Japan Generative AI Market By Component (Services, Software), By Technology (Diffusion Networks, Generative Adversarial Networks (GANs),and Others), By Model (Image & Video Generative Models, Large Language Models, Multi-Modal Generative Models), By Application (Computer Vision, Natural Language Processing (NLP), and Others), By End-Use (Automotive, BFSI, Healthcare, Manufacturing, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50730

-

Aug 2024

-

302

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

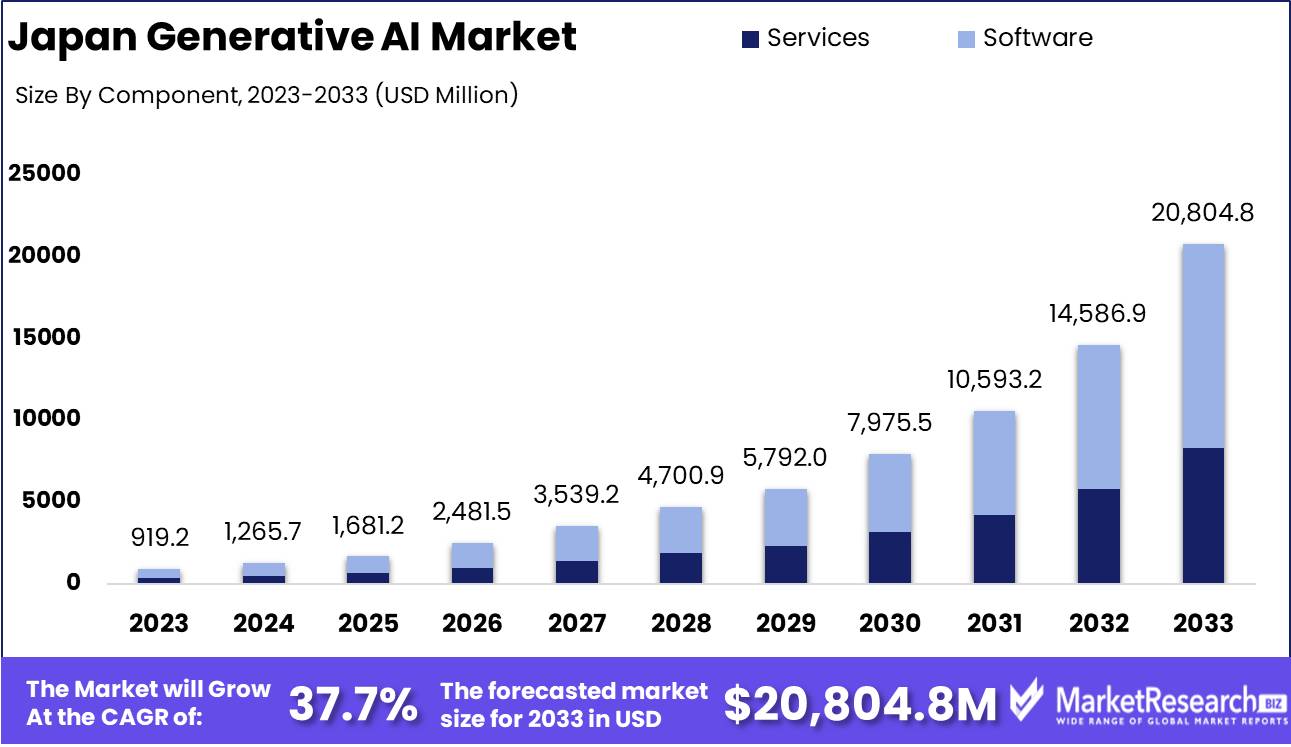

The Japan Generative AI Market was valued at USD 919.2 Mn in 2023. It is expected to reach USD 20804.8 Mn by 2033, with a CAGR of 37.7% during the forecast period from 2024 to 2033.

The Japan Generative AI Market focuses on the development, adoption, and implementation of generative AI technologies across various industries in Japan. This market is driven by the country's commitment to advancing AI research, supported by state-of-the-art infrastructure like the Fugaku supercomputer and strategic collaborations between leading tech firms. With applications ranging from natural language processing to creative industries, the market is poised for significant growth as Japan leverages its technological expertise and innovation to develop AI solutions tailored to its unique cultural and economic needs.

The Japan Generative AI Market is positioned for rapid expansion, bolstered by the nation's strong technological infrastructure and strategic initiatives aimed at enhancing AI capabilities. The Fugaku supercomputer, with its peak performance of 442 petaflops, is a cornerstone of Japan's AI research efforts, enabling the development of large language models and other AI applications tailored specifically to Japanese data and cultural contexts. This high-performance computing resource is crucial for advancing AI research and keeping Japan competitive in the AI landscape.

The Japan Generative AI Market is positioned for rapid expansion, bolstered by the nation's strong technological infrastructure and strategic initiatives aimed at enhancing AI capabilities. The Fugaku supercomputer, with its peak performance of 442 petaflops, is a cornerstone of Japan's AI research efforts, enabling the development of large language models and other AI applications tailored specifically to Japanese data and cultural contexts. This high-performance computing resource is crucial for advancing AI research and keeping Japan competitive in the AI landscape.Government-backed collaborations, such as the partnership between Preferred Networks and Samsung, are set to further strengthen Japan's position in the generative AI market. The use of advanced 2-nanometer chip technology in these collaborations highlights Japan's commitment to staying at the forefront of AI hardware innovation, which is essential for supporting the complex computations required by generative AI models.

Japan's focus on integrating AI across various sectors, including manufacturing, healthcare, and finance, is expected to drive significant demand for generative AI solutions. The market is also likely to benefit from Japan's unique cultural emphasis on precision, efficiency, and quality, which aligns well with the capabilities of generative AI technologies.

The Japan generative AI market is poised for substantial growth, supported by cutting-edge technology, strategic partnerships, and a strong governmental push towards AI innovation. Companies that invest in this market, particularly those focusing on tailored AI solutions and advanced hardware capabilities, will be well-positioned to capitalize on Japan's growing demand for generative AI applications.

Key Takeaways

- By Component: Software dominates with 60%, essential for implementing AI-driven solutions.

- By Technology: Generative Adversarial Networks (GANs) constitute 35%, crucial for generating high-quality data and simulations.

- By Model: Large Language Models make up 40%, widely used for advanced natural language processing tasks.

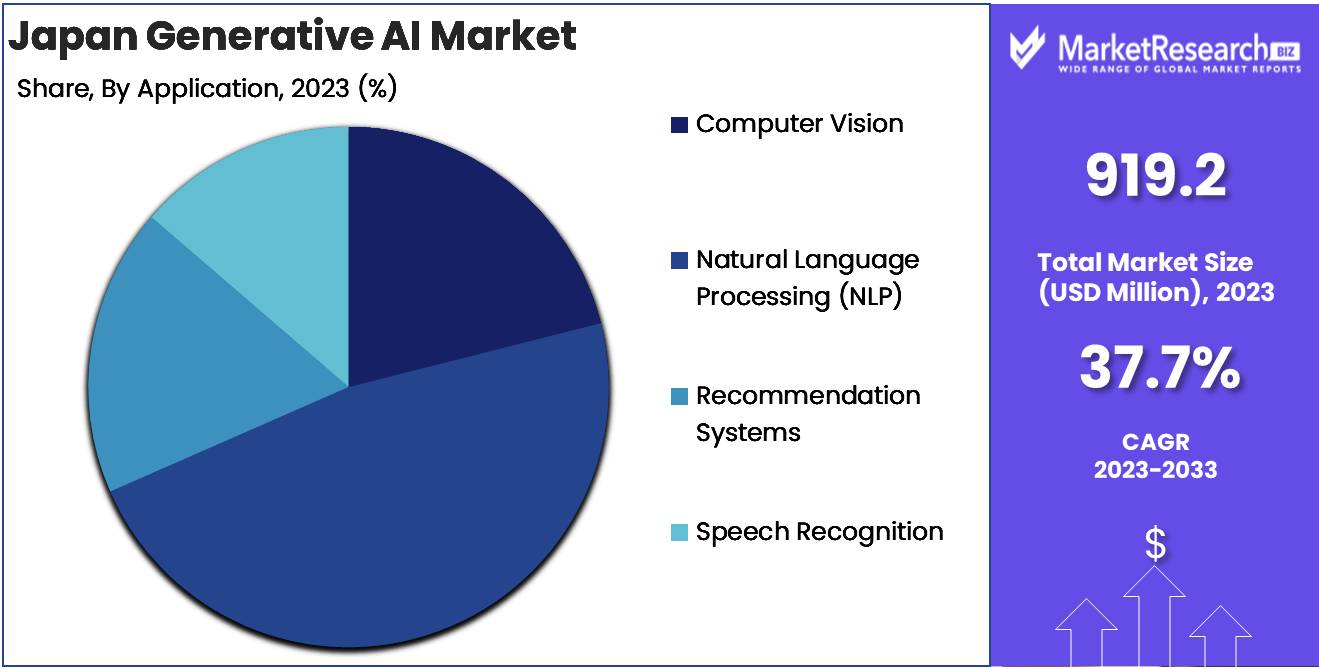

- By Application: Natural Language Processing (NLP) represents 45%, highlighting the importance of AI in understanding and generating human language.

- By End-Use: Media & Entertainment accounts for 30%, leveraging AI for content creation and personalization.

- Regional Dominance: Japan commands 100% of the market share, reflecting the country's focus on advanced AI technologies.

- Growth Opportunity: Expanding AI applications in multilingual NLP and localization can enhance Japan's role in AI advancements.

Driving factors

Widespread Adoption of AI Technologies Across Industries Fuels Market Expansion

The Japan generative AI market is experiencing robust growth, largely driven by the widespread adoption of AI technologies across various industries. From healthcare to finance, and from retail to automotive, businesses in Japan are increasingly leveraging AI to enhance operational efficiency, improve customer experiences, and innovate new products and services.

This cross-industry adoption is not only expanding the market but also fostering an ecosystem where generative AI solutions are being continuously developed and refined to meet specific industry needs. As more sectors embrace AI, the demand for advanced generative AI models and tools is expected to rise, contributing significantly to the market's expansion.

Government Support for AI Innovation as a Catalyst for Growth

The Japanese government's proactive support for AI innovation plays a crucial role in the growth of the generative AI market. Through initiatives such as the "Society 5.0" vision and various AI research and development programs, the government is fostering an environment conducive to AI advancements. Financial incentives, regulatory support, and partnerships with private enterprises are driving the development and deployment of AI technologies across the country.

This governmental backing not only accelerates innovation within the generative AI sector but also encourages the adoption of AI solutions across different industries, thereby contributing to the market's overall growth.

Rising Demand for AI-Driven Automation in Manufacturing and Services

Japan's strong industrial base and service-oriented economy are key drivers of the demand for AI-driven automation, particularly in manufacturing and service sectors. As companies seek to improve productivity, reduce costs, and address labor shortages, there is a growing reliance on AI technologies to automate complex processes. Generative AI, with its ability to optimize production lines, enhance quality control, and innovate service delivery, is becoming increasingly integral to these industries.

This rising demand for AI-driven automation is not only boosting the adoption of generative AI but also creating new opportunities for market players to develop tailored AI solutions that cater to the specific needs of Japan's manufacturing and service sectors.

Restraining Factors

Cultural and Regulatory Challenges as Key Restraints

The growth of the Japan generative AI market is tempered by cultural and regulatory challenges that are unique to the region. Japan has a well-established cultural framework that emphasizes privacy, traditional business practices, and cautious adoption of new technologies. These cultural factors can create resistance to the widespread implementation of generative AI, particularly in industries that are deeply rooted in conventional methods.

Japan's stringent regulatory environment around data privacy and AI deployment further complicates the integration of generative AI solutions. Compliance with these regulations can be both time-consuming and costly, slowing the pace of AI adoption and limiting market growth.

High Initial AI Implementation Costs as a Barrier to Entry

Another significant restraint on the Japan generative AI market is the high initial costs associated with AI implementation. Developing and deploying generative AI solutions requires substantial investment in technology, infrastructure, and talent. For many companies, especially small and medium-sized enterprises (SMEs), these high costs present a significant barrier to entry.

The financial burden of implementing AI systems, combined with the ongoing expenses for maintenance and upgrades, can deter businesses from adopting generative AI technologies, thereby constraining the market's expansion. Furthermore, the return on investment (ROI) for AI initiatives may take time to materialize, making it difficult for companies to justify the upfront costs.

By Component Analysis

Software components account for a substantial 60% of the Japan generative AI market.

In 2023, Software held a dominant market position in the "By Component" segment of the Japan Generative AI Market, capturing more than a 60% share. The overwhelming preference for software solutions is largely driven by Japan's advanced technological infrastructure and the widespread adoption of AI-driven applications across various industries. Generative AI software, including frameworks for machine learning, deep learning, and other AI models, has become integral in developing and deploying AI solutions tailored to specific business needs. The rapid innovation in software development, coupled with the increasing need for custom AI applications, has significantly bolstered the software segment's growth.On the other hand, the Services segment, while essential, represented a smaller market share. Services such as consulting, implementation, and maintenance are crucial in supporting the deployment of generative AI solutions. However, their growth is more gradual compared to software, as many organizations in Japan prefer investing in in-house software capabilities. Nonetheless, as the complexity of AI deployments increases, demand for specialized services is expected to grow, contributing to the overall expansion of the market.

By Technology Analysis

GANs dominate the technology segment with a 35% share.

In 2023, Generative Adversarial Networks (GANs) held a dominant market position in the "By Technology" segment of the Japan Generative AI Market, capturing more than a 35% share. GANs have gained significant traction due to their ability to generate highly realistic images, videos, and even data, making them indispensable in fields such as media, entertainment, and advertising. The adoption of GANs in creative industries, coupled with their potential in enhancing image and video quality, has been a key driver of their market dominance in Japan.Diffusion Networks, Transformers, and Variational Auto-Encoders (VAEs) also contributed to the market, albeit with smaller shares. Diffusion Networks, known for their application in generating data by reversing a diffusion process, have shown promise in scientific research and industrial applications. Transformers, particularly in natural language processing, have seen steady growth, while VAEs, with their focus on unsupervised learning, have found niche applications in data compression and generative tasks. However, none of these technologies matched the widespread adoption and versatility of GANs in the Japanese market.

By Model Analysis

Large language models lead the market by model type, holding a 40% share.

In 2023, Large Language Models held a dominant market position in the "By Model" segment of the Japan Generative AI Market, capturing more than a 40% share. The dominance of Large Language Models (LLMs) is largely due to their extensive use in natural language processing (NLP) applications, including chatbots, virtual assistants, and automated content creation. LLMs have become foundational in developing AI applications that require advanced language understanding and generation capabilities, making them highly sought after in Japan's tech-driven market.Image & Video Generative Models and Multi-Modal Generative Models also played significant roles but with smaller market shares. Image & Video Generative Models are crucial in industries like media and entertainment, where there is a growing demand for high-quality visual content. Multi-Modal Generative Models, which integrate multiple data types such as text, image, and audio, are gaining traction as they enable more sophisticated and versatile AI applications. Despite these advancements, Large Language Models remained the most influential in shaping the generative AI landscape in Japan.

By Application Analysis

NLP applications are prominent, representing 45% of the market.

In 2023, Natural Language Processing (NLP) held a dominant market position in the "By Application" segment of the Japan Generative AI Market, capturing more than a 45% share. NLP has become increasingly important in Japan as industries seek to enhance communication with customers and automate content generation. The application of NLP in chatbots, virtual assistants, and language translation services has driven its adoption across various sectors, including e-commerce, customer service, and finance. The ability of NLP to process and understand human language with high accuracy has made it indispensable in the Japanese AI ecosystem.Computer Vision, Recommendation Systems, and Speech Recognition also contributed to the market, with varying degrees of adoption. Computer Vision, primarily used in image and video analysis, has seen significant uptake in security, healthcare, and automotive sectors. Recommendation Systems, essential in e-commerce and content streaming services, have driven personalization efforts. Speech Recognition, although popular in smart devices and assistive technologies, accounted for a smaller share compared to NLP, reflecting the broader applicability of natural language processing in the market.

By End-Use Analysis

The media & entertainment industry dominates the end-use sector with a 30% share.

In 2023, Media & Entertainment held a dominant market position in the "By End-Use" segment of the Japan Generative AI Market, capturing more than a 30% share. The media and entertainment industry in Japan has embraced generative AI technologies to create innovative content, enhance production processes, and deliver personalized experiences to audiences. AI-driven tools for content creation, video editing, and virtual reality have revolutionized the way media is produced and consumed, driving the sector's dominance in the generative AI market.Other sectors, such as Automotive, BFSI (Banking, Financial Services, and Insurance), Healthcare, and Retail, also adopted generative AI technologies but on a smaller scale. The Automotive industry leveraged AI for designing and simulating vehicle models, while BFSI focused on enhancing customer experience and fraud detection. Healthcare applied AI in medical imaging and drug discovery, and Retail utilized AI for personalized recommendations and inventory management. Despite these advancements, the Media & Entertainment sector remained the most prominent end-user, capitalizing on the creative potential of generative AI.

Key Market Segments

By Component

- Services

- Software

By Technology

- Diffusion Networks

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-Encoders

By Model

- Image & Video Generative Models

- Large Language Models

- Multi-Modal Generative Models

By Application

- Computer Vision

- Natural Language Processing (NLP)

- Recommendation Systems

- Speech Recognition

By End-Use

- Automotive

- BFSI

- Healthcare

- Manufacturing

- Media & Entertainment

- Retail

- Others

Growth Opportunity

Expansion in Robotics, Healthcare, and Entertainment Drives AI Innovation

In 2024, the Japan generative AI market is expected to see significant opportunities arising from its strong foothold in robotics, healthcare, and entertainment sectors. Japan’s leadership in robotics, particularly in automation and service robots, provides a fertile ground for the integration of generative AI. In healthcare, the aging population creates a growing demand for AI-driven solutions in medical diagnostics, elderly care, and personalized treatment plans.

Japan's entertainment industry, known for its influence in gaming, animation, and virtual experiences, is increasingly leveraging AI to enhance content creation and user engagement. These sectors are set to be pivotal in driving the adoption of generative AI, offering substantial growth opportunities for companies that can develop specialized AI solutions tailored to these industries.

AI Tools for Japanese Language and Culture Enhance Market Penetration

The development of AI tools that cater specifically to the Japanese language and culture represents a unique growth opportunity in the Japan generative AI market. As AI continues to permeate various aspects of daily life and business, there is a rising demand for generative AI models that are proficient in understanding and generating content in Japanese. This includes applications in customer service, content creation, and language translation.

AI tools that are culturally attuned to Japanese norms and practices can drive higher adoption rates by providing more relevant and relatable user experiences. Companies that focus on these localized AI solutions are likely to gain a competitive edge in the market, as they can offer products that resonate deeply with the Japanese consumer base.

Latest Trends

Rising Interest in AI-Generated Content Transforms Industries

In 2024, a notable trend in the Japan generative AI market is the growing interest in AI-generated content across various industries. From marketing and advertising to entertainment and media, Japanese companies are increasingly leveraging AI to create content that is not only cost-effective but also highly personalized.

This trend is particularly prominent in the entertainment sector, where AI is being used to generate music, scripts, and even virtual characters. The ability of generative AI to produce high-quality content that resonates with specific audiences is driving its adoption, transforming how content is created and consumed in Japan.

Strengthening Collaboration Between Japanese Corporations and AI Firms

Another significant trend in the Japan generative AI market is the increasing collaboration between Japanese corporations and AI firms. As Japan seeks to maintain its competitive edge in technology and innovation, partnerships with leading AI companies from around the world are becoming more common.

These collaborations allow Japanese companies to access cutting-edge AI technologies and expertise, accelerating the development and deployment of generative AI solutions. Moreover, such partnerships facilitate the exchange of knowledge and best practices, fostering innovation within Japan's AI ecosystem. This trend is expected to drive the market forward, as Japanese corporations leverage expertise to enhance their AI capabilities.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the Japan Generative AI Market is expected to experience robust growth, driven by strategic investments from technology giants. Microsoft and Google are at the forefront, leveraging their extensive cloud infrastructure to provide scalable AI solutions tailored to Japan's unique business environment. Amazon Web Services (AWS) continues to strengthen its position by offering a comprehensive suite of AI tools and services, catering to both enterprises and startups looking to integrate generative AI into their operations.

DeepMind and OpenAI are pivotal in advancing AI research and development within Japan. Their focus on creating sophisticated AI models is instrumental in pushing the boundaries of AI capabilities, particularly in areas like natural language processing and autonomous systems. Meta (Facebook AI Research) and Hugging Face are also significant players, contributing to the open-source AI community, which is gaining traction among Japanese developers and researchers.

Emerging players like Stability AI and Midjourney are making their mark by offering innovative generative AI tools that are increasingly being adopted in creative industries and beyond. These companies are carving out a niche in the Japanese market by addressing the growing demand for AI-driven content creation and design solutions.

Market Key Players

- Microsoft

- DeepMind

- IBM

- Amazon Web Services (AWS)

- Midjourney

- Open AI

- Stability AI

- Cerebras Systems

- Anthropic

- Meta (Facebook AI Research)

- Hugging Face

- NVIDIA

- Jasper AI

- Graphcore

- Mythic AI

- Xilinx

Recent Development

- In January 2024, Google expanded its generative AI research division in Japan, aiming to boost innovation by 20% and support local AI initiatives.

- In March 2024, Microsoft launched a new generative AI platform tailored for Japanese enterprises, focusing on improving productivity by 25% in various industries.

Report Scope

Report Features Description Market Value (2023) USD 919.2 Mn Forecast Revenue (2033) USD 20804.8 Mn CAGR (2024-2033) 37.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Services, Software), By Technology (Diffusion Networks, Generative Adversarial Networks (GANs), Transformers, Variational Auto-Encoders), By Model (Image & Video Generative Models, Large Language Models, Multi-Modal Generative Models), By Application (Computer Vision, Natural Language Processing (NLP), Recommendation Systems, Speech Recognition), By End-Use (Automotive, BFSI, Healthcare, Manufacturing, Media & Entertainment, Retail, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Microsoft, DeepMind, IBM, Google, Amazon Web Services (AWS), Midjourney, Open AI, Stability AI, Cerebras Systems, Anthropic, Meta (Facebook AI Research), Hugging Face, NVIDIA, Jasper AI, Graphcore, Mythic AI, Xilinx Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Microsoft

- DeepMind

- IBM

- Amazon Web Services (AWS)

- Midjourney

- Open AI

- Stability AI

- Cerebras Systems

- Anthropic

- Meta (Facebook AI Research)

- Hugging Face

- NVIDIA

- Jasper AI

- Graphcore

- Mythic AI

- Xilinx