Marine Radar Market Report By Type (X-band Radar, S-band Radar, Ku-band Radar, Others), By Technology (Pulse Radar, Frequency Modulated Continuous Wave [FMCW] Radar, Doppler Radar), By Application (Commercial Ships, Defense Vessels, Recreational Boats, Others), By End User (OEMs, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

25807

-

July 2024

-

321

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

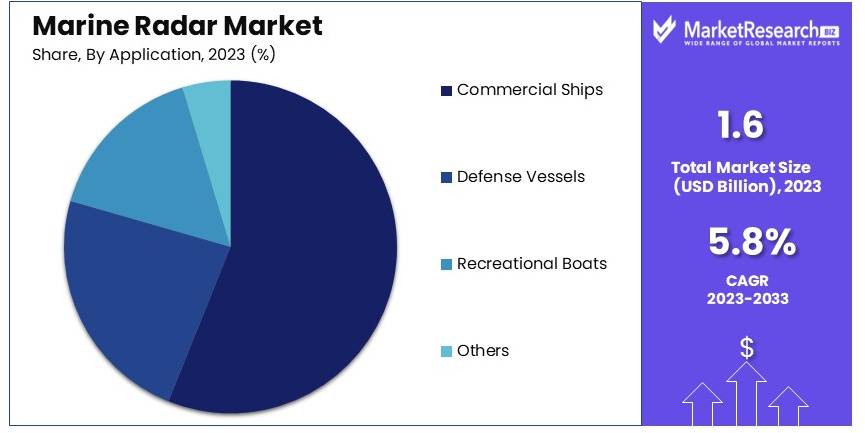

The Global Marine Radar Market size is expected to be worth around USD 2.8 Billion by 2033, from USD 1.6 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

The marine radar market focuses on equipment used to detect objects around vessels. This technology helps in navigation and avoiding collisions. It is crucial for safe marine operations. The market includes different radar types, such as X-band and S-band radars. These radars are used on commercial ships, fishing vessels, and recreational boats. Key players in this market are companies that manufacture radar systems and components.

Growing demand for marine safety and increasing maritime trade drive this market. Advances in technology, such as improved detection capabilities and integration with other navigation systems, are also boosting growth. Regulatory requirements for maritime safety are influencing market trends. Companies in this sector are investing in research and development to offer innovative solutions.

The marine radar market is experiencing significant growth, driven by the robust expansion of global maritime trade. According to the International Chamber of Shipping (ICS), the international shipping industry facilitates around 90% of world trade, utilizing over 50,000 merchant ships and employing nearly 2 million seafarers. This extensive network underscores the critical need for advanced radar systems to ensure safe and efficient navigation.

Marine radars are essential for collision avoidance, navigation, and port operations. The demand for these systems is bolstered by the increasing focus on maritime safety and the stringent regulations imposed by international maritime organizations. The adoption of advanced technologies, such as Automatic Identification Systems (AIS) integrated with radar, enhances situational awareness and operational efficiency, further driving market growth.

The global supply of seafarers, estimated at 1,892,720, predominantly comes from countries like the Philippines, Russia, Indonesia, China, and India. These nations play a pivotal role in the global maritime workforce, ensuring the continuous operation of merchant fleets worldwide. The availability of skilled seafarers is crucial for the effective utilization and maintenance of marine radar systems.

Additionally, the modernization of existing fleets and the development of new ports and shipping routes contribute to the increasing demand for marine radars. As emerging economies invest in maritime infrastructure, the market is expected to witness sustained growth. The integration of radar systems with other maritime technologies, such as satellite communication and Global Positioning Systems (GPS), is anticipated to further enhance their functionality and appeal.

The marine radar market is poised for steady growth, driven by the vital role of maritime trade in the global economy, the continuous supply of skilled seafarers, and technological advancements in radar systems. This market dynamic presents significant opportunities for manufacturers and stakeholders in the marine radar industry.

Key Takeaways

- Market Value: The Marine Radar Market was valued at USD 1.6 billion in 2023, and is expected to reach USD 2.8 billion by 2033, with a CAGR of 5.8%.

- Type Analysis: X-band Radar dominated with 55%; crucial for detailed imaging.

- Technology Analysis: Pulse Radar led with 45%; important for range and resolution.

- Application Analysis: Commercial Ships held 60%; significant for navigation safety.

- End User Analysis: OEMs dominated with 70%; indicating strong market reliance on original equipment manufacturers.

- Dominant Region: Asia Pacific led with 44%; driven by robust shipbuilding industry.

- High Growth Region: North America, driven by modernization of naval fleets.

- Analyst Viewpoint: The market is poised for steady growth with increased demand for advanced radar systems in both commercial and defense sectors.

Driving Factors

Increasing Maritime Trade and Shipping Activities Drive Market Growth

The rise in global maritime trade and shipping activities has driven the demand for advanced marine radar systems. These systems play a crucial role in enhancing situational awareness, navigation safety, and collision avoidance for vessels operating in congested waters. The expansion of the Panama Canal, for instance, has significantly increased maritime traffic, necessitating the adoption of modern radar systems to ensure safe navigation. In 2023, global maritime trade volumes were estimated to grow by 3.8%, further highlighting the need for reliable radar systems.

The increased movement of goods across the seas requires vessels to navigate safely through busy shipping lanes. Marine radar systems provide real-time data on vessel positions, weather conditions, and potential obstacles, thereby reducing the risk of collisions and accidents. As international trade continues to expand, the reliance on maritime transport grows, leading to a higher demand for efficient navigation and safety systems. This growth in maritime activities is further supported by the development of new ports and shipping routes, which require state-of-the-art radar systems to manage increased traffic.

Stringent Maritime Regulations and Safety Standards Drive Market Growth

Governments and international organizations have implemented stringent regulations and safety standards for maritime operations, boosting the adoption of marine radar systems. These regulations aim to reduce the risk of accidents, collisions, and environmental incidents. The International Maritime Organization (IMO) mandates the use of specific radar systems on ships based on their size and operational areas. For instance, SOLAS (Safety of Life at Sea) regulations require ships over 300 gross tonnage to be equipped with marine radar systems.

Such regulations ensure that ships are equipped with the necessary technology to navigate safely and avoid accidents. Compliance with these regulations is not optional, making the installation of advanced radar systems a priority for shipowners and operators. Additionally, regional regulatory bodies, like the European Maritime Safety Agency (EMSA), enforce strict safety standards, further driving the market for radar systems. As these regulations become more comprehensive, the demand for high-performance radar systems continues to rise, ensuring safer maritime operations.

Technological Advancements in Radar Technology Drive Market Growth

Continuous advancements in radar technology, such as solid-state transceivers, digital signal processing, and advanced target tracking algorithms, have significantly improved the performance and reliability of marine radar systems. These technological innovations enable enhanced target detection, resolution, and tracking capabilities, even in challenging weather conditions or cluttered environments. The introduction of Doppler radar technology, for instance, has greatly enhanced the ability to detect and track small targets, such as buoys or debris.

These advancements have made radar systems more accurate and reliable, ensuring better situational awareness and safety for maritime operations. Improved digital signal processing allows for clearer images and more precise data, which is crucial for navigation and collision avoidance. Moreover, advancements in radar technology have led to the development of compact and energy-efficient systems, making them more accessible and cost-effective for various types of vessels. As a result, the adoption of advanced marine radar systems is expected to grow, driven by the need for enhanced performance and safety in maritime operations.

Restraining Factors

High Capital Investment and Maintenance Costs Restrain Market Growth

Marine radar systems, especially those for large vessels or specialized applications, require substantial capital investment. The initial cost of these systems is high, making them less accessible to smaller maritime operators or companies with limited budgets. Maintenance and repair costs further add to the financial burden.

For instance, the cost of maintaining advanced radar systems can be significant due to the need for specialized technicians and expensive spare parts. This high expenditure can deter small and mid-sized shipping companies from investing in the latest radar technologies, thus limiting market growth. Additionally, the economic constraints faced by these operators often result in prolonged usage of outdated systems, which can compromise safety and efficiency.

Technical Challenges in Harsh Maritime Environments Restrain Market Growth

Marine radar systems must operate in harsh maritime environments, which present several technical challenges. These systems face extreme weather conditions, saltwater exposure, and electromagnetic interference. Designing robust and reliable systems that can withstand these challenges while maintaining high performance is technically complex and costly.

The harsh environment can lead to frequent malfunctions and the need for regular maintenance, increasing operational costs. For instance, saltwater corrosion can damage radar components, reducing their lifespan and reliability. The complexity and cost of developing systems that can endure these conditions can slow down technological advancement and adoption, thereby restraining market growth.

Type Analysis

X-band radar dominates with 55% market share due to its superior resolution and accuracy.

X-band radar is the most dominant segment in the marine radar market, driven by its superior resolution and accuracy, which are crucial for navigation and collision avoidance. X-band radars operate at a higher frequency range (8-12 GHz) and provide finer detail, making them ideal for detecting small objects and navigating through congested waters.

This high resolution is particularly valuable for vessels operating in busy shipping lanes and ports, where precise detection of other ships, buoys, and obstacles is essential for safe navigation. The demand for X-band radar is further fueled by stringent maritime safety regulations that mandate the use of advanced radar systems on vessels. These radars are widely adopted by commercial ships, defense vessels, and recreational boats, contributing to their dominant position in the market.

S-band radar, although not as dominant as X-band, plays a significant role, especially in long-range detection and harsh weather conditions. Operating at a lower frequency range (2-4 GHz), S-band radars are less affected by rain, fog, and other atmospheric conditions, making them suitable for large vessels and open sea navigation. These radars are essential for long-haul voyages and defense applications, where reliability and range are critical. The market for S-band radar is supported by the growing fleet of commercial and defense vessels, which require robust radar systems for safe and efficient operation.

Ku-band radar and other types of radar systems occupy smaller market shares but serve niche applications. Ku-band radar, operating at even higher frequencies (12-18 GHz), offers high resolution and is used in specific applications where detailed imaging is necessary. The "others" category includes various specialized radar systems used for specific maritime purposes, such as weather monitoring and scientific research.

Technology Analysis

Pulse radar dominates with 45% market share due to its reliability and widespread use.

Pulse radar is the most widely used technology in marine radar systems, primarily due to its reliability and effectiveness in various maritime conditions. Pulse radars transmit high-power pulses and measure the time it takes for the echoes to return, providing accurate information about the distance and size of objects. This technology is highly effective for long-range detection and is used extensively in both commercial and defense applications. The dominance of pulse radar is attributed to its proven track record and the continuous improvements in radar technology, which have enhanced its performance and reliability. Additionally, pulse radar systems are compatible with various radar types, including X-band and S-band, further solidifying their market position.

Frequency modulated continuous wave (FMCW) radar is gaining traction in the market due to its high resolution and ability to detect close-range targets with great accuracy. FMCW radars emit continuous waves that vary in frequency, allowing for precise measurement of target distance and speed. This technology is particularly useful for navigation in congested waters and for applications where high-resolution imaging is crucial. The growing adoption of FMCW radar is driven by advancements in radar technology and the increasing demand for sophisticated navigation systems.

Doppler radar, which measures the velocity of objects by detecting changes in the frequency of the returned signal, is also an important segment. Doppler radars are highly effective in detecting moving objects and assessing their speed and direction. This technology is particularly valuable in defense applications and for vessels operating in areas with high traffic density. The adoption of Doppler radar is supported by the need for advanced situational awareness and collision avoidance systems.

Application Analysis

Commercial ships dominate with 60% market share due to high demand for navigation safety and efficiency.

Commercial ships represent the largest application segment in the marine radar market, driven by the high demand for navigation safety and operational efficiency. The commercial shipping industry relies heavily on advanced radar systems to ensure safe navigation through busy shipping lanes and ports. These radars provide real-time data on vessel positions, weather conditions, and potential obstacles, enabling ship operators to make informed decisions and avoid collisions.

The dominance of commercial ships in the marine radar market is supported by the continuous growth in global maritime trade, which necessitates the adoption of reliable radar systems to manage increasing traffic volumes. Additionally, stringent maritime safety regulations mandate the use of advanced radar systems on commercial vessels, further driving the demand for these systems.

Defense vessels also represent a significant application segment, driven by the need for advanced radar systems for surveillance, target detection, and navigation in defense operations. Defense vessels, including naval ships and patrol boats, require robust radar systems capable of operating in challenging conditions and providing accurate information for tactical decision-making. The adoption of advanced radar technology in defense applications is supported by increasing defense budgets and the need for modernizing naval fleets.

Recreational boats, while a smaller segment, still contribute to the market growth. The demand for radar systems in this segment is driven by the need for safety and navigation assistance for private and leisure boating. As the popularity of recreational boating increases, so does the demand for affordable and reliable radar systems that enhance the safety and enjoyment of boating activities.

The "others" category includes specialized applications such as scientific research vessels and fishing boats. These applications require specific radar systems tailored to their unique needs, such as weather monitoring and fish detection.

End User Analysis

OEMs dominate with 70% market share due to the integration of advanced radar systems in new vessels.

OEMs represent the largest end user segment in the marine radar market, driven by the integration of advanced radar systems in new vessels during the manufacturing process. Shipbuilders and vessel manufacturers are increasingly incorporating state-of-the-art radar systems to meet regulatory requirements and enhance the safety and efficiency of their vessels. The dominance of OEMs in the market is supported by the continuous growth in the shipbuilding industry, which necessitates the adoption of advanced navigation and safety systems. Additionally, OEMs benefit from long-term contracts and partnerships with radar system manufacturers, ensuring a steady demand for their products.

The aftermarket segment, although smaller, plays a crucial role in the market. This segment includes the maintenance, repair, and upgrade of radar systems on existing vessels. The demand for aftermarket services is driven by the need to keep radar systems operational and up-to-date with the latest technological advancements. As vessels age, the need for regular maintenance and upgrades becomes critical to ensure continued safety and compliance with maritime regulations. The aftermarket segment also benefits from the growing trend of retrofitting older vessels with modern radar systems to enhance their performance and extend their operational life.

In summary, the marine radar market is segmented by type, technology, application, and end user, with each segment contributing to the overall market dynamics. X-band radar, pulse radar, commercial ships, and OEMs dominate their respective segments, driven by factors such as superior performance, reliability, high demand for navigation safety, and integration in new vessels. The market is supported by continuous technological advancements, stringent safety regulations, and the growing need for safe and efficient maritime operations.

Key Market Segments

By Type

- X-band Radar

- S-band Radar

- Ku-band Radar

- Others

By Technology

- Pulse Radar

- Frequency Modulated Continuous Wave (FMCW) Radar

- Doppler Radar

By Application

- Commercial Ships

- Defense Vessels

- Recreational Boats

- Others

By End User

- OEMs

- Aftermarket

Growth Opportunities

Autonomous and Unmanned Maritime Operations Offer Growth Opportunity

The rising trend of autonomous and unmanned maritime operations, including the use of unmanned surface vessels (USVs) and unmanned underwater vehicles (UUVs), presents a significant growth opportunity for marine radar systems. These systems are essential for situational awareness, collision avoidance, and remote monitoring in autonomous maritime operations. Autonomous vessels rely heavily on radar systems to navigate and avoid obstacles without human intervention.

This dependence on advanced radar technology drives the demand for innovative and reliable radar systems. Recent advancements in autonomous maritime technology, along with increasing investments in autonomous vessels, are expected to fuel the growth of the marine radar market.

Integration with Artificial Intelligence and Machine Learning Offers Growth Opportunity

The integration of artificial intelligence (AI) and machine learning algorithms with marine radar systems offers growth opportunities for enhanced target detection, tracking, and decision support. AI-enabled radar systems can analyze complex data patterns, identify potential threats or anomalies, and provide actionable insights to operators, improving overall maritime security and efficiency.

This integration allows for real-time data processing and advanced analytics, leading to more accurate and timely decision-making. The market for AI in marine radar systems is expected to expand significantly, driven by the need for smarter and more efficient maritime operations. For instance, AI in the maritime industry is projected to grow at a CAGR of 10% from 2023 to 2028, underscoring the increasing importance of AI-driven radar systems in enhancing maritime safety and operational efficiency.

Trending Factors

Coastal Surveillance and Maritime Security Applications Are Trending Factors

The increasing need for coastal surveillance and maritime security has driven the demand for advanced marine radar systems. These systems play a crucial role in monitoring maritime borders, detecting illegal activities (such as smuggling or piracy), and supporting search and rescue operations.

Many coastal nations are investing in radar systems to enhance their maritime domain awareness capabilities. This trend is supported by rising security concerns and the need for effective monitoring of vast coastal areas.

Integration with Other Maritime Systems Are Trending Factors

The integration of marine radar systems with other maritime systems, such as Automatic Identification System (AIS), Global Positioning System (GPS), and Electronic Chart Display and Information System (ECDIS), has created a synergistic effect, enhancing overall maritime situational awareness and decision-making. This integration has become increasingly important for efficient vessel management and compliance with maritime regulations.

The combined use of these technologies allows for more comprehensive data collection and analysis, improving navigation safety and operational efficiency. The trend towards integrated maritime systems is driven by the need for seamless communication and data sharing between different navigation and safety tools. The market for integrated marine systems is expected to grow at a steady pace, driven by advancements in technology and increasing regulatory requirements for maritime safety and efficiency.

Regional Analysis

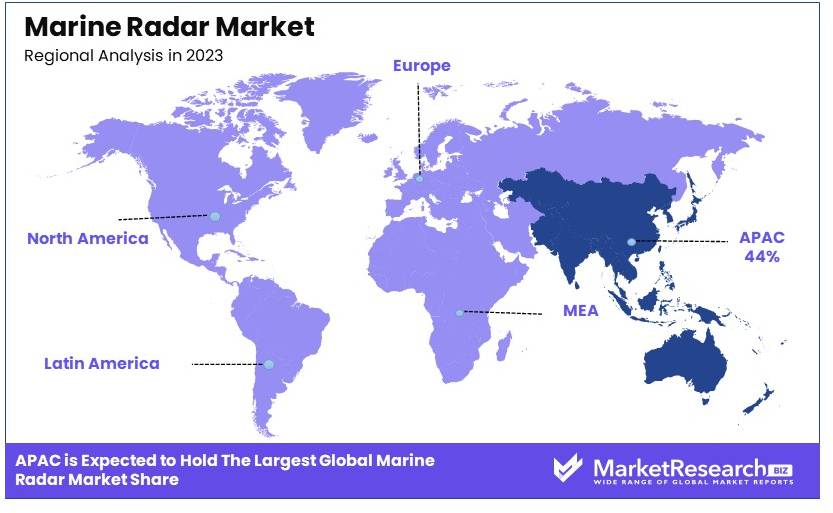

Asia Pacific Dominates with 44% Market Share

Asia Pacific holds 44% of the marine radar market. Several factors drive this dominance. The region has a strong shipbuilding industry, particularly in China, Japan, and South Korea. High investments in maritime safety and port infrastructure further boost the market. Moreover, increased trade activities and maritime disputes have led to higher demand for marine radars.

The marine radar market in Asia Pacific benefits from the region's extensive coastline and busy shipping lanes. Governments in this area prioritize naval defense, enhancing radar systems. The region's economic growth also fuels investments in advanced maritime technologies. These characteristics create a robust market for marine radars.

Asia Pacific's market share in marine radar is expected to grow. Economic expansion, rising maritime activities, and technological advancements will drive this trend. The region's focus on improving maritime safety will also support market growth. Asia Pacific's influence on the global marine radar market is likely to remain strong.

North America Holds 25% Market ShareNorth America accounts for 25% of the marine radar market. The region's high demand for advanced radar systems and strong defense sector drive this share. Innovations in radar technology and a significant number of recreational boats also contribute. This region's market is projected to grow steadily, supported by continuous technological advancements.

Europe Captures 20% Market ShareEurope holds a 20% share of the marine radar market. The region benefits from a strong maritime tradition and significant investments in naval defense. The presence of leading marine radar manufacturers and stringent safety regulations also play a role. Europe's market is expected to grow, driven by innovations and modernization of marine systems.

Middle East & Africa Accounts for 6% Market ShareThe Middle East & Africa region holds a 6% market share. Key factors include investments in port infrastructure and maritime security. The region's strategic location along key shipping routes enhances its market potential. However, economic and political instability may impact growth rates.

Latin America Holds 5% Market ShareLatin America has a 5% share in the marine radar market. The region's focus on upgrading port facilities and enhancing maritime safety drives this share. Economic development and increasing trade activities contribute to market growth. However, market expansion may be slower due to economic challenges.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Marine Radar Market features prominent companies like Raytheon Technologies Corporation, Furuno Electric Co., Ltd., and others. These players significantly impact market dynamics and development.

Raytheon Technologies Corporation and Furuno Electric Co., Ltd. lead the market with advanced radar technologies. Their innovative solutions and strong market presence give them a strategic advantage.

Northrop Grumman Corporation and Lockheed Martin Corporation focus on cutting-edge marine radar systems. Their expertise in defense and marine technologies enhances their market influence.

Saab AB and Kongsberg Gruppen provide high-quality radar systems. Their strategic positioning and continuous innovation strengthen their market presence.

Japan Radio Co., Ltd. and Terma A/S offer advanced radar solutions with a focus on accuracy and reliability. Their extensive product ranges impact market trends.

Garmin Ltd. and Hensoldt AG leverage their technological expertise to offer innovative radar systems. Their market strategies and strong distribution networks boost their influence.

Kelvin Hughes Limited and Northrop Grumman Sperry Marine B.V. focus on marine navigation and radar solutions. Their advanced products and strategic market positioning enhance their impact.

Icom Inc. and Simrad bring a wide range of marine radar products to the market. Their competitive pricing and innovative features improve their market presence.

BendixKing offers reliable and advanced radar solutions. Its focus on customer satisfaction and product innovation strengthens its market standing.

In summary, these companies drive the Marine Radar Market through innovation, strategic positioning, and market influence. Their advanced technologies and robust product offerings shape the market’s future.

Market Key Players

- Raytheon Technologies Corporation

- Furuno Electric Co., Ltd.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Saab AB

- Kongsberg Gruppen

- Japan Radio Co., Ltd.

- Terma A/S

- Garmin Ltd.

- Hensoldt AG

- Kelvin Hughes Limited

- Northrop Grumman Sperry Marine B.V.

- Icom Inc.

- Simrad

- BendixKing

Recent Developments

March 2023 / Global Ocean Security Technologies (GOST): GOST introduced the GNT-Evolution IDP hard-wired security package. This comprehensive system includes marine-grade satellite-tracking and security features such as door and hatch sensors, infrared beam sensors, and high-water sensors. It aims to enhance security for yachts and commercial vessels by providing real-time global tracking and alerts.

November 2023 / Raymarine: Raymarine unveiled the Pathfinder, a new solid-state radar system for commercial marine navigation. This system is designed for vessels up to 10,000 tons, including superyachts and ocean-going cargo vessels. The Pathfinder radar offers exceptional clarity and an intuitive user interface, making it easier to install and retrofit on various types of vessels.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Billion Forecast Revenue (2033) USD 2.8 Billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (X-band Radar, S-band Radar, Ku-band Radar, Others), By Technology (Pulse Radar, Frequency Modulated Continuous Wave [FMCW] Radar, Doppler Radar), By Application (Commercial Ships, Defense Vessels, Recreational Boats, Others), By End User (OEMs, Aftermarket) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Raytheon Technologies Corporation, Furuno Electric Co., Ltd., Northrop Grumman Corporation, Lockheed Martin Corporation, Saab AB, Kongsberg Gruppen, Japan Radio Co., Ltd., Terma A/S, Garmin Ltd., Hensoldt AG, Kelvin Hughes Limited, Northrop Grumman Sperry Marine B.V., Icom Inc., Simrad, BendixKing Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Raytheon Technologies Corporation

- Furuno Electric Co., Ltd.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Saab AB

- Kongsberg Gruppen

- Japan Radio Co., Ltd.

- Terma A/S

- Garmin Ltd.

- Hensoldt AG

- Kelvin Hughes Limited

- Northrop Grumman Sperry Marine B.V.

- Icom Inc.

- Simrad

- BendixKing