low Cost Carrier Market By Aircraft Type(Narrow Body, Wide Body), By Distribution Channel(Online, Travel Agency), By Operations(International, Domestic), By Application(Individual, Commercial) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42730

-

Feb 2022

-

156

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

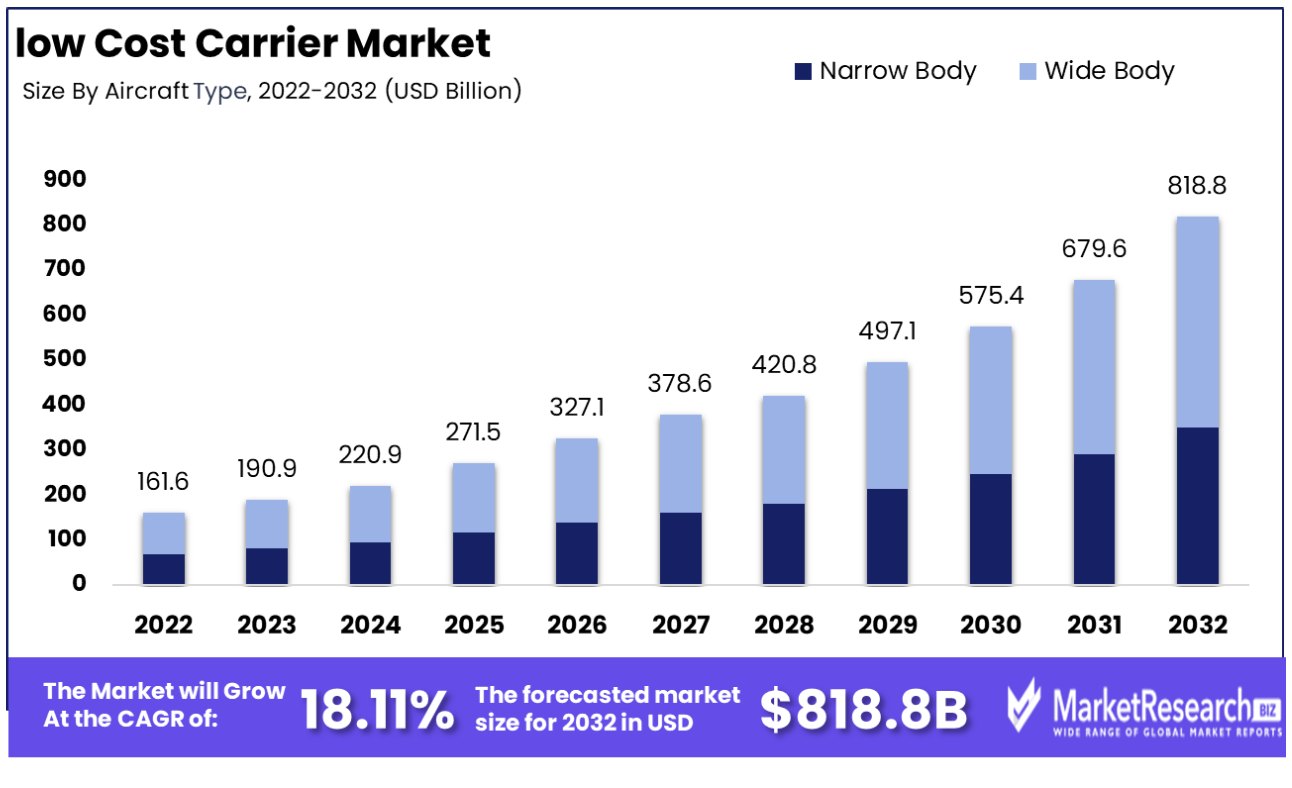

The low-cost carrier market was valued at USD 161.59 billion in 2022. It is expected to reach USD 818.8 billion by 2032, with a CAGR of 18.11% during the forecast period.

The surge in demand for air travel, the sudden rise in the tourism and travel industry, and the change in consumer preferences are some of the main driving factors for the low-cost carrier market expansion. A low-cost carrier (LCC) is an airline that lowers the ticket price at the cost of decreasing operating expenses and provides fewer facilities to the passengers. LCCs produce a major share of their revenue from charging extra amounts of money for subsidiary services like baggage, on-board food facilities, seat allocation, etc.

Currently, low-cost carriers are accountable for a third of the world’s planned airline capacity. In the past few months, the LCCs for the flights, seats, and other services have surged by 2% points.

According to the aviation market analysis, the capacity of LCC in the US has rapidly increased. As per the report, Atlanta has increased the LCC capacity by 20.3% in 2023, earlier in 2019 it was 15.9%. Likewise, there are several other airlines such as Denver, Dallas Ft Worth, Chicago O’Hare, LA, Charlotte, Phoenix Sky Harbour, Seattle-Tacoma, Orlando, and San Francisco, who have increased the LCC capacity as compared to 2019. These are nine of the ten largest US airports that have not only increased the LCC capacity but also opened new business opportunities.

Earlier consumers assumed that the airlines were an expensive mode of transportation. LCCs are cost-effective which means that the airline can provide air prices that are low and budget-friendly. Now, most consumers prefer to travel by air due to its low price which has brought about competitiveness in the market. As per LCC standards, airlines should sell the tickets directly to the consumers. This will allow better regulation of inventory and fares. It also saves the airline from giving more commission to the third-party supply channel.

Advanced technologies are always a vital tool for low-cost carriers while keeping the cost minimal, whether it is done online or physically which ensures quick aircraft operational times. Technology is now allowing LCCs to provide virtual flight connections to its consumers that will help them to link between single LCC flights easily without worrying about luggage and missed connections. The demand of LCCs will rapidly increase due to such convenience and technology assistance that will help in market expansion in the coming years.

Driving Factors

Affordability Fuels Demand in Air Travel

Low-Cost Carrier (LCC) market growth has been driven primarily by consumer demand for affordable air travel. In a world where cost efficiency is increasingly important for both leisure and business travelers, LCCs have capitalized on this demand by offering no-frills services at lower prices than traditional airlines.

This affordability has made air travel more accessible to a broader audience, leading to increased passenger volumes. The trend towards budget-conscious travel is expected to persist, suggesting sustained growth for LCCs as they continue to fulfill the need for economical air travel options.

Policy Modifications Impact LCC Operations

Changes in government policies and regulations significantly influence the Low-Cost Carrier market. Deregulation in various regions has allowed LCCs to compete more effectively with traditional airlines, providing opportunities for expansion and new market entry.

Policy modifications regarding air travel rights, airport charges, and operational regulations also impact LCCs' operational strategies and cost structures. Governmental support in some regions has further encouraged the growth of LCCs. Policy and regulatory reforms play a pivotal role in shaping the aviation industry, with significant long-term ramifications for LCC market growth and sustainability.

Low Operating Costs Drive Competitive Advantage

The inherent low operating cost structure of LCCs is a key factor driving their market growth. By focusing on cost-saving strategies such as single aircraft type fleets, direct sales without intermediaries, and high aircraft utilization rates, LCCs maintain lower operating costs compared to traditional carriers.

This cost efficiency allows them to offer lower fares, attracting price-sensitive customers and maintaining a competitive edge in the market. The ongoing focus on operational efficiency and cost management is likely to continue driving the market, as LCCs leverage their low-cost structures to expand their customer base and market presence.

Restraining Factors

Competition from Traditional Airlines Challenges Low-Cost Carrier Market Growth

The low-cost carrier (LCC) market faces significant competition from traditional airlines, which is a major factor limiting its growth. Traditional airlines, with their established brand presence and customer loyalty, have been adapting to market changes by offering competitive fares and additional services.

Many have introduced budget-friendly options and streamlined operations to compete directly with LCCs. This intensified competition makes it challenging for LCCs to capture market share, especially in routes where traditional airlines have a strong presence. Additionally, the loyalty programs and comprehensive service offerings of traditional airlines can make them more appealing to certain customer segments, further challenging LCCs’ market expansion.

Uncertain Regulatory Environment Limits Low-Cost Carrier Market Expansion

An uncertain regulatory environment also restricts the expansion of the low-cost carrier market. Aviation is a heavily regulated industry, and LCCs often face challenges navigating complex and changing regulatory landscapes. Regulations affecting route permissions, airport access, and operational requirements can vary significantly across different regions and countries.

Additionally, changes in aviation policies, such as those related to environmental standards or passenger rights, can impose additional costs and operational constraints on LCCs. This regulatory uncertainty can lead to unpredictability in market conditions, making it difficult for LCCs to plan long-term strategies and investments, thereby constraining their growth potential.

low-cost carrier market Segmentation Analysis

By Aircraft Type

Narrow-body aircraft are the backbone of the low-cost carrier (LCC) market. Their dominance is largely due to their cost-effectiveness, fuel efficiency, and suitability for short to medium-haul routes, which are the mainstay of LCC operations. These aircraft, such as the Boeing 737 and Airbus A320 families, offer the perfect balance between passenger capacity and operational costs, enabling LCCs to maintain low ticket prices.

The growth of this segment is propelled by continuous improvements in aircraft technology, including more fuel-efficient engines and aerodynamic designs. However, the narrow-body segment faces challenges in scaling up capacity for high-demand routes and maintaining profitability on longer routes.

While less dominant in the LCC market, wide-body aircraft are gradually finding their place, particularly for low-cost long-haul operations. These aircraft offer higher passenger capacity and range, opening new opportunities for LCCs to expand their route networks. However, their higher operational costs and complexities make them less prevalent in the traditional LCC model.

By Distribution Channel

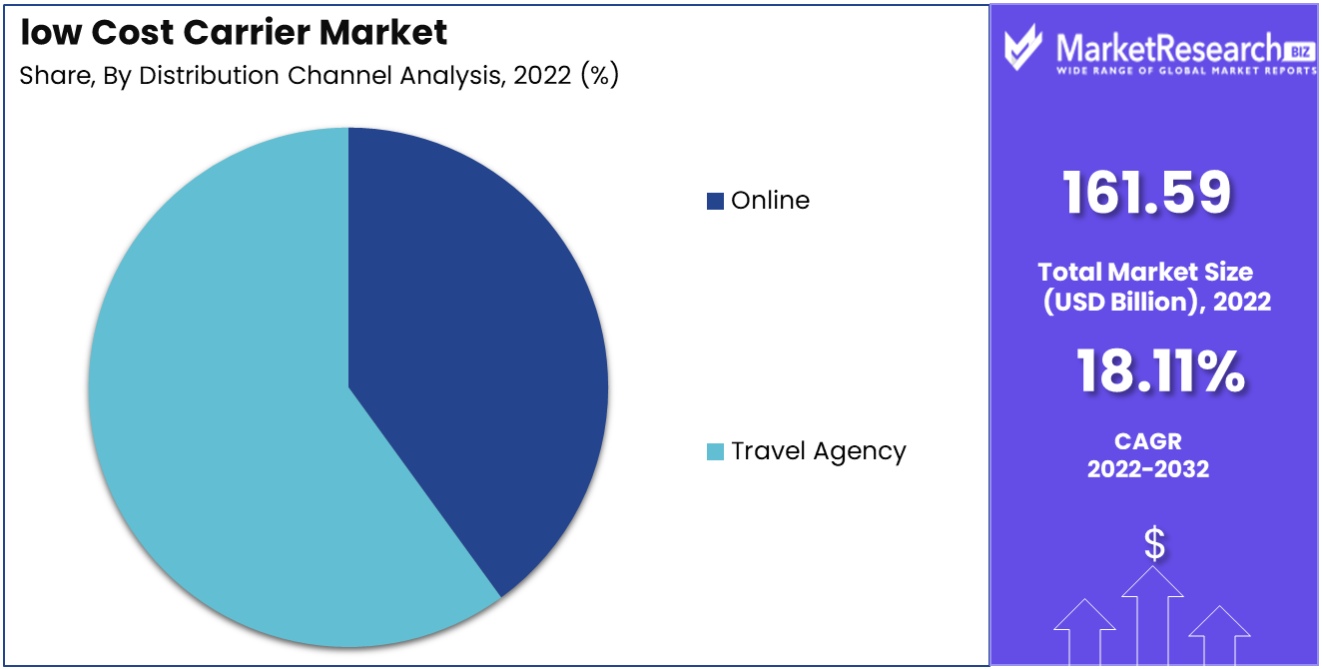

The online distribution channel is the primary driver for ticket sales in the LCC market. The dominance of online channels stems from their ability to offer lower fares by eliminating intermediaries, aligning perfectly with the cost-saving ethos of LCCs. Online platforms, including airline websites and mobile apps, enable direct customer engagement, personalized marketing, and operational efficiencies.

The growth of this segment is further fueled by the increasing internet penetration and consumer preference for digital solutions. However, LCCs face challenges in differentiating themselves in the highly competitive online marketplace.

Travel agencies, though less dominant in the era of online bookings, continue to play a role in the Low-Cost Carrier (LCC) market, especially for specific customer segments that prefer traditional booking methods or require additional travel services. Their presence is particularly notable in markets where digital penetration is lower, or where customers value personalized service and bundled travel packages.

By Operations

International operations represent the most significant growth area for LCCs. The expansion of LCCs into international markets is driven by the liberalization of air travel regulations, increasing global tourism, and the emergence of secondary airports offering lower operating costs. LCCs are successfully challenging traditional carriers on international routes by offering competitive fares and point-to-point services. However, they face challenges such as varying international regulations, currency fluctuations, and the need for strategic partnerships.

Domestic operations remain a fundamental part of LCC strategies, especially in large and geographically diverse markets. These operations serve as a feeder network and foundation for expanding into international markets, allowing LCCs to build a robust customer base and brand recognition at a national level before scaling up to global operations. This strategy also enables LCCs to fine-tune their operational efficiency and customer service in a familiar market before tackling the complexities of international air travel.

By Application

Individual travelers constitute the primary customer base for LCCs. This segment's dominance is driven by the growing consumer demand for affordable air travel, the rise of solo travel trends, and the budget-conscious nature of leisure travelers. LCCs cater to this segment with their low-fare business model, simplified services, and flexible booking options. The challenge for LCCs is to maintain service quality and customer satisfaction while keeping operational costs low.

The commercial segment, including business and corporate travelers, is increasingly using LCCs for cost-effective travel solutions. While not the dominant segment, it presents growth opportunities for LCCs, especially in developing tailored products and services for business travelers.

low-cost carrier Market Industry Segments

By Aircraft Type

- Narrow Body

- Wide Body

By Distribution Channel

- Online

- Travel Agency

By Operations

- International

- Domestic

By Application

- Individual

- Commercial

Growth Opportunities

Increasing Air Passenger Traffic Boosts Growth in Low-Cost Carrier Market

The continual increase in air passenger traffic presents a significant growth opportunity for the low-cost carrier (LCC) market. As more people choose air travel for both leisure and business, LCCs are well-positioned to capture a large segment of this growing market with their affordable pricing strategies.

The trend towards budget-conscious traveling, especially among the younger demographic and in emerging economies, is driving the popularity of LCCs. The increase in passenger numbers indicates a robust expansion potential for LCCs, as they continue to attract price-sensitive customers and expand their customer base.

Efficiency-Enhancing Measures Propel Low Cost Carrier Market

Efficiency-enhancing measures are key drivers of growth in the low-cost carrier market. LCCs constantly strive to improve operational efficiency, reduce costs, and increase aircraft utilization. Innovations in fuel management, route optimization, and streamlined boarding processes contribute to lower operational costs, allowing LCCs to maintain competitive fares.

These ongoing efforts to enhance efficiency not only improve profitability but also strengthen the market position of LCCs, making them more attractive to cost-conscious travelers. The focus on operational efficiency is crucial for the sustained growth and competitiveness of LCCs in the aviation market.

Low-cost Carrier Market Regional Analysis

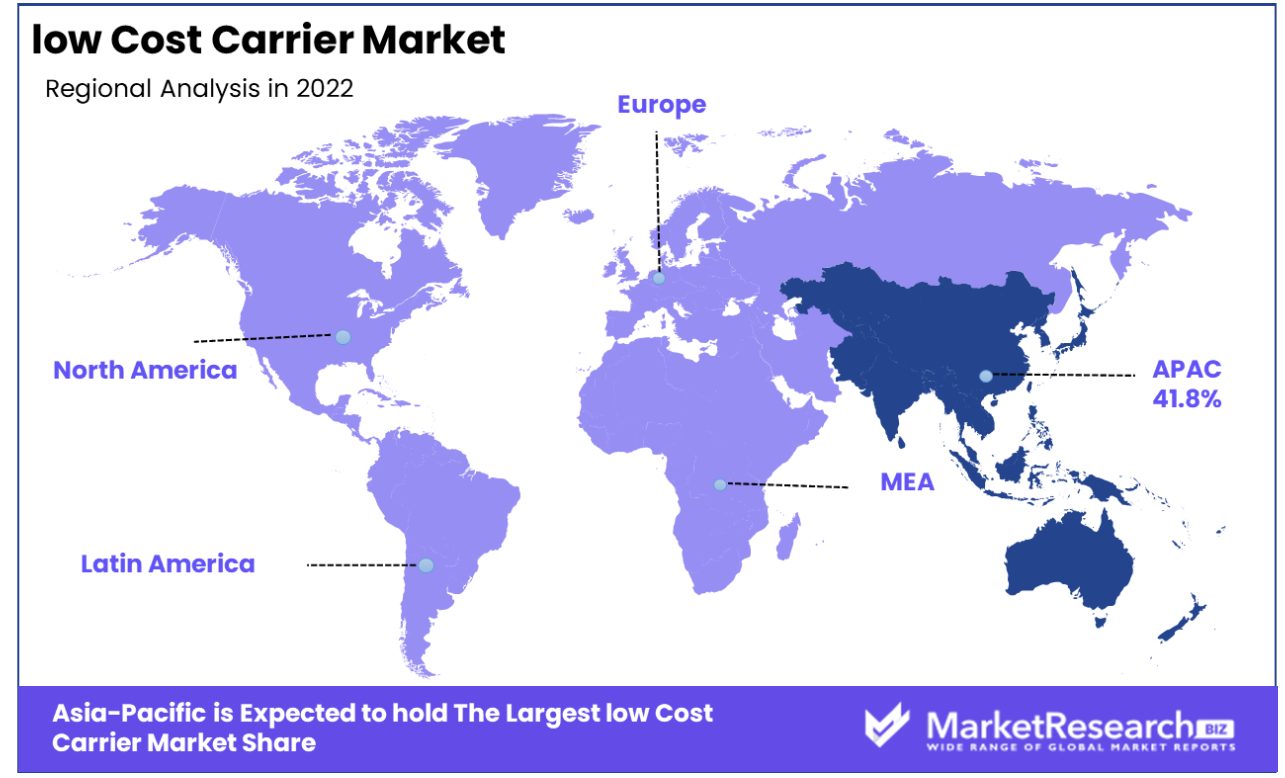

Asia Pacific Dominates with 41.8% Market Share in Low-Cost Carrier Market

Asia Pacific holds a remarkable 41.8% market share for Low-Cost Carriers (LCCs) thanks to an expansive and rapidly developing aviation market. This growth is fueled by the rising middle-class population and increasing affordability of air travel. Countries like China, India, and Southeast Asian nations have seen a surge in air travel demand, driven by economic growth and urbanization. Additionally, the region's diverse tourism destinations stimulate the demand for budget-friendly travel options, making LCCs a preferred choice for many travelers.

Asia Pacific LCC market benefits from liberalized air transport policies and the establishment of numerous new LCCs offering various segments of service to their target markets. Competitive pricing strategies, efficient operational models, and a focus on cost-effective routes have been key to the success of LCCs in this region. Moreover, the digitalization of booking systems and innovative marketing strategies have made it easier for customers to access affordable travel options, further driving the market growth.

Europe's Mature Market with Strong Operational Efficiency

Europe’s LCC market is characterized by its maturity, operational efficiency, and strong regulatory frameworks. The presence of well-established LCCs in the region, coupled with a high demand for budget travel among European travelers, supports the market. Europe's extensive route network and the adoption of innovative cost-saving measures are key to the market's sustainability.

North America's Innovation and Market Expansion

In North America, the LCC market is growing, driven by innovative business models and an expanding route network. The United States and Canada have seen a steady increase in LCC operations, with carriers exploring new destinations and enhancing customer service to remain competitive. The market's growth is bolstered by a focus on cost management and the implementation of technology-driven solutions.

low-cost carrier market Key Player Analysis

In the Low-Cost Carrier (LCC) Market, a highly competitive and dynamic aviation sector, the companies listed are key players shaping the industry's landscape. Air Asia and Indigo, leading LCCs in Asia, are pivotal in offering affordable air travel, underlining the market's growth in emerging economies. Their strategic positioning caters to the growing middle-class population and increasing domestic travel in the region.

Ryanair, known for its ultra-low fares in Europe, has been instrumental in revolutionizing budget travel, influencing market trends towards cost reduction and operational efficiency. Similarly, Wizz Air has made significant inroads in Central and Eastern Europe, capitalizing on its low-cost model to expand its network.

Scoot and Flydubai have become important players in the Asia-Pacific and Middle Eastern markets, respectively, offering competitive prices and expanding routes to underserved destinations. Their strategies reflect the industry's expansion into new markets and focus on connecting diverse regions.

Southwest Airlines, a pioneer in the LCC market in the U.S., continues to influence the industry with its customer-centric approach and operational model. JetBlue Airways and Spirit Airlines, also based in the U.S., contribute to the market with unique value propositions, blending low fares with quality service.

Low-cost Carrier Industry Key Players

- Air Asia

- Ryanair

- Indigo

- Scoot

- Southwest Airlines

- Eurowings

- flydubai

- Virgin Australia

- JetBlue Airlines

- Wizz Air

- Spirit Airlines

Market Recent Development

- In December 2023, Salam Air, a prominent low-cost carrier, introduced direct flights between Hyderabad and Muscat, Oman. This marked a significant expansion in air connectivity for Hyderabad's Rajiv Gandhi International Airport.

- In November 2023, Norse Atlantic Airways announced its plan to raise $45 million through a private placement to improve liquidity during the fall and winter seasons when demand decreases.

- In July 2023, IndiGo finalized an order for 500 aircraft from the Airbus 320neo family, making it the single largest purchase agreement in commercial aviation history.

- In April 2023, The Bangkok Central Bankruptcy Court approved the revised business rehabilitation plan of Thai AirAsia X, allowing the carrier to move forward with its growth plans, including adding aircraft and opening new routes. The plan also includes measures to increase cash flow and revenue.

Report Scope

Report Features Description Market Value (2022) USD 161.59 billion Forecast Revenue (2032) USD 818.8 billion CAGR (2023-2032) 18.11% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Micro-Organisms(Microalgae, Bacteria, Yeast, Fungal), By Application (Fish Oil Substitute, Bio-Fuel Feedstock, Functional Oils, Animal Feed, Infant Formulae, Pharmaceutical Products, Aquaculture) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Goerlich Pharma GmbH, Cellana Inc., Alltech, Royal DSM NV, Xiamen Huison Biotech Co.Ltd., DIC Corporation, Cargill Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-