Global Ammonia Market By Product Form(Liquid, Gas, Powder), By Application(Agriculture & Fertilizers , Textile, Refrigerants, Pharmaceuticals, Textile, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

4449

-

May 2023

-

172

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Ammonia Market Size, Share, Trends Analysis

- Driving Factors

- Restraining Factors

- Ammonia Market Segmentation Analysis

- Ammonia Industry Segments

- Growth Opportunities

- Ammonia Market Regional Analysis

- Ammonia Industry By Region

- Ammonia Market Key Player Analysis

- Ammonia Industry Key Players

- Ammonia Market Recent Development

- Report Scope

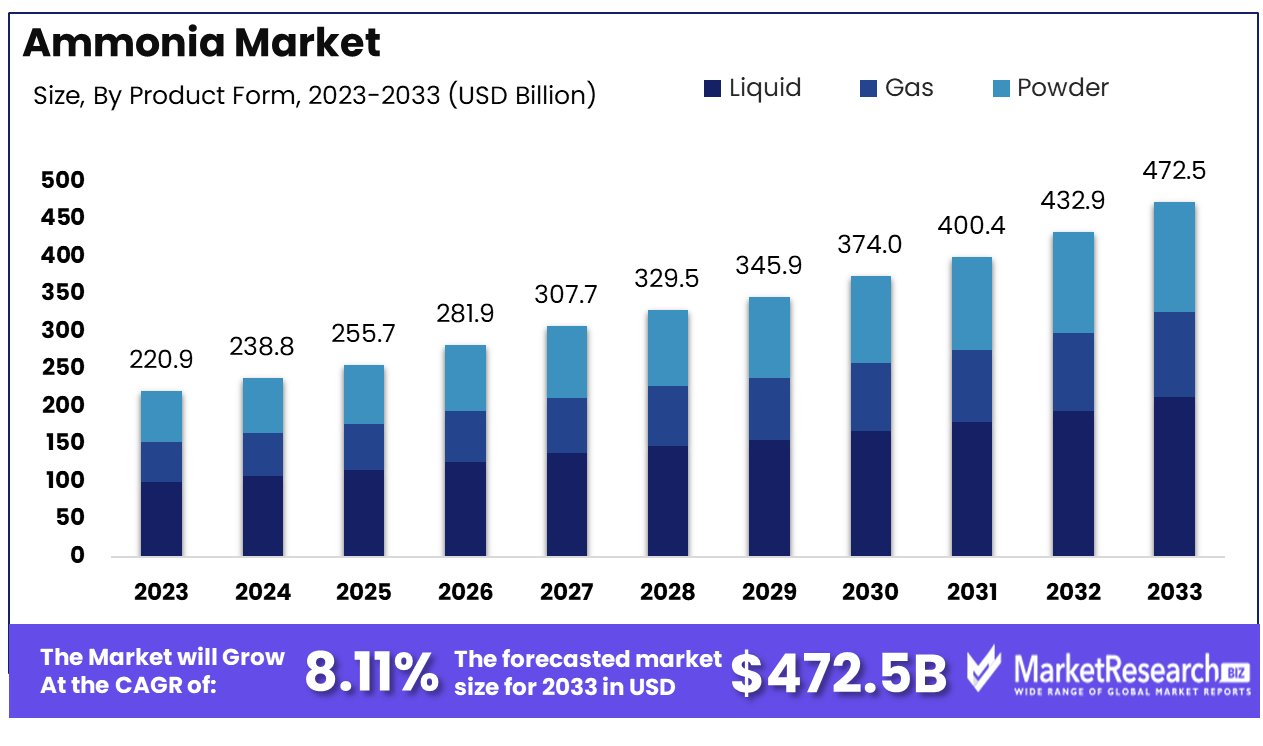

The ammonia market was valued at USD 220.93 billion in 2023. It is expected to reach USD 472.5 billion by 2033, with a CAGR of 8.11% during the forecast period from 2024 to 2033.

The surge in demand for fertilizers in agriculture and water treatment processes are some of the main driving factors for the ammonia market. Ammonia is a natural gas that acts as a chemical building block for a wide range of commercial and household products, including fertilizers and cleaning supplies. It is also used for stabilizers, neutralizers, and refrigerants, especially in food transportation and water treatment processes.

Ammonia is also used in the production of plastics, fabrics, explosives, and pharmaceuticals. More than 90% of the ammonia produced globally is used in fertilizers to provide sustainable food production for billions of individuals all around the world.

According to an article published by CBH Group in March 2023, highlights include the launch of a new Kwinana fertilizer facility center, which will substantially deliver several advantages to western Australian grain farmers. This project starts CBH’s liquid fertilizer business, and its granular fertilizer capacity is 15,000 metric tons. Additionally, this new center has the capacity to store 32,000 metric tons of urea ammonium nitrate and 55,000 metric tons of huge amounts of granular fertilizer.

According to a report published by the United States Department of Agriculture in March 2023, highlights include the announcement that the USDA department will get USD 3 billion in applications from more than 350 independent businesses from 47 states and 2 territories for the first two rounds of the new grant initiative program to augment new domestic fertilizer manufacturing capacity. It was also declared that the first USD 29 million will be provided under the first round, which aims at projects that can come online or virtual in the near term.

Ammonia is used for various purposes, such as household cleaning. It is effective in removing stains and household grime from vegetable oil or animal fats, like cooking grease and wine stains. It is also used in the industrial sector, where it helps to purify water supplies and can capture a significant amount of heat from its surroundings. These are utilized in the water and wastewater treatment, rubber, food and beverage sectors, and paper industries. This is also used in the pharmaceutical industry.

There was a huge impact on the agricultural industry that led to a boost in the fertilizer price rate during the time of the Russia-Ukraine war. Russia is one of the world's largest fertilizer exporters. Russia also accounts for 23% of the ammonia exports.

Additionally, the manufacturing of ammonia that gets collaborated with the source will help decrease the dependence on exports from one country to another while providing a cleaner and more sustainable manufacturing process. The demand for the global ammonia market will expand due to its requirements in fertilizers and industrial manufacturing, which will help in market expansion in the coming years.

Driving Factors

Fertilizer Demand Drives Ammonia Market Growth

Ammonia, a crucial nitrogen source, accounts for about 70-88% of its use in manufacturing various nitrogenous fertilizers like urea and ammonium phosphate. This surge in demand is closely tied to the growing global population and the urgent need to enhance agricultural productivity, particularly in emerging economies.

The International Energy Agency (IEA) forecasts a nearly 40% increase in ammonia demand by 2050, spurred by the agricultural sector's expansion in regions like Africa, Latin America, the Middle East, and Southeast Asia. This trend underscores ammonia's pivotal role in addressing food security challenges, thereby reinforcing its market growth.

Refrigeration Needs Spur Ammonia Demand

The ammonia market is also buoyed by its widespread use in refrigeration applications, where it's prized for its superior thermophysical properties. The expansion of the global cold chain market, essential for preserving perishable goods, is fueling the demand for ammonia as an industrial refrigerant.

Predicted to grow substantially, the cold chain market's expansion directly correlates with increased ammonia usage. This demand is set to rise further with the growth of industries reliant on effective refrigeration, positioning ammonia as a key player in the cold storage and logistics sectors.

Ammonia's Role in Low-Carbon Energy Transition

A significant driver for the ammonia market is the shift towards low-carbon energy sources. Ammonia, especially in its 'green' or 'blue' forms, is gaining traction as a sustainable energy carrier. This is due to its potential in storing and transporting hydrogen energy efficiently.

The rising emphasis on clean energy solutions positions ammonia as a critical component in the energy transition, catering to the increasing demand for eco-friendly fuel alternatives. This shift not only augments the current market growth but also sets a trajectory for sustained expansion, aligning with global environmental goals.

Restraining Factors

Safety Concerns Impede Wider Adoption of Ammonia

Safety concerns significantly restrict the growth of the ammonia market. Ammonia's toxic and hazardous nature requires substantial investment in safety measures and personnel training to ensure safe handling and storage.

Additionally, the public perception of ammonia as a high-risk substance can be a major deterrent to its adoption in new applications, such as its use as a marine fuel. This concern over safety not only affects the operational costs for companies dealing with ammonia but also influences regulatory policies and public acceptance, potentially limiting the expansion of its use in various industries.

Competition from Alternative Products Challenges Ammonia Market

Alternatives to ammonia, such as urea and natural gas, are increasingly competing as feedstocks in various applications, posing a challenge to the growth of the ammonia market. Urea, for instance, is often preferred for certain agricultural and industrial applications due to its less hazardous nature.

Furthermore, the growing innovations in electric vehicles (EVs) are reducing the demand growth for fertilizers, which traditionally constitute a significant portion of ammonia's market. As EVs become more prevalent, the reduced need for agricultural products for biofuel production could further impact the demand for ammonia-based fertilizers, challenging the market's expansion.

Ammonia Market Segmentation Analysis

By Product Form :

Liquid ammonia is the dominant product form in the ammonia market. This dominance is due to its extensive use in various industrial and agricultural applications. With a density of approximately 682.6 kg/m^3 at 0°C and atmospheric pressure, liquid ammonia is stored under pressure and is a key component in the production of fertilizers. Its high nitrogen content makes it essential for synthesizing ammonium nitrate and urea, which are widely used as nitrogenous fertilizers. In refrigeration, liquid ammonia serves as an effective coolant due to its high heat of vaporization and compatibility with various refrigeration systems.

Gaseous ammonia, while also important, has a more specialized application scope. With a density of 0.7929 kg/m^3 at 0°C and atmospheric pressure, it is used in industrial settings for pollution control by neutralizing sulfuric and nitric acid emissions. Powder form of ammonia, though less common, finds niche applications in certain industrial processes. The versatility, efficiency, and effectiveness of liquid ammonia in large-scale agricultural and industrial applications underscore its dominance in the market.

By Application

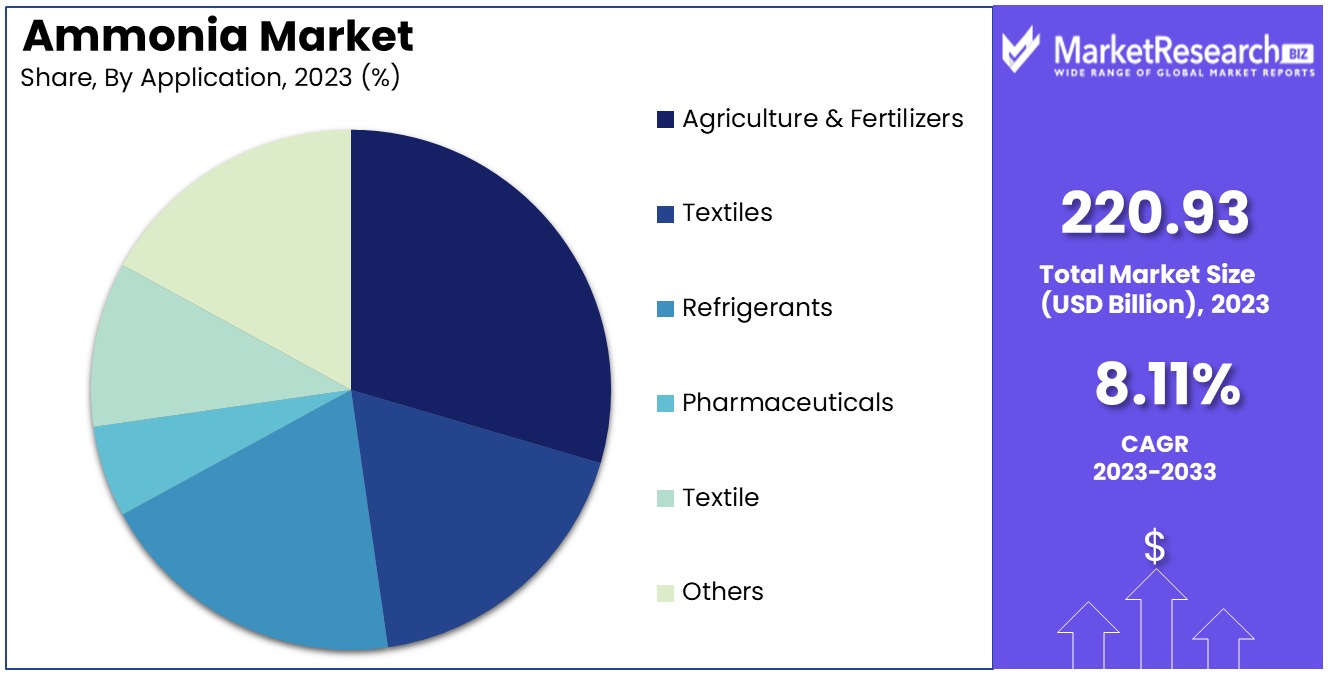

Agriculture & Fertilizers is the dominating segment in the ammonia market, holding a 41% share. Ammonia is a critical component in fertilizer production, which is essential for modern agriculture. The synthesis of ammonium nitrate, urea, and other nitrogenous fertilizers relies heavily on ammonia. These fertilizers play a crucial role in enhancing soil fertility and increasing crop yields, addressing the growing food demand of the global population.

Other applications such as Textiles, Refrigerants, Pharmaceuticals, and Textile also significantly contribute to the ammonia market. In the textile industry, ammonia is used in the pretreatment of fibers and dyeing processes. As a refrigerant, ammonia's efficiency in large industrial refrigeration systems is well-recognized. In pharmaceuticals, it is used in the production of various drugs and medical products.

However, the agricultural sector's reliance on ammonia-based fertilizers for crop production and the critical role of these fertilizers in global food security make Agriculture & Fertilizers the most significant application segment in the ammonia market. The ongoing efforts to increase agricultural productivity and the continuous development of more efficient fertilizer products are expected to maintain this segment's leading position.

Ammonia Industry Segments

By Product Form

- Liquid

- Gas

- Powder

By Application

- Agriculture & Fertilizers

- Textiles

- Refrigerants

- Pharmaceuticals

- Textile

- Others

Growth Opportunities

Transition to Green Ammonia Marks a New Era in Ammonia Market Growth

The shift towards green ammonia, driven by the global move towards zero-carbon emissions, presents significant growth opportunities in the ammonia market. Green ammonia, particularly relevant for sectors like power generation and agriculture, is still in early development stages and requires substantial technological innovation and policy support for large-scale implementation.

The current ammonia production method, the Haber-Bosch process, is energy-intensive, accounting for 1-2% of global energy consumption. A more efficient process for green ammonia production is essential to meet the growing demand sustainably. As such, the development of green ammonia production methods is key to transforming the market and aligning it with global sustainability goals.

Technological Advancements Propel Bio Ammonia Market Forward

Continuous innovation in technology is driving the growth of the bio ammonia market. The conventional production of ammonia is energy-intensive and contributes to about 2% of global CO2 emissions. In response, there's a significant push towards developing bioprocessing technologies for biological ammonia production.

Companies like OCI Global, the only producer of ISCC PLUS certified bio-ammonia in Europe and the US, are leading this charge. OCI’s use of biomethane from organic waste for ammonia production results in a GHG reduction of over 70% compared to traditional methods. Such advancements are not only environmentally beneficial but also offer a competitive edge, paving the way for geographic and product expansion in the ammonia market.

Ammonia Market Regional Analysis

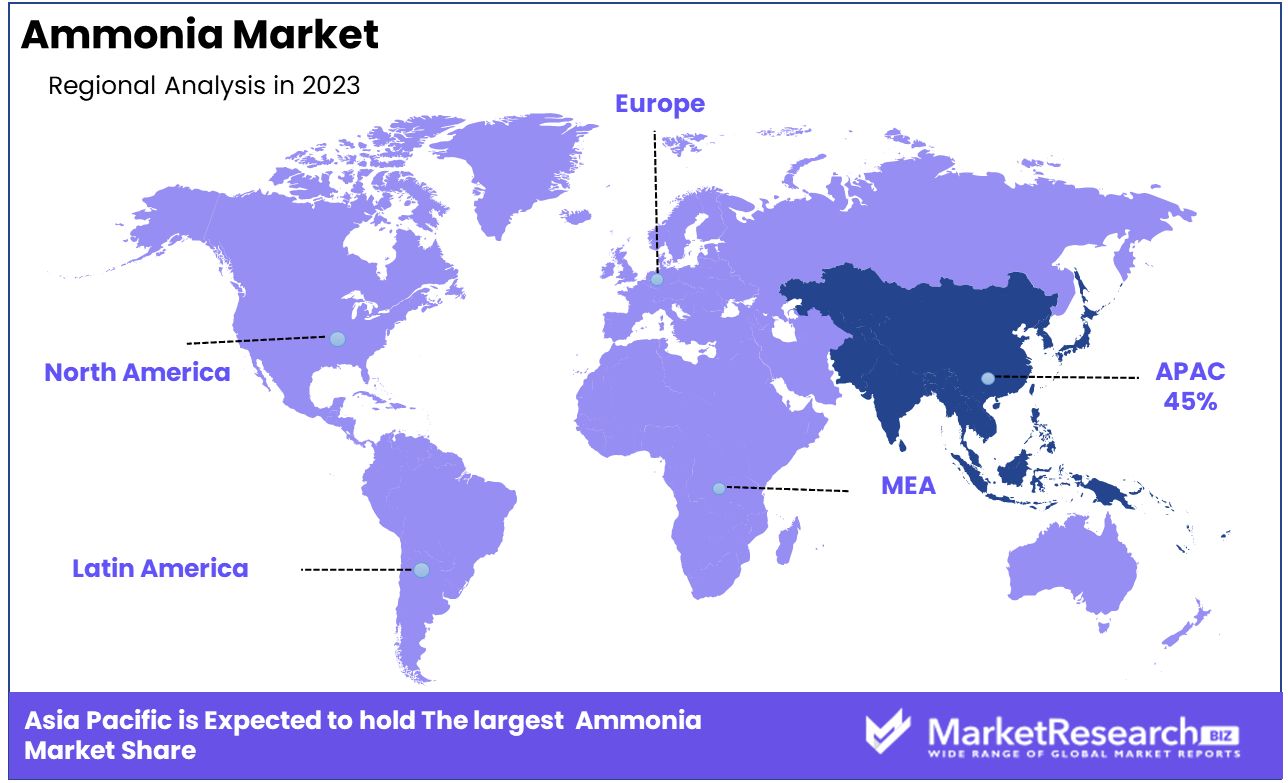

Asia-Pacific Dominates with 45% Market Share in Ammonia Market

Asia-Pacific's dominant 45% share in the global ammonia market is largely due to the region's extensive agricultural activities and the increasing demand for ammonia-based fertilizers. China, as the largest producer in the region, along with significant contributions from India, Thailand, Japan, South Korea, and Australia, drives this dominance. The growth of the ammonia market in Asia-Pacific is also propelled by the region’s expanding industrial sector, which uses ammonia in various applications, including the production of plastics, fibers, and other chemicals.

The ammonia market in Asia-Pacific is characterized by its innovative approaches to ammonia production, especially in the context of green energy. Japan and South Korea's joint initiatives in hydrogen and ammonia production, aiming to create a joint supply network, reflect the region's commitment to sustainable and alternative energy sources. The move towards green ammonia production, as seen in Japan’s aim to import 3 million tonnes of ammonia for fuel by 2030 and the MOU signed for green ammonia production opportunities in India, highlights a shift towards environmentally friendly practices. This focus on green ammonia is expected to play a pivotal role in reducing carbon emissions and promoting cleaner energy alternatives in the region.

North America: Advanced Production Technologies and High Demand

North America's ammonia market is driven by advanced production technologies and a high demand from the agricultural sector. The region, with the United States as a key player, utilizes natural gas as a primary feedstock for ammonia production, leading to cost-effective and large-scale production.

Europe: Focus on Sustainability and Innovation

Europe’s ammonia market is characterized by a strong focus on sustainability and innovation. The region is actively exploring renewable energy sources for ammonia production to reduce carbon footprint. The European Union’s environmental regulations and the growing emphasis on reducing greenhouse gas emissions are driving the development of green ammonia production technologies.

Ammonia Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Ammonia Market Key Player Analysis

In the Ammonia Market, an essential sector for agricultural and industrial applications, the companies listed are key in driving global production and supply. CF Industries Holdings Inc., Yara, and Nutrien Ltd are industry leaders, renowned for their large-scale ammonia production capacities and global distribution networks. Their strategic positioning emphasizes operational efficiency, sustainability, and meeting the growing global demand for ammonia, particularly in fertilizers.

SABIC Agri-Nutrients Company and IFFCO stand out for their significant contributions to the agricultural sector, providing essential nutrients for crop production. Their focus on innovation and sustainability reflects the industry's commitment to supporting global food security.

Ammonia Industry Key Players

- SABIC Agri-Nutrients Company

- EuroChem

- Nutrien Ltd

- Group DF

- OCI

- IFFCO

- QATAR FERTILISER COMPANY

- Yara International ASA

- CF Industries Holdings Inc.

- LFC

- BASF SE

- Trammo

- Mitsubishi

- Koch Industries Inc.

- Mitsui

Ammonia Market Recent Development

- In June 2023, BASF SE and Yara Clean Ammonia announced their partnership for joint research to develop and establish a world-scale low-carbon blue ammonia production plant with an overall production capacity in the range of 1.2 up to 1.4 million tons per year that will also capture carbon throughout the US Gulf Coast region. By collaborating both companies will meet the ever-growing demand in the world for ammonia with low-carbon

- In May 2023, SABIC Agri-Nutrients Company and IFFCO announced a partnership to deliver 5,000 metric tonnes of low-carbon ammonia certified coming from Saudi Arabia to IFFCO for fertilizer production. This partnership will help improve the company's operations in the researched market.

Report Scope

Report Features Description Market Value (2023) USD 149.3 billion Forecast Revenue (2033) USD 273.3 billion CAGR (2024-2032) 6.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Form(Liquid, Gas, Powder), By Application(Agriculture & Fertilizers, Textiles, Refrigerants, Pharmaceuticals, Textile, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape SABIC Agri-Nutrients Company, EuroChem, Nutrien Ltd, Group DF, OCI, IFFCO, QATAR FERTILISER COMPANY, Yara International ASA, CF Industries Holdings Inc., LFC, BASF SE, Trammo, Mitsubishi, Koch Industries Inc., Mitsui Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- SABIC Agri-Nutrients Company

- EuroChem

- Nutrien Ltd

- Group DF

- OCI

- IFFCO

- QATAR FERTILISER COMPANY

- Yara International ASA

- CF Industries Holdings Inc.

- LFC

- BASF SE

- Trammo

- Mitsubishi

- Koch Industries Inc.

- Mitsui