Industrial Air Compressors Market By Product Type (Reciprocating, Rotary, Centrifugal), By Lubrication (Oil-filled, Oil-free), By Form Factor (Portable, Stationary), By Industry (Oil & Gas, Manufacturing, Healthcare/ Pharmaceutical, And Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37039

-

May 2023

-

154

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

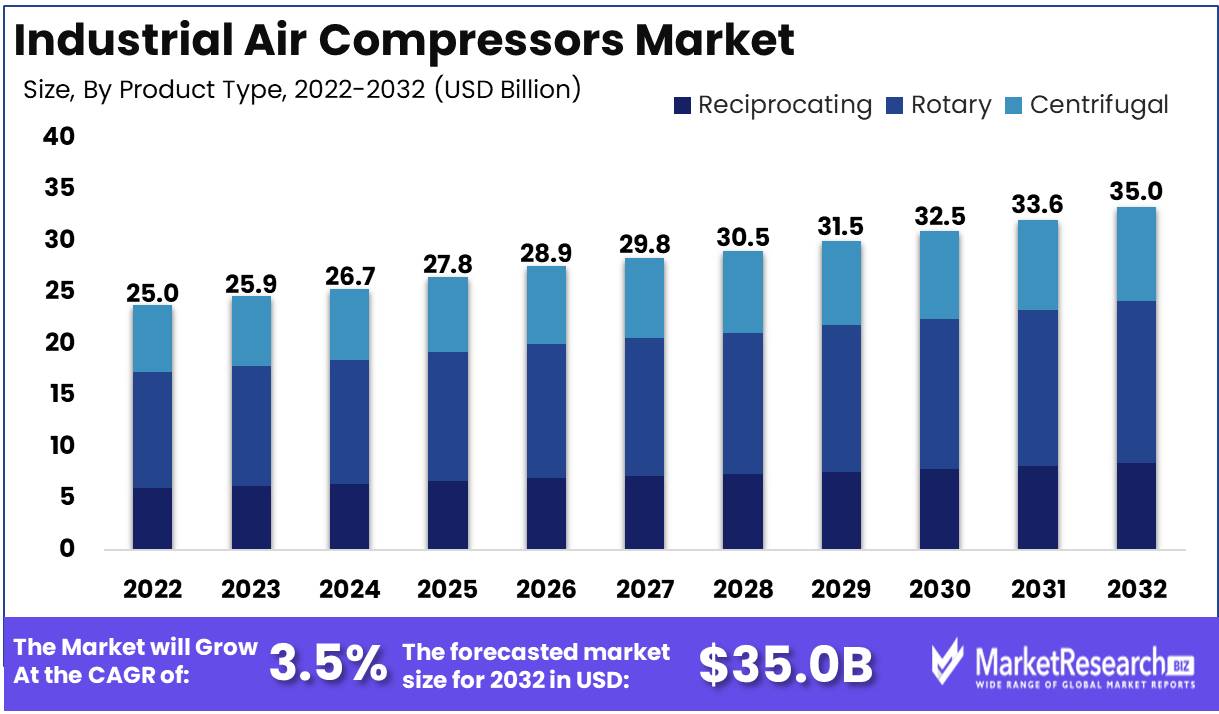

Industrial Air Compressors Market size is expected to be worth around USD 35.0 Bn by 2032 from USD 25.0 Bn in 2022, growing at a CAGR of 3.5% during the forecast period from 2023 to 2032.

Industrial Air Compressors Market is a rapidly expanding industry that is essential for numerous applications. A device that compresses gas or air, which can then be utilized in a variety of ways, is known as an air compressor. The use of these compressors ranges from industrial manufacturing to medical equipment. This article will provide an overview of Industrial Air Compressors Market, including its definition, objectives, benefits, innovations, growth, and applications. A device that compresses gas or air for use in various applications is an industrial air compressor. These compressors are utilized in numerous industries, including the automotive, medicinal, and manufacturing sectors, among others. The objectives of the industrial air compressors market are to provide efficient and dependable compressors, provide businesses with cost-effective solutions, minimize environmental impact, and ensure worker safety.

Industrial Air Compressors Market is vital to numerous industries. Air compressors are a dependable and efficient source of energy for a variety of applications, including manufacturing and transportation. In addition, they are economical, allowing businesses to save money on their energy expenses. In addition, air compressors emit no hazardous pollutants, making them a sustainable choice for businesses and manufacturers.

Industrial Air Compressors Market has witnessed numerous noteworthy innovations in recent years. The development of oil-free air compressors is one of the most significant innovations on the market. Advanced technology eliminates the need for oil-lubricated elements in these compressors, making them more environmentally friendly and simpler to maintain. The development of variable speed motors and the use of digital technology to enhance compressor performance are two additional innovations of note.

In recent years, numerous companies have made substantial investments in the industrial air compressors market. These investments have led to the development of new products and services, such as air compressors that are more efficient and dependable. Companies such as Atlas Copco, Ingersoll Rand, and Sullair have all made substantial market investments, and their products are utilized across a variety of industries.

Driving factors

Increasing Demand for Low-Maintenance and Energy-Efficient Products

Increasing demand for energy-efficient and low-maintenance compressed air systems has propelled Industrial Air Compressors Market to record levels of expansion. Diverse industries seek efficient solutions to satisfy their compressed air needs, resulting in an increase in air compressor production and adoption. This increase in demand can be attributed to the benefits provided by these systems, including reduced energy consumption, lower maintenance costs, and improved operational efficiency.

Utilization Rising in the Manufacturing, Construction, and Oil & Gas Sectors

In industries such as manufacturing, construction, and oil & gas, the demand for air compressors has increased substantially. Multiple applications, such as smart pneumatics tools, apparatus operation, and advanced process control, rely significantly on compressed air in these industries. As a consequence, Industrial Air Compressors Market has experienced a substantial increase, propelled by the rising demand for compressed air in these industries.

Technological Developments and Heightened Consciousness

Continuous technological advancements have played a vital role in the expansion of Industrial Air Compressors Market. Innovative and high-performance compressors have been developed, resulting in increased output, enhanced dependability, and decreased downtime. These developments have increased industry awareness of the benefits of utilizing air compressors, resulting in their pervasive adoption across numerous industries.

Development of the Automotive Sector and Compressed Air Systems

The extension of the automotive industry has contributed to the expansion of Industrial Air Compressors Market. Compressed air systems play a crucial role in automotive production processes, including assembly line operations, pneumatic tooling, and paint application. The demand for compressed air systems has increased proportionally to the growth of the automotive industry, thereby contributing to the expansion of the market.

Government Regulations and Rising Healthcare and Pharmaceutical Demand

The demand for air compressors has increased substantially as a result of government regulations promoting energy efficiency and environmental sustainability. For critical applications such as medical equipment operation, pharmaceutical manufacturing processes, and cleanroom environments, various industries, including healthcare and pharmaceuticals, require compressed air. As a result, Industrial Air Compressors Market has increased due to the increased demand from these industries.

Restraining Factors

Factors Limiting Industrial Air Compressors Market

Numerous industrial procedures are dependent on the industrial air compressors market. The oil and gas industry, the automotive industry, and the manufacturing sector all utilize these compressors. They can be used, among other things, to operate pneumatic instruments, transport materials, and pressurize air for combustion processes. A number of obstacles limit the market's expansion potential for industrial air compressors. This article examines a number of the most significant factors impeding the growth of the industrial air compressors market.

High installation and maintenance costs

The high cost of installation and maintenance is one of the largest obstacles on Industrial Air Compressors Market. Installation and upkeep of industrial air compressors require specialized knowledge, resulting in expensive labor costs. Moreover, the fundamental materials, components, and spare parts necessary for the construction, installation, and maintenance of compressors are expensive, resulting in increased production costs.

Price fluctuations for raw materials

The volatility of raw material prices is another significant factor influencing the expansion of Industrial Air Compressors Market. Changes in the prices of steel, copper, and other metals used to manufacture compressors have a substantial effect on production costs. Manufacturers bear the cost of fluctuating prices, which are ultimately passed on to consumers.

Availability of Low-Cost Alternatives

The availability of low-cost alternatives, such as used or reconditioned compressors, is another significant factor restraining Industrial Air Compressors Market. Although these alternatives are not as efficient or dependable as new compressors, they provide end-users who cannot afford new compressors with cost savings.

High decibel levels and environmental issues

The excessive decibel levels generated by industrial air compressors raise environmental and health concerns. Employees may experience hearing loss and stress-related disorders due to compressor noise pollution. In addition, the disturbance causes environmental concerns in the area. In response to these concerns, regulations governing compressor noise levels have been enacted.

By Product Type Analysis

Rotary segment dominates Industrial Air Compressors Market. Globally, Industrial Air Compressors Market is expanding at a significant rate. Increasing demand for compressed air in various industries, such as manufacturing, construction, and automotive, is a significant contributor to this growth. Among the various varieties of air compressors on the market, the rotary segment holds the largest market share. Rotary air compressors are utilized extensively in a variety of industrial applications due to their high energy efficiency, constant air supply, and low noise levels. Two helical rotors are used in rotary compressors to compress air as it passes through the device. This results in an uninterrupted passage of compressed air without the need for pulsation dampeners.

Due to its energy efficiency and minimal maintenance costs, the rotary segment of the industrial air compressors market is acquiring traction with consumers. Increasingly, consumers seek air compressors that can deliver a constant and uninterrupted supply of compressed air, and rotary air compressors satisfy this demand. In the coming years, the rotary segment of the industrial air compressors market is anticipated to record the highest growth rate. The extensive use of compressed air in numerous industrial applications, such as the manufacturing, construction, and automotive industries, is anticipated to increase demand.

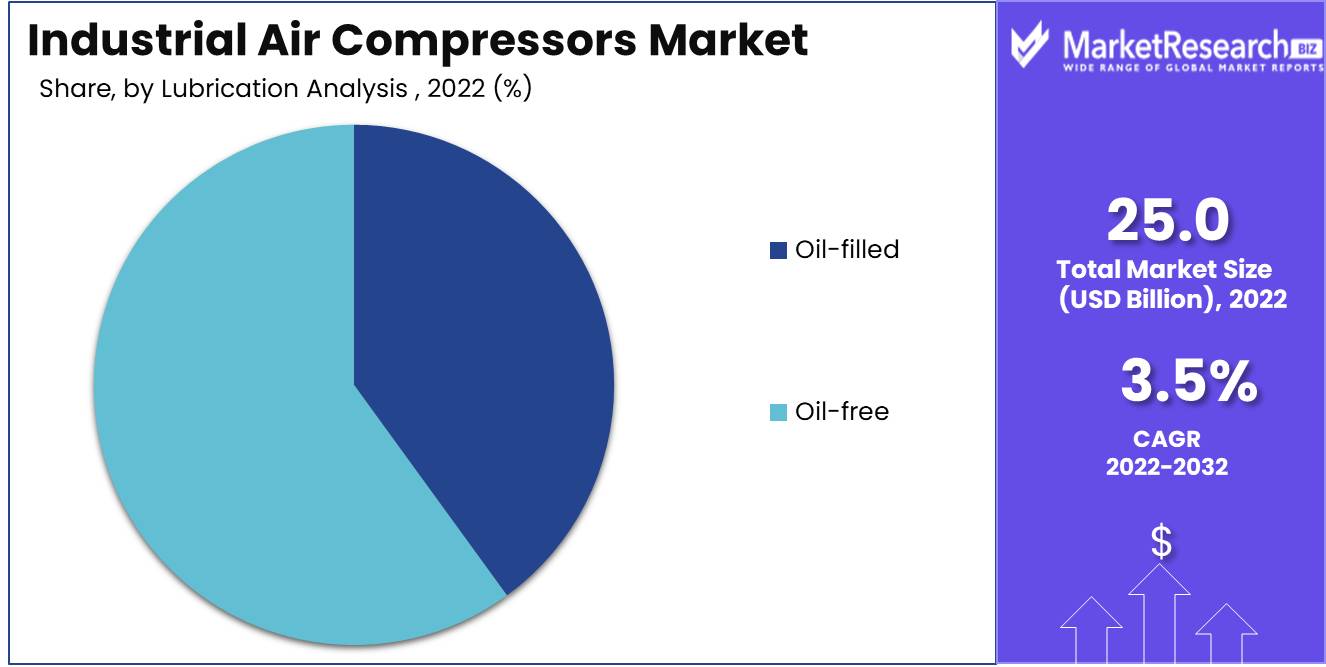

By Lubrication Analysis

Oil-free industrial air compressors market Leads Another important factor in air compressor compatibility is lubrication type. Due to its eco-friendliness, minimal maintenance, and energy efficiency, oil-free industrial air compressors dominate the market. Oil-free air compressors compress without lubrication. This produces clean, oil-free compressed air, making it excellent for high-quality compressed air applications.

Eco-friendly, energy-efficient, low-maintenance air compressors are in demand. Consumers across sectors prefer oil-free air compressors because they meet all these standards. The oil-free industrial air compressors market is expected to develop the quickest. Oil-free air compressors are being adopted due to industry demand for clean, oil-free compressed air and their eco-friendliness, cheap maintenance, and great energy efficiency.

By Industry Analysis

The Manufacturing sector dominates Industrial Air Compressors Market. Industrial Air Compressors Market is segmented by end-use industries, such as manufacturing, automotive, and construction, among others. Due to the extensive use of compressed air in a variety of manufacturing processes, the manufacturing industry segment holds the largest market share. Various manufacturing processes, such as air tools, spray painting, washing, and chilling, utilize compressed air. The use of compressed air improves production efficiency, lowers operating expenses, and provides a secure working environment for employees. As a result, demand for industrial air compressors in the manufacturing sector is anticipated to increase substantially over the next few years.

The demand for air compressors that provide high-quality compressed air, energy efficiency, and minimal maintenance costs is increasing in the manufacturing industry. The manufacturing segment of the industrial air compressors market satisfies all of these criteria, thereby gaining consumer favor.

Key Market Segments

By Product Type

- Reciprocating

- Rotary

- Centrifugal

By Lubrication

- Oil-filled

- Oil-free

By Form Factor

- Portable

- Stationary

By Industry

- Oil & Gas

- Manufacturing

- Healthcare/ Pharmaceutical

- Food & Beverages

- Energy & Utility

- Consumer Goods

- Metal & Mining

- Transportation

- Others (Construction, Automotive, etc.)

Growth Opportunity

Compressors that are Eco-Friendly and Energy-Efficient

The operation of industrial air compressors is heavily dependent on energy efficiency. Compressed air systems utilize a substantial quantity of energy and account for a substantial portion of industrial electricity costs. Therefore, there is a high demand for energy-efficient and eco-friendly compressors. These compressors contribute to environmental sustainability by reducing energy usage and greenhouse gas emissions.

Growth of the Oil and Gas Sector in Emerging Economies

The oil and gas industry is a major consumer of industrial air compressors for applications ranging from exploration to refining. The expansion of the oil and gas industry in emerging economies such as India, Brazil, and Russia is anticipated to increase the demand for industrial air compressors. The increase in oil and gas exploration activities, coupled with the growing trend of automation in the industry, is anticipated to drive the growth of the industrial air compressors market over the next several years.

Increasing Demand for Compressed Air in the Healthcare and Pharmaceutical Industries

The medical and pharmaceutical industries rely significantly on compressed air for a variety of applications, such as respiration equipment, drug delivery systems, and laboratory applications. Consequently, the rising demand for compressed air in the healthcare and pharmaceutical industries is anticipated to fuel the industrial air compressors market's expansion.

Increasing the Adoption of Mobile and Portable Air Compressors

Numerous industries, including the construction, mining, and marine sectors, are adopting portable and mobile air compressors at an increasing rate. These compressors are ideal for remote and off-site work due to their high mobility and adaptability. In the future years, Industrial Air Compressors Market is anticipated to expand due to rising demand for these compressors.

Increasing Automation and Digitalization in the Industrial Sector

The increasing prevalence of automation and digitalization across numerous industries is fueling the demand for air compressors. Automation and digitization boost efficiency and productivity, but also increase the demand for air compressors. As industrial processes become increasingly automated and digitized, the demand for air compressors will continue to rise, driving the expansion of Industrial Air Compressors Market.

Latest Trends

Increase IoT-Enabled Compressor Adoption

Increased adoption of IoT-enabled compressors for remote monitoring and predictive maintenance is one of the most significant market trends in the industrial air compressor sector. With the advent of the Internet of Things (IoT), businesses can now monitor and analyze the performance of their equipment in real time. IoT-enabled compressors offer numerous advantages, including improved predictive maintenance, decreased downtime, and increased operational efficiency. These compressors are able to analyze data in real-time, anticipate prospective problems, and alert maintenance personnel.

Increasing Customization and Tailored Solutions

Another significant trend is the increasing trend of customization and industry-specific solutions. No two industries or applications require identical compressor types. As a result, an increasing number of businesses are emphasizing the provision of customized solutions to satisfy the specific needs of their clients. Personalized compressors have a number of advantages over conventional, off-the-shelf models. The application-specific design of these compressors increases their efficacy, efficiency, and dependability.

Digital Controls and Variable Speed Drives

In addition, technological advances in compressors, such as digital controls and variable speed motors, are propelling the market. These technologies allow compressors to modify their performance in response to demand, resulting in increased energy efficiency and decreased operating costs. Variable speed drives, for instance, can modify the motor's speed to match the specific load requirements, thereby reducing energy consumption and extending the life of the compressor. Digital controls, on the other hand, provide real-time data and analytics that can be used to optimize performance and identify potential issues prior to their escalation.

Oil-Free Compressors for Clean Air Applications

As the value of clean and antiseptic environments increases, so does the demand for oil-free compressors for applications that require pure air. Designed to eradicate the risk of oil contamination, oil-free compressors are suitable for industries such as pharmaceuticals, food, and beverages. Additionally, oil-free compressors are more energy-efficient than conventional oil-lubricated compressors. Without lubricating lubricant, these compressors are able to operate at higher rates and pressures, resulting in enhanced performance and efficiency.

Lower Operating Expenses and Carbon Footprint

Finally, there is a transition toward energy-efficient compressors in an effort to reduce operational expenses and carbon footprint. As energy costs continue to rise, many businesses are searching for ways to reduce expenses while simultaneously increasing their sustainability. Energy-efficient compressors consume less energy than conventional compressors, resulting in lower operating expenses and a smaller carbon footprint. These compressors can also help businesses achieve their sustainability objectives, demonstrating their commitment to reducing their environmental impact.

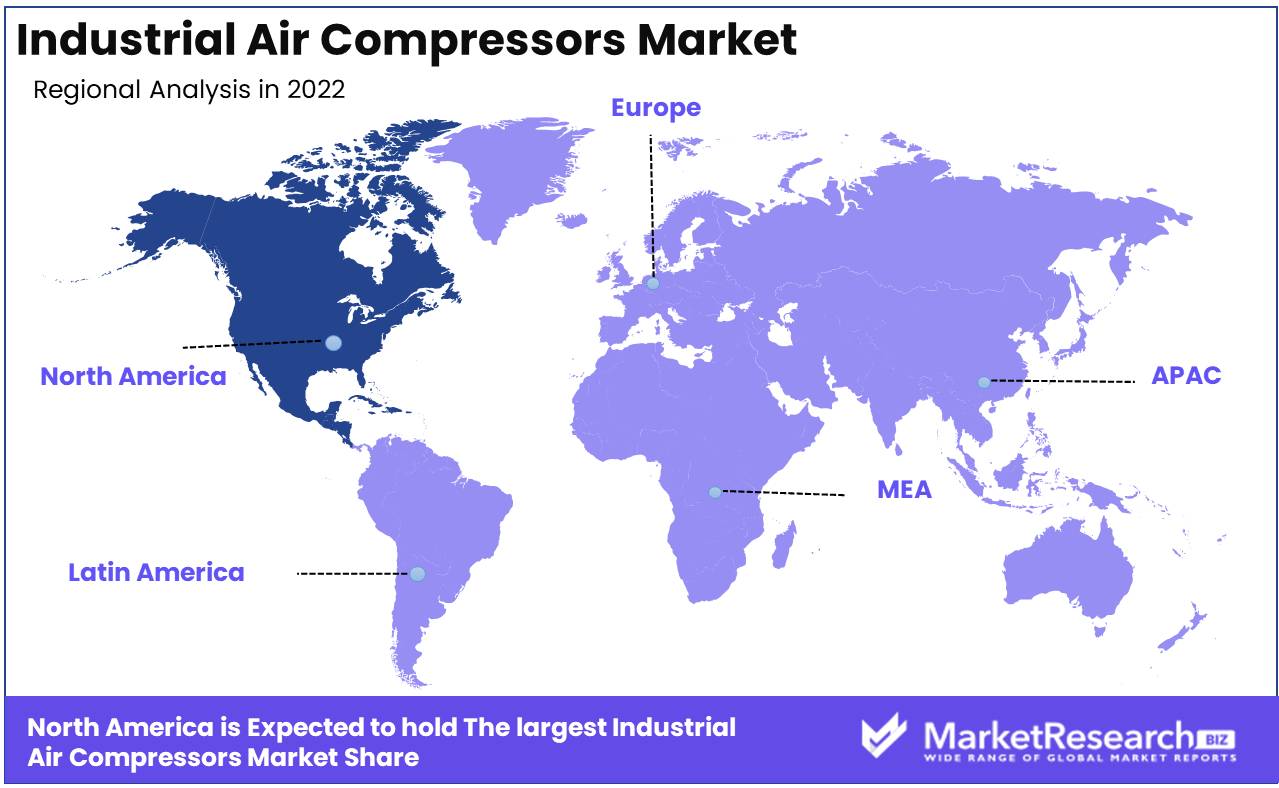

Regional Analysis

The North American region has long been regarded as a key participant in the compressor market, with the presence of a number of industry leaders propelling market expansion. The demand for energy-efficient compressors is increasing, as consumers seek not only to reduce their energy costs but also their carbon footprint. These factors are contributing to the expansion of the North American compressor market. With the expansion of the industrial sector, the demand for compressors of superior quality has also increased. This has led to the emergence of several new market participants, which has intensified competition. However, established companies have met this challenge head-on and have been able to maintain their market position by offering clients compressors that are technologically advanced and energy-efficient.

Rising awareness of the negative effects of climate change is one of the most important factors driving the increased demand for energy-efficient compressors. Now that consumers are more aware of their carbon footprint, they are searching for methods to reduce it. This transition towards energy-efficient products has manifested in the expansion of the North American compressor market. The market for compressors in North America is segmented based on type, application, and end-use industry. The category segment includes centrifugal, rotary, and reciprocating compressors, while the application segment includes air, gas, and refrigeration compressors. Manufacturing, oil & gas, electricity generation, and chemicals & petrochemicals are included in the end-use industry segment.

In North America, the manufacturing industry is one of the largest end-users of compressors, accounting for a significant portion of the market. Due to their high demand for compressors, the oil & gas and power generation industries are also significant contributors to the North American compressor market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Industrial Air Compressors Market is extremely competitive, with numerous global participants. Companies such as Atlas Copco AB, Ingersoll-Rand PLC, Gardner Denver Holdings Inc., Kaeser Kompressoren SE, and BOGE Kompressoren Otto Boge GmbH & Co. KG are market leaders. These corporations are industry leaders in the design, production, and distribution of industrial air compressors. Atlas Copco AB, which was established in 1873, is a globally renowned manufacturer of industrial tools and apparatus. They are experts in the design and production of energy-efficient compressed air systems, such as dryers, filtration, and pipework. Atlas Copco is also a leader in sustainable solutions and has been recognized for multiple years as one of the world's most ethical businesses.

Founded in 1871, Ingersoll-Rand PLC is a global leader in the manufacturing of industrial apparatus. They specialize in the development of innovative and integrated solutions, including turbines, tools, and compressors. Additionally, Ingersoll-Rand provides energy-efficient and dependable products to various industries, including the food and beverage, automotive, and construction sectors. Gardner Denver Holdings, Inc. is one of the largest providers of industrial equipment solutions in the globe. They offer a vast selection of products, including air compressors, pumps, blowers, and filtration. Gardner Denver is committed to providing innovative solutions for compressed air that assure operational efficiency and productivity.

The family-owned company Kaeser Kompressoren SE manufactures energy-efficient and dependable compressed air systems. Kaeser has been a market leader for over a century and is renowned for its engineering expertise, technological advancements, and service dependability. BOGE Kompressoren Otto Boge GmbH & Co. KG is a German company that designs and manufactures compressed air systems for various applications that are energy-efficient. BOGE offers oil-free and oil-lubricated compressors, energy recovery systems, and air treatment systems.

Top Key Players in Industrial Air Compressors Market

- Ariel Corporation

- Howden Group Ltd.

- IHI Corporation

- Ltd

- Kaeser Kompressoren Co.ltd.

- Kobe Steel

- Ltd

- Mayekawa Mfg. Co.

- LTD

- Mikuni Kikai Kogyo Co.ltd.

- Mitsui E&S Holdings Co.

- Ltd

- Siemens AG

- The Japan Steel Worksltd.

- Hitachi Ltd

- Ingersoll Rand Inc.

- Parker Hannifin Corporation

- Elgi Equipments

- Mitsubishi Heavy Industries Ltd.

- Sulzer Ltd.

Recent Development

In the ever-expanding market for industrial air compressors, companies continually test the limits of innovation and technology. Major industry participants have recently announced game-changing new developments and expansions.

In September 2021, Atlas Copco made ripples when it introduced a new line of energy-efficient and oil-free air compressors. These compressors are designed to deliver high-quality compressed air while consuming minimal energy, making them both cost-effective and environmentally beneficial.

In August 2021, Not to be surpassed, Gardner Denver introduced a new line of oil-lubricated rotary screw compressors. These compressors are designed to deliver optimal performance and dependability in industrial applications, allowing businesses to continue operating efficiently.

In July of 2021, Ingersoll Rand made a significant acquisition by acquiring Domnick Hunter, a leader in filtration and separation technologies. This move strengthens Ingersoll Rand's market position and enables the company to provide customers with a broader selection of compressed air solutions.

In June 2021, Sullair released a new line of portable air compressors for the construction industry. These compressors are built to withstand the rigors of construction sites while delivering compressed air reliably to power pneumatic tools and equipment.

In May 2021, Kaeser Compressors expanded its German manufacturing facility to satisfy the rising demand for compressed air systems. This expansion enables the company to increase its production capacity and better serve its global clients.

Report Scope

Report Features Description Market Value (2022) USD 25.0 Bn Forecast Revenue (2032) USD 35.0 Bn CAGR (2023-2032) 3.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type: Reciprocating, Rotary, Centrifugal

By Lubrication: Oil-filled, Oil-free

By Form Factor: Portable, Stationary

By Industry: Oil & Gas, Manufacturing, Healthcare/ Pharmaceutical, Food & Beverages, Energy & Utility, Consumer Goods, Metal & Mining, Transportation, Others (Construction, Automotive, etc.)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ariel Corporation, Howden Group Ltd., IHI Corporation, Ltd, Kaeser Kompressoren Co.ltd., Kobe Steel, Ltd, Mayekawa Mfg. Co., LTD, Mikuni Kikai Kogyo Co.ltd., Mitsui E&S Holdings Co., Ltd, Siemens AG, The Japan Steel Worksltd., Hitachi Ltd, Ingersoll Rand Inc., Parker Hannifin Corporation, Elgi Equipments, Mitsubishi Heavy Industries Ltd., Sulzer Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ariel Corporation

- Howden Group Ltd.

- IHI Corporation

- Ltd

- Kaeser Kompressoren Co.ltd.

- Kobe Steel

- Ltd

- Mayekawa Mfg. Co.

- LTD

- Mikuni Kikai Kogyo Co.ltd.

- Mitsui E&S Holdings Co.

- Ltd

- Siemens AG

- The Japan Steel Worksltd.

- Hitachi Ltd

- Ingersoll Rand Inc.

- Parker Hannifin Corporation

- Elgi Equipments

- Mitsubishi Heavy Industries Ltd.

- Sulzer Ltd.