Managed Pressure Drilling Market Report By Technology (Constant Bottom Hole Pressure (CBHP), Return Flow Control Drilling (RFCD), Mud Cap Drilling (MCD), Dual Gradient Drilling (DGD)), By Application (Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

3688

-

April 2024

-

291

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

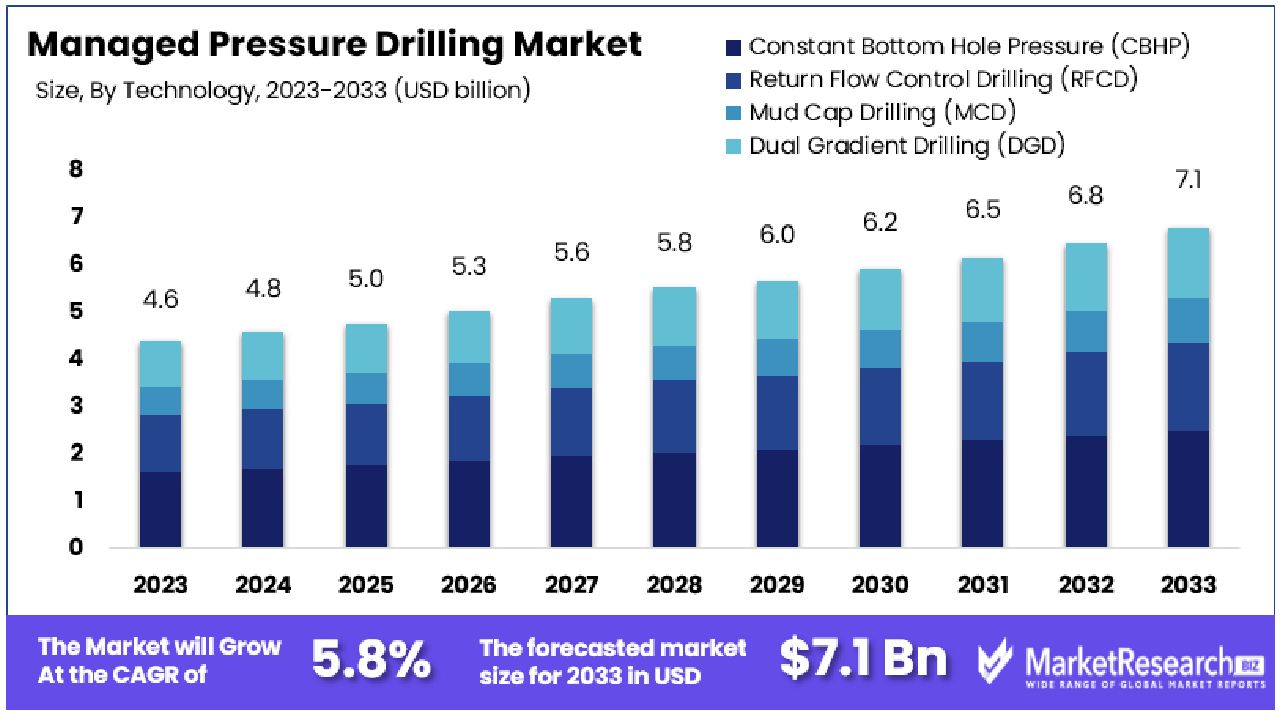

The Global Managed Pressure Drilling Market size is expected to be worth around USD 7.1 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 5.80% during the forecast period from 2024 to 2033.

Managed pressure drilling (MPD) is a precision drilling technology designed to optimize drilling by managing the annular pressure profile throughout the wellbore. This method enhances the safety and efficiency of drilling operations, particularly in challenging environments such as deepwater or unstable formations.

MPD technology allows operators to more accurately control pressures, reducing the risk of common drilling hazards like blowouts or stuck pipe incidents. This approach is increasingly adopted in oil and gas projects to minimize non-productive time and optimize resource extraction. The managed pressure drilling market is critical for companies looking to improve drilling performance and safety margins.

The Managed Pressure Drilling (MPD) market is experiencing significant growth, driven by the rising global demand for energy and the subsequent increase in liquid fuels production.

According to the U.S. Energy Information Administration, global liquid fuels production escalated from 95.71 million barrels per day in 2021 to 99.94 million barrels per day in 2022, underscoring the expanding need for advanced drilling technologies. MPD systems are integral in meeting this demand by enabling more precise control over wellbore pressures, which enhances drilling efficiency and safety.

This market is particularly relevant in complex drilling environments where traditional methods fall short. By mitigating the risks associated with high-pressure and high-temperature drilling conditions, MPD systems improve the economic viability of oil and gas extraction projects. This technology not only reduces non-productive time caused by drilling-related issues but also extends the life of oil and gas reservoirs, maximizing resource extraction.

The adoption of MPD technologies is further supported by the industry's push towards reducing environmental impact and improving safety standards. Regulatory bodies and environmental agencies are increasingly stringent, making the effective management of wellbore pressures a critical component of compliant operations.

As the industry continues to face geological challenges and economic pressures, the reliance on MPD technologies is expected to grow. Companies operating in this market are poised to benefit from the increasing investment in energy resources, particularly in regions with complex reservoirs. The market's expansion is projected to continue, driven by technological advancements and the global need for more efficient and safer drilling practices. This positions the MPD market as a crucial area for investment and development in the oil and gas sector.

Key Takeaways

- Market Value: The Global Managed Pressure Drilling (MPD) Market is expected to reach USD 7.1 billion by 2033, growing from USD 4.6 billion in 2023, with a Compound Annual Growth Rate (CAGR) of 5.80% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Technology Analysis: Constant Bottom Hole Pressure (CBHP) technology leads, preferred for its ability to maintain steady bottom hole pressure and mitigate common drilling challenges.

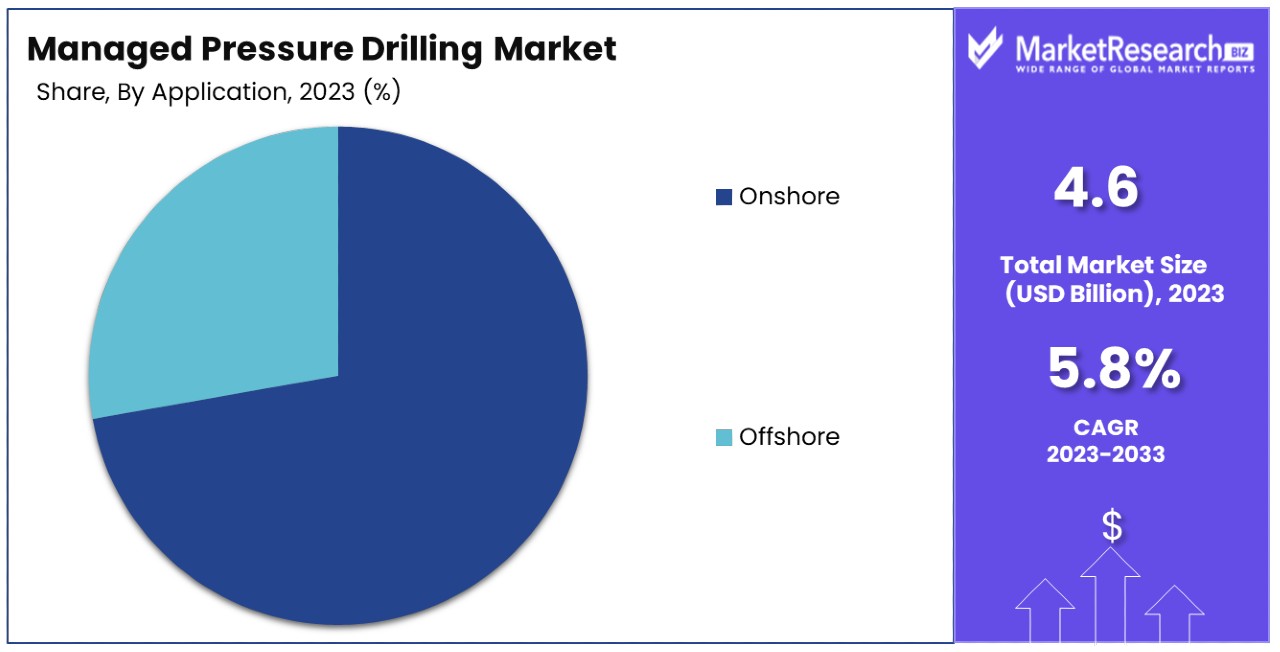

- Application Analysis: The Onshore segment is predominant, benefiting from extensive onshore oil and gas exploration and the need for advanced drilling technologies to manage complex geological conditions.

- Regional Dominance:

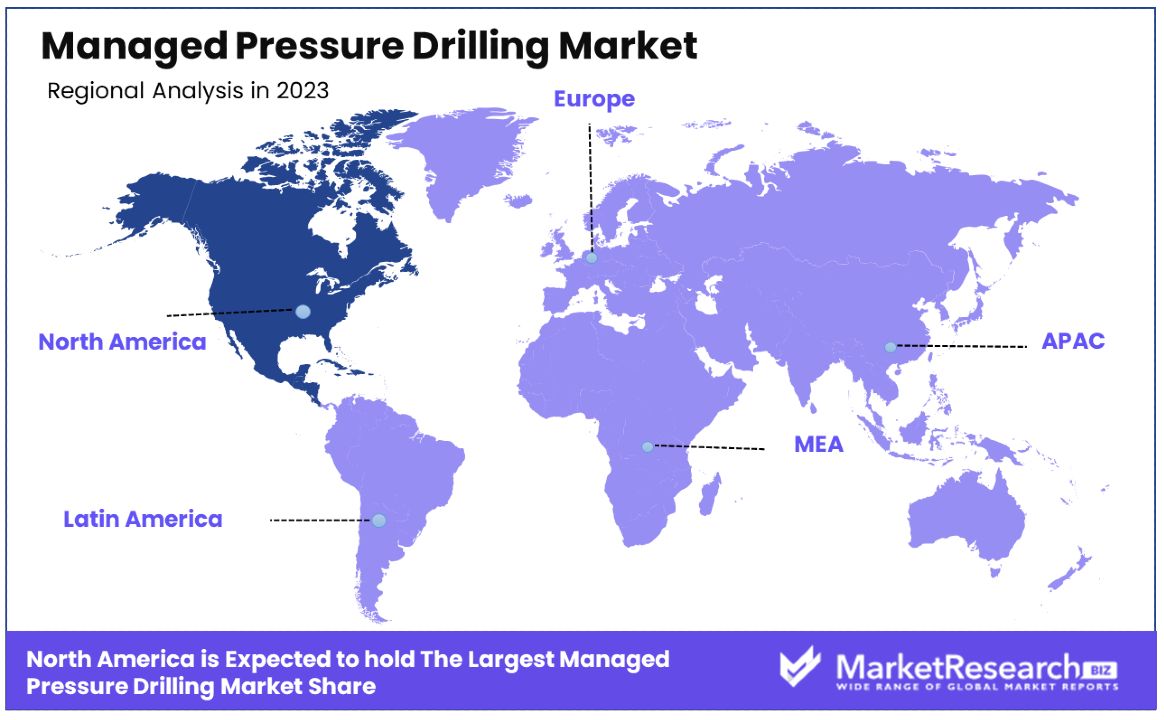

- North America: Holds the largest market share at 35%, driven by technological advancements and extensive drilling activities.

- Middle East: Noted for expanding oil production and integrating advanced drilling technologies, which support the region's significant role in the global MPD market.

- Analyst Viewpoint: The MPD market's growth is largely driven by the increasing complexity of drilling environments and the critical need for precise pressure control to enhance safety and minimize non-productive time. Advancements in MPD technology, particularly in CBHP, are crucial for addressing the evolving challenges in both onshore and offshore drilling scenarios.

- Growth Opportunities: The market offers substantial growth opportunities in developing regions where oil and gas exploration activities are expanding. Further advancements in MPD technologies that enhance environmental safety and operational efficiency are likely to propel market growth.

Driving Factors

Deepwater Exploration Elevates MPD Demand

The burgeoning exploration and production (E&P) activities in deepwater and ultra-deepwater regions are significantly fueling the demand for Managed Pressure Drilling (MPD). As the offshore drilling market projects to reach $53.5 billion by 2026, MPD's role becomes pivotal in navigating these complex environments, including shale gas exploration.

In the U.S., offshore drilling contributes to 15% of crude oil and 2% of gas production as of 2020. The extension of E&P activities into deeper and more challenging offshore terrains necessitates the deployment of MPD to ensure safe drilling within stringent pressure boundaries.

Efficiency and Time Savings Spur MPD Utilization

Managed Pressure Drilling's capability to precisely control wellbore pressure translates into faster drilling rates, reduced incidences of kicks and losses, and minimized troubleshooting time.

This efficiency is increasingly acknowledged in the industry, with about 80% of deepwater rig tenders stipulating MPD capability. The adoption of MPD significantly enhances overall drilling efficiency, a crucial factor in time-sensitive and cost-intensive deepwater operations.

Unlocking High-Pressure Reservoirs Boosts Reserves Access

MPD technology is pivotal in tapping into high pressure/high temperature reservoirs previously deemed inaccessible using conventional drilling methods. This advancement unlocks new reserves, potentially reshaping global energy landscapes.

The USGS's global estimate of undiscovered, technically recoverable conventional oil and gas resources highlights significant potential in regions like the Middle East, North Africa, South America, and the Caribbean. These areas, with estimated resources of 279 billion barrels of oil and extensive natural gas reserves, present lucrative opportunities for MPD application, underpinning its critical role in accessing previously unreachable reserves.

Restraining Factors

High Upfront Capital Costs Deter Managed Pressure Drilling Market Growth

High upfront capital costs significantly restrain the growth of the managed pressure drilling (MPD) market. The deployment of MPD technology necessitates the procurement of expensive and complex equipment such as choke manifolds and corrosion-resistant bottomhole assemblies.

These specialized tools, essential for the safe and effective implementation of MPD, entail a substantial initial investment, making it financially challenging for many companies to adopt this technology. This high cost barrier especially affects smaller firms or those with limited capital, thereby slowing down market expansion as potential adopters may be deterred by the significant upfront financial commitment.

Shortage of Skilled Personnel Hampers Managed Pressure Drilling Market Expansion

The lack of skilled personnel is a critical factor hindering the growth of the managed pressure drilling market. MPD operations require highly trained rig crews who can proficiently handle the equipment and optimize wellbore pressure in real-time.

This necessitates a workforce with specialized training and experience in MPD techniques, which is currently in short supply. The shortage of experienced personnel not only limits the ability to implement MPD technologies effectively but also poses risks to operational safety and efficiency. Overcoming this challenge is crucial for the broader adoption and growth of MPD, as skilled personnel are fundamental to its successful deployment and operation.

Technology Analysis

CBHP Technology Dominates Managed Pressure Drilling Market for Enhanced Wellbore Pressure Control

Constant Bottom Hole Pressure (CBHP) technology is the dominant segment in the managed pressure drilling (MPD) market. The preference for CBHP is primarily due to its effectiveness in maintaining steady bottom hole pressure, crucial for preventing common drilling problems like kicks, lost circulation, and wellbore instability. CBHP uses a closed-loop system that allows for precise control of the wellbore pressure, making it highly efficient in challenging drilling environments, such as those with narrow pressure windows or unpredictable formations. The ability of CBHP to minimize non-productive time and enhance safety while drilling is a significant factor contributing to its widespread adoption in the oil and gas industry.

Other technologies in the MPD market include Return Flow Control Drilling (RFCD), Mud Cap Drilling (MCD), and Dual Gradient Drilling (DGD). RFCD is notable for its ability to manage downhole pressures and mitigate risks associated with uncontrolled fluid flow. MCD is particularly useful in situations where conventional circulation is not feasible, and it is often applied in wells with significant lost circulation issues. DGD, on the other hand, is designed for deepwater drilling environments and aims to address the challenges posed by the high pressure and temperature conditions characteristic of these settings. Although these technologies have specific applications and benefits, CBHP's versatility and broad applicability make it the preferred technology in the managed pressure drilling market.

Application Analysis

Onshore Operations Drive Adoption of Managed Pressure Drilling for Safe and Efficient Drilling Practices

In terms of application, the Onshore segment holds a dominant position in the managed pressure drilling market. The onshore segment's dominance is driven by the continued expansion of onshore oil and gas exploration and production activities worldwide. Onshore operations, often characterized by complex geological formations and challenging drilling conditions, benefit significantly from the application of MPD technologies. MPD enhances the safety and efficiency of onshore drilling operations, allowing for better control over wellbore pressures, which is crucial in preventing drilling-related risks and non-productive time.

While Onshore leads the market, the Offshore segment also plays a critical role in the MPD market. Offshore drilling operations, especially in deepwater and ultra-deepwater environments, present unique challenges that MPD technologies are well-suited to address. Offshore wells often encounter complex pressure regimes and harsh environmental conditions, making managed pressure drilling an essential tool for ensuring operational safety and efficiency. The application of MPD in offshore settings is particularly beneficial in mitigating the risks associated with drilling in high-pressure, high-temperature reservoirs, and in minimizing the environmental impact of drilling activities.

Key Market Segments

By Technology

- Constant Bottom Hole Pressure (CBHP)

- Return Flow Control Drilling (RFCD)

- Mud Cap Drilling (MCD)

- Dual Gradient Drilling (DGD)

By Application

- Onshore

- Offshore

Growth Opportunities

Remote Operations Demand Boosts Managed Pressure Drilling Market

The rising demand for remote operations in drilling activities presents a significant growth opportunity for the managed pressure drilling (MPD) market. MPD's ability to provide real-time downhole data is crucial for drilling remote offline wells efficiently. This technology offers enhanced control and monitoring of drilling operations, even in remote or challenging environments.

As the industry increasingly moves towards remote and automated operations for improved safety and efficiency, the demand for MPD systems is expected to surge, driving market growth as these solutions become essential for modern drilling practices.

Depletion of Traditional Reserves Elevates Need for MPD in Complex Reservoirs

The depletion of easy-to-reach oil and gas reserves is compelling companies to explore more complex and challenging reservoirs. In these scenarios, MPD services become essential for successful drilling operations.

MPD provides better control over wellbore pressures, enabling safer and more efficient drilling in environments where traditional methods are less effective or too risky. As the industry confronts the reality of dwindling traditional reserves, the necessity to tap into more complex reservoirs will likely drive the demand for advanced drilling solutions like MPD, presenting a significant expansion opportunity in the market.

Trending Factors

Shifting Industry Dynamics and Market Competitiveness Are Trending Factors

As the oil and gas industry evolves, shifting market dynamics and increased competition are key drivers for the adoption of Managed Pressure Drilling (MPD) solutions. Companies like Halliburton are leveraging MPD to offer tailored drilling technologies that enhance operational performance and provide a competitive edge. This trend is significant in the pressure drilling industry where innovation is critical for success.

Recent market analysis shows that operators using MPD can reduce drilling time by up to 30%, significantly lowering costs and improving efficiency. As the demand for oil remains robust, the ability of MPD to adapt to diverse drilling environments makes it a critical tool in maintaining competitiveness within the pressure drilling market.

Expansion of Unconventional Resource Development Are Trending Factors

The development of unconventional resources like shale and tight reservoirs has significantly influenced the managed pressure drilling market. These reservoirs require advanced drilling techniques provided by MPD to effectively manage pore pressure and optimize well placement.

Companies such as Baker Hughes are at the forefront, offering MPD services that enhance drilling accuracy and efficiency in these complex formations. This adaptation has led to a notable increase in the pressure drilling market size, with forecasts suggesting a continual growth trend during the forecast period. The ability to maximize hydrocarbon extraction from unconventional sources is a major factor driving the expansion of MPD services in regions rich in such resources, particularly in North America and Asia Pacific.

Focus on Environmental Sustainability and Carbon Footprint Reduction Are Trending Factors

Environmental sustainability and reducing carbon footprints have become crucial in the pressure drilling industry. MPD services contribute to these goals by minimizing drilling-related emissions and enhancing well integrity, which leads to less environmental disturbance. Operators like TotalEnergies are incorporating MPD to achieve sustainability objectives while ensuring cost-efficiency and operational effectiveness.

This focus is aligned with global regulatory trends and stakeholder expectations, positioning MPD as a sustainable drilling solution. The adoption of environmentally friendly drilling practices is not only a compliance strategy but also a market differentiator that is expected to attract more investment into the sector, especially during the forecast period, as companies strive to meet both environmental and production targets.

Regional Analysis

North America Dominates with 35% Market Share in Managed Pressure Drilling Market

North America's significant 35% market share in the managed pressure drilling (MPD) market is primarily driven by the region's robust oil and gas industry, particularly in the United States and Canada. The region's emphasis on maximizing oil and gas extraction efficiency and the presence of complex and challenging drilling environments necessitate the use of advanced drilling techniques like MPD. Additionally, the presence of key industry players and technological innovators in MPD, such as Halliburton, Schlumberger, and Weatherford, contributes to the region's market dominance. These companies invest heavily in R&D to enhance drilling efficiency and safety, fostering market growth.

The market dynamics in North America are influenced by the increasing exploration and production activities, particularly in unconventional resources like shale and tight reserves. The need for cost-effective and environmentally responsible drilling solutions in these complex geologies drives the adoption of MPD.

Moreover, regulatory pressures for safer drilling operations and the industry's focus on reducing non-productive time (NPT) and minimizing risks further boost the MPD market. The region's technological advancements in oilfield services and the growing adoption of automation and data analytics in drilling operations also contribute to market growth.

Europe: Focus on Offshore Exploration and Technological Adoption

Europe's managed pressure drilling market is driven by its focus on offshore oil and gas exploration, particularly in the North Sea region. Companies like BP and Total are actively involved in adopting advanced drilling technologies to manage the complex geologies and harsh conditions of offshore fields. The market is also supported by Europe's stringent environmental and safety regulations, which promote the adoption of MPD technologies.

Middle East: Expanding Oil Production and Technological Integration

The Middle East, with its vast oil reserves, shows significant growth in the MPD market. Countries like Saudi Arabia and the UAE are investing in advanced drilling technologies to enhance oil recovery from their extensive onshore and offshore fields. The region's focus on maintaining its position as a leading oil exporter drives the adoption of MPD, supported by key regional players such as Saudi Aramco and ADNOC. The market is further bolstered by the increasing integration of digital technologies in drilling operations.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Managed Pressure Drilling (MPD) Market, a critical sector for enhancing drilling efficiency and safety in challenging environments, the companies listed are key in driving innovation and operational excellence. Schlumberger Limited and Halliburton Company are industry leaders, renowned for their comprehensive MPD solutions and global service networks. Their strategic positioning emphasizes technological innovation, safety, and operational efficiency, significantly influencing drilling practices and standards in the oil and gas sector.

Weatherford International Ltd. and Baker Hughes Incorporated are prominent players known for their advanced MPD technologies and customized service offerings. They cater to a wide range of drilling environments, reflecting the industry's shift towards more adaptable and sophisticated drilling solutions. National Oilwell Varco, L.P., with its focus on specialized equipment and systems, plays a crucial role in advancing MPD capabilities, showcasing the market's potential for enhancing control over drilling operations.

Aker Solutions and STRATA Energy Services Inc., with their targeted approaches and technological expertise, contribute significantly to the market's competitive dynamics, offering solutions that address the evolving needs of modern drilling operations. Ensign Energy Services Inc. and Archer, recognized for their operational excellence and innovation, play pivotal roles in the adoption and advancement of MPD techniques, particularly in complex and high-risk drilling scenarios.

Market Key Players

- Weatherford International Ltd.

- Halliburton Company

- Baker Hughes Incorporated

- Schlumberger Limited

- National Oilwell Varco, L.P.

- Aker Solutions

- Ensign Energy Services Inc.

- STRATA Energy Services Inc.

- Blade Energy Partners, Ltd.

- Archer

Recent Developments

- In 2023, a significant development in the managed pressure drilling (MPD) market involves Halliburton's collaboration with Oil States Industries to enhance deepwater MPD solutions. The announcement was made by Halliburton, the oilfield services giant, indicating a strategic partnership with Oil States Industries to provide operators with improved handling and streamlined installation of various aspects of deepwater managed pressure drilling equipment, control systems, and services.

- In July 2022, Stena Drilling announced a contract with Shell UK Ltd for their Mobile Offshore Drilling Unit (MODU). Work will commence during two quarters of 2023 under this firm contract with an option for direct extension for up to an extra year if required.

- In March 2022, Nabors Industries Ltd. made an $8 Million investment in GA Drilling as evidence of its commitment to deeper drilling techniques for creating super-hot, ultra-deep rock reservoirs. Furthermore, Nabors' energy transition strategy focused on markets with low carbon emissions that provide opportunities for rapid expansion.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 7.1 Billion CAGR (2024-2033) 5.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Constant Bottom Hole Pressure (CBHP), Return Flow Control Drilling (RFCD), Mud Cap Drilling (MCD), Dual Gradient Drilling (DGD)), By Application (Onshore, Offshore) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Weatherford International Ltd., Halliburton Company, Baker Hughes Incorporated, Schlumberger Limited, National Oilwell Varco, L.P., Aker Solutions, Ensign Energy Services Inc., STRATA Energy Services Inc., Blade Energy Partners, Ltd., Archer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Managed Pressure Drilling Market Overview

- 2.1. Managed Pressure Drilling Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Managed Pressure Drilling Market Dynamics

- 3. Global Managed Pressure Drilling Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Managed Pressure Drilling Market Analysis, 2016-2021

- 3.2. Global Managed Pressure Drilling Market Opportunity and Forecast, 2023-2032

- 3.3. Global Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Technology, 2016-2032

- 3.3.1. Global Managed Pressure Drilling Market Analysis by Technology: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Technology, 2016-2032

- 3.3.3. Constant Bottom Hole Pressure (CBHP)

- 3.3.4. Return Flow Control Drilling (RFCD)

- 3.3.5. Mud Cap Drilling (MCD)

- 3.3.6. Dual Gradient Drilling (DGD)

- 3.4. Global Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.4.1. Global Managed Pressure Drilling Market Analysis by Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.4.3. Onshore

- 3.4.4. Offshore

- 4. North America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Managed Pressure Drilling Market Analysis, 2016-2021

- 4.2. North America Managed Pressure Drilling Market Opportunity and Forecast, 2023-2032

- 4.3. North America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Technology, 2016-2032

- 4.3.1. North America Managed Pressure Drilling Market Analysis by Technology: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Technology, 2016-2032

- 4.3.3. Constant Bottom Hole Pressure (CBHP)

- 4.3.4. Return Flow Control Drilling (RFCD)

- 4.3.5. Mud Cap Drilling (MCD)

- 4.3.6. Dual Gradient Drilling (DGD)

- 4.4. North America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.4.1. North America Managed Pressure Drilling Market Analysis by Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.4.3. Onshore

- 4.4.4. Offshore

- 4.5. North America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Managed Pressure Drilling Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Managed Pressure Drilling Market Analysis, 2016-2021

- 5.2. Western Europe Managed Pressure Drilling Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Technology, 2016-2032

- 5.3.1. Western Europe Managed Pressure Drilling Market Analysis by Technology: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Technology, 2016-2032

- 5.3.3. Constant Bottom Hole Pressure (CBHP)

- 5.3.4. Return Flow Control Drilling (RFCD)

- 5.3.5. Mud Cap Drilling (MCD)

- 5.3.6. Dual Gradient Drilling (DGD)

- 5.4. Western Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.4.1. Western Europe Managed Pressure Drilling Market Analysis by Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.4.3. Onshore

- 5.4.4. Offshore

- 5.5. Western Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Managed Pressure Drilling Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Managed Pressure Drilling Market Analysis, 2016-2021

- 6.2. Eastern Europe Managed Pressure Drilling Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Technology, 2016-2032

- 6.3.1. Eastern Europe Managed Pressure Drilling Market Analysis by Technology: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Technology, 2016-2032

- 6.3.3. Constant Bottom Hole Pressure (CBHP)

- 6.3.4. Return Flow Control Drilling (RFCD)

- 6.3.5. Mud Cap Drilling (MCD)

- 6.3.6. Dual Gradient Drilling (DGD)

- 6.4. Eastern Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.4.1. Eastern Europe Managed Pressure Drilling Market Analysis by Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.4.3. Onshore

- 6.4.4. Offshore

- 6.5. Eastern Europe Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Managed Pressure Drilling Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Managed Pressure Drilling Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Managed Pressure Drilling Market Analysis, 2016-2021

- 7.2. APAC Managed Pressure Drilling Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Technology, 2016-2032

- 7.3.1. APAC Managed Pressure Drilling Market Analysis by Technology: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Technology, 2016-2032

- 7.3.3. Constant Bottom Hole Pressure (CBHP)

- 7.3.4. Return Flow Control Drilling (RFCD)

- 7.3.5. Mud Cap Drilling (MCD)

- 7.3.6. Dual Gradient Drilling (DGD)

- 7.4. APAC Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.4.1. APAC Managed Pressure Drilling Market Analysis by Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.4.3. Onshore

- 7.4.4. Offshore

- 7.5. APAC Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Managed Pressure Drilling Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Managed Pressure Drilling Market Analysis, 2016-2021

- 8.2. Latin America Managed Pressure Drilling Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Technology, 2016-2032

- 8.3.1. Latin America Managed Pressure Drilling Market Analysis by Technology: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Technology, 2016-2032

- 8.3.3. Constant Bottom Hole Pressure (CBHP)

- 8.3.4. Return Flow Control Drilling (RFCD)

- 8.3.5. Mud Cap Drilling (MCD)

- 8.3.6. Dual Gradient Drilling (DGD)

- 8.4. Latin America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.4.1. Latin America Managed Pressure Drilling Market Analysis by Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.4.3. Onshore

- 8.4.4. Offshore

- 8.5. Latin America Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Managed Pressure Drilling Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Managed Pressure Drilling Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Managed Pressure Drilling Market Analysis, 2016-2021

- 9.2. Middle East & Africa Managed Pressure Drilling Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Technology, 2016-2032

- 9.3.1. Middle East & Africa Managed Pressure Drilling Market Analysis by Technology: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Technology, 2016-2032

- 9.3.3. Constant Bottom Hole Pressure (CBHP)

- 9.3.4. Return Flow Control Drilling (RFCD)

- 9.3.5. Mud Cap Drilling (MCD)

- 9.3.6. Dual Gradient Drilling (DGD)

- 9.4. Middle East & Africa Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.4.1. Middle East & Africa Managed Pressure Drilling Market Analysis by Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.4.3. Onshore

- 9.4.4. Offshore

- 9.5. Middle East & Africa Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Managed Pressure Drilling Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Managed Pressure Drilling Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Managed Pressure Drilling Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Managed Pressure Drilling Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Weatherford International Ltd.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Halliburton Company

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Baker Hughes Incorporated

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Schlumberger Limited

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. National Oilwell Varco, L.P.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Aker Solutions

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Ensign Energy Services Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. STRATA Energy Services Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Blade Energy Partners, Ltd.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Archer

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Technology in 2022

- Figure 2: Global Managed Pressure Drilling Market Attractiveness Analysis by Technology, 2016-2032

- Figure 3: Global Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 4: Global Managed Pressure Drilling Market Attractiveness Analysis by Application, 2016-2032

- Figure 5: Global Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Managed Pressure Drilling Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Figure 10: Global Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 11: Global Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Figure 13: Global Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 14: Global Managed Pressure Drilling Market Share Comparison by Region (2016-2032)

- Figure 15: Global Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Figure 16: Global Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Figure 17: North America Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Technologyin 2022

- Figure 18: North America Managed Pressure Drilling Market Attractiveness Analysis by Technology, 2016-2032

- Figure 19: North America Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 20: North America Managed Pressure Drilling Market Attractiveness Analysis by Application, 2016-2032

- Figure 21: North America Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Managed Pressure Drilling Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Figure 26: North America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 27: North America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Figure 29: North America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 30: North America Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Figure 31: North America Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Figure 32: North America Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Figure 33: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Technologyin 2022

- Figure 34: Western Europe Managed Pressure Drilling Market Attractiveness Analysis by Technology, 2016-2032

- Figure 35: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 36: Western Europe Managed Pressure Drilling Market Attractiveness Analysis by Application, 2016-2032

- Figure 37: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Managed Pressure Drilling Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Figure 42: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 43: Western Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Figure 45: Western Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 46: Western Europe Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Figure 48: Western Europe Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Figure 49: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Technologyin 2022

- Figure 50: Eastern Europe Managed Pressure Drilling Market Attractiveness Analysis by Technology, 2016-2032

- Figure 51: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 52: Eastern Europe Managed Pressure Drilling Market Attractiveness Analysis by Application, 2016-2032

- Figure 53: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Managed Pressure Drilling Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Figure 58: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 59: Eastern Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Figure 61: Eastern Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 62: Eastern Europe Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Figure 64: Eastern Europe Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Figure 65: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Technologyin 2022

- Figure 66: APAC Managed Pressure Drilling Market Attractiveness Analysis by Technology, 2016-2032

- Figure 67: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 68: APAC Managed Pressure Drilling Market Attractiveness Analysis by Application, 2016-2032

- Figure 69: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Managed Pressure Drilling Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Figure 74: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 75: APAC Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Figure 77: APAC Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 78: APAC Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Figure 80: APAC Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Figure 81: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Technologyin 2022

- Figure 82: Latin America Managed Pressure Drilling Market Attractiveness Analysis by Technology, 2016-2032

- Figure 83: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 84: Latin America Managed Pressure Drilling Market Attractiveness Analysis by Application, 2016-2032

- Figure 85: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Managed Pressure Drilling Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Figure 90: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 91: Latin America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Figure 93: Latin America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 94: Latin America Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Figure 96: Latin America Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Figure 97: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Technologyin 2022

- Figure 98: Middle East & Africa Managed Pressure Drilling Market Attractiveness Analysis by Technology, 2016-2032

- Figure 99: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 100: Middle East & Africa Managed Pressure Drilling Market Attractiveness Analysis by Application, 2016-2032

- Figure 101: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Managed Pressure Drilling Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Figure 106: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 107: Middle East & Africa Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Figure 109: Middle East & Africa Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 110: Middle East & Africa Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Figure 112: Middle East & Africa Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- List of Tables

- Table 1: Global Managed Pressure Drilling Market Comparison by Technology (2016-2032)

- Table 2: Global Managed Pressure Drilling Market Comparison by Application (2016-2032)

- Table 3: Global Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Table 7: Global Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 8: Global Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Table 10: Global Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 11: Global Managed Pressure Drilling Market Share Comparison by Region (2016-2032)

- Table 12: Global Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Table 13: Global Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Table 14: North America Managed Pressure Drilling Market Comparison by Application (2016-2032)

- Table 15: North America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Table 19: North America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 20: North America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Table 22: North America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 23: North America Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Table 24: North America Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Table 25: North America Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Table 26: Western Europe Managed Pressure Drilling Market Comparison by Technology (2016-2032)

- Table 27: Western Europe Managed Pressure Drilling Market Comparison by Application (2016-2032)

- Table 28: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Table 32: Western Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 33: Western Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Table 35: Western Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 36: Western Europe Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Table 38: Western Europe Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Table 39: Eastern Europe Managed Pressure Drilling Market Comparison by Technology (2016-2032)

- Table 40: Eastern Europe Managed Pressure Drilling Market Comparison by Application (2016-2032)

- Table 41: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Table 45: Eastern Europe Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 46: Eastern Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Table 48: Eastern Europe Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 49: Eastern Europe Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Table 51: Eastern Europe Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Table 52: APAC Managed Pressure Drilling Market Comparison by Technology (2016-2032)

- Table 53: APAC Managed Pressure Drilling Market Comparison by Application (2016-2032)

- Table 54: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Table 58: APAC Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 59: APAC Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Table 61: APAC Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 62: APAC Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Table 63: APAC Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Table 64: APAC Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Table 65: Latin America Managed Pressure Drilling Market Comparison by Technology (2016-2032)

- Table 66: Latin America Managed Pressure Drilling Market Comparison by Application (2016-2032)

- Table 67: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Table 71: Latin America Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 72: Latin America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Table 74: Latin America Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 75: Latin America Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Table 77: Latin America Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- Table 78: Middle East & Africa Managed Pressure Drilling Market Comparison by Technology (2016-2032)

- Table 79: Middle East & Africa Managed Pressure Drilling Market Comparison by Application (2016-2032)

- Table 80: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Technology (2016-2032)

- Table 84: Middle East & Africa Managed Pressure Drilling Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 85: Middle East & Africa Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Technology (2016-2032)

- Table 87: Middle East & Africa Managed Pressure Drilling Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 88: Middle East & Africa Managed Pressure Drilling Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Managed Pressure Drilling Market Share Comparison by Technology (2016-2032)

- Table 90: Middle East & Africa Managed Pressure Drilling Market Share Comparison by Application (2016-2032)

- 1. Executive Summary

-

- Weatherford International Ltd.

- Halliburton Company

- Baker Hughes Incorporated

- Schlumberger Limited

- National Oilwell Varco, L.P.

- Aker Solutions

- Ensign Energy Services Inc.

- STRATA Energy Services Inc.

- Blade Energy Partners, Ltd.

- Archer