Industrial Tapes Market Product Type(Filament Tapes, Aluminum Tapes, Duct Tapes, Others), Application(Manufacturing Industry, Automotive Industry, Logistics Industry), Backing Material(Polypropylene, Paper, Polyvinyl Chloride), Mode of Application(Masking, Conducting, Packaging Design), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

10331

-

May 2023

-

188

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Industrial Tapes Market Dynamics

- Industrial Tapes Market Segmentation Analysis

- Industrial Tapes Industry Segments

- Industrial Tapes Market Growth Opportunity

- Industrial Tapes Market Regional Analysis

- Industrial Tapes Industry By Region

- Industrial Tapes Market Share Analysis

- Industrial Tapes Industry Key Players

- Industrial Tapes Market Recent Development

- Report Scope

Report Overview

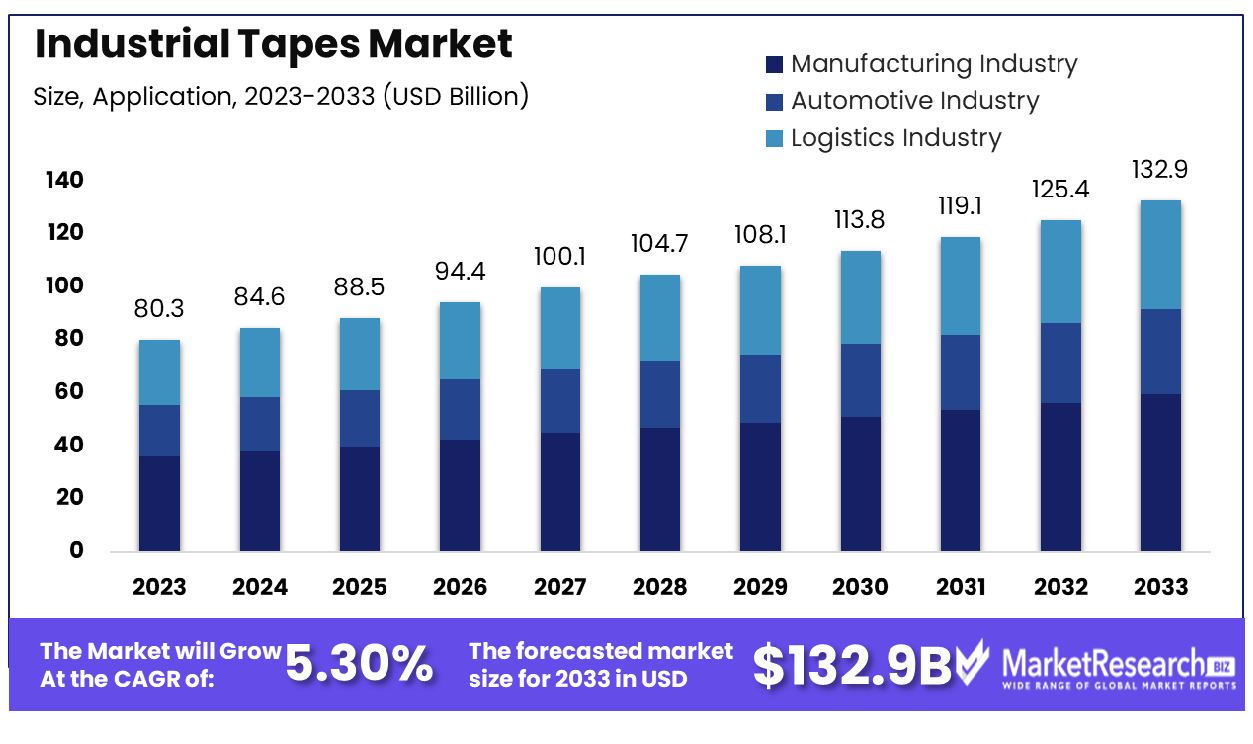

The industrial tapes market was valued at USD 80.3 billion in 2023. It is expected to reach USD 132.9 billion by 2033, with a CAGR of 5.30% during the forecast period from 2024 to 2033.

The surge in demand in various sectors and government policies are some of the main driving factors for the industrial tapes market expansion. Industrial tapes are widely used for industrial applications. These industrial adhesive tapes are widely used to cover manufacturing production holes and attachments.

These exceptional features enable them to be an ideal choice for different sectors. These are made up of copper, lead, plastic, and metal foil. Several types are accessible at CGS tapes, which are stretchable, translucent, and can hold pressure. These are biodegradable, UV and moisture-resistant.

Industrial tapes are also used in a wide range of industries to bond elements, join materials, and provide great cohesion. Due to its high-end performance industrial tapes are available in each market to offer industrial products. In the automotive industry, these industrial tapes are commonly used as the automotive industry is quite vast and so are the production requirements. It is roughly estimated that 800,000 to 900,000 square meters are full of industrial adhesive tapes that can be used to help this industry.

Adhesive tapes are used every day to make sure and gather the 2 to 5 Km cables that are required to run inside a new vehicle, up to 50 adhesive tapes are used in one new vehicle. These are commonly used to protect different components in the production process. The automotive industry also requires the usage of industrial tape to hold the screws and studs so that the car seats and dashboards can easily get stuck in one place.

In the packaging industry, industrial tapes play a major role. The main function of these types is to safeguard and seal the packages by protecting the intact contents from external components during the transmission, storage, and handling process. Industrial tapes ensure that the products reach their desired designation in good condition. Various types of industrial tapes are designed for different functionality in the packaging.

Pressure-sensitive adhesive tapes are ideal for quick applications while water-activated tapes can provide reliable seals when handling heavy packaging materials. Packaging key companies can customize solutions based on each product's unique packaging needs using different kinds of tapes; therefore, demand will only continue to increase in coming years due to increasing usage across industries and thus contributing to market expansion.

Industrial Tapes Market Dynamics

Diverse Industrial Applications Propel Market Growth

The industrial tapes market is experiencing robust growth driven by its extensive applications across various industries, including automotive, packaging, medical, and construction. These tapes offer specific functionalities such as bonding, sealing, and insulating, meeting diverse industry needs.

As sectors like automotive and construction continue to innovate and expand, the demand for specialized industrial tapes that contribute to efficiency, safety, and durability is expected to rise, further propelling market growth. The industrial tapes market relies on double-sided tape for strong and reliable bonding in various manufacturing applications.

Globalization and Industrialization Fuel Demand

The increasing globalization of businesses and rapid industrialization in developing countries are significant drivers of the industrial tapes market. As companies expand their operations globally, the need for robust, efficient packaging and manufacturing solutions, including industrial tapes, grows.

Industrial tapes play a crucial role in ensuring product safety and efficiency during transportation and handling. Emerging economies' continued industrial expansion should propel demand for these tapes and result in market expansion.

Eco-Friendly Demand Shapes Market Trends

The growing demand for environmentally friendly products is shaping the industrial tapes market. Companies are increasingly seeking tapes that are not only efficient and safe but also minimize environmental impact. Industrial tapes that save time, money, and resources while reducing waste and emissions are particularly appealing.

As sustainability becomes a priority for businesses and regulators, the market for eco-friendly industrial tapes is expected to expand, with innovations focusing on biodegradability and recyclability driving future growth.

Availability of Alternative Bonding Solutions Limits Industrial Tapes Market Adoption

The availability of alternative bonding solutions like mechanical fasteners and liquid adhesives can limit the adoption of industrial tapes in certain applications. While industrial tapes offer advantages like ease of use and clean application, some industries might prefer traditional bonding methods for their perceived durability or cost-effectiveness.

In scenarios requiring extreme strength or where the bonding material is exposed to harsh conditions, alternatives might be favored over tapes. Due to this trend, industrial tapes are unlikely to experience growth as applications-specific solutions tend to be preferred over industrial tapes.

Stringent Regulations Impact Industrial Tapes Market in Certain Regions

Stringent regulations on the use of certain chemicals used in industrial tape production could impede their adoption in some regions. Environmental and health concerns have led to regulations restricting the use of volatile organic compounds (VOCs) and other hazardous materials in manufacturing processes.

Compliance with these regulations can increase production costs and complexity. In regions with particularly strict standards, this can hinder the marketability of certain industrial tapes, pushing manufacturers to reformulate products or potentially lose market share to compliant alternatives.

Industrial Tapes Market Segmentation Analysis

Product Type Analysis

In the industrial tapes market, Filament Tapes are recognized as the dominant segment. Their strength and durability, coupled with the ability to withstand high tension and environmental conditions, make them a preferred choice in various industrial applications. Filament tapes are extensively used for heavy-duty packaging, bundling, and reinforcement tasks, especially in sectors that require robust holding power and long-term stability.

While filament tapes lead due to their versatility and strength, other types such as Aluminum Tapes, Duct Tapes, and Adhesive Transfer Tapes also play significant roles. Aluminum tapes are sought after for their thermal and electrical conductivity properties, duct tapes for their wide range of uses in repair and maintenance, and adhesive transfer tapes for their clean application and strong adhesive properties.

Application Analysis

The Manufacturing Industry emerges as the dominant application segment for industrial tapes. The diverse needs of manufacturing, from assembly to packaging and maintenance, require a variety of tapes with specific properties. In this sector, tapes are not just used for binding but also tasks like thermal management, electrical insulation, and labeling.

The Automotive Industry and Logistics Industries also substantially use industrial tapes. Automotive manufacturers utilize specialized tapes for assembly, wiring, and thermal management, while the logistics industry relies on tapes for secure and efficient packaging solutions.

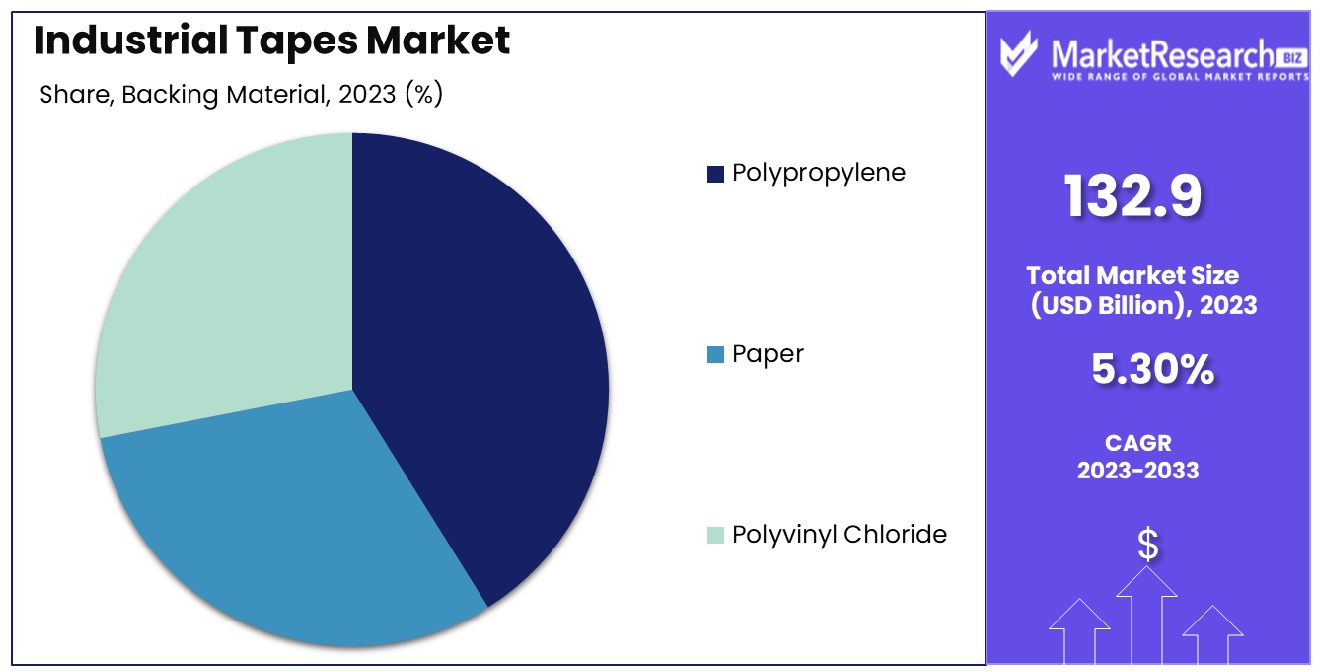

Backing Material Analysis

Polypropylene is the leading backing material in the industrial tapes market. Its popularity is attributed to its balance of flexibility, strength, and resistance to moisture and chemicals, making it suitable for a wide range of industrial applications. Polypropylene tapes are frequently employed for packaging, bundling, and labeling applications where their strength and resistance to damage are crucial.

Paper and Polyvinyl Chloride (PVC) are also important backing materials, each offering unique properties. Paper tapes are widely favored due to their eco-friendliness and easy application in applications like painting and surface protection, while PVC tapes offer electrical insulation properties as well as longevity.

Mode of Application Analysis

Masking, Conducting, and Packaging Design are key modes of application for industrial tapes. Masking tapes are extensively used in painting and surface protection during manufacturing and construction processes. Conducting tapes, typically made from materials like aluminum, are essential for electromagnetic shielding and heat dissipation. Packaging design uses a variety of tapes to secure and brand packages, playing a crucial role in logistics and product presentation.

Industrial Tapes Industry Segments

Product Type

- Filament Tapes

- Aluminum Tapes

- Duct Tapes

- Adhesive Transfer Tapes

- Others

Application

- Manufacturing Industry

- Automotive Industry

- Logistics Industry

Backing Material

Mode of Application

- Masking

- Conducting

- Packaging Design

Industrial Tapes Market Growth Opportunity

Versatility Across Industries Spurs Growth in Industrial Tapes Market

The industrial tapes market's service to several industries, including automotive, aerospace, construction, and manufacturing, presents significant growth opportunities. As these sectors expand and transform, their needs for tapes that meet specific industrial specifications increase.

Industrial tapes are used for various applications, from bonding and sealing to insulation and packaging. The diversity of applications across multiple industries underlines a broad market potential, as each sector's growth can contribute to an increased demand for industrial tapes, driven by the continuous need for reliable and efficient bonding solutions.

Technological Advancements Drive Innovation in the Industrial Tapes Market

Ongoing technological advancements are leading to the development of innovative industrial tape products, creating growth opportunities in the market. Manufacturers are continually improving tape materials, adhesives, and production processes to offer stronger, more versatile, and application-specific tapes.

Innovations such as enhanced adhesive formulations and eco-friendly materials meet the changing demands of industries looking for more efficient and sustainable solutions. The commitment to innovation and product development is key to expanding the market, as new and improved tapes can address a wider range of industrial challenges.

Industrial Tapes Market Regional Analysis

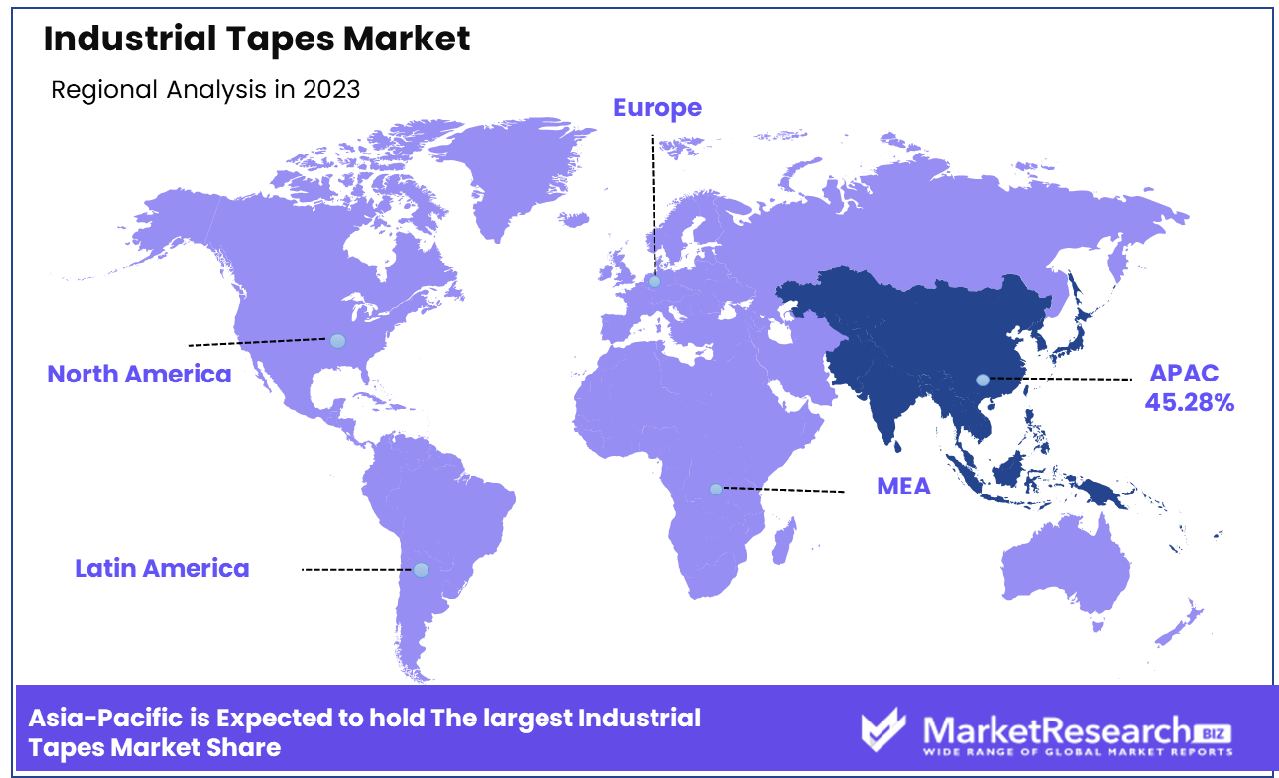

Asia-Pacific Dominates with 45.28% Market Share in Industrial Tapes Market

Asia-Pacific's commanding 45.28% share of the industrial tapes market is primarily driven by the region's expansive manufacturing sector and rapid industrialization, particularly in China, India, and Japan. Growing production activities across automotive, electronics, and construction industries contribute significantly to an increasing need for industrial tapes.

Furthermore, export-oriented growth in this region combined with cost-effective labor and raw materials drives market expansion. Furthermore, urbanization key trends and industrial improvements further increase this need. Tapes used for bonding, sealing, assembly, or sealing operations often serve this function best.

Asia-Pacific region markets are driven by innovation in tape technologies, particularly for specific industrial uses. The increasing emphasis on sustainable manufacturing practices and the demand for eco-friendly adhesives are also shaping the market. Additionally, the growing small and medium-sized enterprises (SMEs) in the region and the expanding infrastructure development projects require high-performance industrial tapes, driving market growth.

North America: Advanced Manufacturing and Technological Leadership

North America’s industrial tapes market is driven by advanced manufacturing sectors and technological leadership, particularly in the United States. The region's emphasis on quality and durability, along with the presence of major tape manufacturers, contributes to market growth. Aerospace, automotive, and electronics industries where precision and performance are of utmost importance favor using industrial tapes with specialized properties.

Europe: Focus on Quality and Sustainability

Europe's industrial tapes market stands out for its strong commitment to quality and sustainability. Europe's stringent environmental regulations and push for green manufacturing drive demand for eco-friendly tapes that deliver on performance. Automotive, construction, and renewable energy sectors present ample opportunities for industrial tape growth within Europe's market, as does product innovation; maintaining high industrial standards should continue driving market expansion across the continent.

Industrial Tapes Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

In the industrial tapes market, companies such as 3M, Avery Dennison Corporation, Tesa SE, and Nitto Denko Corporation are at the forefront, significantly influencing the market with their wide range of products and strong global presence. 3M, known for its innovation, offers a diverse portfolio of tapes catering to various industrial needs, reinforcing its position as a market leader.

Avery Dennison and Tesa SE are also prominent, known for their specialized adhesive solutions and commitment to sustainability, which resonate well with current market demands. Nitto Denko stands out with its high-performance tapes used in numerous sectors, driving its strategic positioning.

Companies like Intertape Polymer Group, Shape Technologies, and Scapa Group further enrich the market with their unique product offerings and strategic acquisitions, enhancing their market reach and portfolio diversity. Lintec Corporation and Berry Global focus on technological advancements and expanding their product lines to meet the evolving needs of industries.

Industrial Tapes Industry Key Players

- 3M Company (US)

- Avery Dennison Corporation (US)

- Tesa SE (Germany)

- Nitto Denko Corporation (Japan)

- Intertape Polymer Group Inc. (US)

- Shape Technologies, LLC (US)

- Scapa Group plc (UK)

- Lintec Corporation (Japan)

- Berry Global, Inc. (US)

- Saint-Gobain S.A. (France)

- Dow (US)

- Henkel AG (Germany)

- Eastman Chemical Company or its subsidiaries (US)

- Ashland Inc. (US)

- H.B. Fuller Company (US)

- Microseal Industries Inc.

- Necal Corporation

Industrial Tapes Market Recent Development

- In April 2023, Thermo Fisher Scientific Inc. introduced two novel wet chemistry analyzers, providing fully automated testing in compliance with the U.S. Environmental Protection Agency (EPA) standards. These systems cater to environmental, agricultural, and industrial testing laboratories with precise and streamlined analytical capabilities.

- In December 2022, ABB launched a Sensi+ analyzer, revolutionizing natural gas quality monitoring. This single device detects H2S, H2O, and CO2 contaminants, enhancing pipeline safety, efficiency, and cost-effectiveness with real-time analysis, swift upset responses, and reduced emissions.

- In November 2022, Mettler Toledo introduced the latest iteration of Easy Vis, a compact solution for analyzing liquid samples. This device evaluates optical spectrum, color, and water characteristics, combining functionalities of a colorimeter, spectrophotometer, and water testing methods within a single, portable unit, replacing the need for three separate instruments.

Report Scope

Report Features Description Market Value (2023) USD 80.3 Billion Forecast Revenue (2033) USD 132.9 Billion CAGR (2024-2032) 5.30% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type(Filament Tapes, Aluminum Tapes, Duct Tapes, Adhesive Transfer Tapes, Others), Application(Manufacturing Industry, Automotive Industry, Logistics Industry), Backing Material(Polypropylene, Paper, Polyvinyl Chloride), Mode of Application(Masking, Conducting, Packaging Design) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape 3M Company (US), Avery Dennison Corporation (US), Tesa SE (Germany), Nitto Denko Corporation (Japan), Intertape Polymer Group Inc. (US), Shape Technologies, LLC (US), Scapa Group plc (UK), Lintec Corporation (Japan), Berry Global, Inc. (US), Saint-Gobain S.A. (France), Dow (US), Henkel AG (Germany), Eastman Chemical Company or its subsidiaries (US), Ashland Inc. (US), H.B. Fuller Company (US), Microseal Industries Inc., Necal Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Industrial Tapes Market Overview

- 2.1. Industrial Tapes Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Industrial Tapes Market Dynamics

- 3. Global Industrial Tapes Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Industrial Tapes Market Analysis, 2016-2021

- 3.2. Global Industrial Tapes Market Opportunity and Forecast, 2023-2032

- 3.3. Global Industrial Tapes Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 3.3.1. Global Industrial Tapes Market Analysis by Product Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 3.3.3. Filament Tapes

- 3.3.4. Aluminum Tapes

- 3.3.5. Duct Tapes

- 3.3.6. Adhesive Transfer Tapes

- 3.3.7. Others

- 3.4. Global Industrial Tapes Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.4.1. Global Industrial Tapes Market Analysis by Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.4.3. Manufacturing Industry

- 3.4.4. Automotive Industry

- 3.4.5. Logistics Industry

- 3.5. Global Industrial Tapes Market Analysis, Opportunity and Forecast, By Backing Material, 2016-2032

- 3.5.1. Global Industrial Tapes Market Analysis by Backing Material: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Backing Material, 2016-2032

- 3.5.3. Polypropylene

- 3.5.4. Paper

- 3.5.5. Polyvinyl Chloride

- 3.6. Global Industrial Tapes Market Analysis, Opportunity and Forecast, By Mode of Application, 2016-2032

- 3.6.1. Global Industrial Tapes Market Analysis by Mode of Application: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Mode of Application, 2016-2032

- 3.6.3. Masking

- 3.6.4. Conducting

- 3.6.5. Packaging Design

- 4. North America Industrial Tapes Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Industrial Tapes Market Analysis, 2016-2021

- 4.2. North America Industrial Tapes Market Opportunity and Forecast, 2023-2032

- 4.3. North America Industrial Tapes Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 4.3.1. North America Industrial Tapes Market Analysis by Product Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 4.3.3. Filament Tapes

- 4.3.4. Aluminum Tapes

- 4.3.5. Duct Tapes

- 4.3.6. Adhesive Transfer Tapes

- 4.3.7. Others

- 4.4. North America Industrial Tapes Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.4.1. North America Industrial Tapes Market Analysis by Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.4.3. Manufacturing Industry

- 4.4.4. Automotive Industry

- 4.4.5. Logistics Industry

- 4.5. North America Industrial Tapes Market Analysis, Opportunity and Forecast, By Backing Material, 2016-2032

- 4.5.1. North America Industrial Tapes Market Analysis by Backing Material: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Backing Material, 2016-2032

- 4.5.3. Polypropylene

- 4.5.4. Paper

- 4.5.5. Polyvinyl Chloride

- 4.6. North America Industrial Tapes Market Analysis, Opportunity and Forecast, By Mode of Application, 2016-2032

- 4.6.1. North America Industrial Tapes Market Analysis by Mode of Application: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Mode of Application, 2016-2032

- 4.6.3. Masking

- 4.6.4. Conducting

- 4.6.5. Packaging Design

- 4.7. North America Industrial Tapes Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Industrial Tapes Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Industrial Tapes Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Industrial Tapes Market Analysis, 2016-2021

- 5.2. Western Europe Industrial Tapes Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 5.3.1. Western Europe Industrial Tapes Market Analysis by Product Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 5.3.3. Filament Tapes

- 5.3.4. Aluminum Tapes

- 5.3.5. Duct Tapes

- 5.3.6. Adhesive Transfer Tapes

- 5.3.7. Others

- 5.4. Western Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.4.1. Western Europe Industrial Tapes Market Analysis by Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.4.3. Manufacturing Industry

- 5.4.4. Automotive Industry

- 5.4.5. Logistics Industry

- 5.5. Western Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Backing Material, 2016-2032

- 5.5.1. Western Europe Industrial Tapes Market Analysis by Backing Material: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Backing Material, 2016-2032

- 5.5.3. Polypropylene

- 5.5.4. Paper

- 5.5.5. Polyvinyl Chloride

- 5.6. Western Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Mode of Application, 2016-2032

- 5.6.1. Western Europe Industrial Tapes Market Analysis by Mode of Application: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Mode of Application, 2016-2032

- 5.6.3. Masking

- 5.6.4. Conducting

- 5.6.5. Packaging Design

- 5.7. Western Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Industrial Tapes Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Industrial Tapes Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Industrial Tapes Market Analysis, 2016-2021

- 6.2. Eastern Europe Industrial Tapes Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 6.3.1. Eastern Europe Industrial Tapes Market Analysis by Product Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 6.3.3. Filament Tapes

- 6.3.4. Aluminum Tapes

- 6.3.5. Duct Tapes

- 6.3.6. Adhesive Transfer Tapes

- 6.3.7. Others

- 6.4. Eastern Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.4.1. Eastern Europe Industrial Tapes Market Analysis by Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.4.3. Manufacturing Industry

- 6.4.4. Automotive Industry

- 6.4.5. Logistics Industry

- 6.5. Eastern Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Backing Material, 2016-2032

- 6.5.1. Eastern Europe Industrial Tapes Market Analysis by Backing Material: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Backing Material, 2016-2032

- 6.5.3. Polypropylene

- 6.5.4. Paper

- 6.5.5. Polyvinyl Chloride

- 6.6. Eastern Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Mode of Application, 2016-2032

- 6.6.1. Eastern Europe Industrial Tapes Market Analysis by Mode of Application: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Mode of Application, 2016-2032

- 6.6.3. Masking

- 6.6.4. Conducting

- 6.6.5. Packaging Design

- 6.7. Eastern Europe Industrial Tapes Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Industrial Tapes Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Industrial Tapes Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Industrial Tapes Market Analysis, 2016-2021

- 7.2. APAC Industrial Tapes Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Industrial Tapes Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 7.3.1. APAC Industrial Tapes Market Analysis by Product Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 7.3.3. Filament Tapes

- 7.3.4. Aluminum Tapes

- 7.3.5. Duct Tapes

- 7.3.6. Adhesive Transfer Tapes

- 7.3.7. Others

- 7.4. APAC Industrial Tapes Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.4.1. APAC Industrial Tapes Market Analysis by Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.4.3. Manufacturing Industry

- 7.4.4. Automotive Industry

- 7.4.5. Logistics Industry

- 7.5. APAC Industrial Tapes Market Analysis, Opportunity and Forecast, By Backing Material, 2016-2032

- 7.5.1. APAC Industrial Tapes Market Analysis by Backing Material: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Backing Material, 2016-2032

- 7.5.3. Polypropylene

- 7.5.4. Paper

- 7.5.5. Polyvinyl Chloride

- 7.6. APAC Industrial Tapes Market Analysis, Opportunity and Forecast, By Mode of Application, 2016-2032

- 7.6.1. APAC Industrial Tapes Market Analysis by Mode of Application: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Mode of Application, 2016-2032

- 7.6.3. Masking

- 7.6.4. Conducting

- 7.6.5. Packaging Design

- 7.7. APAC Industrial Tapes Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Industrial Tapes Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Industrial Tapes Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Industrial Tapes Market Analysis, 2016-2021

- 8.2. Latin America Industrial Tapes Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Industrial Tapes Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 8.3.1. Latin America Industrial Tapes Market Analysis by Product Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 8.3.3. Filament Tapes

- 8.3.4. Aluminum Tapes

- 8.3.5. Duct Tapes

- 8.3.6. Adhesive Transfer Tapes

- 8.3.7. Others

- 8.4. Latin America Industrial Tapes Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.4.1. Latin America Industrial Tapes Market Analysis by Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.4.3. Manufacturing Industry

- 8.4.4. Automotive Industry

- 8.4.5. Logistics Industry

- 8.5. Latin America Industrial Tapes Market Analysis, Opportunity and Forecast, By Backing Material, 2016-2032

- 8.5.1. Latin America Industrial Tapes Market Analysis by Backing Material: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Backing Material, 2016-2032

- 8.5.3. Polypropylene

- 8.5.4. Paper

- 8.5.5. Polyvinyl Chloride

- 8.6. Latin America Industrial Tapes Market Analysis, Opportunity and Forecast, By Mode of Application, 2016-2032

- 8.6.1. Latin America Industrial Tapes Market Analysis by Mode of Application: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Mode of Application, 2016-2032

- 8.6.3. Masking

- 8.6.4. Conducting

- 8.6.5. Packaging Design

- 8.7. Latin America Industrial Tapes Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Industrial Tapes Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Industrial Tapes Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Industrial Tapes Market Analysis, 2016-2021

- 9.2. Middle East & Africa Industrial Tapes Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Industrial Tapes Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 9.3.1. Middle East & Africa Industrial Tapes Market Analysis by Product Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 9.3.3. Filament Tapes

- 9.3.4. Aluminum Tapes

- 9.3.5. Duct Tapes

- 9.3.6. Adhesive Transfer Tapes

- 9.3.7. Others

- 9.4. Middle East & Africa Industrial Tapes Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.4.1. Middle East & Africa Industrial Tapes Market Analysis by Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.4.3. Manufacturing Industry

- 9.4.4. Automotive Industry

- 9.4.5. Logistics Industry

- 9.5. Middle East & Africa Industrial Tapes Market Analysis, Opportunity and Forecast, By Backing Material, 2016-2032

- 9.5.1. Middle East & Africa Industrial Tapes Market Analysis by Backing Material: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Backing Material, 2016-2032

- 9.5.3. Polypropylene

- 9.5.4. Paper

- 9.5.5. Polyvinyl Chloride

- 9.6. Middle East & Africa Industrial Tapes Market Analysis, Opportunity and Forecast, By Mode of Application, 2016-2032

- 9.6.1. Middle East & Africa Industrial Tapes Market Analysis by Mode of Application: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Mode of Application, 2016-2032

- 9.6.3. Masking

- 9.6.4. Conducting

- 9.6.5. Packaging Design

- 9.7. Middle East & Africa Industrial Tapes Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Industrial Tapes Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Industrial Tapes Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Industrial Tapes Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Industrial Tapes Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. 3M Company (US)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Avery Dennison Corporation (US)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Tesa SE (Germany)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Nitto Denko Corporation (Japan)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Intertape Polymer Group Inc. (US)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Shape Technologies, LLC (US)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Scapa Group plc (UK)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Lintec Corporation (Japan)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Berry Global, Inc. (US)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Saint-Gobain S.A. (France)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Dow (US)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Eastman Chemical Company or its subsidiaries (US)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Ashland Inc.(US)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. H.B. Fuller Company (US)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Microseal industries Inc.

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Necal Corporation

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Industrial Tapes Market Revenue (US$ Mn) Market Share by Product Type in 2022

- Figure 2: Global Industrial Tapes Market Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 3: Global Industrial Tapes Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 4: Global Industrial Tapes Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 5: Global Industrial Tapes Market Revenue (US$ Mn) Market Share by Backing Materialin 2022

- Figure 6: Global Industrial Tapes Market Market Attractiveness Analysis by Backing Material, 2016-2032

- Figure 7: Global Industrial Tapes Market Revenue (US$ Mn) Market Share by Mode of Applicationin 2022

- Figure 8: Global Industrial Tapes Market Market Attractiveness Analysis by Mode of Application, 2016-2032

- Figure 9: Global Industrial Tapes Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Industrial Tapes Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 14: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 15: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Figure 16: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Figure 17: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 19: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 20: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Figure 21: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Figure 22: Global Industrial Tapes Market Market Share Comparison by Region (2016-2032)

- Figure 23: Global Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Figure 24: Global Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Figure 25: Global Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Figure 26: Global Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Figure 27: North America Industrial Tapes Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 28: North America Industrial Tapes Market Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 29: North America Industrial Tapes Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 30: North America Industrial Tapes Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 31: North America Industrial Tapes Market Revenue (US$ Mn) Market Share by Backing Materialin 2022

- Figure 32: North America Industrial Tapes Market Market Attractiveness Analysis by Backing Material, 2016-2032

- Figure 33: North America Industrial Tapes Market Revenue (US$ Mn) Market Share by Mode of Applicationin 2022

- Figure 34: North America Industrial Tapes Market Market Attractiveness Analysis by Mode of Application, 2016-2032

- Figure 35: North America Industrial Tapes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Industrial Tapes Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 40: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 41: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Figure 42: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Figure 43: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 45: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 46: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Figure 47: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Figure 48: North America Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Figure 49: North America Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Figure 50: North America Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Figure 51: North America Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Figure 52: North America Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Figure 53: Western Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 54: Western Europe Industrial Tapes Market Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 55: Western Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 56: Western Europe Industrial Tapes Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 57: Western Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Backing Materialin 2022

- Figure 58: Western Europe Industrial Tapes Market Market Attractiveness Analysis by Backing Material, 2016-2032

- Figure 59: Western Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Mode of Applicationin 2022

- Figure 60: Western Europe Industrial Tapes Market Market Attractiveness Analysis by Mode of Application, 2016-2032

- Figure 61: Western Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Industrial Tapes Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 66: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 67: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Figure 68: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Figure 69: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 71: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 72: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Figure 73: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Figure 74: Western Europe Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Figure 76: Western Europe Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Figure 77: Western Europe Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Figure 78: Western Europe Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Figure 79: Eastern Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 80: Eastern Europe Industrial Tapes Market Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 81: Eastern Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 82: Eastern Europe Industrial Tapes Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 83: Eastern Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Backing Materialin 2022

- Figure 84: Eastern Europe Industrial Tapes Market Market Attractiveness Analysis by Backing Material, 2016-2032

- Figure 85: Eastern Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Mode of Applicationin 2022

- Figure 86: Eastern Europe Industrial Tapes Market Market Attractiveness Analysis by Mode of Application, 2016-2032

- Figure 87: Eastern Europe Industrial Tapes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Industrial Tapes Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 92: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 93: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Figure 94: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Figure 95: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 97: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 98: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Figure 99: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Figure 100: Eastern Europe Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Figure 102: Eastern Europe Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Figure 103: Eastern Europe Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Figure 104: Eastern Europe Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Figure 105: APAC Industrial Tapes Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 106: APAC Industrial Tapes Market Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 107: APAC Industrial Tapes Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 108: APAC Industrial Tapes Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 109: APAC Industrial Tapes Market Revenue (US$ Mn) Market Share by Backing Materialin 2022

- Figure 110: APAC Industrial Tapes Market Market Attractiveness Analysis by Backing Material, 2016-2032

- Figure 111: APAC Industrial Tapes Market Revenue (US$ Mn) Market Share by Mode of Applicationin 2022

- Figure 112: APAC Industrial Tapes Market Market Attractiveness Analysis by Mode of Application, 2016-2032

- Figure 113: APAC Industrial Tapes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Industrial Tapes Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 118: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 119: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Figure 120: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Figure 121: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 123: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 124: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Figure 125: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Figure 126: APAC Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Figure 128: APAC Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Figure 129: APAC Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Figure 130: APAC Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Figure 131: Latin America Industrial Tapes Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 132: Latin America Industrial Tapes Market Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 133: Latin America Industrial Tapes Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 134: Latin America Industrial Tapes Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 135: Latin America Industrial Tapes Market Revenue (US$ Mn) Market Share by Backing Materialin 2022

- Figure 136: Latin America Industrial Tapes Market Market Attractiveness Analysis by Backing Material, 2016-2032

- Figure 137: Latin America Industrial Tapes Market Revenue (US$ Mn) Market Share by Mode of Applicationin 2022

- Figure 138: Latin America Industrial Tapes Market Market Attractiveness Analysis by Mode of Application, 2016-2032

- Figure 139: Latin America Industrial Tapes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Industrial Tapes Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 144: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 145: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Figure 146: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Figure 147: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 149: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 150: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Figure 151: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Figure 152: Latin America Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Figure 154: Latin America Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Figure 155: Latin America Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Figure 156: Latin America Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Figure 157: Middle East & Africa Industrial Tapes Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 158: Middle East & Africa Industrial Tapes Market Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 159: Middle East & Africa Industrial Tapes Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 160: Middle East & Africa Industrial Tapes Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 161: Middle East & Africa Industrial Tapes Market Revenue (US$ Mn) Market Share by Backing Materialin 2022

- Figure 162: Middle East & Africa Industrial Tapes Market Market Attractiveness Analysis by Backing Material, 2016-2032

- Figure 163: Middle East & Africa Industrial Tapes Market Revenue (US$ Mn) Market Share by Mode of Applicationin 2022

- Figure 164: Middle East & Africa Industrial Tapes Market Market Attractiveness Analysis by Mode of Application, 2016-2032

- Figure 165: Middle East & Africa Industrial Tapes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Industrial Tapes Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 170: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 171: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Figure 172: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Figure 173: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 175: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 176: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Figure 177: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Figure 178: Middle East & Africa Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Figure 180: Middle East & Africa Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Figure 181: Middle East & Africa Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Figure 182: Middle East & Africa Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

"

- List of Tables

- "

- Table 1: Global Industrial Tapes Market Market Comparison by Product Type (2016-2032)

- Table 2: Global Industrial Tapes Market Market Comparison by Application (2016-2032)

- Table 3: Global Industrial Tapes Market Market Comparison by Backing Material (2016-2032)

- Table 4: Global Industrial Tapes Market Market Comparison by Mode of Application (2016-2032)

- Table 5: Global Industrial Tapes Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 9: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 10: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Table 11: Global Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Table 12: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 14: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 15: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Table 16: Global Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Table 17: Global Industrial Tapes Market Market Share Comparison by Region (2016-2032)

- Table 18: Global Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Table 19: Global Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Table 20: Global Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Table 21: Global Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Table 22: North America Industrial Tapes Market Market Comparison by Application (2016-2032)

- Table 23: North America Industrial Tapes Market Market Comparison by Backing Material (2016-2032)

- Table 24: North America Industrial Tapes Market Market Comparison by Mode of Application (2016-2032)

- Table 25: North America Industrial Tapes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 29: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 30: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Table 31: North America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Table 32: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 34: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 35: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Table 36: North America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Table 37: North America Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Table 38: North America Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Table 39: North America Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Table 40: North America Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Table 41: North America Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Table 42: Western Europe Industrial Tapes Market Market Comparison by Product Type (2016-2032)

- Table 43: Western Europe Industrial Tapes Market Market Comparison by Application (2016-2032)

- Table 44: Western Europe Industrial Tapes Market Market Comparison by Backing Material (2016-2032)

- Table 45: Western Europe Industrial Tapes Market Market Comparison by Mode of Application (2016-2032)

- Table 46: Western Europe Industrial Tapes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 50: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 51: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Table 52: Western Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Table 53: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 54: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 55: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 56: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Table 57: Western Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Table 58: Western Europe Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Table 59: Western Europe Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Table 60: Western Europe Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Table 61: Western Europe Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Table 62: Western Europe Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Table 63: Eastern Europe Industrial Tapes Market Market Comparison by Product Type (2016-2032)

- Table 64: Eastern Europe Industrial Tapes Market Market Comparison by Application (2016-2032)

- Table 65: Eastern Europe Industrial Tapes Market Market Comparison by Backing Material (2016-2032)

- Table 66: Eastern Europe Industrial Tapes Market Market Comparison by Mode of Application (2016-2032)

- Table 67: Eastern Europe Industrial Tapes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Table 69: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 71: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 72: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Table 73: Eastern Europe Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Table 74: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 75: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 76: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 77: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Table 78: Eastern Europe Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Table 79: Eastern Europe Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Table 80: Eastern Europe Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Table 81: Eastern Europe Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Table 82: Eastern Europe Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Table 83: Eastern Europe Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Table 84: APAC Industrial Tapes Market Market Comparison by Product Type (2016-2032)

- Table 85: APAC Industrial Tapes Market Market Comparison by Application (2016-2032)

- Table 86: APAC Industrial Tapes Market Market Comparison by Backing Material (2016-2032)

- Table 87: APAC Industrial Tapes Market Market Comparison by Mode of Application (2016-2032)

- Table 88: APAC Industrial Tapes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: APAC Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Table 90: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 92: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 93: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Table 94: APAC Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Table 95: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 96: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 97: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 98: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Table 99: APAC Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Table 100: APAC Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Table 101: APAC Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Table 102: APAC Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Table 103: APAC Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Table 104: APAC Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Table 105: Latin America Industrial Tapes Market Market Comparison by Product Type (2016-2032)

- Table 106: Latin America Industrial Tapes Market Market Comparison by Application (2016-2032)

- Table 107: Latin America Industrial Tapes Market Market Comparison by Backing Material (2016-2032)

- Table 108: Latin America Industrial Tapes Market Market Comparison by Mode of Application (2016-2032)

- Table 109: Latin America Industrial Tapes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 110: Latin America Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Table 111: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 112: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 113: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 114: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Table 115: Latin America Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Table 116: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 117: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 118: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 119: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Table 120: Latin America Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Table 121: Latin America Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Table 122: Latin America Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Table 123: Latin America Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Table 124: Latin America Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Table 125: Latin America Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- Table 126: Middle East & Africa Industrial Tapes Market Market Comparison by Product Type (2016-2032)

- Table 127: Middle East & Africa Industrial Tapes Market Market Comparison by Application (2016-2032)

- Table 128: Middle East & Africa Industrial Tapes Market Market Comparison by Backing Material (2016-2032)

- Table 129: Middle East & Africa Industrial Tapes Market Market Comparison by Mode of Application (2016-2032)

- Table 130: Middle East & Africa Industrial Tapes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 131: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) (2016-2032)

- Table 132: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 133: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 134: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 135: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Backing Material (2016-2032)

- Table 136: Middle East & Africa Industrial Tapes Market Market Revenue (US$ Mn) Comparison by Mode of Application (2016-2032)

- Table 137: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 138: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 139: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 140: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Backing Material (2016-2032)

- Table 141: Middle East & Africa Industrial Tapes Market Market Y-o-Y Growth Rate Comparison by Mode of Application (2016-2032)

- Table 142: Middle East & Africa Industrial Tapes Market Market Share Comparison by Country (2016-2032)

- Table 143: Middle East & Africa Industrial Tapes Market Market Share Comparison by Product Type (2016-2032)

- Table 144: Middle East & Africa Industrial Tapes Market Market Share Comparison by Application (2016-2032)

- Table 145: Middle East & Africa Industrial Tapes Market Market Share Comparison by Backing Material (2016-2032)

- Table 146: Middle East & Africa Industrial Tapes Market Market Share Comparison by Mode of Application (2016-2032)

- 1. Executive Summary

-

- 3M Company (US)

- Avery Dennison Corporation (US)

- Tesa SE (Germany)

- Nitto Denko Corporation (Japan)

- Intertape Polymer Group Inc. (US)

- Shape Technologies, LLC (US)

- Scapa Group plc (UK)

- Lintec Corporation (Japan)

- Berry Global, Inc. (US)

- Saint-Gobain S.A. (France)

- Dow (US)

- Henkel AG (Germany)

- Eastman Chemical Company or its subsidiaries (US)

- Ashland Inc. (US)

- H.B. Fuller Company (US)

- Microseal Industries Inc.

- Necal Corporation