Lysine Market By Live Stock(Swine/hog, Poultry, Others), By Application(Animal Feed, Food & Dietary Supplements, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

8323

-

Jul 2023

-

158

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

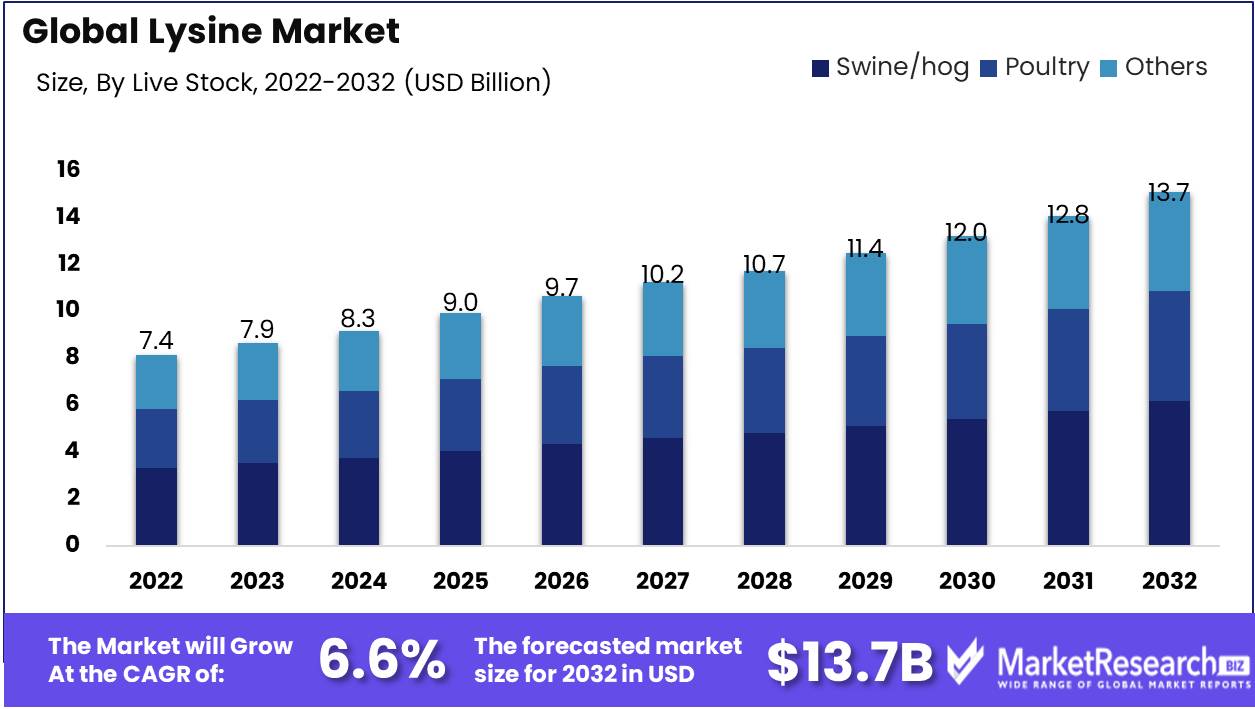

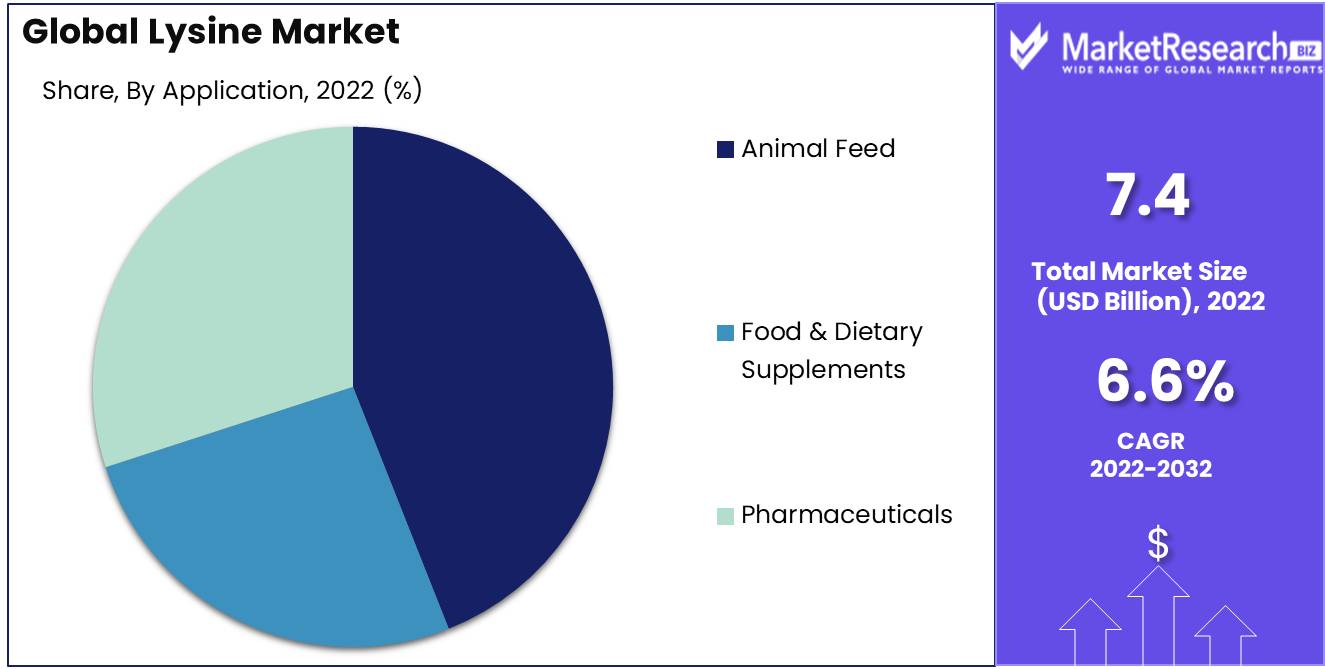

Lysine Market size is expected to be worth around USD 13.7 Bn by 2032 from USD 7.4 Bn in 2022, growing at a CAGR of 6.6% during the forecast period from 2023 to 2032.

The Lysine market seeks to meet the rising demand for this essential amino acid by offering it in a variety of forms. Lysine can be derived from both natural and synthetic sources, allowing it to be utilized in a variety of industries and applications. The lysine market has witnessed significant growth and innovation over the years as a result of its ubiquitous use and numerous advantages.

One of the primary objectives of the lysine market is to ensure a consistent and dependable lysine supply. This has resulted in the establishment of production facilities all over the world, employing cutting-edge technologies and procedures to meet the growing demand. By incorporating innovation and efficiency, the market aims to improve the quality and availability of lysine for a variety of industries.

The significance and benefits of lysine in various fields cannot be emphasized. In the animal feed industry, lysine is an essential additive that enhances the overall nutritional quality of animal feed. It plays a crucial role in promoting the growth and health of livestock, resulting in increased meat and milk production. Additionally, lysine supplementation can help reduce reliance on expensive protein sources and environmental impacts.

Significant market innovations have revolutionized the production and application of lysine. Through biotechnology and genetic engineering, scientists have developed microorganism strains that produce lysine in a highly effective manner. This innovation has substantially increased lysine production while simultaneously reducing costs and mitigating environmental impacts.

The lysine market has attracted significant investments from both established and new participants. Agricultural and pharmaceutical multinational corporations have recognized the potential of lysine and incorporated it into their products and services. This merger has strengthened Lysine's position on the market and broadened its influence into additional industries.

The lysine market's growth and applications are multifaceted. Pharmaceuticals, cosmetics, food and beverages, and nutritional supplements are just a few of the industries that have embraced lysine thanks to its wide range of applications. Its importance as a dietary supplement continues to grow, and its applications in pharmaceuticals for the treatment of specific medical conditions are being investigated.

Driving factors

Increasing Animal Feed Demand

Over the years, the Lysine Market has expanded significantly due to a number of driving factors. The increasing demand for animal fodder is one of these factors. As the global population continues to increase, so has the demand for meat and dairy products. This surge in meat consumption has led to a greater demand for lysine, an essential nutrient in animal nutrition.

Lysine, an essential amino acid, supports animal growth, muscle development, and overall health. Farmers of livestock and poultry have realized the advantages of lysine supplementation in animal diets, resulting in a surge in demand.

Increasing Population and Meat Consumption Worldwide

The Lysine Market is experiencing significant expansion due to the expanding global population and the ever-increasing demand for meat. As the global population continues to increase, so too does the demand for sufficient and nutritious food sources. Meat, a rich source of protein, has become a staple in the diets of millions of people around the globe.

The demand for meat has been rising as a result of increasing disposable income and shifting dietary preferences. This surge in meat consumption has led to more efficient animal husbandry techniques.

Increasing Interest in Functional Food Ingredients

The Lysine Market is being led by an increase in demand for functional food constituents. Consumers today are more concerned than ever about their health and well-being. In addition to fundamental nutrition, they seek out food products that offer additional health benefits. This has led to a surge in demand for functional food constituents such as lysine.

As an essential amino acid, lysine provides numerous health benefits. It contributes to the synthesis of collagen, which is necessary for maintaining healthy skin, joints, and connective tissues. Moreover, lysine is essential for immune system support, bone health promotion, and calcium absorption.

Restraining Factors

Fluctuations in Raw Material Prices

The Lysine Market is a dynamic industry that frequently experiences a number of restraining factors that limit its growth and profitability. The volatility of raw material prices is one of the most significant challenges facing the industry. The function of raw materials in the production of lysine is crucial, and any fluctuations in their prices can have a significant impact on the market.

Primarily, lysine is produced from maize and soybeans, which are subject to market forces and external factors such as weather and political events. These variables can cause price fluctuations in raw materials, resulting in an increase in production costs for lysine producers. Consequently, this can impact the pricing of lysine products, making it difficult for businesses to maintain market competitiveness.

Stringent Government Regulations

The presence of stringent government regulations is an additional factor restraining the Lysine Market. Globally, governments impose regulations to ensure the safety, quality, and morality of lysine production. These regulations are intended to protect consumers, promote honest business practices, and prevent the misuse of lysine-containing products.

Compliance with regulatory standards and the acquisition of required certifications can incur significant costs for lysine manufacturers. From mandatory testing and documentation requirements to restrictions on the use of certain raw materials, these regulations can create entry barriers for new participants and increase production costs overall.

Live Stock Analysis

The Swine/hog segment is currently at the forefront of the Lysine market. Farmers of swine and hogs have recognized the significance of lysine in maintaining the health and growth of their animals, resulting in a substantial increase in demand for the substance. This segment has emerged as the largest Lysine consumer, propelling market expansion.

The economic growth of emerging nations has played a significant role in driving the growth of the Swine/hog segment. As these economies continue to expand, the demand for livestock products, particularly pork, increases. This has resulted in an increase in the number of swine/hog farms, which has created a substantial market for lysine.

In addition to consumer trends and behavior, the dominance of the Swine/hog segment in the Lysine market is also attributable to the segment's size. Consumers are becoming more aware of the quality of the meat they ingest, resulting in an increased demand for leaner and healthier pork. Lysine plays a crucial function in enhancing the quality and nutritional value of meat, making it a consumer favorite.

Application Analysis

While the Swine/hog segment dominates the Lysine market, the Animal Feed segment is also experiencing rapid expansion. Manufacturers of animal feed have recognized the significance of Lysine in assuring the optimal growth and development of animals, resulting in a rise in its use.

Similar to the Swine/hog segment, economic growth in emerging economies has been a key factor in the expansion of the Animal Feed segment. As disposable incomes increase in these economies, the demand for livestock and dairy products increases. This has led to an increase in animal husbandry, which has created a substantial market for Lysine in animal feed.

In addition to consumer trends and behavior, the adoption of the Animal Feed segment in the Lysine market has been influenced by the Animal Feed segment. Increasing consumer demand for high-quality livestock and dairy products necessitates enhanced animal nutrition. The addition of lysine to animal feed is essential for meeting these requirements, making it an essential ingredient for feed manufacturers.

Key Market Segments

By Live Stock

- Swine/hog

- Poultry

- Others

By Application

- Animal Feed

- Food & Dietary Supplements

- Pharmaceuticals

Growth Opportunity

Increasing Lysine Demand in the Pharmaceutical Industry

The pharmaceutical industry has always been a vital sector, and its lysine market growth prospects are enormous. Lysine, an essential amino acid, is important for protein synthesis, immune system function, and tissue repair. Pharmaceutical companies have increased their research and development efforts to incorporate lysine into a variety of drugs and supplements as a result of its potential health benefits. This rising demand for lysine in the pharmaceutical industry presents market participants with new opportunities for product innovation and market expansion.

Increasing Lysine Application in Sports Nutrition

The demand for sports nutrition products has been exploding as a result of rising health consciousness and an increasing emphasis on physical fitness. Lysine, an essential amino acid that promotes muscle growth and repair, has made its way into formulations for sports nutrition. Athletes and fitness devotees are becoming increasingly aware of the advantages of lysine supplementation for enhancing performance, promoting muscle growth, and accelerating recovery. Consequently, there is a developing opportunity for the lysine market to cater to this niche segment and tap into the continuously expanding sports nutrition market.

Lysine in the Cosmetics Industry

Due to shifting consumer preferences and an increasing emphasis on personal grooming, the personal care and cosmetics industry is expanding rapidly around the globe. Lysine has acquired popularity as an active ingredient in cosmetic formulations due to its beneficial effects on skin and hair. Its moisturizing, anti-aging, and reparative properties make it a valuable ingredient in skin care, hair care, and even cosmetics products. The increasing demand for natural and organic personal care products increases the industry's potential for lysine use. This presents an opportunity for market participants to develop innovative lysine-based cosmetic products that cater to consumers' evolving requirements.

Latest Trends

Increasing Demand for Eco-Friendly and Sustainable Production Techniques

As consumers become more aware of environmental sustainability, the demand for eco-friendly and sustainable production methods has increased dramatically. Historically dependent on fossil fuels and energy-intensive processes, lysine production has evolved in recent years. Innovative strategies, such as fermentation-based production techniques employing renewable raw materials, have acquired popularity. These sustainable practices not only reduce the carbon footprint but also improve the final product's quality.

Increasing Demand for Lysine-Enriched Foods and Beverages

The increasing demand for functional foods and beverages has been driven by consumer's desire for a healthful lifestyle. Due to the essential amino acid properties of lysine, it has become a popular ingredient in a variety of food and beverage products. It serves an essential role in boosting protein content, enhancing nutritional profiles, and promoting overall health. With the rise in popularity of plant-based diets, lysine supplementation is becoming increasingly essential because it helps meet the recommended amino acid intake.

Industry Growth in Functional Foods and Nutraceuticals

Driven by consumers' growing awareness of preventive healthcare and wellness, the functional food and nutraceuticals industry is expanding rapidly around the globe. Lysine, which is well-known for its beneficial effects on immune function, collagen synthesis, and wound healing, has many applications in this industry. It is a common component in nutritional supplements, sports nutrition products, and medical consumables. As the demand for functional foods and nutraceuticals continues to increase, so does the demand for lysine of superior quality.

Construction of New Lysine Derivatives with Improved Properties

Innovation and research and development have a significant impact on the lysine market. Continuous efforts are made to develop new lysine derivatives with improved properties in order to meet shifting consumer demands and improve product performance. These derivatives offer enhanced stability, increased bioavailability, and formulation compatibility. They have applications in the pharmaceutical, cosmetic, and animal feed industries, among others. Companies at the forefront of lysine derivatives research and development are poised to drive market growth by revealing new possibilities and applications.

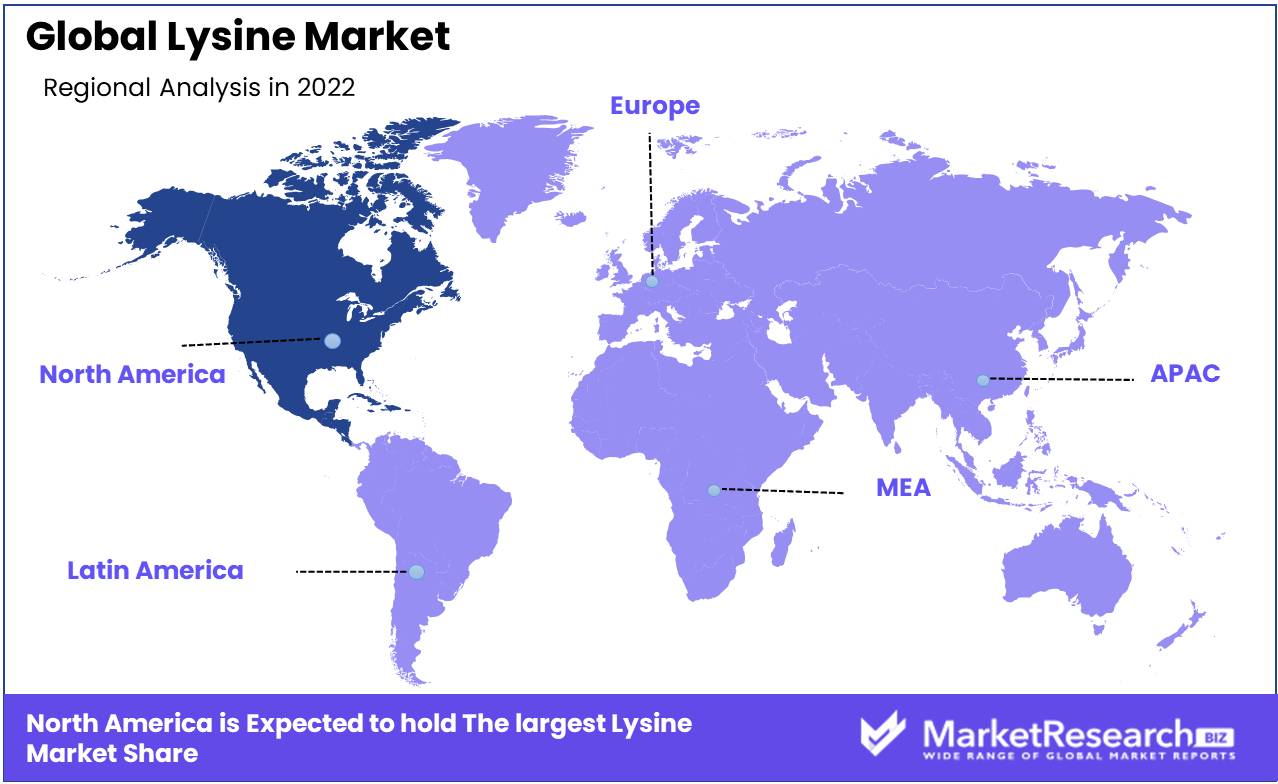

Regional Analysis

Asia-Pacific is the largest market for lysine, accounting for more than forty percent of the global market. Increasing demand for animal feed, rising population, and expanding awareness of the health benefits of lysine are driving market growth in this region.

Lysine, an essential amino acid, serves a vital role in animal growth and development. It is an essential ingredient in animal feed, particularly in the poultry and swine industries. As the demand for meat and poultry products continues to rise, so has the demand for lysine as a feed additive.

In recent years, the Asia-Pacific region, which includes China, India, Japan, and South Korea, has experienced rapid economic growth and urbanization. This has led to a rise in disposable income and a shift in dietary preferences, including an increase in meat and animal product consumption. As a consequence, the region's demand for lysine has increased, making it the largest market in the world.

Particularly China has emerged as a major participant in the lysine market. Due to China's large population and expanding middle class, the demand for lysine in animal feed has increased dramatically. The nation is now the largest producer and consumer of lysine in the Asia-Pacific region, accounting for a significant share of the market. Furthermore, government initiatives promoting animal husbandry and agricultural development have contributed to the rise in demand for lysine.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Cargill Incorporated, a US company, is a leader in the lysine market. Cargill has earned a reputation as a dependable and trustworthy industry partner by placing a strong emphasis on sustainable practices and the delivery of high-quality products. The company's sophisticated manufacturing processes enable them to produce lysine of superior quality, thereby meeting the diverse needs of a variety of end-users.

Dow, an established multinational corporation headquartered in the United States, has solidified its position as a key participant in the lysine market. Significant investments in research and development have enabled the company to introduce innovative solutions and technologies that considerably contribute to the industry's growth. Dow's commitment to sustainability and its robust supply chain management has bolstered its market reputation.

BASF SE, headquartered in Germany, has played a pivotal role in the lysine market due to its extensive product portfolio and market penetration. The company stands out from its rivals thanks to its strong emphasis on customer satisfaction and continuous improvement. In addition, BASF's commitment to sustainable production methods and adherence to stringent quality standards have earned them the trust of consumers around the globe.

Chr. Hansen Holding A/S, a Danish biotechnology company, has become a major player in the lysine market through its innovative research and development efforts. Their innovative approach has paved the way for novel solutions that meet the industry's evolving needs. The company's dedication to continuous refinement, sustainable sourcing, and stringent quality control has solidified its position as a market leader.

Top Key Players in Lysine Market

- Cargill Incorporated (U.S)

- Dow (US)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (US)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (USA)

- Alltech (US)

- Associated British Foods plc (UK)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (US)

- Kent Nutrition Group (US)

- J. D. HEISKELL & CO. (US)

- Perdue Farms (US)

- SunOpta (Canada)

- Scratch Peck Feeds (US)

Recent Development

- In 2022, Ajinomoto (Japan), one of the world's leading producers of amino acids, has signaled its commitment to supplying lysine by launching a state-of-the-art production facility in China. Set to commence operations, this facility is slated to bolster Ajinomoto's already significant presence in the region and cater to the escalating demand for lysine in China, the world's largest consumer of animal feed.

- In 2022, Kyowa Hakko Bio (Japan) has made a significant acquisition, securing a lysine production facility in the United States. This strategic move allows Kyowa Hakko Bio to establish a strong foothold in the American market, effectively positioning itself to cater to the growing demand for lysine in North America.

- In 2021, BASF (Germany), a global leader in chemical production, has taken steps to increase its lysine production capacity in China. Recognizing the immense potential for lysine in the country, BASF aims to capitalize on the Chinese market's flourishing livestock industry, reinforcing its commitment to meeting the growing demands of customers in the region.

Report Scope

Report Features Description Market Value (2022) USD 7.4 Bn Forecast Revenue (2032) USD 13.8 Bn CAGR (2023-2032) 6.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Live Stock(Swine/hog, Poultry, Others), By Application(Animal Feed, Food & Dietary Supplements, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cargill Incorporated (U.S), Dow (US), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (US), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (USA), Alltech (US), Associated British Foods plc (UK), Charoen Pokphand Foods PCL (Thailand), Nutreco (Netherlands), ForFarmers. (Netherlands), De Heus Animal Nutrition (Netherlands), Land O'Lakes (US), Kent Nutrition Group (US), J. D. HEISKELL & CO. (US), Perdue Farms (US), SunOpta (Canada), Scratch Peck Feeds (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Lysine Market Overview

- 2.1. Lysine Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Lysine Market Dynamics

- 3. Global Lysine Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Lysine Market Analysis, 2016-2021

- 3.2. Global Lysine Market Opportunity and Forecast, 2023-2032

- 3.3. Global Lysine Market Analysis, Opportunity and Forecast, By By Live Stock, 2016-2032

- 3.3.1. Global Lysine Market Analysis by By Live Stock: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Live Stock, 2016-2032

- 3.3.3. Swine/hog

- 3.3.4. Poultry

- 3.3.5. Others

- 3.4. Global Lysine Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Lysine Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Animal Feed

- 3.4.4. Food & Dietary Supplements

- 3.4.5. Pharmaceuticals

- 4. North America Lysine Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Lysine Market Analysis, 2016-2021

- 4.2. North America Lysine Market Opportunity and Forecast, 2023-2032

- 4.3. North America Lysine Market Analysis, Opportunity and Forecast, By By Live Stock, 2016-2032

- 4.3.1. North America Lysine Market Analysis by By Live Stock: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Live Stock, 2016-2032

- 4.3.3. Swine/hog

- 4.3.4. Poultry

- 4.3.5. Others

- 4.4. North America Lysine Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Lysine Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Animal Feed

- 4.4.4. Food & Dietary Supplements

- 4.4.5. Pharmaceuticals

- 4.5. North America Lysine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Lysine Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Lysine Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Lysine Market Analysis, 2016-2021

- 5.2. Western Europe Lysine Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Lysine Market Analysis, Opportunity and Forecast, By By Live Stock, 2016-2032

- 5.3.1. Western Europe Lysine Market Analysis by By Live Stock: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Live Stock, 2016-2032

- 5.3.3. Swine/hog

- 5.3.4. Poultry

- 5.3.5. Others

- 5.4. Western Europe Lysine Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Lysine Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Animal Feed

- 5.4.4. Food & Dietary Supplements

- 5.4.5. Pharmaceuticals

- 5.5. Western Europe Lysine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Lysine Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Lysine Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Lysine Market Analysis, 2016-2021

- 6.2. Eastern Europe Lysine Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Lysine Market Analysis, Opportunity and Forecast, By By Live Stock, 2016-2032

- 6.3.1. Eastern Europe Lysine Market Analysis by By Live Stock: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Live Stock, 2016-2032

- 6.3.3. Swine/hog

- 6.3.4. Poultry

- 6.3.5. Others

- 6.4. Eastern Europe Lysine Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Lysine Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Animal Feed

- 6.4.4. Food & Dietary Supplements

- 6.4.5. Pharmaceuticals

- 6.5. Eastern Europe Lysine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Lysine Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Lysine Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Lysine Market Analysis, 2016-2021

- 7.2. APAC Lysine Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Lysine Market Analysis, Opportunity and Forecast, By By Live Stock, 2016-2032

- 7.3.1. APAC Lysine Market Analysis by By Live Stock: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Live Stock, 2016-2032

- 7.3.3. Swine/hog

- 7.3.4. Poultry

- 7.3.5. Others

- 7.4. APAC Lysine Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Lysine Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Animal Feed

- 7.4.4. Food & Dietary Supplements

- 7.4.5. Pharmaceuticals

- 7.5. APAC Lysine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Lysine Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Lysine Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Lysine Market Analysis, 2016-2021

- 8.2. Latin America Lysine Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Lysine Market Analysis, Opportunity and Forecast, By By Live Stock, 2016-2032

- 8.3.1. Latin America Lysine Market Analysis by By Live Stock: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Live Stock, 2016-2032

- 8.3.3. Swine/hog

- 8.3.4. Poultry

- 8.3.5. Others

- 8.4. Latin America Lysine Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Lysine Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Animal Feed

- 8.4.4. Food & Dietary Supplements

- 8.4.5. Pharmaceuticals

- 8.5. Latin America Lysine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Lysine Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Lysine Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Lysine Market Analysis, 2016-2021

- 9.2. Middle East & Africa Lysine Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Lysine Market Analysis, Opportunity and Forecast, By By Live Stock, 2016-2032

- 9.3.1. Middle East & Africa Lysine Market Analysis by By Live Stock: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Live Stock, 2016-2032

- 9.3.3. Swine/hog

- 9.3.4. Poultry

- 9.3.5. Others

- 9.4. Middle East & Africa Lysine Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Lysine Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Animal Feed

- 9.4.4. Food & Dietary Supplements

- 9.4.5. Pharmaceuticals

- 9.5. Middle East & Africa Lysine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Lysine Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Lysine Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Lysine Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Lysine Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Cargill Incorporated (U.S)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Dow (US)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. BASF SE (Germany)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Chr. Hansen Holding A/S (Denmark)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. DSM (Netherlands)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. DuPont (US)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Evonik Industries AG (Germany)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. NOVUS INTERNATIONAL (USA)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Alltech (US)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Associated British Foods plc (UK)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Charoen Pokphand Foods PCL (Thailand)

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Nutreco (Netherlands)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. ForFarmers. (Netherlands)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. De Heus Animal Nutrition (Netherlands)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Land O'Lakes (US)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Kent Nutrition Group (US)

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. J. D. HEISKELL & CO. (US)

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Perdue Farms (US)

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. SunOpta (Canada)

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. Scratch Peck Feeds (US)

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Lysine Market Revenue (US$ Mn) Market Share by Live Stock in 2022

- Figure 2: Global Lysine Market Attractiveness Analysis by Live Stock, 2016-2032

- Figure 3: Global Lysine Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 4: Global Lysine Market Attractiveness Analysis by Application, 2016-2032

- Figure 5: Global Lysine Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Lysine Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Lysine Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Lysine Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Figure 10: Global Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 11: Global Lysine Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Figure 13: Global Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 14: Global Lysine Market Share Comparison by Region (2016-2032)

- Figure 15: Global Lysine Market Share Comparison by Live Stock (2016-2032)

- Figure 16: Global Lysine Market Share Comparison by Application (2016-2032)

- Figure 17: North America Lysine Market Revenue (US$ Mn) Market Share by Live Stockin 2022

- Figure 18: North America Lysine Market Attractiveness Analysis by Live Stock, 2016-2032

- Figure 19: North America Lysine Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 20: North America Lysine Market Attractiveness Analysis by Application, 2016-2032

- Figure 21: North America Lysine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Lysine Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Lysine Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Figure 26: North America Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 27: North America Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Figure 29: North America Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 30: North America Lysine Market Share Comparison by Country (2016-2032)

- Figure 31: North America Lysine Market Share Comparison by Live Stock (2016-2032)

- Figure 32: North America Lysine Market Share Comparison by Application (2016-2032)

- Figure 33: Western Europe Lysine Market Revenue (US$ Mn) Market Share by Live Stockin 2022

- Figure 34: Western Europe Lysine Market Attractiveness Analysis by Live Stock, 2016-2032

- Figure 35: Western Europe Lysine Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 36: Western Europe Lysine Market Attractiveness Analysis by Application, 2016-2032

- Figure 37: Western Europe Lysine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Lysine Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Lysine Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Figure 42: Western Europe Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 43: Western Europe Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Figure 45: Western Europe Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 46: Western Europe Lysine Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Lysine Market Share Comparison by Live Stock (2016-2032)

- Figure 48: Western Europe Lysine Market Share Comparison by Application (2016-2032)

- Figure 49: Eastern Europe Lysine Market Revenue (US$ Mn) Market Share by Live Stockin 2022

- Figure 50: Eastern Europe Lysine Market Attractiveness Analysis by Live Stock, 2016-2032

- Figure 51: Eastern Europe Lysine Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 52: Eastern Europe Lysine Market Attractiveness Analysis by Application, 2016-2032

- Figure 53: Eastern Europe Lysine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Lysine Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Lysine Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Figure 58: Eastern Europe Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 59: Eastern Europe Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Figure 61: Eastern Europe Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 62: Eastern Europe Lysine Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Lysine Market Share Comparison by Live Stock (2016-2032)

- Figure 64: Eastern Europe Lysine Market Share Comparison by Application (2016-2032)

- Figure 65: APAC Lysine Market Revenue (US$ Mn) Market Share by Live Stockin 2022

- Figure 66: APAC Lysine Market Attractiveness Analysis by Live Stock, 2016-2032

- Figure 67: APAC Lysine Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 68: APAC Lysine Market Attractiveness Analysis by Application, 2016-2032

- Figure 69: APAC Lysine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Lysine Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Lysine Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Figure 74: APAC Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 75: APAC Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Figure 77: APAC Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 78: APAC Lysine Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Lysine Market Share Comparison by Live Stock (2016-2032)

- Figure 80: APAC Lysine Market Share Comparison by Application (2016-2032)

- Figure 81: Latin America Lysine Market Revenue (US$ Mn) Market Share by Live Stockin 2022

- Figure 82: Latin America Lysine Market Attractiveness Analysis by Live Stock, 2016-2032

- Figure 83: Latin America Lysine Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 84: Latin America Lysine Market Attractiveness Analysis by Application, 2016-2032

- Figure 85: Latin America Lysine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Lysine Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Lysine Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Figure 90: Latin America Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 91: Latin America Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Figure 93: Latin America Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 94: Latin America Lysine Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Lysine Market Share Comparison by Live Stock (2016-2032)

- Figure 96: Latin America Lysine Market Share Comparison by Application (2016-2032)

- Figure 97: Middle East & Africa Lysine Market Revenue (US$ Mn) Market Share by Live Stockin 2022

- Figure 98: Middle East & Africa Lysine Market Attractiveness Analysis by Live Stock, 2016-2032

- Figure 99: Middle East & Africa Lysine Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 100: Middle East & Africa Lysine Market Attractiveness Analysis by Application, 2016-2032

- Figure 101: Middle East & Africa Lysine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Lysine Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Lysine Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Figure 106: Middle East & Africa Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 107: Middle East & Africa Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Figure 109: Middle East & Africa Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 110: Middle East & Africa Lysine Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Lysine Market Share Comparison by Live Stock (2016-2032)

- Figure 112: Middle East & Africa Lysine Market Share Comparison by Application (2016-2032)

List of Tables

- Table 1: Global Lysine Market Comparison by Live Stock (2016-2032)

- Table 2: Global Lysine Market Comparison by Application (2016-2032)

- Table 3: Global Lysine Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Lysine Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Lysine Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Table 7: Global Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 8: Global Lysine Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Table 10: Global Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 11: Global Lysine Market Share Comparison by Region (2016-2032)

- Table 12: Global Lysine Market Share Comparison by Live Stock (2016-2032)

- Table 13: Global Lysine Market Share Comparison by Application (2016-2032)

- Table 14: North America Lysine Market Comparison by Application (2016-2032)

- Table 15: North America Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Lysine Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Table 19: North America Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 20: North America Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Table 22: North America Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 23: North America Lysine Market Share Comparison by Country (2016-2032)

- Table 24: North America Lysine Market Share Comparison by Live Stock (2016-2032)

- Table 25: North America Lysine Market Share Comparison by Application (2016-2032)

- Table 26: Western Europe Lysine Market Comparison by Live Stock (2016-2032)

- Table 27: Western Europe Lysine Market Comparison by Application (2016-2032)

- Table 28: Western Europe Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Lysine Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Table 32: Western Europe Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 33: Western Europe Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Table 35: Western Europe Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 36: Western Europe Lysine Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Lysine Market Share Comparison by Live Stock (2016-2032)

- Table 38: Western Europe Lysine Market Share Comparison by Application (2016-2032)

- Table 39: Eastern Europe Lysine Market Comparison by Live Stock (2016-2032)

- Table 40: Eastern Europe Lysine Market Comparison by Application (2016-2032)

- Table 41: Eastern Europe Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Lysine Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Table 45: Eastern Europe Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 46: Eastern Europe Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Table 48: Eastern Europe Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 49: Eastern Europe Lysine Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Lysine Market Share Comparison by Live Stock (2016-2032)

- Table 51: Eastern Europe Lysine Market Share Comparison by Application (2016-2032)

- Table 52: APAC Lysine Market Comparison by Live Stock (2016-2032)

- Table 53: APAC Lysine Market Comparison by Application (2016-2032)

- Table 54: APAC Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Lysine Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Table 58: APAC Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 59: APAC Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Table 61: APAC Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 62: APAC Lysine Market Share Comparison by Country (2016-2032)

- Table 63: APAC Lysine Market Share Comparison by Live Stock (2016-2032)

- Table 64: APAC Lysine Market Share Comparison by Application (2016-2032)

- Table 65: Latin America Lysine Market Comparison by Live Stock (2016-2032)

- Table 66: Latin America Lysine Market Comparison by Application (2016-2032)

- Table 67: Latin America Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Lysine Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Table 71: Latin America Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 72: Latin America Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Table 74: Latin America Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 75: Latin America Lysine Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Lysine Market Share Comparison by Live Stock (2016-2032)

- Table 77: Latin America Lysine Market Share Comparison by Application (2016-2032)

- Table 78: Middle East & Africa Lysine Market Comparison by Live Stock (2016-2032)

- Table 79: Middle East & Africa Lysine Market Comparison by Application (2016-2032)

- Table 80: Middle East & Africa Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Lysine Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Lysine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Lysine Market Revenue (US$ Mn) Comparison by Live Stock (2016-2032)

- Table 84: Middle East & Africa Lysine Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 85: Middle East & Africa Lysine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Lysine Market Y-o-Y Growth Rate Comparison by Live Stock (2016-2032)

- Table 87: Middle East & Africa Lysine Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 88: Middle East & Africa Lysine Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Lysine Market Share Comparison by Live Stock (2016-2032)

- Table 90: Middle East & Africa Lysine Market Share Comparison by Application (2016-2032)

- 1. Executive Summary

-

- Cargill Incorporated (U.S)

- Dow (US)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (US)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (USA)

- Alltech (US)

- Associated British Foods plc (UK)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (US)

- Kent Nutrition Group (US)

- J. D. HEISKELL & CO. (US)

- Perdue Farms (US)

- SunOpta (Canada)

- Scratch Peck Feeds (US)