Industrial Gas Regulator Market By Type (Single-Stage Regulator, Dual Stage Regulator), By Gas Type (Inert Gases, Toxic Gases, Corrosive Gases), By Material (Brass, Stainless Steel), By Application (Oil and Gas, Chemical, Steel and Metal Processing, Medical Care, Food and Beverage, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50132

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

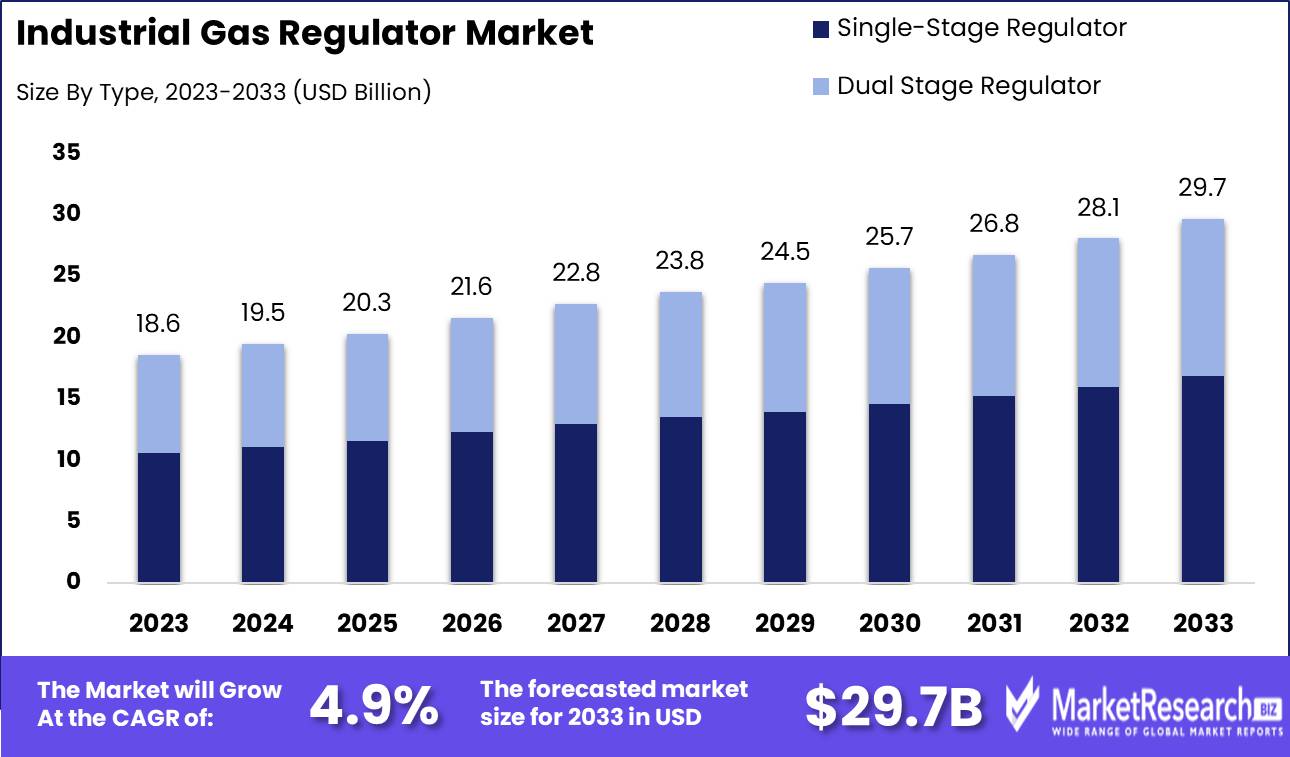

The Industrial Gas Regulator Market was valued at USD 18.6 billion in 2023. It is expected to reach USD 29.7 billion by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033.

The Industrial Gas Regulator Market encompasses the global supply and demand for devices that control the flow and pressure of gases used in various industrial applications. These regulators ensure safety and efficiency in sectors such as manufacturing, chemical processing, and energy production by maintaining optimal gas delivery. Market growth is driven by increased industrialization, advancements in automation, and stringent safety regulations.

The Industrial Gas Regulator Market is poised for substantial growth, driven by several critical factors that highlight its strategic importance in various industries. A significant driver is the increasing demand in the healthcare sector, where the precision and reliability of gas regulators are paramount for applications such as medical oxygen delivery and anesthesia. The healthcare industry's rigorous standards necessitate advanced gas regulator technologies, contributing to market expansion.

Additionally, technological advancements have facilitated the development of more efficient and accurate gas regulators, which enhance operational safety and efficiency across industrial applications. Innovations such as digital pressure regulators and IoT-enabled devices are transforming traditional practices, offering real-time monitoring and precise control, thereby reducing downtime and maintenance costs.

Moreover, the market is significantly influenced by stringent safety regulations imposed by governments and international bodies. These regulations mandate the use of certified and reliable gas regulators to prevent hazardous incidents, driving the demand for high-quality products. Environmental concerns also play a pivotal role, as industries seek sustainable solutions to reduce their carbon footprint. Advanced gas regulators that optimize gas usage and minimize emissions align with the global push towards greener industrial practices. In summary, the industrial gas regulator market is on a robust growth trajectory, underpinned by healthcare demand, technological innovations, regulatory frameworks, and environmental imperatives. These factors collectively enhance the market's value proposition, making it a critical component of industrial safety and efficiency.

Key Takeaways

- Market Growth: The Industrial Gas Regulator Market was valued at USD 18.6 billion in 2023. It is expected to reach USD 29.7 billion by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033.

- By Type: Single-Stage Regulators dominated, while Dual-Stage served specialized needs.

- By Gas Type: Inert gases dominated due to broad industrial applications and safety.

- By Material: Brass regulators dominated due to cost-effectiveness and versatility.

- By Application: Oil and gas dominated the industrial gas regulator market.

- Regional Dominance: North America leads the industrial gas regulator market with a 35% share.

- Growth Opportunity: Embracing technology and rising natural gas demand offers significant growth opportunities for the industrial gas regulator market.

Driving factors

Increasing Demand for Industrial Gases Driving Market Expansion

The Industrial Gas Regulator Market is witnessing significant growth primarily due to the escalating demand for industrial gases across various sectors. Industrial gases such as oxygen, nitrogen, hydrogen, and carbon dioxide are essential in numerous applications, including manufacturing, healthcare, electronics, and food and beverages. According to recent statistics, the global industrial gas market is projected to reach USD 126.80 billion by 2028, growing at a CAGR of 6.1% from 2021 to 2028. This surge in demand necessitates the efficient regulation and control of gas flow, pressure, and distribution, thereby driving the demand for advanced industrial gas regulators. The increased adoption of industrial gases for enhanced productivity and operational efficiency in industries is a critical driver for the growth of the Industrial Gas Regulator Market.

Technological Advancements Enhancing the Efficiency and Safety of Gas Regulation Systems

Technological advancements in industrial gas regulator systems have significantly contributed to the market's growth. Innovations such as smart gas regulators, which offer real-time monitoring and control, and the integration of IoT and AI technologies have revolutionized how industrial gases are managed. These advancements provide enhanced accuracy, efficiency, and safety in gas regulation, meeting the stringent requirements of modern industrial applications. For instance, smart regulators can automatically adjust pressure levels based on real-time data, reducing the risk of leaks and ensuring optimal gas usage. The integration of such technologies is expected to propel the market forward, as industries increasingly adopt these advanced solutions to improve operational performance and reduce costs.

Government Initiatives Supporting Market Growth through Regulations and Incentives

Government initiatives and regulations play a pivotal role in shaping the Industrial Gas Regulator Market. Governments worldwide are implementing stringent safety and environmental regulations that mandate the use of reliable and efficient gas regulation systems. For example, the European Union's regulations on industrial emissions and the U.S. Occupational Safety and Health Administration's (OSHA) standards for gas handling and storage necessitate the adoption of high-quality gas regulators.

Additionally, governments are providing incentives and subsidies to promote the use of clean energy and sustainable industrial practices, further boosting the demand for advanced gas regulators. These regulatory frameworks and support mechanisms are essential in driving the growth of the Industrial Gas Regulator Market, ensuring compliance with safety standards, and encouraging the adoption of innovative technologies.

Restraining Factors

High Initial Investment: A Barrier to Market Expansion

The Industrial Gas Regulator Market faces significant challenges due to the high initial investment required for setting up production facilities and infrastructure. This financial burden can deter new entrants and slow the expansion efforts of existing players. High costs are associated with acquiring advanced technology, maintaining safety standards, and ensuring regulatory compliance. These expenses can lead to a slower return on investment (ROI), which may dissuade potential investors and companies from committing substantial capital. Consequently, the growth rate of the market can be restrained as firms may be cautious about expanding their operations or upgrading their equipment.

Shortage of Skilled Personnel: Limiting Operational Efficiency

A critical factor restraining the growth of the Industrial Gas Regulator Market is the shortage of skilled personnel. The industry requires a workforce with specialized knowledge in handling and maintaining gas regulators, ensuring safety protocols, and operating advanced machinery. The lack of adequately trained professionals can lead to operational inefficiencies, increased safety risks, and potential downtime. This shortage can also inflate labor costs as companies compete for a limited pool of skilled workers, further adding to operational expenses. As a result, the market's growth can be hampered by these human resource constraints, affecting the overall productivity and expansion capabilities of businesses within the industry.

By Type Analysis

In 2023, Single-Stage Regulators dominated, while Dual-Stage served specialized needs.

In 2023, The Single-Stage Regulator held a dominant market position in the By Type segment of the Industrial Gas Regulator Market. Characterized by its simplicity and cost-effectiveness, the Single-Stage Regulator is designed to reduce cylinder pressure to a usable level in a single step, making it a preferred choice for applications requiring moderate precision. Its robust construction and ease of maintenance contribute to its widespread adoption across various industries, including manufacturing, healthcare, and chemical processing. The growing demand for efficient gas management solutions, driven by the expansion of industrial activities and stringent safety regulations, has further bolstered the market share of Single-Stage Regulators.

Conversely, Dual-Stage Regulators, while not as dominant as their single-stage counterparts, cater to applications necessitating greater accuracy and stability. These regulators reduce cylinder pressure in two stages, providing a more consistent output despite fluctuations in input pressure. This characteristic makes them essential in high-precision environments such as laboratory settings and specialty gas applications. Although Dual-Stage Regulators represent a smaller market share, their significance in specialized applications underscores their continued relevance and steady demand within the industrial gas regulator market.

By Gas Type Analysis

In 2023, Inert gases dominated due to broad industrial applications and safety.

In 2023, Inert gases held a dominant market position in the "By Gas Type" segment of the Industrial Gas Regulator Market. The prevalence of inert gases, such as argon, helium, and nitrogen, in various industrial applications contributed significantly to this dominance. These gases are crucial in welding, semiconductor manufacturing, and metal fabrication due to their non-reactive nature, ensuring safety and process stability. Their widespread use in food packaging and preservation, where they prevent oxidation and spoilage, further bolstered market demand. The increasing need for high-purity gases in the electronics and pharmaceutical industries also played a pivotal role. With advancements in manufacturing technologies and the growing emphasis on product quality and safety, the reliance on inert gases is projected to continue rising.

Toxic gases, such as chlorine and ammonia, represented another significant segment. These gases are essential in chemical processing, water treatment, and refrigeration systems. Their hazardous nature necessitates precise regulation and control, driving demand for advanced gas regulators. Stringent environmental and safety regulations also propel market growth, as industries seek compliant and efficient solutions.

Corrosive gases, including hydrogen chloride and sulfur dioxide, are integral in industries like petrochemicals, pharmaceuticals, and metallurgy. These gases require specialized regulators that can withstand corrosive environments. The increasing complexity of industrial processes and the need for robust, durable equipment underscore the importance of this segment. As industries evolve, the demand for high-performance regulators tailored for corrosive gases is anticipated to grow, reflecting broader market trends toward safety and efficiency in challenging conditions.

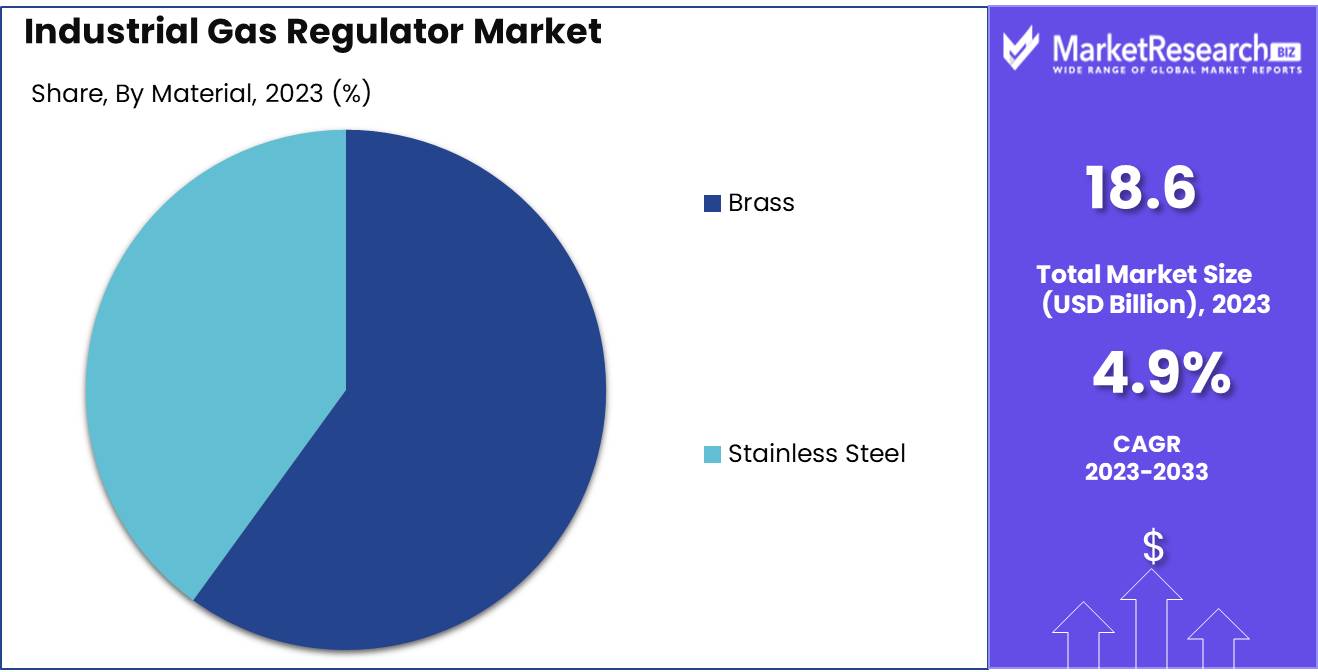

By Material Analysis

In 2023, Brass regulators dominated due to cost-effectiveness and versatility.

In 2023, Brass held a dominant market position in the By Material segment of the Industrial Gas Regulator Market. Brass regulators are highly favored due to their excellent machinability, durability, and resistance to corrosion, making them suitable for a wide range of industrial applications. The material’s inherent properties, such as low friction and robust strength, ensure reliable performance under various operational pressures, which is critical in industrial settings where safety and precision are paramount. Moreover, the cost-effectiveness of brass compared to other metals makes it a preferred choice for manufacturers looking to balance quality and affordability.

Conversely, stainless steel regulators are gaining traction due to their superior resistance to extreme temperatures and corrosive environments. Stainless steel’s robustness and high tensile strength make it ideal for critical applications in industries such as petrochemical, oil and gas, and chemical processing, where durability and reliability are essential. The material’s ability to withstand harsh conditions without compromising performance ensures operational efficiency and safety. While stainless steel regulators tend to be more expensive than their brass counterparts, their longevity, and minimal maintenance requirements often justify the higher initial investment.

By Application Analysis

In 2023, Oil and gas dominated the industrial gas regulator market.

In 2023, The Oil and gas sector held a dominant market position in the industrial gas regulator market by application. This sector's preeminence can be attributed to the high demand for precise and reliable gas regulation to ensure safety and efficiency in exploration, production, and refining processes. Industrial gas regulators are crucial for controlling the pressure and flow of various gases, which are integral in the drilling, extraction, and transportation of oil and gas. Additionally, the continuous investment in new oil and gas projects and the maintenance of existing infrastructures drive the consistent demand for these regulators.

The chemical industry also significantly contributes to the industrial gas regulator market, utilizing these devices for handling gases in processes like synthesis, reaction control, and product storage. Steel and metal processing demand regulators for furnaces and cutting operations, ensuring precise gas flow to maintain quality and safety.

In the medical care sector, regulators are essential for managing gases used in patient care and laboratory applications, ensuring consistent delivery and pressure. The food and beverage industry uses gas regulators in carbonation, packaging, and preservation processes, maintaining product quality.

Other sectors including electronics, automotive, and research institutions, leverage gas regulators for various applications, reflecting the broad utility and critical importance of these devices across multiple industries.

Key Market Segments

By Type

- Single-Stage Regulator

- Dual Stage Regulator

By Gas Type

- Inert Gases

- Toxic Gases

- Corrosive Gases

By Material

- Brass

- Stainless Steel

By Application

- Oil and Gas

- Chemical

- Steel and Metal Processing

- Medical Care

- Food and Beverage

- Others

Growth Opportunity

Technological Advancements Driving Innovation and Efficiency

The technological advancements stand out as a pivotal growth driver for the global industrial gas regulator market. Innovations in digital and IoT-enabled gas regulators are revolutionizing the industry by enhancing precision, safety, and operational efficiency. These advanced regulators offer real-time monitoring and remote control capabilities, allowing for proactive maintenance and minimizing downtime. The integration of AI and machine learning algorithms further optimizes gas flow and pressure, reducing waste and improving energy efficiency. Companies investing in these cutting-edge technologies are likely to gain a competitive edge, as they can offer more reliable and efficient solutions to their clients, particularly in sectors such as healthcare, manufacturing, and energy.

Rising Natural Gas Demand as a Catalyst for Market Expansion

The increasing global demand for natural gas is another significant factor propelling the industrial gas regulator market forward. Natural gas, being a cleaner and more efficient energy source compared to coal and oil, is experiencing heightened demand across various industries, including power generation, transportation, and residential heating. This surge in natural gas consumption necessitates robust and precise regulation systems to ensure safe and efficient distribution. As countries and corporations continue to transition towards more sustainable energy sources, the need for advanced gas regulators that can handle the complexities of natural gas distribution will escalate. This trend presents a substantial opportunity for market players to innovate and expand their product portfolios to meet the evolving needs of the industry.

Latest Trends

Integration of Smart Technologies

The industrial gas regulator market is poised to experience significant transformation through the integration of smart technologies. This trend is driven by the increasing demand for precision and efficiency in gas regulation processes across various industries, including healthcare, manufacturing, and energy. Smart gas regulators, equipped with IoT capabilities, provide real-time monitoring, data analytics, and automated adjustments. These advanced features enable predictive maintenance, reduce downtime, and enhance safety by allowing for immediate detection and rectification of anomalies. Companies are likely to invest heavily in upgrading their infrastructure to incorporate these smart solutions, driven by the potential for cost savings and operational efficiencies.

Rising Demand for Specialty Gas Regulators

Another critical trend shaping the market is the rising demand for specialty gas regulators. Industries such as electronics, pharmaceuticals, and biotechnology require high-purity gases, necessitating regulators that can maintain stringent control over gas delivery. Specialty gas regulators are designed to handle specific gases like ammonia, hydrogen, and highly corrosive or toxic substances, ensuring safety and reliability in critical applications. This demand is fueled by the growth of advanced manufacturing processes and the expansion of sectors like semiconductor fabrication and pharmaceutical research, where precise gas control is paramount. Manufacturers are responding by developing highly specialized and customizable regulators to meet these stringent requirements.

Regional Analysis

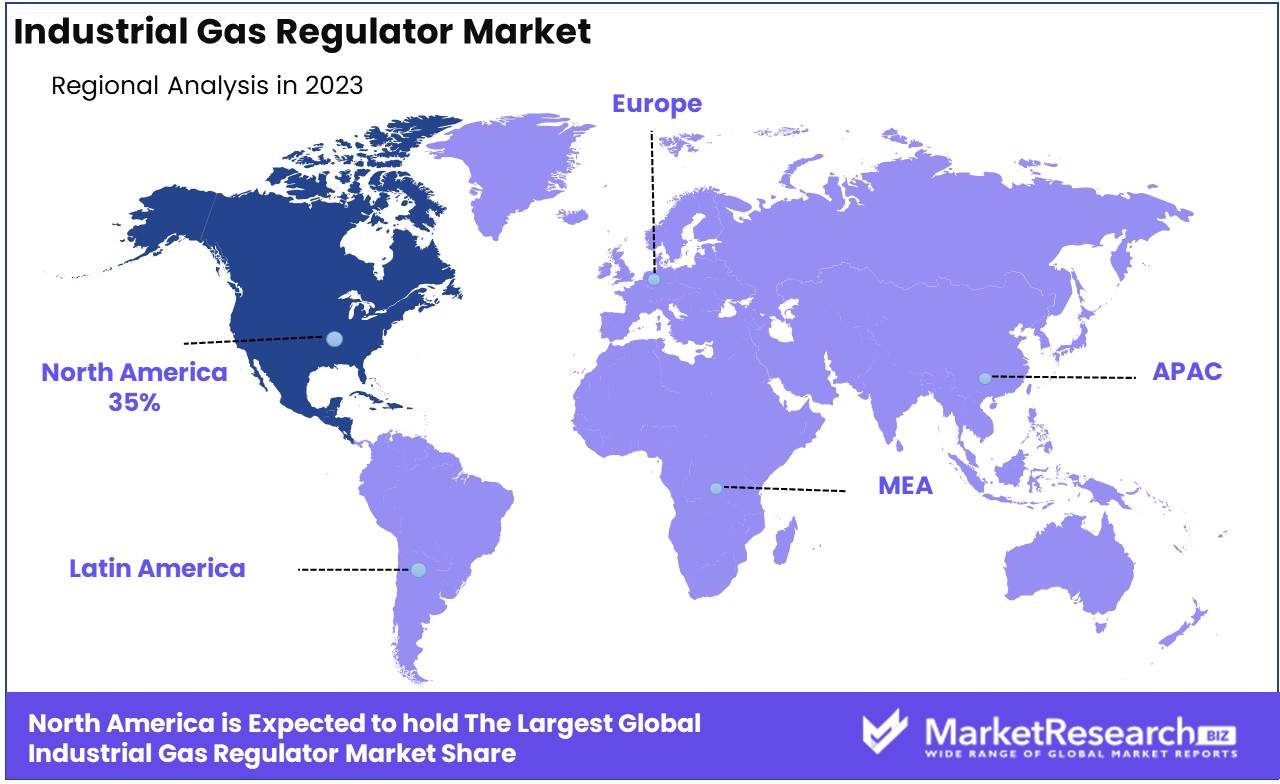

North America leads the industrial gas regulator market with a 35% share.

The industrial gas regulator market exhibits distinct regional dynamics, reflecting varying levels of industrialization, technological advancement, and regulatory frameworks. North America, the leading region with approximately 35% market share, benefits from a robust industrial base, advanced technological infrastructure, and stringent safety standards driving demand for high-quality gas regulators. The United States, in particular, plays a pivotal role due to its expansive oil & gas sector and increasing investments in healthcare and manufacturing industries.

In Europe, accounting for around 25% of the market, stringent environmental regulations and a well-established industrial sector foster significant demand. Germany, France, and the UK are prominent markets, driven by their strong automotive and chemical industries. The region’s focus on sustainable and energy-efficient solutions further propels the market for advanced gas regulators.

The Asia Pacific region, capturing about 30% of the market, is experiencing rapid growth, fueled by the industrial expansion in China, India, and Japan. The burgeoning manufacturing sector, coupled with increasing investments in the energy and healthcare sectors, underpins the market’s growth. Government initiatives to boost industrial output and improve healthcare infrastructure are critical regional drivers.

The Middle East & Africa and Latin America collectively contribute the remaining 10%, with steady growth anticipated. In the Middle East, the oil & gas industry is a primary consumer, whereas Latin America’s market is bolstered by the expanding industrial and healthcare sectors in Brazil and Mexico. Despite their smaller market shares, these regions present substantial growth opportunities driven by ongoing industrialization and infrastructural developments.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Industrial Gas Regulator Market is poised for significant growth, driven by robust demand across various industrial sectors. Key players in this market are strategically positioned to leverage their technological advancements, extensive distribution networks, and strong market presence.

Emerson Electric Co. (U.S.) and Dupont (U.S.) are anticipated to maintain their leadership roles through innovation and broad product portfolios. Emerson's focus on precision and efficiency aligns well with increasing industrial demands for high-performance regulators. Similarly, Dupont's advancements in materials science contribute to the development of durable and reliable regulators.

European giants Linde (Germany) and Air Liquide (France) continue to expand their global footprint, leveraging their strong R&D capabilities. Their strategic acquisitions and collaborations enhance their ability to serve diverse markets, particularly in emerging economies.

Praxair Technology, Inc. (U.S.) and Air Products and Chemicals Inc. (U.S.) are expected to benefit from their robust supply chains and strong customer relationships, ensuring consistent market share growth. Meanwhile, companies like SOLVAY (Belgium) and BASF SE (Germany) bring chemical expertise that supports innovative regulator solutions.

Asian players, including Iwatani Corporation (Japan) and GCE Group (Sweden), are expanding their influence through technological advancements and strategic partnerships. These companies are well-positioned to cater to the growing industrial base in Asia-Pacific. Emerging companies like Gulf Cryo (UAE) and Ellenbarrie Industrial Gases (India) are gaining traction by focusing on local market needs and expanding their product offerings.

Overall, the industrial gas regulator market is characterized by intense competition, continuous innovation, and strategic expansions, with key players leveraging their strengths to capture significant market share.

Market Key Players

- Emerson Electric Co. (U.S.)

- Dupont (U.S.)

- Linde (Germany)

- Air Liquide (France)

- Praxair Technology, Inc. (U.S.)

- SOLVAY (Belgium)

- Air Products and Chemicals Inc. (U.S.)

- Cavagna Group SPA (Italy)

- GCE Group (Sweden)

- Iwatani Corporation (Japan)

- Messer SE & Co. KGaA (Germany)

- Matheson Tri-Gas Inc. (U.S.)

- Iceblick Ltd. (Ukraine)

- Advanced Specialty Gases (U.S.)

- BASF SE (Germany)

- Buzwair Group (Qatar)

- Ellenbarrie Industrial Gases (India)

- Gulf Cryo (UAE)

- Proton Gases (India)

Recent Development

- In May 2024, Emerson Electric Co. launched a series of energy-efficient gas regulators aimed at reducing operational costs and minimizing environmental impact. These regulators feature innovative materials and design improvements that enhance durability and performance in demanding industrial environments.

- In March 2024, Air Products and Chemicals Inc. introduced a new line of advanced digital gas regulators designed to improve precision and efficiency in gas flow control. These regulators integrate IoT capabilities, allowing for real-time monitoring and adjustments, expected to drive increased adoption in industrial processes.

- In February 2024, Linde PLC announced the acquisition of Cryogenic Gas Solutions, a leading provider of advanced cryogenic equipment. This strategic move aims to enhance Linde's capabilities in delivering high-performance gas regulation solutions for industrial applications, strengthening its position in the global market.

Report Scope

Report Features Description Market Value (2023) USD 18.6 Billion Forecast Revenue (2033) USD 29.7 Billion CAGR (2024-2032) 4.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Single-Stage Regulator, Dual Stage Regulator), By Gas Type (Inert Gases, Toxic Gases, Corrosive Gases), By Material (Brass, Stainless Steel), By Application (Oil and Gas, Chemical, Steel and Metal Processing, Medical Care, Food and Beverage, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Emerson Electric Co. (U.S.), Dupont (U.S.), Linde (Germany), Air Liquide (France), Praxair Technology, Inc. (U.S.), SOLVAY (Belgium), Air Products and Chemicals Inc. (U.S.), Cavagna Group SPA (Italy), GCE Group (Sweden), Iwatani Corporation (Japan), Messer SE & Co. KGaA (Germany), Matheson Tri-Gas Inc. (U.S.), Iceblick Ltd. (Ukraine), Advanced Specialty Gases (U.S.), BASF SE (Germany), Buzwair Group (Qatar), Ellenbarrie Industrial Gases (India), Gulf Cryo (UAE), Proton Gases (India) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Emerson Electric Co. (U.S.)

- Dupont (U.S.)

- Linde (Germany)

- Air Liquide (France)

- Praxair Technology, Inc. (U.S.)

- SOLVAY (Belgium)

- Air Products and Chemicals Inc. (U.S.)

- Cavagna Group SPA (Italy)

- GCE Group (Sweden)

- Iwatani Corporation (Japan)

- Messer SE & Co. KGaA (Germany)

- Matheson Tri-Gas Inc. (U.S.)

- Iceblick Ltd. (Ukraine)

- Advanced Specialty Gases (U.S.)

- BASF SE (Germany)

- Buzwair Group (Qatar)

- Ellenbarrie Industrial Gases (India)

- Gulf Cryo (UAE)

- Proton Gases (India)