Industrial Fasteners Market By Material (Metal, Plastic), By Product Type (Externally Threaded, Internally Threaded, Non-Threaded), By Application (Automotive, Aerospace, Industrial Machinery, Home appliances, Furniture, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4550

-

May 2023

-

154

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

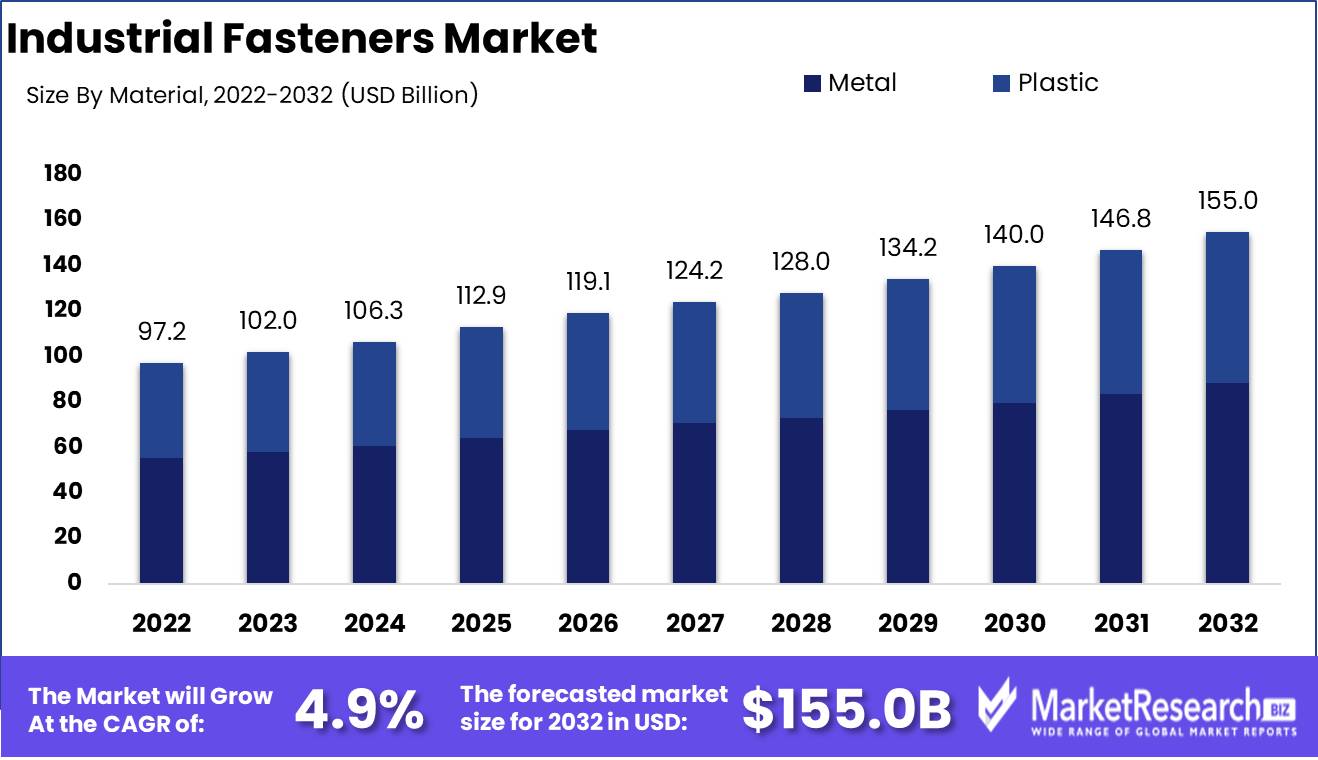

Industrial Fasteners Market size is expected to be worth around USD 155.0 Bn by 2032 from USD 97.2 Bn in 2022, growing at a CAGR of 4.9% during the forecast period from 2023 to 2032.

Industrial Fasteners Market comprises the production, distribution, and utilization of various fastening devices utilized in industrial contexts. These fasteners are devised and manufactured in a variety of shapes, sizes, and materials to satisfy the needs of various industries. The primary objective of the industrial fasteners market is to provide dependable and efficient solutions for joining and securing various components, materials, and structures.

There is no denying the significance of industrial fasteners, as they offer numerous benefits in terms of mechanical stability, durability, and simplicity of assembly. The term industrial refers to the process of converting raw materials into finished goods. Whether apparatus is being assembled, buildings are being constructed, or pipelines are being installed, fasteners ensure that the components remain securely affixed, enduring vibrations, dynamic loads, and environmental factors.

Due to advancements in materials, design techniques, and manufacturing processes, the industrial fasteners market has witnessed significant innovation. The development of high-strength alloys and composites, for instance, has led to the production of fasteners with enhanced tensile strength, corrosion resistance, and fatigue properties. In addition, the advent of technologies such as 3D printing has revolutionized the production of fasteners, allowing for complex geometries and customized designs.

These innovative fasteners have attracted significant investment and have been incorporated into a wide range of products and services across industries. Aerospace companies, for instance, rely significantly on high-performance fasteners to ensure the structural integrity and safety of aircraft. Advanced fastening systems are utilized by automakers to enhance vehicle performance, reduce vehicle weight, and improve fuel economy. The construction industry relies on specialized fasteners for securing building facades and merging structural components.

Increasing demand from industries including automotive, aerospace, construction, energy, and electronics is driving the growth of the industrial fasteners market. As these industries continue to grow and innovate, the need for dependable and effective fastening solutions becomes increasingly crucial. Moreover, the emergence of new applications, such as renewable energy systems and lightweight materials, augments the market's growth potential.

Driving factors

Growing industrial and building activity

The need for industrial fasteners is driven by construction and industry. Economic growth necessitates large-scale infrastructure, industries, and industrial units. These industries depend on fasteners to secure components. The structural integrity of buildings, bridges, and other structures is supported by the use of fasteners, which may be found in many different places. Thus, global urbanization and industrialization are driving the industrial fasteners market.

Automotive and aerospace growth

Fasteners are essential to assuring the performance, dependability, and safety of their products in the automotive and aerospace sectors, which are recognized for their relentless pursuit of innovation. High-quality, lightweight fasteners are needed as these sectors grow. Technologically enhanced fastening systems are needed by car manufacturers for fuel efficiency and safety and aerospace firms for lighter aircraft. Automotive and aerospace growth fuels industrial fasteners market development.

Growing need for robust fastening solutions

Extreme-pressure, vibration, and environmental fastening solutions are needed in many sectors. Industrial fasteners, which secure connections, prevent loosening, and improve efficiency, are essential to product safety and dependability. As enterprises in automotive, construction, and manufacturing seek trustworthy and lasting fastening solutions, the industrial fasteners market has grown.

Fastener and coating innovations

Fastener makers are always exploring new materials and coatings to improve performance and longevity. High-strength alloys, stainless steel, and corrosion-resistant coatings have made fasteners more resistant to wear, temperature changes, and chemical exposure. The market for industrial fasteners is strengthened by its ability to deliver long-lasting performance in demanding applications.

Globalizing commerce and manufacturing

Globalization has transformed commerce and production, expanding supply chains and cross-border cooperation. Manufacturers need trustworthy fastening solutions to satisfy production demands, which has increased demand for industrial fasteners. Fasteners secure parts and provide high-quality products during assembly. Thus, global commerce and production have boosted the industrial fasteners market.

Restraining Factors

Variations in Raw Material Prices

Prices of raw materials play a crucial function in the industrial fasteners market. Fluctuations in the prices of basic materials, such as steel, aluminum pigment, and plastics, can have a substantial effect on the profitability of manufacturers and alter the market's dynamics. These price fluctuations may be caused by a number of variables, such as global supply and demand, currency fluctuations, geopolitical events, and trade policies. As a participant in the industry, it is crucial to closely monitor these price fluctuations, make informed procurement decisions, and investigate alternative sourcing options in order to mitigate potential risks and maintain cost competitiveness.

Rivalry from Alternative Joining Techniques

Alternative methods of joining components, such as adhesives, welding, and riveting, pose potential competition in the market for industrial fasteners, which have been a tried-and-true method for decades. These alternative methods offer benefits in terms of lightweight designs, increased efficiency, and decreased assembly time. To remain ahead of the competition, manufacturers in the market for industrial fasteners must continuously innovate, improve their product offerings, and educate consumers about the distinct advantages of fasteners over alternative joining methods. Maintaining market dominance can be accomplished by highlighting the durability, dependability, and cost-effectiveness of fasteners in particular applications.

Obstacles to Compliance with Standards

The industrial fasteners market must adhere to stringent quality and regulatory standards to ensure safe and dependable operations. Due to the enormous variety of fastener types and applications, as well as the numerous international regulations and certifications, meeting these standards can be difficult. Manufactures must invest in stringent quality management systems, conduct routine audits, and engage in continuous improvement activities. Businesses can increase customer confidence, foster trust, and obtain a market advantage by assuring compliance with industry standards and certifications.

Cost and Supply Chain factors to consider

The market for industrial fasteners is cost-sensitive and requires efficient supply chain management. Frequently, the costs of basic materials, manufacturing processes, labor, and transportation increase for manufacturers. To remain competitive, it is essential to optimize the supply chain, streamline operations, and investigate opportunities for cost savings. By collaborating closely with suppliers, instituting lean manufacturing practices, and employing advanced technologies such as automation and predictive analytics, a business can increase operational efficiency, decrease expenses, and increase customer value.

Economic Recession Effects on End-User

The market for industrial fasteners is highly dependent on the performance of end-user industries such as the automotive, aerospace, construction, and machinery sectors. During economic downturns, these industries may experience a decline in demand, which may have repercussions for the demand for industrial fasteners. There may be obstacles such as decreased orders, inventory administration, and delayed payments. To navigate such difficult times, businesses should diversify their consumer base across numerous industries, invest in research and development, and cultivate strong customer relationships to form long-term partnerships.

Material Analysis

The industrial fasteners market is dominated by the metal segment, which accounts for a significant share of the overall market. Metal fasteners are widely used in various industries due to their durability, strength, and resistance to corrosion. They play a crucial role in providing structural integrity and reliability to the products they are used in.

Consumer trends and behavior towards the metal segment of industrial fasteners have also contributed to its dominance in the market. Consumers are increasingly focused on the quality and performance of the products they purchase. Metal fasteners are perceived as premium products that offer superior strength and reliability, which aligns with the consumer demand for durable and long-lasting products.

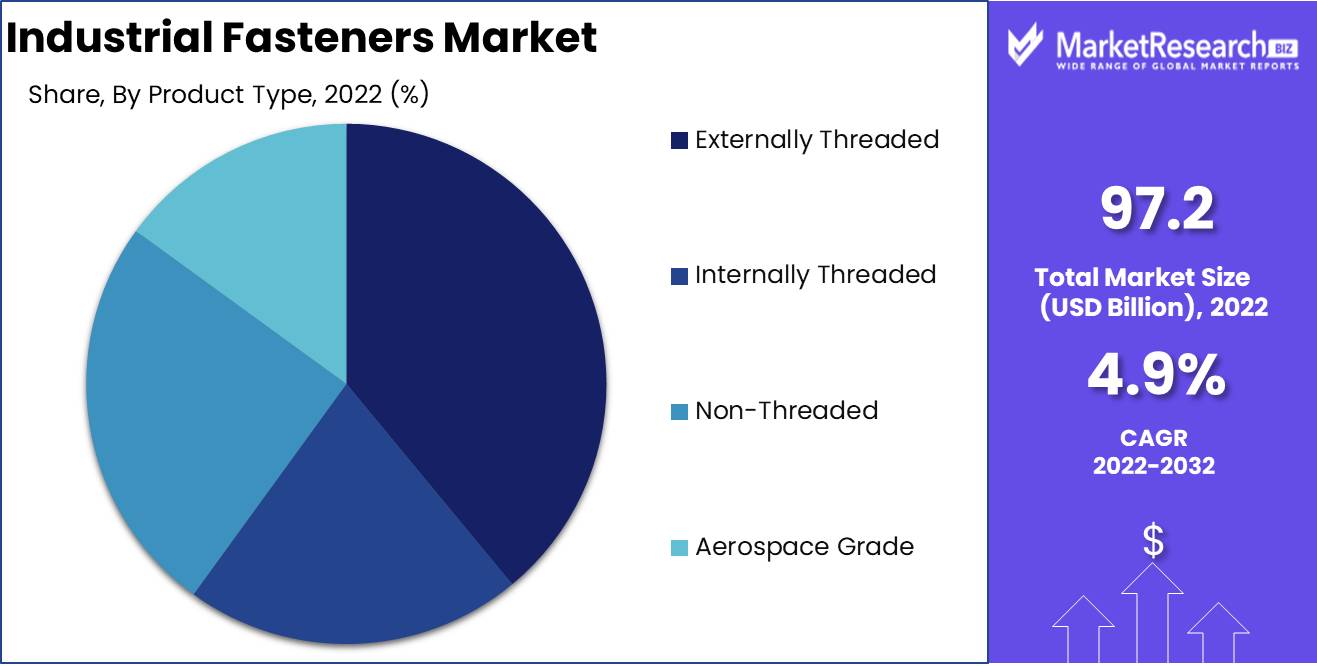

Product Type Analysis

Among the different types of industrial fasteners, the externally threaded segment holds the dominant position in the market. Externally threaded fasteners, such as bolts and screws, are extensively used in a wide range of applications, including construction, machinery, and automotive, among others. Their versatility, ease of installation, and ability to withstand heavy loads make them indispensable in various industries.

Consumer trends and behavior towards externally threaded fasteners have also contributed to their dominance in the market. Consumers value practicality and convenience, and externally threaded fasteners offer simplicity and ease of use. Their straightforward installation process and wide availability have made them a popular choice among consumers in various industries.

Application Analysis

The automotive segment dominates the industrial fasteners market, accounting for a significant share of the overall market. Fasteners play a critical role in the automotive industry, where they are used in various applications, including chassis, engine, body, and interior components. The automotive industry demands fasteners that can withstand high loads, vibrations, and extreme temperatures while maintaining structural integrity.

Consumer trends and behavior towards automotive fasteners have also contributed to the dominance of this segment in the market. Consumers are increasingly concerned about the safety, performance, and aesthetic appeal of their vehicles. Automotive fasteners play a crucial role in ensuring the overall quality and reliability of vehicles, thereby influencing consumer purchasing decisions.

Key Market Segments

By Material

- Metal

- Plastic

By Product Type

- Externally Threaded

- Internally Threaded

- Non-Threaded

- Aerospace Grade

By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home appliances

- Furniture

- Other Applications

Growth Opportunity

Customized and Specialized Fasteners

The development of specialized and customized fasteners is one of the most significant growth opportunities in the industrial fasteners market. There is a growing demand for fasteners that meet specific requirements as a result of technological advances and changing consumer needs. This includes fasteners that are resistant to corrosion, capable of withstanding extreme temperatures, or designed for particular applications. Companies that can provide customized solutions to their customers have a competitive advantage and greater market growth potential.

Infrastructure Development

Infrastructure development in emergent markets represents a second opportunity for expansion. As several developing nations work to improve their infrastructure, the demand for industrial fasteners to support construction initiatives is growing. This creates a favorable environment for fastener manufacturers to enter these markets and satisfy the rising demand. Companies can capitalize on latent opportunities and position themselves for long-term growth by strategically targeting emerging economies with robust infrastructure development plans.

Manufacturers and Construction Firms

Collaboration with original equipment manufacturers (OEMs) and construction firms is an additional growth opportunity for the industrial fasteners market. OEMs play a crucial role in a variety of industries, and their partnerships with fastener manufacturers can fuel market expansion and development. By working closely with original equipment manufacturers, fastener manufacturers can ensure that their products are seamlessly incorporated into the overall manufacturing process. Similarly, establishing solid relationships with construction firms enables fastener manufacturers to become preferred suppliers for large-scale projects, thereby enhancing their growth potential.

Lightweight and Strong Fastener Components

Adoption of lightweight and high-strength fastening materials also presents a substantial growth opportunity for the industrial fasteners market. Lightweight materials such as titanium and aluminum are acquiring popularity as industries strive to improve efficiency, reduce costs, and boost performance. These materials have high strength-to-weight ratios, making them ideal for applications in which weight reduction is crucial. Companies that invest in R&D to create innovative fasteners with these materials can increase their market share and stimulate growth.

Latest Trends

Automotive/Aerospace Fastener Growth

Automotive and aerospace industries have grown rapidly, increasing demand for specialty fasteners that fulfill their strict criteria. Advanced fastening systems are needed to meet automobile industry demands for lightweighting, safety, and performance. These fasteners protect crucial components from excessive stress and vibration. In the aircraft engines business, fasteners must resist severe temperatures, pressures, and stresses for safety and dependability. Manufacturers are investing in R&D to improve automotive and aerospace fasteners' performance and efficiency.

Corrosion-Resistant and High-Performance Fastener

Corrosion threatens infrastructure, maritime equipment, and industrial gear. Corrosion-resistant fasteners that can tolerate hostile environments are in demand to address this issue. Industries choose corrosion-resistant materials like stainless steel and specialized alloys. In harsh working circumstances like oil and gas, high-performance fasteners that can endure high temperatures, pressures, and mechanical strains are in demand.

Self-Locking and Tamper-Resistant Fasteners

Industries must ensure component safety and security. Self-locking and tamper-resistant fasteners meet this demand. Nylon patches or pellets prevent self-locking fasteners from loosening. These fasteners are used in safety-critical industries including aviation and automotive. Tamper-resistant fasteners also prevent unwanted entry. Electronics, healthcare, and public infrastructure benefit from this.

Lightweight and Composite Fasteners Rise

Composites are becoming more popular as sectors prioritize weight reduction and fuel economy. Traditional fasteners may not bind these materials well. Manufacturers are developing lightweight and composite fasteners. These fasteners use new designs, coatings, and materials to increase bonding strength without losing composite weight savings. Lightweight sectors including automotive, aerospace, and renewable energy require such fasteners.

Automated Fastening Systems

Automation and Industry 4.0 are replacing manual fastening procedures. Automated fastening systems are faster, more accurate, and less error-prone. These systems use robots, AI, and machine vision to fasten accurately. In industries like automotive, electronics, and aerospace, where large-scale manufacturing and quality control are essential, automated fastening systems have grown. Manufacturers will continue to automate fastening operations.

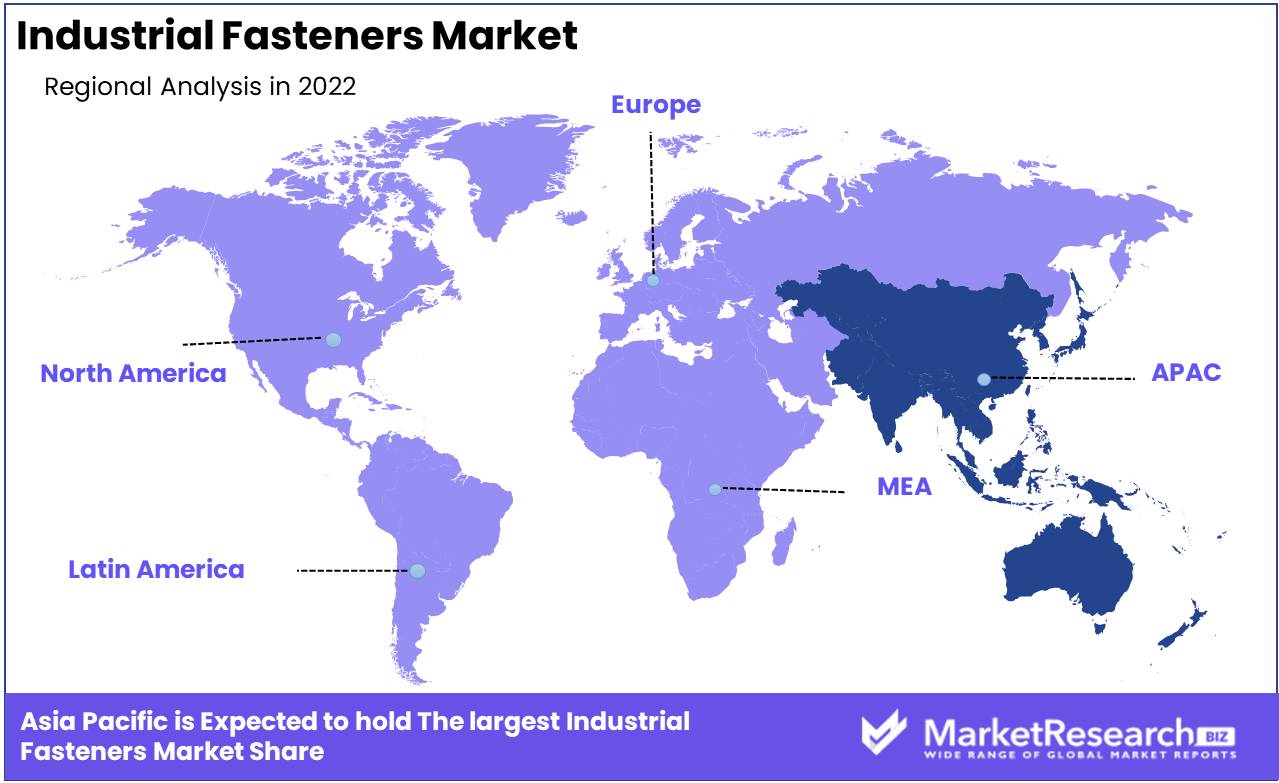

Regional Analysis

The Industrial Fasteners market is dominated by the Asia-Pacific region. In recent years, the market for industrial fasteners has expanded significantly, primarily due to the rising demand for efficient and dependable fastening solutions in a variety of industries. A significant portion of the market has been captured by the Asia-Pacific (APAC) region, which has evolved as a dominant force among global regions. APAC continues to drive the growth of the industrial fasteners market with its flourishing manufacturing sector, robust infrastructure development, and rapid industrialization.

As businesses strive to increase productivity, enhance efficiencies, and ensure the safety and longevity of their products, the demand for high-quality fastening solutions grows. Industrial fasteners are essential for joining different components, ensuring structural integrity, and facilitating effortless disassembly when necessary. Among others, they have extensive applications in the automotive, aerospace, construction, electronics, and machinery industries.

The Asia-Pacific region, which includes China, India, Japan, South Korea, and ASEAN countries, has a substantial manufacturing sector. Strong demand for industrial fasteners has been primarily driven by the proliferation of manufacturing facilities in these nations. For example, the automotive industry relies extensively on fasteners for vehicle assembly. As APAC continues to be a global manufacturing center, the demand for automotive fasteners has skyrocketed, contributing to the region's market dominance.

Manufacturers, suppliers, and industry stakeholders must strategically position themselves to capitalize on the region's development potential as Asia-Pacific continues to dominate the global industrial fasteners market. Companies can gain a competitive advantage in this ever-changing environment by remaining attuned to shifting market trends, leveraging technology and innovation, and providing high-quality, customized fastening solutions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Switzerland-based ABB Limited leads power and automation technology. ABB offers several productivity, efficiency, and safety solutions in the industrial fasteners market. ABB fasteners are reliable, durable, and high-performing. Robotics, electrical systems, and automation help the firm create new fastening solutions for automotive, aerospace, and industrial industries.

Siemens AG, a German multinational, dominates the industrial fasteners market. Siemens provides fastening solutions for industrial industries such as power generation, transportation, and infrastructure. Siemens fasteners are precision-made and tested to assure longevity and performance. Sustainability and innovation have made the firm a market leader.

US-based Honeywell International Inc. is known for its wide range of industrial products and solutions. Precision, dependability, and efficiency characterize the company's fastening solutions. Honeywell's diversified fasteners perform in difficult applications, enabling safe and secure operations in aerospace, military, and oil & gas. Honeywell introduces new fastening technologies to fulfill client needs via research and development.

Industrial automation leader Rockwell Automation also knows industrial fasteners. Customers get comprehensive production solutions from the company's fasteners, which interface easily with its automation and control systems. Rockwell Automation's fastening products are high-quality, reliable, and compatible, enabling uninterrupted operations in automotive, food & beverage, and pharmaceutical sectors.

Baumer Ltd., based in Switzerland, makes top-notch industrial sensors and equipment. The company's fasteners complement its sensors, providing accurate and dependable mounting options in numerous applications. Baumer's durable, accurate, and easy-to-install fastening products are trusted globally. Baumer improves manufacturing, medical, and agricultural efficiency by integrating sensors and fasteners.

US-based Encoder Products Company Inc. makes high-performance encoders and sensors. The company's encoder solutions and fasteners interact flawlessly to improve position and motion detection accuracy. Robotics, industrial automation, and renewable energy use Encoder devices Company's strong, precise, and compatible fastening devices. The firm guarantees that their fasteners match global client demands with a strong focus to customer satisfaction.

Top Key Players in Industrial Fasteners Market

- ABB Limited (Switzerland)

- Siemens AG (Germany)

- Honeywell International Inc. (U.S.)

- Rockwell Automation (U.S.)

- Baumer Ltd (Switzerland)

- Encoder Products Company Inc (U.S.)

- Fuji Electric Co. Ltd. (Japan)

- Delta Electronics Inc (Taiwan)

- Emerson Electric (U.S.)

- Omron Corporation (Japan)

- Panasonic Corporation (Japan)

- Baumuller Holding GmbH & Co. KG (Germany)

- Balluff GmbH (Germany)

- Sensata Technologies Inc (U.S.)

- Festo Corporation (Germany)

- Parker-Hannifin Corporation (U.S.)

- SMC Corporation (Japan)

- DESTACO (U.S.)

- SWISS Automation Inc (U.S.)

- Mitsubishi Electric Corporation (Japan)

Recent Development

- Fastenal Corporation to Open New Distribution Center in China (2023): This strategic move is aimed at meeting the growing demand for industrial fasteners and enhancing the company's supply chain capabilities in the region.

- Stanley Black & Decker's Acquisition of Black Hills Industrial Group (2022): This move is expected to bolster Stanley Black & Decker's product portfolio, particularly in the industrial fasteners sector.

- Würth Group to Establish New Manufacturing Plant in Mexico (2021): This expansion reflects Würth Group's commitment to meeting the growing demand for industrial fasteners in the region while ensuring proximity to key markets.

- Acument Global Technologies' Acquisition of Apex Tool Group (2020): This strategic move aims to broaden Acument's product range by adding Apex Tool Group's extensive portfolio of high-quality tools and fastening solutions.

Report Scope:

Report Features Description Market Value (2022) USD 97.2 Bn Forecast Revenue (2032) USD 155.0 Bn CAGR (2023-2032) 4.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Metal, Plastic )

By Product Type (Externally Threaded, Internally Threaded, Non-Threaded, Aerospace Grade)

By Application (Automotive, Aerospace, Building & Construction, Industrial Machinery, Home appliances, Furniture, Other ApplicationsRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Limited (Switzerland), Siemens AG (Germany), Honeywell International Inc. (U.S.), Rockwell Automation (U.S.), Baumer Ltd (Switzerland), Encoder Products Company Inc (U.S.), Fuji Electric Co. Ltd. (Japan), Delta Electronics Inc (Taiwan), Emerson Electric (U.S.), Omron Corporation (Japan), Panasonic Corporation (Japan), Baumuller Holding GmbH & Co. KG (Germany), Balluff GmbH (Germany), Sensata Technologies Inc (U.S.), Festo Corporation (Germany), Parker-Hannifin Corporation (U.S.), SMC Corporation (Japan), DESTACO (U.S.), SWISS Automation Inc (U.S.), Mitsubishi Electric Corporation (Japan) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Industrial Fasteners Market Overview

- 2.1. Industrial Fasteners Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Industrial Fasteners Market Dynamics

- 3. Global Industrial Fasteners Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Industrial Fasteners Market Analysis, 2016-2021

- 3.2. Global Industrial Fasteners Market Opportunity and Forecast, 2023-2032

- 3.3. Global Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 3.3.1. Global Industrial Fasteners Market Analysis by By Material: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 3.3.3. Metal

- 3.3.4. Plastic

- 3.4. Global Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 3.4.1. Global Industrial Fasteners Market Analysis by By Product Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 3.4.3. Externally Threaded

- 3.4.4. Internally Threaded

- 3.4.5. Non-Threaded

- 3.4.6. Aerospace Grade

- 3.5. Global Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.5.1. Global Industrial Fasteners Market Analysis by By Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.5.3. Automotive

- 3.5.4. Aerospace

- 3.5.5. Building & Construction

- 3.5.6. Industrial Machinery

- 3.5.7. Home appliances

- 3.5.8. Furniture

- 3.5.9. Other Applications

- 4. North America Industrial Fasteners Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Industrial Fasteners Market Analysis, 2016-2021

- 4.2. North America Industrial Fasteners Market Opportunity and Forecast, 2023-2032

- 4.3. North America Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 4.3.1. North America Industrial Fasteners Market Analysis by By Material: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 4.3.3. Metal

- 4.3.4. Plastic

- 4.4. North America Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 4.4.1. North America Industrial Fasteners Market Analysis by By Product Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 4.4.3. Externally Threaded

- 4.4.4. Internally Threaded

- 4.4.5. Non-Threaded

- 4.4.6. Aerospace Grade

- 4.5. North America Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.5.1. North America Industrial Fasteners Market Analysis by By Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.5.3. Automotive

- 4.5.4. Aerospace

- 4.5.5. Building & Construction

- 4.5.6. Industrial Machinery

- 4.5.7. Home appliances

- 4.5.8. Furniture

- 4.5.9. Other Applications

- 4.6. North America Industrial Fasteners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Industrial Fasteners Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Industrial Fasteners Market Analysis, 2016-2021

- 5.2. Western Europe Industrial Fasteners Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 5.3.1. Western Europe Industrial Fasteners Market Analysis by By Material: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 5.3.3. Metal

- 5.3.4. Plastic

- 5.4. Western Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 5.4.1. Western Europe Industrial Fasteners Market Analysis by By Product Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 5.4.3. Externally Threaded

- 5.4.4. Internally Threaded

- 5.4.5. Non-Threaded

- 5.4.6. Aerospace Grade

- 5.5. Western Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.5.1. Western Europe Industrial Fasteners Market Analysis by By Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.5.3. Automotive

- 5.5.4. Aerospace

- 5.5.5. Building & Construction

- 5.5.6. Industrial Machinery

- 5.5.7. Home appliances

- 5.5.8. Furniture

- 5.5.9. Other Applications

- 5.6. Western Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Industrial Fasteners Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Industrial Fasteners Market Analysis, 2016-2021

- 6.2. Eastern Europe Industrial Fasteners Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 6.3.1. Eastern Europe Industrial Fasteners Market Analysis by By Material: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 6.3.3. Metal

- 6.3.4. Plastic

- 6.4. Eastern Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 6.4.1. Eastern Europe Industrial Fasteners Market Analysis by By Product Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 6.4.3. Externally Threaded

- 6.4.4. Internally Threaded

- 6.4.5. Non-Threaded

- 6.4.6. Aerospace Grade

- 6.5. Eastern Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.5.1. Eastern Europe Industrial Fasteners Market Analysis by By Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.5.3. Automotive

- 6.5.4. Aerospace

- 6.5.5. Building & Construction

- 6.5.6. Industrial Machinery

- 6.5.7. Home appliances

- 6.5.8. Furniture

- 6.5.9. Other Applications

- 6.6. Eastern Europe Industrial Fasteners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Industrial Fasteners Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Industrial Fasteners Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Industrial Fasteners Market Analysis, 2016-2021

- 7.2. APAC Industrial Fasteners Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 7.3.1. APAC Industrial Fasteners Market Analysis by By Material: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 7.3.3. Metal

- 7.3.4. Plastic

- 7.4. APAC Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 7.4.1. APAC Industrial Fasteners Market Analysis by By Product Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 7.4.3. Externally Threaded

- 7.4.4. Internally Threaded

- 7.4.5. Non-Threaded

- 7.4.6. Aerospace Grade

- 7.5. APAC Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.5.1. APAC Industrial Fasteners Market Analysis by By Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.5.3. Automotive

- 7.5.4. Aerospace

- 7.5.5. Building & Construction

- 7.5.6. Industrial Machinery

- 7.5.7. Home appliances

- 7.5.8. Furniture

- 7.5.9. Other Applications

- 7.6. APAC Industrial Fasteners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Industrial Fasteners Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Industrial Fasteners Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Industrial Fasteners Market Analysis, 2016-2021

- 8.2. Latin America Industrial Fasteners Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 8.3.1. Latin America Industrial Fasteners Market Analysis by By Material: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 8.3.3. Metal

- 8.3.4. Plastic

- 8.4. Latin America Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 8.4.1. Latin America Industrial Fasteners Market Analysis by By Product Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 8.4.3. Externally Threaded

- 8.4.4. Internally Threaded

- 8.4.5. Non-Threaded

- 8.4.6. Aerospace Grade

- 8.5. Latin America Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.5.1. Latin America Industrial Fasteners Market Analysis by By Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.5.3. Automotive

- 8.5.4. Aerospace

- 8.5.5. Building & Construction

- 8.5.6. Industrial Machinery

- 8.5.7. Home appliances

- 8.5.8. Furniture

- 8.5.9. Other Applications

- 8.6. Latin America Industrial Fasteners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Industrial Fasteners Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Industrial Fasteners Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Industrial Fasteners Market Analysis, 2016-2021

- 9.2. Middle East & Africa Industrial Fasteners Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 9.3.1. Middle East & Africa Industrial Fasteners Market Analysis by By Material: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 9.3.3. Metal

- 9.3.4. Plastic

- 9.4. Middle East & Africa Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 9.4.1. Middle East & Africa Industrial Fasteners Market Analysis by By Product Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 9.4.3. Externally Threaded

- 9.4.4. Internally Threaded

- 9.4.5. Non-Threaded

- 9.4.6. Aerospace Grade

- 9.5. Middle East & Africa Industrial Fasteners Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.5.1. Middle East & Africa Industrial Fasteners Market Analysis by By Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.5.3. Automotive

- 9.5.4. Aerospace

- 9.5.5. Building & Construction

- 9.5.6. Industrial Machinery

- 9.5.7. Home appliances

- 9.5.8. Furniture

- 9.5.9. Other Applications

- 9.6. Middle East & Africa Industrial Fasteners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Industrial Fasteners Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Industrial Fasteners Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Industrial Fasteners Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Industrial Fasteners Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. ABB Limited (Switzerland)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Siemens AG (Germany)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Honeywell International Inc. (U.S.)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Rockwell Automation (U.S.)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Baumer Ltd (Switzerland)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Encoder Products Company Inc (U.S.)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Fuji Electric Co. Ltd. (Japan)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Delta Electronics Inc (Taiwan)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Emerson Electric (U.S.)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Omron Corporation (Japan)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Panasonic Corporation (Japan)

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Baumuller Holding GmbH & Co. KG (Germany)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Balluff GmbH (Germany)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Sensata Technologies Inc (U.S.)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Festo Corporation (Germany)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Parker-Hannifin Corporation (U.S.)

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. SMC Corporation (Japan)

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. DESTACO (U.S.)

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. SWISS Automation Inc (U.S.)

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. Mitsubishi Electric Corporation (Japan)

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Material in 2022

- Figure 2: Global Industrial Fasteners Market Attractiveness Analysis by By Material, 2016-2032

- Figure 3: Global Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 4: Global Industrial Fasteners Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 5: Global Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 6: Global Industrial Fasteners Market Attractiveness Analysis by By Application, 2016-2032

- Figure 7: Global Industrial Fasteners Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Industrial Fasteners Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 12: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 13: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 14: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 16: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 17: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 18: Global Industrial Fasteners Market Share Comparison by Region (2016-2032)

- Figure 19: Global Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Figure 20: Global Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Figure 21: Global Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Figure 22: North America Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 23: North America Industrial Fasteners Market Attractiveness Analysis by By Material, 2016-2032

- Figure 24: North America Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 25: North America Industrial Fasteners Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 26: North America Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 27: North America Industrial Fasteners Market Attractiveness Analysis by By Application, 2016-2032

- Figure 28: North America Industrial Fasteners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Industrial Fasteners Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 33: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 34: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 35: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 37: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 38: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 39: North America Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Figure 40: North America Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Figure 41: North America Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Figure 42: North America Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Figure 43: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 44: Western Europe Industrial Fasteners Market Attractiveness Analysis by By Material, 2016-2032

- Figure 45: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 46: Western Europe Industrial Fasteners Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 47: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 48: Western Europe Industrial Fasteners Market Attractiveness Analysis by By Application, 2016-2032

- Figure 49: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Industrial Fasteners Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 54: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 55: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 56: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 58: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 59: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 60: Western Europe Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Figure 62: Western Europe Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Figure 63: Western Europe Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Figure 64: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 65: Eastern Europe Industrial Fasteners Market Attractiveness Analysis by By Material, 2016-2032

- Figure 66: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 67: Eastern Europe Industrial Fasteners Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 68: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 69: Eastern Europe Industrial Fasteners Market Attractiveness Analysis by By Application, 2016-2032

- Figure 70: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Industrial Fasteners Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 75: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 76: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 77: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 79: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 80: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 81: Eastern Europe Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Figure 83: Eastern Europe Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Figure 84: Eastern Europe Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Figure 85: APAC Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 86: APAC Industrial Fasteners Market Attractiveness Analysis by By Material, 2016-2032

- Figure 87: APAC Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 88: APAC Industrial Fasteners Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 89: APAC Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 90: APAC Industrial Fasteners Market Attractiveness Analysis by By Application, 2016-2032

- Figure 91: APAC Industrial Fasteners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Industrial Fasteners Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 96: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 97: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 98: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 100: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 101: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 102: APAC Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Figure 104: APAC Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Figure 105: APAC Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Figure 106: Latin America Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 107: Latin America Industrial Fasteners Market Attractiveness Analysis by By Material, 2016-2032

- Figure 108: Latin America Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 109: Latin America Industrial Fasteners Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 110: Latin America Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 111: Latin America Industrial Fasteners Market Attractiveness Analysis by By Application, 2016-2032

- Figure 112: Latin America Industrial Fasteners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Industrial Fasteners Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 117: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 118: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 119: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 121: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 122: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 123: Latin America Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Figure 125: Latin America Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Figure 126: Latin America Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Figure 127: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 128: Middle East & Africa Industrial Fasteners Market Attractiveness Analysis by By Material, 2016-2032

- Figure 129: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 130: Middle East & Africa Industrial Fasteners Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 131: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 132: Middle East & Africa Industrial Fasteners Market Attractiveness Analysis by By Application, 2016-2032

- Figure 133: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Industrial Fasteners Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 138: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 139: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 140: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 142: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 143: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 144: Middle East & Africa Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Figure 146: Middle East & Africa Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Figure 147: Middle East & Africa Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- List of Tables

- Table 1: Global Industrial Fasteners Market Comparison by By Material (2016-2032)

- Table 2: Global Industrial Fasteners Market Comparison by By Product Type (2016-2032)

- Table 3: Global Industrial Fasteners Market Comparison by By Application (2016-2032)

- Table 4: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 8: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 9: Global Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 10: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 12: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 13: Global Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 14: Global Industrial Fasteners Market Share Comparison by Region (2016-2032)

- Table 15: Global Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Table 16: Global Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Table 17: Global Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Table 18: North America Industrial Fasteners Market Comparison by By Product Type (2016-2032)

- Table 19: North America Industrial Fasteners Market Comparison by By Application (2016-2032)

- Table 20: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 24: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 25: North America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 26: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 28: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 29: North America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 30: North America Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Table 31: North America Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Table 32: North America Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Table 33: North America Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Table 34: Western Europe Industrial Fasteners Market Comparison by By Material (2016-2032)

- Table 35: Western Europe Industrial Fasteners Market Comparison by By Product Type (2016-2032)

- Table 36: Western Europe Industrial Fasteners Market Comparison by By Application (2016-2032)

- Table 37: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 41: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 42: Western Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 43: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 45: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 46: Western Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 47: Western Europe Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Table 49: Western Europe Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Table 50: Western Europe Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Table 51: Eastern Europe Industrial Fasteners Market Comparison by By Material (2016-2032)

- Table 52: Eastern Europe Industrial Fasteners Market Comparison by By Product Type (2016-2032)

- Table 53: Eastern Europe Industrial Fasteners Market Comparison by By Application (2016-2032)

- Table 54: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 58: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 59: Eastern Europe Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 60: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 62: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 63: Eastern Europe Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 64: Eastern Europe Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Table 66: Eastern Europe Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Table 67: Eastern Europe Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Table 68: APAC Industrial Fasteners Market Comparison by By Material (2016-2032)

- Table 69: APAC Industrial Fasteners Market Comparison by By Product Type (2016-2032)

- Table 70: APAC Industrial Fasteners Market Comparison by By Application (2016-2032)

- Table 71: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 75: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 76: APAC Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 77: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 79: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 80: APAC Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 81: APAC Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Table 82: APAC Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Table 83: APAC Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Table 84: APAC Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Table 85: Latin America Industrial Fasteners Market Comparison by By Material (2016-2032)

- Table 86: Latin America Industrial Fasteners Market Comparison by By Product Type (2016-2032)

- Table 87: Latin America Industrial Fasteners Market Comparison by By Application (2016-2032)

- Table 88: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 92: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 93: Latin America Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 94: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 96: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 97: Latin America Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 98: Latin America Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Table 100: Latin America Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Table 101: Latin America Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- Table 102: Middle East & Africa Industrial Fasteners Market Comparison by By Material (2016-2032)

- Table 103: Middle East & Africa Industrial Fasteners Market Comparison by By Product Type (2016-2032)

- Table 104: Middle East & Africa Industrial Fasteners Market Comparison by By Application (2016-2032)

- Table 105: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 109: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 110: Middle East & Africa Industrial Fasteners Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 111: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 113: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 114: Middle East & Africa Industrial Fasteners Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 115: Middle East & Africa Industrial Fasteners Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Industrial Fasteners Market Share Comparison by By Material (2016-2032)

- Table 117: Middle East & Africa Industrial Fasteners Market Share Comparison by By Product Type (2016-2032)

- Table 118: Middle East & Africa Industrial Fasteners Market Share Comparison by By Application (2016-2032)

- 1. Executive Summary

-

- ABB Limited (Switzerland)

- Siemens AG (Germany)

- Honeywell International Inc. (U.S.)

- Rockwell Automation (U.S.)

- Baumer Ltd (Switzerland)

- Encoder Products Company Inc (U.S.)

- Fuji Electric Co. Ltd. (Japan)

- Delta Electronics Inc (Taiwan)

- Emerson Electric (U.S.)

- Omron Corporation (Japan)

- Panasonic Corporation (Japan)

- Baumuller Holding GmbH & Co. KG (Germany)

- Balluff GmbH (Germany)

- Sensata Technologies Inc (U.S.)

- Festo Corporation (Germany)

- Parker-Hannifin Corporation (U.S.)

- SMC Corporation (Japan)

- DESTACO (U.S.)

- SWISS Automation Inc (U.S.)

- Mitsubishi Electric Corporation (Japan)