Global Meat Extract Market By Type (Chicken, Pork, Beef, Fish, Others), By Form (Powder, Liquid, Granule, Paste), By Source (Conventional, Organic), By Application (Ready Meals, Snacks, Soups and Broths, Seasonings, Others), By End-User (Food Processing, Lab Testing), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

15936

-

February 2025

-

163

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

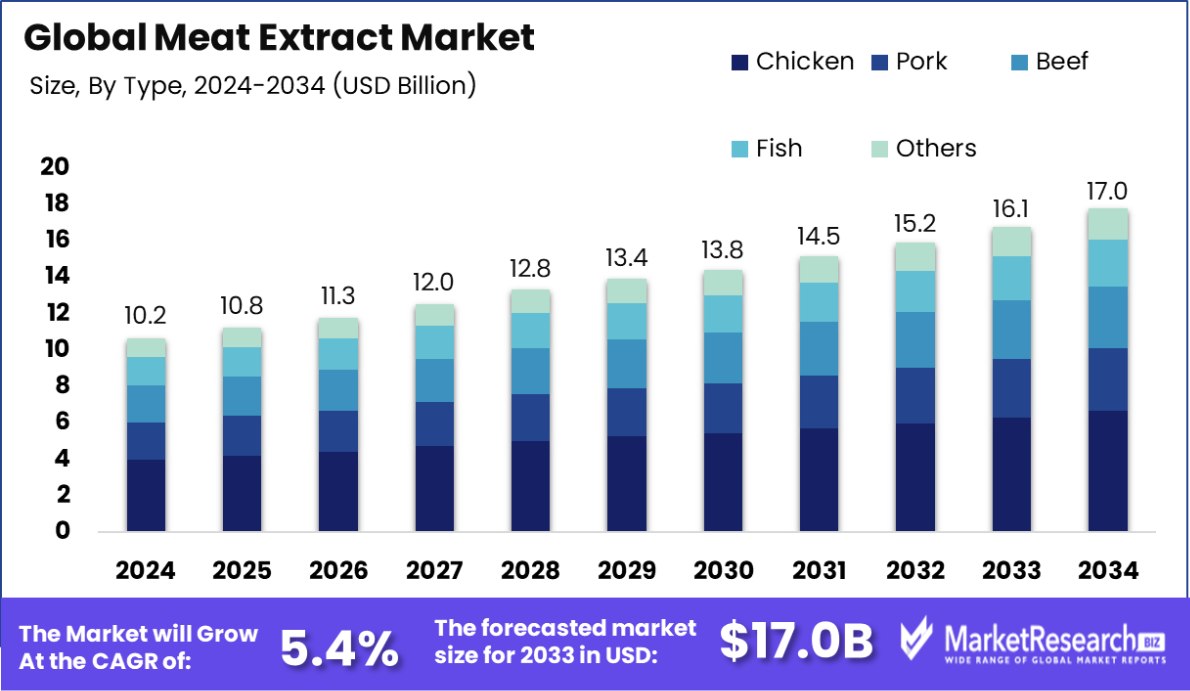

The Meat Extract Market was valued at USD 10.2 billion in 2024. It is expected to reach USD 17.0 billion by 2034, with a CAGR of 5.4% during the forecast period from 2025 to 2034. North America holds 39.2% of the Meat Extract Market, valued at USD 3.9 Bn.

Meat extract is a concentrated form of meat broth, typically made by boiling meat to extract its flavor, nutrients, and proteins. The process involves reducing the liquid to a thick, viscous consistency, which can be used as a base for soups, broths, and sauces, and as a flavor enhancer in various culinary products.

It is rich in amino acids, vitamins, and minerals, making it a potent ingredient in both food and pharmaceuticals. Meat extract is widely used in the food industry for its flavoring properties and in microbiological media for culturing bacteria.

The meat extract market has experienced steady growth due to its widespread application in food production, particularly in soups, seasonings, sauces, and ready-to-eat meals. The demand for meat extract is also driven by the expanding food service industry, especially in regions like North America, Europe, and Asia.

As consumers increasingly demand convenience and high-protein foods, meat extract plays a key role in satisfying these preferences. Additionally, with the rise of health-conscious consumers, there has been a shift towards natural, nutrient-dense ingredients, further supporting the market's expansion.

The growth of the meat extract market is largely fueled by increasing consumer demand for convenient, protein-rich, and flavorful food products. As lifestyles become busier, ready-to-eat meals and convenience foods are in higher demand, with meat extract serving as a key ingredient in enhancing taste and nutritional content.

Furthermore, the growing trend of natural and clean-label products boosts the adoption of meat extract, as it is perceived as a more authentic and wholesome ingredient compared to artificial flavorings.

Demand for meat extract is growing in both food processing and pharmaceutical sectors. In food production, it is primarily used in the creation of soups, gravies, and snack foods. Meanwhile, in microbiological applications, meat extract is essential for cultivating a wide range of microorganisms. Consumer preference for savory, protein-enhanced, and naturally sourced products continues to drive this demand, particularly in the health and wellness sectors.

There are significant opportunities in the meat extract market, especially in emerging economies where urbanization and changing diets are leading to greater consumption of processed foods. Moreover, innovations in plant-based and synthetic meat extracts present new avenues for growth, catering to the rising popularity of plant-based diets.

Key Takeaways

- The Meat Extract Market was valued at USD 10.2 billion in 2024. It is expected to reach USD 17.0 billion by 2034, with a CAGR of 5.4% during the forecast period from 2025 to 2034.

- Chicken-based meat extracts dominate the market, accounting for 39.2% of total market share globally.

- Powdered meat extracts are preferred, making up 47.4% of the market due to convenience and storage.

- Conventional meat extract sources lead the market, representing 79.2%, reflecting consumer trust in traditional methods.

- Ready meals represent 37.3% of the market, where meat extracts are used for flavor and nutrition.

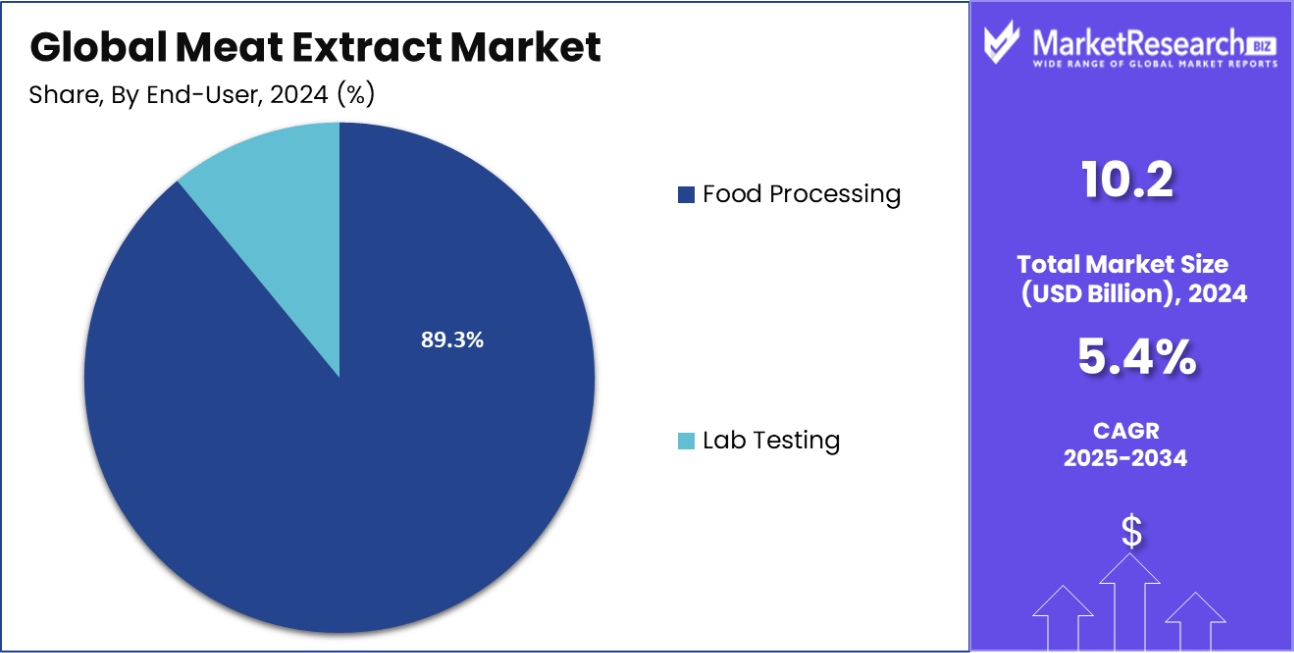

- The food processing sector accounts for 89.3%, utilizing meat extracts in production for flavor enhancement.

- North America holds 39.2% of the meat extract market, valued at USD 3.9 Bn.

Driving Factors

Rising Demand for Convenient, Ready-to-Eat Foods

As consumers continue to prioritize convenience due to busy lifestyles, the demand for ready-to-eat meals, soups, and snacks has surged. Meat extract plays a crucial role in these products, offering quick, flavorful, and protein-rich solutions. This trend is especially strong in urban areas, where the need for fast, nutritious meals drives meat extract market growth.

Growing Consumer Preference for Natural Ingredients

In recent years, there has been a noticeable shift towards natural and clean-label ingredients in food products. Consumers are increasingly seeking authentic, wholesome ingredients free from artificial additives. Meat extract fits well into this trend as a natural, nutrient-rich option that enhances both the flavor and nutritional value of food products without relying on synthetic flavors or preservatives.

Expansion of the Global Foodservice Industry

The global foodservice industry is experiencing robust growth, especially in fast food, casual dining, and quick-service restaurants. As these establishments continue to expand, there is a higher demand for ingredient solutions like meat extract, which enhances flavor and consistency in large-scale food preparation. This growing demand within the food service sector significantly contributes to the overall growth of the meat extract market.

Restraining Factors

Rising Popularity of Plant-Based and Vegan Diets

With the increasing shift towards plant-based and vegan diets, the demand for meat-derived products, including meat extract, is facing resistance. Many consumers are opting for alternatives to animal-based ingredients, seeking cruelty-free, plant-based options. This trend challenges the growth of the meat extract market, as more individuals choose plant-derived flavors and proteins over traditional meat-based ingredients.

Ethical Concerns and Sustainability Issues

Ethical concerns surrounding the production of meat products, along with the environmental impact of meat production, have created hesitancy among certain consumer segments. With growing awareness of sustainability issues and the environmental footprint of meat industries, consumers are increasingly wary of animal-derived ingredients, including meat extract, impacting the overall demand for such products in the market.

Volatility in Meat Prices and Supply Chain Disruptions

The fluctuating prices of meat, driven by factors like livestock disease outbreaks, feed costs, and environmental conditions, can disrupt the availability and pricing of meat extract. Such volatility in the meat industry affects manufacturers' ability to maintain stable production levels. Supply chain disruptions, including those caused by global events like pandemics, further restrict the steady supply of meat extract to meet demand.

By Type Analysis

Chicken meat extract holds a dominant share of 39.2% in the market.

In 2024, Chicken held a dominant market position in the By Type segment of the Meat Extract Market, with a 39.2% share. The Meat Extract Market's segmentation by type highlights the varying preferences for different meats across regions and consumer groups.

Chicken's widespread popularity, combined with its versatility in culinary applications, has solidified its dominant position in the market. Pork, with its global consumption, remains a strong competitor, particularly in European and Asian markets.

Beef continues to maintain a solid presence, driven by its demand in both traditional and processed meat products, especially in Western countries. Fish, though accounting for a smaller share, sees increasing demand in markets focused on health-conscious consumers seeking omega-3-rich proteins.

By Form Analysis

Powdered meat extract accounts for 47.4% of the overall market share.

In 2024, Powder held a dominant market position in the By Form segment of the Meat Extract Market, with a 47.4% share. The dominance of Powder in the Meat Extract Market can be attributed to its convenience, long shelf life, and ease of use in a variety of food applications. Its popularity in the production of soups, sauces, and ready-to-eat meals has positioned Powder as the leading form in the segment.

Liquid, while holding a significant share, is preferred for applications requiring immediate dissolution or in liquid-based food products like broths and gravies. Granule, though lesser in share, is gaining traction due to its usability in both home and industrial kitchens where precise control over seasoning is required.

Paste, with its minimal market share, is mainly used in niche products, offering rich flavor and high concentration in specialized recipes.

By Source Analysis

Conventional sources contribute to 79.2% of the meat extract market’s supply.

In 2024, Conventional held a dominant market position in the By Source segment of the Meat Extract Market, with a 79.2% share. The significant dominance of Conventional meat extracts in the market can be attributed to their widespread availability, cost-effectiveness, and the large-scale production capabilities that support the high demand for processed meat products.

Conventional meat extracts continue to be the preferred choice for both industrial manufacturers and consumers due to their affordability and consistent supply. Organic meat extracts, though representing a smaller share of the market, have been gaining traction in response to increasing consumer awareness of health and sustainability concerns.

As demand for natural, hormone-free, and sustainably produced foods continues to rise, Organic products have seen growth, especially in markets where consumers prioritize clean-label and eco-friendly products. However, despite these trends, the higher cost and limited supply of Organic meat extracts hinder their broader adoption, keeping Conventional products at the forefront of the market.

By Application Analysis

Ready meals represent 37.3% of the total demand for meat extract products.

In 2024, Ready Meals held a dominant market position in the By Application segment of the Meat Extract Market, with a 37.3% share. The leading position of Ready Meals in the market can be attributed to the growing demand for convenient, time-saving food options.

With increasing consumer preference for quick and easy meal solutions, Ready Meals have become a staple in households, driving the demand for meat extracts used in the preparation of these products. The ability to offer both flavor and nutritional benefits has made meat extracts a key ingredient in the Ready Meals segment.

Snacks, with their substantial share, reflect the continued popularity of on-the-go and portable food options, where meat extracts are used to enhance taste and provide protein-rich snacks. Soups and Broths remain an important application, particularly in regions with a strong tradition of soup consumption, while Seasonings hold a smaller but significant share, used primarily in flavoring and enhancing the taste of various dishes.

By End-User Analysis

Food processing industries dominate, comprising 89.3% of the meat extract market demand.

In 2024, Food Processing held a dominant market position in the By End-User segment of the Meat Extract Market, with an 89.3% share. The dominance of Food Processing in the Meat Extract Market is driven by the widespread use of meat extracts in the production of processed food products such as soups, sauces, ready meals, and snacks.

Food manufacturers rely heavily on meat extracts to enhance flavor, add nutritional value, and improve the overall taste profile of their products. As consumer demand for convenient, ready-to-eat meals continues to rise, the need for meat extracts in food processing applications is expected to maintain its strong growth trajectory.

Lab Testing, while holding a smaller market share, plays a critical role in ensuring the quality, safety, and compliance of meat extract products. These tests are vital for verifying the authenticity, concentration, and nutritional content of meat extracts, ensuring that they meet regulatory standards and consumer expectations.

Key Market Segments

By Type

- Chicken

- Pork

- Beef

- Fish

- Others

By Form

- Powder

- Liquid

- Granule

- Paste

By Source

- Conventional

- Organic

By Application

- Ready Meals

- Snacks

- Soups and Broths

- Seasonings

- Others

By End-User

- Food Processing

- Lab Testing

Growth Opportunity

Expansion of Plant-Based Meat Extract Offerings

The rise in plant-based food trends creates a promising opportunity for companies to diversify their meat extract product lines. By developing plant-based alternatives, businesses can cater to the growing demand for vegan and vegetarian options. This trend is expected to gain traction due to increasing awareness of health benefits and environmental concerns, positioning brands for significant market growth.

Regional Growth in Emerging Markets Demand

Emerging economies, particularly in Asia-Pacific and Africa, present a lucrative growth opportunity for meat extract manufacturers. As disposable incomes rise and urbanization increases, the demand for meat-based products, including extracts, will continue to expand. Companies targeting these regions with localized offerings and cost-effective solutions can tap into a rapidly growing consumer base for sustainable long-term growth.

Innovation in Functional and Nutritional Meat Extracts

Consumers are increasingly looking for products that offer added nutritional value. Meat extract companies can capitalize on this trend by incorporating functional ingredients, such as collagen, amino acids, and protein fortifications, into their offerings. These innovations will appeal to health-conscious individuals and athletes, boosting market growth and establishing brands as leaders in the functional food space.

Latest Trends

Growing Popularity of Clean Label Meat Extracts

Consumers are increasingly looking for clean, natural food products without artificial additives. This trend is prompting meat extract manufacturers to focus on clean-label formulations, which emphasize transparency in ingredient sourcing and production methods. By meeting this demand, brands can build trust and appeal to health-conscious consumers seeking minimally processed, wholesome ingredients.

Surge in Demand for High-Protein Meat Extracts

With the rising interest in protein-rich diets, the demand for high-protein meat extracts is gaining momentum. These extracts are being marketed as convenient and nutrient-dense options for consumers seeking to enhance muscle growth or maintain a healthy lifestyle. Manufacturers are responding by developing products with higher protein content to cater to this trend, especially among athletes and fitness enthusiasts.

Adoption of Sustainable Sourcing Practices in Meat Extraction

As sustainability becomes a core consumer value, the meat extract industry is prioritizing ethical and environmentally friendly sourcing practices. Companies are adopting sustainable farming methods and exploring plant-based sources to create meat extracts. This trend aligns with growing concerns about climate change, offering businesses a chance to connect with eco-conscious consumers while promoting responsible sourcing practices.

Regional Analysis

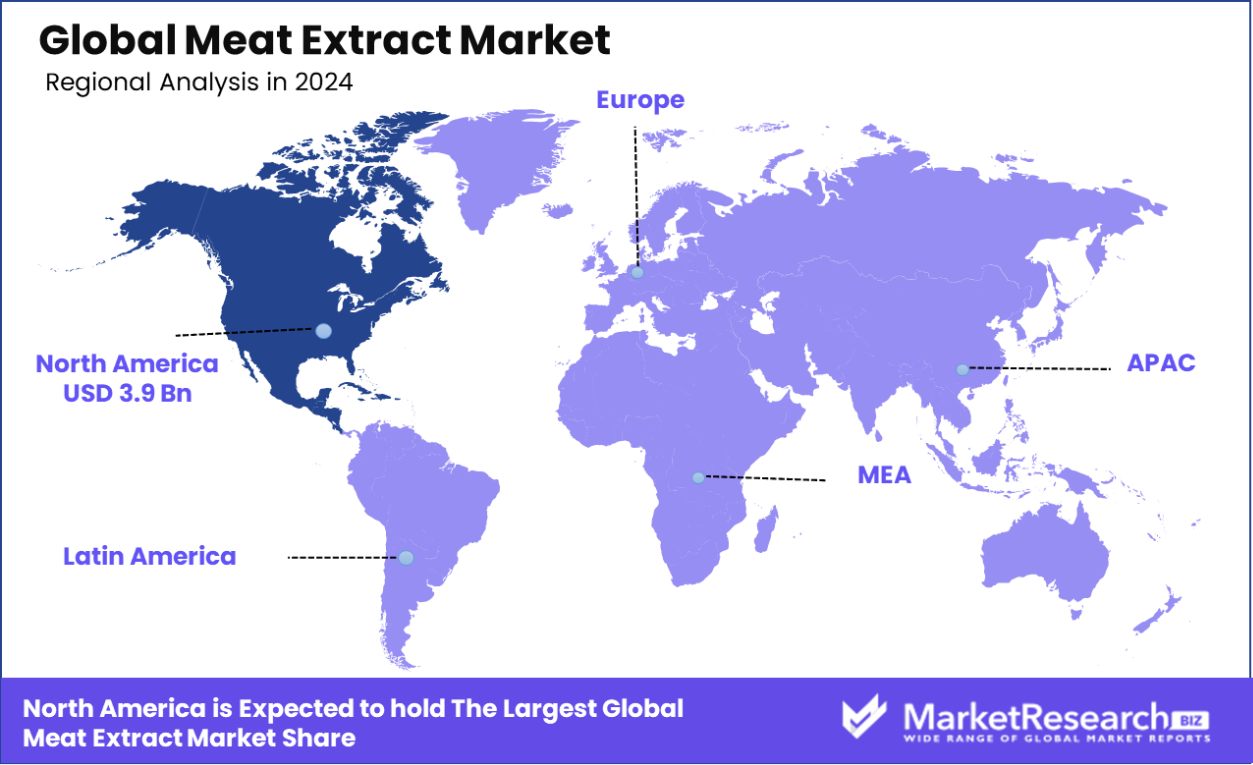

The North American meat extract market holds a 39.2% share, valued at USD 3.9 billion.

The global Meat Extract Market is experiencing significant growth across various regions, with North America leading the charge. North America dominates the market, accounting for 39.2% of the total share, valued at USD 3.9 billion.

This growth can be attributed to the high demand for protein-rich food products and a strong preference for premium, high-quality meat extracts in the region. Additionally, the increasing trend towards health-conscious eating, combined with a robust food processing industry, further drives market demand.

In Europe, the market is fueled by the rising demand for convenience and functional food products, along with growing interest in clean-label and natural food offerings. The region's demand for meat extracts is supported by strong regulations and consumer preference for quality ingredients in food production.

The Asia Pacific region is expected to witness rapid growth due to rising disposable incomes, urbanization, and evolving dietary preferences, which are driving demand for meat extracts.

The Middle East & Africa and Latin America are also poised for moderate growth. While their market share is smaller, the increasing consumption of processed and ready-to-eat food products presents opportunities for market expansion in these regions, particularly in emerging economies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Meat Extract Market is set to be highly competitive, with key players driving growth through innovation, strategic partnerships, and geographic expansion. Companies such as Givaudan and Nikken Foods are likely to remain at the forefront of the market due to their extensive research and development (R&D) capabilities and their ability to meet evolving consumer demands for natural, clean-label products. Givaudan’s strong position in flavor and fragrance solutions enhances its portfolio, making it a dominant player in the flavoring and extraction space.

Essentia Protein Solutions continues to hold a strong position by leveraging its expertise in providing protein-rich solutions tailored to meet the needs of health-conscious consumers. Their innovative products are expected to cater to the increasing demand for functional foods that offer nutritional benefits.

Companies like JBS S.A., one of the largest protein producers globally, are expected to continue leveraging their scale to benefit from cost efficiencies and expand their market reach. Meanwhile, Carnad A/S and Diana Group are anticipated to see growth by capitalizing on trends such as clean-label and natural ingredients, which are becoming increasingly popular in the meat extract space.

In Asia-Pacific, Henan Yong Da Foods and Foodex Inti Ingredients are likely to see continued demand driven by emerging markets, where increasing disposable incomes and changing dietary habits are fueling the need for meat extract products.

Maverick Biosciences and IDF (International Dehydrated Foods, Inc.) are also poised for significant growth, focusing on product innovation and sustainable sourcing practices to stay competitive in this dynamic market. As consumer preferences shift towards healthier and more sustainable food options, these key players are expected to continue enhancing their portfolios to maintain market leadership.

Top Key Players in the Market

- Givaudan

- Nikken Foods

- Essentia Protein Solutions

- IDF

- Haco Holding AG

- CHIMAB S.p.A.

- Henan Yong Da Foods

- Diana Group

- Foodex Inti Ingredients, PT

- Titan Biotech Ltd.

- Carnad A/S

- JBS S.A.

- Maverick Biosciences

- Idf (International Dehydrated Foods, Inc.)

- Activ International

Recent Developments

- In 2023, Diana Group accelerated its research into sustainable, natural ingredients for food and beverages, especially in the areas of functional foods and animal nutrition.

- In 2023, Maverick Biosciences focused on the development of cutting-edge biotechnology for food processing, launching bio-based food ingredients and improving food safety protocols.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 17.0 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Chicken, Pork, Beef, Fish, Others), By Form (Powder, Liquid, Granule, Paste), By Source (Conventional, Organic), By Application (Ready Meals, Snacks, Soups and Broths, Seasonings, Others), By End-User (Food Processing, Lab Testing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Givaudan, Nikken Foods, Essentia Protein Solutions, IDF, Haco Holding AG, CHIMAB S.p.A., Henan Yong Da Foods, Diana Group, Foodex Inti Ingredients, PT, Titan Biotech Ltd., Carnad A/S, JBS S.A., Maverick Biosciences, Idf (International Dehydrated Foods, Inc.), Activ International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Givaudan

- Nikken Foods

- Essentia Protein Solutions

- IDF

- Haco Holding AG

- CHIMAB S.p.A.

- Henan Yong Da Foods

- Diana Group

- Foodex Inti Ingredients, PT

- Titan Biotech Ltd.

- Carnad A/S

- JBS S.A.

- Maverick Biosciences

- Idf (International Dehydrated Foods, Inc.)

- Activ International