Light Sensor Market By Function Type (Ambient Light Sensing, Proximity Detection, Other),By Output (Analog, Digital),By Applications (Placement Detection, Brightness Control, Digital Segment, Other),By End-Use (Automotive, Consumer Electronics, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

23017

-

May 2023

-

151

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

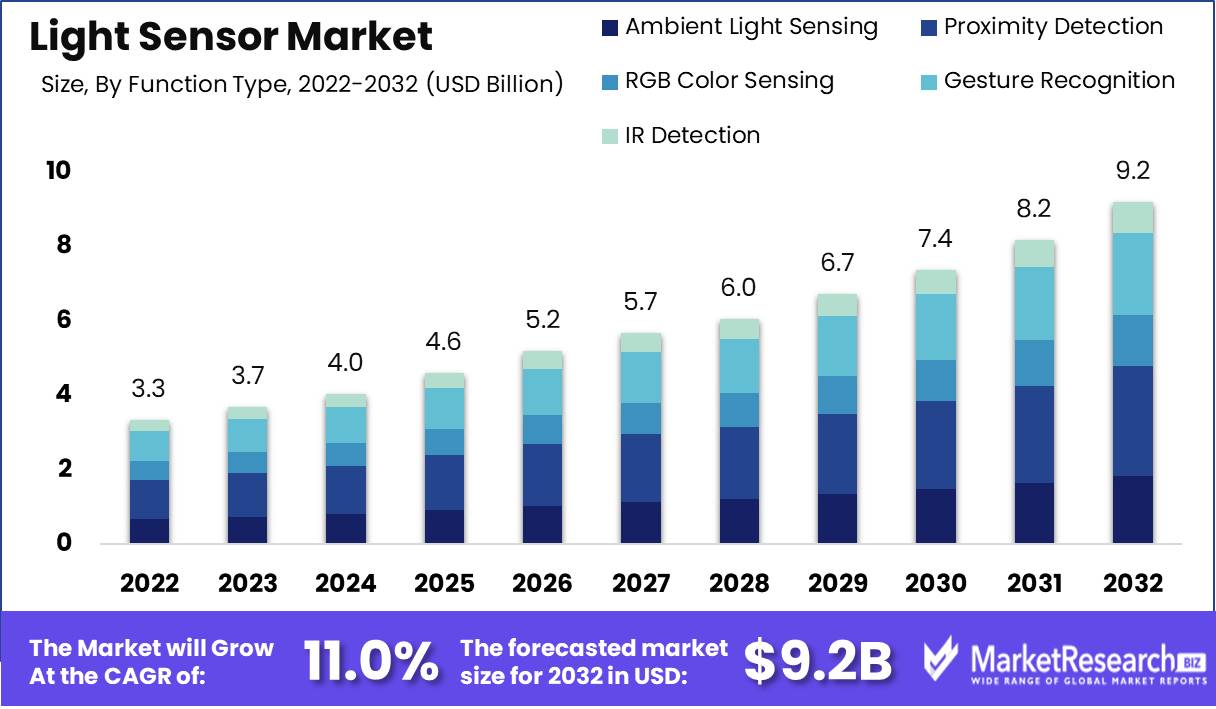

Light Sensor Market size is expected to be worth around USD 9.2 Bn by 2032 from USD 3.3 Bn in 2022, growing at a CAGR of 11.0% during the forecast period from 2023 to 2032.

The light sensor market has emerged as a significant participant in the rapidly advancing technological environment of today, owing to its diverse range of applications and capacity to generate environmentally friendly products and services. Both industries and investors are showing interest in the light sensor markets. In this analysis, we will delve into significant innovations, major investments, integration into products and services, and the ethical considerations associated with these markets.

Prior to delving further into the complexities of the light sensor market, it is imperative to establish a clear and concise definition of this technology and its objectives. A light sensor, also known as a photodetector, is a device that detects and quantifies light levels, converting them into electrical signals. Its primary objective is to facilitate the adaptability of devices or systems to variations in ambient lighting conditions, thereby enhancing performance and optimizing energy consumption.

Light sensors are of great importance in a wide range of industries. Light sensors have gained significant popularity due to their various advantages and benefits. They play a crucial role in enhancing energy efficiency by precisely measuring light levels. This enables the optimization of settings on devices equipped with light sensors, resulting in reduced overall energy consumption. Consequently, the utilization of light sensors not only benefits individual users but also contributes to the development of a more environmentally friendly and sustainable ecosystem.

The light sensor market has witnessed significant advancements in recent times, leading to a multitude of innovative solutions that have had a transformative impact on various industries. An example of technological advancement is the integration of ambient light sensors in smartphones and tablets. This feature enables the automatic adjustment of display brightness, resulting in enhanced user experience and energy efficiency. Moreover, the utilization of light sensors has resulted in significant advancements in the development of adaptive lighting systems in automotive vehicles, thereby enhancing safety and visibility on roadways.

The light sensor market has garnered significant investments from established companies and startups, leading to extensive research and development endeavors. Consequently, light sensors have been integrated into a wide range of products and services. For instance, within the healthcare industry, light sensors are utilized in pulse oximeters and wearable devices that monitor vital signs.

The expansion of the light sensor market has been driven by its widespread adoption in various sectors, including consumer electronics, automotive, healthcare, industrial automation, and smart buildings. The integration of light sensors into consumer electronics, such as smartphones, tablets, smart TVs, and wearable devices, has witnessed substantial uptake.

Driving factors

Smart Lighting Adoption Rising

The use of smart lighting systems is driving the growth of the light sensor market. In recent years, there has been a substantial shift toward energy-efficient lighting, and smart lighting systems have emerged as vital participants. Smart lighting systems improve user experience, energy savings, and lighting control. These systems regulate lighting conditions based on user preferences and ambient parameters using sensors, wireless connections, and sophisticated algorithms.

Auto and CE Industry Growth

Another factor driving the light sensor market is the growth of the automotive and consumer electronics industries. Vehicles and technological devices are becoming smarter as technology advances. This progress has increased demand for light sensors, which improve product functioning and usability. Automatic headlamp control, adaptive cruise control, and rain-sensing wipers utilize light sensors in the automotive industry. These sensors help vehicles adapt to changing lighting and improve road safety.

Energy-Efficient Lighting Demand

A key driving factor for the light sensor market is the ever-increasing demand for energy-efficient lighting solutions. Incandescent and fluorescent lighting use a lot of energy and harm the environment. Thus, LED (Light Emitting Diode) lighting is being promoted worldwide as a sustainable option.LED lighting uses less energy, lasts longer, and costs less to maintain. LED lighting systems use light sensors to automatically alter brightness based on ambient lighting conditions to save energy.

IoT and Connected Device Growth

The Internet of Things (IoT) and connected devices are driving the light sensor market. The IoT revolution has transformed how devices and systems interact, generating a massive network of smart devices and sensors. This network offers seamless communication, data exchange, and automation, improving different aspects of life. As said, light sensors enable smart lighting systems in this IoT ecosystem. They also work in smart homes, buildings, and cities. sustainability and quality of life.

Smart City Projects

The focus on smart city projects is driving the light sensor market. Cities are becoming smarter, more sustainable, and more efficient due to urbanization and its issues. Smart city programs attempt to improve numerous aspects of urban living, including energy management, transportation, infrastructure, and public services. Light sensors are key to smart city initiatives, especially intelligent lighting systems. Local authorities can efficiently control street lighting and reduce energy usage and light pollution by installing light sensors around the city.

Restraining Factors

Commoditization and Price Competition

With its many applications in automotive, consumer electronics, and industrial automation, the light sensor market is saturated with manufacturers and providers. Due to market saturation, light sensors are now commodities, resulting in a price decline. It is also challenging for businesses to differentiate their products only on quality and features due to the flood of cheaper alternatives flooding the market.

Existing Lighting System Integration Issues

Integration issues with existing lighting systems further limit the light sensor market. Light sensors must be smoothly incorporated into existing lighting infrastructure as demand for energy-efficient lighting grows. Retrofitting existing lighting systems with light sensors can be complicated and need technical expertise and planning. Compatibility difficulties between lighting control systems and protocols might delay and cost more to integrate light sensors.

Ambient Light Detection Issues

Light sensors must accurately detect ambient light to work well in diverse applications. Light sensors can't reliably measure ambient light due to technology limitations. Weather, obstacles, and reflective surfaces can affect ambient light measurements. Light sensor technologies have improved, yet they still have limitations in giving exact and reliable readings.

Possible Lighting Sensitivity

The light sensor market is also challenged by sensitivity concerns in specific lighting conditions. Light sensors may be affected by brightness, color temperature, and other factors in different lighting situations. Some light sensors may not detect and respond to modest lighting changes, resulting in inaccurate readings and poor performance. Light sensors may have trouble adjusting to sudden daylight changes in outdoor lighting systems.

External Power Dependency

The light sensor market mainly relies on external power sources, which can limit some applications. It's hard to use light sensors when power is unstable. In remote or outdoor sites without power infrastructure, using external power sources for light sensors is difficult. Installing and maintaining additional power sources may raise complexity and investment costs.

Function Type Analysis

The proximity detection segment dominates the light sensor market. This segment has grown significantly and is important in many industries. A sensor's proximity detection ability allows it to identify objects within a particular distance. Smartphones, cars, and factories use it extensively.

Emerging economies' economic growth is driving proximity detection segment adoption. These economies, like China, India, and Brazil, are rapidly industrializing and urbanizing. Thus, proximity detection sensors have become increasingly popular as the demand for safety and security technologies rises.

Consumer preferences and behaviors are also driving proximity detection segment growth. Sleek, functional, and easy-to-use devices are in demand. Proximity sensors provide gesture recognition and touchless control. Consumers choose devices with proximity detection.

Application Analysis

The digital segment leads the light sensor market. Digital light sensors' accuracy, dependability, and versatility have led to their widespread adoption. These sensors transform light signals into digital signals, making them versatile.

Similar to the proximity detection segment, growing economies are driving the adoption of digital light sensors. These economies are undergoing tremendous technological and infrastructure growth, leading to increased use of digital light sensors.

Consumer preferences and behaviors also drive digital segment growth. Consumers depend more on digital devices and technologies. Digital light sensors improve the user experience in smartphones and smart TVs. Digital light sensors are a crucial component of consumer electronics due to their ability to automatically change screen brightness, optimize battery usage, and increase image quality.

End-Use Analysis

The consumer electronics segment is the biggest end-use segment in the light sensor market. Smartphones, tablets, laptops, and smartwatches are just a few examples of consumer electronics that largely rely on light sensors for a variety of capabilities.

Emerging economies' economic growth has boosted the consumer electronics segment. These economies demand consumer electronics due to rising disposable income and affordability. Smartphones and other electronic devices have increased the demand for light sensors.

Consumer trends and behaviors affect the consumer electronics segment's growth. Consumer preferences for devices with high-quality displays, improved battery life, and efficient power usage drive the incorporation of light sensors in consumer electronics. Light sensors improve user experience by automatically adjusting brightness, power-saving settings, and image quality.

Key Market Segments

By Function Type

- Ambient Light Sensing

- Proximity Detection

- RGB Color Sensing

- Gesture Recognition

- IR Detection

By Output

- Analog

- Digital

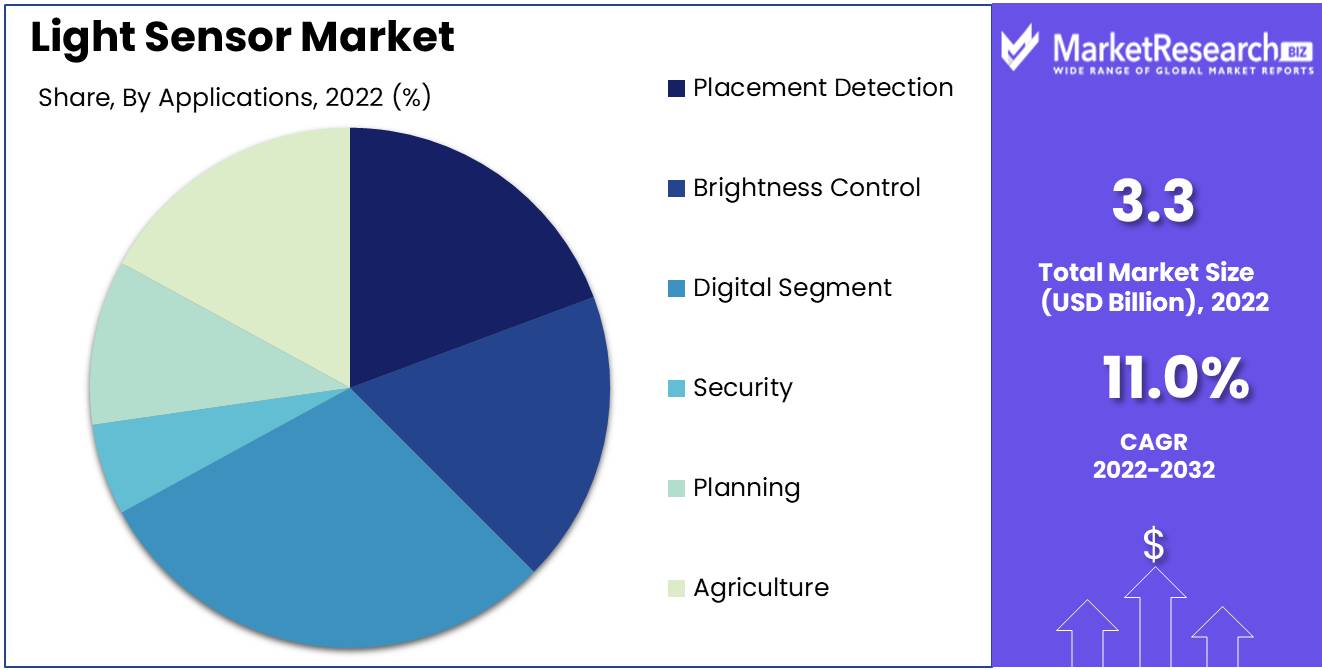

By Applications

- Placement Detection

- Brightness Control

- Digital Segment

- Security

- Planning

- Agriculture

By End-Use

- Automotive

- Consumer Electronics

- Healthcare

- Other End-Uses

Growth Opportunity

Safer Cars

The integration of light sensor technologies becomes more and more important as the automotive industry moves toward automation and safety. Light sensor enables advanced driving assistance systems (ADAS) to function properly, contributing to greater vehicle performance, higher safety, and enhanced user experience. Light sensors help with automatic headlamp control, adaptive cruise control, rain sensors, and more by precisely detecting ambient light conditions.

AV Light Sensors

Autonomous driving technology will increase the demand for light sensor integration in vehicles. Light sensors are needed to optimize energy-efficient lighting systems as electric vehicles (EVs) increase. Automotive manufacturers may create vehicles that are safer, more fuel-efficient, and perform better overall by utilizing the power of light sensors, maximizing the market's potential for growth in the automotive industry.

Environmental Monitoring Light Sensors

Industries are increasingly environmentally mindful. Expanding into environmental monitoring applications can benefit the light sensor market. Light sensor measurements and monitoring include UV radiation, air quality, and light pollution.

Sustainable Light Sensors

Environmental concerns among governments, companies, and individuals have increased the demand for accurate and dependable environmental monitoring technologies. Light sensors provide non-intrusive, cost-effective, and efficient data collection to help policymakers and stakeholders make sustainable decisions.

Light Sensors Improve Consumer Electronics

The light sensor market can carve out a niche while contributing to the larger cause of environmental conservation by satisfying the rising demand for environmental monitoring. Collaboration with environmental agencies, research institutes, and technology providers will boost market growth and cement the light sensor market's role in environmental monitoring.

Automatic brightness adjustments, ambient light sensor detection for screen upgrades, and proximity sensing for touch-free interactions are made possible by the integration of light sensors in consumer electronics.Latest Trends

Light Sensors in Smart Lighting and Home Automation

Technology has increased the demand for smart, energy-efficient lighting. Smart lighting and home automation systems are popular due to their energy savings, convenience, and personalization. By automatically altering the brightness of the lights based on ambient lighting conditions, the light sensor market is essential to these systems. This integration enables optimal energy utilization and light enjoyment. The integration of light sensors in smart lighting solutions is expected to experience significant growth in the next years due to a growing focus on sustainability and energy conservation.

Proximity and Gesture Control Applications Expand

Gesture control and proximity sensing have become popular in smartphones, gaming consoles, healthcare, and automotive industries. These apps make technology easier to use by letting users control devices with intuitive movements. Infrared sensors detect and convert hand gestures or proximity into digital commands in these systems. The growth of gesture control and proximity sensing applications is expected to drive the demand for light sensors further due to the increasing demand for touchless control and improved user experiences.

Light Sensors in Automotive Safety and Driver Assistance

Automobile manufacturers prioritize safety and driver-aid systems to decrease road accidents. These systems rely on light sensors for precise data for adaptive lighting, blind-spot detection, and collision avoidance. Light sensors can detect things in blind zones, alter beam intensity, and prevent accidents. The utilization of light sensors in automobile safety applications is poised for significant growth as the demand for improved driver assistance systems continues to rise.

RGB Color Sensors Gaining Popularity

Photography, printing, and display industries require accurate color sensing and reproduction. RGB light sensors allow accurate color sensing and analysis. RGB light sensors are becoming essential in devices like cameras, scanners, and colorimeters as color accuracy demands rise. These sensors reproduce colors accurately, helping professionals get consistent results. RGB light sensors' rise in color-intensive industries shows their value.

Displays with Ambient Light Sensing

High-resolution screens and energy-efficient devices have advanced display technologies. The utilization of ambient light sensing in display devices provides ideal visuals. Smartphones, tablets, laptops, and TVs maximize battery life and user comfort by automatically adjusting screen brightness to ambient light. Ambient light sensors adapt devices to the environment, improving readability and lowering eye strain. The demand for flawless user experiences is expected to drive the growth of ambient light sensors in the display industry.

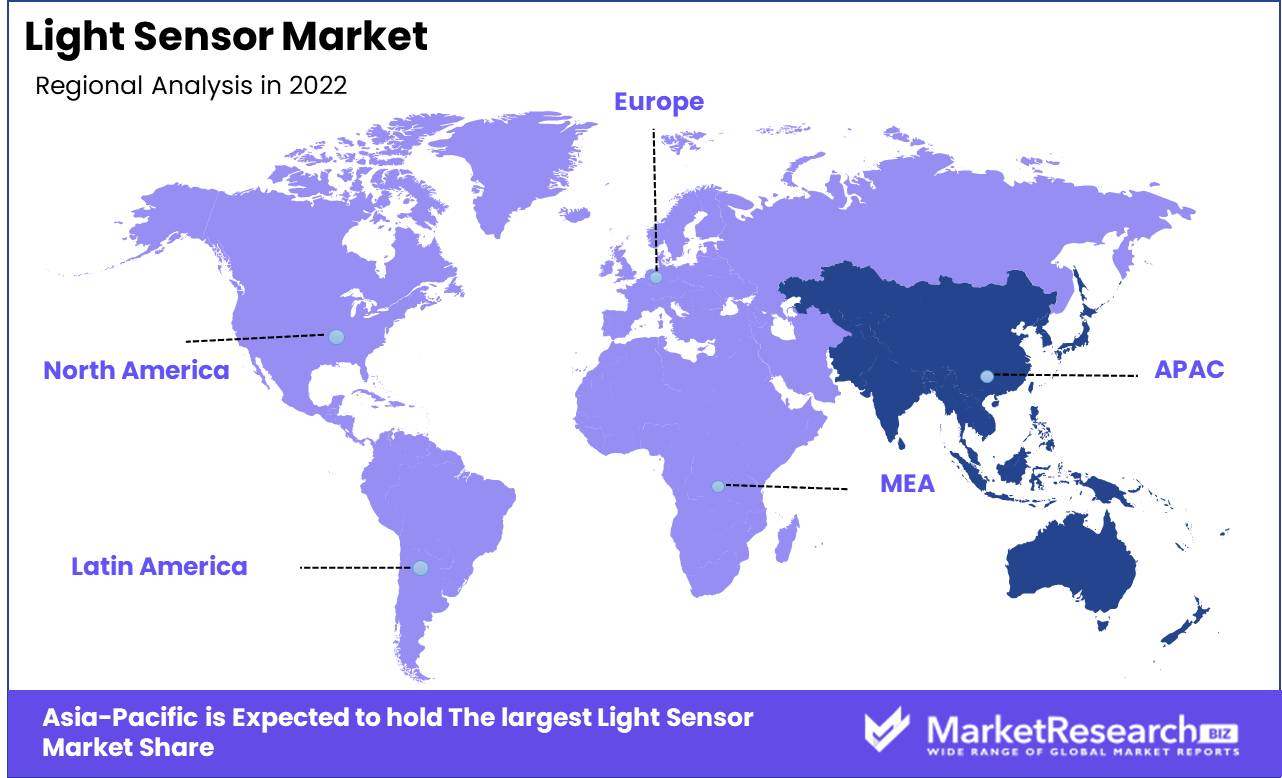

Regional Analysis

The Asia-Pacific region's large customer base is a major element in its light sensor market dominance. A large population in the region is adopting smart gadgets and IoT technologies. Manufacturers are adding light sensors to smartphones, wearables, and other products to meet demand. Thus, the Asia-Pacific region has become a light sensor production hub, offering a wide range of precision and reliable devices.

The region's dominance is also due to energy efficiency's rise. Governments in the Asia Pacific region prioritize the development and deployment of sustainable technologies to address environmental issues. Light sensors automatically alter display brightness, saving power and energy. This emphasis on eco-friendly methods has spurred the integration of light sensors in numerous sectors, supporting market growth in the region.

The Asia Pacific region has a growing automobile sector. To improve safety and driving enjoyment, automakers have added advanced driver-assistance systems (ADAS) to meet rising demand. ADAS uses ambient light sensors and proximity sensors to control headlamps, alter illumination, and monitor drivers. The Asia Pacific region's automobile market dominance has driven demand for light sensors.

The region's commitment to research and development has also helped light sensor market innovation. Advanced light sensor technologies are being developed by academic and technological institutes in the Asia-Pacific region. The region's leadership in miniaturization, sensitivity, and performance has been strengthened by this joint approach.

The Asia-Pacific region also has a supportive regulatory framework, government initiatives, and investment incentives. Policies and laws in major countries in the region promote semiconductor and electronics growth. Numerous foreign firms have been drawn to these activities, which have resulted in the construction of production facilities and research institutions specializing in light sensors. These industry heavyweights have strengthened the region's market dominance.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Texas Instruments (TI) is an American technology company. TI, a pioneer in the light sensor market, offers a wide range of technologically superior light sensor products. These sensors are designed for high precision, reliability, and efficiency and cater to consumer electronics, automotive, and industrial applications.

Panasonic Corporation, a Japanese multinational electronics company, is another major light sensor market player. Panasonic has a wide range of light sensors to meet the needs of many industries thanks to its commitment to innovation and technology.

Siemens, a German technology giant, has advanced the light sensor market. Precision, durability, and versatility characterize the company's light sensors. Siemens develops new solutions that cater to a variety of industrial applications using its experience in sensor technology.

American multinational Honeywell International Inc. dominates the light sensor market. Honeywell's light sensors are designed to meet crucial applications in aerospace, medical, and industrial automation.

ABB, a pioneering technology leader in electrification, automation, and digitalization, has established itself as a light sensor market player. The company's light sensors excel in performance, precision, and reliability.

Analog Devices, a global leader in high-performance analog and digital signal processing, has contributed to the light sensor market. The company's light sensors have high sensitivity, low power consumption, and high performance, making them appropriate for many applications.

Top Key Players in Light Sensor Market

- Texas Instruments Incorporated (U.S.)

- Panasonic Corporation (Japan)

- Siemens (Germany)

- Honeywell International Inc. (U.S.)

- ABB (Switzerland)

- Analog Devices, Inc. (U.S.)

- General Electric Company (U.S.)

- Kongsberg (Norway)

- Emerson Electric Co. (U.S.)

- STMicroelectronics (Switzerland)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Maxim Integrated (U.S.)

- Mouser Electronics, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- T.E. Connectivity (Switzerland)

- OMEGA Engineering Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Endress+Hauser Hauser Group Services AG (Switzerland)

- Amphenol Corporation (U.S.)

Recent Development

- In 2023, The light sensor market is expected to boom, cementing its position as a key industry sector.

- In 2022, Light sensors were integrated into vehicles, improving driving experiences, safety, and fuel efficiency.

- In 2021, The automobile industry will be the second-largest light sensor market.

- In 2020, The sector had the third-highest light sensor market share. These sensors provide accurate diagnosis, surgery, and patient monitoring.

- In 2019, Light sensors have spread throughout industries.

Report Scope

Report Features Description Market Value (2022) USD 3.3 Bn Forecast Revenue (2032) USD 9.2 Bn CAGR (2023-2032) 11.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Function Type (Ambient Light Sensing, Proximity Detection, RGB Color Sensing, Gesture Recognition, IR Detection), By Output (Analog, Digital), By Applications (Placement Detection, Brightness Control, Digital Segment, Planning, Agriculture), By End-Use (Automotive, Consumer Electronics, Healthcare, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Texas Instruments Incorporated (U.S.), Panasonic Corporation (Japan), Siemens (Germany), Honeywell International Inc. (U.S.), ABB (Switzerland), Analog Devices, Inc. (U.S.), General Electric Company (U.S.), Kongsberg (Norway), Emerson Electric Co. (U.S.), STMicroelectronics (Switzerland), Microchip Technology Inc. (U.S.), NXP Semiconductors (Netherland), Maxim Integrated (U.S.), Mouser Electronics, Inc. (U.S.), Robert Bosch GmbH (Germany), T.E. Connectivity (Switzerland), OMEGA Engineering Inc. (U.S.), Semiconductor Components Industries, LLC (U.S.), Endress+Hauser Hauser Group Services AG (Switzerland), Amphenol Corporation (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Texas Instruments Incorporated (U.S.)

- Panasonic Corporation (Japan)

- Siemens (Germany)

- Honeywell International Inc. (U.S.)

- ABB (Switzerland)

- Analog Devices, Inc. (U.S.)

- General Electric Company (U.S.)

- Kongsberg (Norway)

- Emerson Electric Co. (U.S.)

- STMicroelectronics (Switzerland)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Maxim Integrated (U.S.)

- Mouser Electronics, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- T.E. Connectivity (Switzerland)

- OMEGA Engineering Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Endress+Hauser Hauser Group Services AG (Switzerland)

- Amphenol Corporation (U.S.)