Medical Foods Market Report By Route of Administration (Oral Nutritional Supplements, Enteral Nutrition, Parenteral Nutrition), By Ingredient Type (Vitamins & Minerals, Proteins, Carbohydrates, Omega-3 Fatty Acids, Fiber, Others), By Application (Nutritional Deficiencies, Alzheimer's Disease, Diabetes, Metabolic Syndrome, Chronic Kidney Disease, Inborn Errors of Metabolism, Others), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

2436

-

March 2024

-

185

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

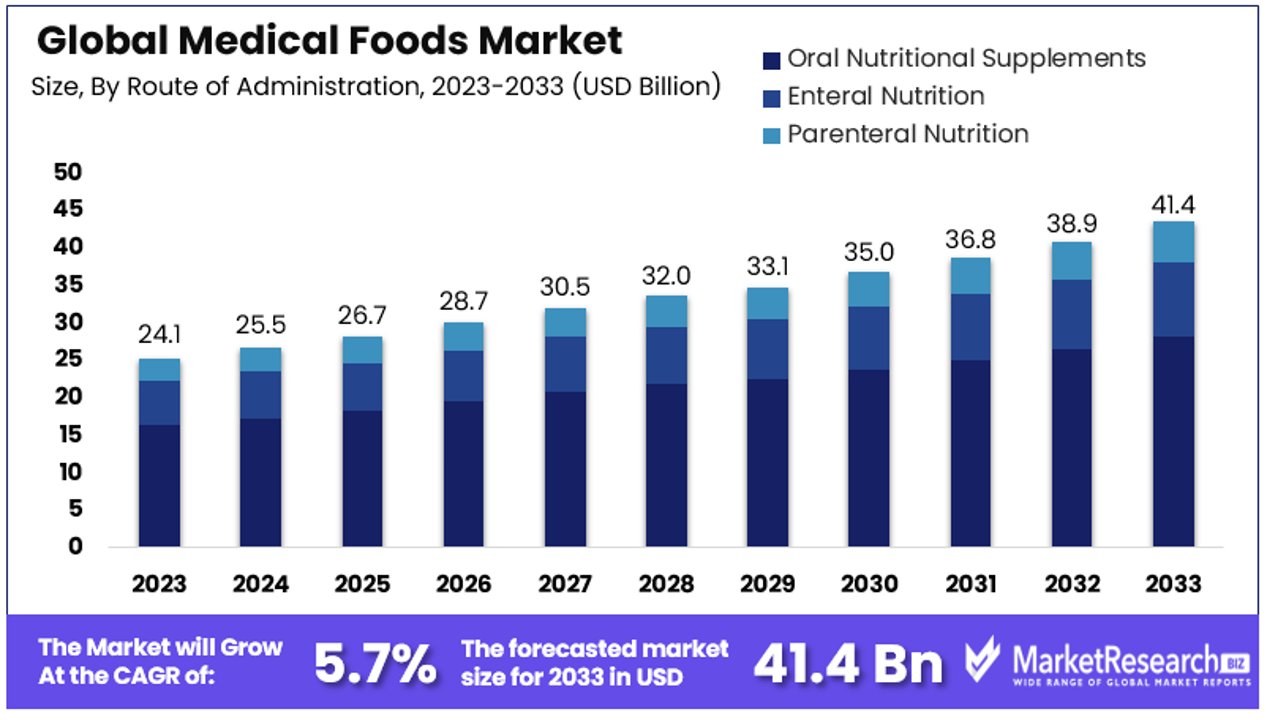

The Global Medical Foods Market size is expected to be worth around USD 41.4 Billion by 2033, from USD 24.1 Billion in 2023, growing at a CAGR of 5.70% during the forecast period from 2024 to 2033.

The surge in demand for the advanced technologies and rise in nutritional solutions are some of the main key driving factors for the medical foods.

The medical foods are defined as the specialized nutritional food products that are used for the dietary management of particular medical conditions under the monitor of healthcare experts. Not as the conventional foods and dietary supplements, the medical food products are developed to identify unique nutritional requirements related with specific diseases, medical conditions and disorders.

They generally comprise of the ingredients like proteins, carbohydrates, fats, minerals, vitamins and other nutrients costumed to meet the distinct nutritional needs of individuals with particular health risks.

Medical foods are developed to complement standard treatments and therapies by aiding to manage the nutritional aspects of a medical condition. They are basically used in situations where daily dietary adjustments alone may not be sufficient to meet the nutritional requirements.

Such products need rigorous testing to make safety, efficiency and compliance with regulatory standards. Medical foods play an important role in supporting the whole well-being of individuals with different medical situations by contributing to enhance clinical results and quality of life.

According to an article published by Danone in July 2023, highlights that Danone has introduced new innovative science based probiotic supplement to support breastfeeding experiences. Mastitis affects approximately 1 out 4 breastfeeding mothers. It is considered as one of the main cause of an initial and unwanted end to breastfeeding.

Danone’s new probiotic supplements, Almimama has introduced in Spain that can support breastfeeding by helping to decrease the occurrence of mastitis. Despite the well-known advantages of breastfeeding for the health of both mother and baby, only 48% of babies under 6 months of age are exclusively breastfed.

The recent benefits of medical foods consist of the targeted formulations that identifies particular nutritional deficiencies and metabolic imbalances related with different medical conditions. Such products provide accurate nutrient ratios and bioavailability by improving their effectiveness in supporting disease management and promoting whole health.

The advancement in research and technology have led to the growth of new innovative ingredients and delivery systems by enhancing the convenience, palatability and compliance of medical food products for patients. The demand for the medical food will increase due to its requirement in medical sectors that will help in market expansion in the coming years.

Key Takeaways

- Market Value: The Global Medical Foods Market is anticipated to reach USD 41.4 Billion by 2033, exhibiting steady growth from its 2023 value, with a CAGR of 5.70% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Route of Administration Analysis: Oral Nutritional Supplements (ONS) dominate the market with a commanding 68% share due to their ease of administration, versatility, and patient preference.

- Ingredient Type Analysis: Vitamins & Minerals lead the segment by offering essential nutrients required for various physiological functions and disease management, followed by proteins, carbohydrates, omega-3 fatty acids, and fiber.

- Application Analysis: Nutritional deficiencies represent the dominant application, addressing widespread gaps in dietary intake across populations, followed by specialized segments targeting conditions like Alzheimer's disease, diabetes, metabolic syndrome.

- Regional Analysis: North America dominates the market with a 30% share, driven by well-established healthcare infrastructure and rising awareness of nutritional management. Europe holds approximately 28% of the market share, propelled by increasing healthcare expenditure.

- Analyst Viewpoint: The growth of the medical foods market is driven by increasing awareness of nutritional management in disease conditions, rising prevalence of chronic diseases, and advancements in nutritional science. Opportunities lie in innovating formulations to cater to specialized therapeutic needs, expanding distribution channels, and leveraging technology for targeted patient outreach.

- Market Key Players: Key players in the global medical foods market include companies such as Nestlé Health Science, Abbott Laboratories, Nutricia, Danone S.A., and Fresenius Kabi, among others, reflecting a mix of established industry leaders and emerging innovators driving market growth and innovation.

Driving Factors

Rising Geriatric Population Drives Market Growth

The growing number of elderly individuals globally, with a projected increase in the United States from 58 million in 2022 to 82 million by 2050, marks a 47% rise, significantly impacts the Medical Foods Market. This demographic shift is instrumental in driving demand for medical foods, as older adults often require specialized nutritional solutions to manage age-related health conditions effectively. Medical foods, designed to address issues like osteoporosis or cognitive decline, are increasingly integral to this population's health management strategies.

The rising geriatric population not only underscores the need for tailored nutritional interventions but also signifies the potential for market expansion. This trend aligns with the broader healthcare industry's focus on personalized medicine, including nutrition, as a critical component of comprehensive care for the elderly. As the population ages, the demand for medical foods is expected to surge, underpinning the market's growth trajectory and highlighting its role in supporting healthy aging.

Growing Prevalence of Chronic Diseases Propels Market Expansion

Chronic diseases, responsible for nearly 75% of aggregate healthcare spending in the U.S. at an estimated cost of around $5300 per person annually, drive significant demand for medical foods. The increasing incidence of conditions such as diabetes, cardiovascular diseases, and neurological disorders necessitates specialized nutritional support, which medical foods can uniquely provide. This need positions medical foods as a pivotal component of disease management strategies, fueling market growth.

The correlation between chronic disease management and the efficacy of medical foods highlights a clear path for market expansion. As healthcare systems and patients continue to recognize the value of targeted nutritional interventions in managing chronic conditions, the demand for medical foods is set to rise. This trend not only reflects the immediate needs of the healthcare industry but also the market's capacity to respond to evolving health challenges through innovation in medical nutrition.

Advancements in Medical Research Enhance Market Potential

Continuous advancements in medical and nutritional research catalyze the development of innovative medical food products, designed to address a wide array of medical conditions effectively. Research-backed formulations targeting specific health issues, such as metabolic disorders or gastrointestinal problems, enhance the efficacy and appeal of medical foods in the market. This innovation drive is a testament to the industry's commitment to leveraging scientific insights for the creation of effective nutritional solutions.

As research uncovers new understandings of disease mechanisms and nutritional impacts, the medical foods market is poised for growth, fueled by an expanding portfolio of products that cater to precise medical needs. The synergy between ongoing research efforts and market development underscores the dynamic nature of the medical foods industry, highlighting its adaptability and the growing recognition of medical nutrition as an essential element of modern healthcare.

Restraining Factors

Lack of Awareness in the Medical Community Restrains Market Growth

A significant challenge impeding the Medical Foods Market's growth is the insufficient awareness among healthcare professionals regarding the benefits and applications of medical foods. This knowledge gap can lead to underutilization, as physicians and dietitians may not fully recommend these specialized nutritional solutions to patients who could significantly benefit from them.

Despite medical foods' proven efficacy in managing various health conditions through targeted nutrition, their potential remains partially untapped due to this lack of awareness. Education and information dissemination efforts within the medical community are essential to bridge this gap, enhancing healthcare professionals' understanding and confidence in prescribing medical foods. Enhancing awareness could dramatically improve market penetration and growth, as informed recommendations by healthcare providers are a critical driver of patient adoption.

Cost Concerns Limit Market Penetration

The higher cost of medical foods compared to regular foods or dietary supplements presents a barrier to market growth. For many consumers and healthcare providers, especially those conscious of budget constraints, the price differential may make medical foods a less attractive option. This price sensitivity can deter individuals from incorporating medical foods into their healthcare regimen, impacting the market's expansion.

The cost factor is particularly challenging in regions with limited insurance coverage for such products, where the out-of-pocket expense for patients becomes a significant consideration. Addressing these cost concerns through strategies such as insurance coverage expansion, subsidies, or the development of more cost-effective production methods could mitigate this barrier, enhancing accessibility and adoption of medical foods across a broader demographic.

Route of Administration Analysis

The Medical Foods Market is significantly segmented by the route of administration, with Oral Nutritional Supplements (ONS) holding a dominant 68% market share. This dominance is largely due to the ease of administration, patient preference, and the versatility of formulations that can cater to a broad spectrum of medical conditions and dietary needs.

Oral supplements offer a non-invasive method to deliver essential nutrients effectively, making them highly favored in both clinical and homecare settings. The convenience and efficiency of ONS, combined with the growing awareness of nutritional management in disease conditions, have propelled their demand.

Enteral and parenteral nutrition, while holding smaller market shares, play critical roles in scenarios where oral intake is not possible or insufficient. Enteral nutrition is crucial for patients with functional gastrointestinal tracts but who are unable to achieve adequate nutrition orally. Parenteral nutrition, on the other hand, is reserved for patients with non-functional or severely impaired gastrointestinal tracts, providing direct nutrient absorption into the bloodstream. These segments, though smaller in comparison to ONS, are essential in comprehensive medical care, particularly for critically ill or post-surgical patients, and contribute to the overall growth of the medical foods market through their specialized applications.

Ingredient Type Analysis

In the Medical Foods Market, the Vitamins & Minerals segment leads by offering essential nutrients required for a wide range of physiological functions and disease management. This dominance reflects the foundational role of vitamins and minerals in maintaining health and managing deficiencies, especially in populations with specific medical conditions or dietary restrictions. The broad applicability of these nutrients across multiple health conditions, from bone health to immune support, underscores their significance in medical foods.

Proteins, Carbohydrates, Omega-3 Fatty Acids, and Fiber constitute the other vital segments. Proteins are critical for tissue repair and muscle maintenance, especially in conditions like sarcopenia and during recovery from surgery or illness. Carbohydrates provide a primary energy source, essential for patients requiring energy-dense diets. Omega-3 fatty acids are recognized for their anti-inflammatory properties and benefits in cardiovascular health and cognitive function. Fiber plays a role in gastrointestinal health and is particularly important in medical conditions affecting the digestive system.

Application Analysis

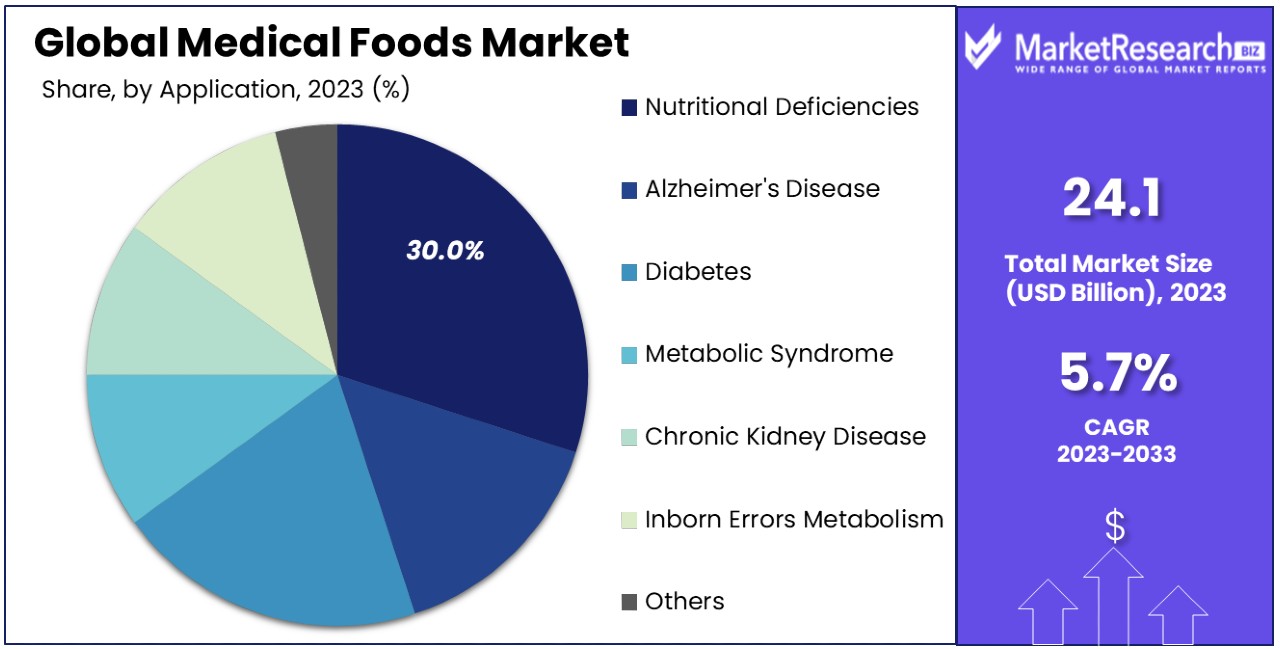

In the Medical Foods Market, addressing nutritional deficiencies emerges as the dominant application, accounting for approximately 30% of the market. This prominence is underpinned by the widespread prevalence of nutritional gaps across various populations, driven by factors such as inadequate dietary intake, absorption issues, and increased nutritional needs due to chronic conditions or aging. Medical foods designed to address these deficiencies provide targeted nutrition solutions that can significantly improve patient outcomes, contributing to this segment's dominance.

Other segments like Alzheimer's disease, diabetes, metabolic syndrome, chronic kidney disease, and inborn errors of metabolism represent crucial areas of focus within the medical foods market. These conditions require specialized dietary management to mitigate symptoms, prevent progression, or address specific metabolic needs, underscoring the importance of medical foods in therapeutic strategies. For instance, medical foods targeting Alzheimer's disease are formulated to support cognitive function, while those for diabetes aim to manage blood glucose levels through tailored nutritional profiles.

The growth potential within these sub-segments is substantial, given the rising incidence of chronic diseases and the increasing recognition of nutrition's role in disease management. Innovations in medical food formulations, driven by advances in nutritional science and patient-centric care models, are expanding the application range. As healthcare professionals and patients become more informed about the benefits of medical foods in managing complex health conditions, demand across these specialized segments is expected to rise, further diversifying the market and reinforcing its growth trajectory.

Distribution Channel Analysis

Within the distribution channels for the Medical Foods Market, hospitals stand out as the leading segment, facilitating direct access to patients requiring medical nutrition as part of their treatment plan. This dominance is attributed to the integral role of hospitals in diagnosing and managing diseases, where medical foods are often initiated as part of a comprehensive care strategy. The controlled environment of hospitals ensures that medical foods are recommended and administered under professional supervision, enhancing patient adherence and outcomes.

Specialty clinics, pharmacies, and online retail represent additional vital channels through which medical foods are distributed. Specialty clinics offer targeted care for specific conditions like diabetes or kidney disease, making them crucial points for the distribution of condition-specific medical foods. Pharmacies, including community and hospital pharmacies, provide accessible outlets for patients following hospital discharge or those managing chronic conditions, supporting ongoing treatment and maintenance.

Online retail has seen significant growth as a distribution channel for medical foods, offering convenience, a broad product selection, and the ability to reach a wider patient base, particularly in geographically dispersed or underserved areas.

Key Market Segments

By Route of Administration

- Oral Nutritional Supplements

- Enteral Nutrition

- Parenteral Nutrition

By Ingredient Type

- Vitamins & Minerals

- Proteins

- Carbohydrates

- Omega-3 Fatty Acids

- Fiber

- Others

By Application

- Nutritional Deficiencies

- Alzheimer's Disease

- Diabetes

- Metabolic Syndrome

- Chronic Kidney Disease

- Inborn Errors of Metabolism

- Others

By Distribution Channel

- Hospitals

- Specialty Clinics

- Pharmacies

- Online Retail

- Others

Growth Opportunities

Rising Demand for Personalized Nutrition Offers Growth Opportunity

The escalating interest in personalized nutrition marks a pivotal growth opportunity for the Medical Foods Market. This trend is fueled by consumers' growing awareness of the role diet plays in health and the desire for nutritional solutions tailored to individual health conditions and preferences. Medical foods are uniquely positioned to meet this demand, providing targeted nutritional support for conditions such as diabetes, chronic kidney disease, and metabolic syndrome.

The ability to customize medical food formulations to address specific nutritional deficiencies or to complement a patient's unique metabolic profile not only enhances the efficacy of medical interventions but also increases patient adherence and satisfaction. As consumers continue to seek out health products that are specifically designed for their personal health needs, the medical foods market is expected to see significant growth. This trend underscores the importance of innovation in product development and marketing strategies to cater to the increasing demand for personalized nutrition solutions.

Integration with Conventional Therapies Offers Growth Opportunity

The integration of medical foods into conventional drug-based therapies presents a significant growth opportunity within the Medical Foods Market. As the healthcare industry embraces a more holistic approach to disease management, the role of specialized nutrition in supporting drug therapies has gained prominence. Medical foods offer a non-pharmacological intervention that can enhance the efficacy of conventional treatments, improve patient outcomes, and possibly reduce healthcare costs by mitigating disease progression and complications.

This complementary approach is particularly relevant for chronic diseases, where long-term management is essential, and nutritional status can significantly impact disease trajectories and quality of life. The trend towards integrating medical foods with conventional therapies not only broadens the market's potential but also emphasizes the importance of collaborative care models that leverage the synergistic benefits of nutrition and pharmacology.

Trending Factors

Focus on Disease-Specific Formulations Are Trending Factors

The trend towards developing disease-specific formulations within the Medical Foods Market is gaining momentum. This approach addresses a spectrum of health conditions, from metabolic syndromes to neurological disorders, tailoring nutritional solutions directly to the unique needs of individuals facing these challenges. This specificity in product development allows for a more effective management of various medical conditions, enhancing the quality of life for patients.

The emphasis on disease-specific formulations reflects the market's commitment to innovation and its ability to respond to the nuanced demands of healthcare today. As manufacturers continue to explore and expand these targeted offerings, the potential for growth in the medical foods market is significant. This trend not only meets the growing demand for personalized healthcare solutions but also positions medical foods as an integral component of modern therapeutic strategies, driving further interest and adoption across healthcare settings.

Regulatory Support and Compliance Are Trending Factors

Regulatory support and compliance within the Medical Foods Market are critical factors shaping current trends and facilitating market expansion. Clear and supportive regulatory frameworks ensure the safety, quality, and efficacy of medical foods, bolstering consumer confidence and driving market growth. The establishment of specific guidelines and standards for the manufacturing and marketing of medical foods plays a pivotal role in maintaining product integrity and trust among consumers and healthcare providers.

As the market continues to evolve, adherence to these regulatory requirements becomes increasingly important, guiding manufacturers through the process of bringing innovative and compliant products to market. This trend highlights the symbiotic relationship between regulatory bodies and the medical foods industry, where compliance not only safeguards public health but also promotes innovation and market development.

Regional Analysis

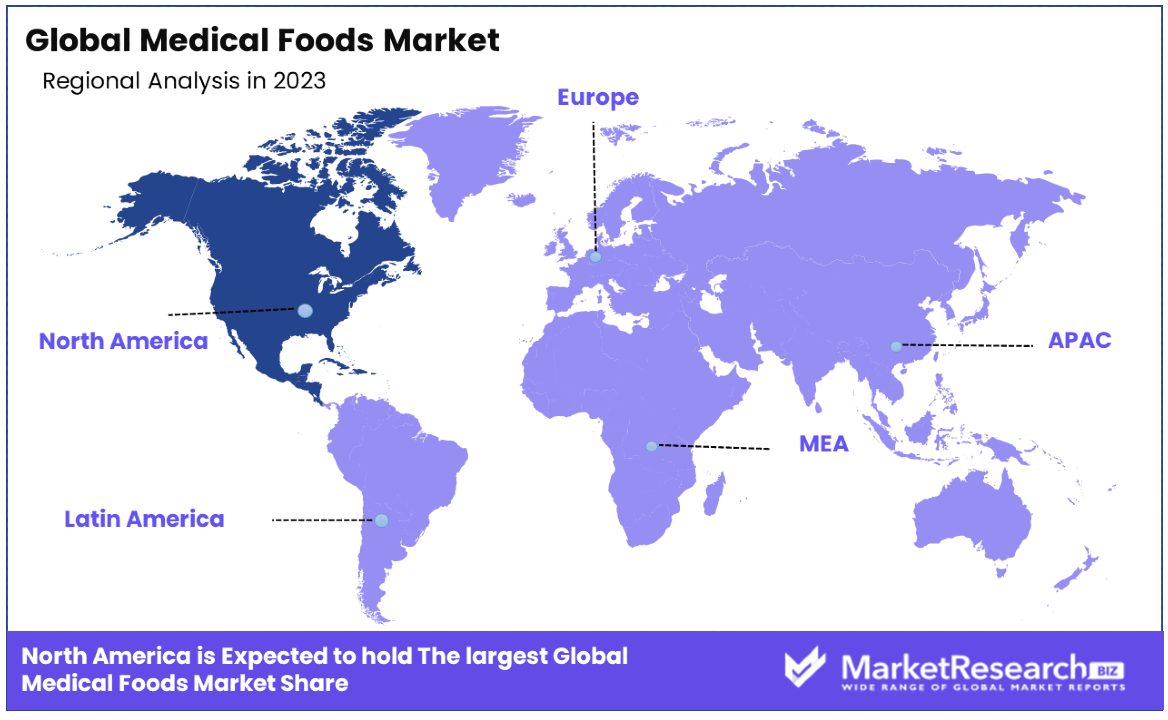

North America Dominates with 30% Market Share in the Medical Foods Market

North America, holding a 30% share of the Medical Foods Market, showcases its dominance due to a combination of advanced healthcare infrastructure, strong regulatory support, and a growing awareness of medical nutrition therapy. The region's high prevalence of chronic diseases, such as diabetes and Alzheimer's, has amplified the demand for specialized nutritional solutions, positioning medical foods as an essential component of comprehensive care plans.

The dynamics of the North American market are influenced by its robust regulatory framework, which ensures the safety and efficacy of medical foods. This regulatory environment, coupled with cutting-edge research and development facilities, fosters innovation and encourages the introduction of novel medical food products. Additionally, the presence of leading healthcare companies and institutions supports the market's growth and expansion.

The future of North America's market presence appears promising, with continued advancements in medical research and growing patient preference for personalized nutrition expected to further drive demand for medical foods. As healthcare approaches become more integrated and focused on holistic well-being, medical foods are poised to play a crucial role in treatment regimens across the region.

Europe:

Europe holds approximately 28% of the Medical Foods Market share, driven by increasing healthcare expenditure, a growing elderly population, and heightened awareness regarding nutritional management of diseases. The region's strong emphasis on healthcare quality and patient well-being, along with supportive healthcare policies, underpins the market's growth. Europe's commitment to research and innovation in healthcare further contributes to the development of advanced medical food products.

Asia Pacific:

The Asia Pacific region, with a 25% market share, is experiencing rapid growth in the Medical Foods Market. Factors such as rising healthcare awareness, increasing chronic disease prevalence, and economic growth are pivotal. The region's expanding healthcare infrastructure and growing middle class are key drivers of demand for medical foods. With significant investments in healthcare and wellness, the Asia Pacific is set to see substantial growth in the medical foods sector.

Middle East & Africa:

Holding a 10% share, the Middle East & Africa region is witnessing gradual growth in the Medical Foods Market. The region's developing healthcare infrastructure, along with increasing awareness of disease-specific nutritional therapy, contributes to market expansion. Despite being in the early stages of development, the market is expected to grow, fueled by improving healthcare standards and rising health consciousness among the population.

Latin America:

Latin America, with a 7% share in the Medical Foods Market, shows potential for growth, supported by its evolving healthcare landscape and increasing chronic disease burden. The region's growing focus on preventive healthcare and patient-centered approaches to treatment are encouraging the adoption of medical foods. As healthcare systems in countries like Brazil and Mexico advance, the demand for specialized nutritional solutions is likely to increase, contributing to market growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Medical Foods Market, major players like Mead Johnson & Company LLC, Abbott Nutrition, Danone Nutricia, and Fresenius Kabi AG have significantly influenced the industry's landscape. These key companies drive the market through strategic product launches and the development of extensive product portfolios. Technological advancements play a crucial role, enhancing the ease of consumption and catering to specific needs, such as pre-thickened products for patients with gastrointestinal disorders.

The oral segment, particularly, benefits from such innovations, with oral route solutions being developed for their ease of use and effectiveness. The liquid segment, too, sees a substantial impact from these advancements, providing vital nutritional support in accessible formats. Major factors contributing to the market's evolution include a focus on addressing the unique nutritional needs of patients through scientifically formulated medical foods.

These major players have also extended their reach into various regional markets, adapting to local needs and regulatory environments. The emphasis on conditions like gastrointestinal disorders has led to the creation of targeted solutions, ensuring patients receive the specific nutrition required for their health conditions.

The strategic positioning of companies within the Medical Foods Market is defined by their commitment to innovation, patient-centric product development, and the adaptation to the changing landscape of medical nutrition. Through product launches and the expansion of product portfolios, these companies continue to set the pace for the industry, addressing the complex dietary needs of patients across the globe.

Market Key Players

- Mead Johnson & Company LLC

- Medical Pharma Inc.

- Alfasigma USA, Inc.

- Victus, Inc.

- Cambrooke Therapeutics

- Abbott

- Danone Nutricia

- Otsuka Pharmaceutical Factory, Inc.

- Fresenius Kabi AG

- Abbott Laboratories

- Cerecin Inc.

- Primus Pharmaceuticals Inc.

- Nestlé S.A.

- Danone S.A.

- Medtrition, Inc.

Recent Developments

- On February 2024, the Department of Health and Human Services (HHS) hosted the first-ever "Food is Medicine" summit and launched three public-private partnerships aimed at improving the nation's nutrition to advance better health and well-being.

- On January 2024, the American Heart Association announced grants totaling $7.8 million to 19 research projects nationwide as part of its Health Care by Food™ initiative, focusing on identifying effective approaches for incorporating healthy food into healthcare delivery

- On January 2024, Vitality and Tangelo announced a strategic partnership to provide Vitality members with easy access to high-quality, affordable, convenient, and condition-tailored nutritious food options.

Report Scope

Report Features Description Market Value (2023) USD 24.1 Billion Forecast Revenue (2033) USD 41.4 Billion CAGR (2024-2033) 5.70% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Route of Administration (Oral Nutritional Supplements, Enteral Nutrition, Parenteral Nutrition), By Ingredient Type (Vitamins & Minerals, Proteins, Carbohydrates, Omega-3 Fatty Acids, Fiber, Others), By Application (Nutritional Deficiencies, Alzheimer's Disease, Diabetes, Metabolic Syndrome, Chronic Kidney Disease, Inborn Errors of Metabolism, Others), By Distribution Channel (Hospitals, Specialty Clinics, Pharmacies, Online Retail, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Mead Johnson & Company LLC, Medical Pharma Inc., Alfasigma USA, Inc., Victus, Inc., Cambrooke Therapeutics, Abbott Nutrition, Danone Nutricia, Otsuka Pharmaceutical Factory, Inc., Fresenius Kabi AG, Abbott Laboratories, Cerecin Inc., Primus Pharmaceuticals Inc., Nestlé S.A., Danone S.A., Medtrition, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbott

- Targeted Medical Pharma Inc.

- Danone

- MEIJI Holdings Co.

- Fresenius Kabi AG

- Nestlé S.A.

- Primus Pharmaceuticals Inc.

- Mead Johnson & Company LLC

- VICTUS INC.