Life Science Tools Market By Technology (Genomics, Cell Biology, Proteomics, Stem Cell Research, Immunology), By Product (Consumables, Instruments, Services), By Application (Drug Discovery and Development, Clinical Diagnostics, Genomic and Proteomic Research, Cell Biology Research, Others), By End-User (Biopharmaceutical Companies, Government & Academic Institutes, Industrial Applications, Healthcare, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48171

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

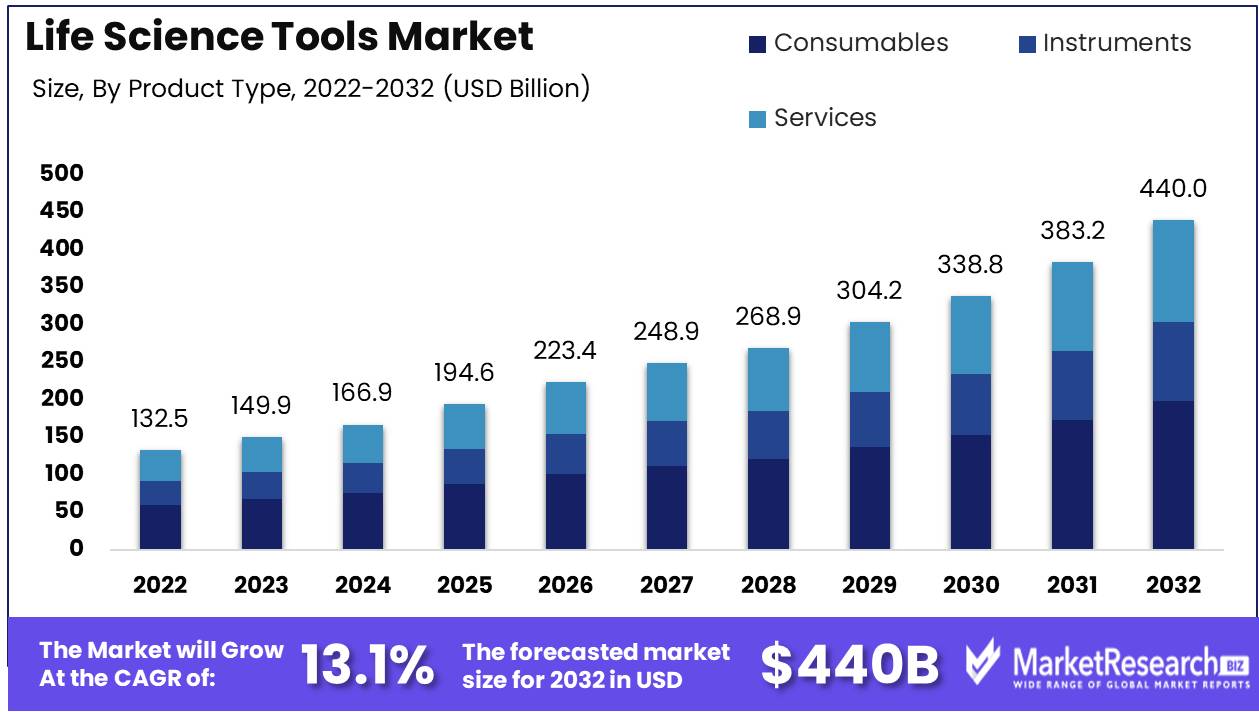

The Life Science Tools Market was valued at USD 132.5 billion in 2023. It is expected to reach USD 440.0 billion by 2033, with a CAGR of 13.1% during the forecast period from 2024 to 2033.

The Life Science Tools Market encompasses a broad range of products and technologies used in research, diagnostics, and therapeutic development within the life sciences sector. This market includes instruments, reagents, consumables, and software essential for activities such as genomic sequencing, proteomics, cell biology, and drug discovery. Advancements in these tools drive innovation and efficiency in scientific research and clinical applications, fostering the development of personalized medicine and biotechnology solutions.

The Life Science Tools market is poised for significant growth, driven by a confluence of technological advancements and increased financial investments. Innovations in sequencing technologies, bioinformatics, and imaging techniques are at the forefront, enhancing the capabilities and efficiency of life science research. These advancements enable researchers to conduct more precise and comprehensive studies, thereby accelerating discoveries and therapeutic developments.

Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into life science tools is revolutionizing data analysis and predictive modeling, offering unprecedented insights and fostering a more robust research environment. Such technological integration not only streamlines complex data processes but also enhances the accuracy and speed of research outcomes, positioning the market for robust expansion.

However, The high costs associated with advanced life science tools and equipment present a significant barrier to growth, particularly in emerging economies where funding is often limited. In addition, strategic collaborations and partnerships within the industry are likely to mitigate some of these cost barriers, facilitating broader adoption of cutting-edge tools. Overall, while cost constraints present a notable challenge, the trajectory of the Life Science Tools market remains positive, underpinned by continuous technological advancements and strong investment flows.

Key Takeaways

- Market Growth: The Life Science Tools Market was valued at USD 132.5 billion in 2023. It is expected to reach USD 440.0 billion by 2033, with a CAGR of 13.1% during the forecast period from 2024 to 2033.

- By Technology: Cell Biology dominated due to advancements in single-cell analysis.

- By Product: Consumables dominated the diverse Life Science Tools Market.

- By Application: Drug Discovery and Development dominated the Life Science Tools Market.

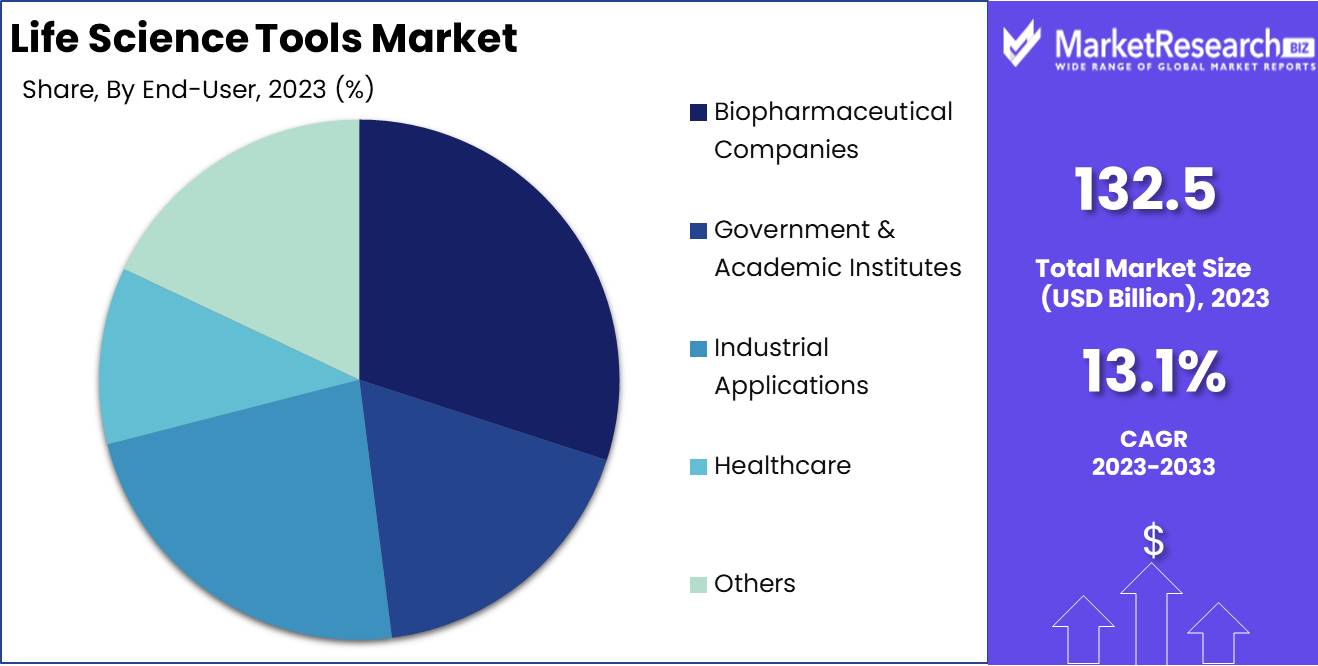

- By End-User: Biopharmaceutical Companies dominate the diverse life science tools market.

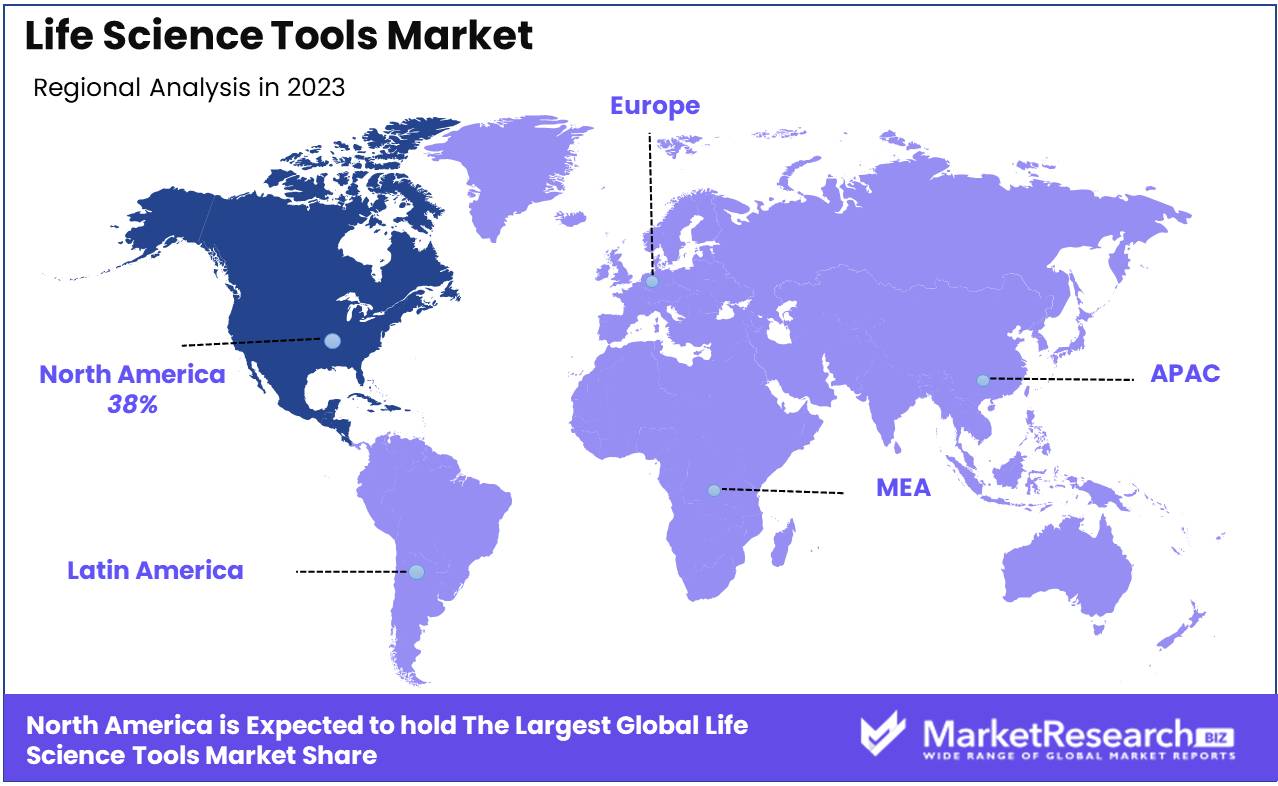

- Regional Dominance: North America dominates the Life Science Tools market with 38% largest share.

- Growth Opportunity: The life science tools market will grow significantly, driven by rising diagnostic test demand and miniaturized, automated instruments.

Driving factors

Surge in Biopharmaceutical Demand and Escalating Funding for Life Science Research

The life science tools market is significantly propelled by the increasing demand for biopharmaceuticals, coupled with the heightened investment in life science research. The biopharmaceutical sector has witnessed substantial growth, driven by the rising prevalence of chronic diseases and the development of advanced therapeutic solutions. In 2022, global biopharmaceutical sales were estimated to be over $350 billion, reflecting a robust annual growth rate. This surge is underpinned by substantial investments from both the public and private sectors.

These investments facilitate the development and refinement of life science tools, enhancing their precision, efficiency, and applicability. The influx of capital ensures sustained research and development (R&D) activities, leading to the introduction of cutting-edge tools that cater to the evolving needs of biopharmaceutical companies. Consequently, this symbiotic relationship between biopharmaceutical demand and research funding drives the expansion of the life science tools market.

Expanding Role of Cell Biology Technology in Drug Discovery

The growing application of cell biology technology in drug discovery is another pivotal factor fueling the growth of the life science tools market. Cell biology tools, including advanced imaging systems, high-throughput screening platforms, and cell culture technologies, are integral to the drug discovery process. These tools enable researchers to understand disease mechanisms at a cellular level, identify potential drug targets, and evaluate the efficacy and toxicity of new compounds.

The adoption of cell biology technologies has been accelerated by the need for more efficient and precise drug discovery processes. For instance, high-content screening (HCS) systems have revolutionized the identification of drug candidates by allowing simultaneous testing of thousands of compounds. The global market for HCS is projected to reach $1.2 billion by 2025, indicating its critical role in drug discovery.

Moreover, advances in cell biology technologies, such as CRISPR-Cas9 gene editing and induced pluripotent stem cells (iPSCs), have opened new avenues for personalized medicine and regenerative therapies. These innovations necessitate sophisticated tools and technologies, thereby driving market growth. The integration of artificial intelligence (AI) and machine learning (ML) in cell biology further enhances the capabilities of life science tools, providing deeper insights and accelerating the drug discovery timeline.

Increased Prevalence of Infectious Diseases and Genetic Disorders

The rising incidence of target infectious diseases and genetic disorders is a key driver of the life science tools market. The global health landscape has seen a surge in infectious diseases, such as COVID-19, which underscored the critical need for advanced diagnostic tools and research capabilities. According to the World Health Organization (WHO), there were over 500 million confirmed COVID-19 cases worldwide by mid-2022, highlighting the urgent demand for robust life science tools.

Genetic disorders, affecting approximately 10% of the global population, also contribute significantly to market growth. The increased focus on understanding and treating these disorders has led to the adoption of advanced genomic and proteomic tools. Technologies such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) are pivotal in diagnosing genetic conditions and tailoring personalized treatment plans. The global NGS market is expected to reach $20 billion by 2026, reflecting its growing importance in healthcare.

Furthermore, the development of targeted therapies for genetic disorders necessitates the use of sophisticated life science tools for precise genetic analysis and manipulation. The convergence of these factors creates a conducive environment for the growth of the life science tools market, as researchers and healthcare providers seek innovative solutions to address these pressing health challenges.

Restraining Factors

Regulatory Complexity as a Major Barrier to Market Expansion

The complexity of the regulatory landscape is a significant restraining factor in the growth of the Life Science Tools Market. Regulatory requirements for life science tools, which vary widely across regions, create a multifaceted challenge for market players. Navigating these diverse and often stringent regulatory standards demands substantial resources and expertise. Compliance with agencies such as the FDA in the United States, the EMA in Europe, and the PMDA in Japan requires comprehensive documentation, rigorous testing, and ongoing quality assurance, which can be both time-consuming and costly.

For instance, gaining approval for new life science tools involves detailed submission processes, clinical trials, and post-market surveillance. This regulatory burden can slow down the time-to-market for innovative tools, thereby delaying the potential revenue generation from these products. Smaller companies, in particular, may find it difficult to allocate the necessary resources for compliance, potentially stifling innovation and limiting their market entry. Consequently, the complex regulatory landscape acts as a significant impediment to the rapid growth and scalability of life science tools.

Intellectual Property Challenges Limiting Innovation and Market Dynamics

Intellectual property (IP) challenges pose another formidable barrier to the growth of the Life Science Tools Market. The life sciences sector is highly dependent on innovation and the development of proprietary technologies. However, the process of securing and defending patents can be fraught with difficulties. Patent applications are often complex, requiring significant legal expertise and financial investment. Additionally, the lifecycle of patents means that companies must continually innovate to maintain a competitive edge, which can be a resource-intensive endeavor.

The threat of IP litigation further exacerbates this challenge. Companies must be vigilant in protecting their intellectual property from infringement, which can lead to costly legal battles. For example, high-profile cases of patent disputes can result in substantial financial losses and distract companies from their core research and development activities. Furthermore, the fear of infringement can deter smaller companies from entering the market, limiting competition and potentially slowing the pace of innovation. This defensive posture can reduce the overall dynamism of the market, as companies may become more risk-averse in their research endeavors.

By Technology Analysis

In 2023, Cell Biology dominated due to advancements in single-cell analysis.

In 2023, Cell Biology held a dominant market position in the By Technology segment of the Life Science Tools Market, encompassing key areas such as Genomics, Proteomics, Stem Cell Research, and Immunology. The robust growth of the Cell Biology sector is driven by advancements in single-cell analysis technologies, enhancing our understanding of cellular mechanisms and disease pathways. This progress has significant implications for personalized medicine and therapeutic interventions.

Genomics within this domain leverages next-generation sequencing (NGS) and CRISPR technologies to explore genetic variations and their impacts on cellular functions. These innovations contribute to the rising demand for genomic analysis tools. Proteomics, focusing on the large-scale study of proteins, complements genomic data, offering insights into protein expression and interactions, which are vital for biomarker discovery and drug development.

Stem Cell Research continues to expand, driven by its potential in regenerative medicine and tissue engineering. Advances in cell culture techniques and differentiation protocols have bolstered this field, supporting the development of novel therapeutic strategies for various diseases. Lastly, Immunology benefits from enhanced cell biology tools, facilitating the study of immune responses and the development of immunotherapies, including cancer immunotherapy and vaccines.

By Product Analysis

In 2023, Consumables dominated the diverse Life Science Tools Market.

In 2023, Consumables held a dominant market position in the by-product segment of the Life Science Tools Market. This dominance can be attributed to the ongoing demand for high-quality reagents, kits, and labware necessary for various research and diagnostic applications. Consumables, including assay kits, reagents, and laboratory chemicals, are indispensable in life sciences research due to their single-use nature, ensuring experimental consistency and reliability.

Conversely, Instruments also saw significant demand, driven by advancements in analytical technologies such as next-generation sequencing (NGS), mass spectrometry, and PCR systems. These instruments are crucial for enabling complex biological analyses and supporting the growth of personalized medicine. High capital investment and technological advancements in automation further propel this segment.

Lastly, Services encompass a wide array of offerings from contract research and manufacturing to data analysis and bioinformatics services. The increasing trend towards outsourcing in the life sciences sector, coupled with the need for specialized expertise, has bolstered this segment. Services ensure cost-efficiency, flexibility, and access to advanced technological capabilities for companies, making it a vital component of the market landscape.

By Application Analysis

In 2023, Drug Discovery and Development dominated the Life Science Tools Market.

In 2023, Drug Discovery and Development held a dominant market position in the By Application segment of the Life Science Tools Market. This segment's prominence can be attributed to the increasing investment in pharmaceutical research and development, coupled with technological advancements in drug discovery methodologies. Key innovations such as high-throughput screening, artificial intelligence, and bioinformatics have accelerated the pace at which new therapeutic agents are identified and developed, significantly contributing to this segment's growth.

Clinical Diagnostics followed closely, driven by the growing need for accurate and early disease detection, which has been amplified by the recent global health crises. The advent of advanced diagnostic tools, including next-generation sequencing and advanced imaging techniques, has enabled more precise and rapid diagnosis, thereby improving patient outcomes.

Genomic and Proteomic Research represented another critical segment, propelled by the surge in genomics initiatives and proteomics research aimed at understanding complex biological systems. The increasing availability of genomic data and sophisticated analytical tools has opened new avenues for research and therapeutic development.

Cell Biology Research also played a vital role, supported by advancements in cell imaging technologies, stem cell research, and regenerative medicine. The potential for developing innovative treatments for various diseases through cellular therapies has heightened the significance of this segment.

Other applications, including environmental testing and forensic science, contributed to the market by leveraging life science tools for diverse analytical purposes, underlining the broad applicability and essential nature of these tools across multiple domains.

By End-User Analysis

In 2023, Biopharmaceutical Companies dominated the diverse life science tools market.

In 2023, Biopharmaceutical Companies held a dominant market position in the By End-User segment of the Life Science Tools Market. This segment, encompassing five key areas biopharmaceutical companies, government and academic institutes, industrial applications, healthcare, and others illustrates the diverse application and critical importance of life science tools across industries.

Biopharmaceutical Companies lead due to their significant investment in research and development, driven by the increasing demand for novel therapeutics and personalized medicine. Their focus on innovation, coupled with substantial financial resources, propels advancements in genomics, proteomics, and bioinformatics, fostering the adoption of cutting-edge life science tools.

Government and Academic Institutes play a pivotal role by contributing to foundational research and development. Funded by public and private grants, these institutions drive early-stage research, often collaborating with industry players to translate basic research into clinical applications. Industrial Applications leverage life science tools for quality control, process optimization, and environmental monitoring, reflecting their critical role in ensuring the safety and efficacy of products ranging from pharmaceuticals to food and beverages.

Healthcare facilities utilize these tools for diagnostic purposes, improving patient outcomes through advanced diagnostic techniques and personalized treatment plans. The Others category includes entities such as contract research organizations (CROs) and agricultural biotechnology firms, which adopt life science tools for specialized research and commercial purposes.

Key Market Segments

By Technology

- Genomics

- Cell Biology

- Proteomics

- Stem Cell Research

- Immunology

By Product

- Consumables

- Instruments

- Services

By Application

- Drug Discovery and Development

- Clinical Diagnostics

- Genomic and Proteomic Research

- Cell Biology Research

- Others

By End-User

- Biopharmaceutical Companies

- Government & Academic Institutes

- Industrial Applications

- Healthcare

- Others

Growth Opportunity

Increasing Demand for Diagnostic Tests

The post-pandemic era has heightened the global focus on healthcare, particularly on the need for efficient and accurate diagnostic tests. This surge in demand is largely driven by a growing awareness of early disease detection's critical role in improving patient outcomes. According to market reports, the diagnostic testing segment is expected to see a significant uptick, fueled by the increasing prevalence of chronic diseases and the continuous threat of emerging infectious diseases. As healthcare systems worldwide prioritize early detection and prevention, companies specializing in diagnostic tools are likely to experience robust growth. This trend is further supported by technological advancements that enhance the accuracy and efficiency of these tests, making them more accessible and reliable.

Increasing Demand for Miniaturized and Automated Instruments

Parallel to the demand for diagnostic tests is the rising interest in miniaturized and automated instruments. These tools offer enhanced precision, efficiency, and ease of use, which are essential for modern laboratory environments. Automation in life science tools minimizes human error, increases throughput, and ensures reproducibility, thereby addressing the critical needs of research and clinical laboratories. The trend towards miniaturization, driven by the need for portable and user-friendly devices, is also a significant growth catalyst. This demand is particularly strong in genomics, proteomics, and personalized medicine, where precision and high-throughput capabilities are paramount.

Latest Trends

Digital Transformation: Enhancing Data-Driven Precision

The life science tools market is undergoing a profound digital transformation, fundamentally altering the landscape of research and development. Advanced data analytics, artificial intelligence (AI), and machine learning (ML) are increasingly integrated into laboratory workflows, enhancing the precision, speed, and reproducibility of experiments. The adoption of cloud-based platforms facilitates seamless data sharing and collaboration across global research teams, driving innovation and accelerating time-to-market for new therapies.

Furthermore, digital solutions enable more sophisticated modeling and simulation, reducing the reliance on costly and time-consuming physical trials. This transformation is not only streamlining research processes but also creating a more agile and responsive R&D environment, capable of addressing complex biological questions with unprecedented accuracy.

Automation and Robotics: Revolutionizing Laboratory Efficiency

Automation and robotics are set to revolutionize laboratory operations, offering significant improvements in efficiency, throughput, and reliability. High-throughput screening, liquid handling systems, and automated sample preparation are becoming standard in life science laboratories, minimizing human error and increasing consistency in experimental results. Robotics are particularly impactful in areas such as genomics and proteomics, where they can handle large volumes of samples with precision and speed that far exceed manual capabilities.

Additionally, the integration of robotics with AI-driven systems allows for adaptive learning and optimization of laboratory workflows, leading to enhanced productivity and innovation. As these technologies continue to evolve, they are expected to play a crucial role in addressing the increasing demand for high-quality, reproducible scientific data, ultimately driving advancements in personalized medicine and other cutting-edge fields.

Regional Analysis

North America dominates the Life Science Tools market with 38% largest share.

The Life Science Tools market exhibits a diverse regional distribution, with North America leading the sector. In North America, the market is driven by substantial investments in biotechnological research, robust healthcare infrastructure, and a high adoption rate of advanced technologies. The region accounted for approximately 38% of the global market share in 2023, underscored by the presence of major industry players and significant funding from government and private entities.

Europe follows closely, characterized by extensive research initiatives and supportive regulatory frameworks. Countries like Germany, the UK, and France are pivotal, contributing to around 28% of the market share. The Asia Pacific region is witnessing rapid growth, driven by increasing healthcare expenditure, burgeoning biotech industries, and expanding R&D activities, particularly in China, Japan, and India. This region accounts for about 22% of the market, reflecting its emerging status and investment influx.

In the Middle East & Africa, the market is expanding steadily, supported by improving healthcare infrastructure and growing academic research, though it still represents a smaller share at approximately 6%. Latin America, with Brazil and Mexico as key contributors, is gradually developing its life science tools market, accounting for roughly 6% of the global share, driven by increasing awareness and investment in healthcare and research sectors.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Life Science Tools Market in 2024 is poised for significant growth, driven by technological advancements, increased research funding, and a rising focus on personalized medicine. Agilent Technologies continues to excel through its comprehensive suite of analytical instruments and lab services, addressing critical needs in genomics, proteomics, and metabolomics. Becton, Dickinson, and Company is enhancing its market position by expanding its diagnostics and biosciences segments, catering to the burgeoning demand for advanced molecular diagnostics.

Hoffmann-La Roche Ltd. and Bio-Rad Laboratories, Inc. are pioneering advancements in genomics and life science research, with Roche's robust investments in precision medicine and Bio-Rad’s innovation in digital PCR technology. Danaher Corporation and Thermo Fisher Scientific, Inc. dominate the market with their diverse portfolios, integrating acquisitions to bolster their life sciences capabilities.

Illumina, Inc. remains a key player in next-generation sequencing (NGS), driving personalized healthcare initiatives. Meanwhile, Merck KGaA and Qiagen N.V. are enhancing their genomic and proteomic research tools, emphasizing precision medicine.

Emerging trends in imaging and analytical instruments see Bruker Corporation, ZEISS International, and Oxford Instruments plc pushing the envelope in high-resolution imaging and spectroscopy. GE Healthcare and Shimadzu Corporation's advancements in bioimaging and analytical technologies further diversify the market landscape.

In conclusion, the strategic initiatives, robust R&D investments, and technological innovations by these key players are anticipated to propel the Life Science Tools Market forward, fostering a dynamic and competitive environment.

Market Key Players

- Agilent Technologies

- Becton, Dickinson, and Company

- Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Danaher Corporation

- GE Healthcare

- Hitachi, Ltd.

- Illumina, Inc.

- Merck KGaA

- Oxford Instruments plc

- Qiagen N.V.

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- ZEISS International

Recent Development

- In June 2024, Thermo Fisher Scientific announced the acquisition of Olink Proteomics for $3.1 billion. This strategic move aims to enhance Thermo Fisher's portfolio in proteomics and genomics, providing researchers with advanced tools for protein biomarker discovery and validation.

- In April 2024, Danaher Corporation launched a new high-throughput cell analyzer platform, the Cytiva AccelX. This platform is designed to accelerate cell biology research by offering enhanced speed and precision in cell analysis, which is crucial for drug discovery and development processes.

- In March 2024, PerkinElmer entered into a strategic partnership with Illumina to co-develop and market advanced sequencing solutions. This collaboration aims to leverage Illumina's sequencing technology and PerkinElmer's expertise in automation and sample preparation to streamline next-generation sequencing workflows.

Report Scope

Report Features Description Market Value (2023) USD 132.5 Billion Forecast Revenue (2033) USD 440.0 Billion CAGR (2024-2032) 13.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Genomics, Cell Biology, Proteomics, Stem Cell Research, Immunology), By Product (Consumables, Instruments, Services), By Application (Drug Discovery and Development, Clinical Diagnostics, Genomic and Proteomic Research, Cell Biology Research, Others), By End-User (Biopharmaceutical Companies, Government & Academic Institutes, Industrial Applications, Healthcare, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Agilent Technologies, Becton, Dickinson and Company, Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Bruker Corporation, Danaher Corporation, GE Healthcare, Hitachi, Ltd., Illumina, Inc., Merck KGaA, Oxford Instruments plc, Qiagen N.V., Shimadzu Corporation, Thermo Fisher Scientific, Inc., ZEISS International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Agilent Technologies

- Becton, Dickinson, and Company

- Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Danaher Corporation

- GE Healthcare

- Hitachi, Ltd.

- Illumina, Inc.

- Merck KGaA

- Oxford Instruments plc

- Qiagen N.V.

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- ZEISS International