Maintenance Repair And Operations (MRO) Market By Product Type (Maintenance Products, Repair Products, Operations Products), By Service Type (Maintenance & Repair Services, Consulting and Training), By End-User Industry (Manufacturing, Energy, Healthcare, Transportation, Other), By Distribution Channel, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

40519

-

Aug 2023

-

137

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

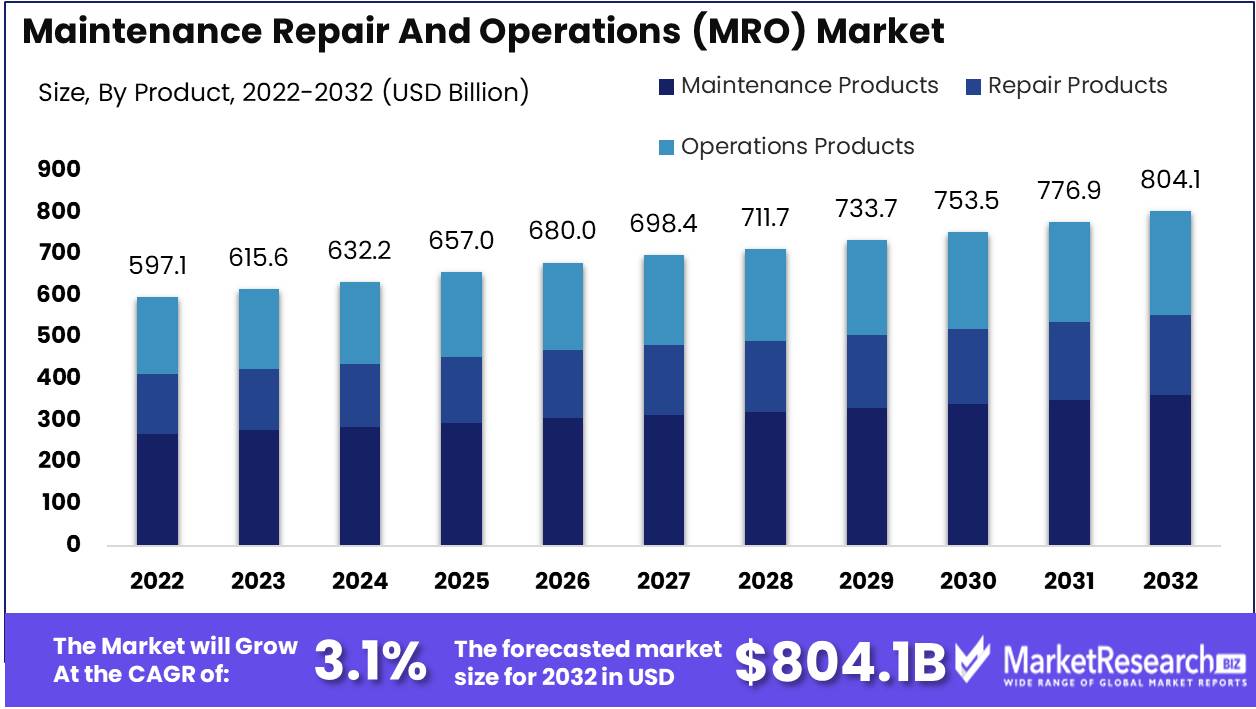

Maintenance Repair And Operations (MRO) Market size is expected to be worth around USD 804.1 Bn by 2032 from USD 597.1 Bn in 2022, growing at a CAGR of 3.1% during the forecast period from 2023 to 2032.

The maintenance repair and operations (MRO) market plays a vital role in ensuring the smooth functioning of industries on a global scale within the context of the dynamic contemporary business landscape. The MRO market encompasses the comprehensive range of tasks involved in the maintenance, repair, and operation of various machinery, equipment, and systems that are crucial for the effective functioning of industries. The task involves the management and preservation of production facilities, utilities, and infrastructure with the aim of optimizing productivity and minimizing disruptions.

The principal aim of the maintenance repair and operations (MRO) market is to guarantee the reliable and continuous functioning of essential assets, to prolong their lifespan, and to reduce overall operational expenses. By implementing efficient maintenance, repair, and operations (MRO) strategies, organizations have the ability to mitigate unforeseen equipment failures, optimize equipment functionality, and enhance occupational safety for workers. The importance of the MRO market cannot be overstated. Efficient maintenance, repair, and operations (MRO) practices can significantly minimize operational downtime, enhance productivity, and improve financial performance for industries heavily reliant on machinery and equipment.

The maintenance repair and operations (MRO) market is subject to ongoing innovations that are focused on enhancing efficiency and maintenance protocols. The implementation of predictive maintenance and proactive monitoring systems has significantly transformed asset management practices within companies. These advanced technologies employ real-time data, sensors, and analytics to anticipate equipment malfunctions, strategize maintenance operations, and enhance resource allocation.

Considerable investments have been allocated towards the integration of maintenance, repair, and operations (MRO) products and services across various industries. Organizations operating in diverse sectors including manufacturing, aerospace, oil and gas, healthcare, and transportation have been actively engaged in exploring maintenance, repair, and operations (MRO) solutions with the aim of enhancing operational efficiency and augmenting their financial performance. The integration of MRO services has experienced significant growth, resulting in the expansion of the market and the emergence of profitable prospects for both established participants and newcomers.

The primary factor driving the growth of the maintenance repair and operations (MRO) market can be attributed to its extensive array of applications spanning various industries. MRO activities encompass a comprehensive range of tasks necessary for the maintenance of efficient operations, including preventive maintenance, routine inspections, emergency repairs, and spare parts management. The MRO market is currently witnessing significant growth due to the emergence of Industry 4.0 and the increasing prevalence of automation and digitalization.

Driving factors

Industrial and Manufacturing Activities

One of the key driving factors in the maintenance repair and operations (MRO) market is the increasing industrial and manufacturing activities across various sectors. As economies strive for growth, industrial production gains momentum, resulting in higher demand for maintenance, repair, and operations services. With industries becoming increasingly complex and intricate, there is a growing need for skilled technicians, spare parts, and MRO solutions to ensure uninterrupted operations. By leveraging our expertise in the MRO market, we can provide businesses with tailor-made solutions, enabling them to effectively manage their maintenance needs and optimize operational performance.

Infrastructure and Facility Management

The growth of infrastructure and facility management also plays a critical role in driving the MRO market. As cities expand, commercial buildings multiply, and organizations invest in new infrastructure projects, the demand for facility management services and solutions escalates. Efficient MRO practices are paramount in ensuring the smooth functioning and longevity of these structures. At, our comprehensive MRO services encompass facility management, helping businesses maintain their assets, minimize disruptions, and extend the lifespan of critical infrastructure.

Transportation and Logistics Sectors

The expansion of the transportation and logistics sectors further contributes to the growth of the maintenance repair and operations (MRO) market. With the continuous growth in e-commerce, international trade, and globalization, the demand for efficient transportation and logistics services is skyrocketing. Road, rail, air, and maritime transportation management systems are vital for the movement of goods and people, making proper maintenance and repair of vehicles, vessels, and infrastructure essential. At, our expertise in the MRO market allows us to provide transportation and logistics companies with tailored solutions to optimize their operational reliability, reduce maintenance costs, and improve overall efficiency.

Equipment Reliability and Uptime

In today's competitive business environment, organizations recognize the importance of equipment reliability and uptime as key drivers of productivity and profitability. Downtime costs can be substantial, impacting not only production schedules but also customer satisfaction and revenue. Monitoring, maintaining, and repairing equipment promptly and effectively are, therefore, crucial for businesses to remain competitive. Our MRO solutions at tackle this challenge head-on, providing clients with comprehensive preventive and corrective procedures, incorporating best industry practices to ensure maximum equipment reliability and uptime.

Advancements in MRO Technologies

The continuous advancements in MRO technologies have revolutionized the way businesses handle their maintenance and repair operations. Innovative tools, software, and predictive maintenance techniques have significantly enhanced the efficiency, accuracy, and speed of MRO activities. At, we embrace these technological advancements, integrating cutting-edge solutions into our services to offer increased visibility, real-time monitoring, data analytics, and optimization capabilities. By leveraging these advancements, businesses can streamline their MRO processes, reduce costs, and gain a competitive edge in the market.

Restraining Factors

Budget Constraints and Cost Pressures

In the dynamic and competitive environment of the Maintenance Repair and Operations (MRO) market, potential budget constraints and cost pressures act as significant restraining factors. With the increasing demand for MRO services, organizations often face limitations in allocating substantial budgets for their maintenance and repair activities. Smart business planning and efficient resource allocation can help organizations mitigate these constraints. By implementing cost-effective strategies and utilizing innovative technologies, companies can optimize their MRO processes, ensuring minimum expenses while maintaining high-quality standards.

Limited Availability of Skilled Technicians

The availability of skilled technicians is another crucial factor that often poses challenges in the maintenance repair and operations (MRO) market. The maintenance and repair processes require specialized expertise and technical skills to ensure efficient operations. In today's rapidly advancing technological landscape, finding skilled technicians who possess the necessary knowledge and experience can be a daunting task. The shortage of skilled professionals may result in delays and suboptimal maintenance practices.

Complexities in Managing Diverse MRO Needs

The complexities associated with managing diverse Maintenance Repair and Operations needs can act as significant restraining factors in the market. Organizations often deal with a wide range of equipment, machinery, and systems, each with unique maintenance requirements. Managing this diversity effectively requires proper planning, organization, and coordination. Organizations need to create a systematic approach to prioritize and schedule maintenance activities, considering the specific maintenance requirements of each asset.

Potential Regulatory and Compliance Requirements

In the Maintenance Repair and Operations market, organizations must also contend with potential regulatory and compliance requirements. Various industries, such as aviation, healthcare, and manufacturing, have strict regulations in place to ensure safety and quality standards. Complying with these requirements often involves additional costs and resources. Organizations need to stay updated with the latest regulations and invest in the necessary measures to meet the compliance standards. Failure to do so can result in legal repercussions, reputational damage, and compromised operational efficiency.

Equipment Lifespan and Technological Obsolescence

The maintenance repair and operations (MRO) market also faces the potential impact of equipment lifespan and technological obsolescence. As equipment ages, its maintenance requirements become more demanding, leading to increased costs and operational challenges. Moreover, with rapid technological advancements, equipment and systems can quickly become obsolete, requiring organizations to upgrade or replace them entirely. The cost and complexities associated with technological transitions can strain MRO operations.

Product Type Analysis

The maintenance products segment has emerged as the dominant force in the maintenance repair and operations (MRO) market. This segment includes a wide range of products such as lubricants, adhesives, cleaning agents, and paints, among others. These products play a vital role in the upkeep and maintenance of various equipment and machinery used in industries.

Consumer trends and behavior also play a crucial role in the popularity of the maintenance products segment. Consumers are becoming more conscious of the need for regular maintenance to ensure the longevity and efficiency of their equipment. They are actively seeking out high-quality maintenance products that can help them achieve optimal performance and reduce downtime.

Service Type Analysis

The maintenance and repair services segment has established its dominance in the maintenance repair and operations (MRO) market. This segment encompasses a wide range of services including equipment repair, installation, calibration, and preventive maintenance. These services are essential for ensuring the smooth functioning of equipment and machinery.

Consumer trends and behavior also contribute to the popularity of maintenance and repair services. Consumers are increasingly outsourcing their maintenance needs to specialized service providers. This allows companies to focus on their core competencies while leaving the maintenance and repair tasks to the experts. Additionally, the growing complexity of equipment and machinery has made it more challenging for companies to handle maintenance in-house, leading to an increased demand for external service providers.

End-User Industry Analysis

The manufacturing segment has emerged as the dominant force in the maintenance repair and operations (MRO) market. Manufacturing industries rely heavily on equipment and machinery to produce goods, making maintenance a critical aspect of their operations. This segment includes industries such as automotive, electronics, food and beverage, and pharmaceuticals, among others.

Consumer trends and behavior also play a crucial role in the dominance of the manufacturing segment in the maintenance repair and operations (MRO) market. Consumers are increasingly demanding high-quality products, which require well-maintained machinery and equipment for production. Manufacturers are keenly aware of the importance of efficient maintenance practices to meet consumer expectations and maintain a competitive edge.

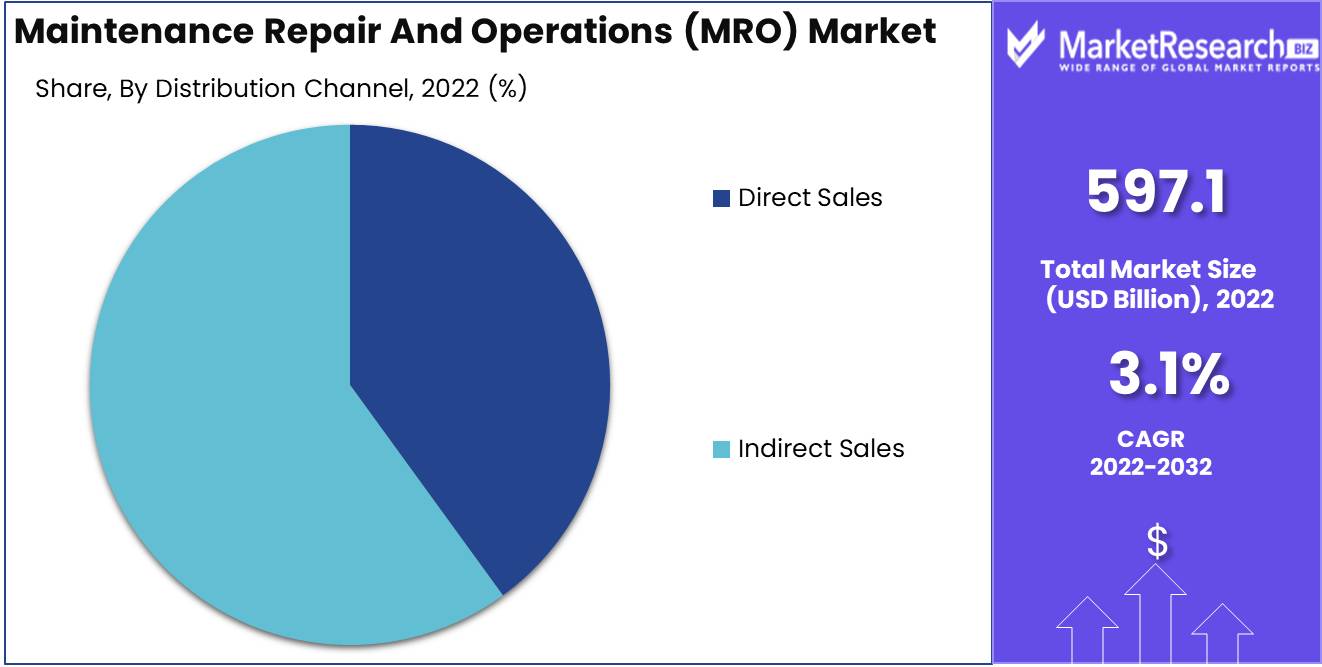

Distribution Channel Analysis

The indirect sales segment has established its dominance in the maintenance repair and operations (MRO) market. Indirect sales refer to the distribution of MRO products and services through distributors, wholesalers, and online platforms. This distribution channel offers convenience, accessibility, and a wide range of products to customers.

Consumer trends and behavior also contribute to the popularity of the indirect sales segment. Consumers are increasingly turning to online platforms for their purchasing needs, including MRO products. The convenience of online shopping, coupled with a wide selection and competitive pricing, makes indirect sales channels an attractive option for consumers in the MRO market.

Key Market Segments

By Product Type

- Maintenance Products

- Repair Products

- Operations Products

By Service Type

- Maintenance & Repair Services

- Consulting and Training

By End-User Industry

- Manufacturing

- Energy

- Healthcare

- Transportation

- Other End-User Industries

By Distribution Channel

- Direct Sales

- Indirect Sales

Growth Opportunity

Harnessing the Power of Artificial Intelligence

One significant growth opportunity lies in the integration of artificial intelligence (AI) into the MRO sector. AI-powered systems can analyze vast amounts of data in real-time, enabling predictive maintenance and condition monitoring solutions to identify potential equipment failures before they occur. By leveraging AI technology, MRO organizations can proactively schedule maintenance, minimize downtime, and optimize overall equipment effectiveness. Adopting AI in MRO not only enhances operational efficiency but also reduces costs and enhances customer satisfaction.

Empowering Supply Chain through Collaboration

Collaboration forms yet another significant growth opportunity in the maintenance repair and operations (MRO) market. By fostering strong partnerships with original equipment manufacturers (OEMs) and suppliers, MRO providers can enhance their service offerings and expand their customer base. OEMs can provide valuable insights into equipment design and maintenance requirements, enabling MRO companies to offer more comprehensive and tailored solutions to their clients. Additionally, collaboration with suppliers ensures the availability of high-quality spare parts and reduces lead times, further improving operational efficiency.

Leveraging Augmented Reality (AR) for Enhanced Maintenance Operations

The integration of augmented reality (AR) in MRO operations represents a promising growth opportunity. AR technology enables technicians to access real-time information and instructions, overlaying digital data onto physical equipment. This immersive experience enhances maintenance operations by providing technicians with step-by-step guidance, remote technical support, and instant access to manuals and troubleshooting information. AR technology not only improves efficiency but also reduces the chances of errors and minimizes training time for new technicians.

The Rise of Blockchain in MRO

Blockchain technology presents an untapped growth opportunity for the maintenance repair and operations (MRO) market. Blockchain provides a secure and transparent decentralized ledger, facilitating seamless data sharing and collaboration in the MRO ecosystem. By leveraging blockchain, MRO providers can enhance traceability and accountability, ensuring the authenticity and integrity of critical maintenance information, warranties, and transactional data. This technology streamlines the procurement process, automates record-keeping, and reduces the risk of counterfeit parts, ultimately improving operational efficiency and customer trust.

Latest Trends

Predictive Maintenance and Asset Management Solutions

One of the major trends revolutionizing the MRO market is the growing adoption of predictive maintenance and asset management solutions. With advancements in technology, businesses are now equipped with sophisticated tools that enable them to predict impending equipment failures and proactively address maintenance needs. This approach helps minimize downtime, optimizes asset performance, and reduces overall costs. As companies increasingly embrace the concept of predictive maintenance, it has become vital for MRO service providers to offer comprehensive solutions that leverage data analytics, machine learning, and artificial intelligence (AI).

Mobile and Cloud-Based MRO Applications

In an era dominated by mobile devices and cloud computing, the demand for mobile and cloud-based MRO applications has skyrocketed. These applications empower technicians and maintenance teams with seamless access to critical information, enabling them to address maintenance issues promptly and efficiently. The mobility aspect of these applications ensures that technicians can access real-time data, collaborate with colleagues remotely, and receive timely notifications about equipment conditions. Concurrently, the cloud-based nature of these solutions allows for centralized data storage, facilitating efficient documentation, analysis, and reporting.

Digital Twin Technology in Equipment Maintenance

Digital twin technology, a virtual replica of physical assets, is increasingly finding its place in equipment maintenance practices. By creating a digital twin, companies gain a deeper understanding of their assets, enabling them to monitor performance, identify potential anomalies, and optimize maintenance strategies. Through the utilization of real-time data and advanced analytics, businesses can proactively detect issues, simulate scenarios, and make informed decisions regarding necessary maintenance or replacement.

MRO Outsourcing and Service Level Agreements

As businesses focus on their core competencies, there has been an undeniable rise in MRO outsourcing. This trend allows companies to delegate maintenance, repair, and operations responsibilities to specialized service providers, enabling them to leverage expertise, reduce costs, and focus on strategic initiatives. To ensure effective outsourcing relationships, businesses are increasingly relying on service level agreements (SLAs), which outline expectations, performance metrics, and desired outcomes. SLAs establish clear communication channels, hold service providers accountable, and facilitate the integration of key performance indicators (KPIs) to measure the success of outsourced MRO services.

Sustainable and Green MRO Practices

In the wake of increasing environmental consciousness, sustainable and green MRO practices have gained significant momentum. Businesses across industries are embracing sustainability as a core value, promoting resource conservation, waste reduction, and environmentally friendly alternatives. The adoption of sustainable MRO practices entails optimizing energy consumption, embracing circular economy principles, deploying eco-friendly materials, and implementing efficient waste management strategies.

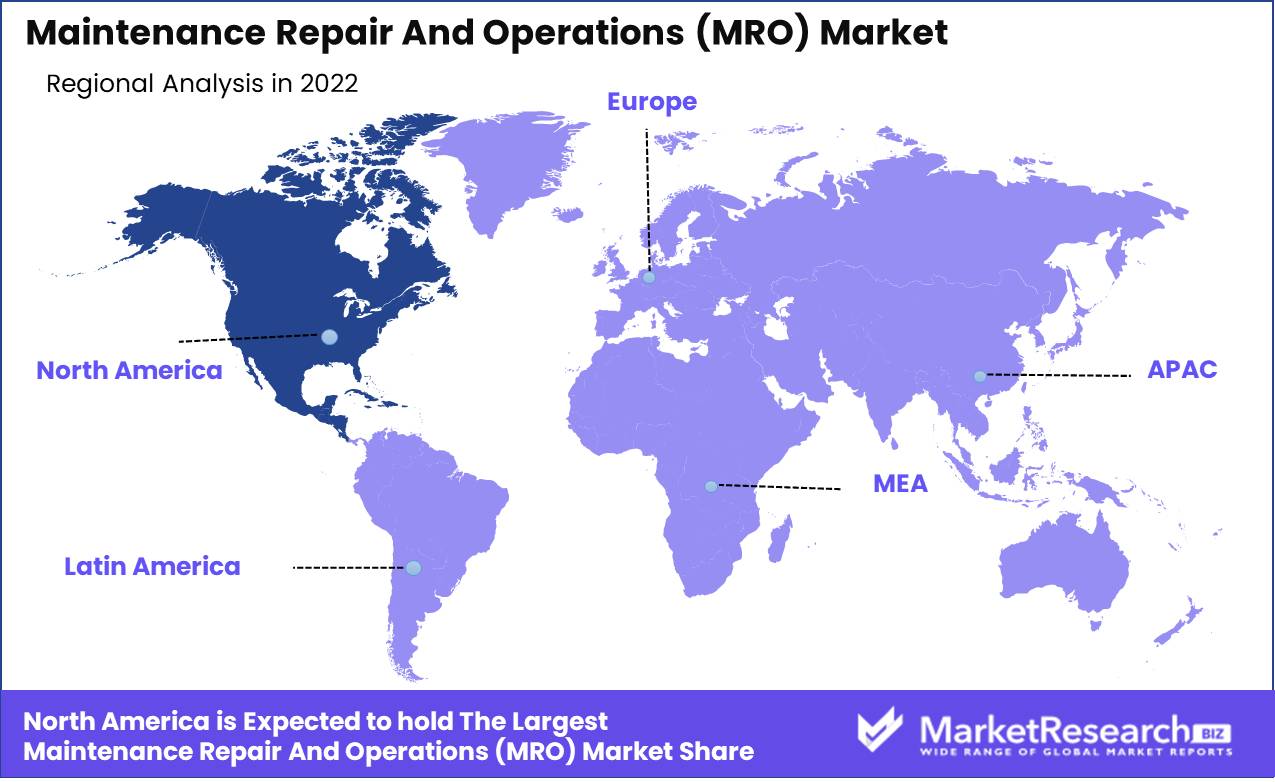

Regional Analysis

North America Region Dominates the maintenance repair and operations (MRO) market. In today's highly competitive business landscape, maintenance, repair, and operations (MRO) have become critical components for industries across the globe. Companies are increasingly realizing the importance of efficient MRO practices to ensure smooth operations, minimize downtime, and maintain equipment reliability. The North America region, in particular, has emerged as a dominant force in the MRO market, showcasing its robust infrastructure, cutting-edge technology, and responsive service providers.

The North America region encompasses countries such as the United States and Canada, which together boast a significant share in the global maintenance repair and operations (MRO) market. This dominance can be attributed to several factors, including a strong focus on innovation, advanced manufacturing capabilities, and an extensive network of suppliers and distributors. Let's delve deeper into why North America holds such a prominent position in the MRO market.

North America's MRO market benefits from a well-established infrastructure. The region boasts state-of-the-art manufacturing facilities, reliable transportation networks, and efficient logistics systems, enabling seamless flow of MRO products and services. This strong infrastructure ensures quick turnaround times, reduced lead times, and enhanced customer satisfaction – all critical factors contributing to North America's dominance in the MRO market.

The region has a vast pool of highly skilled professionals who specialize in various MRO disciplines. From mechanical and electrical technicians to engineering experts, North America boasts a well-educated workforce that can handle complex maintenance and repair tasks with precision. This availability of skilled labor ensures that companies operating in North America can have their maintenance needs promptly addressed, minimizing equipment downtime and optimizing operational efficiency.

In addition to its strong infrastructure and skilled workforce, the North America region is also home to a plethora of innovative and technologically advanced companies. These companies leverage cutting-edge technologies such as artificial intelligence, predictive analytics, and IoT (Internet of Things) to revolutionize the MRO landscape. By harnessing the power of data and automation, North American companies can predict equipment failures, identify maintenance requirements in advance, and proactively address potential issues.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

MRO markets have grown significantly over time. MRO products and services are in high demand as firms prioritize asset and equipment optimization. This report examines MRO market leaders Adolf Würth GmbH & Co. KG (Germany), Airgas Inc. (U.S.), Applied Maintenance Supplies & Solutions (U.S.), KAMAN CORPORATION (U.S.), RUBIX (U.K.), and Motion Industries Inc. These MRO giants are leaders due to their knowledge and dedication.

Germany-based MRO distributor Adolf Würth GmbH & Co. KG is a global leader. Würth offers a wide range of fasteners, tools, chemicals, safety equipment, and more for maintenance, repair, and operations. Quality, reliability, and customer satisfaction have helped the organization dominate the MRO market.

US-based Airgas Inc. distributes industrial, medicinal, and speciality gases and related goods. Airgas dominates the MRO market with its wide distribution network and diverse customer base. Safety, efficiency, and innovation help the organization satisfy consumers' different needs.

Applied Maintenance Supplies & Solutions (Applied MSS) is a U.S. MRO supplier of bearings, electrical supplies, lubricants, and more. Applied MSS services manufacturing, oil and gas, automotive, and food processing with a wide range of quality products. Its MRO prominence is due to its strong customer service and technological skills.

MRO market innovator KAMAN CORPORATION is based in the US. The aerospace and industrial distributor sells bearings, power transmission components, fluid power products, automation, and aircraft hardware. KAMAN's unique solutions and excellent customer service have made it a major MRO player.

UK-based RUBIX distributes maintenance, repair, and operations goods across Europe. The company sells bearings, pneumatics, power transmission components, and tools under several brands. RUBIX leads the maintenance repair and operations (MRO) market because to its strong European footprint, strategic relationships, and sustainability.

Motion Industries Inc., based in the US, is a significant industrial MRO distributor. The company supplies bearings, power transmission components, electrical goods, and fluid power supplies to manufacturing, mining, agriculture, and construction. Motion Industries' value-added services, technical competence, and fast delivery have made it a leading MRO company.

Top Key Players in Maintenance Repair And Operations (MRO) Market

- Adolf Würth GmbH & Co. KG (Germany)

- Airgas Inc. (U.S.)

- Applied Maintenance Supplies & Solutions (U.S.)

- KAMAN CORPORATION (U.S.)

- RUBIX (U.K.)

- Motion Industries Inc (U.S.)

Recent Development

- In 2023, Honeywell, renowned for its groundbreaking innovations across various sectors, has set its sights on transforming the MRO landscape with their latest project. Scheduled for release this pioneering platform aims to streamline MRO processes, reduce downtime, and optimize maintenance workflows.

- In 2022, Rolls-Royce, a leading player in the MRO segment, unveiled its plans to expand its production capacity for MRO services within the United Kingdom. This strategic move comes as the company aims to cater to the growing demand for exceptional MRO support.

- In 2021, Addressing the burgeoning need for advanced maintenance solutions, MTU Aero Engines announced its partnership with Siemens. The collaboration aims to leverage the expertise of both companies to develop an innovative MRO solution specifically for aircraft engines.

- In 2020, United Technologies Corporation (UTC) made headlines with its acquisition of Rockwell Collins, an esteemed provider of first-rate MRO services. This strategic move aimed to strengthen UTC's MRO capabilities, offering a diversified portfolio of innovative solutions to a diverse range of customers.

Report Scope:

Report Features Description Market Value (2022) USD 597.1 Bn Forecast Revenue (2032) USD 804.1 Bn CAGR (2023-2032) 3.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Maintenance Products, Repair Products, Operations Products), By Service Type (Maintenance & Repair Services, Consulting and Training), By End-User Industry (Manufacturing, Energy, Healthcare, Transportation, Other End-User Industries), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Adolf Würth GmbH & Co. KG (Germany), Airgas Inc. (U.S.), Applied Maintenance Supplies & Solutions (U.S.), KAMAN CORPORATION (U.S.), RUBIX (U.K.), Motion Industries Inc (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Adolf Würth GmbH & Co. KG (Germany)

- Airgas Inc. (U.S.)

- Applied Maintenance Supplies & Solutions (U.S.)

- KAMAN CORPORATION (U.S.)

- RUBIX (U.K.)

- Motion Industries Inc (U.S.)