Knitwear Market Report By Product Type (Innerwear, T-Shirts & Shirts, Sweaters & Jackets, Sweatshirts & Hoodies, and Others), By Material Type (Natural, Synthetic, Blended, Others), By End-User, Distribution Channel , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

-

44382

-

May 2023

-

199

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

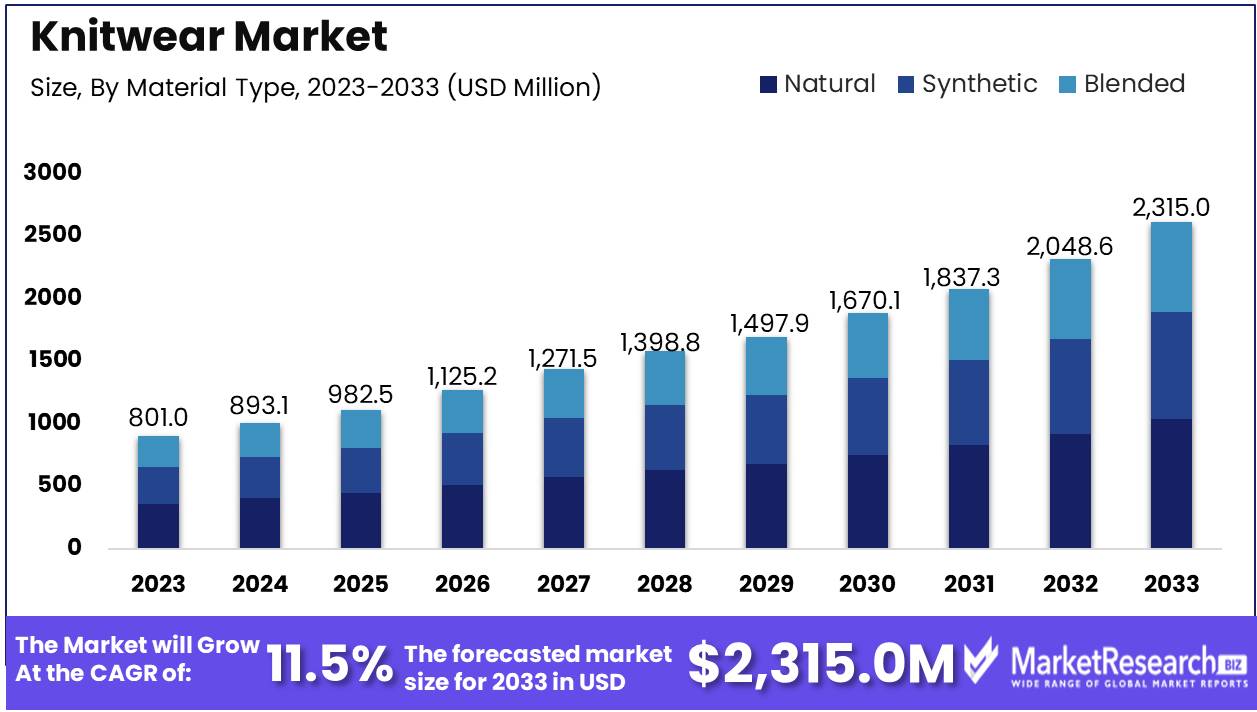

The Knitwear Market was valued at USD 801.0 million in 2023. It is expected to reach USD 2,315.0 million in 2033, with a CAGR of 11.5 % during the forecast period from 2024 to 2033.

The Knitwear Market is a dynamic and multifaceted sector that plays a significant role in the global apparel industry. Product offerings in this market include sweaters, cardigans, knit tops, dresses, and other accessories available in men, women, and children categories, so their scope is quite broad. The Activity thus in the market would come from the fusion between traditional craftsmanship with contemporary or modern technical innovations, hence a space of growth and creativity.

The knitwear market is undergoing a major shift, highlighted by key investments and partnerships that showcase the industry's changing landscape and potential for future growth. For instance, in 2023, Fakir Knitwear Limited announced a significant move with a $45.82 million investment to build a new knit composite factory in Bangabandhu Sheikh Mujib Shilpa Nagar (BSMSN), Chattogram. This decision reflects a larger trend towards increasing production capacity and enhancing the integration of different processes within the knitwear sector.

In another development, Ramp Knitwear and similar companies successfully raised over $32.9 million through two rounds of funding in 2024, involving three investors. This influx of funds highlights the industry's appeal to investors and its readiness for innovation and expansion. Moreover, the collaboration between Danish fashion brand Object and recycling pioneer Sodra Group in 2024 to create a knitwear line partly made from textile waste marks a significant step towards sustainable practices and innovation in materials within the knitwear market.

Technological progress is also a key theme, as seen with the introduction of Autarkic Direct Feeding (ADF) machines by Stoll. These machines bring new possibilities for flexibility and creativity in knitwear design, showing a strong push towards innovation. This is happening in a market that's being shaped by various factors, such as changing fashion trends, the impact of seasons, new materials, cultural and lifestyle shifts, and changes in consumer demographics.

These developments collectively signal a knitwear market that's not just growing and becoming more diverse, but also moving towards sustainability, technological advancement, and a stronger focus on meeting consumer needs. This creates a rich landscape for strategic investments and partnerships, offering a way to leverage new opportunities and tackle the challenges in an ever-evolving market environment.

Key Takeaways

- Market Growth - In 2023, the value of the Knitwear Market was $801.0 million. It's projected to grow to $2,315.0 million by 2033, experiencing an annual growth rate of 25.4% from 2024 to 2033.

- Analyst view Point - The knitwear market is experiencing transformative growth through strategic investments, technological innovation, and a shift towards sustainable practices.

- Product Type: Sweatshirts & Hoodies dominate the knitwear market, commanding a 35.2% share, reflecting a strong consumer preference for casual and versatile attire.

- Material Type : Natural fibers dominate the knitwear market with a commanding 48.5% share, underscoring a consumer shift towards eco-friendly and sustainable materials.

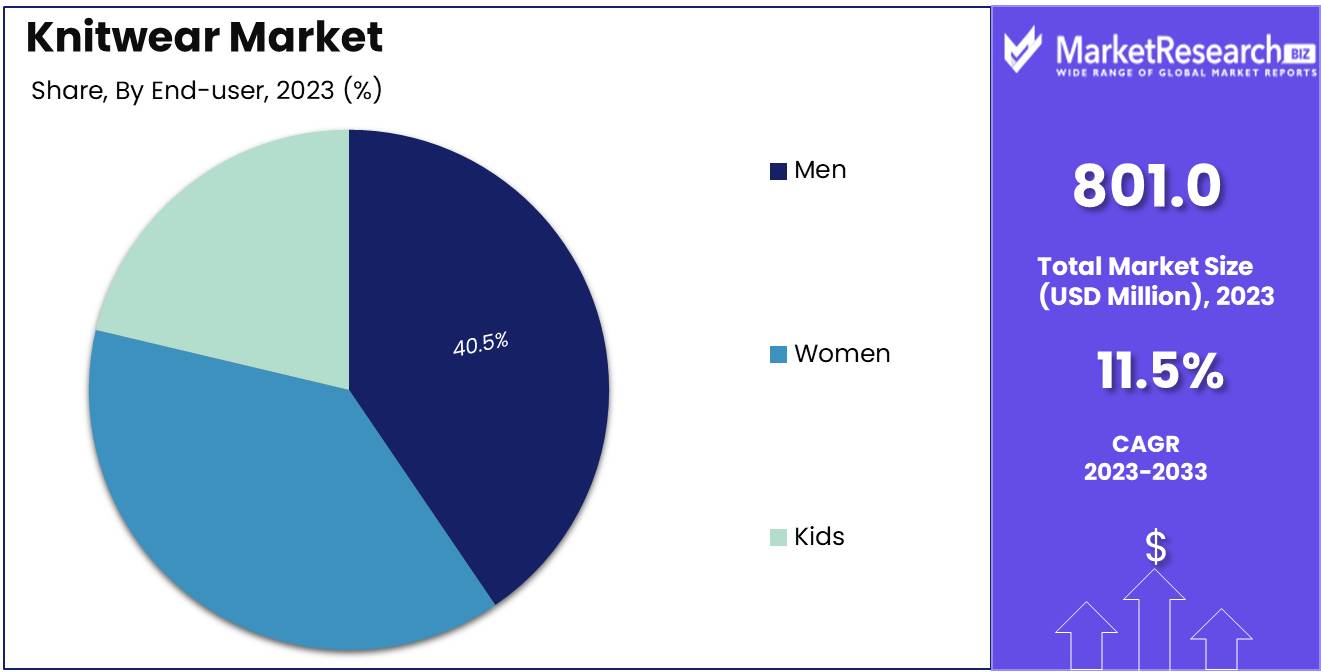

- End-user : The men segment dominates the knitwear market with a 40.5% share, driven by increasing demand for versatile and comfortable apparel

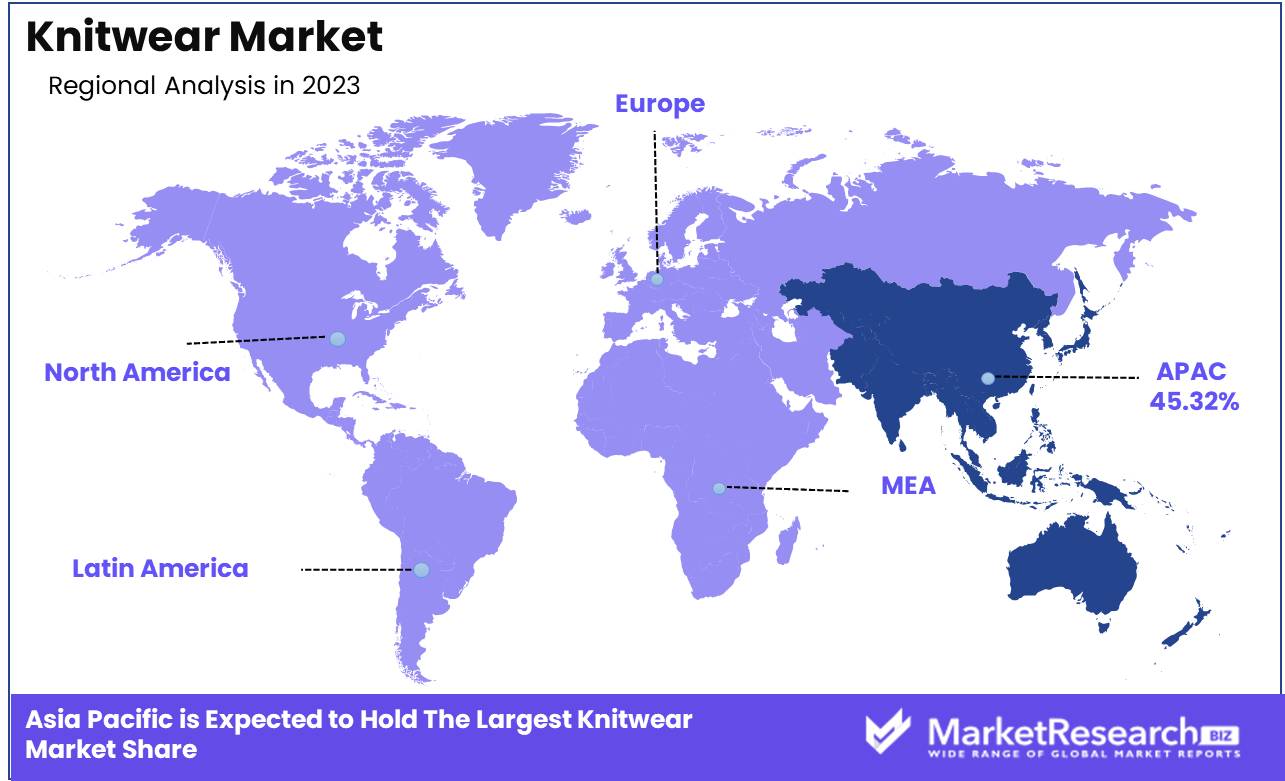

- Regional Dominance: The Asia-Pacific region dominates the knitwear market with a 45.32% share, driven by its robust manufacturing capabilities and expanding consumer base.

- Growth Opportunity: Rising demand in developing countries and the expansion of e-commerce are key growth drivers for the knitwear market, with digital platforms expected to play a crucial role in reaching a broader consumer base in 2024.

Driving Factor

Fashion Trends Drive Market Growth

Fashion trends are a pivotal force propelling the knitwear market forward. As the global fashion landscape evolves, so does consumer demand for knitwear that aligns with the latest styles, colors, and designs. This constant flux encourages innovation among knitwear manufacturers and designers, who strive to incorporate contemporary fashion elements into their products. The influence of fashion trends is not just about aesthetics; it also involves the integration of new fabrics and knitting technologies to create pieces that are not only stylish but also comfortable and functional.

Cultural and Lifestyle Influences Reshape Market Contours

The knitwear market is deeply influenced by cultural and lifestyle trends, reflecting broader societal shifts towards casual, comfortable, and sustainable clothing. The rise of remote work, for instance, has amplified the demand for cozy, versatile knitwear suitable for both home and office settings, illustrating how lifestyle changes directly impact market dynamics.

Moreover, the increasing consumer consciousness around ethical and sustainable fashion has pushed brands to adopt eco-friendly practices and materials, resonating with a growing segment of the market. These cultural shifts not only shape product design and marketing strategies but also foster a more engaged and loyal customer base, driving growth through a strong alignment with consumer values and expectations.

Material Innovation Shapes Market Dynamics

Material innovation stands at the core of the knitwear market's evolution, offering new opportunities for differentiation and value addition. Advances in textile technology have led to the development of high-performance, sustainable, and versatile yarns, revolutionizing product offerings. These innovations meet a growing consumer demand for durability, comfort, and eco-friendliness, attributes increasingly sought after in the fashion industry.

The integration of smart textiles, capable of temperature regulation, moisture management, and even health monitoring, further exemplifies how material innovation not only caters to aesthetic preferences but also functional needs. This convergence of fashion, functionality, and sustainability through material innovation significantly contributes to market growth, appealing to a broader consumer base looking for products that align with their values and lifestyle needs.

Retraining Factors

Fluctuating Raw Materials Prices Retraining Market Growth

The volatility of raw material prices significantly restraints the growth of the knitwear market. Costs of essential materials like cotton, nylon, rayon, and polyester are closely tied to global commodities markets, including crude oil prices, and are subject to natural fluctuations in conditions such as rainfall, humidity, and solar radiation. These fluctuations can lead to unpredictability in production costs, impacting the bottom line for knitwear manufacturers. When raw material costs rise, manufacturers may be forced to increase product prices, potentially reducing consumer demand.

Moreover, smaller players in the market, with less capacity to absorb cost increases, may find it particularly challenging to compete, leading to reduced diversity within the market. The interplay between raw material cost volatility and market dynamics underscores a complex relationship where manufacturers must navigate price sensitivities while striving to maintain quality and innovation in a competitive landscape.

Limited Supply of Raw Materials and Costly Production Processes Retraining Market Growth

The knitwear market's growth is further restrained by the limited availability of certain high-demand raw materials, such as cashmere wool, and the intricate, often costly, production processes involved. Cashmere wool, known for its softness, warmth, and lightweight properties, is highly sought after in the knitwear industry. However, its production involves extensive labor and resource inputs, from the careful rearing of cashmere goats to the delicate processing of their wool.

This limited supply, coupled with high demand, drives up costs, making cashmere products more expensive and less accessible to a broader market segment. The challenge is exacerbated for manufacturers striving to balance cost-efficiency with the growing consumer demand for sustainable and ethically produced goods. This constraint not only affects pricing and accessibility but also influences market competition and innovation, as brands seek alternative materials and production methods that offer similar quality without the associated high costs and supply limitations.

Product Type Analysis

In 2023, Sweatshirts & Hoodies held a dominant market position in the Product Type segment of the knitwear market, capturing more than a 35.2% share. This significant market share can be attributed to the growing consumer preference for casual and comfortable clothing, bolstered by the rise of remote working and the increasing popularity of athleisure trends. The versatility and functionality of sweatshirts and hoodies, catering to both fitness enthusiasts and those seeking comfort in day-to-day wear, have positioned them as staple items in consumers' wardrobes.

Following closely, T-Shirts & Shirts accounted for a 22.3% share of the market, driven by the universal appeal of these garments. Their ease of integration into various styles, from casual to semi-formal, along with the vast array of designs and materials available, has solidified their position within the knitwear sector.

Sweaters & Jackets constituted a 17.8% share, reflecting their essential role in colder climates and transitional seasons. Innovations in materials and knitting techniques have expanded their appeal beyond just warmth and comfort, incorporating fashion-forward designs that cater to a broad demographic.

The Innerwear segment, though more niche, captured a 10.1% share, emphasizing the importance of comfort, fabric quality, and durability in consumer choices for foundational garments. This segment's growth is also influenced by increasing awareness and demand for sustainable and ethically produced knitwear.

Shorts & Trousers, Evening Dresses, Suits, & Leggings, and Other Accessories collectively accounted for the remaining 14.6% of the market share. These segments benefit from seasonal trends, evolving fashion preferences, and the expansion of knitwear into formal and occasion wear, demonstrating the versatility and adaptability of knit fabrics across various apparel categories.

Material Type Analysis

In 2023, Natural Material held a dominant market position in the Material Type segment of the knitwear market, capturing more than a 48.5% share. This prominence underscores a growing consumer inclination towards sustainability and eco-friendliness, with natural materials like cotton, wool, and silk being highly prized for their comfort, breath ability, and biodegradability. The push towards environmentally responsible fashion has significantly influenced this shift, with both consumers and brands prioritizing materials that offer lower environmental footprints without compromising on quality and durability.

Synthetic fibers followed closely, accounting for a 31.7% share of the market. The popularity of synthetic materials such as polyester, nylon, and acrylic can be attributed to their durability, ease of maintenance, and versatility in design and coloration.

Blended materials, combining the best of both natural and synthetic fibers, captured a 19.8% share of the market. This segment benefits from the synergistic qualities of blended fibers, such as enhanced durability, improved texture, and added functionality .

End-user Analysis

In 2023, Men held a dominant market position in the End-user segment of the knitwear market, capturing more than a 40.5% share. This significant portion of the market can be attributed to the expanding range of knitwear options catering to men's fashion, combining functionality with style. The growth in this segment reflects a broader trend towards casual, versatile clothing that suits various occasions, from office wear to leisure activities. The increased focus on comfort, coupled with the rising interest in fashion among men, has contributed to the expansion of knitwear products tailored to their needs, including sweaters, cardigans, and knit-based activewear.

Women constituted a close second, accounting for 38.2% of the market share. The women's segment benefits from a wide variety of styles, patterns, and innovations in knitwear, ranging from everyday essentials to high-fashion items.

Kids' knitwear captured a 21.3% share, underlining the importance of durability, comfort, and ease of care in clothing for this demographic. The segment's growth is fueled by the parents' desire for high-quality, versatile knitwear that withstands the active lifestyle of children while being gentle on their sensitive skin.

Key Market Segments

Product Type

- Innerwear

- T-Shirts & Shirts

- Sweaters & Jackets

- Sweatshirts & Hoodies

- Shorts & Trousers

- Evening Dresses, Suits, & Leggings

- Other Accessories

Material Type

- Natural

- Synthetic

- Blended

End-user

- Men

- Women

- Kids

Distribution Channel

- Online

- Offline

Growth Opportunities

Emerging Markets Driving Demand

One of the most significant opportunities for the knitwear market in 2024 lies in the rising demand from developing countries. As economies grow, so does the middle class, bringing with it increased disposable income and a keen interest in fashion. This demographic shift presents a vast potential customer base for knitwear products, particularly in regions experiencing rapid urbanization and Westernization of consumer tastes. Brands that can tap into these markets with tailored marketing strategies and localized product offerings stand to gain a substantial foothold.

E-Commerce Expansion

The increasing penetration of the e-commerce industry offers another lucrative avenue for knitwear market growth. Online retail platforms provide an accessible, wide-reaching channel for brands to connect with consumers globally, breaking down traditional geographical and logistical barriers. In 2024, leveraging digital marketing and e-commerce platforms will be crucial for knitwear brands aiming to expand their reach and capitalize on the convenience and personalized shopping experiences that online retail offers.

Trends Analysis

Embracing Sustainability and Eco-Friendly Practices

As we move into 2024, sustainability is not just a trend but a cornerstone of the knitwear market's evolution. Brands are increasingly committing to eco-friendly practices, from sourcing sustainable materials to implementing energy-efficient production methods. This shift is driven by a growing consumer awareness of environmental issues and a demand for products that align with greener lifestyles. The use of organic fibers, recycling of textile waste, and reduction of water and chemical use in manufacturing processes are becoming standard practices, as both consumers and companies prioritize the planet's health alongside product quality.

Integration of Smart Fabrics

The knitwear market is set to be revolutionized by the incorporation of smart fabrics, which blend traditional comfort and warmth with cutting-edge technology. In 2024, expect to see knitwear items embedded with sensors and wearable technology, offering functionalities such as temperature regulation, health monitoring, and even connectivity to smartphones and other devices. This trend caters to a tech-savvy consumer base that values functionality and innovation, opening up new possibilities for knitwear in sports, healthcare, and everyday fashion.

Regional analysis

Asia-Pacific: The Leading knitwear Market Share with 45.32% Share: Dominating the global landscape, Asia-Pacific's stronghold in the knitwear market is unmistakable, holding a 45.32% share. This dominance is largely fueled by the powerhouse economies of China and India, both of which are key players in textile manufacturing and exportation. The region benefits from advanced production capabilities, cost efficiencies, and a rapidly expanding middle class with increasing disposable incomes, particularly in countries like South Korea and those within the ASEAN group. The diversity in fashion trends across these countries further propels market growth, making Asia-Pacific a crucial region for knitwear sales and innovation.

North America: A Hub of Innovation and Sustainability: In North America, the US and Canada represent significant markets, characterized by a strong demand for high-quality, sustainable knitwear. The region's consumers show a pronounced preference for eco-friendly and ethically produced garments, driving brands to focus on sustainable practices. The presence of both established and emerging designers, particularly in the US, adds to the region's reputation for innovative and trend-setting knitwear designs.

Europe: Tradition and Luxury Define the Market: Europe's knitwear market is deeply rooted in a rich tradition of textile craftsmanship, with countries like Italy and France being synonymous with luxury knitwear.

Latin America: Emerging with Vibrant Potential: Latin America, led by Brazil and Mexico, is emerging as a vibrant market for knitwear, thanks to its growing fashion industry and increasing consumer spending power.

Middle East & Africa: Luxury and Expanding Markets: The Middle East, particularly the GCC countries, represents a niche but lucrative knitwear Industry, characterized by a demand for luxury and high-end knitwear products.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the 2024 global knitwear market, key players are poised to leverage their unique strengths and strategic initiatives to navigate the evolving consumer preferences and technological advancements. Among these, Adidas AG and Puma SE, both hailing from Germany, stand out for their strong foothold in the sportswear segment, continuously innovating with smart fabrics and sustaainable materials to meet the growing demand for eco-friendly and high-performance knitwear. Their commitment to sustainability and innovation aligns closely with the market's shift towards environmentally responsible fashion.

Gildan Activewear Inc is another significant contender, known for its vast range of casual and activewear. The company's focus on ethical manufacturing and supply chain transparency resonates well with the increasing consumer demand for brands with strong corporate social responsibility.

Italian luxury brands like Loro Piana S.p.A. and Maglificio Ripa S.p.a stand at the forefront of the high-end segment, offering exquisite knitwear that combines traditional craftsmanship with modern aesthetics. Their emphasis on quality and heritage appeals to a niche market that values artisanal luxury.

In the U.S., Ralph Lauren and Nike Inc. continue to be key players, with their iconic designs and broad market appeal. Ralph Lauren's classic American styling and Nike's innovation in athletic knitwear offer diverse choices to consumers across various segments.

The U.K. 's Marks and Spencer Group plc and Hackett Ltd are notable for their blend of quality, value, and style, catering to a wide audience with their extensive knitwear collections.

Emerging players like Ecowool from New Zealand and Sana Hastakala (P) Ltd. from Nepal are carving out niches with their focus on sustainable, locally sourced wool and artisanal craftsmanship, appealing to the global market's growing appetite for ethically produced and unique knitwear.

As we look to 2024, these key players, with their diverse strategies and market positioning, are set to drive the global knitwear market forward, navigating challenges and seizing opportunities in a rapidly changing fashion landscape.

Top Key Players in Knitwear Market

- Adidas AG (Germany)

- Gildan Activewear Inc

- Loro Piana S.p.A. (Italy)

- Puma SE (Germany)

- Ralph Lauren (U.S.)

- The Nautical Company (UK) Ltd

- Victoria's Secret (the USA)

- Maglificio Ripa S.p.a (Italy)

- LENZING AG (Austria)

- Ecowool (New Zealand)

- Sana Hastakala (P) Ltd. (Nepal)

- THE GAP, INC (U.S.)

- Hackett Ltd (London)

- Marks and Spencer Group plc. (U.K)

- Nike Inc., (U.S.)

Recent Developments

- In 2023, Fakir Knitwear Limited plans to spend around $45.82 million to build a new factory at Bangabandhu Sheikh Mujib Shilpa Nagar in Mirsarai, Chattogram.

- In 2024, Ramp Knitwear and some other companies together got more than $32.9 million from two rounds of investment from three different investors.

- In 2024, the Danish fashion company Object, which is part of Bestseller, teamed up with the recycling company Sodra Group to create a new line of knitwear that includes materials made from recycled textiles.

- In 2023, a new type of knitting machine called Autarkic Direct Feeding (ADF) was introduced by Stoll. These machines can work with yarn in a more flexible way, allowing for more creative knitting designs.

Report Scope

Report Features Description Market Value (2023) USD 801.0 Million Forecast Revenue (2033) USD 2,315.0 Million CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Innerwear, T-Shirts & Shirts, Sweaters & Jackets, Sweatshirts & Hoodies, Shorts & Trousers, Evening Dresses, Suits, & Leggings, Other Accessories), Material Type (Natural, Synthetic, Blended), End-user (Men, Women, Kids), Distribution Channel (Online, Offline) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Adidas AG (Germany), Gildan Activewear Inc, Loro Piana S.p.A. (Italy), Puma SE (Germany), Ralph Lauren (U.S.), The Nautical Company (UK) Ltd, Victoria's Secret (the USA), Maglificio Ripa S.p.a (Italy), LENZING AG (Austria), Ecowool (New Zealand), Sana Hastakala (P) Ltd. (Nepal), THE GAP, INC (U.S.), Hackett Ltd (London), Marks and Spencer Group plc. (U.K), Nike Inc., (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-