Global Methyl Methacrylate (MMA) Market Trends, Applications, Analysis, Growth, and Forecast: 2017 to 2027

-

6633

-

May 2023

-

155

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

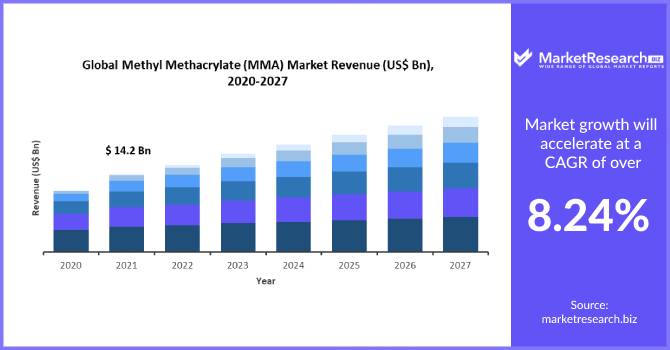

Global Methyl Methacrylate Market Overview :

“The global Methyl Methacrylate Market size is expected to be worth around US$ xx Billion by 2021 from US$ X.xx million in 2031, growing at a CAGR of X.x% during the forecast period 2021 to 2031.”

The report offers insightful and detailed information regarding the various key players operating in the market, their financials, supply chain trends, technological innovations, key developments, apart from future strategies, acquisitions & mergers, and market footprint. The global methyl methacrylate market report has been segmented on the basis of product, application, end-use industries, and region.

This report is based on synthesis, analysis, and interpretation of information gathered regarding the target market from various sources. Our analysts have analyzed the information and data and gained insights using a mix of primary and secondary research efforts with the primary objective to provide a holistic view of the market.

In addition, an in-house study has been made of the global economic conditions and other economic indicators and factors to assess their respective impact on the market historically, as well as the current impact in order to make informed forecasts about the scenarios in future.

Methyl methacrylate is an acid ester and is a colorless monomer compound. Methyl methacrylate is primarily used in the manufacturing process of poly-methyl methacrylate. Poly-methyl methacrylate is a transparent thermoplastic utilized as a shatter-resistant alternative for glass. Poly-methyl methacrylate is used in form of sheets to produce LCD screens, mobile phone screens, and monitors, owing to its excellent tensile strength, transparency, polishing, flexural strength, scratch resistance, and UV tolerance properties.

Methyl methacrylate is widely used in surface coatings (lacquers, acrylic latexes, and enamels) and adhesives. Some other key applications for methyl methacrylate include use for impact modification as emulsion polymers principally for textiles, leather, paper, and floor polishes, in the mineral-filled sheet, polymer concrete, and polyesters. Methyl methacrylate is also used as a starting material to produce other esters of methacrylic acid (via transesterification).

Rising demand for methyl methacrylate products from the automotive and construction industries is a major factor driving growth of the global methyl methacrylate market. In addition, rising demand for methyl methacrylate from aviation industries is another major factor driving growth of the global methyl methacrylate market.

Rising demand from automobiles industry, owing to its improved vehicle design capabilities, and increasing acceptance of emission control and lightweight vehicles are other major factors expected to drive growth of the global methyl methacrylate market.

Asia Pacific methyl methacrylate market is estimated to account for major share in terms of revenue in the global methyl methacrylate market. Asia Pacific methyl methacrylate market is also anticipated to witness fastest growth in terms of revenue over the next 5 years, owing to increasing demand from the automobile, electronics, and construction industries the in countries in this region.

China market is expected to account for significant share in terms of revenue in the Asia Pacific, whereas the India market is anticipated to register highest CAGR over the forecast period. Rapid growth in urban regions and increasing disposable income of people in this region are key factors fueling growth of construction, automotive, and electronics industries, which in turn is expected to fuel growth of methyl methacrylate in this region.

Global Methyl Methacrylate Market Segmentation:

Segmentation by products:

- Poly methyl methacrylate (PMAA)

- Methacrylic acid (MAA)

- Methyl methacrylate-butadiene-styrene (MBS)

- Ethyl methacrylate (EMA)

- Butyl methacrylate (BMA)

- 2-ethyl hexyl methacrylate(2-EHMA)

Segmentation by application:

- Transparent glass substitute

- Adhesive

- Medical implants

- Resin

- Surface coatings

- Others (lenses, daylight redirection, and emulsion polymers)

Segmentation by end-use industries:

- Construction

- Automotive

- Electronics

- Aviation

- Others (medical, paints, and sports)

Segmentation by region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Evonik Industries AG

- DowDuPont, Inc.

- Sumitomo Chemical Company, Limited

- Formosa Plastics Corporation

- Arkema Inc.

- Saudi Basic Industries Corporation (SABIC)

- Kuraray Co., Ltd.

- Mitsubishi Chemical Holdings Corporation

- Asahi Kasei Corporation

- Huntsman International LLC