Lignocaine Market By Formulation (Injections, Creams, Ointments & Gels, Others), By Application (Dentistry, Cardiac Arrhythmia, Epilepsy, Cosmetic Surgery, General Surgery), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47081

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

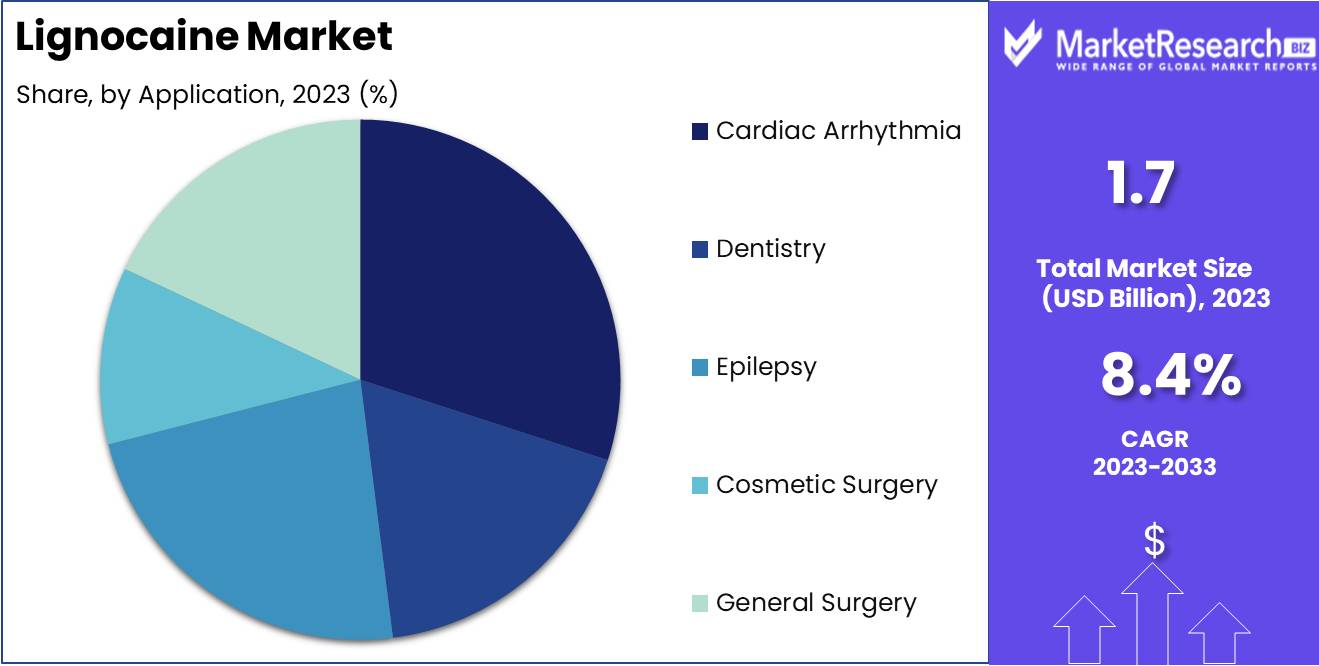

The Lignocaine Market was valued at USD 1.7 billion in 2023. It is expected to reach USD 3.7 billion by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

The lignocaine market encompasses the global trade and utilization of lignocaine, also known as lidocaine, a versatile anesthetic and antiarrhythmic agent widely used in medical and dental procedures. This market includes the production, distribution, and application of lignocaine in various forms such as injectables, topical solutions, and patches.

The lignocaine market is experiencing a robust growth trajectory, driven by a confluence of factors enhancing its demand and application. A significant driver is the increasing number of surgical procedures worldwide. As healthcare systems expand and the global population ages, the frequency of surgeries is on the rise, consequently escalating the need for effective local anesthetics like lignocaine. This trend is particularly pronounced in emerging markets where access to surgical care is improving, and in developed regions where advanced surgical techniques are becoming more prevalent. Additionally, lignocaine's efficacy and safety profile make it a preferred choice among anesthetists, further solidifying its market position.

Moreover, the market is witnessing innovation in delivery methods, which is contributing to its growth. The development of transdermal patches and aerosol sprays represents a significant advancement in patient care, providing more effective and user-friendly administration options. These innovative delivery systems enhance patient compliance and satisfaction by offering pain management solutions that are less invasive and more convenient. This trend aligns with the broader healthcare shift towards personalized and patient-centered care, which prioritizes both efficacy and patient experience.

As these novel delivery methods gain traction, they are expected to open new avenues for lignocaine application, thereby expanding its market potential. Collectively, these factors underscore a positive outlook for the lignocaine market, positioning it for sustained growth and innovation in the coming years.

Key Takeaways

- Market Growth: The Lignocaine Market was valued at USD 1.7 billion in 2023. It is expected to reach USD 3.7 billion by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

- By Formulation: Injections dominated Lignocaine Market formulations due to critical pain management.

- By Application: Cardiac Arrhythmia dominated lignocaine market applications due to high demand.

- By Distribution Channel: Hospital Pharmacies dominated the Lignocaine market distribution channels.

- Regional Dominance: North America dominates the lignocaine market with a 35% share.

- Growth Opportunity: The global lignocaine market will grow significantly due to rising chronic pain management and drug delivery advancements.

Driving factors

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive procedures (MIPs) significantly drives the growth of the lignocaine market. These procedures, which include surgeries and diagnostic techniques requiring smaller incisions or no incisions at all, rely heavily on local anesthetics like lignocaine to minimize pain and facilitate faster recovery times. As healthcare providers and patients alike favor these less invasive options for their reduced risk and quicker rehabilitation, the necessity for effective local anesthesia rises correspondingly. This demand is particularly prominent in cosmetic surgery, dental procedures, and various outpatient surgical interventions, where lignocaine is a preferred anesthetic due to its efficacy and safety profile.

Growing Prevalence of Chronic Pain Conditions

The rise in chronic pain conditions worldwide also propels the lignocaine market forward. Chronic pain, affecting approximately 20% of the global population, often necessitates ongoing pain management strategies. Lignocaine, known for its potent analgesic properties, is widely used in managing chronic pain through various formulations, including topical gels, patches, and injectable solutions. The increasing incidence of conditions such as arthritis, neuropathic pain, and post-operative pain amplifies the need for effective local anesthetics. For instance, the Centers for Disease Control and Prevention (CDC) report that about 54.4 million adults in the United States have some form of arthritis, highlighting a substantial patient base requiring pain relief solutions.

Advancements in Drug Delivery Technologies

Technological advancements in drug delivery systems have revolutionized the administration of lignocaine, further spurring market growth. Innovative delivery methods such as transdermal patches, controlled-release formulations, and novel injectables enhance the efficacy and patient compliance of lignocaine treatments. These advancements address the limitations of traditional delivery methods, such as fluctuating plasma levels and the need for frequent dosing. For instance, the development of extended-release formulations and microneedle patches allows for sustained and targeted delivery of lignocaine, improving therapeutic outcomes.

Restraining Factors

Adverse Side Effects of Lignocaine: A Major Market Constraint

The side effects associated with lignocaine, including nausea, dizziness, and allergic reactions, significantly restrain market growth. These adverse effects can lead to patient discomfort and a lack of confidence among healthcare providers, ultimately limiting the widespread adoption of lignocaine. Medical professionals may hesitate to prescribe or use lignocaine, especially when safer alternatives are available, thus dampening market demand. In the context of an increasingly safety-conscious healthcare environment, these side effects pose a substantial barrier to market expansion.

Limited Availability of Alternative Products: Constraining Market Diversification

The limited availability of alternative products to lignocaine further complicates market dynamics. While lignocaine remains a critical local anesthetic, the lack of readily available substitutes restricts competition and innovation within the market. This scarcity can lead to over-reliance on lignocaine, despite its known side effects, as healthcare providers have few options to turn to. The resulting market rigidity hinders diversification and slows the pace of introducing potentially safer and more effective anesthetic agents.

Additionally, the development pipeline for new anesthetics faces significant regulatory and research hurdles, prolonging the time before alternatives can enter the market and thus perpetuating the dominance of lignocaine despite its drawbacks.

By Formulation Analysis

In 2023, Injections dominated Lignocaine Market formulations due to critical pain management.

In 2023, Injections held a dominant market position in the "By Formulation" segment of the Lignocaine Market. This prominence can be attributed to the widespread use of lignocaine injections in surgical procedures, dental treatments, and emergency medicine, where rapid onset and precision in pain management are crucial. Creams, as the second-leading formulation, cater primarily to dermatological applications, providing localized pain relief for conditions such as minor burns, insect bites, and skin irritations. Ointments and gels, closely following creams, are favored in musculoskeletal treatments, offering sustained release and deeper penetration for conditions like arthritis and muscle sprains.

Lastly, other formulations, including sprays and patches, are gaining traction due to their ease of use and versatility, particularly in outpatient and home care settings. The overall market dynamics reflect a growing preference for lignocaine's efficacy across diverse medical applications, with injections leading due to their critical role in acute pain management and procedural anesthesia. Each formulation segment continues to evolve, driven by innovation and expanding therapeutic uses.

By Application Analysis

In 2023, Cardiac Arrhythmia dominated lignocaine market applications due to high demand.

In 2023, Cardiac Arrhythmia held a dominant market position in the By Application segment of the Lignocaine Market. This preeminence can be attributed to several critical factors. Primarily, the rising prevalence of cardiac arrhythmias globally has significantly increased the demand for effective management and treatment solutions, where lignocaine is a key therapeutic agent. Furthermore, advancements in medical technologies and increased healthcare expenditures have facilitated more frequent and widespread use of lignocaine in arrhythmia treatment protocols.

In comparison, Dentistry also contributes substantially to lignocaine consumption, driven by the drug's widespread use as a local anesthetic in routine dental procedures. Epilepsy applications benefit from lignocaine's utility in managing certain neuropathic pain conditions, although its market share is comparatively lower. Cosmetic Surgery sees lignocaine as essential for minor surgical procedures and aesthetic enhancements, catering to the growing demand for minimally invasive cosmetic treatments. Lastly, General Surgery incorporates lignocaine for its anesthetic properties in various surgical contexts, enhancing patient care quality. Collectively, these applications highlight the multifaceted role of lignocaine across medical disciplines, with cardiac arrhythmia treatment emerging as the leading segment.

By Distribution Channel Analysis

In 2023, Hospital Pharmacies dominated the Lignocaine market distribution channels.

In 2023, Hospital pharmacies held a dominant market position in the "By Distribution Channel" segment of the Lignocaine market. This dominance can be attributed to several factors. Firstly, hospital pharmacies benefit from direct access to patients undergoing surgical procedures and treatments requiring local anesthesia, driving consistent demand for lignocaine. Additionally, the advanced infrastructure and specialized personnel within hospital settings ensure efficient administration and monitoring of lignocaine use, further cementing their leading role.

Conversely, retail pharmacies, while not as dominant, still play a crucial role in the lignocaine market. These pharmacies cater to outpatient needs and offer lignocaine-based products for minor procedures and pain management, accessible to a broader population. Retail pharmacies' widespread presence and convenience make them an essential distribution channel, particularly for over-the-counter lignocaine products used for minor injuries, dental issues, and other localized pain conditions.

Key Market Segments

By Formulation

- Injections

- Creams

- Ointments & Gels

- Others

By Application

- Dentistry

- Cardiac Arrhythmia

- Epilepsy

- Cosmetic Surgery

- General Surgery

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

Growth Opportunity

The rise in Chronic Pain Management

The global lignocaine market is poised for significant growth in 2024, driven primarily by the increasing prevalence of chronic pain conditions. Chronic diseases pain affects millions worldwide, necessitating effective and reliable management solutions. Lignocaine, known for its efficacy as a local anesthetic, plays a critical role in pain management, especially in conditions like neuropathic pain and post-operative recovery. The rise in the geriatric population, who are more prone to chronic pain, further fuels the demand for lignocaine. Healthcare providers are increasingly adopting lignocaine-based treatments to enhance patient quality of life, thereby driving market growth.

Advancements in Drug Delivery Technologies

Another key driver of growth in the lignocaine market is the advancement in drug delivery technologies. Innovations such as transdermal patches, topical gels, and controlled-release formulations have revolutionized the administration of lignocaine, making it more effective and patient-friendly. These advancements improve the bioavailability and therapeutic efficacy of lignocaine, reducing side effects and enhancing patient compliance. For instance, the development of lignocaine patches for continuous, localized pain relief represents a significant advancement, catering to both acute and chronic pain management needs.

Latest Trends

Rising Demand for Minimally Invasive Procedures

The global healthcare landscape is increasingly favoring minimally invasive procedures, a trend significantly impacting the lignocaine market. Patients and healthcare providers prefer these procedures due to their benefits, such as reduced recovery times, lower risks of complications, and overall cost-effectiveness. Lignocaine, a local anesthetic, is pivotal in this context, as its application ensures patient comfort and procedural efficiency.

As the demand for minimally invasive surgeries like laparoscopic procedures, endoscopies, and catheter-based treatments grows, the utilization of lignocaine is expected to rise correspondingly. This trend underscores a robust market trajectory driven by patient-centric healthcare approaches and technological advancements in surgical methodologies.

Advancements in Drug Delivery Technologies

Innovations in drug delivery technologies are poised to reshape the lignocaine market in 2024. Traditional methods of administering lignocaine are being supplemented and, in some cases, replaced by advanced delivery systems. These include transdermal patches, controlled-release formulations, and needle-free injectors. Such advancements not only enhance the efficacy and safety profiles of lignocaine but also improve patient compliance and experience. For instance, transdermal patches provide a steady release of lignocaine, minimizing the need for frequent dosing and reducing potential side effects.

Furthermore, controlled-release formulations ensure sustained analgesic effects, crucial for chronic diseases pain management. The integration of these cutting-edge technologies into clinical practice is expected to drive market growth and expand the therapeutic applications of lignocaine.

Regional Analysis

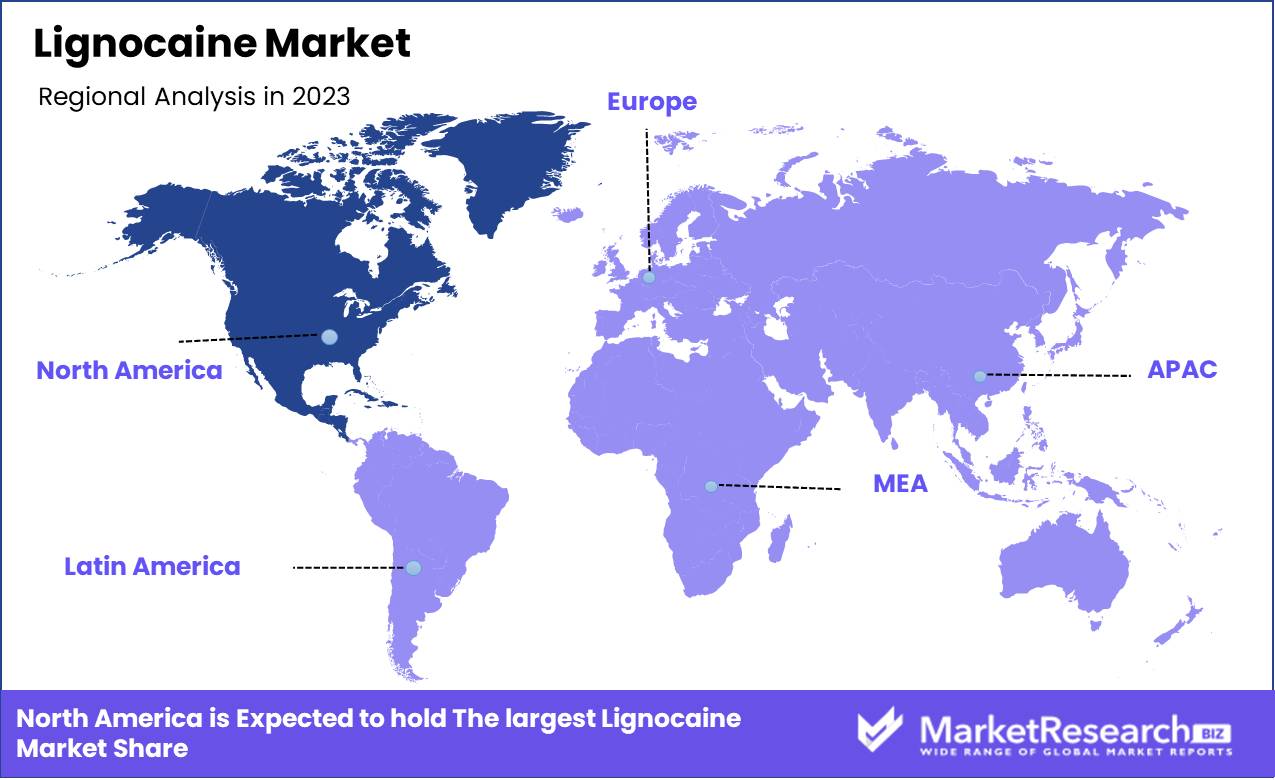

North America dominates the lignocaine market with a 35% share.

The lignocaine market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominates the market with a significant share, accounting for approximately 35% of the global lignocaine market. This dominance is attributed to the high prevalence of chronic pain conditions, advanced healthcare infrastructure, and increased healthcare expenditure. The U.S. and Canada are the primary contributors in this region due to their robust pharmaceutical industry and extensive use of lignocaine in medical procedures.

Europe holds a substantial share of the lignocaine market, driven by the rising geriatric population and the increasing incidence of surgeries. Countries such as Germany, France, and the UK lead the market in this region, benefiting from strong healthcare systems and a focus on pain management.

The Asia Pacific region is expected to witness the highest growth rate during the forecast period, propelled by the growing healthcare sector, increasing disposable incomes, and rising awareness about pain management solutions. Major contributors include China, India, and Japan, where rapid urbanization and improvements in healthcare infrastructure are key factors.

The Middle East & Africa region shows moderate growth, primarily due to the expanding healthcare sector and increasing adoption of advanced medical treatments in countries like the UAE and South Africa. Latin America is also experiencing growth in the lignocaine market, with Brazil and Mexico leading the way. The region benefits from improving healthcare facilities and a rising number of surgical procedures.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global lignocaine market in 2024 is poised for significant growth, driven by diverse applications in medical and pharmaceutical sectors. Key players such as SCILEX Pharmaceuticals, Inc. and Hisamitsu Pharmaceutical Co., Inc. are leading the charge with innovative formulations and extensive distribution networks. SCILEX's emphasis on non-opioid pain management aligns with growing market demands for safer analgesics. Hisamitsu’s established presence in transdermal drug delivery further strengthens its market position.

Jiangsu Tianji Pharmaceutical Co. Ltd. and SOFMEDICA are notable for their robust manufacturing capabilities and strategic regional expansions, enhancing their competitiveness in emerging markets. Meanwhile, industry giants like Pfizer, Inc. and Teikoku Pharma USA, Inc. leverage their extensive R&D capabilities and global reach to drive market penetration and product diversification.

Medline Industries, Inc. and SonoScape Medical Corp. contribute significantly with their advanced medical devices, which complement lignocaine’s applications in diagnostics and treatment procedures. KARL STORZ and PENTAX Medical are enhancing the therapeutic landscape through innovative endoscopic technologies, expanding lignocaine’s use in minimally invasive surgeries.

The strategic initiatives of companies like Actavis Labs UT Inc. and Endomed Systems focus on niche markets and novel delivery systems, ensuring sustained growth. The presence of comprehensive data providers such as Dun & Bradstreet, Inc. supports these companies with critical market intelligence, fostering informed decision-making and strategic planning.

Market Key Players

- SCILEX Pharmaceuticals, Inc.

- Hisamitsu Pharmaceutical Co., Inc.

- Jiangsu Tianji Pharmaceutical Co. Ltd.

- SOFMEDICA

- Perkin Elmer

- Medline Industries, Inc.

- SonoScape Medical Corp.

- Pfizer Inc.

- KARL STORZ.

- Teikoku Pharma USA, Inc.

- Endomed Systems

- Actavis Labs UT Inc.

- Dun & Bradstreet, Inc.

- PENTAX Medical, among others

Recent Development

- In April 2024, Biohaven Ltd. reported that its ongoing single ascending dose (SAD) study with BHV-1300 showed promising preliminary safety and IgG lowering data. This study involves lignocaine as a key component in pain management therapies being tested for various autoimmune conditions.

- In March 2024, Sarepta Therapeutics, in collaboration with Roche, announced a new development program focusing on a lignocaine-based treatment for Duchenne Muscular Dystrophy (DMD). This collaboration leverages Sarepta's existing expertise in gene therapy to enhance delivery mechanisms.

- In February 2024, Teva Pharmaceuticals launched a new generic version of the lignocaine patch, increasing competition in the market. This launch is expected to provide more affordable options for chronic pain management for patients.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 3.7 Billion CAGR (2024-2032) 8.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Formulation (Injections, Creams, Ointments & Gels, Others), By Application (Dentistry, Cardiac Arrhythmia, Epilepsy, Cosmetic Surgery, General Surgery), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape SCILEX Pharmaceuticals, Inc., Hisamitsu Pharmaceutical Co., Inc., Jiangsu Tianji Pharmaceutical Co. Ltd., SOFMEDICA, Perkin Elmer, Medline Industries, Inc., SonoScape Medical Corp., Pfizer Inc., KARL STORZ., Teikoku Pharma USA, Inc., Endomed Systems, Actavis Labs UT Inc., Dun & Bradstreet, Inc., PENTAX Medical, among others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- SCILEX Pharmaceuticals, Inc.

- Hisamitsu Pharmaceutical Co., Inc.

- Jiangsu Tianji Pharmaceutical Co. Ltd.

- SOFMEDICA

- Perkin Elmer

- Medline Industries, Inc.

- SonoScape Medical Corp.

- Pfizer, Inc.

- KARL STORZ.

- Teikoku Pharma USA, Inc.

- Endomed Systems

- Actavis Labs UT Inc.

- Dun & Bradstreet, Inc.

- PENTAX Medical, among others