Global Management Decision Market By Component(Software, Services), By Deployment Mode(On-premises, Cloud-based), By Function(Credit Risk Management, Collection Management, Customer Experience Management, Fraud Detection Management, Pricing Optimization, Others), By Organization Size(Small and Medium-sized Enterprises, Large Enterprises), By Industry Vertical(BFSI, Manufacturing, Retail and E-Commerce, IT and Telecom, Healthcare, Government, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends,

-

46800

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Component Analysis

- By Deployment Mode Analysis

- By Function Analysis

- By Organization Size Analysis

- By Industry Vertical Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

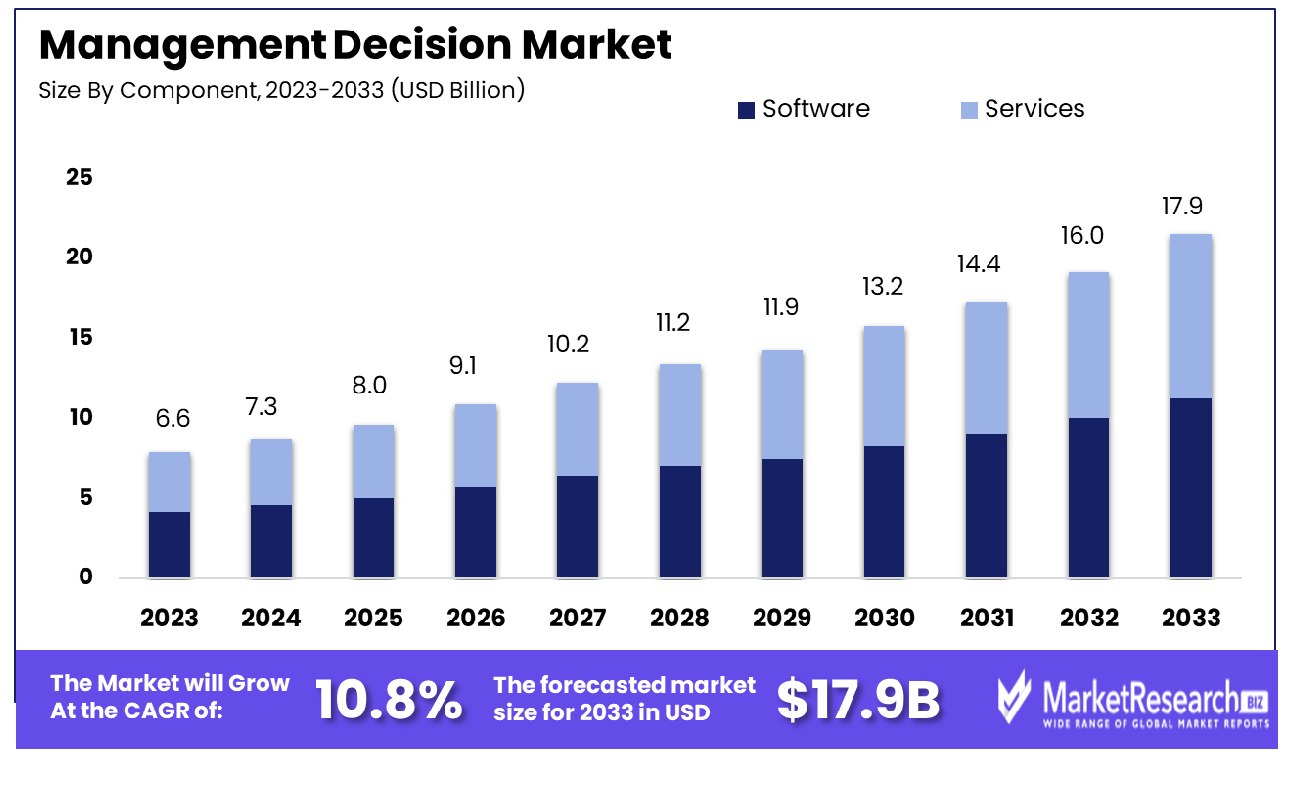

The Global Management Decision Market was valued at USD 6.6 billion in 2023. It is expected to reach USD 17.9 billion by 2033, with a CAGR of 10.8% during the forecast period from 2024 to 2033.

The Management Decision Market encompasses a dynamic landscape of tools, technologies, and strategies designed to enhance organizational decision-making processes. It comprises a range of solutions tailored to streamline executive-level choices, optimize resource allocation, and mitigate risks. This market segment incorporates advanced analytics, predictive modeling, and artificial intelligence to empower leaders in interpreting data, identifying trends, and forecasting outcomes with precision.

As organizations navigate increasingly complex environments, the Management Decision Market emerges as a critical enabler of agility and competitiveness, offering executives the insights and tools necessary to make informed, strategic decisions that drive sustainable growth and maximize performance.

In the realm of the Management Decision Market, a nuanced analysis reveals a landscape poised for significant transformation. With the advent of Artificial Intelligence (AI), the trajectory of Information Technology Service Management (ITSM) is set to undergo substantial evolution.

Approximately 75% of ITSM professionals anticipate profound impacts from AI by 2025, signaling a paradigm shift in operational methodologies and service delivery frameworks. This forecast is substantiated by tangible data indicating that organizations embracing AI-driven automation witness a remarkable 30% surge in workforce productivity, attributable to streamlined processes and enhanced efficiencies.

Moreover, the integration of automation technologies augments the efficacy of IT support functions, evidenced by the resolution of 80% of tickets during initial interactions, particularly for routine tasks such as password resets. Despite these advancements, it's imperative to note that expedited resolution times do not invariably translate to heightened user satisfaction, underscoring the need for a holistic approach toward service quality enhancement.

Furthermore, the proliferation of cloud-native platforms emerges as a pivotal driver reshaping the IT landscape, with an anticipated surge to accommodate 95% of new digital workloads by 2025, marking a substantial uptick from the 30% recorded in 2021. This trajectory is mirrored in the robust 29% year-over-year growth witnessed in investments directed towards cloud infrastructure services, underlining the escalating demand for scalable and agile computing solutions.

In essence, the confluence of AI-driven automation and the ascendance of cloud-native platforms delineates a landscape brimming with opportunities and challenges for stakeholders within the Management Decision Market. As organizations navigate this dynamic terrain, strategic foresight and adaptive capabilities will be indispensable in harnessing the full potential of transformative technologies while mitigating associated risks.

Key Takeaways

- Market Growth: The Global Management Decision Market was valued at USD 6.6 billion in 2023. It is expected to reach USD 17.9 billion by 2033, with a CAGR of 10.8% during the forecast period from 2024 to 2033.

- By Component: Software components dominated, holding a 62% market share.

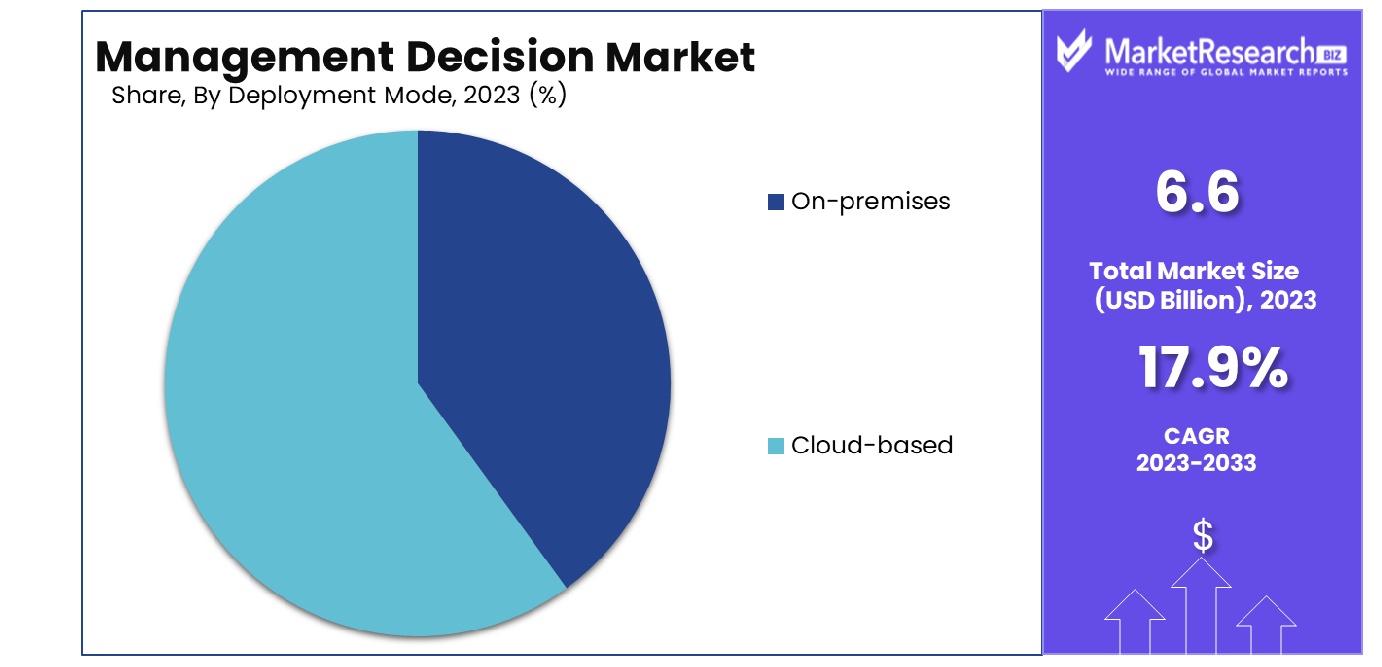

- By Deployment Mode: Cloud-based deployment leads, claim 65% of the market.

- By Function: Credit risk management represents 25% of the function segment.

- By Organization Size: SMEs prevail, capturing 65% in the organization size category.

- By Industry Vertical: The BFSI industry holds a 23% share in market verticals.

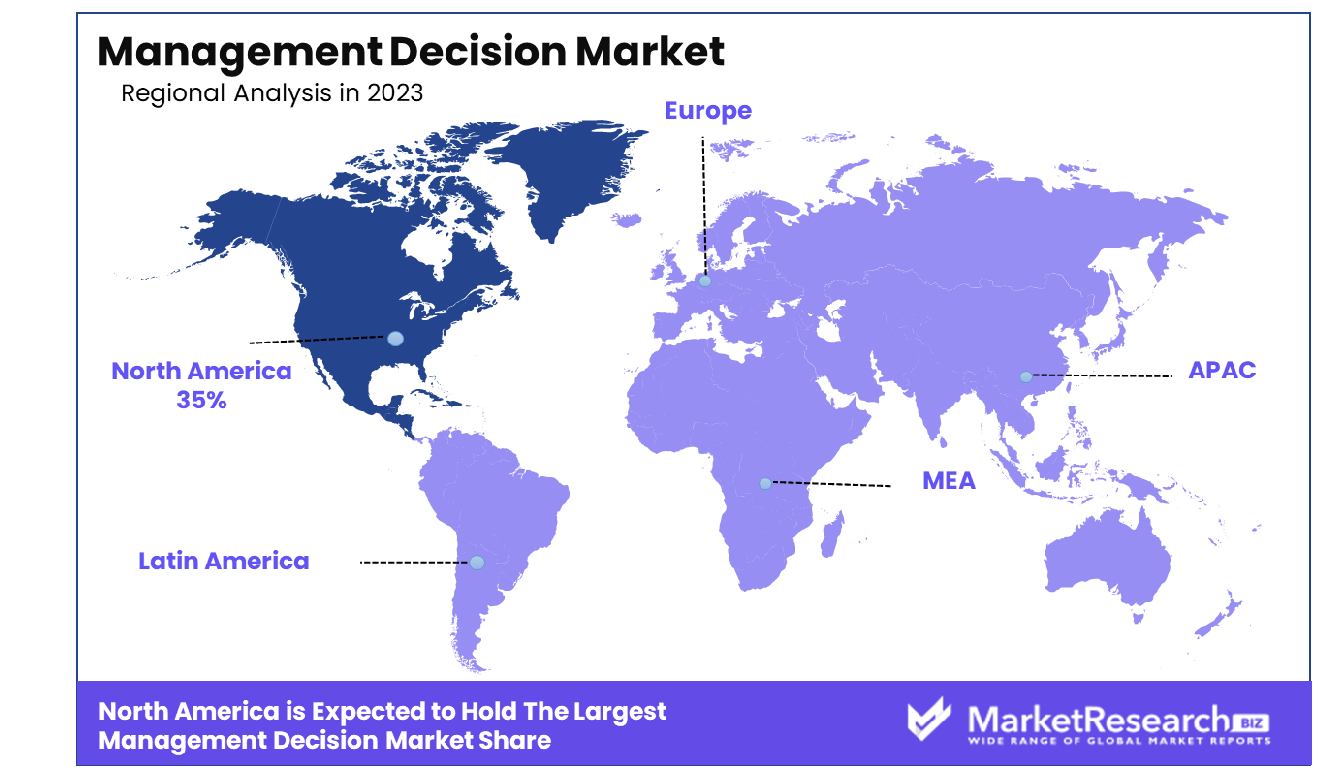

- Regional Dominance: North America holds 35% of the global Management Decision market.

- Growth Opportunity: Automation and AI in management decision-making enhance efficiency, reduce errors, and drive growth by optimizing operations and ensuring compliance.

Driving factors

Demand for Implementation and Integration Services

The Management Decision Market is witnessing significant growth fueled by the increasing demand for implementation and integration services. As organizations aim to streamline decision-making processes, the integration of advanced management decision software with existing IT infrastructure becomes crucial. This demand is driven by the need for seamless data flow and enhanced decision-making accuracy, which directly contributes to operational efficiency.

Implementation services further ensure that the software is customized to meet the specific needs of businesses, enhancing user adoption and satisfaction. This trend is reflected in statistics showing a surge in service-related expenditures within the sector, indicating a compound annual growth rate (CAGR) projected at approximately 12% over the next five years.

Increased Commercial Investments in Developing Nations

Developing nations are becoming hotbeds for commercial investments, partly due to their economic growth potentials and increasingly favorable business environments. This shift is catalyzing the expansion of the Management Decision Market in these regions. As businesses in these countries adopt modern management practices, the demand for robust decision-making tools escalates.

This is not only enhancing the market penetration of management decision solutions but also encouraging local innovations and adaptations of these technologies. The influx of investments is not just expanding the market size but also diversifying the technological landscape, thereby stimulating further growth.

Preference for Profit-Boosting Software and Services

In an era where maximizing profitability is paramount, companies are increasingly turning to management decision software and services that can enhance profit margins. These tools help in identifying cost-cutting measures, optimizing resource allocation, and improving overall business efficiencies. The preference for such profit-boosting solutions is a significant driver for the market, as evidenced by the rising adoption rates among both SMEs and large enterprises.

The deployment of these solutions leads to measurable improvements in financial outcomes, justifying the investment and driving further market growth. This preference is quantitatively supported by market analyses predicting a steady increase in adoption, with a notable impact on the market's annual revenue growth.

Restraining Factors

Limited Scalability and Adaptability of Management Decision Software

A significant restraining factor for the growth of the Management Decision Market is the limited scalability and adaptability of some management decision software. As businesses evolve, the need for software that can scale and adapt to changing requirements becomes critical. However, some existing solutions in the market struggle to accommodate growing data volumes or adapt to new business models efficiently.

This limitation can deter larger enterprises or rapidly expanding businesses from adopting these solutions, thereby restricting market growth. Such scalability challenges are particularly pronounced in industries experiencing fast technological changes, where the inability of decision software to adapt quickly can lead to reduced competitiveness and market share.

High Costs Associated with Ongoing Maintenance and Support

Another critical barrier to the expansion of the Management Decision Market is the high costs associated with ongoing maintenance and support of decision software. These costs can be prohibitively high, especially for small and medium-sized enterprises (SMEs), which form a substantial part of the market base.

Continuous software updates, system checks, and the need for technical support staff can escalate the total cost of ownership, making it less attractive for businesses with limited budgets. This economic burden can slow down the adoption rate of management decision solutions, as potential users might opt for less costly alternatives or defer the adoption of advanced decision-making tools.

By Component Analysis

In the component segment, software took a dominant position with a 62% market share.

In 2023, Software held a dominant market position in the By Component segment of the Management Decision Market, capturing more than a 62% share. This substantial market presence can be primarily attributed to the increasing reliance on advanced decision-making tools that leverage analytics and artificial intelligence to optimize business operations. Software solutions in this sector are designed to enhance the accuracy and efficiency of strategic decisions, streamlining processes and reducing operational costs.

The Services component, while smaller in comparison, also plays a crucial role in supporting the implementation and effective use of these software tools. Services accounted for the remaining market share, indicating robust demand for consulting, integration, and maintenance services. These services are critical for ensuring that the software solutions are tailored to specific organizational needs and are effectively integrated into existing business systems.

The substantial lead of the Software segment over Services underscores the trend toward digital automation and the growing trust in software solutions to handle complex decision-making processes. As organizations continue to face dynamic market conditions, the demand for software that can provide comprehensive analytics and real-time decision support is expected to grow. This trend is likely to drive further innovations and developments in the sector, potentially increasing the market share of the Software segment even more in the coming years.

By Deployment Mode Analysis

Cloud-based solutions prevailed in deployment mode, capturing 65% of the market.

In 2023, Cloud-based solutions held a dominant market position in the By Deployment Mode segment of the Management Decision Market, capturing more than a 65% share. This dominance underscores the increasing preference for cloud-based platforms, which offer scalability, remote accessibility, and reduced upfront costs. These attributes are particularly valuable in today's fast-paced business environments where agility and the capacity for rapid scaling dictate competitive advantage.

On-premises solutions, representing the remainder of the market, continue to be relevant, especially among organizations that prioritize control over their data and systems due to security concerns or regulatory requirements. However, the trend is clearly tilting towards cloud-based solutions due to their lower barrier to entry and flexibility in handling extensive data sets and complex analytics.

The preference for cloud-based deployment can be largely attributed to its alignment with the ongoing digital transformation in various industries. Organizations are increasingly adopting cloud-based decision management systems to enhance their decision-making processes with advanced analytics and machine learning capabilities. Moreover, the integration of cloud-based platforms with other digital tools enhances their appeal by providing a more interconnected and streamlined workflow.

As businesses continue to recognize the strategic value of real-time decision-making capabilities, cloud-based platforms are expected to further solidify their position in the market. This trend is likely to accelerate innovation and expansion in cloud services, further driving the growth of this segment in the Management Decision Market.

By Function Analysis

Credit risk management led the function category, holding a 25% share.

In 2023, Credit Risk Management held a dominant market position in the By Function segment of the Management Decision Market, capturing more than a 25% share. This prominence is indicative of the growing importance of managing credit risk effectively amidst increasing market volatility and regulatory complexities. Financial institutions and businesses are investing in sophisticated credit risk management solutions to mitigate risks and enhance profitability by accurately assessing the creditworthiness of borrowers and monitoring loan performance.

Following Credit Risk Management, the segments of Collection Management, Customer Experience Management, Fraud Detection Management, Pricing Optimization, and Others also play significant roles in the market. Collection Management tools are essential for optimizing debt recovery processes, while Customer Experience Management systems help companies enhance service delivery and customer satisfaction. Fraud Detection Management is crucial in preventing financial losses through advanced analytics and pattern recognition technologies. Pricing Optimization utilizes data analytics to set prices effectively to maximize revenue and market share.

The variety in functional applications reflects the diverse needs of organizations to harness data-driven insights across different operational domains. Credit Risk Management’s larger share, however, highlights the particularly critical nature of financial risk assessment in the current economic environment.

The ongoing advancements in analytics and artificial intelligence are expected to drive further growth in this segment, as organizations seek more robust tools for real-time and predictive risk analysis. This need aligns with a broader market trend towards integrated and automated decision-making platforms, capable of enhancing operational efficiencies and supporting strategic business decisions.

By Organization Size Analysis

Small and medium-sized enterprises dominated the organization size aspect with 65%.

In 2023, Small and Medium-sized Enterprises (SMEs) held a dominant market position in the By Organization Size segment of the Management Decision Market, capturing more than a 65% share. This significant market presence reflects the increasing adoption of decision management systems among SMEs, driven by the need to enhance operational efficiencies and competitiveness in a rapidly evolving business landscape. The affordability and scalability of cloud-based solutions have particularly facilitated this trend, enabling SMEs to leverage advanced analytics and decision-making tools that were previously accessible only to larger corporations.

Large Enterprises also form a substantial part of the market but with a smaller share compared to SMEs. These organizations typically have more complex decision-making needs and higher budgets, which allow them to invest in comprehensive, customized solutions that integrate deeply with their existing IT infrastructures. However, the agility and quick adoption rates of SMEs have propelled them to the forefront in utilizing management decision systems.

The dominance of SMEs in this market segment can be attributed to their need for rapid, data-driven decision-making tools that can streamline operations and reduce costs, thus allowing them to pivot and adapt quickly to market changes. The use of management decision systems by SMEs not only improves decision accuracy but also enhances responsiveness to customer needs and market opportunities.

As the market continues to evolve, the adoption of management decision systems is expected to keep growing among SMEs, driven by technological advancements and the increasing availability of tailor-made solutions that cater to the specific needs of smaller businesses. This trend is likely to foster innovation and competitiveness, further cementing the role of SMEs in driving the market's expansion.

By Industry Vertical Analysis

Within industry verticals, BFSI accounted for 23%, leading the sector.

In 2023, the Banking, Financial Services, and Insurance (BFSI) sector held a dominant market position in the by-industry vertical segment of the Management Decision Market, capturing more than a 23% share. This leading position highlights the critical importance of advanced decision-making tools in the BFSI industry, driven by the need to manage risk, comply with stringent regulations, and enhance customer service in a highly competitive market.

Following BFSI, other sectors such as Manufacturing, Retail and E-Commerce, IT and Telecom, Healthcare, Government, and Others also significantly contribute to the market. The Manufacturing sector leverages decision management systems to optimize production and supply chain operations. Retail and E-Commerce use these tools for pricing optimization and customer experience management, while IT and Telecom deploy them to manage service delivery and network operations. Healthcare organizations implement decision systems primarily for patient care management and operational efficiency, and Government entities utilize them for public service management and regulatory compliance.

The BFSI sector’s substantial share underscores its reliance on sophisticated analytical tools to perform credit risk assessments, fraud detection, and regulatory compliance checks efficiently. As financial institutions continue to face volatile economic conditions and evolving regulatory landscapes, the demand for robust, data-driven decision support systems is expected to remain strong.

Moving forward, the integration of AI and machine learning technologies is anticipated to further enhance the capabilities of management decision systems, particularly in the BFSI sector, driving more precise and predictive decision-making processes. This trend will likely maintain the sector's lead in the market while fostering innovation across all industry verticals.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-premises

- Cloud-based

By Function

- Credit Risk Management

- Collection Management

- Customer Experience Management

- Fraud Detection Management

- Pricing Optimization

- Others

By Organization Size

- Small and Medium-sized Enterprises

- Large Enterprises

By Industry Vertical

- BFSI

- Manufacturing

- Retail and E-Commerce

- IT and Telecom

- Healthcare

- Government

- Others

Growth Opportunity

Rising Trend of Automation and Intelligent Decision-Making

The global management decision market is witnessing a significant surge in automation and intelligent decision-making processes. Organizations are increasingly adopting these technologies to streamline operations and enhance decision accuracy. This trend is propelled by the need to handle complex business environments efficiently and make faster, data-driven decisions.

As businesses continue to face volatile market conditions, the reliance on automated and intelligent decision systems is expected to grow, thereby driving the market expansion throughout 2023.

Decision Automation Leveraging AI, Data Analytics, and Predefined Business Rules

Decision automation, which integrates artificial intelligence (AI), data analytics, and predefined business rules, stands as a cornerstone for growth in the management decision market. This integration enables businesses to automate complex decision-making processes, ensuring consistency and eliminating human biases.

AI and analytics provide insights from large data sets, while predefined rules help in maintaining regulatory compliance and standardizing operations. The synergy of these technologies not only boosts efficiency but also supports adaptive and scalable decision-making frameworks, essential for sustaining competitive advantage.

Enhanced Productivity and Reduced Risks and Errors

The adoption of management decision solutions directly contributes to enhanced productivity by optimizing decision-making processes and reducing the time taken to resolve issues. Moreover, these solutions significantly minimize risks and errors associated with human decision-making.

By leveraging advanced analytics and simulation models, organizations can predict outcomes and assess various decision scenarios before implementation. This proactive approach to managing decisions helps mitigate potential risks and reduce errors, thereby improving overall operational reliability and business outcomes.

Latest Trends

Growing Demand for Medical and Healthcare Equipment

The escalating requirement for medical and healthcare equipment has been identified as a prominent driver for the global Management Decision market in 2023. This surge is primarily due to an aging global population and increasing health awareness among consumers.

Management decision tools are increasingly being utilized to optimize the supply chains and operations of medical equipment manufacturers, ensuring efficient resource allocation and timely delivery of essential medical supplies. Additionally, these tools facilitate enhanced data analysis for better decision-making in healthcare settings, thus improving patient outcomes and operational efficiencies.

Rapid Growth in 5G and LTE Technology

The rapid advancement and deployment of 5G service and LTE technologies are significantly influencing the Management Decision market. As these technologies enhance connectivity and data transfer speeds, organizations are finding new opportunities to implement more sophisticated decision-making tools that rely on real-time data.

The integration of 5G enables quicker response times and more agile decision-making processes in dynamic market conditions. Consequently, companies across various sectors are keen to leverage this technological growth to gain a competitive edge, driving further investments in advanced management decision systems that can capitalize on the improved telecommunications infrastructure.

Regional Analysis

North America holds a 35% share of the global Management Decision market.

The Management Decision Market demonstrates substantial variability across global regions, reflecting diverse business practices and technological adoption rates. In North America, the market holds a dominant position, commanding approximately 35% of the global share. This dominance is primarily driven by a robust financial sector and the widespread integration of advanced analytics and AI technologies across industries aiming to optimize decision-making processes.

Moving to Europe, the region shows strong growth, supported by increasing regulatory compliance requirements and the adoption of management decision solutions among SMEs and large enterprises. Europe's focus on enhancing operational efficiency and data-driven strategies significantly contributes to the market's expansion.

In the Asia Pacific, rapid industrialization, coupled with digital transformation initiatives, accelerates the adoption of management decision systems. Countries like China, Japan, and India are pivotal, leveraging these solutions to gain a competitive edge in the global market. This region is anticipated to exhibit the highest growth rate during the forecast period due to its large-scale technological adoption and investment in AI and machine learning.

The Middle East & Africa region is gradually embracing management decision solutions, driven by sectors such as banking, healthcare, and retail. Investments in smart city projects and infrastructure developments also boost market growth, though at a slower pace compared to other regions.

Latin America shows promise with increased adoption of cloud-based solutions, allowing smaller enterprises to implement sophisticated management decision systems. Economic stabilization and a focus on business efficiency fuel the market's growth in this region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the 2023 Global Management Decision Market, key players such as IBM, FICO, SAS, Oracle, and Pega Systems have maintained significant positions due to their robust offerings and strategic innovations. IBM leads with its advanced analytics and integration capabilities that cater to complex business environments, enhancing decision-making processes across various industries. FICO, renowned for its analytical models and decision management solutions, continues to expand its reach by integrating artificial intelligence with traditional credit scoring processes.

SAS and Oracle remain pivotal in the market due to their comprehensive and scalable solutions. SAS's analytics-driven decision management tools are crucial for organizations seeking data-intensive decision support, while Oracle's cloud-based platforms provide flexibility and efficiency in operational decision-making.

Pega Systems and TIBCO Software stand out for their process automation and real-time data analytics capabilities, respectively, enabling faster and more accurate management decisions. Smaller entities like Sapiens International Corporation, Sparkling Logic, and Decision Management Solutions also contribute significantly, focusing on niche areas such as insurance and personalized customer engagement strategies.

Additionally, companies like Experian and Equifax emphasize enhanced decision-making in financial services through improved risk assessment and customer insights. Salesforce.com introduces AI-driven analytics to its CRM systems, enhancing decision-making in customer relations.

Emerging players like Manthan Software Services Pvt. Ltd. highlight the growing influence of AI and machine learning in retail and consumer-oriented decision systems, indicating a shift towards more adaptive and customer-centric decision frameworks.

Overall, the landscape in 2023 is highly competitive, with each key player leveraging unique strengths to solidify their market presence and address the increasingly complex needs of global clients in the management decision market.

Market Key Players

- IBM

- FICO

- SAS

- Oracle

- Pega systems

- Tibco Software

- Sapiens International Corporation Experian

- Equifax

- Actico

- Parmenides

- Sparkling Logic

- Decision Management Solutions

- Open Rules

- TIBCO

- Experian

- Fair Isaac Corporation

- Salesforce.com, Inc.

- Manthan Software Services Pvt. Ltd.

Recent Development

- In April 2022, The Wall Street Journal's corporate ranking underscores the competitive edge of diverse cultures. Studies highlight diverse teams' innovation and productivity, reinforcing PwC's findings on board perceptions. Companies like BCG emphasize the financial advantages of diversity.

- In October 2021, Peter Drucker and Henry Mintzberg advocated for a holistic approach to management, integrating liberal arts with science. Drucker's Drucker Institute at Claremont Graduate University and Mintzberg's McGill University program exemplify this, promoting innovative management decision-making.

Report Scope

Report Features Description Market Value (2023) USD 6.6 Billion Forecast Revenue (2033) USD 17.9 Billion CAGR (2024-2032) 10.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Software, Services), By Deployment Mode(On-premises, Cloud-based), By Function(Credit Risk Management, Collection Management, Customer Experience Management, Fraud Detection Management, Pricing Optimization, Others), By Organization Size(Small and Medium-sized Enterprises, Large Enterprises), By Industry Vertical(BFSI, Manufacturing, Retail and E-Commerce, IT and Telecom, Healthcare, Government, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM, FICO, SAS, Oracle, Pega systems, Tibco Software, Sapiens International Corporation Experian, Equifax, Actico, Parmenides, Sparkling Logic, Decision Management Solutions, Open Rules, TIBCO, Experian, Fair Isaac Corporation, Salesforce.com, Inc., Manthan Software Services Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM

- FICO

- SAS

- Oracle

- Pega systems

- Tibco Software

- Sapiens International Corporation Experian

- Equifax

- Actico

- Parmenides

- Sparkling Logic

- Decision Management Solutions

- Open Rules

- TIBCO

- Experian

- Fair Isaac Corporation

- Salesforce.com, Inc.

- Manthan Software Services Pvt. Ltd.