Maritime Digitization Market By Technology (AI, IoT, Blockchain, Others), By Application (Fleet Management, Vessel Management, Energy Management, Inventory Management, Predictive Maintenance), By End User (Ports And Terminals, Shipping Companies, Maritime Freight Forwarders), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51017

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

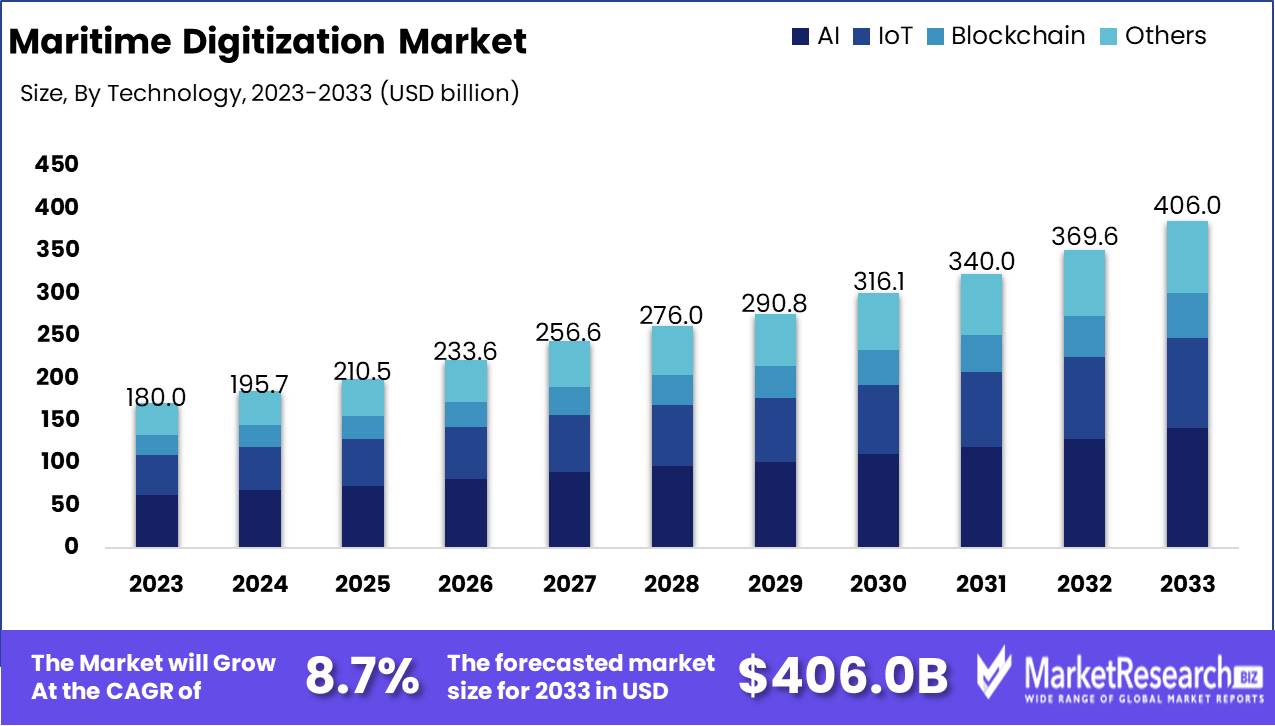

The Maritime Digitization Market was valued at USD 180.0 billion in 2023. It is expected to reach USD 406.0 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

The Maritime Digitization Market refers to integrating digital technologies such as IoT, AI, big data, and blockchain into the maritime industry, aimed at enhancing operational efficiency, safety, and sustainability. This market is driven by the growing need for automation in shipping operations, fleet management, predictive maintenance, and compliance with stringent environmental regulations. Maritime digitization enables real-time data exchange, streamlining communication between ports, vessels, and logistics providers.

The maritime digitization market is poised for significant growth, driven by increasing operational efficiency and cost reduction demand. The integration of advanced technologies such as artificial intelligence, IoT, and blockchain into maritime operations has enabled shipping companies to optimize route planning, fuel consumption, and cargo handling, thereby reducing operational costs and improving overall productivity. Additionally, the adoption of smart shipping solutions, including autonomous vessels and digital platforms, has enhanced the industry's ability to monitor and manage real-time data. This shift toward digital transformation is further supported by advancements in cloud computing and big data analytics, which allow for more accurate forecasting and decision-making.

However, challenges remain in the form of high initial implementation costs and data privacy concerns. The substantial upfront investment required for digitizing shipping infrastructure, including upgrading legacy systems and training personnel, can be a significant barrier for many companies, particularly small and medium-sized operators.

Furthermore, with the increasing volume of data being generated, concerns around cybersecurity and data privacy have emerged as critical risks. Despite these challenges, the market is expected to continue its upward trajectory as industry players recognize the long-term benefits of digitization in terms of improved efficiency and sustainability. Overall, the maritime digitization market is likely to see robust growth, with increased adoption of smart shipping technologies playing a central role in shaping the industry's future.

Key Takeaways

- Market Growth: The Maritime Digitization Market was valued at USD 180.0 billion in 2023. It is expected to reach USD 406.0 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

- By Technology: AI dominated maritime digitization, optimizing operations and safety.

- By Application: Fleet Management dominated maritime digitization through operational optimization.

- By End User: Ports and Terminals dominated maritime digitization for efficiency.

- Regional Dominance: North America leads the maritime digitization market with a 35% largest share.

- Growth Opportunity: The integration of AI/ML and rising demand for remote operations will drive operational efficiency, cost reduction, and safety, positioning the maritime digitization market for significant growth.

Driving factors

Operational Efficiency as a Catalyst for Maritime Digitization

The demand for improved operational efficiency is a primary driver of growth in the maritime digitization market. Digital tools, such as automated navigation systems, data analytics platforms, and AI-driven vessel management systems, are helping to streamline operations across maritime industries. These technologies enable shipping companies to reduce fuel consumption, optimize routes, and improve fleet management.

For instance, predictive maintenance systems powered by machine learning allow operators to anticipate equipment failures, thus reducing downtime and repair costs. The increased focus on operational efficiency is also influenced by the need to cut operational costs, particularly in a highly competitive global shipping market where profit margins are often tight. A report indicated that digitization in the maritime sector could reduce operational costs by as much as 25%, demonstrating the strong correlation between digitization and cost efficiency.

Safety and Security Enhancements Drive Digital Investments

The growing importance of safety and security in the maritime industry significantly contributes to the adoption of digitization technologies. Digital solutions such as cybersecurity systems, automated surveillance, and real-time monitoring tools are increasingly being utilized to address risks ranging from cyber threats to piracy. According to a report, cyber incidents are among the top threats to shipping operations, with digital systems being a crucial defense mechanism.

In addition to cybersecurity, advances in safety technologies like real-time weather tracking, collision avoidance systems, and autonomous vessels improve navigational safety, reducing the risk of accidents. The International Maritime Organization (IMO) mandates stricter safety regulations, which also pressure maritime operators to invest in digital technologies to comply with international safety standards. These enhancements not only protect assets but also help to avoid disruptions in operations, thereby increasing operational continuity and minimizing financial losses.

Technological Advancements as the Backbone of Market Expansion

Technological advancements are fundamentally transforming the maritime industry, driving the digitization market's rapid expansion. Technologies such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain are revolutionizing how maritime operations are conducted. IoT enables real-time data collection from sensors on vessels, ports, and containers, allowing for more effective decision-making and improving asset visibility. AI applications in autonomous shipping, predictive analytics, and fleet management have accelerated, leading to more streamlined, cost-effective, and safer maritime operations. Blockchain technology, while still emerging, is being adopted to increase transparency and security in global shipping supply chains, offering improved tracking of shipments and reducing the risks of fraud.

Furthermore, 5G and satellite communication technologies enable enhanced connectivity in remote maritime areas, ensuring real-time data transmission even in isolated waters. Study projects that global spending on maritime IoT solutions could exceed $16 billion by 2026, underscoring the growing reliance on advanced technologies in this sector.

Restraining Factors

Concerns about Software's Data Privacy and High Initial Cost: Limiting Market Adoption Among Traditional Stakeholders

Data privacy concerns, coupled with the high initial costs associated with digitization solutions, represent a significant restraining factor for the maritime digitization market. Stakeholders in the maritime industry, particularly in regions with stringent data protection regulations, remain cautious about integrating advanced digital tools. The complexity of ensuring compliance with various international privacy laws such as the European Union's General Data Protection Regulation (GDPR) adds layers of challenges. Furthermore, traditional maritime operators are often reluctant to transition from legacy systems due to concerns about how sensitive operational data will be handled and safeguarded by digital platforms.

The high upfront investment required for software development, hardware installation, and system integration further discourages small and medium-sized enterprises (SMEs) from embracing maritime digitization. Many players in the sector operate with tight profit margins, and the costs associated with training staff, maintaining infrastructure, and managing ongoing software updates exacerbate this reluctance. While larger shipping companies may have the financial bandwidth to absorb these costs, smaller operators are more constrained. This situation results in a slow rate of adoption, particularly among smaller players and regions with limited access to capital investment, thus tempering the overall growth of the maritime digitization market.

Increased Risk of Cyber-Attacks and Data Breaches: Heightened Security Concerns Hindering Digital Transformation

The growing threat of cyber-attacks and data breaches is another critical factor restraining the growth of the maritime digitization market. As maritime operators increasingly rely on interconnected digital systems for navigation, logistics, and communication, the risk of cyber-attacks targeting these systems rises sharply. The International Maritime Organization (IMO) and other regulatory bodies have underscored the vulnerabilities in the sector, citing increasing reports of cyber-attacks aimed at disrupting operations, stealing sensitive data, or demanding ransom.

These security threats lead to apprehension among industry participants, who fear the potentially disastrous impact of a breach on both operational efficiency and reputation. A major cyber incident could not only halt port operations or ship navigation but also expose critical data related to cargo, trade routes, and customer information. Consequently, many companies delay or limit their digital investments until they can ensure robust cybersecurity measures are in place.

By Technology Analysis

In 2023, AI dominated maritime digitization, optimizing operations and safety.

In 2023, Artificial Intelligence (AI) held a dominant market position in the "By Technology" segment of the Maritime Digitization Market, driven by its capability to optimize operations, enhance decision-making, and reduce costs. AI-powered systems are employed in various maritime applications, including autonomous navigation, predictive maintenance, and real-time vessel tracking. These innovations have led to increased operational efficiency and safety, reinforcing AI’s significant role in this sector.

The Internet of Things (IoT) has also gained traction by enabling seamless connectivity between vessels, ports, and offshore platforms. IoT devices facilitate data exchange, enabling remote monitoring and control, which enhances overall operational visibility.

Blockchain technology, though emerging, is being explored for its potential to streamline maritime logistics, improve supply chain transparency, and ensure secure transactions. Its adoption is growing slowly but steadily, especially in documentation and cargo tracking.

Other technologies, including big data analytics and cloud computing, support the sector by enhancing data management, operational scalability, and real-time insights, further contributing to the overall digitization of the maritime industry. Together, these technologies drive the digital transformation of maritime operations globally.

By Application Analysis

In 2023, Fleet Management dominated maritime digitization through operational optimization.

In 2023, Fleet Management held a dominant position in the "By Application" segment of the Maritime Digitization Market. This can be attributed to the increasing demand for real-time tracking, fuel management, and route optimization solutions. The integration of advanced digital platforms to enhance operational efficiency, reduce fuel costs, and improve decision-making processes has led to the widespread adoption of fleet management systems. These solutions provide fleet operators with critical insights, ensuring effective asset utilization and compliance with environmental regulations.

Vessel Management also witnessed substantial growth due to the rising adoption of IoT-enabled systems, enabling remote monitoring of vessel performance and diagnostics. Energy Management is gaining traction, driven by the growing emphasis on sustainability and the need to optimize fuel consumption and reduce emissions.

Inventory Management plays a vital role in streamlining supply chains, reducing delays, and ensuring the availability of critical components, further driving demand. Lastly, Predictive Maintenance is increasingly adopted, leveraging data analytics and AI to anticipate equipment failures, minimize downtime, and ensure continuous operations. These trends are expected to shape the future of the maritime digitization landscape.

By End User Analysis

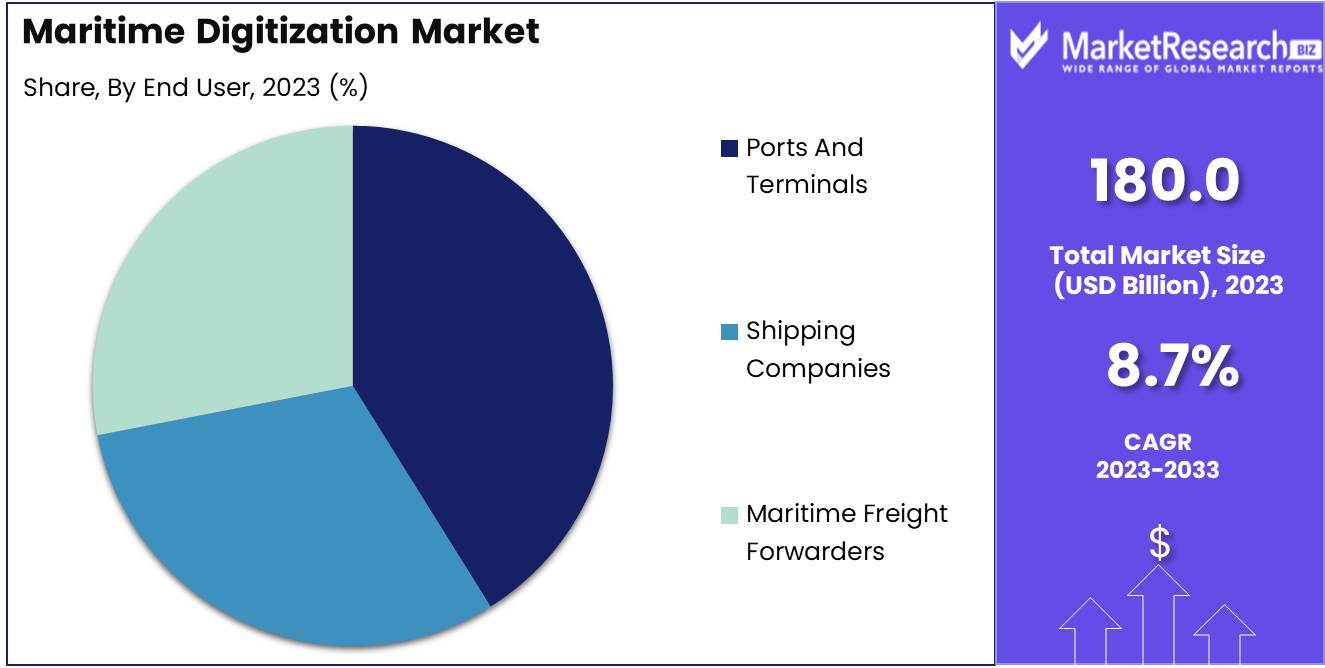

In 2023, Ports and Terminals dominated maritime digitization for efficiency.

In 2023, Ports and Terminals held a dominant market position in the end-user segment of the Maritime Digitization Market. This can be attributed to the critical role that ports and terminals play in global trade, driving the adoption of digital solutions to enhance operational efficiency. Increased port congestion and the need for streamlined cargo management have led to the accelerated implementation of technologies like automated terminals, IoT-based asset tracking, and blockchain-enabled platforms. Ports and terminals increasingly prioritize real-time data analytics, predictive maintenance, and digital twin solutions to minimize downtime and improve throughput.

Shipping Companies, as the second-largest segment, are progressively investing in digitalization to optimize fuel efficiency, enhance navigation through AI-based route optimization, and comply with stringent environmental regulations. This trend is propelled by rising demand for sustainable shipping practices and reduced operational costs through digital solutions.

Maritime Freight Forwarders also see growth in digitization efforts, particularly in end-to-end supply chain visibility and process automation. The integration of cloud platforms and advanced analytics is transforming traditional freight forwarding, enabling improved tracking, better demand forecasting, and more accurate shipping schedules across complex logistics networks.

Key Market Segments

By Technology

- AI

- IoT

- Blockchain

- Others

By Application

- Fleet Management

- Vessel Management

- Energy Management

- Inventory Management

- Predictive Maintenance

By End User

- Ports And Terminals

- Shipping Companies

- Maritime Freight Forwarders

Growth Opportunity

Integration of AI and Machine Learning

The maritime industry is experiencing a significant shift towards digitization, with AI and machine learning (ML) playing a crucial role in transforming operations. The integration of AI and ML in maritime digitization is expected to provide opportunities for enhanced operational efficiency and predictive maintenance. By leveraging AI algorithms, ship operators can monitor vessel performance, detect faults in real time, and optimize fuel consumption.

Moreover, machine learning enables data-driven decision-making, improving cargo routing, weather forecasting, and crew management. The growing adoption of AI and ML is likely to accelerate as maritime players seek to reduce operational costs, minimize human error, and enhance environmental sustainability.

Demand for Remote Operations

Another key opportunity for maritime digitization is the rising demand for remote operations. With advancements in communication technologies and increased automation, maritime companies are increasingly shifting towards remote monitoring and control of vessels. This trend has been amplified by the COVID-19 pandemic, which underscored the need for operational continuity without physical presence.

Remote operations allow for improved safety, reduced downtime, and enhanced cost-effectiveness by minimizing the need for crew on board. As connectivity improves through the deployment of satellite communication systems and IoT devices, the demand for remote operations is expected to surge, creating substantial growth opportunities for maritime digitization solutions.

Latest Trends

Smart Ports and Logistics

The adoption of smart port technologies is expected to accelerate, driven by the need for enhanced operational efficiency and environmental sustainability. Automated cargo handling systems, AI-powered traffic management, and blockchain-enabled logistics are becoming critical for optimizing supply chain processes. The integration of these systems allows for real-time tracking, reducing downtime, and improving throughput in busy ports.

Additionally, governments and industry bodies are increasingly supporting investments in smart port infrastructure to mitigate bottlenecks and foster growth. The use of advanced analytics in logistics is anticipated to further enable predictive maintenance and reduce operational costs, enhancing overall port efficiency.

Remote Monitoring and IoT Integration

Remote monitoring solutions, combined with Internet of Things (IoT) integration, are emerging as pivotal tools in improving the safety and operational efficiency of maritime operations. By deploying IoT sensors across vessels, companies can collect real-time data on fuel consumption, engine performance, and navigation systems, enabling predictive maintenance and reducing the risk of equipment failure. This trend is expected to deepen, with more companies adopting digital twins for remote diagnostics and fleet management. This advancement not only reduces operational downtime but also improves safety standards, aligning with global efforts toward greener and more sustainable shipping practices.

Regional Analysis

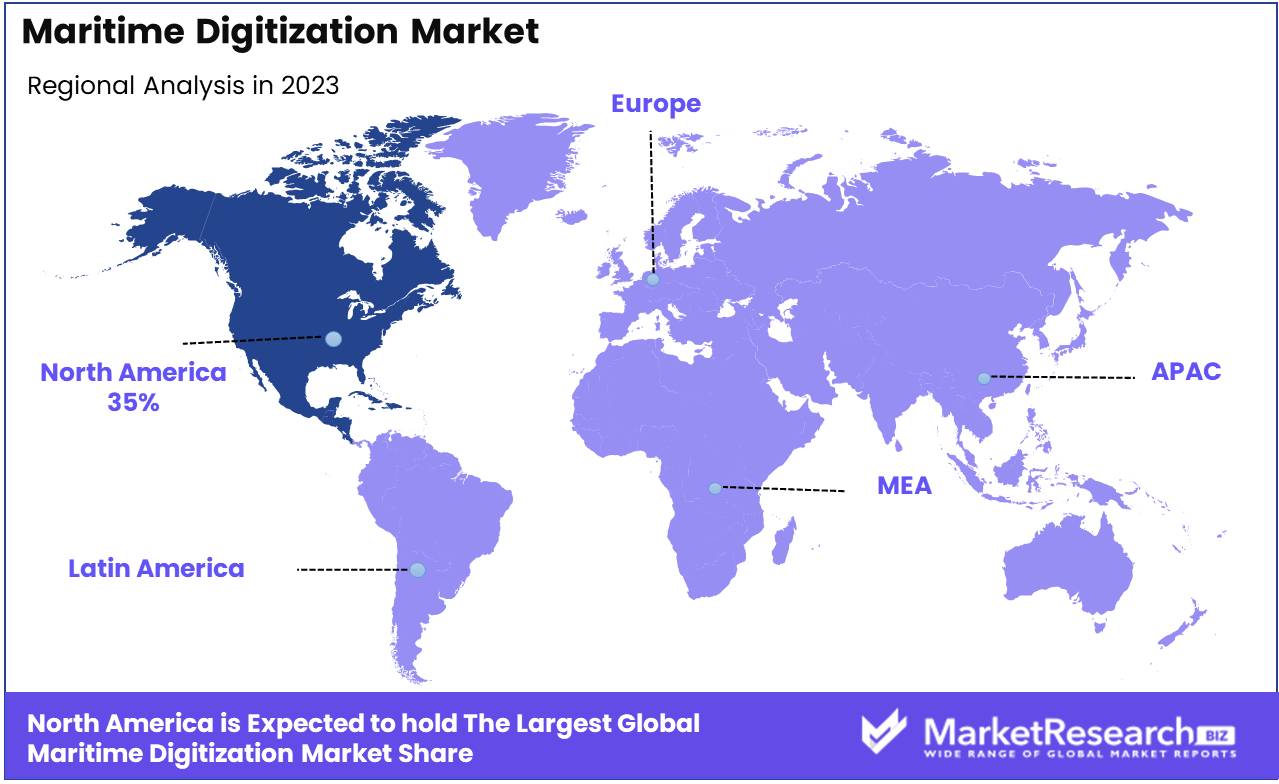

North America leads the maritime digitization market with a 35% largest share.

The maritime digitization market is experiencing significant growth across various regions, driven by advancements in automation, smart shipping solutions, and digitalization technologies. North America dominates the market, accounting for over 35% of the global share due to the early adoption of digital solutions, strong maritime infrastructure, and supportive government policies aimed at enhancing the efficiency of maritime operations. The region’s robust technological advancements in the U.S. and Canada are key drivers of market expansion.

Europe is another prominent player, holding a considerable market share owing to its extensive maritime industry, including ports and shipyards, and its focus on green shipping initiatives. Germany, the Netherlands, and Norway are leading adopters of maritime digitization technologies, which align with the European Union's stringent environmental regulations.

The Asia Pacific region is expected to witness the fastest growth, driven by increasing investments in port automation and rising maritime trade, particularly in China, Japan, and South Korea. China's Belt and Road Initiative (BRI) further accelerates digitization efforts across maritime corridors in the region.

The Middle East & Africa and Latin America show steady growth, with an increasing focus on port modernization and digitization, particularly in countries like the UAE and Brazil. However, these regions still lag behind North America and Europe in terms of technological adoption.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global maritime digitization market is expected to witness significant advancements, driven by the efforts of key players such as MariApps Marine Solutions, xyzt.ai, ORBCOMM, Windward Ltd., Iridium Communications Inc., Perle, SparkCognition, Inmarsat Global Limited, Spire Global Inc., and Lockheed Martin Corporation. These companies are playing a pivotal role in shaping the digitization landscape by leveraging cutting-edge technologies like artificial intelligence (AI), machine learning (ML), satellite communication, and advanced analytics to enhance maritime operations.

MariApps Marine Solutions continues to lead with its integrated maritime software solutions, improving fleet management and operational efficiency. Similarly, xyzt.ai is making waves by offering data analytics and visualization tools that enhance decision-making processes in maritime operations.

ORBCOMM and Iridium Communications Inc. are strengthening the sector with their satellite communication solutions, enabling real-time tracking and monitoring of vessels. Windward Ltd. stands out for its use of AI to provide predictive maritime intelligence, helping stakeholders mitigate risks and optimize operations.

Lockheed Martin Corporation and Spire Global Inc. are contributing through space-based technologies and satellite data services, crucial for navigation, weather forecasting, and global vessel tracking. Inmarsat Global Limited offers critical communication services for ships at sea, supporting everything from safety to real-time data transfer.

Meanwhile, SparkCognition and Perle focus on cybersecurity and edge networking solutions, addressing the increasing need for secure and reliable digital infrastructure within the maritime industry. The combined efforts of these companies are accelerating the digital transformation of the global maritime industry.

Market Key Players

- MariApps Marine Solutions

- xyzt.ai

- ORBCOMM

- Windward Ltd.

- Iridium Communications Inc.

- Perle

- SparkCognition

- Inmarsat Global Limited

- Spire Global Inc.

- Lockheed Martin Corporation

Recent Development

- In September 2024, Kongsberg Digital introduced advanced Voyage Reporting capabilities, designed to streamline operational data collection and reporting for offshore maritime operators. This development aligns with the industry's move toward DataOps and digital twins, improving vessel performance monitoring and compliance reporting by providing real-time data from ships to shore.

- In March 2024, Kongsberg Digital announced significant enhancements in its digital twin and AI-driven technologies for the maritime sector. These tools aim to improve operational efficiency through real-time data monitoring, simulation, and predictive maintenance. This advancement focuses on enabling smarter, more sustainable shipping practices, helping operators make informed decisions for route optimization and fuel savings.

- In December 2023, Sedna introduced AI-powered communication platforms aimed at improving team collaboration and decision-making within maritime operations. The platform helps reduce email overload and provides better data insights for fleet management, enhancing overall operational efficiency.

Report Scope

Report Features Description Market Value (2023) USD 180.0 Billion Forecast Revenue (2033) USD 406.0 Billion CAGR (2024-2032) 8.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (AI, IoT, Blockchain, Others), By Application (Fleet Management, Vessel Management, Energy Management, Inventory Management, Predictive Maintenance), By End User (Ports And Terminals, Shipping Companies, Maritime Freight Forwarders) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape MariApps Marine Solutions, xyzt.ai, ORBCOMM, Windward Ltd., Iridium Communications Inc., Perle, SparkCognition, Inmarsat Global Limited, Spire Global Inc., Lockheed Martin Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- MariApps Marine Solutions

- xyzt.ai

- ORBCOMM

- Windward Ltd.

- Iridium Communications Inc.

- Perle

- SparkCognition

- Inmarsat Global Limited

- Spire Global Inc.

- Lockheed Martin Corporation