Medical Courier Market By Type (Medical Supplies, Transport Prescription Drugs, Lab Specimens, Blood And Organs, Transport X-Rays, Medical Notes), By Application (Hospitals and Clinics, Diagnostic and Clinical Laboratories, Pharmaceuticals and Biotechnology Industries, Blood and Tissue Banks, Public Health Departments, Academia and Research Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47803

-

June 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

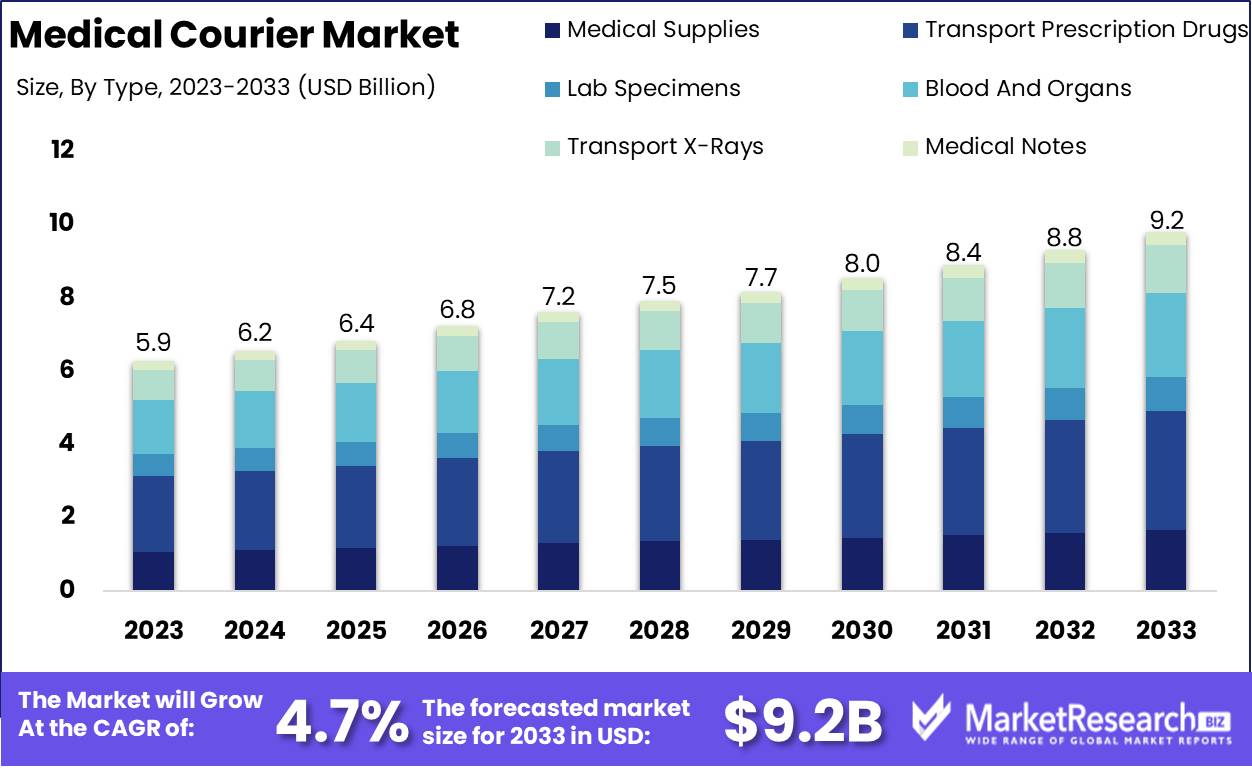

The Global Medical Courier Market was valued at USD 5.9 Bn in 2023. It is expected to reach USD 9.2 Bn by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

The Medical Courier Market involves the specialized transportation of medical specimens, pharmaceutical supplies, medical equipment, and documents related to healthcare. This market is characterized by the need for high reliability, speed, and compliance with strict regulatory standards to ensure the safe and timely delivery of critical medical items. Medical couriers serve hospitals, laboratories, pharmacies, and clinics, providing services that range from same-day delivery to temperature-controlled transport.

The Medical Courier Market is experiencing robust growth, driven by the critical need for reliable and timely transportation of medical specimens, pharmaceuticals, and healthcare equipment. This market's importance is underscored by its compliance with stringent regulatory standards, including OSHA 29 CFR 1910.1030, DOT 49CFR 171-180, and HIPAA/HITECH, which ensure the safe handling and confidentiality of medical items. Companies like Dropoff, which has provided STAT delivery services to healthcare facilities across the US since 2014, exemplify the market's commitment to high-quality service and regulatory adherence.

The Medical Courier Market is experiencing robust growth, driven by the critical need for reliable and timely transportation of medical specimens, pharmaceuticals, and healthcare equipment. This market's importance is underscored by its compliance with stringent regulatory standards, including OSHA 29 CFR 1910.1030, DOT 49CFR 171-180, and HIPAA/HITECH, which ensure the safe handling and confidentiality of medical items. Companies like Dropoff, which has provided STAT delivery services to healthcare facilities across the US since 2014, exemplify the market's commitment to high-quality service and regulatory adherence.Several factors are fueling the expansion of the Medical Courier Market. The increasing complexity of healthcare logistics, coupled with the rising demand for rapid and precise delivery solutions, is a significant driver. Advances in medical technology necessitate the swift and secure transport of specialized equipment and pharmaceuticals, while the growing prevalence of home healthcare services adds another layer of demand for reliable courier services.

The ongoing COVID-19 pandemic has highlighted the essential role of medical couriers in ensuring the uninterrupted supply of critical medical supplies and specimens. This has led to heightened investment in the sector, with a focus on enhancing service capabilities and expanding geographic reach. The integration of advanced tracking and monitoring technologies also contributes to the market's growth, providing real-time visibility and ensuring compliance with regulatory standards.

Key Takeaways

- Market Value: The Global Medical Courier Market was valued at USD 5.9 Bn in 2023. It is expected to reach USD 9.2 Bn by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

- By Type: Transport Prescription Drugs dominates the market with a 35% share, reflecting the critical need for secure and timely delivery of medications.

- By Application: Hospitals and Clinics are the dominant users, accounting for 40% of the market, due to frequent needs for urgent medical supplies and specimen transport.

- Regional Dominance: North America accounts for 45% of the Medical Courier market, showcasing substantial growth.

- Growth Opportunity: The medical courier market is expected to grow as healthcare organizations seek reliable and efficient transport solutions for time-sensitive medical specimens and supplies.

Driving factors

Rapid Delivery Requirement

The increasing necessity for rapid delivery in the medical courier market is a critical driving force behind its expansion. In the healthcare sector, time-sensitive deliveries are paramount, particularly for transporting specimens, organs, and life-saving medications. The demand for swift delivery is propelled by the need to ensure the integrity and efficacy of medical supplies, thereby reducing the risk of contamination and degradation.

This urgency in delivery is fostering innovation in logistics, leading to the adoption of advanced tracking systems, temperature-controlled vehicles, and drones. These technological advancements not only enhance the speed and reliability of medical couriers but also attract substantial investments, further driving market growth.

Growing Demand for Healthcare Services

The escalating demand for healthcare services is another significant contributor to the expansion of the medical courier market. Factors such as an aging population, rising incidence of chronic diseases, and increased accessibility to healthcare services are leading to a higher volume of medical shipments. The necessity to transport diagnostic samples, medical supplies, and pharmaceutical products efficiently and securely is paramount in meeting the healthcare needs of the growing patient population.

This surge in demand is prompting healthcare providers and facilities to rely more heavily on specialized courier services that can ensure timely and safe delivery. Additionally, the growing trend towards home healthcare and telemedicine is boosting the need for reliable medical courier services, as patients increasingly require home delivery of medical supplies and medications.

Restraining Factors

Poor Infrastructure

The presence of poor infrastructure significantly impedes the growth of the medical courier market. In regions where transportation networks are underdeveloped, the efficiency and reliability of medical deliveries are severely compromised. Inadequate roads, lack of proper healthcare facilities, and limited access to advanced logistics technology contribute to delays and increased risk of damage or loss of medical supplies.

This infrastructure deficiency not only hampers the ability to meet rapid delivery requirements but also limits the market expansion to rural and remote areas. Overcoming these infrastructure challenges requires substantial investment in transportation networks and logistics technology, which is essential for enhancing the reach and efficiency of medical courier services.

Higher Logistics Costs

Higher logistics costs pose a significant barrier to the growth of the medical courier market. The specialized nature of medical deliveries, which often require temperature-controlled environments and adherence to strict regulatory standards, adds to the overall cost of logistics. These expenses are further amplified by rising fuel prices, labor costs, and the need for advanced tracking and monitoring systems.

High logistics costs can lead to increased service prices, making it challenging for medical courier companies to remain competitive and accessible, especially in cost-sensitive markets. This financial burden can also stifle innovation and limit the ability to invest in infrastructure improvements, further compounding the challenges faced by the industry.

By Type Analysis

Transport Prescription Drugs led the Medical Courier Market with over 35% share.

In 2023, Transport Prescription Drugs held a dominant market position in the By Type segment of the Medical Courier Market, capturing more than a 35% share. This segment's leadership highlights the critical role of medical courier services in ensuring the safe, timely, and regulatory-compliant delivery of pharmaceuticals to healthcare facilities, pharmacies, and patients.

Following Transport Prescription Drugs, Medical Supplies logistics represented another significant segment in the market. Medical courier services for supplies include the delivery of medical equipment, surgical instruments, and consumables to healthcare providers and facilities.

Lab Specimens transport services also held a notable share in the Medical Courier Market. Couriers specializing in lab specimens handle the collection, transportation, and delivery of biological samples, diagnostic specimens, and clinical trial materials between laboratories, hospitals, and research institutions.

Blood and Organs transport services cater to the critical need for safe and timely delivery of blood products, tissue samples, and organs for transplantation. Medical couriers in this segment play a vital role in facilitating organ procurement and transplant logistics, ensuring organs are transported efficiently while maintaining strict temperature and handling requirements to preserve viability.

Transport X-Rays and Medical Notes logistics round out the Medical Courier Market segments, focusing on the secure and confidential transport of sensitive medical records, imaging studies, and patient documentation.

By Application Analysis

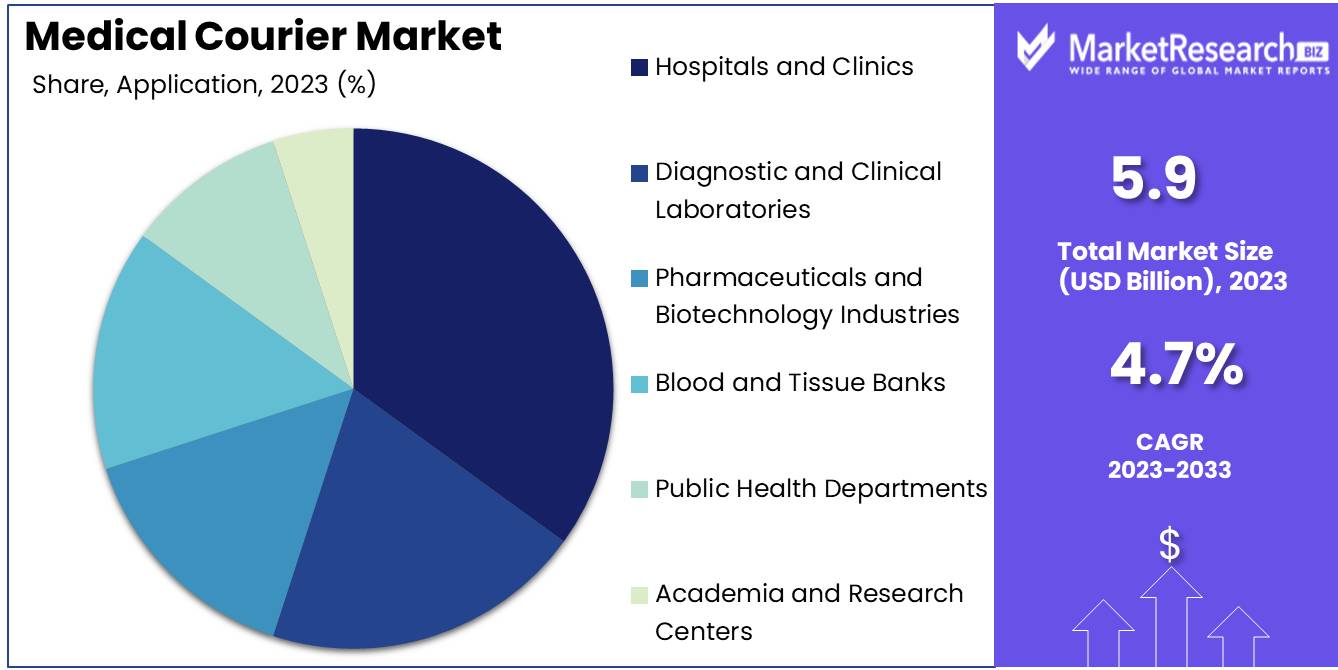

Hospitals and Clinics led the market with share of 30% due to their extensive use of medical courier services for daily operational needs.

In 2023, Hospitals and Clinics held a dominant market position in the By Application segment of the Medical Courier Market, capturing more than a 35% share. This segment's leadership underscores the extensive reliance on medical courier services within healthcare facilities to facilitate timely and secure transport of critical medical supplies, specimens, and pharmaceuticals.

Diagnostic and Clinical Laboratories represented another significant segment in the Medical Courier Market. These facilities rely on medical couriers to transport biological samples, diagnostic specimens, and laboratory test results between hospitals, clinics, and research institutions.

Pharmaceuticals and Biotechnology Industries also held a notable share in the market. Medical courier services for these sectors focus on the safe and compliant transport of pharmaceutical products, biologics, and clinical trial materials.

Blood and Tissue Banks require specialized medical courier services for the transport of blood products, tissue samples, and organs for transplantation. Couriers in this segment play a critical role in facilitating organ procurement, blood donations, and transplant logistics, ensuring the timely delivery and safe handling of these life-saving materials.

Public Health Departments rely on medical couriers for the transport of public health specimens, vaccines, and infectious disease samples. Timely delivery of these items is crucial for disease surveillance, outbreak response, and immunization programs, contributing to public health initiatives and emergency preparedness efforts.

Academia and Research Centers also utilize medical courier services for transporting research materials, laboratory equipment, and scientific samples between campuses and collaborating institutions.

Key Market Segments

By Type

- Medical Supplies

- Transport Prescription Drugs

- Lab Specimens

- Blood And Organs

- Transport X-Rays

- Medical Notes

By Application

- Hospitals and Clinics

- Diagnostic and Clinical Laboratories

- Pharmaceuticals and Biotechnology Industries

- Blood and Tissue Banks

- Public Health Departments

- Academia and Research Centers

Growth Opportunity

Specialized Services

The rising demand for specialized medical courier services offers substantial opportunities for market players. As the healthcare industry continues to evolve, there is an increasing need for couriers capable of handling sensitive and high-value medical shipments such as biological samples, organs for transplantation, and temperature-sensitive pharmaceuticals.

Companies that invest in developing and offering these specialized services will be well-positioned to capture a significant share of the market. The ability to provide reliable, secure, and compliant delivery solutions will be a key differentiator, attracting healthcare providers seeking trusted logistics partners.

E-commerce and Online Healthcare

The surge in e-commerce and online healthcare services is another pivotal factor creating opportunities for the medical courier market in 2024. The growing trend of ordering medications, medical supplies, and health-related products online necessitates efficient and reliable delivery systems. Medical couriers that can integrate with e-commerce platforms and offer seamless delivery solutions will benefit from this expanding market segment. Additionally, the rise of telemedicine and home healthcare services will further boost demand for medical couriers, as patients increasingly rely on home delivery of essential medical items.

Latest Trends

Temperature-Controlled Logistics

One of the most prominent trends in the medical courier market for 2024 is the increasing adoption of temperature-controlled logistics. As the transportation of temperature-sensitive medical products such as vaccines, biological samples, and pharmaceuticals becomes more critical, the demand for advanced cold chain solutions is growing. Companies are investing in state-of-the-art refrigeration units, insulated packaging, and temperature-monitoring systems to ensure the integrity of these products during transit.

This trend is driven by stringent regulatory requirements and the need to maintain the efficacy and safety of medical supplies. The ability to provide reliable temperature-controlled logistics will be a significant competitive advantage, attracting clients who prioritize compliance and quality.

Real-Time Tracking and Monitoring

Real-time tracking and monitoring technologies are transforming the medical courier market by providing unprecedented levels of transparency and efficiency. In 2024, the integration of GPS tracking, IoT devices, and advanced monitoring systems will become standard practice for leading medical courier companies. These technologies enable real-time visibility into the location, condition, and status of shipments, allowing for proactive management of potential issues and delays.

Clients benefit from enhanced transparency, knowing exactly where their critical medical supplies are at any given time. Additionally, real-time data analytics help optimize delivery routes, reduce transit times, and improve overall operational efficiency. The trend towards real-time tracking and monitoring is expected to drive innovation and set new standards for reliability and service quality in the medical courier market.

Regional Analysis

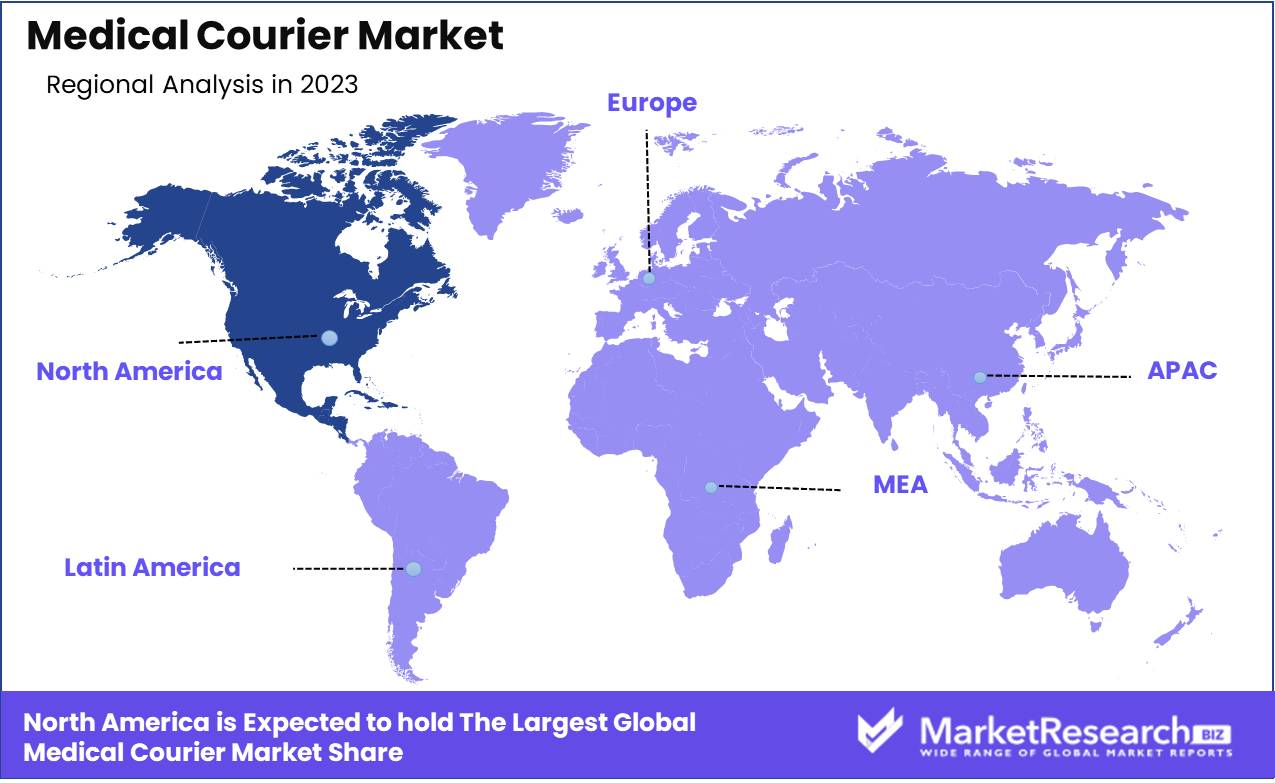

North America leads the global medical courier market with a dominant share of 45%

North America dominates the medical courier market with a commanding share of 45%. This region benefits from a robust healthcare infrastructure, stringent regulatory standards, and a high volume of medical specimen transportation needs. The market in North America is characterized by the presence of established courier service providers specializing in medical logistics, ensuring timely and secure delivery of sensitive healthcare materials.

Europe represents another significant segment in the medical courier market, driven by universal healthcare systems and growing demand for efficient medical supply chain management. Countries such as the UK, Germany, and France are prominent markets for medical courier services, catering to the needs of hospitals, laboratories, and pharmaceutical companies.

Asia Pacific is emerging as a rapidly expanding region in the global medical courier market, fueled by increasing healthcare expenditure, expanding laboratory networks, and improving healthcare infrastructure. Countries like China, Japan, and India are witnessing a rise in demand for specialized courier services to transport diagnostic specimens, pharmaceuticals, and medical equipment efficiently.

Middle East & Africa and Latin America are also integral parts of the medical courier market, albeit with smaller shares compared to North America, Europe, and Asia Pacific. In these regions, the market is driven by efforts to improve healthcare access, enhance diagnostic capabilities, and address logistical challenges in remote areas.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global medical courier market is poised for growth with key players. These companies play critical roles in the transportation and logistics of medical supplies, specimens, and sensitive pharmaceuticals, ensuring timely and secure deliveries across the healthcare sector.

DHL International GmbH, known for its extensive global network and specialized healthcare logistics solutions, continues to lead by integrating advanced tracking technologies and temperature-controlled shipping to maintain the integrity of medical shipments. FedEx Corp and UPS also hold significant market shares, leveraging their extensive logistics infrastructure to provide reliable medical courier services worldwide.

Cencora Inc. and ERS Transition Ltd specialize in medical courier services tailored to pharmaceutical and healthcare providers, focusing on regulatory compliance and efficient delivery processes. Med Logistics Grp and Blaze Express Courier Service offer niche services such as same-day deliveries and specialized handling for medical specimens and samples.

Citysprint Ltd and Affordable Courier Solutions Inc. cater to the growing demand for personalized medical courier services, ensuring flexibility and responsiveness in healthcare logistics. MNX Global Logistics and ZIPLINE International Inc. are innovators in medical drone delivery services, providing rapid response capabilities for urgent medical supplies in remote or challenging environments.

Market Key Players

- DHL International GmbH

- Cencora Inc.

- ERS Transition Ltd

- Send Direct Ltd

- Med Logistics Grp

- Blaze Express Courier Service

- Citysprint Ltd

- Affordable Courier Solutions Inc.

- Aylesford Couriers

- United Parcel Services

- FedEx Corp

- MNX Global Logistics

- Reliant Couriers & Haulage Ltd

- ZIPLINE International Inc

Recent Development

- In June 2024, Bailador Technology Investments invests $20m in Updoc, a telehealth platform linking consumers with health practitioners.

- In May 2024, Zoho Corp invests in Yali Aerospace, specializing in drones for medical supply delivery in remote areas.

Report Scope

Report Features Description Market Value (2023) USD 5.9 Bn Forecast Revenue (2033) USD 9.2 Bn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Medical Supplies, Transport Prescription Drugs, Lab Specimens, Blood And Organs, Transport X-Rays, Medical Notes), By Application (Hospitals and Clinics, Diagnostic and Clinical Laboratories, Pharmaceuticals and Biotechnology Industries, Blood and Tissue Banks, Public Health Departments, Academia and Research Centers) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DHL International GmbH, Cencora Inc., ERS Transition Ltd, Send Direct Ltd, Med Logistics Grp, Blaze Express Courier Service, Citysprint Ltd, Affordable Courier Solutions Inc., Aylesford Couriers, United Parcel Services, FedEx Corp, MNX Global Logistics, Reliant Couriers & Haulage Ltd, ZIPLINE International Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DHL International GmbH

- Cencora Inc.

- ERS Transition Ltd

- Send Direct Ltd

- Med Logistics Grp

- Blaze Express Courier Service

- Citysprint Ltd

- Affordable Courier Solutions Inc.

- Aylesford Couriers

- United Parcel Services

- FedEx Corp

- MNX Global Logistics

- Reliant Couriers & Haulage Ltd

- ZIPLINE International Inc