Global Independent Software Vendors (ISVs) Market Covid-19 Impact Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, and Growth Forecast to 2031

-

22282

-

May 2023

-

157

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Global Independent Software Vendors (ISVs) Market Overview

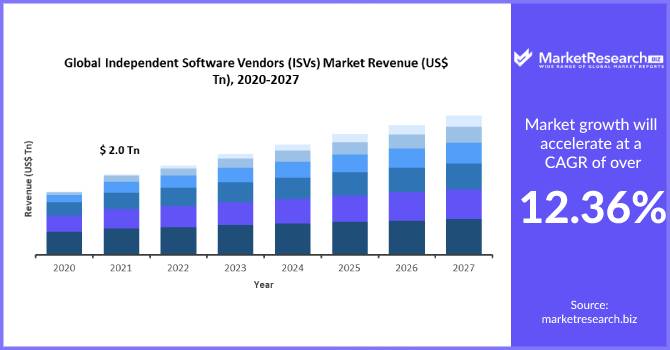

“The global Independent Software Vendors (ISVs) market size is expected to be worth around US$ 6,648.60Bn by 2031 from US$ 1,958.60Bn in 2021, growing at a CAGR of 12.99% during the forecast period 2021 to 2031.”

It is complete with important statistics and other industry-relevant particulars, including factors expected to influence Independent Software Vendors (ISVs) market progress, drivers, restraints, opportunities, trends, sales reviews, landmark developments (existing and anticipated), SWOT analysis, as well as information on other potential revenue generation prospects in unexplored areas of operation.

The data collated by our analysts from both primary and secondary sources are validated by data management solutions, and more importantly, industry experts, to ensure genuine authenticity.

The global Independent Software Vendors (ISVs) market report will encompass imminent threats or challenges from existing industry contenders, as well as potential new market entrants. Additionally, this dossier will also explore existing as well as foreseeable impacts of the ongoing COVID-19 pandemic.

Impacts of the COVID-19 Pandemic:

Most industries across the world have been negatively impacted over the last few months. This can be attributed to significant disruptions experienced by their respective manufacturing and supply-chain operations as a result of various precautionary lockdowns, as well as other restrictions that were enforced by governing authorities across the globe.

The same applies to the global Independent Software Vendors (ISVs) market. Moreover, consumer demand has also subsequently reduced as individuals are now more keen on eliminating non-essential expenses from their respective budgets as the general economic status of most individuals has been severely affected by this outbreak.

These aforementioned elements are expected to burden the revenue trajectory of the global Independent Software Vendors (ISVs) market over the forecast timeline. However, as respective governing authorities begin to lift these enforced lockdowns, the global Independent Software Vendors (ISVs) market is expected to recover accordingly.

Who are the Major Independent Software Vendors (ISVs) Market's Key Players?

Key industry players profiled in this global Independent Software Vendors (ISVs) market include ASG Technologies Group, Inc., Allscripts Healthcare (formerly McKesson Corporation), American Software, Inc., Apple Inc., Arney Computer Systems, Astro Tech, Avgi Solutions, Barnard Software, Inc., Cisco Systems, Inc., VMware, Inc., Autodesk, Inc., Fundamental Software, Inc., Google LLC, GSF Software, GT Software, H & W Computer Systems, Inc., Hewlett Packard Enterprise Company, HostBridge Technology, IBM Corporation, Interskill Interactive, Inc., KELLTON TECH, Lee Technologies, Inc., Levi, Ray and Shoup, Inc, Magic Software Enterprises Ltd, Microsoft Corporation, Numerical Algorithms Group Ltd, Oracle Corporation., Pacific Systems Group, Phoenix Software International, Red Hat Inc., Salesforce.com, Inc., ServiceNow, Inc., Universal Software, Inc., Virtusa Corporation.

Segmentation of the Global Independent Software Vendors (ISVs) Market:

Software Deployment

- Cloud

- On-premise

Application

- Financial Services

- Healthcare

- Industrial & Manufacturing

- Public Sector & Utilities

- Retail

- Service Providers

- Telecom

- Media & Entertainment

- Education

- Others (Hospitality, Transportation, etc.)

Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

What are the Key Factors Covered in this Independent Software Vendors (ISVs) Market Report?

- CAGR of the Independent Software Vendors (ISVs) market during the forecast period 2021-2031.

- Precise estimation of the Independent Software Vendors (ISVs) market size and its contribution to the parent market.

- Detailed information on factors that will drive Independent Software Vendors (ISVs) market growth during the next ten years.

- Accurate predictions on upcoming trends and changes in consumer behaviour.

- The growth of the Independent Software Vendors (ISVs) market across APAC, North America, Europe, South America, and MEA.

- A thorough analysis of the Independent Software Vendors (ISVs) market’s competitive landscape and detailed information on key Players.

- Comprehensive details of factors that will challenge the growth of Independent Software Vendors (ISVs) market vendors.

- Independent Software Vendors (ISVs) Market’s Opportunity Orbits

- Market Investment Feasibility Index

- PEST Analysis

- PORTER’S Five Force Analysis

- Drivers & Restraints Impact Analysis

- Marketing Strategy

- Product Life Cycle Analysis

- Value Chain Analysis

- Cost Structure Analysis

- Macro-economic Factors

[table_custom cagr=5.99% market_size=1,958.60Bn USD projection=6,648.60Bn USD]

-

-

- ASG Technologies Group, Inc.

- Allscripts Healthcare (formerly McKesson Corporation)

- American Software, Inc.

- Apple Inc.

- Arney Computer Systems

- Astro Tech

- Avgi Solutions

- Barnard Software, Inc.

- Cisco Systems, Inc.

- VMware, Inc.

- Autodesk, Inc.

- Fundamental Software, Inc.

- Google LLC

- GSF Software

- GT Software

- H & W Computer Systems, Inc.

- Hewlett Packard Enterprise Company

- HostBridge Technology

- IBM Corporation

- Interskill Interactive, Inc.