Global Instant Noodles Market Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, and Growth Forecast to 2027

-

5329

-

May 2023

-

176

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Global Instant Noodles Market Overview :

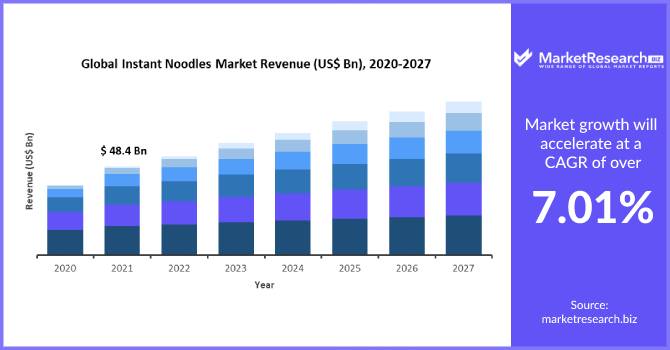

“The global Instant Noodles Market size is expected to be worth around US$ xx Billion by 2021 from US$ X.xx million in 2031, growing at a CAGR of X.x% during the forecast period 2021 to 2031.”

The report offers in-depth insights, revenue details, and other vital information regarding the target market, and the various trends, drivers, restraints, opportunities, and threats till 2027. The report offers insightful and detailed information regarding the various key players operating in the market, their financials, supply chain trends, technological innovations, key developments, apart from future strategies, acquisitions & mergers, and market footprint. The global instant noodles market report has been segmented on the basis of product type, source, packaging, and region.

This report is based on synthesis, analysis, and interpretation of information gathered regarding the target market from various sources. Our analysts have analyzed the information and data and gained insights using a mix of primary and secondary research efforts with the primary objective to provide a holistic view of the market.

In addition, an in-house study has been made of the global economic conditions and other economic indicators and factors to assess their respective impact on the market historically, as well as the current impact in order to make informed forecasts about the scenarios in future.

Instant noodles are dried block of noodles that are packed along with taste maker. Instant noodles mostly come in two packaging types–packets and cups. Dried noodles are precooked before molding them into block and taste maker is packed in separate packet. Instant noodles are made of wheat flour or all-purpose flour, starch, salt, and palm oil.

Taste maker that are present along with instant noodles contains monosodium glutamate, sugar, salt and other seasonings. Instant noodles are popular among population of all age groups, owing to its easy preparation method. Availability of new flavors and different type of instant noodles designed by manufacturers containing dried vegetables, noodles made up of oats or rice etc. increases its demand among health conscious consumers too.

Changing food habits and rising popularity of ready-to-eat food are major factors driving growth of the target market. Instant noodles are affordable, easy to store, have long shelf life, convenient. They also come in different packaging and flavors. These factors are making consumers more inclined towards instant noodles. Increasing working population and changing sedentary lifestyles are other factors expected to drive growth of the global market.

However, over consumption and regular consumption of instant noodles are not considered effective owing to their preparation methods, excessive use of artificial colors, preservatives, flavorings, and lack of availability of essential nutrients, which may hamper growth of global market over the forecast period.

Development of nutritious instant noodles and experimentation with regional flavors can create high revenue opportunities for players in the target market.

The market in Asia Pacific accounts for largest market share in terms of revenue and is expected to maintain its dominancy over the forecast period, owing to rising demand for ready-to-eat food products especially in countries such as China, Japan, South Korea and India. The market in Europe is expected to account for second-highest share in the market in terms of revenue over the forecast period followed by North America.

Global Instant Noodles Market Segmentation:

Segmentation by product type:

- Vegetable

- Chicken

- Sea Food

- Others

Segmentation by source:

- Wheat

- Rice

- Oats

- Others

Segmentation by packaging:

- Packets

- Cups

Segmentation by region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Nestlé S.A.

- Ajinomoto Co. Inc.

- Unilever N.V.

- Campbell Soup Company

- Capital Foods Pvt. Limited

- ITC Limited

- PT Indofood Sukses Makmur Tbk

- Nissin Food Products Co. Ltd.

- Baixiang Food Group

- China National Cereals, Oils and Foodstuffs Corporation (COFCO)