Industrial Gases Market Report By Product (Carbon Dioxide, Argon, Nitrogen, Oxygen, Hydrogen, and Others), By Application (Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, and Others), By Distribution, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

13222

-

May 2023

-

160

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

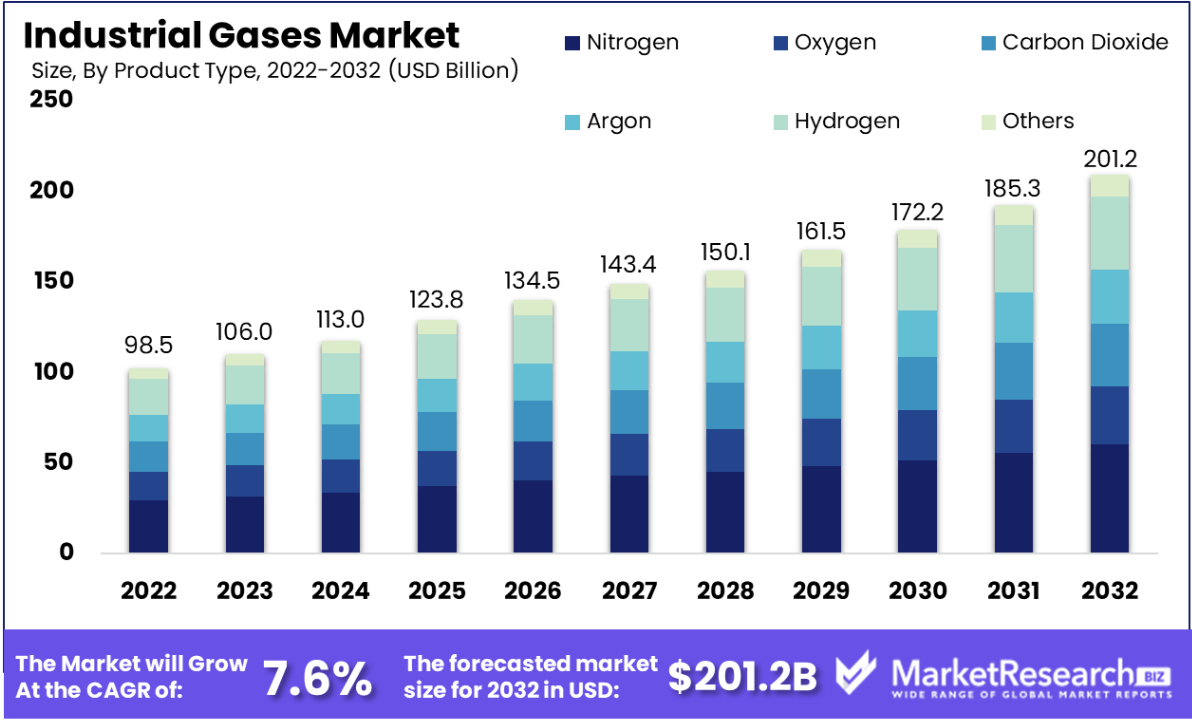

The global industrial gases market size was valued at USD 98.5 billion in 2022 and is expected to grow at a CAGR of 7.6% from 2023 to 2032. It is expected to reach USD 201.2 billion by 2032.

The industrial gases market is a vital and ever-evolving segment of the global chemical and manufacturing landscape. Comprising gases like nitrogen, oxygen, argon, and hydrogen, industrial gases serve as linchpins in a wide array of industries, spanning from food and beverage to healthcare, electronics, and energy. This market thrives on innovation, driven by the increasing demand for green hydrogen, the rising significance of specialty gases in high-tech applications, and the adoption of advanced storage solutions that enhance safety and efficiency.

Sustainability is a core focus, with the industry actively engaged in carbon capture and utilization (CCU) efforts to reduce carbon emissions. Regionally, Asia Pacific leads the way, benefiting from its growing economy, industrialization, and expanding healthcare sector. In summary, the industrial gases market plays an indispensable role in supporting diverse industrial processes, with innovation and sustainability as key driving forces in its continued growth and relevance. The evolution of gas cylinder has significantly impacted the industrial gas market, facilitating safer and more effective storage and transportation solutions.

Key Takeaways

- The food and beverage industry is experiencing substantial growth due to the extensive use of industrial gases in food processing, packaging, and preservation.

- The oil and gas industry is driving significant demand for industrial gases, particularly in refining, separation, and pipeline operations.

- Nitrogen stands out as a prominent industrial gas due to its affordability, safety, and effectiveness in various applications.

- The manufacturing industry is the leading sector for industrial gas usage, supporting processes like welding, cutting, heat treating, and electronics manufacturing.

- Packaged industrial gases, delivered in cylinders and tanks, are the dominant supply mode, offering flexibility and convenience across various industries.

- Asia Pacific dominates the industrial gases market due to its expanding economy, industrialization, and healthcare industry growth.

Driving Factors

Substantial Growth in the food and beverage (F&B) Industry

Due to their widespread usage in freezing and cooling processes to maintain the texture, nutrition, and freshness of a variety of food products, including meat, poultry, fish, baked goods, and vegetables, industrial gases play a significant role in the food and beverage sector. Industrial gases are also widely used in carbonated beverages, including soda, beer, and sparkling water, to add fizz, improve flavor, and enhance the sensory experience of the beverages.

The need for industrial gases in food packaging and preservation to retain product quality, freshness, and texture as well as to produce an inert environment, limit oxidation, prevent spoilage, and reduce microbiological development is further fuelling the market's expansion. Another element driving development is the rising consumption of packaged food items, which is caused by shifting consumer lifestyles and busy schedules.

Significant Demand from the Oil & Gas Industry

Demand for industrial gases like nitrogen, argon, and hydrogen is increasing as a result of the booming oil and gas industry, especially in processes like refining, separation, and pipeline operations. The demand for these gases is expected to grow along with expanded exploration and production efforts since the world's oil consumption is anticipated to increase dramatically and because India currently has a sizable refining capacity. The Industrial Gases Market has excellent growth prospects as a result of the boom in the oil and gas sector.

New Technological Advancements

Rapid technical improvements have recently been seen in the industrial gases industry in an effort to increase product efficiency, advance sustainability, and reduce costs. As a result, the expansion of the market is being positively impacted by the recent development of on-site gas generation systems, which produce industrial gases directly at the point of application, obviating the need for transportation and storage equipment.

Moreover, the development of cutting-edge gas purification methods like pressure swing adsorption (PSA) and membrane separation, which allow for the elimination of pollutants and contaminants, guarantee high quality, and adhere to rigid industry requirements, is encouraging market expansion. Additionally, electrolysis, a sustainable hydrogen generation technique that uses renewable electricity to promote sustainability and lessen reliance on fossil fuels, is helping to fuel market expansion.

Restraining Factors

Limitations on the Environmental Hazards of Industrial Gases

Methane and carbon dioxide are two examples of the industrial gases that offer serious risks to the environment by causing pollution, global warming, and other dangers. Regulations like the U.S. Clean Air Act and the EPA's GHG emissions regulations actively work to reduce these emissions. These rules are essential for environmental protection, but they pose significant difficulties for the industrial gas market. As a result of these problems, the industry faces significant restraints and a potential slowdown.

High Capital Investment

The huge capital expenditure needed to set up a production and distribution facility. Industrial gas production, storage, and transportation infrastructure requires significant financial resources to build and maintain. Smaller firms may be discouraged from entering the industry because of this entrance hurdle. Furthermore, the lengthy timeframe for returns on these investments can be very difficult for enterprises, thus limiting market expansion.

Growth Opportunity

Emerging Hydrogen Economy

Hydrogen has taken the lead in the global search for clean and environmentally friendly energy options. Companies that produce industrial gases are positioned to be key players in the developing hydrogen economy. When created from renewable energy sources, hydrogen is regarded as a clean fuel with uses in energy storage, transportation, and a number of industrial activities. The ability to increase hydrogen generation and delivery creates a large growth opportunity for industrial gas suppliers.

Expansion of the healthcare sector

The COVID-19 pandemic brought to light the crucial function that medicinal gases play in healthcare. It is anticipated that the rising demand for medical oxygen and other speciality gases would persist. Additionally, the expanding healthcare industry in emerging nations offers industrial gas suppliers additional opportunities to sell medical gases and associated equipment.

Modernization and Rapid Technological Advancement

New industrial gas uses are being developed as a result of recent technological advances. For instance, developments in gas separation and cryogenic technology are enabling the creation of novel applications in sectors including electronics, biology, and medicines. Businesses who spend money on R&D to use these technologies will have an advantage over rivals.

Carbon Capture and Storage (CCS)

As climate change mitigation efforts are given more attention, technologies for capturing and storing carbon are becoming more well-known. In these operations, industrial gases, in particular carbon dioxide, are essential. The best-positioned businesses to take advantage of this expansion potential are those that specialize in carbon capture technologies and provide services for safe movement and storage of captured CO2.

By Product Type

The market for industrial gases is thoroughly examined in the report, which divides it into categories for nitrogen, oxygen, carbon dioxide, argon, hydrogen, and other gases. The segment that stands out as the most among these is nitrogen.

The advantages of nitrogen include its affordability, accessibility, and safety in processes including preservation, purging, and blanketing. Its importance is shown by the way it prevents oxidation, corrosion, and spoiling in a variety of industries. Additionally, it is a safe choice because of its non-flammable and non-toxic qualities, which guarantee worker security and reduce potential risks. Strong infrastructure for the production, storage, and delivery of nitrogen is made possible by supportive governmental policies, which also promote accessibility. Market expansion is further accelerated by the use of cutting-edge production technologies that improve yield and purity levels.

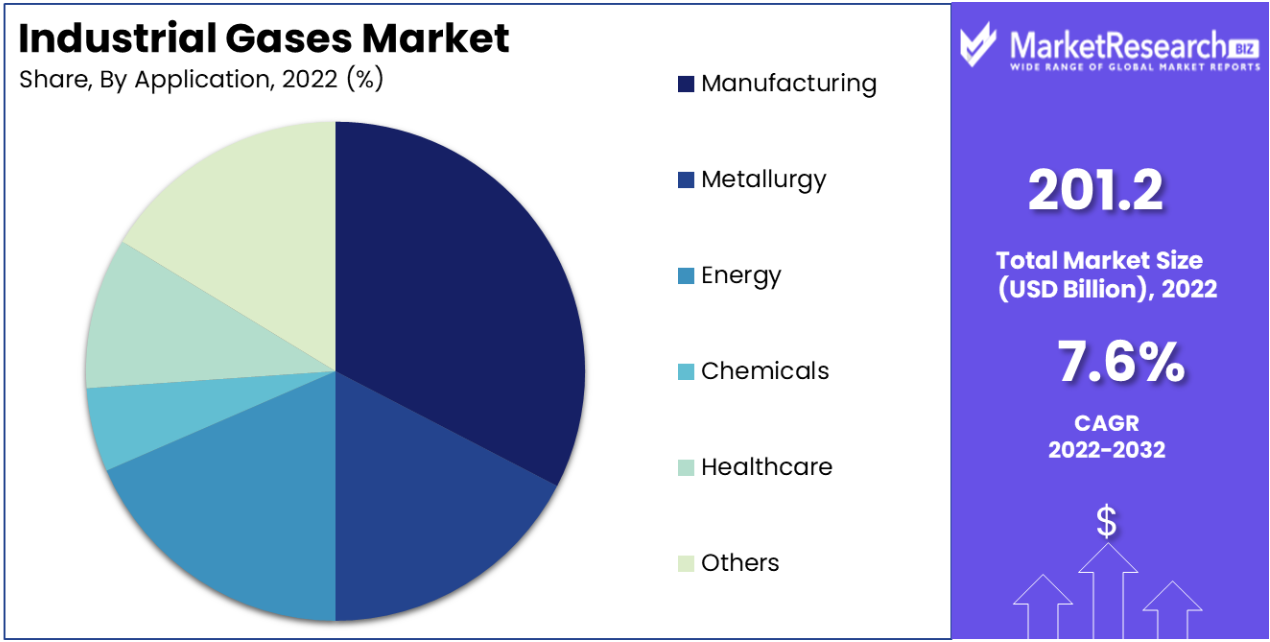

By Application Type

The industrial gases market is carefully broken down in the study, segmented by industry verticals like manufacturing, metallurgy, energy, chemicals, healthcare, and others. Notably, the manufacturing industry emerges as the leading sector.

Industrial gases are used in a variety of manufacturing processes, including welding, cutting, heat treating, fabricating metal, producing chemicals, processing food, and making electronic devices. Besides operational applications, they are essential for process optimization, boosting productivity overall, increasing efficiency, and cutting costs. These gases also maintain high standards for quality and safety, generating inert conditions that inhibit corrosion, oxidation, and microbiological growth.

To accommodate the rising demand, major industry players are deliberately investing in wide-ranging networks and distribution channels. The development of sophisticated manufacturing techniques, particularly three-dimensional (3D) printing, has increased the demand for industrial gases to maintain regulated environments, reduce contamination, and boost productivity.

By Distribution Type

The industrial gases market is carefully analysed in the study, and it is divided into three supply modes: packaged, bulk, and others. It is noteworthy that packaged industrial gases have the lead in the market.

Compressed and liquefied types of packaged industrial gases are delivered in cylinders and tanks. This format not only improves mobility but also convenience, making it possible for products to be transported, stored, and handled with ease across a variety of industries. Welding, cutting, laboratory analysis, food and beverage processing, healthcare, metal fabrication, vehicle repairs, and electronics manufacturing are just a few of their numerous uses. These applications are key market development drivers. Additionally, the existence of a solid network of retail stores, gas filling stations, and distribution hubs for industrial gas providers greatly supports market expansion. Furthermore, packaged industrial gases provide flexibility and customization choices, meeting the special needs and application-specific requirements of clients from a variety of industries.

Key Market Segments

By Product Type

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

By Application Type

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

By Distribution Type

- Bulk

- Packaged

- Others

Latest Trends

Green Hydrogen Drives Industrial Gas Innovation

The industrial gases sector is experiencing a surge in innovation, driven by the growing demand for green hydrogen. Green hydrogen is produced using renewable energy sources, such as wind and solar power, to extract hydrogen from water through electrolysis. This sustainable method of hydrogen production is gaining prominence as nations and industries strive to reduce carbon emissions and transition to cleaner energy sources. Industrial gas companies are at the forefront of this transformation, investing in cutting-edge technologies and processes to efficiently produce and distribute green hydrogen.

Specialty Gases for High-Tech Applications

Specialty gases, characterized by their exceptionally high purity levels and precise formulations, are witnessing increased demand, especially in high-tech industries. These gases are indispensable in semiconductor manufacturing, electronics fabrication, and advanced research laboratories, where even minute impurities can disrupt delicate processes. With the continuous evolution of technology and the ever-increasing demands for precision and quality, industries are increasingly relying on specialty gases to meet their stringent requirements.

Advanced Gas Storage Solutions

The landscape of industrial gas handling is undergoing a profound transformation, thanks to innovative storage solutions. Traditional methods involved the use of cylinders and tanks, which, while providing mobility, posed limitations in terms of safety and ease of handling. However, recent advancements in storage technology have introduced safer and more efficient alternatives. Notably, advanced cryogenic storage systems capable of maintaining gases at extremely low temperatures are reducing the risk of leaks and increasing storage capacity.

Sustainability Focus on Carbon Capture and Utilization (CCU)

Sustainability has taken center stage in the industrial gas industry, with a strong emphasis on carbon capture and utilization (CCU). CCU technologies aim to capture carbon dioxide emissions from industrial processes and convert them into valuable products or store them safely underground. Industrial gas companies are actively engaged in developing and implementing CCU solutions, which involve advanced gas separation and purification techniques for efficient CO2 capture.

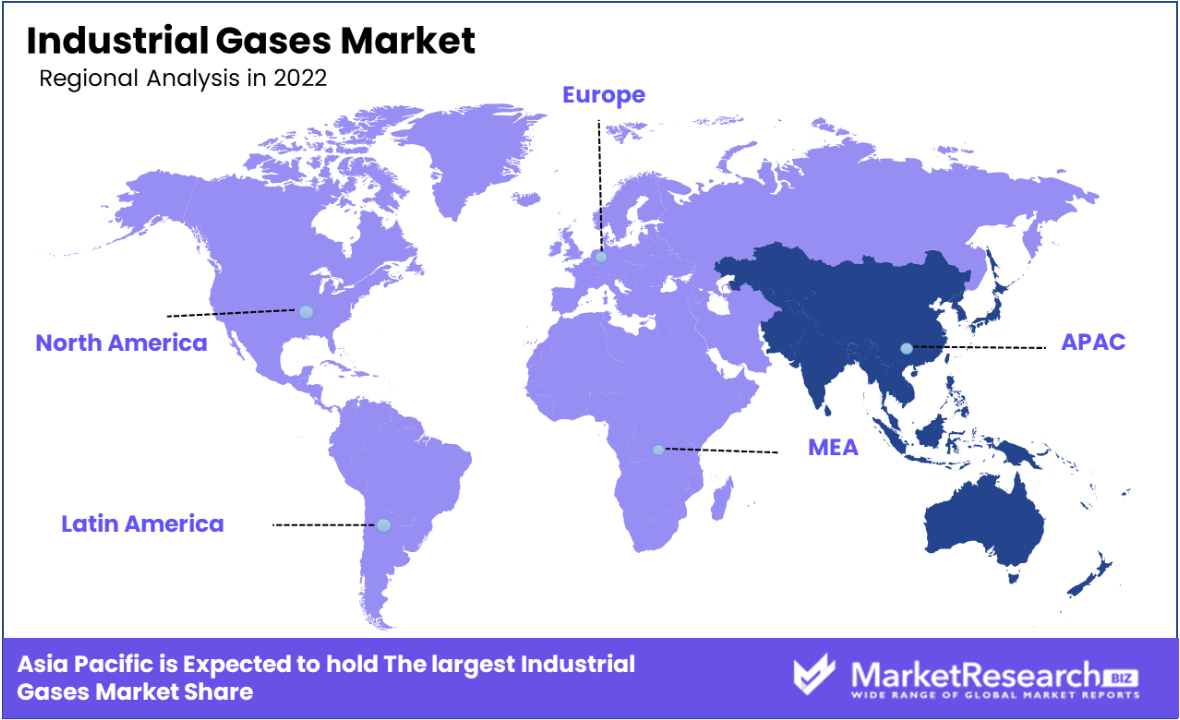

Regional Analysis

Due to its expanding economy, fast industrialization, and substantial infrastructure development, Asia Pacific dominates the market for industrial gases. It is a key location for the production of machinery, chemicals, semiconductors, electronics, and vehicles, all of which largely rely on industrial gases for various processes.

The demand for industrial gases in vital applications like respiratory support, anaesthesia, and medical imaging is being further fueled by the steady growth of the healthcare industry, driven by an older population and increased health consciousness. Together, these elements place Asia Pacific as the key participant in the market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Share and Key Players Analysis

The expanding industrialisation that is driving this growth is the market for industrial gases worldwide. Through new facilities, distribution networks, and regional alliances, major industrial participants are growing globally. Eco-conscious consumers and the promotion of more environmentally friendly business practices are the driving forces behind the development of energy-efficient production technology. In order to improve operational efficiency, streamline supply chains, and improve customer satisfaction, automation and digital technologies are also being integrated.

Key Players of the Industrial Gases Market

- Air Liquide

- Air Products Inc.

- INOX-Air Products Inc.

- Iwatani Corp.

- Linde plc

- Messer

- SOL Group

- Strandmøllen A / S

- Taiyo Nippon Sanso Corp.

Recent Development

- On October 2023, The United States Environmental Protection Agency (EPA) has introduced new measures to address the issue of climate-warming industrial gases, specifically hydroflourocarbons (HFCs), used in various applications. Here are the key developments:

- On October 2023, Atlas Copco, a global industrial equipment and services provider, recently acquired two US-based medical gas system specialists, William G Frank Medical Gas Testing and Consulting, and Medical Gas Credentialing.

- On September 2023, Westfalen, a leading industrial gases specialist, has inaugurated a new filling plant in Arzal on the Atlantic coast of Brittany, France. This marks a significant expansion of the company's operations in the country. France has established itself as Westfalen's largest foreign market.

- The industrial gases industry is set to come together at the Asia-Pacific Industrial Gases Conference 2023, scheduled to be held in Kuala Lumpur, Malaysia, from December 5-7, 2023.

- On May 2023, Messer, the world's largest privately held specialist for industrial, medical, and specialty gases, fully acquired all shares in Messer Industries from the previous minority owner, CVC Capital Partners Fund VII. Messer plans a rapid integration of Messer Industries into Messer SE & Co. KGaA.

- On May 2023, Tunable AS unveiled their groundbreaking gas fingerprint recognition technology at the Sensor + Test event in Germany. This innovative approach offers valuable insights into gas and odor composition, making it an excellent tool for applications like air quality monitoring and process optimization.

Report Scope

Report Features Description Market Value (2022) US$ 98.5 Bn Forecast Revenue (2032) US$ 201.2 Bn CAGR (2023-2032) 7.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Carbon Dioxide, Argon, Nitrogen, Oxygen, Hydrogen, and Others), By Application (Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, and Others), By Distribution (Bulk, Packaged and Others) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Air Liquide, Air Products Inc., INOX-Air Products Inc., Iwatani Corp., Linde plc, Messer, SOL Group, Strandmøllen A/S, Taiyo Nippon Sanso Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Air Liquide

- Air Products Inc.

- INOX-Air Products Inc.

- Iwatani Corp.

- Linde plc

- Messer

- SOL Group

- Strandmøllen A / S

- Taiyo Nippon Sanso Corp.