Global Keratin Products Market Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, and Growth Forecast to 2028

-

14092

-

May 2023

-

186

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

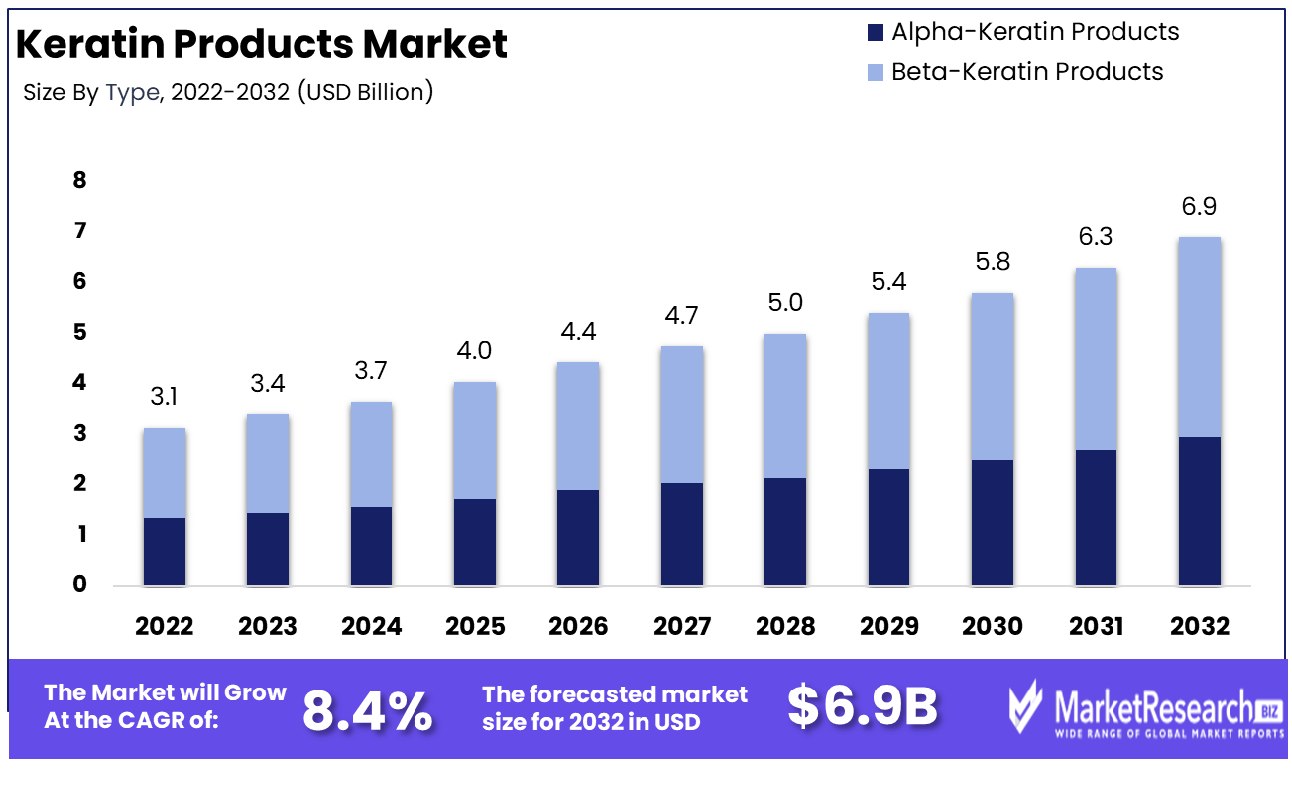

The keratin market size was valued at USD 3.12 billion in 2022. It is expected to reach USD 6.25 billion by 2032, with a CAGR of 8.4% during the forecast period from 2023 to 2032.

The surge in demand for personal care products and healthcare sectors are some of the main driving factors for the keratin market expansion. Keratin is a type of chemical that is generally found in glands, nails, skin, and hair.

It is used by consumers for personal grooming and health maintenance. It provides a protective shield on the outside of the skin to regulate cell proliferation through skin regeneration and whitening, maintaining softness, and flexibility and reducing wrinkles.

Globally individuals are facing the hair fall issue due to some of the environmental factors or genetic disorders. Many consumers are opting for a keratin treatment to make their hair look healthy, smooth, and shiny.

According to medihair research in 2023, around 85% of men and 33% of women have hair loss issues. Androgenetic Alopecia causes 95% of male to lose their hair. More than 65% of American men lose their hair at the age of 35, by the age of 55, around 85% of men have thinning of hair. Alopecia Areata impacts every two people out of every 1,000. The top three countries with the highest rate of male hair loss are Spain with 44.50%, Italy (44.37%) and France (44.25%).

Around 40% of women are impacted with a hair disorder named Alopecia and due to this 63% of women claim to witness issues related to their careers. Additionally, more than half of women face the hair fall issue post-menopause period. Around 50% of women witness hair thinning at the age of 50.

Due to the hair fall issues, consumers go for keratin hair treatments. There are several types of keratin hair treatments available that contain more formaldehyde than others and have less harmful substitutes. Advanced keratin treatments are free from formaldehyde and use glyoxylic acid instead.

The demand for keratin treatment will increase due to its high requirement and several benefits that will help the consumers to resolve their hair fall issue, it will also contribute to keratin market expansion during the forecast period.

Driving Factors

Natural Product Preference Enhances Keratin Market

The growing consumer awareness and preference for natural products significantly drive the keratin market's growth. In a beauty industry increasingly focused on health and sustainability, keratin stands out for its natural properties and benefits for hair and skin.

Consumers, more informed than ever about ingredients in their personal care products, are turning towards options that offer both safety and effectiveness. This shift towards natural, ingredient-conscious choices is not just a trend but a fundamental change in consumer behavior, indicating a sustained demand for keratin in the personal care sector.

Personal Care Industry Demand Boosts Keratin Usage

Rising demand for keratin in the personal care and cosmetics industry is a key growth driver. As the industry expands, so does the need for high-quality ingredients that deliver visible results.

Keratin, known for its strengthening and rejuvenating properties, is increasingly being included in formulations for hair care and skincare products. This reflects a trend among consumers towards ingredients that provide both aesthetic and health benefits, signifying long-term market expansion in line with personal care industry dynamics.

Innovation and Portfolio Expansion Propel Market

Constant product innovation and the upgrading of portfolios by manufacturers to meet increasing requirements are crucial in driving the keratin market forward. As consumer needs become more sophisticated, manufacturers are compelled to innovate and diversify their keratin-based product offerings. This ongoing process of innovation ensures that keratin remains relevant and appealing in a competitive market.

The long-term implication of this trend is a dynamic and ever-evolving keratin market, marked by continual advancements and adaptations to changing consumer preferences and industry standards.

Restraining Factors

Stringent Regulatory Norms and Low Content Availability Restrain Keratin Market Growth

The keratin market's expansion is significantly constrained by stringent regulatory norms and low content availability. Regulatory agencies, particularly in regions like the EU and North America, impose rigorous standards for beauty and personal care products. These regulations, which often pertain to the sourcing, processing, and labeling of keratin, can be challenging for manufacturers to consistently meet.

Additionally, the availability of high-quality keratin is limited, as it largely depends on the supply of raw materials (like wool and feathers), which are subject to variability in quality and quantity. This combination of regulatory challenges and content scarcity makes market entry and expansion difficult for new and existing players in the keratin market.

Uncertain Operational Models and High Upfront Expenses Restrain Keratin Market Growth

Operational uncertainties and high upfront expenses also play a significant role in limiting the growth of the keratin market. The extraction and processing of keratin are complex and cost-intensive, requiring specialized equipment and technology. This high initial investment creates a barrier to entry, particularly for smaller companies or startups.

Moreover, the keratin market is characterized by uncertain operational models, which may arise from fluctuations in raw material availability, varying demand in the beauty and personal care sector, and shifting consumer preferences. These uncertainties can lead to inconsistent revenue streams and deter potential investors, further restraining the market’s growth.

Keratin Market Segmentation Analysis

By Type

Alpha-keratin products dominate the keratin market, primarily due to their widespread use in personal care and cosmetics. Alpha-keratin, a type of protein found abundantly in hair, skin, and nails, is key in formulations aimed at strengthening and repairing these tissues.

The rising demand for hair care products like shampoos, conditioners, and hair treatments rich in keratin underlines this segment's dominance. The trend towards natural and protein-enriched beauty products, along with growing consumer awareness about hair and skin health, further propels the growth of alpha-keratin products.

Beta-keratin products, though less prevalent than alpha-keratin, are significant in specific niche applications, particularly in healthcare. Beta-keratin's unique properties, such as its structural rigidity, find applications in medical formulations and treatments. This segment, while smaller, is pivotal for specialized uses where the structural properties of beta-keratin are advantageous.

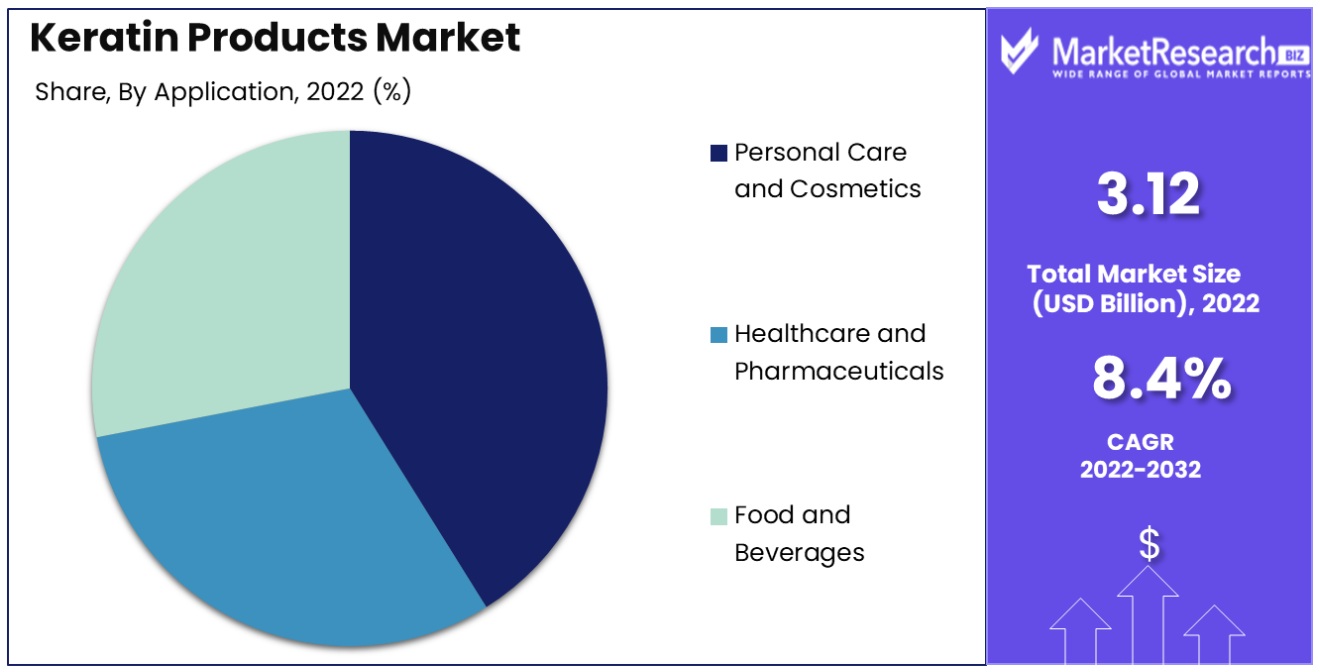

By Application

Personal care and cosmetics represent one of the highest concentrations of alpha-keratin applications, driven by consumer demand for products offering hair strengthening, skin nourishing, and anti-aging benefits.

Keratin's ability to repair and protect keratin-rich tissues such as hair and skin makes it an appealing ingredient in a wide range of beauty and personal care products. Keratin-based innovations, including their incorporation in organic or natural product lines, play a vital role in driving market expansion in this segment.

Keratin can be found across healthcare and pharmaceutical applications including wound care, drug delivery systems, and as a dietary supplement for nail and hair health. Food and beverage industries utilize it as a protein supplement or functional food ingredient; though its role in these areas may seem smaller compared to personal care/cosmetics products is significant.

Keratin Products Industry Segments

By Type

- Alpha-Keratin Products

- Beta-Keratin Products

By Application

- Personal Care and Cosmetics

- Healthcare and Pharmaceuticals

- Food and Beverages

Growth Opportunities

Increasing Demand for Bio-based Products Offers Growth Opportunity in Keratin Market

Increased consumer interest in bio-based products has been one of the primary drivers of growth in the keratin market. As consumers become more environmentally aware, their purchasing behavior has seen a noticeable shift towards natural and sustainable ingredients in beauty and personal care products.

Keratin, long renowned for its beneficial effects on hair and skin, is increasingly being sought-after due to its natural origins. Market data demonstrates a rising preference among consumers for organic and bio-based products containing keratin as an increasingly sought-after ingredient, expanding market penetration for keratin-infused products as well as inspiring innovative formulations in beauty and personal care products.

Technological Advancements Fuel Growth in Keratin Market

Technological advances in keratin extraction and processing have significantly contributed to its market expansion. New techniques that improve its purity and efficacy have broadened its applications across industries including cosmetics, healthcare, textiles, and more.

These advances have enabled the production of high-quality keratin that can easily be integrated into various products. Recent technological developments and innovation in processing natural proteins have resulted in more sustainable production methods, meeting growing consumer demands for high-performance natural ingredients in consumer goods while simultaneously expanding markets.

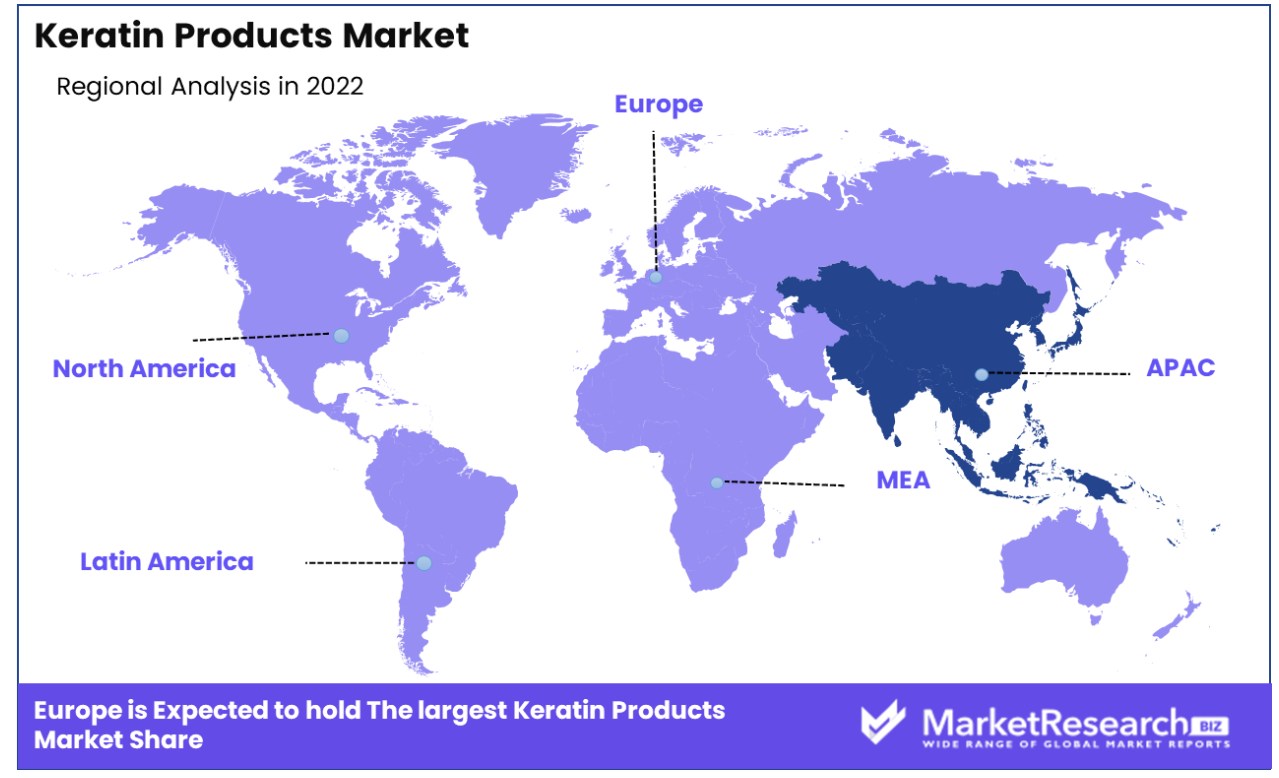

Regional Analysis

Asia Pacific Dominates with 40% Share Market Share

Asia Pacific's commanding 40% share of the global keratin market is largely driven by its robust cosmetics and personal care industry. The region's cultural emphasis on hair care and beauty, combined with a growing consumer base, especially in countries like China, India, and Japan, significantly contributes to this market dominance. Additionally, the availability of raw materials and a thriving biotechnology sector facilitate local production and innovation in keratin-based products.

The region's economic growth, coupled with increasing disposable incomes, further boosts the demand for premium keratin-based products. Moreover, local companies are expanding their global footprint, while international brands are increasingly investing in the region, recognizing its substantial market potential.

Looking ahead, the future influence of Asia Pacific in the global keratin market appears promising. The ongoing trend towards natural and sustainable beauty products, along with continued economic growth, is likely to maintain, if not increase, the region’s market share. Technological advancements in product formulation and a growing emphasis on research and development are expected to further enhance the quality and variety of keratin-based products in the market.

Europe Market Driven by Quality and Innovation

Europe's keratin market is characterized by high-quality standards and a strong focus on innovation. The region's stringent regulations on beauty and personal care products ensure the safety and efficacy of keratin-based products. European consumers, known for their discerning tastes, prefer products that combine luxury with natural ingredients, making keratin a popular choice. The presence of leading cosmetic brands in Europe, known for their research-driven approach, further strengthens the market.

North America Is Growing Demand and Diverse Applications

In North America, the keratin market is driven by diverse applications in beauty, health, and wellness sectors. The region's growing awareness of the benefits of proteins like keratin in hair and skin care, coupled with a strong trend towards natural ingredients, stimulates market growth. The U.S., being a significant market player, sees continued investment in product development, expanding the reach and application of keratin in various personal care products.

Keratin Products Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Player Analysis

In the global keratin market, the influence and strategic positioning of the listed companies collectively reflect a dynamic and diverse industry landscape. Keraplast Technologies and KeraNetics, with their specialized focus on keratin-based products, underscore the market's trend towards niche specialization and innovation in keratin applications.

Parchem (Fine & Specialty Chemical) and BASF, operating in the broader chemical sector, demonstrate the importance of raw material quality and supply chain efficiency in producing keratin ingredients. OSHA, as a regulatory body, highlights the critical role of safety standards and regulations in the market, ensuring product compliance and consumer safety.

Novex and MarciaTeixeira, focusing on keratin-based hair care solutions, reflect the market's strong orientation towards personal care and cosmetic applications. Nanokeratin System, with its advanced hair treatment technologies, underscores the industry's drive toward product innovation and enhancement.

Matrix and Henkel AG & Co. KGaA, known for their extensive product lines in the hair care sector, showcase the importance of brand presence and consumer trust in driving market demand. Kao Corporation and L'Oreal S.A., as global beauty giants, demonstrate the significant influence of large-scale operations and extensive R&D capabilities in shaping market trends and consumer preferences.

Overall, these companies not only contribute to the growth of the keratin market but also represent diverse strategies, from specialized product development to regulatory compliance and brand-driven market influence, essential in navigating this multifaceted industry.

Key Players

- Keraplast Technologies

- Parchem (Fine & Specialty Chemical)

- BASF

- KeraNetics

- OSHA

- Novex

- Marcia Teixeira

- Nanokeratin System

- Matrix

- Henkel AG & Co. KGaA

- Kao Corporation

- L'Oreal S.A.

- P&G Professional

- Unilever

- Keratin Complex

Recent Development

- In October 2023, the Food and Drug Administration (FDA) began considering a ban on certain hair straightening products due to their link to both short-term and long-term health effects. The FDA specifically mentioned products containing formaldehyde and other formaldehyde-releasing chemicals like methylene glycol as being under consideration for the ban.

- In October 2022, a new study conducted by the National Institutes of Health (NIH), and National Cancer Institute revealed that chemicals found in some hair straightening products may increase the risk of developing uterine cancer.

- In September 2022, scientists from Nanyang Technological University, Singapore (NTU Singapore), made a significant breakthrough by creating hydroponics substrates for urban farming using keratin extracted from human hair. This development has the potential to revolutionize urban agriculture by providing a sustainable and eco-friendly growth medium for crops.

- In April 2022, LVMH and its Fendi brand announced a collaboration with London-based institutions, Imperial College London and Central Saint Martins, to develop lab-grown fur using keratin.

Report Scope

Report Features Description Market Value (2022) USD 3.12 billion Forecast Revenue (2032) USD 6.25 billion CAGR (2023-2032) 8.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Alpha-Keratin Products,Beta-Keratin Products), By Application(Personal Care and Cosmetics, Healthcare and Pharmaceuticals, Food and Beverages) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Keraplast Technologies, Parchem (Fine & Specialty Chemical), BASF, KeraNetics, OSHA, Novex, Marcia Teixeira, Nanokeratin System, Matrix, Henkel AG & Co. KGaA, KaoCorporation, L'Oreal S.A., P&G Professional, Unilever, Keratin Complex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Keraplast Technologies

- Parchem (Fine & Specialty Chemical)

- BASF

- KeraNetics

- OSHA

- Novex

- Marcia Teixeira

- Nanokeratin System

- Matrix

- Henkel AG & Co. KGaA

- Kao Corporation

- L'Oreal S.A.

- P&G Professional

- Unilever

- Keratin Complex