Medicinal Mushrooms Market By Types(Chaga, Shiitake, Others), By Distribution Channels(Supermarkets and Hypermarkets, Convenience Stores, E-Commerce), By Form(Fresh, Whole), By Applications(Antioxidants, Immune Enhancer, Others), By End Users(Food & Beverage Industry, Pharmaceutical Industry), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

13605

-

Oct 2023

-

156

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

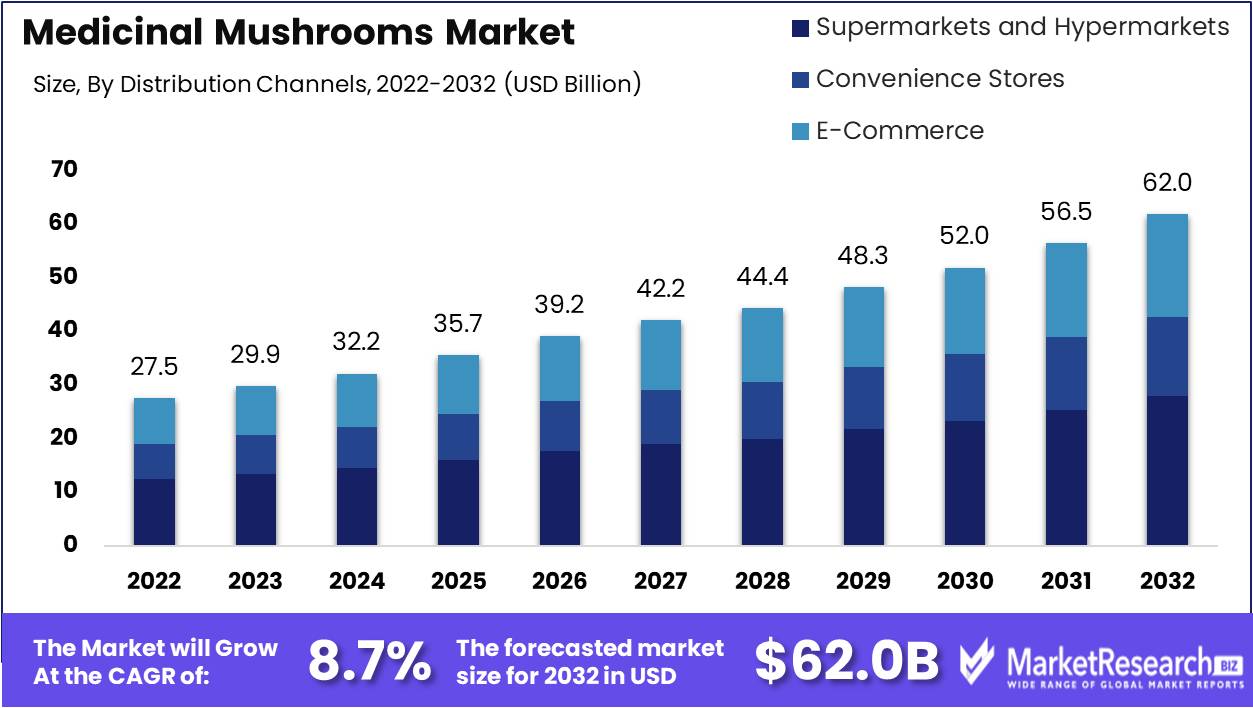

Global Medicinal Mushrooms Market witnessed a valuation of USD 27.5 Bn in 2022 and is anticipated to reach USD 62.0 Bn by 2030, exhibiting a CAGR of 8.7% from 2023 to 2030.

These basidiomycetes mushrooms are renowned as superfoods, nutritional supplements, and nutraceuticals, with a rich history in Traditional Chinese Medicine and a prominent presence in the natural health products category in Asia. Asia, particularly China, holds the distinction of being the largest producer of mushrooms globally, contributing to around 70% of the total production.

With over 14,000 mushroom species worldwide, approximately 350 species are consumed globally. Fungi like Shiitake, Chaga, and Lingzhi (Reishi), among others, have been used as medicinal remedies in Asian countries for centuries, leading to scientific exploration of their medicinal properties, particularly their potential as anticancer agents.

The study, published in Mycology, mentioned that , a new species of medicinal mushroom has been identified in the lush forests of Knysna, South Africa. The newly discovered species has been named Hericium ophelieae, paying homage to the poem Ophélie by Arthur Rimbaud. This marks the first time a species from the medicinal mushroom genus Hericium has been described as endemic to Southern Africa.

The developments in the use of medicinal mushrooms, particularly in the treatment of cancer, have gained attention and undergone extensive research in recent years. Organizations such as the National Cancer Institute (NCI) in the United States have been actively involved in studying the effects of medicinal mushrooms on the immune system and their potential anticancer properties.

A recent preclinical study published in Frontiers in Pharmacology has shed light on the potential of a mushroom-derived product, Ganoderma lucidum Spore and Fruiting Body Extract (GLSF), in preventing lung cancer. The study focused on the effects of GLSF on lung toxicity and tumor development induced by tobacco smoke carcinogens in mice. The promising preclinical evidence opens the door for future clinical trials, offering hope for individuals at increased risk of lung cancer, such as heavy smokers.

Moreover the University of Queensland, Australia, has made significant developments in the field of medicinal mushrooms, particularly in relation to their impact on nerve growth and memory enhancement.The researchers focused on the edible mushroom known as Hericium erinaceus, commonly referred to as 'lion's mane' mushrooms. These mushrooms have a long history of use in traditional medicine in Asian countries. Nutraceutical companies are now taking advantage of these trends and are launching new products in the medicinal mushrooms market.

Medicinal mushrooms are commonly consumed in powder form, although they are also available in dried slices, liquids, fresh, and capsules. Fresh mushrooms typically have high moisture content, ranging from 70% to 95%. The dry matter of mushrooms consists of carbohydrates, proteins, essential fatty acids, and trace amounts of vitamins and minerals.

Driving factors

Pleasant Taste and Unique Flavors

One major driving factor for the growth in medicinal mushroom consumption is their pleasant and unique taste profiles. Mushrooms like reishi and cordyceps have an earthy, umami flavor that consumers find very palatable. Food manufacturers are using mushrooms like shiitake and maitake in snacks, seasonings, and other products to take advantage of their rich and savory tastes. As consumers seek out new and exotic flavors, the unique taste of medicinal mushrooms helps drive product development and consumer demand.

Potential Health Benefits

Another key driver is the potential health benefits of compounds found in medicinal mushrooms. Mushrooms contain a range of bioactive compounds like polysaccharides, peptides, and triterpenes that may have immunomodulating, anti-inflammatory, antioxidant, and other effects on the body. Although more research is needed, the promise of these natural compounds to support wellness and prevent disease is fueling interest in medicinal mushrooms.

On August 9, 2023, a study was published on the journal Foods The study reviews the relationship between Alzheimer’s disease and diet and lifestyle, emphasizing the importance of healthy food consumption in disease prevention and management. The researchers highlight the role of bioactive compounds in mushrooms, particularly neuroprotective small molecules, in potentially delaying the onset and progression of Alzheimer's disease.

Trends in Natural/Holistic Health

Growth in the medicinal mushroom market aligns with broader consumer trends favoring natural, organic, and gut-healthy products. As more consumers seek out holistic and preventative healthcare options, mushrooms fit into the medicinal foods category. Traditional Eastern practices often incorporate mushrooms, so the association with herbal medicine and holistic health drives consumer demand. With gut health a major trend, the prebiotic effects of mushrooms also attract health-conscious consumers to functional foods and supplements containing medicinal mushrooms.

Growth in Sports Nutrition

The sports nutrition category is utilizing medicinal mushrooms for their potential performance and recovery benefits. Compounds like cordyceps are believed to act as exercise enhancers and adaptogens. More athletes and fitness enthusiasts are exploring mushroom-based supplements for gains in endurance, power output, and post-workout recovery. Major sports nutrition brands have released mushroom-based products to capitalize on this growing consumer segment. The trend is fueling demand for medicinal mushroom products overall.

Restraining Factors

Supply-demand gap

The supply of many in-demand medicinal mushrooms is limited. Many species grow only in specific forest environments and cannot be easily cultivated on a mass scale. The time needed to cultivate mushrooms ranges from 3 months up to 18 months depending on the species. This makes it difficult to rapidly expand production. Wild harvesting also damages sensitive habitats which further restricts supply.

Short shelf life of medicinal mushrooms

Another issue is the extremely short shelf life of fresh mushrooms, which spoil within days after harvest. Drying techniques can extend shelf life slightly to 6 months, but this adds additional processing costs. The limited shelf life makes storage and transportation difficult, restricting geographic distribution and requiring rushed transit. Advanced cold chain technologies could help but would drive up costs.

By Type

The Shiitake mushroom segment is expected to dominate the medicinal mushroom market in the coming years. Shiitake mushrooms have been used in traditional Chinese medicine for centuries and modern research has validated many of their purported health benefits. Some key factors that will drive the growth of the Shiitake mushroom segment include its nutritional profile, anti-inflammatory effects, antioxidant properties, anti-cancer effects, and versatility.

Shiitake mushrooms are a good source of B vitamins like folate and niacin. They also provide copper, zinc, and manganese. The polysaccharides and beta-glucans in Shiitake mushrooms have been found to boost immune function. Compounds like lentinan in Shiitake mushrooms exhibit anti-inflammatory properties by inhibiting cytokine production. This can help with inflammatory conditions and diseases. Shiitake mushrooms contain ergothioneine, an amino acid that has antioxidant effects. This can help reduce oxidative stress and damage in the body.

Clinical research indicates the polysaccharides and beta-glucans in Shiitake mushrooms can help fight cancer by boosting immune cell activity and preventing tumor growth. This makes it useful as a supplemental cancer therapy. Shiitake mushrooms have a meaty, umami flavor that makes them easy to include in various dishes, from soups to stir-fries. Their rising popularity globally as a culinary ingredient will further propel market growth.

By Distribution Channels

Supermarkets and hypermarkets are projected to be the leading distribution channels in the medicinal mushroom market over the coming years. The growth in supermarkets and hypermarkets is driven by the increasing demand for dietary supplements and functional foods containing medicinal mushrooms. Shoppers find supermarkets and hypermarkets to be convenient and trusted places to buy food and nutritional supplements. These large-format retail stores dedicate shelf space and promotions to showcase new medicinal mushroom products like capsules, tinctures, powders and fortified foods.

The strong supply chain and inventory management capabilities of supermarkets and hypermarkets ensure a steady supply and availability of medicinal mushroom products. Large retail chains have the buying power to offer competitive pricing and discounts on medicinal mushrooms which appeals to buyers. Supermarkets and hypermarkets will continue to dominate medicinal mushroom distribution channels with their wide assortment, accessibility and aggressive marketing strategies aimed at health-conscious consumers.

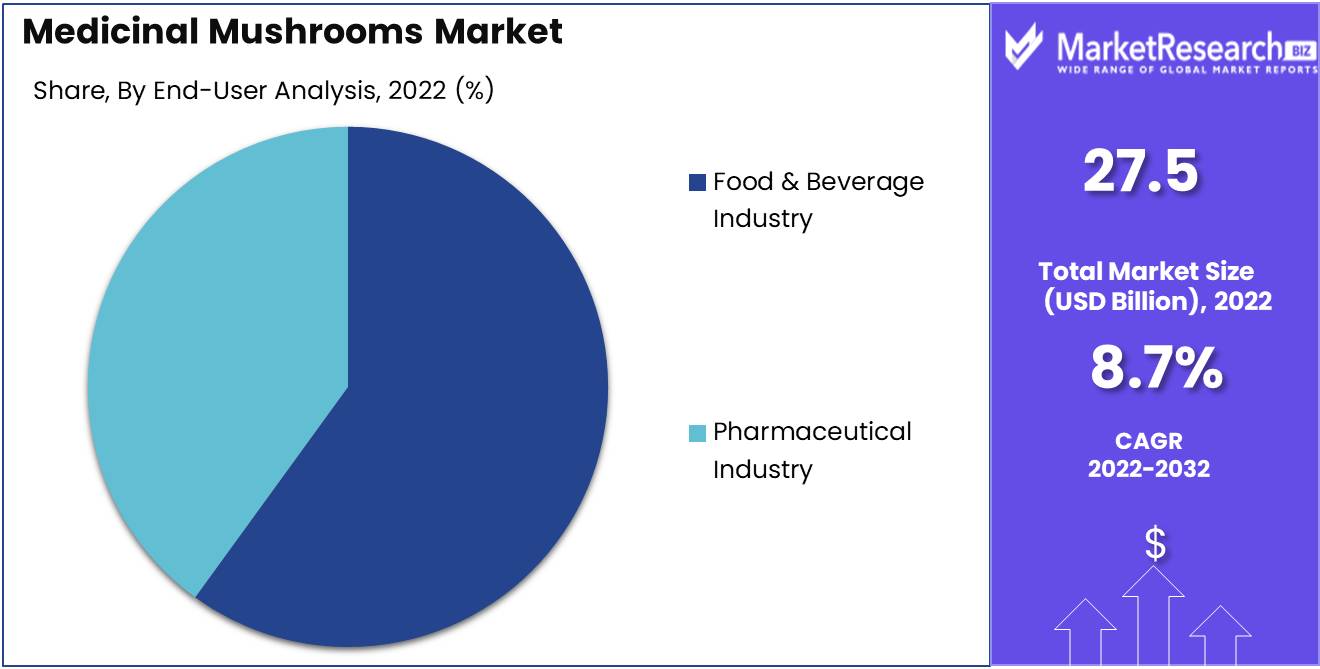

By End Users

The food and beverage industry is anticipated to experience the highest growth rate in the medicinal mushroom market, driven by the increasing demand for ready-to-eat food products and the recognition of the beneficial properties of medicinal mushrooms. The unique taste, texture and nutritional profile of medicinal mushrooms make them an attractive ingredient for food manufacturers.

Companies are incorporating medicinal mushroom varieties like reishi, cordyceps, lion's mane and turkey tail into snacks, beverages and meal replacement products. The anti-inflammatory, antioxidant and immune-boosting effects of medicinal mushrooms further incentivize their use in functional foods and beverages.

The pharmaceutical industry also utilizes medicinal mushrooms for the production of health food and pharmacy products. Pharmaceutical companies are researching medicinal mushrooms and isolating beneficial compounds like polysaccharides, beta-glucans, ganoderic acids and triterpenoids.

These compounds are processed into capsules, tablets, tinctures and tonics that serve as dietary supplements supporting immunity, cognition, energy levels and other health factors. Pharmaceutical players are also creating medicinal mushroom extracts and powders used in protein powders, multivitamins and nutraceuticals.

Key Market Segments

By Types

- Chaga

- Cordyceps

- Reishi

- Lions Mane

- Maitake

- Shiitake

- Turkey Tails

- Others

By Distribution Channels

- Supermarkets and Hypermarkets

- Convenience Stores

- E-Commerce

By Form

- Fresh

- Whole

- Dried

- Liquid

- Capsule

By Applications

- Antioxidants

- Immune Enhancer

- Anti-Cancer

- Skin Care

- Others

By End Users

- Food & Beverage Industry

- Pharmaceutical Industry

Growth Opportunity

Growing Demand for Functional Foods

The increased demand for medicinal mushrooms has opened up opportunities to incorporate mushroom extracts into processed food products. Companies are finding new ways to add mushrooms to foods like snacks, soups, and beverages to capitalize on the health trends. The utilization of mushroom extracts in foods has become more common as consumers seek functional foods with added nutritional benefits. There is potential for innovation as more edible mushrooms become classified as nutraceuticals.

Rising Health Awareness

Another opportunity lies in the growing awareness of medicinal mushrooms' health benefits. As more research elucidates the immune-boosting, anti-inflammatory, and disease-fighting properties of mushrooms, demand increases. Consumers are becoming more conscious of incorporating mushrooms into their diets for both culinary enjoyment and health reasons. This rise in health awareness, especially related to mushrooms' adaptogenic qualities, provides an opening for the medicinal mushroom market. Educational marketing can expand this niche.

New Product Development

Companies have an opportunity to develop new medicinal mushroom products to serve the burgeoning demand. Beyond extracts and powders, there is room for innovation in shelf-stable consumer products that cater to convenience and lifestyle needs. Jerky, granola bars, instant teas/coffees, and even beauty creams infused with mushrooms have growth potential. Capitalizing on consumer interest through unique new offerings can further grow the nascent medicinal mushroom market.

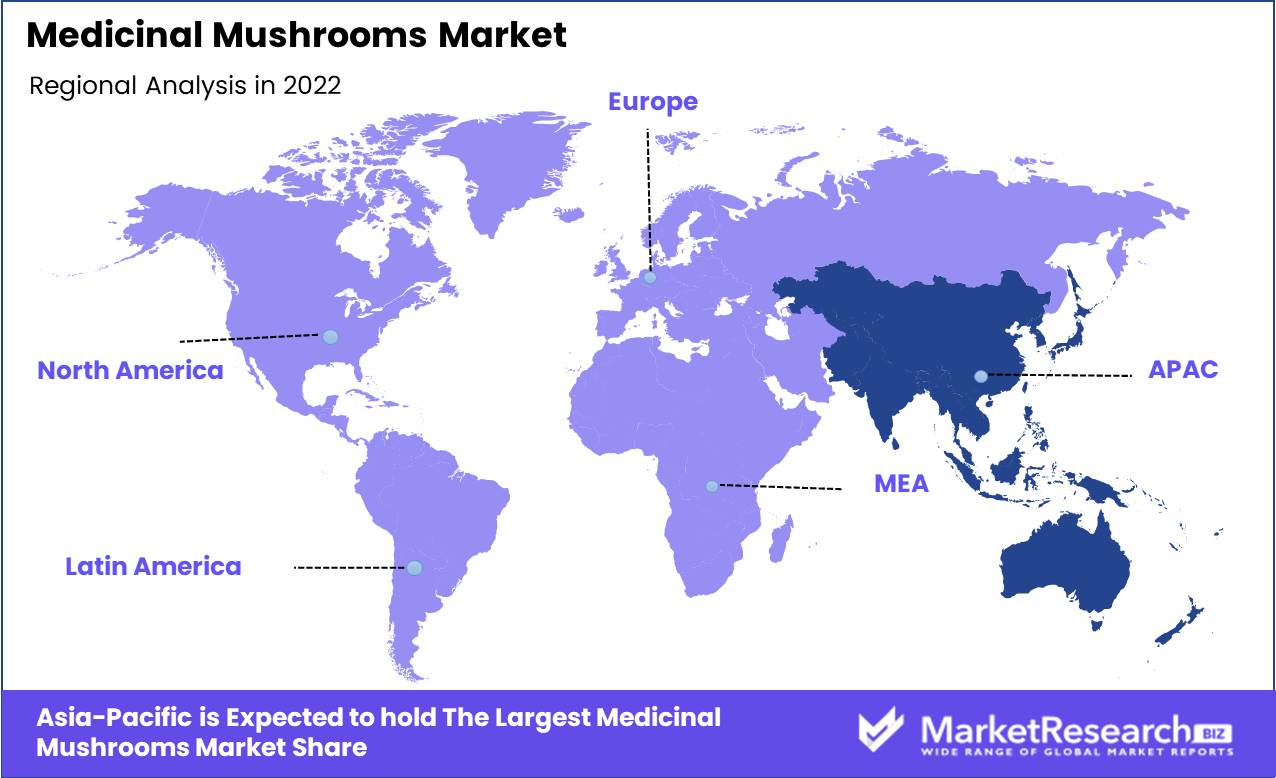

Regional Analysis

Asia Pacific is expected to continue leading the global medicinal mushroom market over the forecast period. This is attributed to the long history of the traditional use of mushrooms for medicinal purposes in the region. Growing consumer awareness of health and wellness products, increase in lifestyle diseases and aging populations are also key factors driving growth in markets like China, Japan, Korea, India, and Australia where consumption of medicinal mushrooms is deeply rooted in culture. The Asia Pacific medicinal mushroom market is projected to expand at a steady growth rate through 2025.

China leads production and exports of popular mushrooms to meet global demand. The nutraceuticals industry in Asia Pacific is also growing rapidly and utilizing medicinal mushrooms in various products. Government support for innovation and favorable regulations around mushrooms give advantages to Asia Pacific players. The region’s producers, exporters, and product manufacturers are likely to benefit by capitalizing on the supply of raw materials and strong consumer demand both locally and internationally. With its unique advantages, Asia Pacific is expected to retain its commanding position in the global medicinal mushroom market over the forecast period.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

FreshCap Mushrooms LTD based in Canada is one of the leading North American suppliers of fresh, dried, and powdered medicinal mushroom products. Netherlands-based Banken Champignons B.V. is a key global producer of chaga and maitake mushrooms along with a line of mushroom extracts. Far West Fungi, founded in 1964, is among the oldest and largest mushroom farms in the US with a product range including medicinal varieties. India’s Swadeshi Mushroom is a prominent manufacturer specializing in high-quality mushroom mycelium biomass production.

These leading companies have secured strong positions in the medicinal mushroom market through strategies like focused R&D, integrated production processes, quality control measures, and expansion of product portfolios and geographic reach. They continue to grow by leveraging their expertise in mushroom cultivation along with consumer demand for the health benefits of medicinal mushrooms.

Top Key Players in Medicinal Mushrooms Market

- FreshCap Mushrooms LTD. (Canada)

- Banken Champignons B.V. (Netherlands)

- Far West Fungi (US)

- Swadeshi Mushroom (India)

- DXN (Malaysia)

- Nikkei Marketing Limited (Canada)

- Chaga Mountain Inc (US)

- Asia Pacific Farm Enterprises (Canada)

- NC Exotic Mushrooms (Netherlands)

- Bonduelle SA (France)

- Nammex (Canada)

- Naturalin (China)

- Real Mushrooms (Canada)

- Mitoku (Japan)

- Hirano Mushroom LLC (Serbia)

- Gourmet Mushrooms Inc. (US)

Recent Development

- In 2022, Innomy, a Spanish business focused on mushroom-based meat substitutes, announced it has successfully raised EUR 1.3 Million (USD 1.26 Million). They say mycelium offers high nutritional value while having low cholesterol and saturated fat content it is one of the most promising protein sources.

- In July 2022, Ethical Naturals and Nammex collaborated to launch a new line of organic mushroom extracts called Mushroom-Plus. These extracts are specifically formulated to address specific health concerns.

- In May 2022, Grove Inc. entered the medicinal mushroom market with its latest product line called Cure Mushrooms. This brand offers a range of mushroom extracts that are produced in the United States.

- In June 2021, The Marley, a company founded by the family of legendary musician Bob Marley, announced a partnership with Silo Wellness Inc., a Toronto-based company that is a leader in the emerging psychedelics industry. Together, the two companies launched Marley One, a new consumer brand focused on functional and psychedelic mushrooms.

- As of February, more than 130 clinical trials worldwide were either underway or scheduled, focusing on the use of psilocybin in various therapeutic contexts. The Seattle-based trial, slated to begin in January 2025 and run for a year, is expected to be a pivotal addition to this growing body of research.

Report Scope

Report Features Description Market Value (2022) USD 27.5 Bn Forecast Revenue (2032) USD 62.0 Bn CAGR (2023-2032) 8.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Types(Chaga, Shiitake, Others), By Distribution Channels(Supermarkets and Hypermarkets, Convenience Stores, E-Commerce), By Form(Fresh, Whole), By Applications(Antioxidants, Immune Enhancer, Others), By End Users(Food & Beverage Industry, Pharmaceutical Industry) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape FreshCap Mushrooms LTD., Banken Champignons B.V., Far West Fungi, Swadeshi Mushroom, DXN, Nikkei Marketing Limited, Chaga Mountain Inc, Asia Pacific Farm Enterprises, NC Exotic Mushrooms, Bonduelle SA, Nammex, Naturalin, Real Mushrooms, Mitoku, Hirano Mushroom LLC, Gourmet Mushrooms Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bonduelle SA

- Monaghan Mushrooms

- Agro Dutch Industries Ltd.

- The Mushroom Company

- Modern Mushroom Farms

- Delftree Mushroom Company

- Banken Champignons

- Hughes Mushrooms

- Scelta Mushrooms BV

- WEIKFIELD PRODUCTS CO. (I) PVT. LTD