Middle East & Africa Roofing Materials Market Report By Material Type (Asphalt Shingles, Metal Roofing, Concrete and Clay Tiles, Slate Roofing, Synthetic Roofing, Others [including wood, fiber cement, etc.]), By Application (Residential, Commercial, Industrial), By End User (Homeowners, Contractors, Developers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

13583

-

July 2024

-

320

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

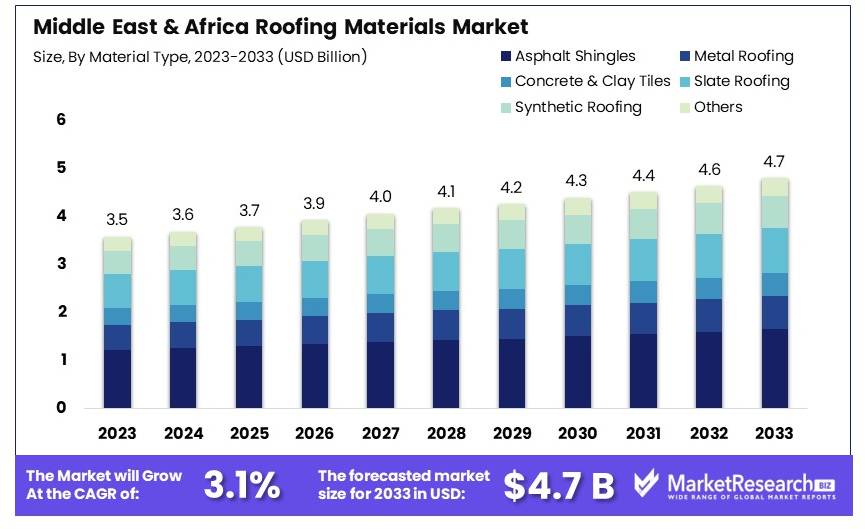

The Middle East & Africa Roofing Materials Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 3.5 Billion in 2023, growing at a CAGR of 3.1% during the forecast period from 2024 to 2033.

The Middle East & Africa Roofing Materials Market encompasses the sale and distribution of products used in roofing applications across the region. This market includes a variety of materials such as bituminous roofing, metal roofing, clay roofing, concrete roofing, and others. The market's expansion is driven by the increasing construction activities in residential, commercial, and industrial sectors, influenced by urbanization and economic growth.

Key factors such as the demand for durable and energy-efficient roofing systems, along with advancements in eco-friendly roofing materials, are pivotal in shaping market trends. The region's diverse climate conditions also dictate the choice of roofing materials, emphasizing the need for products that offer high thermal resistance and longer lifespan.

The roofing materials market in the Middle East and Africa (MEA) is poised for significant expansion, catalyzed by robust infrastructural investments and a flourishing construction sector. As the MENA region is projected to require over USD 100 billion annually for the next five years to sustain and expand its infrastructure—equivalent to about 7% of its annual regional GDP—this substantial financial commitment underscores the potential demand for durable and innovative roofing materials.

The construction industry in the MENA region, a critical indicator for roofing materials demand, is forecasted to grow at a real rate of 3.4% in 2024 and 3.3% in 2025. This growth is primarily fueled by sustained investments in infrastructure projects and a strategic shift towards public-private partnerships (PPPs) and privatisations, particularly with the UAE emerging as a pivotal center for international investments. Such dynamics suggest a burgeoning market for roofing materials, characterized by heightened demand for both quantity and quality.

Manufacturers and distributors within the roofing materials sector are advised to monitor these trends closely, as the regional economic policies and investment influx in construction directly influence market opportunities. Aligning supply chains, technological enhancements, and product offerings with the infrastructural needs and climatic conditions of the MEA region will be key to capitalizing on this growth trajectory. Thus, stakeholders in the roofing materials market are positioned to benefit from strategic investments in capacity expansion and innovation, catering to an increasingly sophisticated market demand.

Key Takeaways

- Market Value: The Middle East & Africa Roofing Materials Market was valued at USD 3.5 billion in 2023 and is expected to reach USD 4.7 billion by 2033, with a CAGR of 3.1%.

- Material Type Analysis: Asphalt Shingles dominated with 35%; widely preferred for durability and cost-effectiveness.

- Application Analysis: Residential sector dominated with 50%; increasing residential construction activities drive demand.

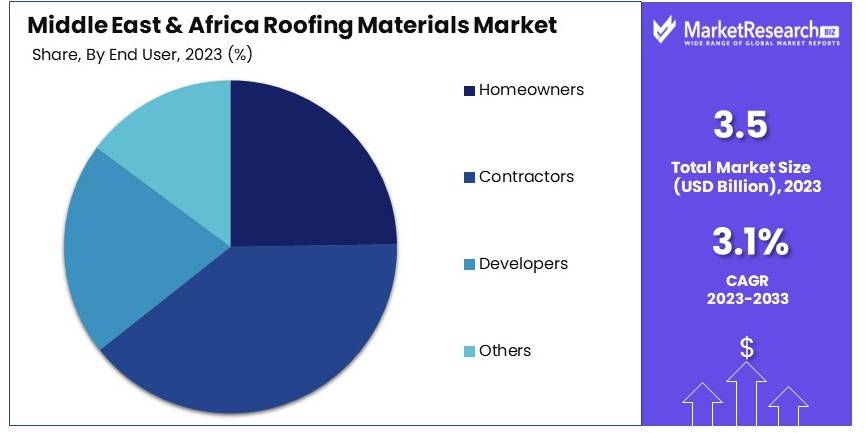

- End User Analysis: Contractors dominated with 40%; essential for installation and maintenance of roofing materials.

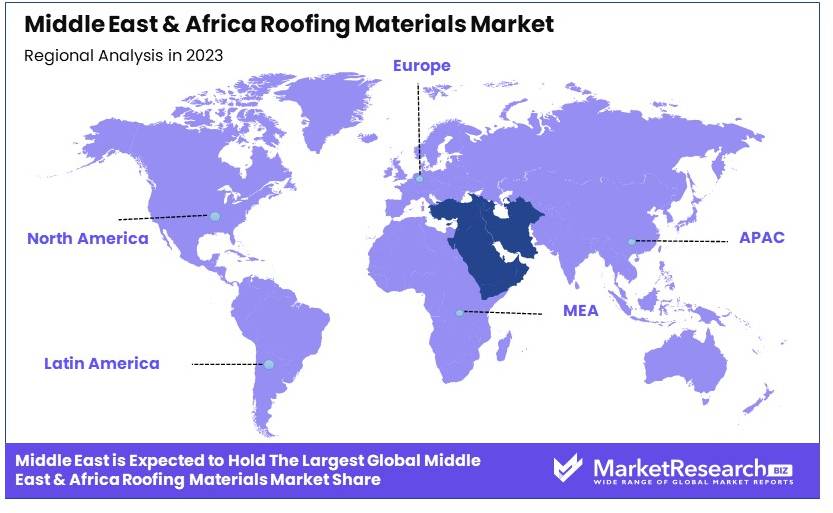

- Dominant Region: Middle East held 54%; significant construction activities and infrastructural development in the region.

- Analyst Viewpoint: The market shows moderate saturation with steady growth, driven by residential and commercial construction, with opportunities in emerging African markets.

Driving Factors

Rapid Urbanization and Infrastructure Development Drives Market Growth

The Middle East and Africa (MEA) roofing materials market is significantly influenced by the rapid pace of urbanization and expansive infrastructure initiatives. As urban populations swell, with the United Nations projecting urban areas in Africa to double by 2050, the demand for both residential and commercial buildings escalates. This surge necessitates a vast array of roofing materials, from traditional tiles to modern metal and membrane roofing systems.

Specifically, in the Middle East, countries like Saudi Arabia and the United Arab Emirates are spearheading growth through large-scale projects like NEOM and the Red Sea Development, demanding robust construction outputs including steel roofing. The combined effect of urban growth and infrastructural projects not only boosts the immediate demand for roofing materials but also supports a long-term market expansion in the region.

Increasing Focus on Energy-Efficient and Eco-Friendly Construction Drives Market Growth

Environmental sustainability is becoming a cornerstone of construction practices in the Middle East and Africa, profoundly impacting the roofing materials market. With an increasing legislative and cultural push towards sustainability, energy-efficient and eco-friendly roofing materials are seeing a spike in demand. These materials, such as cool roof coatings, are essential in regions characterized by hotter climates, including much of MEA.

Cool roofs, by reflecting more sunlight and absorbing less heat, significantly reduce building energy use by up to 15% as per the U.S. Department of Energy. This shift not only meets regulatory standards but also aligns with global environmental goals, thus propelling the market forward by appealing to environmentally conscious consumers and stakeholders.

Growth in the Tourism and Hospitality Sector Drives Market Growth

The MEA region's focus on diversifying its economy has led to substantial investment in the tourism and hospitality sector, directly influencing the roofing materials market. This sector's expansion, with projects ranging from luxury resorts in the United Arab Emirates to beachfront hotels in Morocco, requires durable and aesthetically pleasing roofing solutions.

The demand for high-quality materials, such as advanced polymer composites and attractive clay tiles, is driven by these projects' needs to withstand harsh climatic conditions while maintaining visual appeal. The ongoing development of tourism infrastructure, supported by government initiatives and foreign investment, continuously feeds into the roofing market's growth, making it a critical area for stakeholders to watch.

Restraining Factors

Rapid Urbanization and Infrastructure Development Drives Market Growth

The Middle East and Africa (MEA) roofing materials market is significantly influenced by the rapid pace of urbanization and expansive infrastructure initiatives. As urban populations swell, with the United Nations projecting urban areas in Africa to double by 2050, the demand for both residential and commercial buildings escalates. This surge necessitates a vast array of roofing materials, from traditional tiles to modern metal and membrane roofing systems.

Specifically, in the Middle East, countries like Saudi Arabia and the United Arab Emirates are spearheading growth through large-scale projects like NEOM and the Red Sea Development, demanding robust construction outputs including roofing. The combined effect of urban growth and infrastructural projects not only boosts the immediate demand for roofing materials but also supports a long-term market expansion in the region.

Increasing Focus on Energy-Efficient and Eco-Friendly Construction Drives Market Growth

Environmental sustainability is becoming a cornerstone of construction practices in the Middle East and Africa, profoundly impacting the roofing materials market. With an increasing legislative and cultural push towards sustainability, energy-efficient and eco-friendly roofing materials are seeing a spike in demand. These materials, such as cool roofing systems, are essential in regions characterized by hotter climates, including much of MEA.

Cool roofs, by reflecting more sunlight and absorbing less heat, significantly reduce building energy use by up to 15% as per the U.S. Department of Energy. This shift not only meets regulatory standards but also aligns with global environmental goals, thus propelling the market forward by appealing to environmentally conscious consumers and stakeholders.

Growth in the Tourism and Hospitality Sector Drives Market Growth

The MEA region's focus on diversifying its economy has led to substantial investment in the tourism and hospitality sector, directly influencing the roofing materials market. This sector's expansion, with projects ranging from luxury resorts in the United Arab Emirates to beachfront hotels in Morocco, requires durable and aesthetically pleasing roofing solutions.

The demand for high-quality materials, such as advanced polymer composites and attractive clay tiles, is driven by these projects' needs to withstand harsh climatic conditions while maintaining visual appeal. The ongoing development of tourism infrastructure, supported by government initiatives and foreign investment, continuously feeds into the roofing market's growth, making it a critical area for stakeholders to watch.

Material Type Analysis

Asphalt Shingles dominate with 35% due to affordability and ease of installation.

The roofing materials market in the Middle East & Africa is extensively segmented by material type, with Asphalt Shingles leading as the dominant sub-segment. Asphalt shingles are favored in both residential and commercial sectors primarily due to their cost-effectiveness, ease of installation, and considerable variety in aesthetic options. They hold approximately 35% of the market share within the material type segment. The versatility of asphalt shingles, combined with their durability—typically lasting 20 to 30 years—makes them an attractive choice in regions facing economic constraints and a need for long-term, low-maintenance solutions.

Metal Roofing, Concrete and Clay Tiles, and other materials such as Slate and Synthetic Roofing also play significant roles in the market. Metal roofing, known for its durability and energy efficiency, is becoming increasingly popular in regions with extreme weather conditions due to its high resilience. Concrete and clay tiles are highly valued in hotter climates prevalent across much of the Middle East & Africa for their ability to maintain cooler indoor temperatures, thus enhancing energy efficiency.

Slate roofing, while less common due to its higher cost, offers a premium option with exceptional longevity and a distinct aesthetic appeal. Synthetic roofing materials are gaining traction due to their ability to mimic the appearance of natural materials like slate and wood but at a reduced cost and with less maintenance. The "Others" category, which includes wood and fiber cement, caters to niche markets seeking specific aesthetic or environmental properties, thus rounding out the diverse material type segment.

Application Analysis

Residential segment dominates with 50% due to the rapid expansion of housing needs.

The application of roofing materials in the Middle East & Africa is primarily segmented into residential, commercial, and industrial sectors, with the residential segment taking the lead, holding about 50% of the market. This dominance is driven by the rapid urbanization in countries like Nigeria, South Africa, and Kenya, where the demand for housing continues to grow exponentially. The residential sector's need for roofing materials is fueled by both new construction and renovation projects, where homeowners look for both aesthetic appeal and functional performance in roofing choices.

The commercial sector, although smaller in comparison, is significant and includes the use of roofing materials in buildings such as offices, schools, and hospitals. This segment prioritizes durability and energy efficiency, reflecting the broader environmental and economic goals of the region. Industrial applications, while the smallest segment, are critical, particularly in regions undergoing rapid industrialization.

Here, the focus is on materials that can withstand harsh industrial environments, offering higher resistance to chemicals and extreme temperatures. Both commercial and industrial applications contribute to the overall growth and diversification of the roofing materials market in the Middle East & Africa.

End User Analysis

Contractors dominate with 40% due to their pivotal role in both supply and installation processes.

The end-user segment of the Middle East & Africa roofing materials market is categorized into homeowners, contractors, developers, and others, with contractors holding the largest market share at approximately 40%.

Contractors are pivotal in the roofing materials market as they bridge the gap between manufacturers and the final installation, influencing both product choice and application techniques. Their dominance is attributed to their expertise in selecting appropriate materials that align with both client needs and regional building regulations.

Homeowners, as end users, significantly influence the market through their material preferences, driven by factors such as cost, aesthetics, and durability. Developers also play a crucial role, especially in large-scale residential and commercial projects where their decisions impact the types of roofing materials used, thus affecting broader market trends.

The "Others" category includes various stakeholders like government bodies and institutional facilities that require specialized roofing solutions to meet specific criteria, such as energy efficiency and sustainability standards. This segment's needs further diversify the market's scope and influence the development of new roofing materials tailored to unique requirements.

Key Market Segments

By Material Type

- Asphalt Shingles

- Metal Roofing

- Concrete and Clay Tiles

- Slate Roofing

- Synthetic Roofing

- Others (including wood, fiber cement, etc.)

By Application

- Residential

- Commercial

- Industrial

By End User

- Homeowners

- Contractors

- Developers

- Others

Growth Opportunities

Increasing Demand for Cool Roofing Systems Offers Growth Opportunity

The demand for cool roofing systems is surging in the Middle East & Africa, driven by escalating temperatures and heightened energy efficiency needs. These systems, utilizing reflective materials and coatings, are essential in regions with intense solar exposure, reducing indoor cooling costs by reflecting sunlight instead of absorbing it.

Such technologies not only offer cost savings over time but also align with global trends towards sustainability. This shift presents a significant growth opportunity for manufacturers to innovate and expand their offerings in energy-efficient roofing solutions, which are increasingly becoming a standard requirement in new construction projects across the region.

Adoption of Green Building Practices Offers Growth Opportunity

The growing commitment to environmental sustainability is pushing the adoption of green building practices within the Middle East & Africa roofing materials market. Eco-friendly materials like recycled metal roofing or green roofs, which provide insulation and reduce urban heat islands, are becoming popular choices.

These materials help buildings meet stringent environmental regulations and appeal to a market increasingly driven by eco-conscious consumers. The trend towards sustainable building practices presents manufacturers with the opportunity to diversify their product lines and tap into new market segments eager for green construction solutions.

Trending Factors

Innovative Roofing Materials and Technologies Are Trending Factors

The roofing materials market in the Middle East & Africa is rapidly evolving with the introduction of innovative materials and technologies. Developments such as self-cleaning roofs, which reduce maintenance costs, and solar-integrated roofing, which provides added energy generation, are setting new standards in the industry.

These innovations not only enhance the functional attributes of roofing materials but also improve their environmental footprint. As these technologies gain traction, they are expected to drive considerable market growth, catering to a newer generation of builders and homeowners looking for smart, efficient, and durable roofing solutions.

Increasing Focus on Building Resilience Are Trending Factors

In response to the region's exposure to extreme weather events, there is an increasing focus on building resilience, making it a significant trend in the Middle East & Africa roofing materials market. Materials designed to withstand environmental stressors such as sandstorms and heavy rainfall, like impact-resistant tiles and reinforced membranes, are in high demand.

This trend is influencing both product development and consumer preferences, as stakeholders prioritize durability and safety in their building materials. The emphasis on resilience not only meets immediate practical needs but also ensures long-term sustainability in construction practices, further boosting the market's growth potential.

Regional Analysis

Middle East Dominates with 54% Market Share

The Middle East's 54% dominance in the Middle East & Africa Roofing Materials Market is primarily fueled by extensive infrastructure developments and economic diversification policies. Countries like Saudi Arabia and the UAE are investing heavily in new construction projects, including residential, commercial, and industrial buildings, driven by initiatives such as Vision 2030 and Dubai Plan 2021. These projects require substantial quantities of roofing materials, bolstering the region's market share.

The region's market dynamics are influenced by its harsh climate and the need for durable and energy-efficient roofing solutions. The preference for high-quality, innovative roofing materials that can withstand extreme temperatures and reduce cooling costs is a significant factor. Additionally, the push towards green building practices and sustainable materials continues to reshape the market landscape, aligning with global environmental trends.

Looking ahead, the Middle East's influence on the roofing materials market is expected to continue growing. With ongoing mega-projects and an increasing focus on tourism and commercial sectors, demand for advanced roofing technologies is likely to expand. Furthermore, the region's commitment to sustainability and energy efficiency is set to drive innovation and adoption of new roofing materials, ensuring its market dominance remains strong.

Within the Middle East, the Gulf Cooperation Council (GCC) countries hold a significant portion of the market share, estimated at 35%, due to their robust economic growth and construction activities. The Levant region accounts for a smaller share, around 19%, influenced by more varied economic conditions and political stability. In Africa, North Africa holds approximately 21% of the market, driven by gradual economic recovery and infrastructure investments, while Sub-Saharan Africa, despite being resource-rich, captures about 25% of the market, reflecting its slow but steady growth in construction and urbanization.

Key Regions and Countries

Middle East

- Gulf Cooperation Council (GCC) Countries

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

- Levant

- Turkey

- Egypt

Africa

- North Africa

- Egypt

- Morocco

- Algeria

- Tunisia

- Libya

- Sub-Saharan Africa

- South Africa

- Nigeria

- Kenya

- Ghana

- Ethiopia

Key Players Analysis

The Middle East & Africa Roofing Materials Market includes prominent companies such as Owens Corning, Saint-Gobain S.A., and others. These players significantly impact market dynamics and development.

Owens Corning and Saint-Gobain S.A. lead the market with their advanced roofing solutions. Their strong R&D capabilities and extensive product portfolios give them a strategic advantage.

Kingspan Group plc and GAF Materials Corporation are key players known for their innovative roofing systems. Their focus on energy efficiency and sustainability enhances their market influence.

Jiangsu Kingbang Composite Materials Co., Ltd. and Monier Roofing Systems GmbH provide diverse roofing materials. Their strategic market positioning boosts their presence in the region.

Etex Group and Johns Manville offer high-quality roofing products and solutions. Their commitment to durability and innovation strengthens their market standing.

BMI Group and Ahi Roofing Ltd. focus on advanced roofing technologies. Their continuous product development and customer-focused strategies impact market growth.

Tasblock Pty Ltd. and Fletcher Building Limited bring a wide range of roofing solutions to the market. Their strategic positioning and strong distribution networks enhance their influence.

Sika AG and 3M Company leverage their expertise in construction materials. Their innovative roofing products and technologies improve their market presence.

LafargeHolcim Ltd. provides sustainable roofing solutions. Their focus on eco-friendly materials and innovative designs positions them strategically in the market.

In conclusion, these companies drive the Middle East & Africa Roofing Materials Market with their innovative solutions, strategic positioning, and market influence. Their continuous advancements and commitment to quality shape the market’s future.

Market Key Players

- Owens Corning

- Saint-Gobain S.A.

- Kingspan Group plc

- GAF Materials Corporation

- Jiangsu Kingbang Composite Materials Co., Ltd.

- Monier Roofing Systems GmbH

- Etex Group

- Johns Manville

- BMI Group

- Ahi Roofing Ltd.

- Tasblock Pty Ltd.

- Fletcher Building Limited

- Sika AG

- Atlas Roofing Corporation

- Wienerberger AG

- 3M Company

- LafargeHolcim Ltd.

Recent Developments

- December 2023: Scatec ASA completed the first phase of the Mmadinare 120 MW Solar Complex in Botswana. This project emphasizes the region’s shift towards incorporating renewable energy solutions in new infrastructure developments.

- The UAE is set to witness several major infrastructure projects in 2024. Notable projects include the development of Palm Jebel Ali, which will feature 80 hotels and resorts over 13.4 square kilometers, and the Dubai Reefs project, which aims to create a sustainable community with the world’s largest artificial reef and renewable energy facilities. These projects highlight the UAE's commitment to expanding its infrastructure while promoting sustainability.

Report Scope

Report Features Description Market Value (2023) USD 3.5 Billion Forecast Revenue (2033) USD 4.7 Billion CAGR (2024-2033) 3.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Asphalt Shingles, Metal Roofing, Concrete and Clay Tiles, Slate Roofing, Synthetic Roofing, Others [including wood, fiber cement, etc.]), By Application (Residential, Commercial, Industrial), By End User (Homeowners, Contractors, Developers, Others) Regional Analysis Middle East: Gulf Cooperation Council (GCC) Countries: Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain, Levant, Turkey, Egypt; Africa: North Africa: Egypt, Morocco, Algeria, Tunisia, Libya, Sub-Saharan Africa, South Africa, Nigeria, Kenya, Ghana, Ethiopis Competitive Landscape Owens Corning, Saint-Gobain S.A., Kingspan Group plc, GAF Materials Corporation, Jiangsu Kingbang Composite Materials Co., Ltd., Monier Roofing Systems GmbH, Etex Group, Johns Manville, BMI Group, Ahi Roofing Ltd., Tasblock Pty Ltd., Fletcher Building Limited, Sika AG, 3M Company, LafargeHolcim Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Owens Corning

- Saint-Gobain S.A.

- Kingspan Group plc

- GAF Materials Corporation

- Jiangsu Kingbang Composite Materials Co., Ltd.

- Monier Roofing Systems GmbH

- Etex Group

- Johns Manville

- BMI Group

- Ahi Roofing Ltd.

- Tasblock Pty Ltd.

- Fletcher Building Limited

- Sika AG

- Atlas Roofing Corporation

- Wienerberger AG

- 3M Company

- LafargeHolcim Ltd.