Global Metallurgical Coke Market by Product Typplication (Steel, Foundry Industry, and Other Applications) and by Region – Global Forecast to 2033

-

17345

-

April 2023

-

90

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

The global metallurgical coke market is projected to reach US$ 437.3 Mn by 2033 from US$ 278.9 Mn in 2023 at a CAGR of 4.6%

The metallurgical coke market is extracted from coking or metallurgical coal, which is obtained by the distillation process. In this process, coking coal is distilled at a particularly high temperature (more than 1100oC) in the coke oven in the absence of oxygen.

The resulting product is called Metallurgical Coke. This process is conducted so that coal can be purified from its volatile components. Metallurgical coke is also called met coke, met coke is a key ingredient used in steel and iron manufacturing industries.

Metallurgical Coke Market Overview

Steel is made from iron ore and other elements by heating met coke and limestone in a blast furnace. Because of the stable burning temperature property of met coke and generation of low or no smoke allow it to use vastly in diversified industries such as iron or steel as met coke generates heat without harming the environment enormously.

Some of the data says that more than 90% of the met coke produced is used in these industries. Increasing usage of technology like the dry quenching process helps in decreasing air pollution as compared to conventional processes.

Rapid growing industrialization in emerging nations and enhancement in the steel plants is expected to bolster the growth of the metallurgical coke market globally.

Some factors that contribute to the growth of global metallurgical coke are the rapid growth of steel and iron industries, the versatility of met coke such as steam generation during dry quenching, which can be used to generate electricity in a considerable amount, increased expenditure in infrastructure fuel.

Limited mining approvals by the government and lesser availability of high-quality coal across the regions are the primary reasons that hinder the growth of the target market. Technological advancement in the furnace industry and increased industrialization in emerging economies have created growth opportunities for the global metallurgical coke market.

[report-coverage short_image="https://marketresearch.biz/wp-content/uploads/2020/12/Global-Metallurgical-Coke-Market-Infographics-Segment.jpg"]

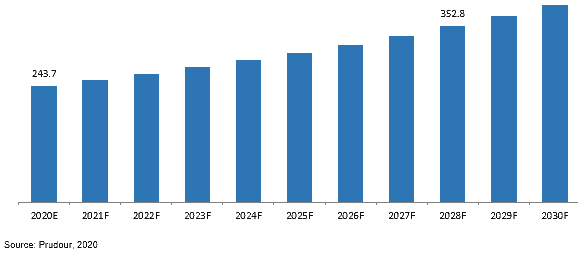

Global Metallurgical Coke Market Revenue (US$ Mn), 2020–2030

Amongst Product Types, the blast furnace coke segment in the global metallurgical coke market is estimated to account for a majority revenue share. Among all the applications, the steel segment is expected to register the highest CAGR.

China's market is expected to dominate the global metallurgical coke market. It is expected to account for the largest market revenue share as compared to that of markets in other regions.

Competitive Landscape

The metallurgical coke market is highly competitive, with several major players dominating the industry. Some of the key players in the market include:

- Steel Corporation

- BlueScope Steel Limited

- Drummond Company Inc. (ABC Coke)

- Gujarat NRE Coke Limited

- JSW Steel Limited

- Hickman

- Williams & Company

- Mid-Continent Coal & Coke Company

- Angang Steel Co.Ltd.

- China Baowu Steel Group Corporation Limited

- ArcelorMittal

- Nippon Steel & Sumitomo Metal Corporation

- POSCO

- Tata Steel Limited

- SunCoke Energy Inc.

- Risun Coal Chemicals Group Ltd.

- Shanxi Coking Coal Group Co.Ltd.

- Taiyuan coal gasification (Group) Corporation Limited

- Shanxi Lubao Coking Group Co. Ltd.

- Jiangxi Black Cat Carbon Black Inc .Ltd

These companies are involved in the production, distribution, and sale of metallurgical coke to customers in various industries, including steel making, iron foundries, and cement production. In addition to these major players, there are several smaller companies operating in the market that specialize in the production of high-quality metallurgical coke for niche markets. The market is also characterized by a high degree of vertical integration, with many steel makers owning or investing in coke production facilities to ensure a reliable supply of coke for their operations.

Segmentation of the Global Metallurgical Coke Market:

Segmentation by Product:

- Blast Furnace Coke

- Nut Coke

- Buckwheat Coke

- Coke Breeze

- Coke Dust

Segmentation by Application:

- Steel

- Foundry Industry and Other Applications

Segmentation by Regions:

- North America

- Europe

- APAC

- South America

- MEA

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Steel Corporation

- BlueScope Steel Limited

- Drummond Company Inc. (ABC Coke)

- Gujarat NRE Coke Limited

- JSW Steel Limited

- Hickman

- Williams & Company

- Mid-Continent Coal & Coke Company

- Angang Steel Co.Ltd.

- China Baowu Steel Group Corporation Limited

- ArcelorMittal

- Nippon Steel & Sumitomo Metal Corporation

- POSCO

- Tata Steel Limited

- SunCoke Energy Inc.

- Risun Coal Chemicals Group Ltd.

- Shanxi Coking Coal Group Co.Ltd.

- Taiyuan coal gasification (Group) Corporation Limited

- Shanxi Lubao Coking Group Co. Ltd.

- Jiangxi Black Cat Carbon Black Inc .Ltd