Global Medical Bed Market By Type(Electric Bed, Semi Electric Bed, Manual Bed), By Application(Outpatient Clinics, Medical Nursing Homes, Medical Laboratory and Research), By Usage(Acute Care, Long Term Care, Psychiatric Care, Maternity), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

2715

-

Feb 2025

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Healthcare Expansion in Emerging Markets

- Innovations in Medical Bed Technology

- Restraining Factors

- Financial Barriers Due to High Costs

- Supply Chain and Distribution Challenges

- By Type Analysis

- By Application Analysis

- By Usage Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

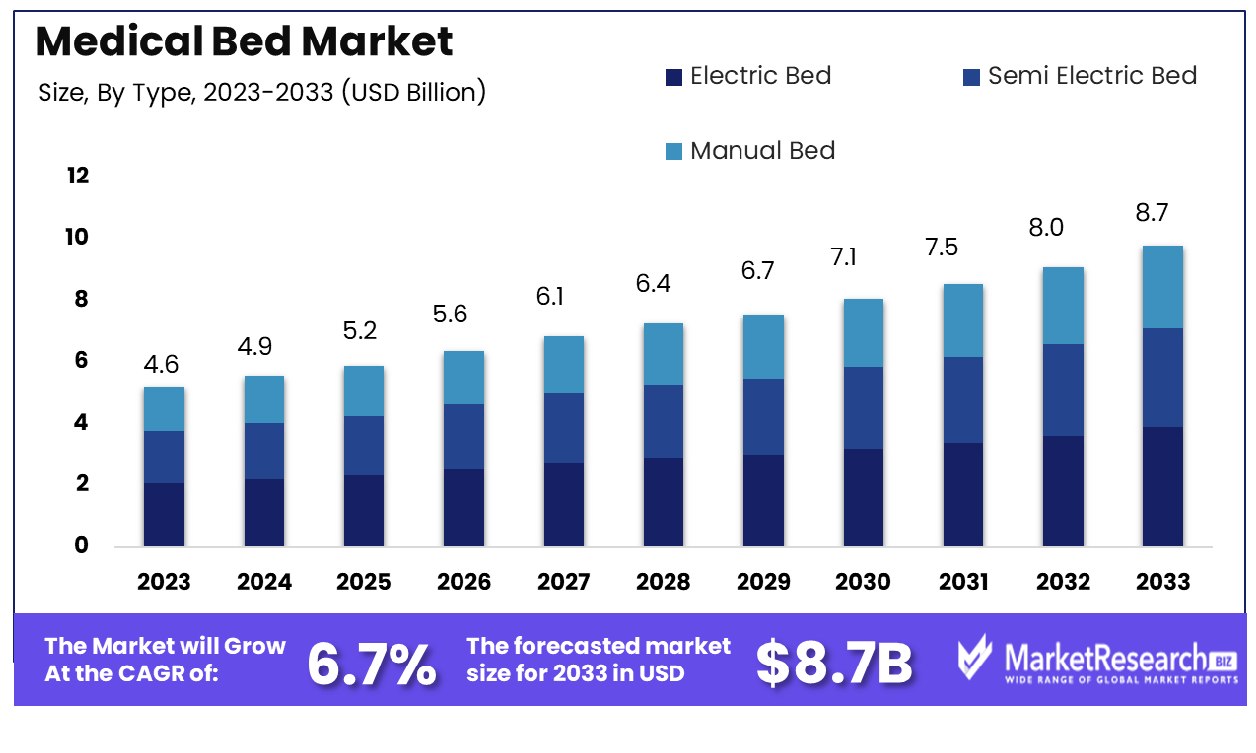

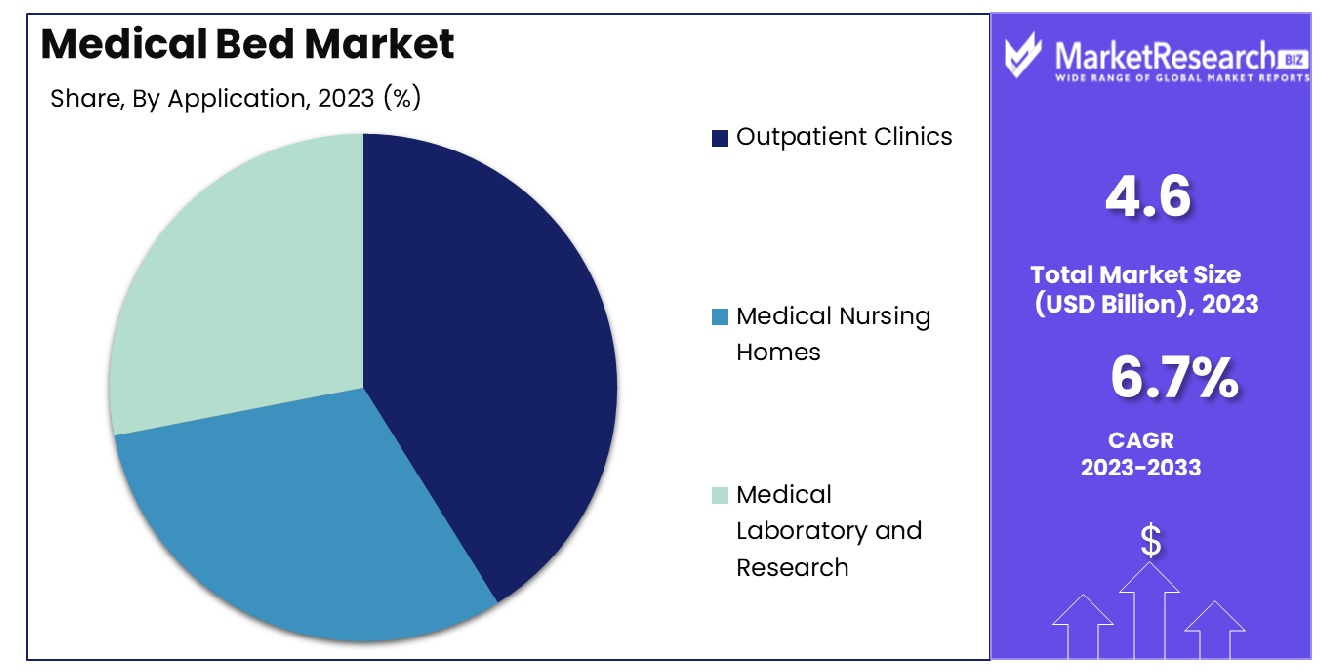

The Global Medical Bed Market was valued at USD 4.6 billion in 2023. It is expected to reach USD 8.7 billion by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

The Medical Bed Market encompasses a range of products designed to support the healthcare industry by enhancing patient care and comfort. This market includes manual, semi-electric, and electric beds, tailored for various medical settings such as hospitals, long-term care facilities, and home care.

As healthcare demands evolve, the market is driven by factors including advancements in medical technology, an aging population, and rising healthcare expenditures. For executives and product managers, understanding this market is crucial for strategic decision-making, product development, and optimizing patient outcomes in healthcare environments.

The Medical Bed Market is witnessing significant transformation, driven by evolving healthcare requirements and technological advancements. In 2020, the U.S. recorded approximately 924,000 hospital beds, a decrease from previous years, illustrating shifts in healthcare facility capacities and resource allocation.

Despite this reduction, the average occupancy rate of hospital beds remained robust at around 65% in 2019, underscoring a sustained demand for inpatient care and efficient utilization of healthcare infrastructure. Furthermore, the average hospital stay in 2020 was noted at 4.5 days, varying with the complexity and type of treatment, which directly influences the demand dynamics for medical beds.

Approximately 10% of these beds are dedicated to intensive care units (ICUs), reflecting the critical segment of the market that requires specialized medical beds equipped with advanced features for acute patient care. This segment is particularly important given the intensity of care and the need for beds that support critical health interventions.

The growth of the medical bed market is also supported by a robust backbone of healthcare professionals. With around 2.9 million registered nurses as of 2020, there is an enhanced focus on improving patient care and outcomes, further stimulating demand for medical beds that are adaptable and supportive of nursing activities.

For industry leaders and decision-makers, these insights into the Medical Bed Market are crucial for strategic planning, indicating a market that, while currently under some pressures, is supported by a consistent need for specialized healthcare solutions and a professional workforce dedicated to patient care. This data-driven analysis aids in identifying opportunities for innovation and investment in the medical bed sector, ensuring alignment with broader healthcare trends and demands.

Key Takeaways

- Market Growth: The Global Medical Bed Market was valued at USD 4.6 billion in 2023. It is expected to reach USD 8.7 billion by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

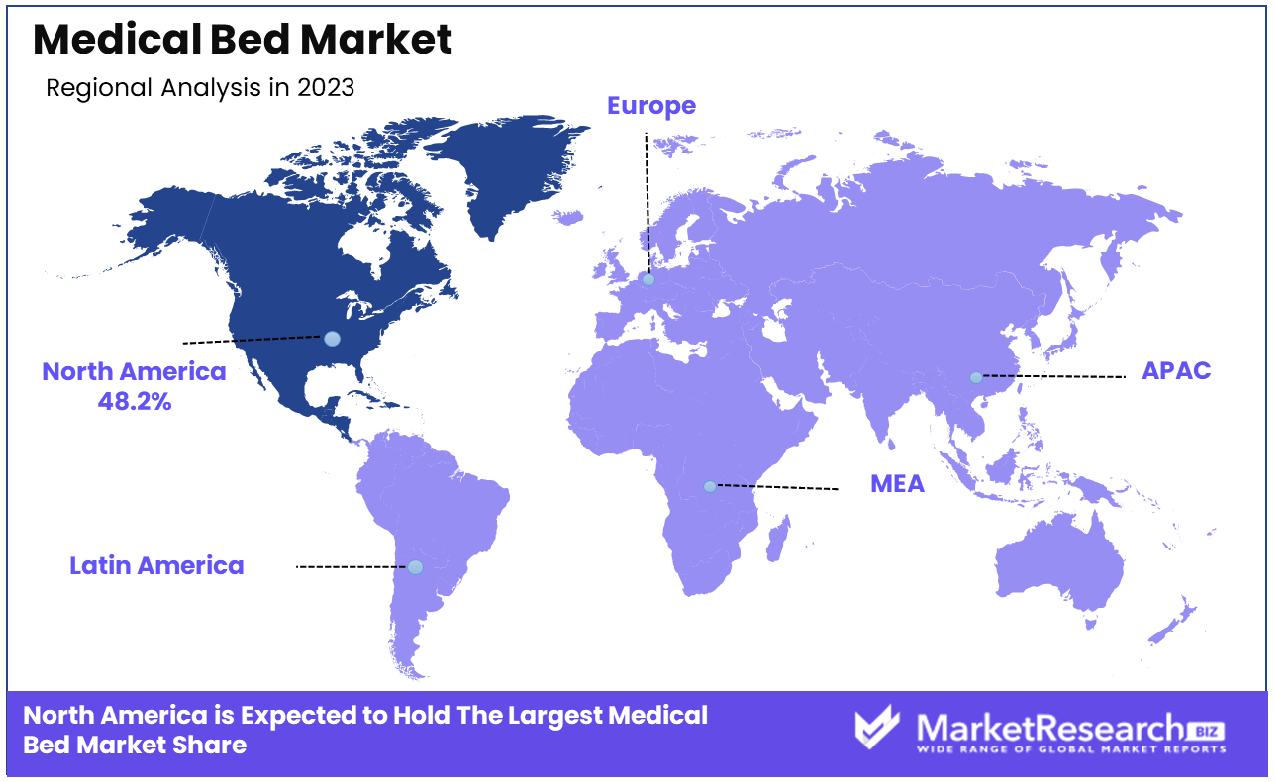

- Regional Dominance: North America holds 48.2% of the global medical bed market.

- By Type: Electric beds dominated the market with a 45.2% share.

- By Application: Outpatient clinics led in the application, holding a 30.4% share.

- By Usage: Acute care usage was predominant, commanding a 50.1% share.

Driving factors

Demographic Shifts and Chronic Disease Prevalence Boost Demand

The increasing global aging population and the rising prevalence of chronic diseases are primary drivers of growth in the Medical Bed Market. An aging demographic typically experiences a higher incidence of conditions such as osteoporosis, arthritis, and cardiovascular diseases, which often necessitate prolonged hospitalization and specialized medical beds to manage these conditions effectively.

The aging global population, expected to double by 2050, necessitates robust healthcare infrastructure, including an increased demand for medical beds equipped to handle long-term care needs.

Healthcare Expansion in Emerging Markets

The expansion of healthcare facilities and services in emerging markets is another critical factor contributing to the growth of the Medical Bed Market. As countries develop, there is a significant increase in healthcare expenditure and infrastructure to meet the growing healthcare needs of the population.

This expansion is not just in terms of quantity but also the quality of medical facilities, driving the demand for modern medical beds that provide enhanced patient care and support advanced medical procedures. This trend is evident in regions like Asia and Africa, where healthcare development is a priority for sustaining economic growth and improving public health outcomes.

Innovations in Medical Bed Technology

Technological advancements in medical bed design and functionality significantly impact market growth. Modern medical beds are increasingly equipped with sophisticated features such as electronic adjustability, built-in monitoring systems, and improved ergonomic designs that enhance patient comfort and safety. These innovations are crucial in intensive care units, as noted by the fact that 10% of hospital beds are designated for ICUs.

The demand for beds that can efficiently integrate with health technology systems demonstrates the critical role of innovation in driving market expansion. These technological enhancements not only improve patient outcomes but also streamline healthcare processes, making efficient use of the 65% occupancy rates recorded in hospitals.

Restraining Factors

Financial Barriers Due to High Costs

The high cost of specialized medical beds poses a significant restraint on the Medical Bed Market. Advanced features such as hydraulic or electronic adjustability, built-in monitoring systems, and specialized materials increase the cost of production, which is then passed on to healthcare facilities.

This pricing barrier can limit the accessibility of the latest medical bed technologies, particularly in underfunded hospitals or in regions with lower healthcare spending. The economic impact is especially felt in emerging markets, where budgets may not accommodate high-end medical beds, thus inhibiting market growth in these regions.

Supply Chain and Distribution Challenges

Challenges in managing the supply chain and logistics for medical bed distribution further complicate the market dynamics. The logistics involved in manufacturing, storing, and transporting large, complex beds across global markets can lead to increased costs and delays in delivery. This factor becomes particularly critical during times of rapid demand spikes, such as during global health crises. Disruptions in the supply chain can lead to shortages in hospital beds, as seen during the early stages of the COVID-19 pandemic when the demand for medical beds surged unexpectedly.

Efficient supply chain management is essential to ensure that the right products are available in the right markets at the right times, minimizing potential losses in sales and customer satisfaction. Combined, these factors not only directly impact the availability and cost of medical beds but also influence strategic decisions regarding inventory and distribution logistics in the healthcare sector.

By Type Analysis

Electric beds dominated the market by type, holding a substantial 45.2% share due to their advanced features.

In 2023, the Medical Bed Market was segmented into three key types: Electric Bed, Semi Electric Bed, and Manual Bed. Electric Bed held a dominant market position in the "By Type" segment, capturing more than a 45.2% share. This prominence can be attributed to the increasing demand for technologically advanced healthcare facilities and the rising prevalence of chronic diseases, which require sophisticated patient management solutions.

Semi Electric Beds also showcased significant market engagement, reflecting a blend of manual and electric features that cater to budget-conscious healthcare facilities while providing essential functionalities. This segment's adaptability and cost-efficiency make it a preferred choice in less critical care scenarios, supporting its substantial market share.

Manual Beds, while less technologically advanced, maintained a stable market presence, driven by their lower cost and widespread usage in settings where minimal patient mobility is required. Their durability and ease of maintenance render them suitable for long-term care facilities and home care settings, particularly in developing regions where cost constraints are predominant.

The distribution of market shares across these segments underscores a clear trend towards automation and patient comfort in the medical sector, with Electric Beds leading the way due to their advanced features and operational efficiencies. This shift is expected to continue as healthcare facilities globally strive to improve patient care and operational efficacy through technological enhancements.

By Application Analysis

Outpatient clinics led by application, capturing 30.4% of the market, reflecting the shift towards outpatient care settings.

In 2023, the Medical Bed Market was categorized by application into three primary segments: Outpatient Clinics, Medical Nursing Homes, and Medical Laboratory and Research. Outpatient Clinics held a dominant market position, capturing more than a 30.4% share. This substantial market share can be primarily attributed to the increasing global emphasis on outpatient care facilities as a cost-effective alternative to hospital stays. The flexibility and efficiency offered by outpatient clinics, combined with rising patient preference for minimally invasive treatments and quicker discharge procedures, have significantly driven the demand for medical beds in this sector.

Medical Nursing Homes followed, reflecting a growing demand driven by the aging global population and the corresponding rise in chronic conditions that require prolonged care. Medical beds in these facilities are crucial for ensuring patient comfort and care quality, contributing to the segment's robust market presence.

The Medical Laboratory and Research segment, while smaller in comparison, is pivotal in specialized medical and clinical research settings. This segment's demand for medical beds is fueled by the need for precise and controlled environments in experimental and clinical research scenarios.

The distribution of market shares across these applications highlights a dynamic shift towards more decentralized and specialized healthcare services, with Outpatient Clinics leading due to their critical role in providing immediate and accessible care. This trend is anticipated to persist as healthcare delivery continues to evolve, focusing on enhancing patient satisfaction and optimizing care delivery costs.

By Usage Analysis

Acute care was the primary usage category, dominating with a 50.1% share, emphasizing its critical role in healthcare.

In 2023, the Medical Bed Market was strategically segmented by usage into four key areas: Acute Care, Long Term Care, Psychiatric Care, and Maternity. Acute Care held a dominant market position, capturing more than a 50.1% share. This leading position is underpinned by the high demand for acute care services, which encompass immediate and intensive treatment for patients with severe, life-threatening conditions. The critical nature of acute care requires facilities to be equipped with high-quality medical beds that offer superior functionality and adaptability to meet diverse patient needs.

Long Term Care also accounted for a significant portion of the market, driven by an aging population and increasing prevalence of chronic diseases that require extended medical supervision and care. Medical beds in this segment are designed to provide enhanced comfort and support, essential for patients who spend extended periods in care.

Psychiatric Care and Maternity beds, while smaller in terms of market share compared to Acute and Long Term Care, are crucial in specialized medical fields. Psychiatric Care beds are tailored to ensure patient safety and comfort, catering to the unique needs of mental health facilities. Meanwhile, Maternity beds are designed to support mothers before, during, and after childbirth, highlighting their critical role in maternal care settings.

The dominance of Acute Care in the Medical Bed Market underscores the sector's essential role in healthcare systems worldwide, driven by an ongoing need for high-quality, adaptable beds that can support a range of medical requirements in critical care environments. This trend is expected to continue as medical technologies evolve and healthcare demands grow.

Key Market Segments

By Type

- Electric Bed

- Semi Electric Bed

- Manual Bed

By Application

- Outpatient Clinics

- Medical Nursing Homes

- Medical Laboratory and Research

By Usage

- Acute Care

- Long Term Care

- Psychiatric Care

- Maternity

Growth Opportunity

Smart Bed Integration and Monitoring Technologies

The development and adoption of smart beds equipped with monitoring technologies represent a significant opportunity for the global Medical Bed Market in 2023. As healthcare providers increasingly focus on data-driven patient care, smart beds offer a way to seamlessly integrate patient monitoring into daily care routines. These beds can track vital signs, sleep patterns, and patient movements, providing real-time data that can be used to adjust treatment plans promptly.

This capability is particularly crucial in managing chronic conditions and post-operative care, where continuous monitoring is essential. The integration of IoT (Internet of Things) and AI (Artificial Intelligence) in medical beds enhances their functionality, making them an integral component of modern medical facilities looking to improve patient outcomes and operational efficiency.

Growth in Home Healthcare Service

Another expanding sector that presents substantial opportunities for the Medical Bed Market is the home healthcare service industry. With a growing preference for aging in place, especially in developed economies, there is an increased demand for medical beds that are adaptable for home use. These beds need to be not only functional and equipped with necessary medical features but also aesthetically pleasing to fit within the home environment.

The expansion of home healthcare services is driven by the need for cost-effective solutions that allow for long-term care at home, reducing the strain on hospital resources and improving the quality of life for patients with chronic illnesses or mobility issues. This trend is expected to accelerate in 2023, prompting bed manufacturers to innovate and expand their offerings to meet home-based care requirements.

Latest Trends

Incorporation of Telemedicine Capabilities in Medical Beds

In 2023, the global medical bed market witnessed a significant shift towards the integration of telemedicine capabilities, responding to the growing necessity for remote patient monitoring. This trend can be attributed to the accelerated adoption of digital health technologies, driven by the enduring impacts of the COVID-19 pandemic.

Medical beds equipped with telemedicine features offer healthcare providers the ability to monitor patient vitals and adjust bed settings remotely, thus enhancing the efficiency of care and minimizing the need for physical contact. This technological enhancement is poised to transform patient management in hospitals and long-term care facilities, making the monitoring process more seamless and less intrusive.

Rising Demand for Beds with Enhanced Safety Features and Patient Comfort

Parallel to technological advancements, there has been a rising demand for medical beds that prioritize patient safety and comfort. The market's focus has broadened from mere functionality to include beds that prevent patient falls, reduce the risk of pressure injuries, and offer improved ergonomic support. Manufacturers are increasingly incorporating adjustable bed features, such as height adjustability and multi-positioning capabilities, which not only enhance patient comfort but also aid healthcare workers in providing care.

This trend highlights a shift towards creating a more patient-centric healthcare environment, where patient safety and comfort are considered pivotal elements in care provision, directly influencing the market's growth trajectory.

Regional Analysis

In 2023, North America dominated the medical bed market, holding a substantial 48.2% share of the global market.

The global medical bed market exhibits significant regional variation, with North America dominating the landscape, holding a commanding market share of 48.2%. This dominance is largely driven by advanced healthcare infrastructure, high healthcare expenditure, and a strong emphasis on healthcare innovation within the region. Additionally, the presence of major market players who consistently innovate in terms of bed functionality and patient safety mechanisms contributes to this substantial market share.

Europe follows closely, with a robust focus on enhancing hospital facilities and expanding the geriatric care infrastructure, responding to its aging population. The region's strong regulatory framework supporting healthcare safety and quality further bolsters the market for medical beds equipped with advanced features.

Asia Pacific is identified as the fastest-growing region in the medical bed market, spurred by rising healthcare investments and an increasing number of hospitals and medical facilities in countries like China and India. The region's market expansion is also supported by growing health awareness and increasing government initiatives aimed at improving healthcare infrastructure.

Meanwhile, the Middle East & Africa and Latin America are emerging markets with growing potential, driven by gradual improvements in healthcare systems and rising medical tourism, especially in countries like the UAE and Brazil. These regions are experiencing increased demand for medical beds as part of broader efforts to modernize and expand healthcare facilities, although they currently hold smaller shares of the global market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

Invacare Corporation, Hill-Rom Services, Inc., and Stryker Corporation in the United States are industry stalwarts known for their innovative bed designs that integrate cutting-edge technology for enhanced patient care and healthcare worker support. Their continued investment in R&D has allowed for advancements in smart bed features, such as remote monitoring and automated adjustments, which have set industry standards.

Medical Depot, Inc. and Umano Medical Inc. in Canada are noted for their focus on patient comfort and safety, pushing the boundaries in ergonomic designs and injury prevention technologies. Their products often cater to specialized healthcare settings, including long-term care facilities and home care environments.

European manufacturers like Arjo in Sweden and LINET in Czechia have made significant inroads in developing beds that are not only technologically advanced but also cater to the stringent regulatory standards of healthcare provision in Europe. These companies emphasize mobility and flexibility in their designs, facilitating easier patient handling and reducing caregiver strain.

Getinge AB and Stiegelmeyer GmbH & Co. KG from Germany are recognized for their high-quality craftsmanship and durability, making their beds a preferred choice in both acute care and specialized medical settings.

Emerging market players like Mobility Aids Sales and Services in India and PARAMOUNT BED CO., LTD. in Japan highlight the global reach of the market, focusing on affordability and accessibility in regions with rapidly developing healthcare infrastructures.

Market Key Players

- Invacare Corporation. (US)

- Hill-Rom Services, Inc. (US)

- Stryker Corporation (US)

- Medical Depot, Inc. (Canada)

- Gendron Inc. (US)

- Arjo. (Sweden)

- HARD Manufacturing Company, Inc. (US)

- GF Health Products, Inc. (US)

- Transfer Master Products, Inc. (US)

- Umano Medical inc. (Canada)

- ProBed Medical Technologies (Canada)

- American Medical Equipment. (US)

- Getinge AB. (Sweden)

- Amico Group of Companies. (US)

- Merivaara (Finland)

- ANTANO GROUP (Italy)

- LINET. (Czechia)

- Stiegelmeyer GmbH & Co. KG (Germany)

- Mobility Aids Sales and Services (India)

- PARAMOUNT BED CO., LTD. (Japan)

Recent Development

- In February 2024, Hill-Rom Services, Inc. announced a merger with a European healthcare equipment provider in February 2024, aiming to broaden their global footprint and enhance their product offerings. This strategic move is anticipated to increase their market share by approximately 10% in the European region, leveraging new distribution channels and technologies.

- In November 2023, Gendron Inc. launched a specialized medical bed designed for bariatric patients, supporting weights up to 1,000 pounds. This product launch responds to the increasing need for smart medical devices catering to the bariatric segment, providing enhanced safety features and comfort for heavier patients.

- In May 2023, Invacare Corporation expanded its product line with the launch of a new series of high-tech medical beds designed to enhance patient comfort and caregiver efficiency. These beds feature customizable settings controlled via a mobile app, addressing the growing demand for technologically advanced healthcare solutions.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 8. Billion CAGR (2024-2032) 6.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Electric Bed, Semi Electric Bed, Manual Bed), By Application(Outpatient Clinics, Medical Nursing Homes, Medical Laboratory and Research), By Usage(Acute Care, Long Term Care, Psychiatric Care, Maternity) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Invacare Corporation. (US), Hill-Rom Services, Inc. (US), Stryker Corporation (US), Medical Depot, Inc. (Canada), Gendron Inc. (US), Arjo. (Sweden), HARD Manufacturing Company, Inc. (US), GF Health Products, Inc. (US), Transfer Master Products, Inc. (US), Umano Medical inc. (Canada), ProBed Medical Technologies (Canada), American Medical Equipment. (US), Getinge AB. (Sweden), Amico Group of Companies. (US), Merivaara (Finland), ANTANO GROUP (Italy), LINET. (Czechia), Stiegelmeyer GmbH & Co. KG (Germany), Mobility Aids Sales and Services (India), PARAMOUNT BED CO., LTD. (Japan) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Invacare Corporation. (US)

- Hill-Rom Services, Inc. (US)

- Stryker Corporation (US)

- Medical Depot, Inc. (Canada)

- Gendron Inc. (US)

- Arjo. (Sweden)

- HARD Manufacturing Company, Inc. (US)

- GF Health Products, Inc. (US)

- Transfer Master Products, Inc. (US)

- Umano Medical inc. (Canada)

- ProBed Medical Technologies (Canada)

- American Medical Equipment. (US)

- Getinge AB. (Sweden)

- Amico Group of Companies. (US)

- Merivaara (Finland)

- ANTANO GROUP (Italy)

- LINET. (Czechia)

- Stiegelmeyer GmbH & Co. KG (Germany)

- Mobility Aids Sales and Services (India)

- PARAMOUNT BED CO., LTD. (Japan)