Metamaterials Market By Product (Electromagnetic, Terahertz, Tunable, Photonic, Frequency Selective Surface (FSS)), By Application (Antenna and Radar, Sensors, Solar Panel and Absorbers, Medical Imaging, Display, Cloaking Devices, Super Lens, Sound Filtering), By End User (Medical, Energy and Power, Telecommunication, Aerospace and Defense, Electronics, Automotive), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46811

-

May 2024

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

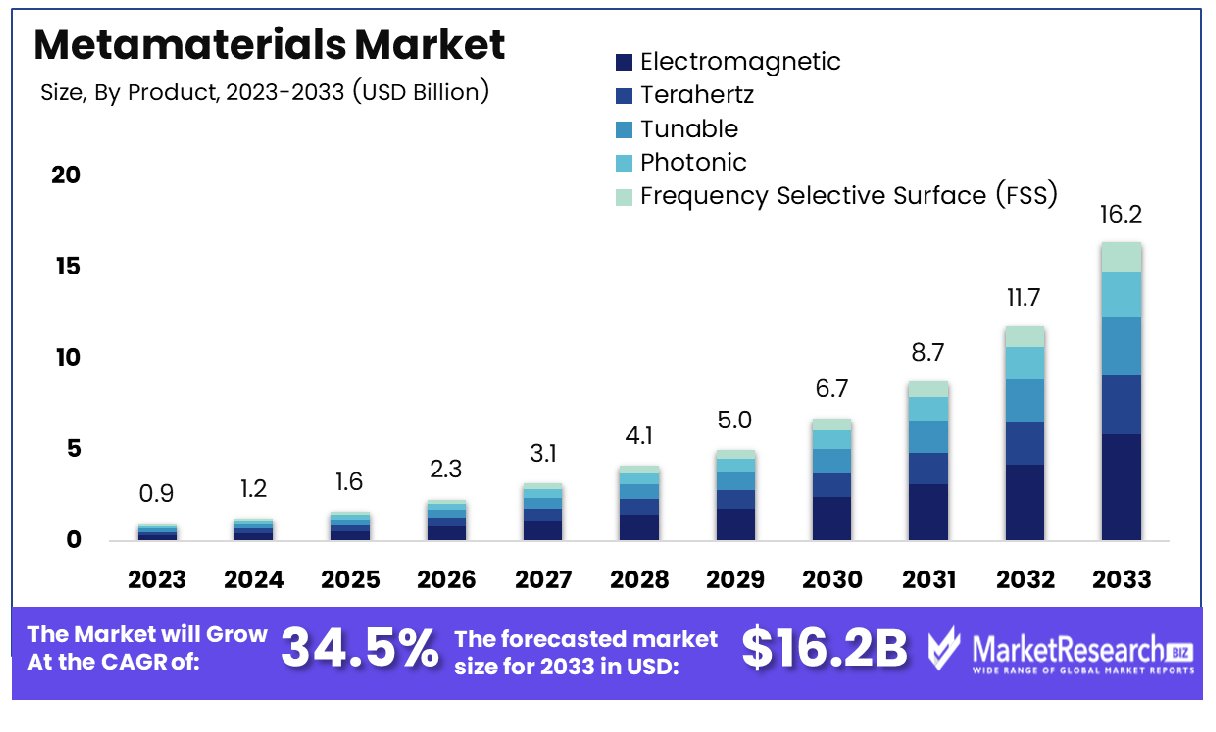

The Global Metamaterials Market was valued at USD 0.9 Bn in 2023. It is expected to reach USD 16.2 Bn by 2033, with a CAGR of 34.5% during the forecast period from 2024 to 2033.

The Metamaterials Market refers to the burgeoning industry focused on materials engineered with properties not found in nature. Leveraging cutting-edge advancements in physics and nanotechnology, metamaterials possess remarkable capabilities to manipulate electromagnetic waves, sound, and other phenomena. This market encompasses a diverse range of applications spanning telecommunications, aerospace, healthcare, and beyond. Metamaterials offer unprecedented opportunities for innovation, enabling the development of ultra-efficient antennas, advanced sensors, cloaking devices, and high-resolution imaging systems.

The metamaterials market is poised for significant growth and innovation, driven by advancements in materials science and burgeoning applications across various industries. Metamaterials, as explored by Veselago in 1968, exhibit unique properties such as negative permittivity and permeability, not found in naturally occurring materials. These characteristics unlock a realm of possibilities for novel device design and functionality, fueling the demand for metamaterial-based solutions.

The metamaterials market is poised for significant growth and innovation, driven by advancements in materials science and burgeoning applications across various industries. Metamaterials, as explored by Veselago in 1968, exhibit unique properties such as negative permittivity and permeability, not found in naturally occurring materials. These characteristics unlock a realm of possibilities for novel device design and functionality, fueling the demand for metamaterial-based solutions.Recent projections by Vicari et al. (2019) underscore the market's potential, with anticipated growth across eight key applications. By 2030, the metamaterial device market is forecasted to reach $10.7 billion, indicating substantial opportunities for stakeholders. Notably, the dominance of communications applications in the early forecast period is expected to shift by 2030, with sensing technologies projected to surpass communications, reaching $5.5 billion compared to $4.4 billion, respectively.

The metamaterials landscape presents a dynamic environment characterized by rapid innovation and evolving demand dynamics. Companies operating in this space must remain agile, leveraging technological advancements to capitalize on emerging opportunities. Furthermore, strategic partnerships and collaborations will be pivotal in driving market penetration and fostering sustainable growth.

Key Takeaways

- Market Value: The Global Metamaterials Market was valued at USD 0.9 Bn in 2023. It is expected to reach USD 16.2 Bn by 2033, with a CAGR of 34.5% during the forecast period from 2024 to 2033.

- By Product: In the Metamaterials Market, Electromagnetic materials dominate, capturing 30% of the market share, driven by their applications ranging from electricity generation to telecommunications and medical imaging.

- By Application: Antenna and Radar systems lead in usage, accounting for 25% of the market, reflecting the crucial role of metamaterials in enhancing communication and radar functionalities.

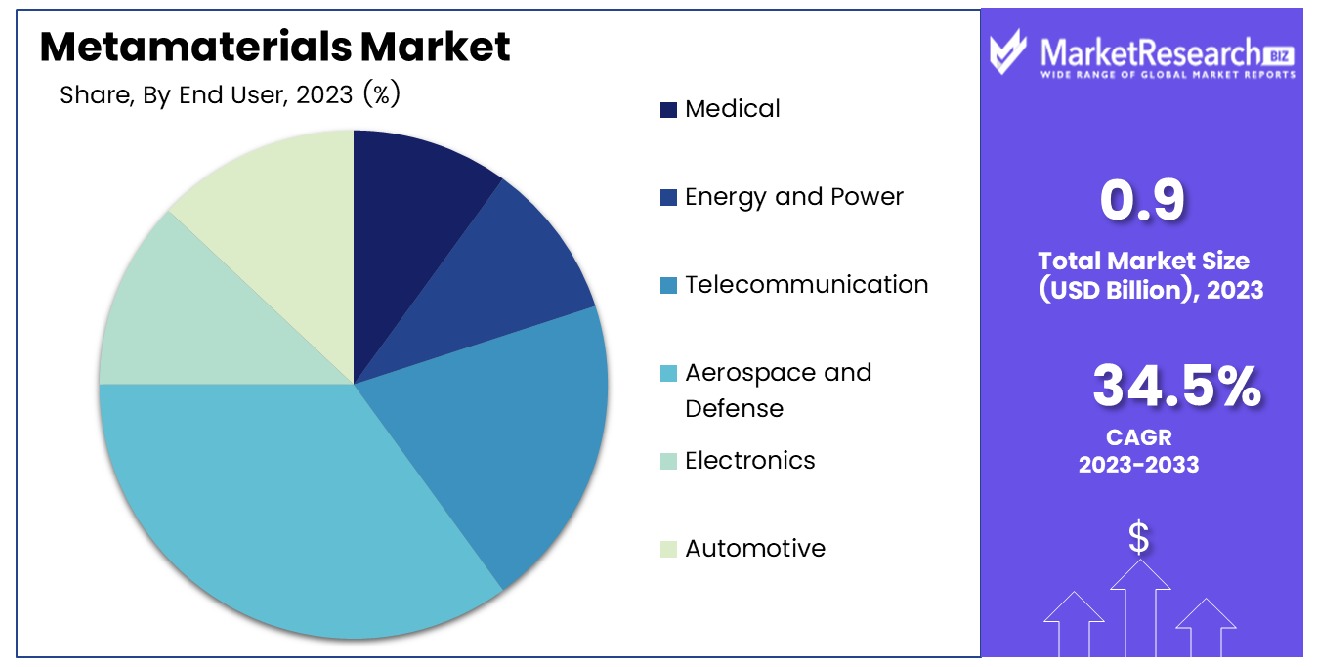

- By End User: Aerospace and Defense sectors emerge as the primary users, constituting 35% of the market, owing to the demand for advanced materials to improve aircraft performance and defense systems.

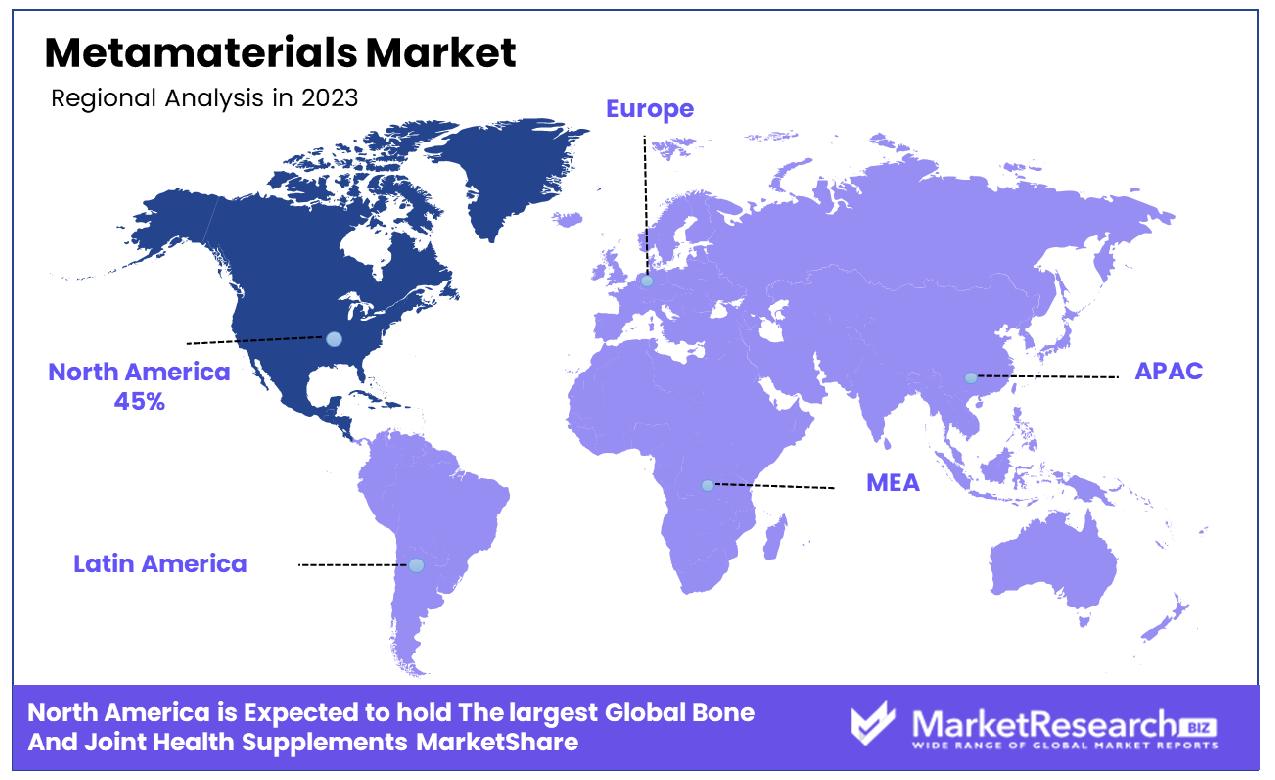

- Regional Dominance: North America asserts its dominance in the Metamaterials Market, commanding a substantial 45% market share.

- Growth Opportunity: The Metamaterials Market holds immense growth potential globally, driven by burgeoning demand for applications in telecommunications, aerospace, and medical imaging, coupled with ongoing innovations in material design and manufacturing processes.

Driving factors

Telecom and Medical Applications

Metamaterials have gained significant traction in both the telecom and medical sectors, playing a pivotal role in driving market expansion. In the telecom industry, the demand for high-performance materials to enhance antenna efficiency and signal processing capabilities has surged. Metamaterials offer unique properties such as negative refractive index and tunability, making them ideal for applications like beamforming, signal filtering, and miniaturization of devices. As telecom companies strive to improve network performance and accommodate the increasing data traffic associated with technologies like 5G, the adoption of metamaterial-based solutions becomes inevitable.

In the medical realm, metamaterials have emerged as revolutionary tools for diagnostic imaging, sensing, and therapy. Metamaterial-based lenses and structures enable the development of advanced medical devices with improved resolution, sensitivity, and functionality. For instance, metamaterial-enhanced MRI coils have demonstrated enhanced signal-to-noise ratios, leading to sharper images and more accurate diagnoses. Additionally, metamaterials hold promise in areas such as non-invasive monitoring, drug delivery systems, and even cloaking technologies for surgical instruments.

Aerospace and Defense Investments

The aerospace and defense sectors are significant contributors to the growth trajectory of the metamaterials market, driven by investments in research, development, and deployment of advanced technologies. Metamaterials offer unparalleled capabilities in areas such as stealth, radar absorption, electromagnetic shielding, and lightweight structural components, aligning perfectly with the stringent requirements of aerospace and defense applications.

In aerospace, the demand for metamaterials stems from the imperative to enhance aircraft performance, reduce radar cross-sections, and mitigate electromagnetic interference. Metamaterial-based structures enable the design of lightweight yet robust materials with tailored electromagnetic properties, facilitating the development of next-generation aircraft with improved efficiency, maneuverability, and survivability.

5G Technology Adoption

The widespread adoption of 5G technology serves as a pivotal catalyst for the metamaterials market, revolutionizing wireless communications and spurring demand for high-performance materials. Metamaterials play a crucial role in enabling the deployment of 5G networks by addressing key challenges such as spectrum congestion, signal propagation, and antenna efficiency.

One of the primary applications of metamaterials in the context of 5G is in antenna design and optimization. Metamaterial-based antennas offer superior performance characteristics, including enhanced gain, beam steering, and multi-band operation, essential for realizing the full potential of 5G networks. By leveraging metamaterials, telecom operators can overcome the limitations of conventional antenna technologies and deliver robust, high-speed connectivity to meet the ever-increasing demands of mobile consumers and IoT devices.

Restraining Factors

Lack of Awareness

One of the significant barriers hindering the metamaterials market's full potential is the lack of awareness among potential end-users and stakeholders. Despite the remarkable capabilities and diverse applications of metamaterials, many industries remain unaware of their existence or potential benefits. Addressing this challenge is crucial for unlocking new opportunities and driving market growth.

Educational initiatives and outreach programs play a pivotal role in raising awareness about metamaterials and their transformative potential. Collaborative efforts involving industry associations, research institutions, and government agencies can facilitate knowledge dissemination through workshops, seminars, and training programs. By showcasing real-world examples and practical applications, these initiatives can demystify metamaterials and illustrate their value proposition to target audiences.

Design and Fabrication Challenges

Design and fabrication challenges represent significant obstacles to the widespread adoption of metamaterials, impacting their scalability, cost-effectiveness, and commercial viability. Overcoming these hurdles is essential for unlocking the full potential of metamaterial technologies and driving market growth.

Innovations in design methodologies and computational tools are instrumental in addressing the complexities associated with metamaterial design. Advanced simulation techniques, such as finite element analysis (FEA) and computational electromagnetics, enable engineers to model and optimize metamaterial structures with precision, reducing the time and resources required for iterative prototyping. Additionally, machine learning algorithms and optimization algorithms can automate the design process, accelerating the discovery of novel metamaterial configurations and performance enhancements.

By Product Analysis

Electromagnetic materials dominate the metamaterials market, holding 30%.

In 2023, Electromagnetic held a dominant market position in the By Product segment of the Metamaterials Market, capturing more than a 30% share. This segment's prominence reflects the widespread adoption and versatile applications of electromagnetic metamaterials across various industries and sectors.

The dominance of Electromagnetic metamaterials in this segment can be attributed to their unique properties and capabilities. Electromagnetic metamaterials are engineered to manipulate electromagnetic waves in unprecedented ways, enabling breakthrough innovations in areas such as telecommunications, imaging, sensing, and energy harvesting.

One key advantage of electromagnetic metamaterials is their ability to control the propagation of electromagnetic waves across a broad spectrum, from radio frequencies to optical frequencies. This versatility makes them suitable for a wide range of applications, from antenna design and microwave components to optical devices and cloaking technology.

By Application Analysis

Antenna and Radar systems lead applications, accounting for 25%.

In 2023, Antenna and Radar held a dominant market position in the By Application segment of the Metamaterials Market, capturing more than a 25% share. This segment's leadership underscores the critical role of metamaterials in advancing antenna and radar technologies across various industries and applications.

The dominance of Antenna and Radar metamaterials in this segment can be attributed to their ability to address longstanding challenges in wireless communication, radar systems, and signal processing. Metamaterial-based antennas offer enhanced performance characteristics, such as improved bandwidth, efficiency, and directivity, compared to traditional antenna designs.

Metamaterials enable the development of compact, lightweight, and multifunctional radar system with improved sensitivity, resolution, and range. These advancements have significant implications for defense, aerospace, automotive, and telecommunications industries, driving demand for metamaterial-based solutions.

By End User Analysis

Aerospace and Defense sectors are primary users, constituting 35%.

In 2023, Aerospace and Defense held a dominant market position in the By End User segment of the Metamaterials Market, capturing more than a 35% share. This segment's prominence underscores the crucial role of metamaterials in advancing technological innovation and performance in the aerospace and defense sectors.

The dominance of Aerospace and Defense end users in this segment can be attributed to the stringent performance requirements, technological sophistication, and strategic importance of metamaterials in these industries. Metamaterials offer unique capabilities to enhance aircraft performance, improve military capabilities, and enable next-generation defense systems.

One key factor driving the adoption of metamaterials in the Aerospace and Defense sector is their ability to manipulate electromagnetic waves, enabling radar stealth, antenna miniaturization, and electromagnetic shielding in aircraft and military equipment. Metamaterial-based antennas and radomes, for example, enable enhanced communication and surveillance capabilities while reducing the radar cross-section of military platforms.

Key Market Segments

By Product

- Electromagnetic

- Terahertz

- Tunable

- Photonic

- Frequency Selective Surface (FSS)

By Application

- Antenna and Radar

- Sensors

- Solar Panel and Absorbers

- Medical Imaging

- Display

- Cloaking Devices

- Super Lens

- Sound Filtering

By End User

- Medical

- Energy and Power

- Telecommunication

- Aerospace and Defense

- Electronics

- Automotive

Growth Opportunity

Transformation Optics and Cloaking

Transformation optics, a revolutionary concept that enables the manipulation of electromagnetic fields through metamaterial structures, emerges as a pivotal driver of growth and innovation in the metamaterials market. By bending and controlling light at will, metamaterials facilitate the development of transformative applications such as cloaking devices, invisibility cloaks, and advanced optics.

These breakthroughs hold immense potential across diverse sectors, including defense, telecommunications, and consumer electronics, where the ability to manipulate light can revolutionize product design, performance, and functionality. With increasing research focus and technological advancements in transformation optics, the metamaterials market stands poised to capitalize on the commercialization of these pioneering solutions, unlocking new revenue streams and market opportunities.

Efficient Solar Power

In the quest for sustainable energy sources, metamaterials emerge as enablers of efficient solar power generation, presenting a significant growth opportunity for the market. Metamaterial-based solar cells offer unparalleled capabilities in light absorption, spectrum management, and energy conversion efficiency, surpassing the limitations of conventional photovoltaic technologies. By leveraging metamaterials, solar panel manufacturers can enhance energy harvesting efficiency, reduce production costs, and improve overall system performance, driving widespread adoption of solar power solutions across residential, commercial, and industrial sectors.

With the global push towards renewable energy and the increasing emphasis on decarbonization, metamaterial-based solar technologies are poised to play a pivotal role in shaping the future of sustainable energy generation, creating vast opportunities for market players to capitalize on the growing demand for clean energy solutions.

Latest Trends

Increased Research Funding

One prominent trend driving the metamaterials market's growth is the surge in research funding from government agencies, private investors, and academic institutions. With growing recognition of metamaterials' transformative potential across various industries, stakeholders are allocating significant resources to advance research and development efforts.

This influx of funding accelerates innovation, fosters collaboration between academia and industry, and propels the commercialization of metamaterial-based solutions. Moreover, initiatives such as public-private partnerships and government grants provide critical support for tackling fundamental research challenges and overcoming barriers to market entry, paving the way for widespread adoption of metamaterial technologies.

Rising Demand for Communication Antennas

Another notable trend shaping the metamaterials market is the escalating demand for communication antennas with the advent of 5G technology and the proliferation of wireless connectivity. Metamaterial-based antennas offer superior performance characteristics, including enhanced bandwidth, beamforming capabilities, and miniaturization, making them ideal for next-generation wireless communication systems.

As telecom operators upgrade their infrastructure to accommodate the growing data traffic and bandwidth requirements of 5G networks, the demand for advanced antennas continues to rise. Metamaterials enable the design of antennas that meet these evolving needs, driving market growth and innovation in the telecommunications sector. Emerging applications such as Internet of Things (IoT), autonomous vehicles, and smart cities further fuel the demand for high-performance communication antennas, positioning metamaterials as a key enabler of future wireless technologies.

Regional Analysis

North America asserts its dominance with 45% share in metamaterials market.

North America dominates the global metamaterials market, commanding a 45% share. This leadership stems from substantial investments in R&D and technological advancements, particularly in industries like telecommunications and aerospace. The United States, home to key players like Metamaterial Technologies Inc. and Kymeta Corporation, leads the region's market landscape. With diverse applications spanning antenna design and medical imaging, North America is poised for sustained growth.

Europe represents a significant market for metamaterials, driven by robust industrialization and innovation. Germany, the United Kingdom, and France are key contributors, fostering a favorable environment for market growth. Strategic collaborations between research institutions and industries propel innovation across various sectors, from consumer electronics to healthcare devices. Europe's focus on sustainability and energy efficiency further boosts metamaterials adoption.

In the Asia Pacific, rapid industrialization and urbanization fuel demand for advanced materials like metamaterials. Countries such as China, Japan, and South Korea are investing heavily in R&D, particularly in electronics and telecommunications. Opportunities abound in sectors like 5G technology, automotive components, and aerospace structures, positioning the region as a key contributor to global market growth.

The Middle East & Africa and Latin America regions show steady growth in the metamaterials market, albeit slower than other regions. Increasing investments in telecommunications infrastructure and rising awareness about metamaterials benefits drive market expansion. However, challenges like limited technological expertise and infrastructure constraints hinder growth. Nonetheless, evolving regulatory frameworks and collaborations with global players present promising opportunities for market development in these regions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Metamaterials Market is poised for significant growth, with several key players driving innovation and market expansion. Among these key companies, Acoustic Metamaterials Group Ltd stands out for its pioneering work in utilizing metamaterials to manipulate sound waves. Their cutting-edge research and development efforts have resulted in groundbreaking advancements in noise control, acoustic cloaking, and sound filtering technologies. As industries increasingly prioritize noise reduction and enhanced sound management, Acoustic Metamaterials Group Ltd is well-positioned to capitalize on these market demands.

Echodyne Corp, another key player, has been instrumental in revolutionizing radar systems through the application of metamaterials. By leveraging metamaterial-based radar technologies, Echodyne Corp has enabled unprecedented radar performance in terms of resolution, range, and adaptability. As defense, aerospace, and automotive sectors seek to enhance their situational awareness and safety measures, Echodyne Corp's innovations are expected to drive significant market growth.

Palo Alto Research Center Incorporated (PARC) also plays a crucial role in advancing metamaterial applications, particularly in the fields of photonics and optoelectronics. PARC's research spans a wide range of applications, including high-speed data transmission, optical sensing, and augmented reality displays. With their expertise in metamaterial design and fabrication, PARC is poised to fuel advancements in communication technologies and optical devices, thereby shaping the future of information exchange and immersive experiences.

Market Key Players

- Acoustic Metamaterials Group Ltd

- Echodyne Corp

- Palo Alto Research Center Incorporated

- Fractal Antenna Systems Inc.

- JEM Engineering LLC

- Kymeta Corporation

- Metamagnetics Inc

- Metamaterial Technologies Inc.

- MetaShield LLC

- Nanoscribe GmbH & Co. KG (Cellink AB)

- Plasmonics Inc.

- TeraView Limited

Recent Development

- In May 2024, IDTechEx explores the potential of Automotive Heads-Up Displays (HUDs) to revolutionize driver experience, focusing on safety, customization, and communication.

- In May 2024, BASF Venture Capital invests in Phomera Metamaterials Inc. during Series A round for photonic crystal metamaterial development, aiming for sustainable technology and material innovation.

- In April 2024, Meta Materials Inc. schedules a corporate update aiming to discuss its advancements in advanced materials and nanotechnology, catering to industries like aerospace, consumer electronics, and clean energy.

Report Scope

Report Features Description Market Value (2023) USD 0.9 Bn Forecast Revenue (2033) USD 16.2 Bn CAGR (2024-2033) 34.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Electromagnetic, Terahertz, Tunable, Photonic, Frequency Selective Surface (FSS)), By Application (Antenna and Radar, Sensors, Solar Panel and Absorbers, Medical Imaging, Display, Cloaking Devices, Super Lens, Sound Filtering), By End User (Medical, Energy and Power, Telecommunication, Aerospace and Defense, Electronics, Automotive) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Acoustic Metamaterials Group Ltd, Echodyne Corp, Palo Alto Research Center Incorporated, Fractal Antenna Systems Inc., JEM Engineering LLC, Kymeta Corporation, Metamagnetics Inc, Metamaterial Technologies Inc., MetaShield LLC, Nanoscribe GmbH & Co. KG (Cellink AB), Plasmonics Inc., TeraView Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Acoustic Metamaterials Group Ltd

- Echodyne Corp

- Palo Alto Research Center Incorporated

- Fractal Antenna Systems Inc.

- JEM Engineering LLC

- Kymeta Corporation

- Metamagnetics Inc

- Metamaterial Technologies Inc.

- MetaShield LLC

- Nanoscribe GmbH & Co. KG (Cellink AB)

- Plasmonics Inc.

- TeraView Limited