In App Purchase Market By Type (Consumable, Non-Consumable, Subscription), By Operating System (Android, iOS, Others), By Application (Gaming, Entertainment and Music, Health and Fitness, Travel and Hospitality, Social Networking, Education and Learning, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46416

-

May 2024

-

136

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

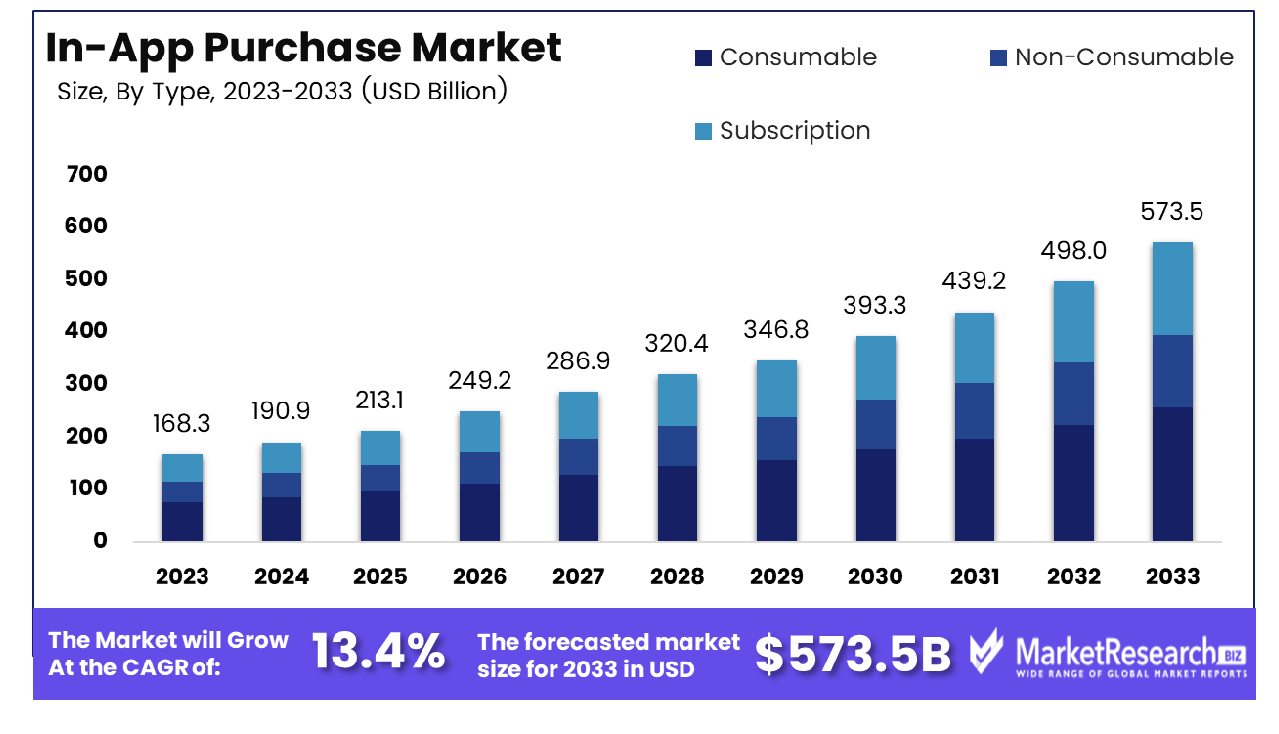

The Global In-App Purchase Market was valued at USD 168.3 Bn in 2023. It is expected to reach USD 573.5 Bn by 2033, with a CAGR of 13.4% during the forecast period from 2024 to 2033.

The In-App Purchase Market encompasses the ecosystem where consumers buy additional content, features, or services within mobile applications. This market has seen exponential growth, driven by the proliferation of smartphones and the shift towards freemium business models. In-app purchases range from virtual goods in gaming apps to premium features in productivity tools. Developers leverage this revenue model to enhance user engagement and monetization strategies. Key components include digital storefronts, payment gateways, and analytics tools that optimize purchase flows. As consumer preferences evolve, the market continues to innovate, offering seamless and personalized purchasing experiences that drive sustained revenue growth.

The In-App Purchase (IAP) Market is a dynamic and rapidly evolving sector within the digital economy. Since its inception in 2009 with Apple's launch of iOS 3.0, which introduced the ability for developers to sell virtual goods and content within apps, the market has expanded significantly. Today, just over 5% of app users engage in in-app spending, a seemingly modest figure that belies the substantial revenue generated due to the scale of the global app user base. Notably, iOS users spend approximately 2.5 times more on in-app purchases compared to their Android counterparts, highlighting a key demographic for developers and marketers to target.

The In-App Purchase (IAP) Market is a dynamic and rapidly evolving sector within the digital economy. Since its inception in 2009 with Apple's launch of iOS 3.0, which introduced the ability for developers to sell virtual goods and content within apps, the market has expanded significantly. Today, just over 5% of app users engage in in-app spending, a seemingly modest figure that belies the substantial revenue generated due to the scale of the global app user base. Notably, iOS users spend approximately 2.5 times more on in-app purchases compared to their Android counterparts, highlighting a key demographic for developers and marketers to target.This market's growth trajectory is fueled by several factors, including the widespread adoption of smartphones, the rise of the freemium model, and advancements in payment technologies. Developers are increasingly leveraging IAPs to drive engagement and monetize their user base, employing sophisticated analytics to optimize purchase flows and personalize user experiences. The ability to sell incremental content and features not only enhances user engagement but also provides a recurring revenue stream that can be more predictable than traditional one-time app sales.

This market is witnessing innovation in payment methods, with seamless integration of digital wallets and one-click purchase options enhancing the user experience. As consumer preferences continue to evolve, driven by a desire for personalized and immersive app experiences, the IAP market is poised for sustained growth. Companies that can effectively harness data analytics to understand user behavior and preferences will be well-positioned to capitalize on this lucrative market. In conclusion, the in-app purchase ecosystem represents a critical revenue channel that, despite its current penetration rates, holds significant untapped potential for future expansion.

Key Takeaways

- Market Value: The Global In-App Purchase Market was valued at USD 168.3 Bn in 2023. It is expected to reach USD 573.5 Bn by 2033, with a CAGR of 13.4% during the forecast period from 2024 to 2033.

- By Type: Consumable purchases, comprising 58% of the market, dominate in-app transactions, driven by items like in-game currency and power-ups.

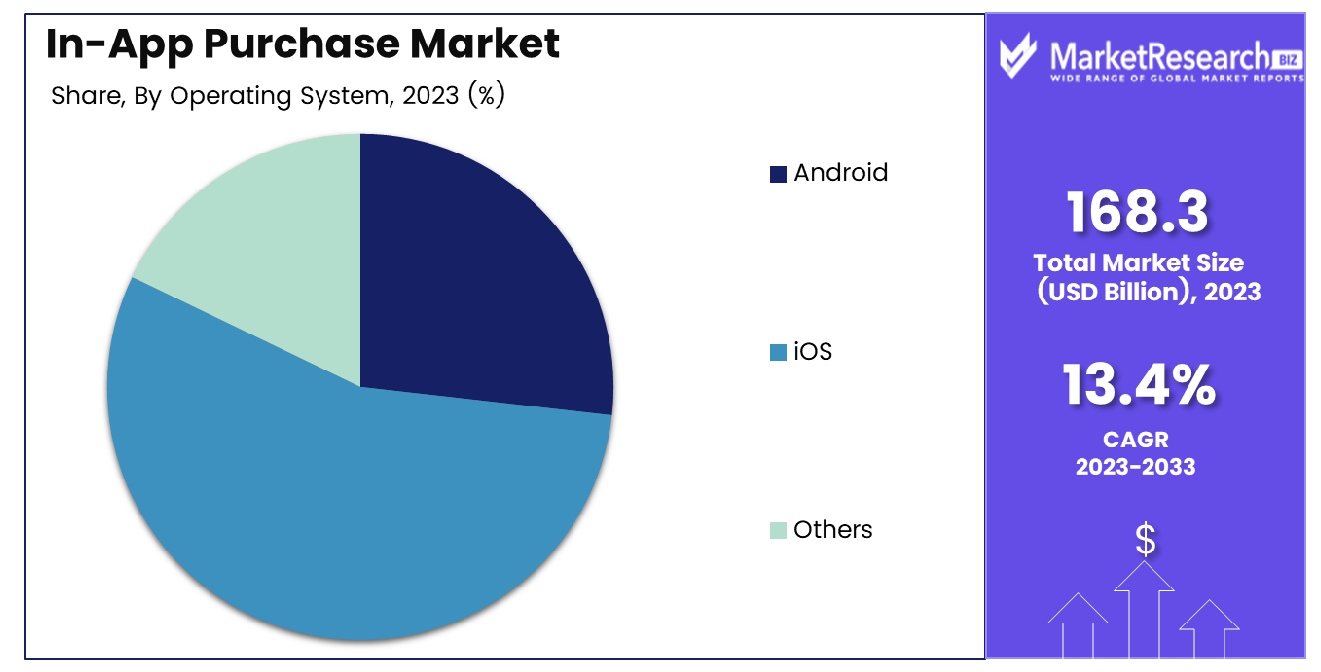

- By Operating System: iOS leads in operating systems with a 62% share, reflecting its users' higher spending habits.

- By Application: Gaming reigns supreme in applications, claiming 67% of in-app purchases, thanks to its extensive offerings and engaging experiences.

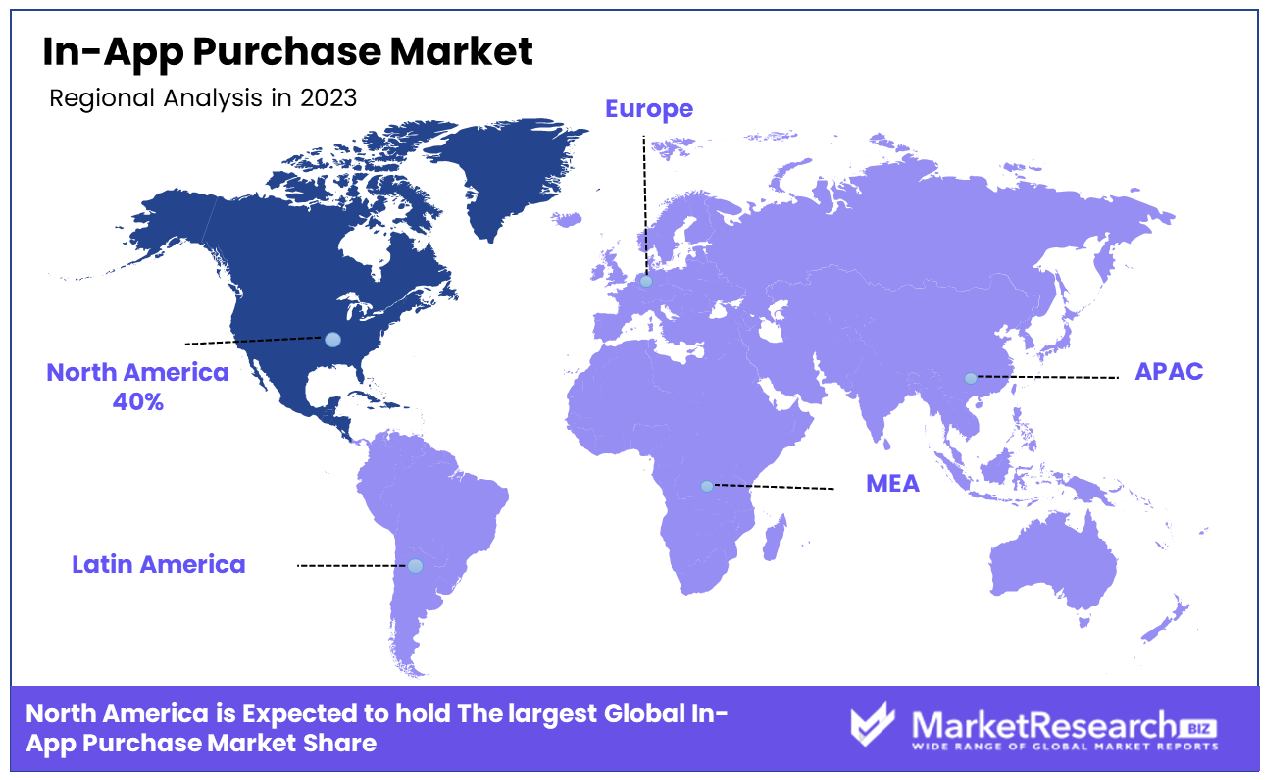

- Regional Dominance: North America maintains precise regional dominance, commanding 40% of the global in-app purchase revenue.

- Growth Opportunity: The growth opportunity in the in-app purchase market involves expanding into emerging markets and enhancing user engagement through personalized experiences, presenting a dynamic landscape for revenue expansion.

Driving factors

Increasing Smartphone Users Globally

The proliferation of smartphones globally has been a cornerstone in driving the growth of the In-App Purchase (IAP) Market. As more individuals gain access to smartphones, the potential customer base for in-app purchases expands exponentially. With smartphones becoming increasingly affordable and accessible across various income brackets and regions, the market size for in-app purchases sees a significant boost.

Statistics indicate a steady rise in smartphone adoption worldwide. For instance, according to Statista, the number of smartphone users globally is projected to reach 7.5 billion by 2026, up from 3.8 billion in 2021. This surge in smartphone users translates directly to increased opportunities for in-app purchases.

Promotional Strategies like Loyalty Programs

Loyalty programs and other promotional strategies wield considerable influence in propelling the growth of the In-App Purchase Market. By offering incentives and rewards to users who make in-app purchases, developers not only encourage repeat purchases but also attract new customers. These strategies enhance user engagement and foster a sense of loyalty among app users, thereby driving revenue growth.

Loyalty programs can take various forms, including discounts, exclusive content, virtual currency, or even access to premium features. By leveraging these incentives effectively, developers can stimulate in-app spending and maximize revenue potential. Additionally, personalized offers tailored to individual user preferences can further amplify the effectiveness of loyalty programs, leading to sustained growth in in-app purchases.

Rising Internet Penetration

The increasing penetration of the internet, particularly in emerging markets, plays a pivotal role in fueling the expansion of the In-App Purchase Market. As more regions gain access to high-speed internet connectivity, users are empowered to explore and engage with a diverse range of mobile applications, many of which offer in-app purchase options.

Rising internet penetration not only broadens the reach of app developers but also facilitates seamless in-app transactions, enhancing the overall user experience. Moreover, improved internet infrastructure enables developers to incorporate advanced features and content within their apps, thereby enticing users to make in-app purchases for access to premium offerings.

Restraining Factors

Digital Illiteracy and Infrastructure Gaps

While factors like increasing smartphone users and rising internet penetration contribute significantly to the growth of the In-App Purchase (IAP) Market, digital illiteracy and infrastructure gaps present challenges that can hinder market expansion, particularly in certain regions. Digital illiteracy, characterized by a lack of familiarity or proficiency with digital technologies, can limit the adoption of smartphones and inhibit users' ability to navigate and utilize mobile applications effectively. In regions where digital literacy rates are low, individuals may be less inclined to engage with in-app purchases due to uncertainties or difficulties in understanding the process.

Addressing digital illiteracy and infrastructure gaps requires concerted efforts from various stakeholders, including governments, NGOs, and technology companies. Initiatives aimed at promoting digital literacy, providing training programs, and improving infrastructure can help bridge these gaps and expand the user base for in-app purchases. By investing in education and infrastructure development, developers can unlock untapped markets and drive growth in regions where digital accessibility remains a challenge.

Privacy Concerns over Data Collection

Privacy concerns over data collection represent another significant factor that can influence the growth trajectory of the In-App Purchase Market. As users become increasingly aware of data privacy issues and the potential risks associated with sharing personal information, they may exhibit reluctance or skepticism towards making in-app purchases.

Instances of data breaches or misuse of personal data can erode trust and deter users from engaging with mobile apps that require access to sensitive information for in-app transactions. Heightened awareness of privacy rights and regulations, such as the General Data Protection Regulation (GDPR) in Europe or the California Consumer Privacy Act (CCPA) in the United States, has prompted developers to prioritize data protection measures and transparency in their practices.

By Type

Consumable purchases, at 58% of the market, dominate in-app transactions, led by items like in-game currency and power-ups.

In 2023, Consumable items held a dominant market position in the In-App Purchase Market, capturing more than a 58% share. Consumable items are those that can be used once and then need to be replenished, such as in-game currency, power-ups, or virtual goods. This segment of the market is characterized by its dynamic nature, driven by the continuous need for users to enhance their in-app experience through purchases.

Consumable items are particularly attractive to app developers due to their potential for recurring revenue streams. By offering consumable items within their apps, developers can encourage frequent purchases, thereby maximizing monetization opportunities. Additionally, the low barrier to entry for consumers, often with low price points, contributes to the widespread adoption of consumable items in the In-App Purchase Market.

Non-Consumable items, on the other hand, represent a different segment of the market, characterized by purchases that provide permanent enhancements or content within the app. Examples of non-consumable items include premium features, ad removal, or additional levels in a game. While non-consumable items may command higher prices compared to consumable items, they typically have lower purchase frequency, leading to a smaller market share of around 30%.

Subscription-based purchases emerged as a significant segment within the In-App Purchase Market, representing approximately 12% of the market share in 2023. Subscriptions offer users ongoing access to premium content or services within an app for a recurring fee. This model provides developers with a predictable revenue stream and fosters user engagement through continuous access to exclusive features or content.

By Operating System

iOS leads in operating systems with a 62% share, reflecting its users' higher spending habits.

In 2023, iOS held a dominant market position in the In-App Purchase Market's By Operating System segment, capturing more than a 62% share. iOS, the operating system developed by Apple, boasts a large and engaged user base, particularly in regions with higher disposable incomes and a strong preference for premium digital experiences. This dominance is underscored by the platform's robust ecosystem, which includes the App Store, renowned for its stringent quality standards, curated content, and seamless payment processes.

iOS's stronghold in the market can be attributed to several factors. Firstly, Apple's focus on user privacy and security instills trust among consumers, encouraging them to make in-app purchases with confidence. Secondly, the affluent demographics of iOS users often translate into higher average spending on digital content and services, further bolstering the platform's revenue potential for developers. Lastly, the seamless integration of in-app purchases into the iOS user experience, coupled with the ease of payment methods such as Apple Pay, facilitates frictionless transactions, driving higher conversion rates.

Android, while a prominent player in the global smartphone market, commands a smaller share of approximately 35% in the In-App Purchase Market. The Android ecosystem, characterized by a diverse range of devices and distribution channels such as the Google Play Store, presents both opportunities and challenges for developers. While the sheer volume of Android users offers a vast potential audience, the platform's fragmentation and varying device specifications can pose technical hurdles for app developers aiming to optimize their in-app purchase experiences across different devices.

Other operating systems, including emerging platforms and niche players, collectively represent a minority share of around 3% in the In-App Purchase Market. These alternative operating systems often cater to specific market segments or regions, offering unique features or targeting niche demographics. While they may present opportunities for developers seeking to tap into underserved markets, their limited user base and ecosystem maturity pose considerable challenges in terms of scalability and revenue potential.

By Application

Gaming reigns supreme in applications, claiming 67% of in-app purchases, thanks to its extensive offerings and engaging experiences.

In 2023, the Gaming segment held a dominant market position in the In-App Purchase Market's By Application segment, capturing more than a 67% share. Gaming has long been at the forefront of the mobile app economy, driving significant revenue through in-app purchases of virtual goods, currency, and additional content.

The dominance of the Gaming segment can be attributed to several key factors. Firstly, the widespread popularity of mobile gaming across diverse demographics ensures a large and engaged user base, facilitating ample opportunities for monetization through in-app purchases. Secondly, the freemium model, where games are free to download but offer optional in-app purchases, has become a proven strategy for driving revenue while maintaining accessibility for users. This model allows developers to offer a compelling gameplay experience upfront, with in-app purchases providing avenues for users to enhance their gameplay or progress faster.

Entertainment and Music emerge as another significant segment within the In-App Purchase Market, albeit with a smaller market share compared to Gaming. This segment includes apps offering premium content such as streaming services, digital downloads, or access to exclusive media. While entertainment and music apps often rely on subscription-based monetization models, in-app purchases can also play a role in offering additional features, content, or merchandise to users, contributing to overall revenue generation.

Health and Fitness, Travel and Hospitality, Social Networking, Education and Learning, and other segments collectively represent the remaining share of the In-App Purchase Market. While these segments cater to specific user needs and interests, their market share in terms of in-app purchases is comparatively smaller. However, they still present opportunities for developers to monetize their apps through various means, such as premium features, subscriptions, or one-time purchases of digital content or services.

Key Market Segments

By Type

- Consumable

- Non-Consumable

- Subscription

By Operating System

- Android

- iOS

- Others

By Application

- Gaming

- Entertainment and Music

- Health and Fitness

- Travel and Hospitality

- Social Networking

- Education and Learning

- Others

Growth Opportunity

Rapid Tech Adoption in Emerging Markets

Emerging markets are experiencing a surge in smartphone penetration and internet accessibility, creating vast opportunities for the in-app purchase market. As more users gain access to mobile devices, the potential customer base for in-app purchases expands exponentially. Countries like India, Brazil, and Indonesia are witnessing rapid tech adoption, fueling the demand for digital content and in-app purchases. Developers and businesses can capitalize on this trend by localizing their apps and offering tailored in-app purchase options to cater to the preferences of users in these regions.

The rise of affordable smartphones and improved internet infrastructure in emerging markets is driving increased engagement with mobile apps. This heightened user engagement presents an ideal environment for monetization through in-app purchases. By understanding the unique characteristics of these markets and leveraging localization strategies, businesses can unlock new revenue streams and establish a strong presence in these burgeoning economies.

New Games and Tech Innovation

The continuous influx of new games and technological innovations is reshaping the in-app purchase landscape, offering fresh opportunities for developers and businesses. The gaming industry, in particular, is witnessing unprecedented growth, fueled by advancements in technology such as augmented reality (AR) and virtual reality (VR). These innovations not only enhance the gaming experience but also open up new avenues for in-app purchases, such as virtual goods and premium content.

The integration of artificial intelligence (AI) and machine learning algorithms is revolutionizing personalized recommendations and targeted marketing within apps. By leveraging these technologies, developers can optimize their in-app purchase strategies and provide users with highly relevant and engaging offers. As consumers become increasingly accustomed to personalized experiences, businesses that embrace AI-driven approaches stand to gain a competitive edge in the market.

Latest Trends

Subscription-Based In-App Purchases Growing

Subscription-based in-app purchases are emerging as a dominant trend in the market, driven by their ability to offer continuous value to users while ensuring a steady revenue stream for developers. Consumers are increasingly opting for subscription models, drawn by the convenience and access to premium content or features. This trend presents significant opportunities for businesses to foster long-term relationships with customers and maximize lifetime value through recurring revenue streams.

iOS Platform Leads In-App Purchases

The iOS platform continues to lead in-app purchases, maintaining its stronghold in the market. With a large and loyal user base, iOS users consistently demonstrate higher engagement and willingness to make in-app purchases compared to Android users. Developers targeting the iOS ecosystem benefit from higher average revenue per user (ARPU) and greater monetization opportunities, making it a lucrative platform for in-app purchases.

Real-Time Analytics and AI Personalization

Real-time analytics and AI-driven personalization are revolutionizing the in-app purchase experience, enabling developers to deliver tailored recommendations and offers to users. By leveraging advanced analytics and machine learning algorithms, businesses can gain deeper insights into user behavior and preferences, allowing for more targeted and effective monetization strategies. Real-time analytics also empower developers to adapt quickly to changing market dynamics and optimize their in-app purchase offerings in response to user feedback and trends.

Regional Analysis

North America maintains its dominance in the global in-app purchase market, commanding approximately 40% of the total market share.

North America holds a dominant position in the global in-app purchase market, commanding approximately 40% of the total market share. This leadership is attributed to factors such as high smartphone penetration rates, robust digital infrastructure, and a tech-savvy population. The region, led by the United States, boasts a mature mobile app ecosystem and advanced payment systems, contributing significantly to its dominant position in in-app purchases.

Europe represents a substantial market for in-app purchases, although its dominance is overshadowed by North America. The region accounts for a significant portion of global in-app purchase revenue, with countries like the United Kingdom, Germany, and France being key contributors. While Europe holds a notable market share, it falls behind North America in terms of dominance, with its share being lower than that of its transatlantic counterpart.

The Asia Pacific region emerges as a rapidly growing market for in-app purchases, driven by factors such as increasing smartphone adoption and a diverse mobile app landscape. Countries like China, India, and Indonesia are witnessing a surge in consumer spending on mobile apps, particularly in gaming and entertainment sectors. While Asia Pacific holds immense growth potential, its dominance in the global in-app purchase market is overshadowed by North America, with a lower percentage of market share.

The Middle East & Africa region represents an emerging market for in-app purchases, characterized by evolving consumer behaviors and improving digital infrastructure. While the region shows promising growth prospects, its share in the global in-app purchase market is relatively small compared to North America. Countries like the United Arab Emirates and Saudi Arabia are driving the adoption of mobile apps and in-app purchases, but the region's dominance remains limited in comparison.

Latin America presents a burgeoning market for in-app purchases, fueled by factors such as expanding internet access and a growing tech-savvy population. Countries like Brazil, Mexico, and Argentina exhibit significant potential for in-app purchase revenue generation. However, Latin America's dominance in the global market is overshadowed by North America, with its share being comparatively smaller.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global in-app purchase market is set for continued evolution, with key players like Apple Inc., Disney, Google LLC, and others poised to play pivotal roles in shaping its trajectory.

Apple Inc. remains a frontrunner, leveraging its robust ecosystem of devices and services to drive in-app purchases through the App Store. With initiatives like Apple Arcade and Apple Music, the company continues to expand its offerings, enhancing user engagement and monetization opportunities.

Disney stands out with its diverse portfolio of entertainment content, including movies, TV shows, and games. Through in-app purchases, Disney capitalizes on its iconic brands and characters, offering users premium experiences and exclusive content, thus strengthening customer loyalty and revenue streams.

Google LLC dominates the Android platform, leveraging its vast user base and ecosystem of apps to facilitate in-app purchases through Google Play. The company's emphasis on user experience and developer support ensures a conducive environment for monetization, driving growth in the in-app purchase market.

King.com Ltd., renowned for popular titles like Candy Crush Saga, remains a key player in mobile gaming. Through in-app purchases, King.com monetizes its games effectively, offering users compelling incentives and premium features, thereby sustaining engagement and revenue generation.

Netflix, Inc. has revolutionized the streaming industry, leveraging subscription-based models to drive revenue. While not traditionally associated with in-app purchases, Netflix's experimentation with interactive content and additional features could signal a potential expansion into this space, further diversifying its monetization strategies.

Other notable players like Roblox, InMobi, and Brainly bring unique value propositions to the in-app purchase market, catering to diverse segments such as gaming, advertising, and education. As the market evolves, collaboration, innovation, and adaptation to changing consumer preferences will be crucial for these key players to maintain their competitive edge and drive sustained growth in the global in-app purchase landscape.

Market Key Players

- Apple Inc.

- Disney

- Google LLC

- King.com Ltd.

- Netflix, Inc.

- Creative Clicks

- AdMaven

- POCKETGUARD

- PubMatic

- Roblox

- InMobi

- Brainly

- Recurly

- Propeller Ads

- Tango

Recent Development

- In May 2024, Craftsman Automation plans to double investment in the auto component industry to $7 billion. Analysts suggest a potential 19% return. They specialize in manufacturing auto components.

- In May 2024, Matt Frankel, CFP®, recommends Robinhood for its standout mobile brokerage app and SoFi Active Investing for beginners. Both offer accessible platforms for investing, catering to new investors amidst record market highs in 2024.

Report Scope

Report Features Description Market Value (2023) USD 168.3 Bn Forecast Revenue (2033) USD 573.5 Bn CAGR (2024-2033) 13.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Consumable, Non-Consumable, Subscription), By Operating System (Android, iOS, Others), By Application (Gaming, Entertainment and Music, Health and Fitness, Travel and Hospitality, Social Networking, Education and Learning, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Apple Inc., Disney, Google LLC, King.com Ltd., Netflix, Inc., Creative Clicks, AdMaven, POCKETGUARD, PubMatic, Roblox, InMobi, Brainly, Recurly, Propeller Ads, Tango Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-