Metal Stamping Market Based on Process (Blanking, Embossing, Bending, Other Process), Based on End-Use (Automotive, Aerospace, Consumer Electronics, Industrial Machinery, Other End-Uses), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5252

-

Jul 2023

-

150

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

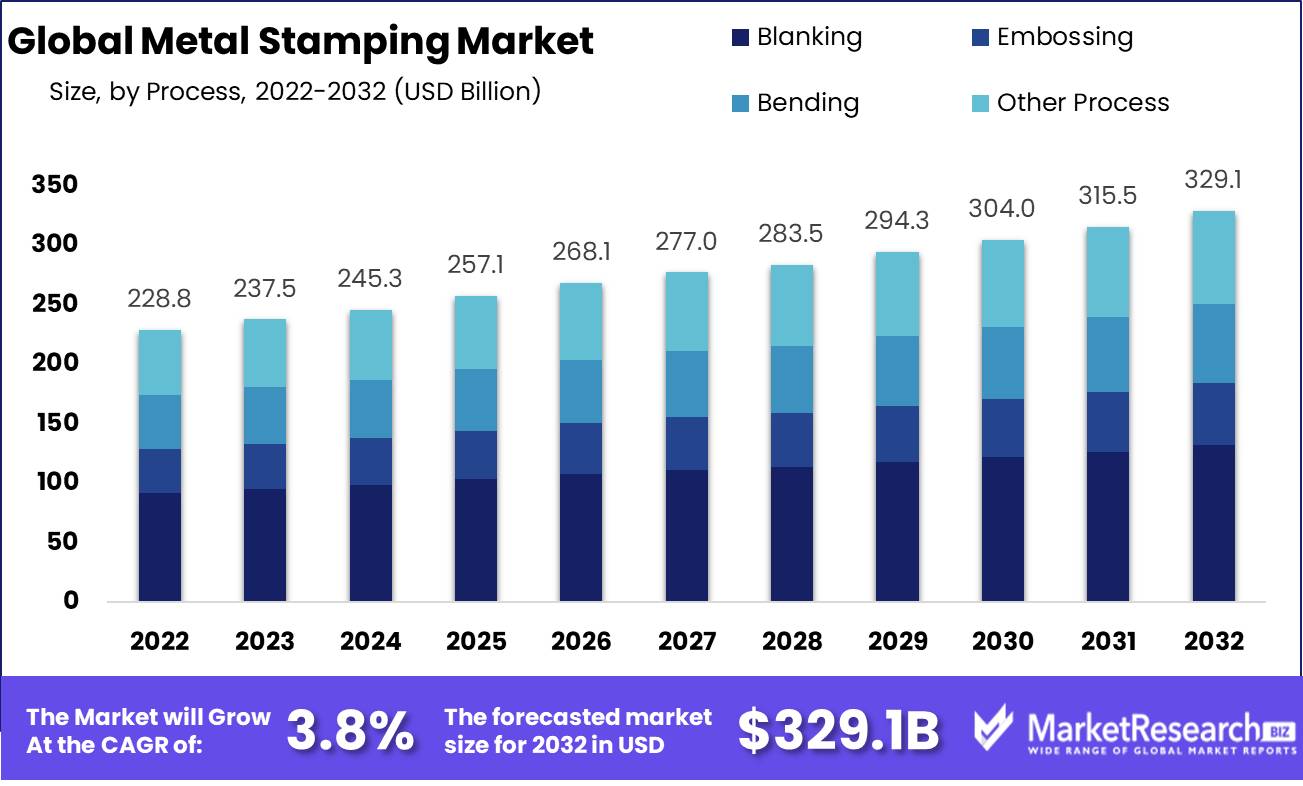

Metal Stamping Market size is expected to be worth around USD 329.1 Bn by 2032 from USD 228.8 Bn in 2022, growing at a CAGR of 3.8% during the forecast period from 2023 to 2032.

The metal stamping market covers the complicated process of making metal goods by combining pressing, forging, and die-casting. The exponential rise of the market can be explained by the growing need for metal goods in a wide range of end-use industries, such as the automotive, aerospace and defense, electronics, medical, and building industries. Metal stamping is the process of bending and forming metal sheets into many different shapes. This is done with a variety of tools and methods, such as blanking, cutting, embossing, coining, and bending. It shouldn't be a wonder that metal stamping has been a key and essential part of the modern industrial business for a long time.

The main goal of metal pressing is to make a large number of metal goods with great precision and accuracy. Specialized machinery is used to cut or shape metal sheets into shapes and sizes that have been carefully planned out. This is a very careful job that requires a lot of attention to detail.

Metal pressing has many benefits that make it better than other ways to make things. For example, it is cheaper, faster, and more accurate than other methods. Also, this process lets makers make complicated shapes and forms that would be hard to make with other methods. Suffice it to say that metal pressing is one of the most important steps in making metal parts that are used in many industries, such as the automobile, aerospace and defense, electronics, and medical device industries.

In recent years, there have been a lot of groundbreaking innovations in the metal stamping industry. These include the use of cutting-edge software for design and simulation, additive manufacturing techniques, and the introduction of robotics into the mix. The combination of these first-of-its-kind improvements has made the metal pressing process much more efficient and accurate, which has led to a decrease in production time and costs.

Driving factors

Impact of the expanding automotive sector

The Metal Stamping Market is expanding rapidly due to the prospering automotive industry. In response to the growing demand for automobiles, manufacturers are turning to metal stamping as a dependable means of manufacturing a variety of vehicle components. This increase in demand has resulted in the widespread adoption of metal stamping technology, making the automotive industry one of the largest consumers of metal-stamped components.

Emergence of Subsequent-Generation Stamping Technology

The rise of stamping technology of the next generation is a factor in the expansion of the metal stamping market. This innovative method surpasses conventional metal stamping techniques in terms of efficacy and cost-effectiveness. Experts anticipate that this revolutionary technology will acquire even more traction in the coming years, propelling the Metal Stamping Market to new heights.

Impact Potential of Emerging Technologies

Emerging technologies like 3D printing and automation have the potential to revolutionize the metal stamping industry, despite the fact that current regulations do not significantly alter the market. These cutting-edge innovations hold the key to increased manufacturing efficiency and cost-effectiveness, ultimately influencing the demand for metal-stamped components.

Restraining Factors

Fluctuating Raw Material Prices

The fluctuating price of raw materials is a significant factor restraining the metal stamping industry. Raw materials are an integral element of the process. The volatile cost of raw materials, such as steel, aluminum, and copper, has a negative impact on the profitability of manufacturers. In addition, the price of raw materials is influenced by various factors, including political instability, economic changes, supply chain disruptions, and environmental regulations. These factors make it challenging for manufacturers to predict production cost, plan their budgets, and maintain market competitiveness.

To overcome this challenge, manufacturers should contemplate diversifying their suppliers and investing in technologies that can recycle raw materials. This strategy can help them reduce their reliance on a single supplier and reduce supply chain risks. Moreover, recycling can help them save on raw material costs and reduce their carbon footprint.

Volatile Demand

The volatile demand for products is an additional important factor restraining the metal stamping market. Several end-user industries, such as the automotive, aerospace, healthcare, and electronics industries, drive the demand for metal stamping products. These industries are susceptible to economic fluctuations, shifting consumer preferences, and technological progress. Consequently, the demand for metal stamping products can fluctuate significantly, resulting in supply chain disruptions and market imbalances.

To overcome this challenge, manufacturers must employ a production strategy that is adaptable to fluctuating demand. This can include strategies such as just-in-time manufacturing, which can help them reduce inventory costs and improve their responsiveness to market changes. In addition, manufacturers should consider collaborating with customers and suppliers to establish long-term relationships that can facilitate stable demand and reduce supply chain risks.

Process Analysis

Blanking Segment Dominates Metal Stamping Market

Due to the emergence of new technologies and an increase in demand for stamped metal products, the metal stamping market has expanded significantly over the past few years. This section will explore the process analysis of the blanking market segment and how it dominates the metal stamping market.

Blanking is a metal stamping process involving the cutting and forming of flat metal sheets using a die and press. The die cuts the metal into the desired shape, while the press controls the cutting and shaping process by applying force to the die. Typically, blankings are used to manufacture components with simple and precise geometries, such as washers, industrial gaskets, and fasteners.

Numerous industries, such as aerospace, automotive, electronics, and construction, utilize the blanking process. For manufacturers who require high-quality, precise components, the process is a popular option due to its simplicity and accuracy. The process is also cost-effective, making it attractive to both small and large manufacturers.

The adoption of the blanking segment of metal stamping has been primarily driven by the economic growth of developing nations. In recent years, developing nations like China, India, and Brazil have experienced substantial economic growth, which has led to an increase in demand for metal components. This growth has prompted manufacturers to adopt more efficient and automated production processes, including blanking.

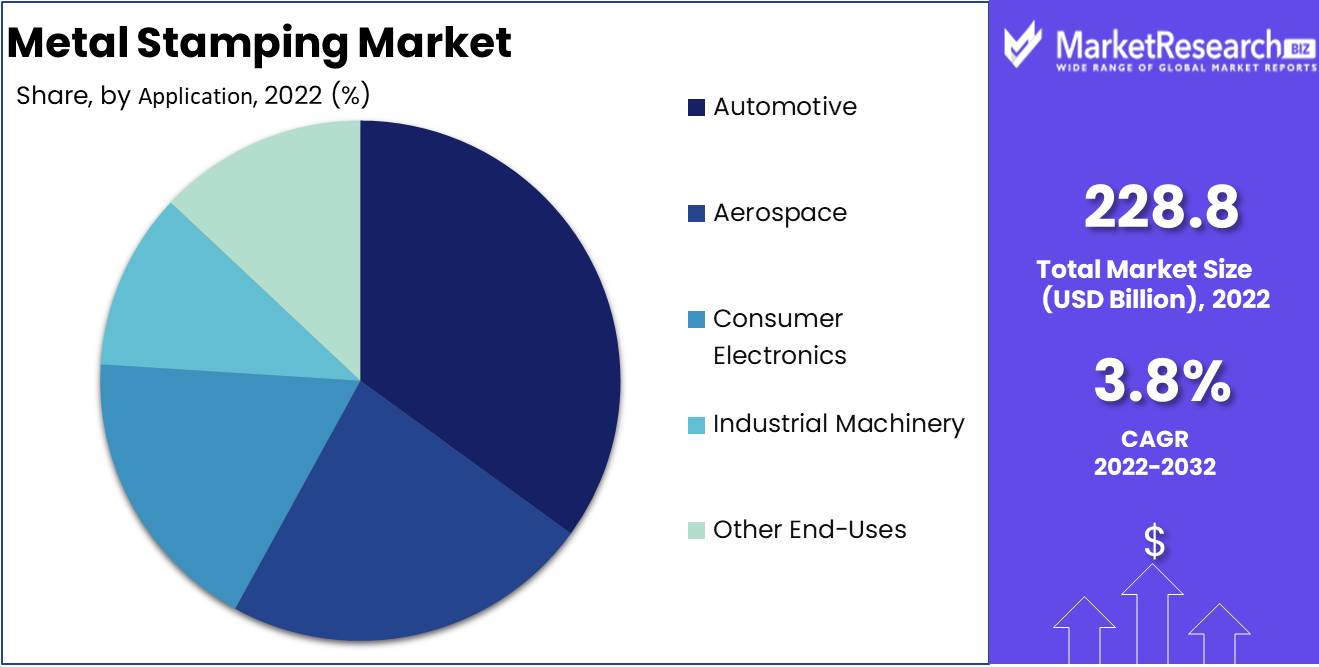

Application Analysis

The automotive sector dominates the metal stamping industry.

The automotive industry is one of the major consumers of metal-stamped products, accounting for a substantial portion of the metal-stamping market. This section explores the application analysis of the automotive segment of the metal stamping market.

The automotive segment of the metal stamping market is driven by the production of body panels, engine parts, and suspension components. The automotive components manufactured by metal stamping are renowned for their dependability, sturdiness, and accuracy, all of which are essential for the automotive industry.

The adoption of the automotive segment of the metal stamping market has been driven by the economic growth of developing nations. As these nations experience economic growth, their demand for automobiles increases, causing manufacturers to produce more automotive components. The increase in demand for automotive components promotes the growth of the automotive segment of the metal stamping market.

Key Market Segments

Based on Process

- Blanking

- Embossing

- Bending

- Other Process

Based on Application

- Automotive

- Aerospace

- Consumer Electronics

- Industrial Machinery

- Other End-Uses

Growth Opportunity

Improved Product Stability, Durability, and Quality

The ability to produce high-quality, stable, and long-lasting products is one of the main factors influencing the growth potential of the metal stamping market. By utilizing sophisticated stamping techniques, manufacturers are able to create complex and intricate parts that are essential in a variety of industries, including the automotive and construction sectors. This has resulted in greater efficiency and dependability of the products, a rise in business productivity, and cost savings for companies.

Demand Increase for Lightweight, Fuel-Efficient Vehicles

The increased demand for lightweight and fuel-efficient vehicles is another factor contributing to the growth potential of the metal stamping market. Metal stamping is a crucial step in the production of auto parts, and the advent of electric and hybrid vehicles has increased the demand for fuel-efficient, lightweight materials such as aluminum. With increased innovation in the automotive industry, metal stamping will continue to play a crucial role in the production of fuel-efficient, lightweight vehicles.

Developing the Construction and Infrastructure Sectors

The construction and infrastructure industries also contribute significantly to the market growth potential of metal stampings. Globally, the demand for infrastructure initiatives such as airports, highways, bridges, and structures has continued to increase at an accelerated rate. With metal stamping, manufacturers are able to produce high-quality components that are essential to the success of these initiatives. The extensive use of metal stamping products in these industries will increase demand for metal stamping services as a whole.

Latest Trends

Growth of the Blanking Process is anticipated to accelerate.

The growth of the blanking process is one of the most important market trends in the metal stamping industry. Blanking is the process of using a die or a blank to cut a piece of metal into the desired shape. Due to its ability to produce parts rapidly and precisely, the blanking process has gained increasing significance. As a consequence, faster growth in the blanking process is expected in the future years.

The rising demand for lightweight and fuel-efficient vehicles is one of the primary factors propelling the growth of the blanking process. The need for lightweight parts is greater than ever due to the growing demand for electric and hybrid vehicles. The blanking process is an ideal method for producing lightweight, precise, and quick parts.

Innovation in Emerging Technologies

The development of new technologies is another significant market trend in the metal stamping industry. Utilization of automation and robotics is one of the most important technological developments in the industry. Automation and robotics have transformed the metal stamping process by increasing productivity and decreasing costs.

Additionally, automation has led to the development of smart manufacturing, which is characterized by the use of sophisticated technology and data to optimize the production process. Real-time monitoring and control of the entire metal stamping process, from design to delivery, is made possible by this technology. In order to reduce costs and increase profits, smart manufacturing is expected to increase the efficacy and precision of metal stamping processes.

Rising Production Costs

Rising metal stamping costs are one of the challenges confronting the metal stamping industry. The rising price of basic materials, labor, and energy has led to an increase in the cost of metal stamping products. Inflation, trade disputes, and supply chain disruptions are expected to continue driving this trend in the coming years.

Metal stamping companies are searching for methods to cut costs without compromising quality in order to meet this challenge. One strategy is to invest in cutting-edge technologies, such as automation and robotics, which can reduce labor costs and boost productivity. A second strategy is to optimize the manufacturing process by identifying and removing inefficiencies.

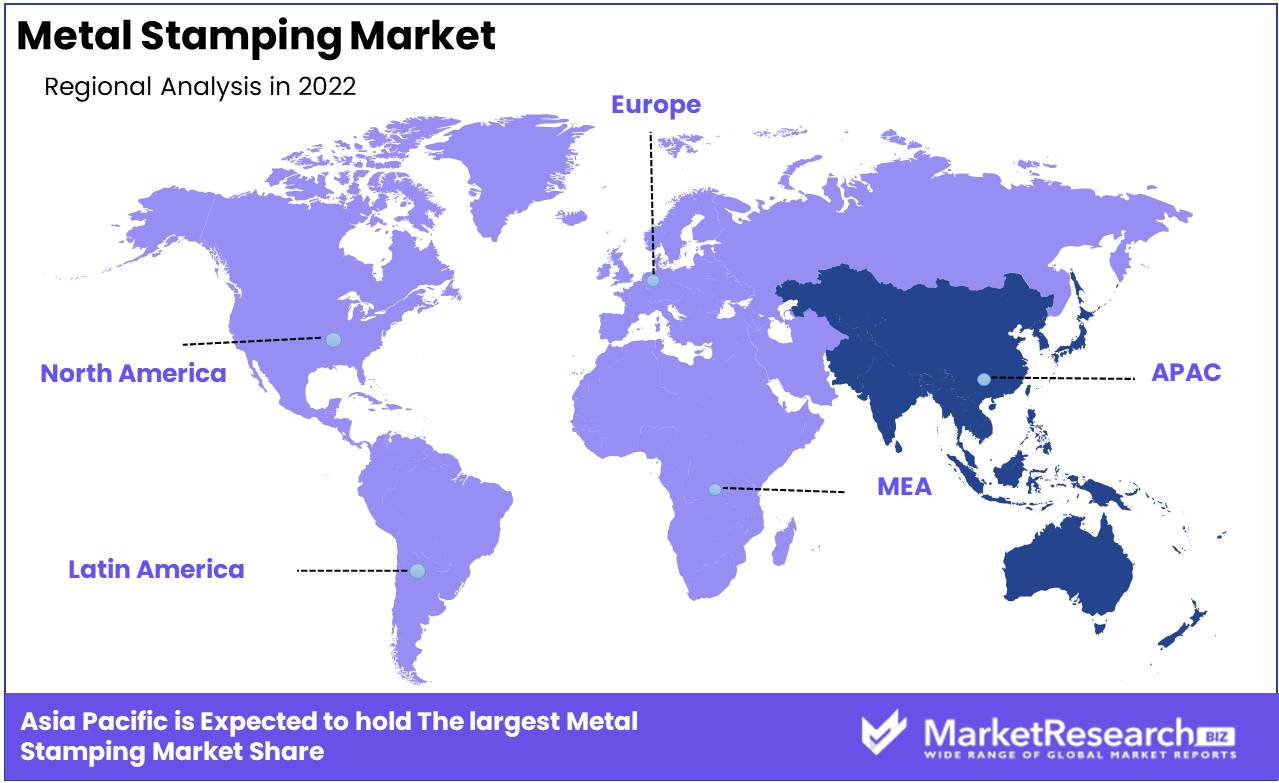

Regional Analysis

Metal stamping holds immense importance in the manufacturing sector, playing a pivotal role across various industries worldwide. This process utilizes specialized machinery to shape, cut, and form metal sheets into desired configurations and dimensions. While metal stamping is a global practice, Asia Pacific, particularly countries such as China, Japan, and South Korea, has emerged as a dominant force within the industry.

Asia Pacific's dominance in the field of metal stamping can be attributed to several key factors, including technological advancements, cost-effectiveness, skilled labor, and market demand. Through significant investments in research and development, the region has been able to develop cutting-edge stamping technologies and machinery. These advancements have significantly bolstered production efficiency and precision, resulting in the widespread recognition and demand for Asia Pacificn metal stamping manufacturers worldwide.

Cost-effectiveness is another critical factor contributing to Asia Pacific's dominance in the metal stamping industry. Countries like China and Vietnam possess a competitive advantage in terms of labor and production costs. Skilled workers in Asia Pacific can operate stamping equipment at lower wages compared to their counterparts in other regions. This cost advantage has attracted numerous multinational companies, prompting them to outsource their metal stamping requirements to Asia Pacific, thereby further solidifying the region's dominance.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

With several big players leading the industry, the metal stamping market is highly competitive. Companies like ARO Metal Stamping, CIE Automotive, Clow Stamping Company, and Kenmode Precision Metal Stamping are among these important players.

ARO Metal Stamping is headquartered in Ontario, Canada, and specializes in delivering high-quality stamped metal parts to clients in a variety of industries, such as the automotive, aerospace, medical, and consumer goods industries. For its dedication to quality and commitment to meeting customer wants, the company is highly respected.

CIE Automotive is a world leader in its industry and has offices in more than 20 countries. The company specializes in making stamped metal parts for the automotive industry and has a track record of delivering precision parts that meet strict standards and deadlines.

Top Key Players in Metal Stamping Market

- CIE Automotive SA

- Tower International, Inc.

- Shiloh Industries, Inc.

- Interplex Holdings Ltd.

- Oberg Industries LLc

- Suzhou Cheersson Precision Metal Forming Co. Ltd.

- Clow Stamping Company Inc.

- Kapco Inc.

- Kenmode Tool & Engineering Inc.

- Manor Tool & Manufacturing.

Recent Development

- In 2022, Gestamp Automoción S.A. acquired a 33% strategic stake in Gescrap Group in December. Gestamp is a Spanish company that is a leading supplier of metal stampings to the automotive industry. Gescrap is a Spanish company that recycles and processes scrap metal.

- In 2022, Gestamp Hotstamping Japan announced a new plant building on its premises in Matsusaka in May. The expansion of the Matsusaka plant is scheduled to be operational by June 2023. The new plant will be used to produce hot-stamped components for the automotive industry. Hot-stamping is a metal-forming process that uses high temperatures to create strong and lightweight components. The new plant will help Gestamp to meet the growing demand for hot-stamped components in the automotive industry.

- In 2023, Arconic Corporation completed the sale of its Russian operations to Promyshlennye Investitsii LLC in November. Arconic is an American company that manufactures aluminum and titanium products. The sale of its Russian operations was necessary due to the sanctions imposed on Russia by the United States and other countries.

- In 2023, Interplex Holdings Pte. Ltd. acquired OCP Group, Inc. in January. OCP Group is a custom connector and cable assembly company. This acquisition will help Interplex to expand its product offerings and reach new markets.

Report Scope

Report Features Description Market Value (2022) USD 329.1 Bn Forecast Revenue (2032) USD 228.8 Bn CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Process(Blanking, Embossing, Bending, Other Process), Based on End-Use(Automotive, Aerospace, Consumer Electronics, Industrial Machinery, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Norbord Inc., Kronospan Limited, West Fraser Timber Co. Ltd., Timber Products Company, Weyerhaeuser Company, Georgia-Pacific LLC, Bucina DDD, spol. s r.o. (Ltd.), Sonae Indústria, Freres Lumber Co., Inc., Dongwha Enterprise Co., Ltd., Kastamonu Entegre, Hampton Affiliates, Duratex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- CIE Automotive SA

- Tower International, Inc.

- Shiloh Industries, Inc.

- Interplex Holdings Ltd.

- Oberg Industries LLc

- Suzhou Cheersson Precision Metal Forming Co. Ltd.

- Clow Stamping Company Inc.

- Kapco Inc.

- Kenmode Tool & Engineering Inc.

- Manor Tool & Manufacturing.