more specialized and intense military missions, but their higher costs and longer development timelines have led to a gradual shift towards smaller satellite designs. Nano-micro satellites have also seen increasing use for research purposes - but have yet to reach similar dominance levels within the military satellite market.

Application Analysis

The military satellite market can be divided based on application into communication, ISR (Intelligence Surveillance Reconnaissance), navigation and others. Communication satellites are projected to lead this market during the forecast period due to increasing demands for secure communication systems within military operations.

ISR (Intelligence, Surveillance and Reconnaissance) services are expected to experience rapid expansion due to increasing military needs for real-time intelligence, surveillance and reconnaissance capabilities. Meanwhile, navigation services should experience moderate growth due to an increasing need for GPS-based navigation systems on military aircraft and ships.

Weather forecasting, earth observation, and scientific research fall under the other applications category, with weather forecasting and earth observation services becoming more essential to military operations as demand for them grows significantly over time. This segment should experience exponential growth during its forecast period due to military demand.

Key Market Segmentation

By Orbit Type

- Geosynchronous Earth Orbit (GEO)

- Low Earth Orbit (LEO)

By Type

- Nano-micro

- Small

- Medium

- Heavy

By Application

- Communication

- ISR (Intelligence, Surveillance, and Reconnaissance)

- Navigation

- Others

Growth Opportunity

Demand For Military Satellites Continues To Increase Exponentially

As military missions become more complicated and geographically dispersed, their need for authentic communications and navigation systems increases rapidly. Satellites for military use play an integral part in such systems and will continue to play an essential role over the coming years.

Technology Advancements Continue To Evolve At An Astonishing Rate

Military forces will soon be able to utilize improved satellite technologies for building stronger, more knowledgeable satellites that enable them to collect more detailed data while communicating more efficiently and navigating with more precision. With such advancements comes greater access to specific information while communicating efficiently and navigating more precisely - this technology gives soldiers access to specific details while communicating efficiently and navigating with greater accuracy.

Expanding Applications

Military satellites are being deployed for multiple uses, including communication and missile warning, navigation and weather forecasting forecasting - opening up new markets as a result.

Latest Trends

- Small satellites that are cost-effective and suitable for military uses are becoming more in demand, with increased demand being seen among users who rely on larger satellites that require extensive upkeep and launch costs. Small satellites offer flexibility when it comes to deployment, offering lower launch costs than launching all at once, lowering launch costs while giving more freedom when choosing how you use satellites. Small satellites may even reduce dependence on larger ones that incur expensive maintenance and launch fees.

- Recent advances in technology are driving an increase in high-throughput satellite (HTS) usage for military communications and surveillance purposes, providing fast internet connectivity essential to military activities as well as reconnaissance. HTSs can also be employed for reconnaissance.

- Military satellite markets are experiencing rapid advances in new technologies like artificial intelligence (AI) and machine learning (ML), blockchain and others that will forever alter their marketplaces. AI/ML analysis helps military leaders make more informed choices when collecting satellite data; blockchain provides secure communication channels between satellites.

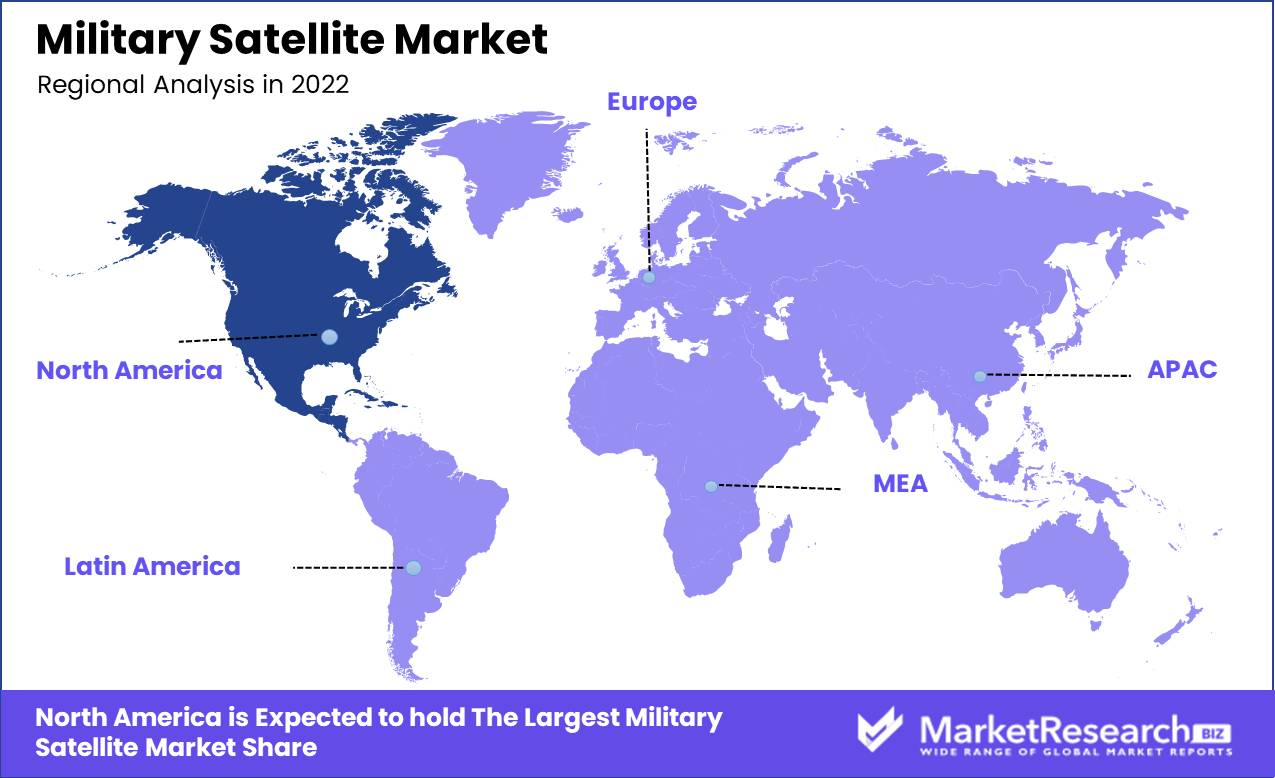

Regional Analysis

North American countries are believed to be leading market players for military satellites due to significant investments made in satellite technologies developed from within the US. Due to their massive defense expenditures and focus on space superiority, it's expected that they'll lead market expansion across North America during their forecast timeline.

European markets are expected to experience moderate growth with major firms like Airbus, Thales and OHB providing advanced satellite technologies to meet European militaries' increasing demands. Yet market expansion will likely remain slower compared to North America.

Asia Pacific represents an emerging high-growth military satellite market. Rising defense expenditures from major economies such as China and India as well as strategic investments made by Japan and South Korea will only serve to further increase Asia Pacific's market share over time.

The rest of the global market, which encompasses regions such as the Middle East, South America, and Africa will likely experience less growth due to lower budgets for defense spending. Israel, Brazil, and Saudi Arabia should contribute toward global market development through key markets that they dominate such as Israel, Brazil, and Saudi Arabia.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Military satellite markets are highly competitive and feature numerous major players. These companies continually invest in research and development activities in order to offer innovative services and products for their customers.

Airbus Defense and Space, Boeing Defense Space and Security, Thales Group and Lockheed Martin Corporation are among the more prominent companies in this market. Each has formed partnerships, collaborations or mergers and acquisitions with others to expand their market reach and number of customers they serve; 2022 marked one such agreement when Airbus Defense and Space signed an agreement with France's Ministry of Defense to offer new generation military satellites for communication purposes.

Top players are making investments in cutting-edge technologies like Artificial Intelligence, Machine Learning and Big Data Analytics to expand the capabilities of their satellite systems. Lockheed Martin Corporation for instance is working on creating new GPS satellites which provide increased security and accuracy.

Furthermore, military satellite market is witnessing an increasing need for smaller satellites which can be launched at lower costs, leading to the emergence of several new players such as SpaceX and OneWeb as market disruptors that threaten traditional players in near future.

Top Key Players

- Airbus Defense and Space

- Boeing Defense, Space & Security

- Thales Group

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Israel Aerospace Industries Ltd.

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- Mitsubishi Electric Corporation

- Viasat Inc

Recent Development

- In September 2023, Russia launched Kosmos-2549, an advanced military satellite designed for reconnaissance and surveillance purposes.

- In April 2023, Ukraine launched the "Brave1" portal to facilitate public-private innovation in April 2023. This platform serves as a hub for various technologies and innovations related to military satellites; ultimately its goal is to enhance Ukraine's technological capacities while expediting the integration of tech into its military infrastructure more quickly.

- In August 2023, DIU announced in August 2023 a solicitation seeking bids from industry for Victus Haze - an "agile space mission". Launch providers need only 24 hours notice to launch payloads into orbit.

- In March 2022, the United States Space Force successfully launched their fifth Advanced Extremely High Frequency (AEHF-5) satellite, designed to offer secure and jam-resistant communications to military forces.

- In June 2022, the European Space Agency (ESA) successfully launched its inaugural military satellite - Athena-Fidus 2 - as a joint project between France and Italy. Designed to provide secure communications to military and government users.

- In August 2022, the India Space Research Organisation (ISRO) successfully deployed a GSAT-7C military satellite to provide communication capabilities to the Indian Air Force.

Report Scope

Report Features Description Market Value (2022) USD 13.1Bn Forecast Revenue (2032) USD 25.9Bn CAGR (2023-2032) 7.25% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Orbit Type (Geosynchronous Earth Orbit (GEO), Low Earth Orbit (LEO)), By Type (Nano-micro, Small, Medium, Heavy), By Application (Communication, ISR (Intelligence, Surveillance, and Reconnaissance), Navigation, Others) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Airbus Defense and Space, Boeing Defense, Space & Security, Thales Group, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Israel Aerospace Industries Ltd., General Dynamics Corporation, L3Harris Technologies, Inc., Mitsubishi Electric Corporation, Viasat Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Airbus Defense and Space

- Boeing Defense, Space & Security

- Thales Group

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Israel Aerospace Industries Ltd.

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- Mitsubishi Electric Corporation

- Viasat Inc