Mezcal Market Report By Aging Process (Joven, Reposado, Añejo, Extra Añejo), By Flavor (Earthy and Smoky Mezcal, Fruity and Floral Mezcal, Herbal and Spicy Mezcal), By Distribution Channel (Retail Stores, Online Retailers, Bars and Restaurants, Direct Sales)By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

37789

-

March 2024

-

187

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

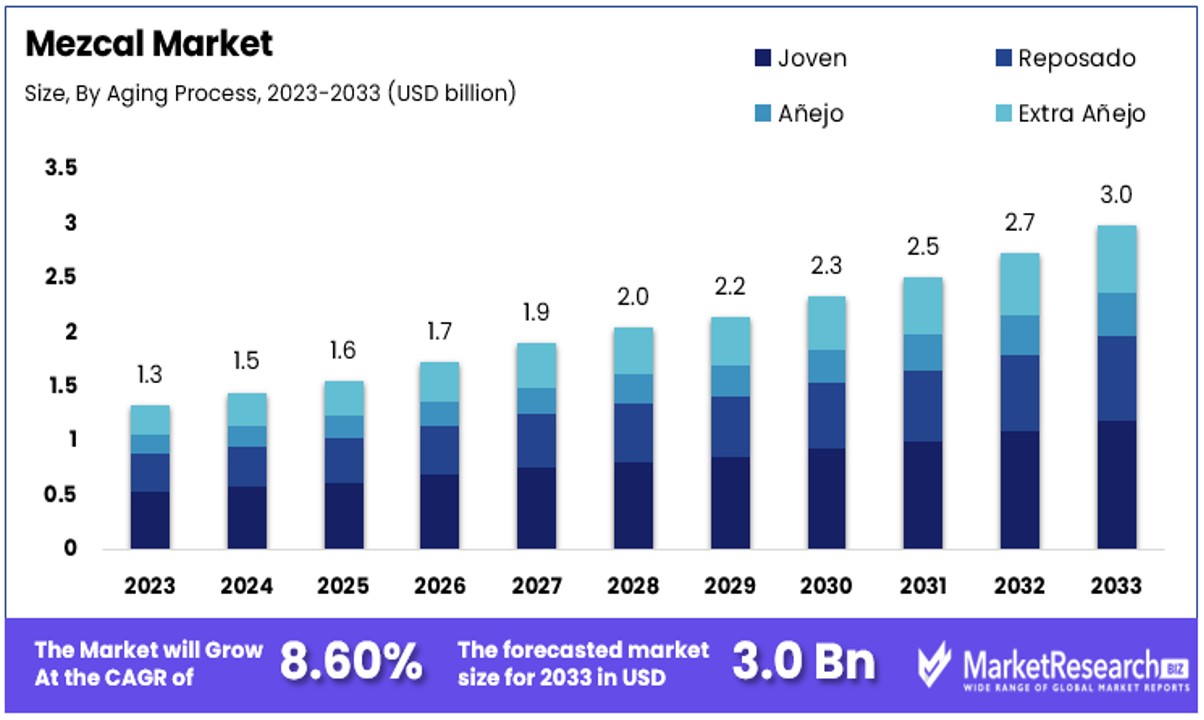

The Global Mezcal Market size is expected to be worth around USD 3.0 Billion by 2033, from USD 1.34 Billion in 2023, growing at a CAGR of 8.60% during the forecast period from 2024 to 2033.

The surge in demand for the cocktails, rise in new varieties of alcoholic beverages and consumer desire for the luxurious and premium drinks are some of the main key driving factors for the Mezcal market.

Mezcal is defined as the distilled alcoholic drinks or beverages that originally belongs from Mexico and mainly manufactured in the Oaxaca regions. It is designed from the agave plant that is specifically the agave espadin type, Mezcal follows traditional and artisanal production methods.

The heart which is also known as Pina of the agave plant is roasted in the earthen pits which gives Mezcal its unique smoky flavour. The cooked agave is then mashed and crushed, fermented and distilled that results in a spirit with an exceptional taste sample that may comprise earthy, herbal notes and fruity flavours.

Beside tequila, which is a type of Mezcal is made particularly from the blue agave, Mezcal can be manufactured from different types of agave species that contributes to its multi and rich flavours. It is also enjoyed neat and in cocktails, and the production method emphasize the cultural and traditional importance of this old spirit.

According to an article published by Bevnet in March 2023, highlights that the global market of the Mezcal has launched Su Casa Mezcal in multiple retail stores, bars, hotels, stadiums and restaurants in New York, new Jersey, Illinois, Florida and California.

Mezcal has gained much attention in the beverage industry due to its artisanal production, several flavour samples and cultural importance. Customers are seeking to have exceptional and authentic experiences, Mezcal’s traditional techniques and unique smoky notes attracts to an upsurge market.

The spirit has become a sign of craftsmanship and heritage by contributing to the renaissance of interest in old and locally crafted spirits. These drinks have the versatility in cocktails that improves its demand by making it a sought after preference for those searching for luxurious and traditional drinking experiences. The demand for the Mezcal will increase due to its requirement in beverage industry that will help in the market expansion in coming years.

Key Takeaways

- Market Value Projection: The Global Mezcal Market is poised to reach USD 3.0 Billion by 2033, experiencing substantial growth from USD 1.34 Billion in 2023, with a CAGR of 8.60% during the forecast period from 2024 to 2033.

- Major Segments:

- Aging Process: Joven (Blanco) mezcal is the dominant sub-segment, reflecting a consumer trend towards purity and authenticity. Reposado, Añejo, and Extra Añejo (Añejo) mezcals cater to consumers seeking sophistication and depth in their spirits.

- Flavor: Earthy and Smoky Mezcal stands out as a significant flavor category, driven by traditional production methods and consumer demand for robust and authentic spirit experiences.

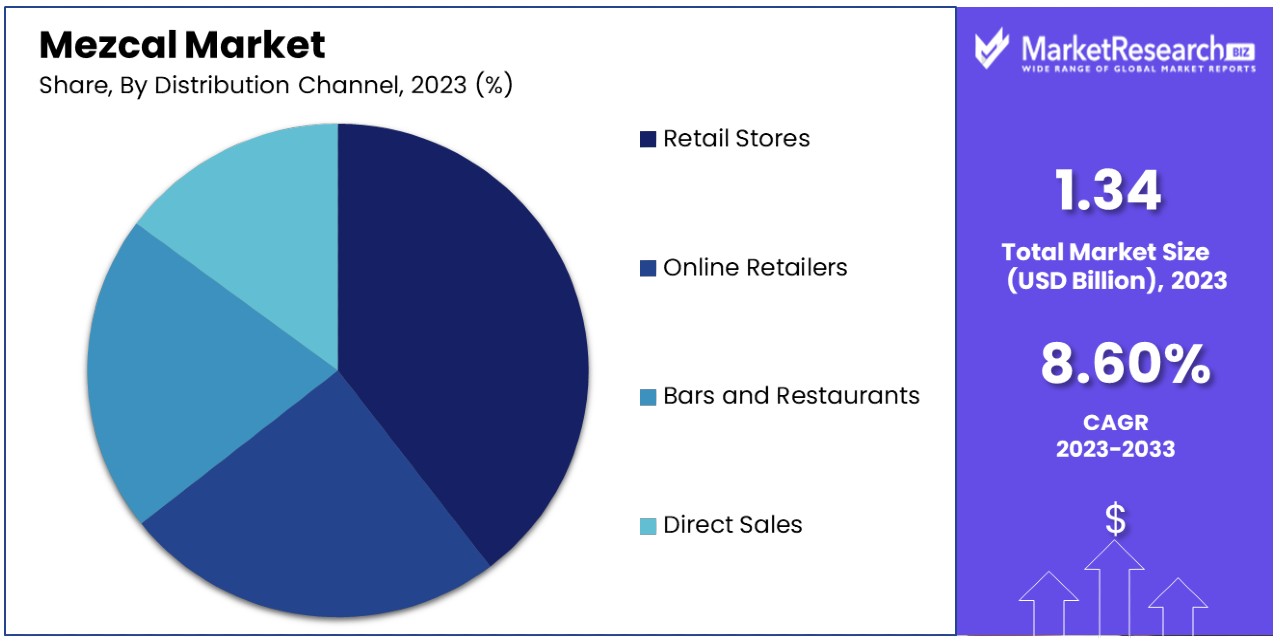

- Distribution Channel: Retail Stores emerge as the dominant distribution channel, offering consumers a tactile shopping experience and personalized recommendations. Online Retailers witness rapid growth, providing convenience and a wider variety of choices.

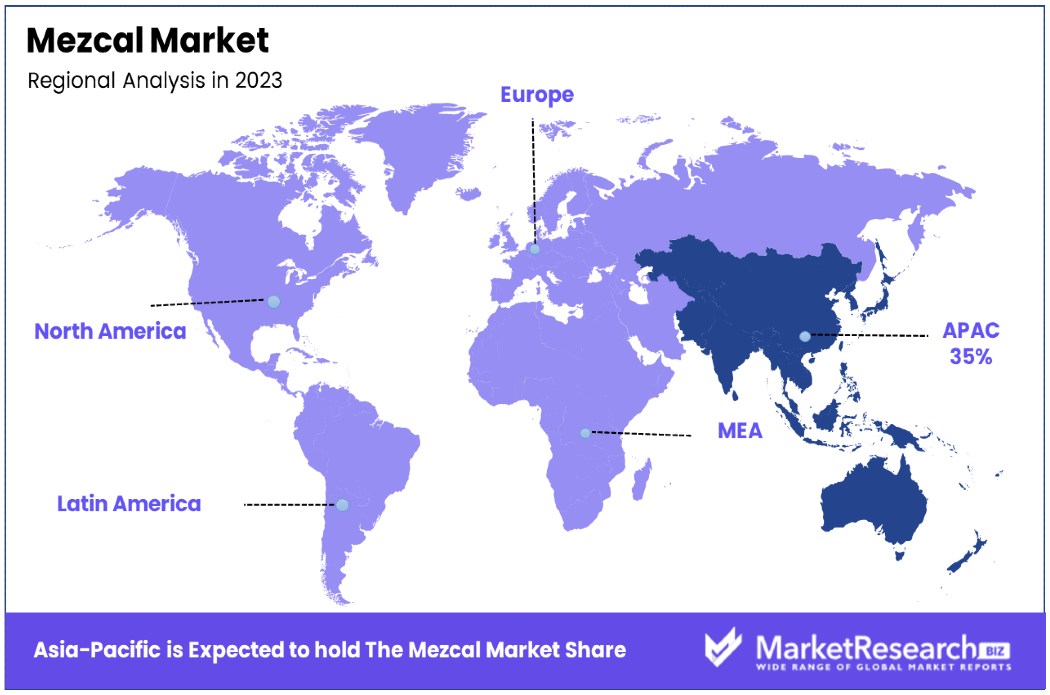

- Regional Dynamics: Asia-Pacific dominates the market with a 35% market share in the Mezcal Market. North America, especially the United States, has historically been a significant market for mezcal, potentially holding around 30% of the market share.

- Analyst Viewpoint: Analysts anticipate significant growth opportunities in the Mezcal Market, driven by evolving consumer preferences towards artisanal spirits, authenticity, and diverse flavor experiences. Investments in production, distribution channels, and marketing strategies are expected to fuel market expansion further.

- Growth Opportunities: Opportunities lie in expanding market reach through diversification of product offerings, innovation in flavor profiles, and strategic partnerships with distribution channels. Additionally, educating consumers about the rich cultural heritage and craftsmanship behind mezcal production presents avenues for growth in the global market.

Driving Factors

Rising Popularity of Craft Spirits Drives Market Growth

The burgeoning interest in artisanal, small-batch spirits is a key driver behind the growth of the Mezcal Market. Consumers increasingly value the unique flavors, production methods, and authenticity that mezcal embodies. This spirit's traditional and labor-intensive distillation process, often involving family-run operations and local agave varieties, resonates with those seeking craft-oriented beverages.

Brands like Del Maguey and Ilegal Mezcal have successfully tapped into this trend, highlighting mezcal's artisanal and terroir-driven attributes. This shift towards craft spirits reflects a broader desire for quality over quantity, pushing mezcal into the spotlight as a symbol of cultural heritage and craftsmanship.

Premiumization and Cocktail Culture Fuel Market Expansion

Mezcal's integration into the luxury segment and its role in the burgeoning cocktail culture have significantly contributed to its market growth. As consumer palates become more sophisticated, there is a noticeable shift towards premium spirits, with mezcal emerging as a favored choice among discerning drinkers and mixologists.

High-end mezcal brands have launched premium expressions, capitalizing on this trend. Their success in upscale bars and restaurants, where mezcal-based craft cocktails are celebrated for their complexity and uniqueness, underscores the spirit's growing allure. This premiumization, coupled with mezcal's versatility in mixology, positions it as a staple in the expanding cocktail culture, enhancing its market presence and appeal.

Renewed Interest in Mexican Culture and Cuisine Boosts Mezcal Demand

The increasing fascination with Mexican culture and cuisine has played a pivotal role in propelling the Mezcal Market forward. As global consumers seek authentic experiences, mezcal's deep cultural roots and its integral role in Mexican traditions make it particularly attractive. This spirit is not just consumed; it's experienced, offering a taste of Mexico's rich heritage.

Restaurants and culinary establishments, have been instrumental in introducing mezcal to a broader audience by pairing it with traditional Mexican dishes. This cultural immersion through cuisine and spirits has not only heightened mezcal's profile but also fostered a deeper appreciation for Mexico's gastronomic contributions, driving demand for mezcal as part of an authentic cultural exploration.

Restraining Factors

Regulatory Challenges and Denomination of Origin Restrains Market Growth

Regulatory challenges and the Denomination of Origin (DO) system, while designed to safeguard mezcal's authenticity and quality, act as significant hurdles for market growth. These regulations impose stringent controls on production methods, agave sourcing, and labeling, which can restrict producers' ability to innovate and expand.

The introduction of stricter rules by the Mezcal Regulatory Council (CRM) in 2018, particularly concerning agave varieties and production processes, sparked industry debate. These regulatory barriers complicate compliance for producers, potentially stifling the mezcal market's growth by limiting the scope for innovation and the introduction of new products to the market.

Perception as a Niche or Obscure Spirit Limits Market Expansion

Mezcal's perception as a niche or obscure spirit, especially in markets less familiar with it, poses a challenge to its wider adoption and growth. In regions like the United States and Europe, where mezcal does not have the longstanding presence of spirits such as tequila, overcoming consumer unfamiliarity remains a challenge.

This perception creates a barrier to attracting new consumers, as those unacquainted with mezcal may view it as an acquired taste or hesitate to try it. Addressing this issue requires sustained education and awareness efforts to shift consumer perceptions and demonstrate mezcal's versatility and unique flavor profile, which is crucial for expanding its consumer base beyond niche markets.

Aging Process Analysis

In the Mezcal Market, Joven (Blanco) is the dominant sub-segment, favored for its pure and unaged profile that offers consumers the most authentic taste of the agave plant. This preference reflects a growing consumer interest in artisanal spirits that are rich in flavor and tradition. Joven mezcal is celebrated for its versatility in cocktails and its ability to convey the terroir of the agave from which it was distilled.

Reposado, Añejo, and Extra Añejo (Añejo) mezcals represent the aged categories, each undergoing a distinct aging process in oak barrels that imparts additional flavors and complexities. Reposado, aged between two months and one year, offers a balance between the agave's natural flavors and the subtleties introduced by aging. Añejo, aged for one to three years, presents a deeper complexity and smoother finish, while Extra Añejo, the longest aged, showcases the most profound transformation, offering rich, nuanced profiles. While these aged mezcals cater to consumers looking for sophistication and depth in their spirits, the popularity of Joven mezcal underscores a market trend towards purity and authenticity.

Flavor Analysis

The Mezcal Market is also segmented by flavor, with Earthy and Smoky Mezcal being a particularly prominent category. This flavor profile is characteristic of the traditional production methods of mezcal, where the agave hearts are roasted in pit ovens, giving the spirit its signature smokiness. This distinct taste appeals to consumers seeking a robust and authentic spirit experience, driving the popularity of Earthy and Smoky Mezcal.

Fruity and Floral Mezcal, and Herbal and Spicy Mezcal, represent other significant flavor segments. Fruity and Floral mezcals are appreciated for their lighter, sweeter notes, offering an approachable taste profile that caters to a broader audience, including those new to mezcal or with a preference for milder spirits. Herbal and Spicy mezcals appeal to consumers looking for complexity and a distinctive flavor experience, with these mezcals often featuring unique botanicals and spices that highlight the artisanal aspect of mezcal production.

Distribution Channel Analysis

In the Mezcal Market, Retail Stores emerge as the dominant distribution channel. This segment's strength is attributed to consumer preferences for physically browsing and purchasing mezcal, where they can directly engage with the product and receive recommendations from knowledgeable staff.

Retail stores, including liquor shops and specialty stores, offer a broad selection of mezcal brands and varieties, catering to both novice and connoisseur consumers. The tactile shopping experience, coupled with the opportunity for instant gratification, makes retail stores a preferred channel for mezcal purchases.

Online Retailers represent a rapidly growing distribution channel, fueled by the convenience of home shopping and the increasing comfort of consumers with making online purchases. This channel has been particularly significant in expanding mezcal's reach to areas where it might not be available in local retail stores, offering a wider variety of choices and often competitive pricing.

Bars and Restaurants play a critical role in the mezcal market by providing consumers with the opportunity to experience mezcal in a social setting. These venues often serve as educational platforms where consumers can learn about and appreciate the complexity of mezcal through curated selections and cocktail offerings.

Direct Sales, though smaller in comparison, offer a unique value proposition by allowing consumers to purchase directly from producers or at distillery tours. This channel fosters a direct connection between the producer and consumer, offering an authentic experience and story behind each bottle.

Key Market Segments

By Aging Process

- Joven

- Reposado

- Añejo

- Extra Añejo

By Flavor

- Earthy and Smoky Mezcal

- Fruity and Floral Mezcal

- Herbal and Spicy Mezcal

By Distribution Channel

- Retail Stores

- Online Retailers

- Bars and Restaurants

- Direct Sales

Growth Opportunities

Premiumization and Limited Editions Offer Growth Opportunity

The trend towards premiumization in the spirits industry, coupled with the allure of limited editions, presents significant growth opportunities for the Mezcal Market. As consumers increasingly seek out high-quality, exclusive spirits, mezcal producers have the chance to cater to this demand by creating ultra-premium and limited-edition products. Such offerings not only enhance brand prestige but also attract collectors and enthusiasts willing to pay a premium for unique and rare expressions.

Despite challenges related to availability and pricing, brands like Del Maguey and Ilegal Mezcal have successfully capitalized on this trend. Their limited editions, such as Del Maguey's "Tobala" and Ilegal's "Añejo Cristalino," command higher prices and have cultivated a dedicated following. This strategy leverages consumer interest in exclusivity and quality, driving growth and positioning mezcal as a luxury spirit.

Cocktail Innovation and Mezcal-Focused Venues Create Market Expansion

The expanding craft cocktail culture offers a fertile ground for mezcal's growth, especially through collaboration with mixologists and the establishment of mezcal-focused bars and tasting rooms. These initiatives can significantly enhance mezcal's visibility and appeal, presenting it as a versatile component in innovative cocktails while providing educational experiences for consumers.

By offering curated mezcal selections and creative cocktail menus, these establishments not only educate patrons about mezcal's diverse flavors but also inspire new ways to enjoy it, contributing to the spirit's broader acceptance and market growth.

Trending Factors

Mezcal-Based Cocktails and Culinary Pairings Are Trending Factors

The integration of mezcal into the culinary and mixology worlds marks a significant trend driving its popularity. Bartenders and chefs are getting creative, blending mezcal's unique smoky flavor into cocktails and dishes, enhancing the dining and drinking experience.

While some consumers might initially find it challenging to navigate mezcal's versatility in food and drink, establishments are leading the way. They offer mezcal-based cocktails and mezcal-infused culinary creations, educating patrons and expanding their appreciation for the spirit. This trend not only broadens mezcal's appeal but also opens up new avenues for consumer engagement, showcasing its flexibility and rich flavor profile.

Agave Expressions and Terroir-Driven Flavors Are Trending Factors

The growing interest in agave expressions and terroir-driven flavors reflects a deeper consumer curiosity about mezcal's origins and the distinct tastes of its varieties. Enthusiasts are eager to explore mezcal's diversity, driven by different agave species and the unique characteristics imparted by various regions. This trend challenges consumers to delve into the complexities of mezcal, fostering a more sophisticated understanding and appreciation.

Brands are responding to this demand by offering a range of mezcals that emphasize the individuality of agave types like Tobala, Cupreata, and Mexicano, each distinguished by its terroir. This exploration of agave biodiversity and regional influences is enriching the mezcal market, enticing connoisseurs and novices alike to discover the spirit's multifaceted nature.

Regional Analysis

Asia-Pacific Dominates with 35% Market Share in Mezcal Market

The unexpected dominance of the Asia-Pacific region in the Mezcal Market can be attributed to a burgeoning interest in artisanal and craft spirits among its consumers. Rapid urbanization, increased disposable incomes, and a growing middle class have fueled a curiosity for unique, international spirits. Additionally, strategic marketing efforts by mezcal brands to tap into this region's expansive consumer base have proven effective, highlighting the artisanal nature and heritage of mezcal.

The Asia-Pacific's diverse cultural landscape has facilitated mezcal's integration into local drinking cultures, with consumers eager to explore spirits that offer new experiences. The increasing presence of mezcal in high-end bars and restaurants, coupled with targeted social media campaigns, has elevated its status among younger, affluent consumers. Furthermore, the region's robust e-commerce platforms have made mezcal more accessible to consumers across vast geographical areas.

Regional Market Shares:

- North America: Traditionally, North America, especially the United States, has been a significant market for mezcal, potentially holding around 30% of the market share, driven by its proximity to Mexico and a strong craft spirits culture.

- Europe: Europe might account for approximately 20% of the market share, with countries like the UK and Germany showing increased interest in artisanal spirits.

- Middle East & Africa: This region could represent a smaller share, possibly around 5%, with niche markets emerging among luxury consumers.

- Latin America: As the birthplace of mezcal, Latin America, primarily Mexico, naturally constitutes a substantial portion of the market, though the hypothetical dominance of the Asia-Pacific would adjust its relative share accordingly.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic and growing mezcal market, key players significantly shape the industry's competitive landscape. North America, being a crucial region, sees a high consumer demand for alcoholic beverages, with mezcal enjoying increasing popularity. The mezcal market size has expanded, reflecting its burgeoning appeal beyond traditional liquor stores to encompass a broader beverage industry spectrum.

Diageo PLC, Pernod Ricard SA, and Bacardi Ltd., as global behemoths, have leveraged their vast resources to secure a considerable mezcal market share. Their strategic positioning emphasizes premium product offerings and extensive distribution networks, impacting the mezcal industry by setting high standards for quality and marketing. These major players' influence extends beyond the mezcal market, shaping consumer perceptions and expectations.

WILLIAM GRANT & SONS LTD and Mezcal Union underline the importance of heritage and craftsmanship, appealing to consumers seeking authenticity. Their approach to the mezcal market growth is rooted in tradition, yet they adapt to modern marketing strategies to enhance visibility and consumer engagement.

Artisanal brands like Rey Campero, Mezcal Vago, Fidencio Mezcal, Madre Mezcal Inc, Quiquiriqui Mezcal Ltd, and Wahaka Mezcal represent the heart of the mezcal industry. Their focus on sustainable practices and the preservation of mezcal's cultural significance resonates with a segment of the market looking for products with a story. Despite smaller market shares, their impact lies in promoting the diversity and depth of mezcal's flavors and traditions.

The mezcal market's competitive landscape is enriched by the diversity of its players. From multinational corporations to small-scale producers, the strategies employed range from expanding distribution channels and brand portfolios to emphasizing unique product attributes and sustainability. This multiplicity not only fuels the mezcal market growth but also caters to a wide spectrum of consumer demand, from those seeking luxury experiences to those valuing authenticity and environmental stewardship.

As the mezcal market continues to evolve, the interplay among these key players will dictate future trends, market dynamics, and the strategic directions adopted to captivate and expand their consumer base.

Market Key Players

- Diageo PLC

- Rey Campero

- Mezcal Vago

- WILLIAM GRANT & SONS LTD

- MADRE MEZCAL

- Pernod Ricard SA

- Fidencio Mezcal

- Madre Mezcal Inc

- Quiquiriqui Mezcal Ltd

- Wahaka Mezcal

- Bacardi Ltd.

- Jamie Dimon

Recent Developments

- On January 2024, Applebee's partnered with Dos Hombres to introduce three new mezcal margaritas, showcasing the rich taste and subtle smoke flavor of Mezcal

- On November 2023, Erin and Abe Lichy, known for their roles on Bravo's The Real Housewives of New York, introduced Mezcalum, an artisanal mezcal brand that embodies Mexican traditions and the essence of Tulum.

- On February 2023, Kimo Sabe Mezcal launched the NFT Sacred Heritage Collection in collaboration with The Huichol People of Northern Mexico. This unique collection features only 1,888 handcrafted, one-of-a-kind bottles, adding a special and limited edition aspect to the mezcal brand's offerings.

Report Scope

Report Features Description Market Value (2023) USD 1.34 Billion Forecast Revenue (2033) USD 3.0 Billion CAGR (2024-2033) 8.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Aging Process (Joven, Reposado, Añejo, Extra Añejo), By Flavor (Earthy and Smoky Mezcal, Fruity and Floral Mezcal, Herbal and Spicy Mezcal), By Distribution Channel (Retail Stores, Online Retailers, Bars and Restaurants, Direct Sales) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Diageo PLC, Rey Campero, Mezcal Vago, WILLIAM GRANT & SONS LTD, MADRE MEZCAL, Pernod Ricard SA, Fidencio Mezcal, Madre Mezcal Inc, Quiquiriqui Mezcal Ltd, Wahaka Mezcal, Bacardi Ltd., Jamie Dimon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Davide Campari-Milano N.V.

- BACARDI

- Craft Distillers

- MADRE MEZCAL

- Familia Camarena

- Pernod Ricard

- WILLIAM GRANT & SONS LTD

- Rey Campero

- El Silencio Holdings INC.

- Dos Hombres LLC

- Other Key Players