Liquid Milk Replacers Market By Type (Medicated, Non-Medicated), By Livestock (Calves, Piglets, Lambs, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

25746

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

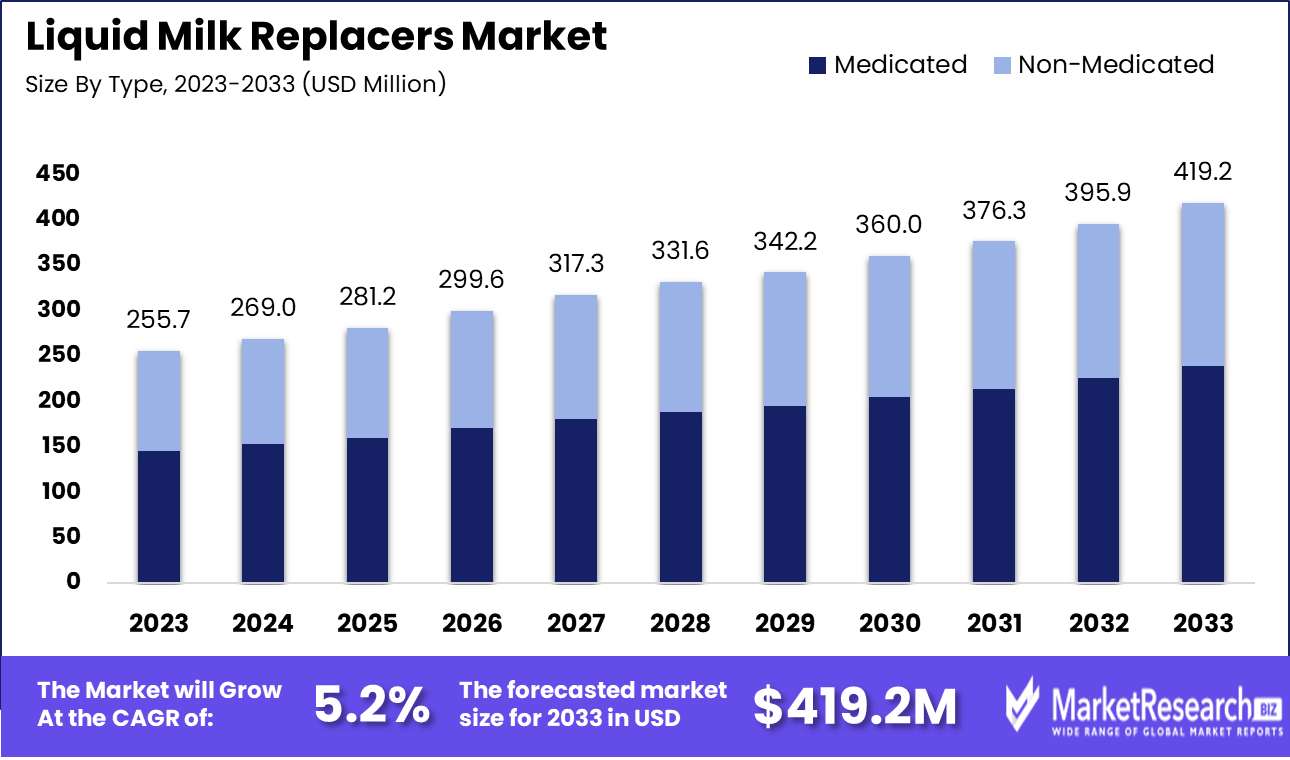

The Liquid Milk Replacers Market was valued at USD 255.7 million in 2023. It is expected to reach USD 419.2 million by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Liquid Milk Replacers Market refers to the industry focused on the production and distribution of alternative nutritional liquids designed to replace natural milk, primarily in the animal husbandry sector. These products are formulated to meet the specific dietary needs of young livestock, including calves, lambs, and piglets, ensuring optimal growth and development. The market is driven by factors such as increasing livestock populations, cost-effectiveness compared to natural milk, and advancements in formulation technologies.

The Liquid Milk Replacers Market is poised for significant growth, driven by the escalating demand for dairy products and the increasing awareness of animal nutrition. As dairy production scales to meet global demands, the role of liquid milk replacers in optimizing livestock nutrition has become increasingly crucial. These products provide a cost-effective solution for farmers seeking to enhance the health and productivity of their herds, particularly in regions where traditional dairy feed is expensive or scarce.

Furthermore, the rising awareness of the importance of balanced nutrition in young animals is fueling the adoption of milk replacers, as they offer a controlled and consistent source of essential nutrients. This trend is expected to continue as more farmers recognize the long-term benefits of incorporating high-quality milk replacers into their feeding programs.

However, the market faces challenges related to the high costs of production, which could potentially hinder the broader adoption of liquid milk replacers. The production process involves sophisticated technology and high-quality raw materials, leading to elevated costs that are often passed on to the end users. Despite this, the market outlook remains positive, supported by the robust demand for dairy products and the growing emphasis on animal health. The positive growth prospects for the market are further underscored by the continuous advancements in product formulations and manufacturing processes, which are likely to enhance the cost-effectiveness and accessibility of liquid milk replacers in the coming years. As the market evolves, stakeholders must navigate these cost challenges while capitalizing on the opportunities presented by the rising demand and nutritional awareness.

Key Takeaways

- Market Growth: The Liquid Milk Replacers Market was valued at USD 255.7 million in 2023. It is expected to reach USD 419.2 million by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Type: The Medicated segment dominates, driven by disease prevention and productivity benefits.

- By Livestock: Calves dominated the Liquid Milk Replacers Market, driven by dairy industry needs.

- Regional Dominance: North America leads the Liquid Milk Replacers Market with a 35% largest share.

- Growth Opportunity: The global Liquid Milk Replacers Market is set for robust growth with significant opportunities arising from the development of medicated liquid milk replacers and the rising livestock population.

Driving factors

Increasing Demand for Livestock Products Drives Market Expansion

The rising global demand for livestock products, such as meat, milk, and other dairy derivatives, significantly fuels the growth of the liquid milk replacers market. As populations grow and incomes increase, particularly in emerging markets, the consumption of animal-based products escalates. This surge in demand necessitates efficient livestock production, including the use of liquid milk replacers to ensure the health and productivity of young animals. The liquid milk replacers market benefits from this trend as it becomes a critical component in maintaining the supply chain of high-quality livestock products. For instance, in regions where dairy consumption is rapidly increasing, such as Asia-Pacific, the demand for milk replacers is expected to grow in tandem with the expanding livestock sector.

Precision Nutrition Enhances Efficiency and Drives Adoption

The adoption of precision nutrition practices is a significant factor contributing to the growth of the liquid milk replacers market. Precision nutrition involves the careful formulation of feed and supplements to meet the specific nutritional needs of individual animals, optimizing their growth and productivity. Liquid milk replacers, formulated with a precise balance of nutrients, play a crucial role in this approach, particularly for young calves and other livestock. By providing an easily digestible and nutritionally complete alternative to natural milk, these replacers help improve growth rates, reduce mortality, and enhance overall farm efficiency. This trend is particularly evident in developed markets where advanced farming techniques are widely adopted, leading to increased market penetration of liquid milk replacers.

Economic Growth and Investment in Dairy Farming Accelerate Market Growth

Economic growth, particularly in developing regions, combined with increased investment in dairy farming infrastructure, significantly bolsters the liquid milk replacers market. As economies expand, there is a corresponding increase in disposable income, leading to greater investment in agricultural technologies and livestock management practices. Governments and private investors are increasingly focusing on modernizing dairy farming to meet the rising demand for dairy products. This includes investments in high-quality feed and nutrition solutions like liquid milk replacers, which are essential for maximizing dairy production efficiency. For example, in countries like India and China, where dairy farming is a critical part of the economy, investments in modern farming practices are expected to drive substantial growth in the liquid milk replacers market.

Restraining Factors

Logistical Challenges: Impact on Market Efficiency and Distribution Costs

Logistical challenges play a significant role in restraining the growth of the Liquid Milk Replacers Market, particularly due to the complexity of transporting perishable products. The need for maintaining optimal storage temperatures throughout the supply chain increases the cost and difficulty of distribution, especially in regions with inadequate cold chain infrastructure. These challenges lead to higher transportation costs and potential delays, affecting the timely delivery of products to end-users, which in turn hampers market growth.

Additionally, the logistical hurdles can result in increased product spoilage, reducing profitability for manufacturers and limiting the availability of products in various regions. According to industry data, inefficiencies in logistics can lead to an average increase of 15-20% in operational costs, directly impacting market expansion.

Regulatory Constraints: Navigating Compliance and Market Entry Barriers

Regulatory constraints are another critical factor restraining the growth of the Liquid Milk Replacers Market. The industry is subject to stringent regulations regarding product composition, labeling, and safety standards, which vary significantly across different regions. Compliance with these regulations requires significant investment in research, development, and testing, which can be a barrier to market entry for new players.

Furthermore, the time-consuming process of obtaining necessary approvals and certifications can delay product launches and restrict the introduction of innovative solutions. These regulatory barriers not only slow down market expansion but also increase the cost of bringing products to market, thereby limiting the overall growth potential. For instance, navigating the complex regulatory landscape in the European Union can add up to 10-15% to the product development costs, affecting competitiveness and market penetration.

By Type Analysis

Medicated segment dominates, driven by disease prevention and productivity benefits.

In 2023, The Medicated segment held a dominant market position in the Liquid Milk Replacers Market. This segment's leadership is driven by its efficacy in improving the health and growth of young livestock, particularly in the prevention and treatment of diseases. The inclusion of specific antibiotics and other medicinal additives in medicated liquid milk replacers addresses common health challenges faced by calves, piglets, and other young animals, thereby reducing mortality rates and enhancing overall productivity. This makes medicated milk replacers a preferred choice among farmers and livestock producers who prioritize animal health and performance.

Meanwhile, the Non-Medicated segment continues to exhibit steady growth, primarily due to increasing demand for natural and organic livestock products. Non-medicated milk replacers, free from antibiotics and medicinal additives, appeal to consumers and producers focusing on organic farming practices and antibiotic-free livestock management. This segment benefits from the rising trend of sustainable and ethical farming, which emphasizes natural animal nutrition without synthetic additives.

Together, both segments cater to distinct market needs, with medicated products leading due to their functional benefits, while non-medicated products gain traction within niche, health-conscious markets.

By Livestock Analysis

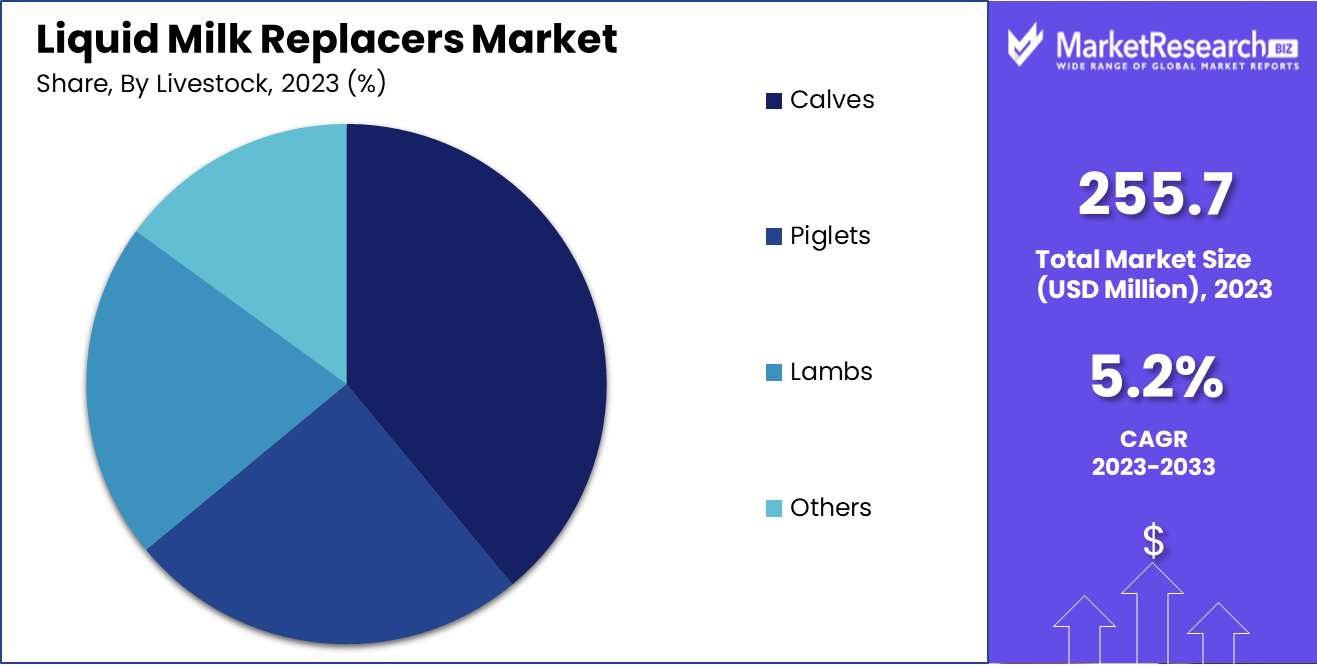

Calves dominated the Liquid Milk Replacers Market, driven by dairy industry needs.

In 2023, Calves held a dominant market position in the "By Livestock" segment of the Liquid Milk Replacers Market. The high demand for liquid milk replacers among calves is primarily driven by the increasing adoption of modern farming practices and the rising emphasis on optimizing calf health and growth rates. Calves, particularly in dairy farming, require nutrient-rich supplements to ensure proper development, which has significantly boosted the demand for liquid milk replacers in this segment. Additionally, the growing global dairy industry, coupled with the increasing awareness of the benefits of early-stage nutrition, has further solidified the dominance of this segment.

Piglets also represented a substantial share of the market, driven by the need to provide adequate nutrition during the early weaning stages. The lambs segment witnessed moderate growth, particularly in regions with a strong presence of sheep farming, where liquid milk replacers are essential for lamb survival and growth.

Other livestock, including goat kids and foals, accounted for a smaller yet growing market share, reflecting the expanding use of liquid milk replacers across diverse animal husbandry practices.

Key Market Segments

By Type

- Medicated

- Non-Medicated

By Livestock

- Calves

- Piglets

- Lambs

- Others

Growth Opportunity

Expanding Medicated Liquid Milk Replacers

The global Liquid Milk Replacers Market is poised to experience significant growth, driven by the increasing adoption of medicated liquid milk replacers. These specialized products offer enhanced nutritional benefits and contribute to improved animal health by addressing specific nutritional deficiencies and preventing diseases. The rising demand for medicated variants is expected to create substantial opportunities for market players to develop innovative formulations tailored to various livestock needs. As livestock producers seek to optimize animal growth and health, the shift towards medicated products represents a key growth opportunity in the market.

Impact of Rising Livestock Population

The global rise in livestock population is another critical factor driving the demand for liquid milk replacers. With the increasing global demand for meat and dairy products, livestock farming has expanded, particularly in regions such as Asia-Pacific and Latin America. This expansion has fueled the need for cost-effective and efficient feeding solutions, including liquid milk replacers. The market is likely to benefit from this trend, as more farmers adopt these products to ensure the healthy development of young animals. The growing livestock population, therefore, presents a significant opportunity for manufacturers to capitalize on the increasing need for high-quality nutritional solutions.

Latest Trends

Rising Demand for Medicated Replacers

The Liquid Milk Replacers Market is anticipated to witness a significant shift towards medicated replacers, driven by the increasing focus on animal health and productivity. Medicated replacers, which include essential nutrients and medications, are becoming integral to livestock management, particularly in the prevention and treatment of common diseases in calves. The rising awareness among farmers about the long-term benefits of these products, including reduced mortality rates and improved growth performance, is expected to bolster market growth. Additionally, regulatory support for the use of medicated replacers is likely to further encourage their adoption, making this a key trend in the market.

Focus on Calves: Enhanced Nutrition and Growth

Another critical trend is the heightened focus on the nutritional needs of calves. With the growing understanding of the importance of early nutrition in the life cycle of livestock, there is an increasing emphasis on providing high-quality liquid milk replacers specifically formulated for calves. These replacers are designed to mimic the nutritional profile of natural milk, ensuring optimal growth and development. The market is expected to see innovations in product formulations, with a focus on enhancing digestibility and nutrient absorption, ultimately leading to healthier and more productive herds. This trend reflects the broader industry movement towards precision livestock farming, where tailored nutrition plays a pivotal role in achieving sustainable growth.

Regional Analysis

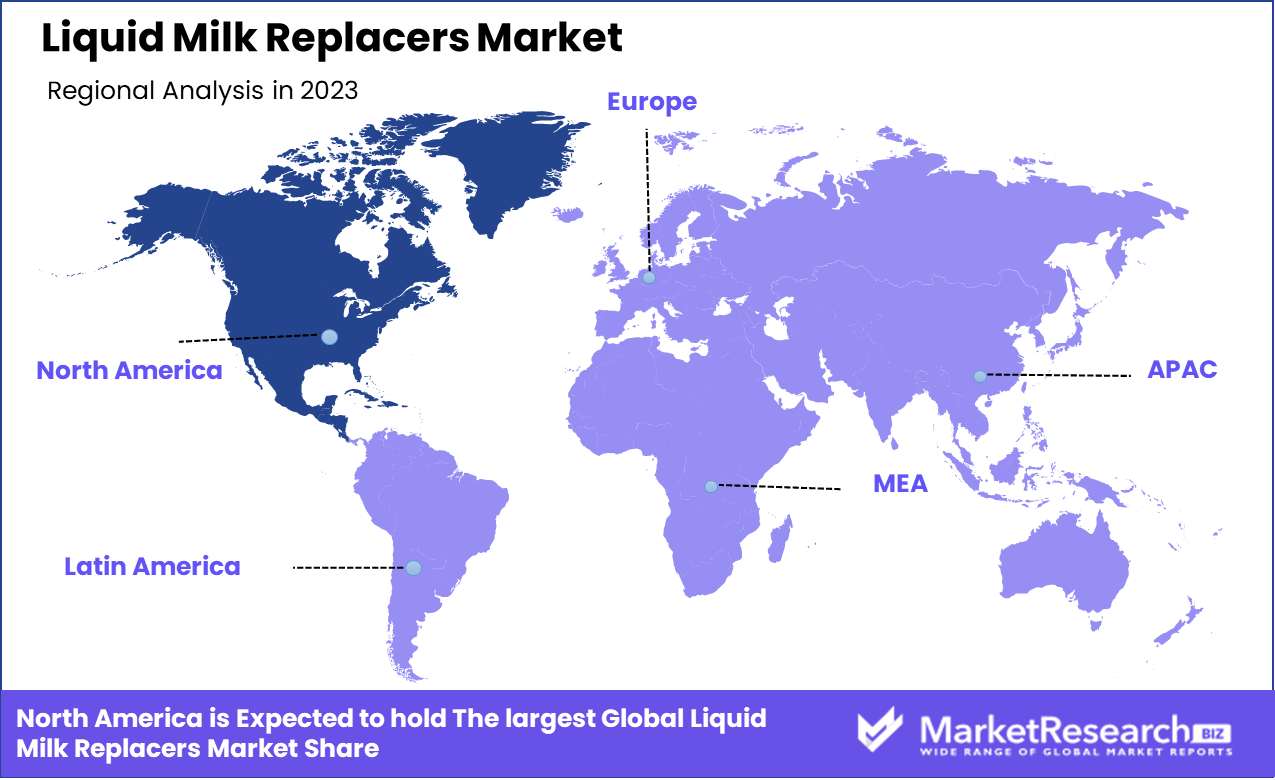

North America leads the Liquid Milk Replacers Market with a 35% largest share.

The Liquid Milk Replacers Market exhibits diverse growth patterns across various regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominates the market, accounting for approximately 35% of the global market share. This dominance can be attributed to the high adoption of advanced animal husbandry practices and the strong presence of key market players in the region. Additionally, the increasing awareness regarding the nutritional benefits of milk replacers in livestock management further drives the market growth in North America.

In Europe, the market is witnessing steady growth, driven by the region's stringent animal nutrition and welfare regulations, which encourage the use of milk replacers. The Asia Pacific market is expected to register the highest growth rate, fueled by the rapid expansion of the dairy industry, particularly in countries like China and India. The growing demand for high-quality dairy products in these countries is propelling the adoption of milk replacers.

In the Middle East & Africa, the market growth is moderate, influenced by the region's increasing focus on improving livestock productivity to meet the rising demand for dairy products. Latin America shows potential for growth, with Brazil and Argentina leading the market due to the expanding dairy industry and rising awareness of animal nutrition.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Liquid Milk Replacers Market is anticipated to witness significant growth, driven by key players such as Land O’Lakes, Glanbia, Liprovit, PETAG, Cargill, Calva Products, CHS, Archer Daniels Midland Company, Lactalis Group, and Nutreco N.V. These companies are strategically positioned to capitalize on the growing demand for liquid milk replacers, particularly in the livestock and animal husbandry sectors.

Land O’Lakes and Cargill are expected to maintain their leadership positions, leveraging their extensive distribution networks and strong brand recognition. Both companies are likely to continue investing in product innovation and expanding their reach into emerging markets, particularly in Asia Pacific and Latin America, where livestock farming is on the rise.

Glanbia and Archer Daniels Midland Company are focusing on enhancing their product portfolios to cater to the evolving nutritional needs of livestock. These companies are likely to benefit from the growing trend towards sustainability and animal welfare, with increased emphasis on high-quality, nutrient-rich milk replacers.

Lactalis Group and Nutreco N.V. are expected to drive market growth through strategic mergers and acquisitions, expanding their market share and enhancing their product offerings. Additionally, Liprovit and PETAG are focusing on niche segments within the market, such as specialized milk replacers for young animals, to differentiate themselves from competitors.

Overall, the key players in the Liquid Milk Replacers Market are likely to pursue a combination of product innovation, strategic partnerships, and expansion into emerging markets to maintain their competitive edge and drive growth.

Market Key Players

- Land O’Lakes

- Glanbia

- Liprovit

- PETAG

- Cargill

- Calva Products

- CHS

- Archer Daniels Midland Company

- Lactalis Group

- Nutreco N.V

Recent Development

- In August 2024, The French cooperative Sodiaal Group announced an investment in new production facilities to increase the output of its liquid milk replacers. The expansion is aimed at meeting the growing demand for high-quality liquid milk replacers in Europe and Asia.

- In July 2024, Trouw Nutrition launched a new liquid milk replacer with added prebiotics and probiotics, targeting the North American market. This product is designed to improve gut health and reduce the incidence of common digestive issues in young animals.

- In June 2024, Cargill introduced a new liquid milk replacer product in Europe that integrates advanced nutritional technology to support better immunity in calves. This launch is part of Cargill's strategy to expand its presence in the European livestock market.

Report Scope

Report Features Description Market Value (2023) USD 255.7 Million Forecast Revenue (2033) USD 398.2 Million CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Medicated, Non-Medicated), By Livestock (Calves, Piglets, Lambs, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Land O’Lakes, Glanbia, Liprovit, PETAG, Cargill, Calva Products, CHS, Archer Daniels Midland Company, Lactalis Group, Nutreco N.V Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Land O’Lakes

- Glanbia

- Liprovit

- PETAG

- Cargill

- Calva Products

- CHS

- Archer Daniels Midland Company

- Lactalis Group

- Nutreco N.V