Hydrogel Wound Filler Market By Type (Amorphous Hydrogels, Impregnated Gauze, Gel Sheets), By Application (Chronic Wounds, Burns, Surgical Wounds, Others), By End-User (Hospitals, Specialty Clinics, Homecare), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50391

-

Aug 2024

-

301

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

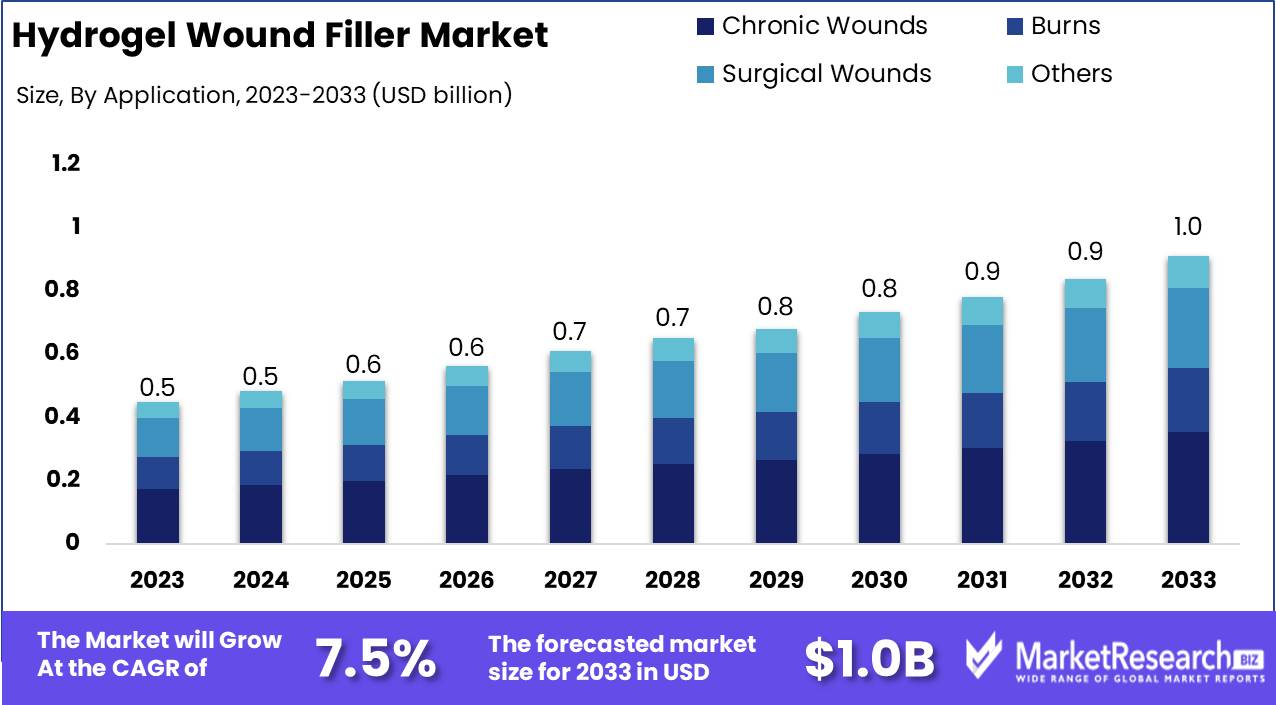

The Global Hydrogel Wound Filler Market was valued at USD 0.5 Bn in 2023. It is expected to reach USD 1.0 Bn by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033.

The Hydrogel Wound Filler Market focuses on the development and application of hydrogels—gel-like substances with high water content used to manage wounds by maintaining a moist environment, promoting healing, and providing pain relief. These products are particularly effective in treating dry or necrotic wounds, burns, and ulcers, where moisture balance is crucial. The market is driven by the increasing prevalence of chronic wounds, advancements in hydrogel technology, and the growing demand for effective wound care solutions. As healthcare systems prioritize patient-centered care, hydrogel wound fillers are becoming an essential component of modern wound management.

The Hydrogel Wound Filler Market is positioned for substantial growth as the demand for advanced wound care solutions intensifies, particularly in the management of chronic wounds. Hydrogel fillers are increasingly recognized for their ability to maintain a moist environment, which is critical for optimal wound healing. The market's expansion is closely tied to innovations that enhance product efficacy and cater to the diverse needs of patients with varying wound types. For instance, standard enteral nutrition formulas, offering 1.0-2.0 kcal/mL, are pivotal in supporting the nutritional demands of patients, indirectly impacting the healing process facilitated by hydrogel wound fillers.

The customization and precision required in wound care are underscored by the development of enteral formulas designed to meet 100% of adult Dietary Reference Intakes (DRIs) within 1,000 to 1,500 mL per day. This level of detail in patient care reflects the broader trend within the hydrogel wound filler market towards personalized treatment approaches. Such tailored solutions not only enhance patient outcomes but also drive the adoption of hydrogel technologies in clinical settings, highlighting their importance in comprehensive wound management strategies.

As the hydrogel wound filler market continues to evolve, it is poised to play an increasingly critical role in the future of wound care. The ongoing advancements in product formulation and the integration of specialized nutritional support underscore the market's potential to address complex wound healing challenges. This growth trajectory will likely be further supported by the rising incidence of chronic conditions, such as diabetes, that necessitate advanced wound care solutions, positioning hydrogel wound fillers as a key component in the broader wound care landscape.

Key Takeaways

- Market Value: The Global Hydrogel Wound Filler Market was valued at USD 0.5 Bn in 2023. It is expected to reach USD 1.0 Bn by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033.

- By Type: Amorphous Hydrogels make up 40% of the market, favored for their adaptability to different wound shapes.

- By Application: Chronic Wounds represent 35%, highlighting the need for effective long-term wound management solutions.

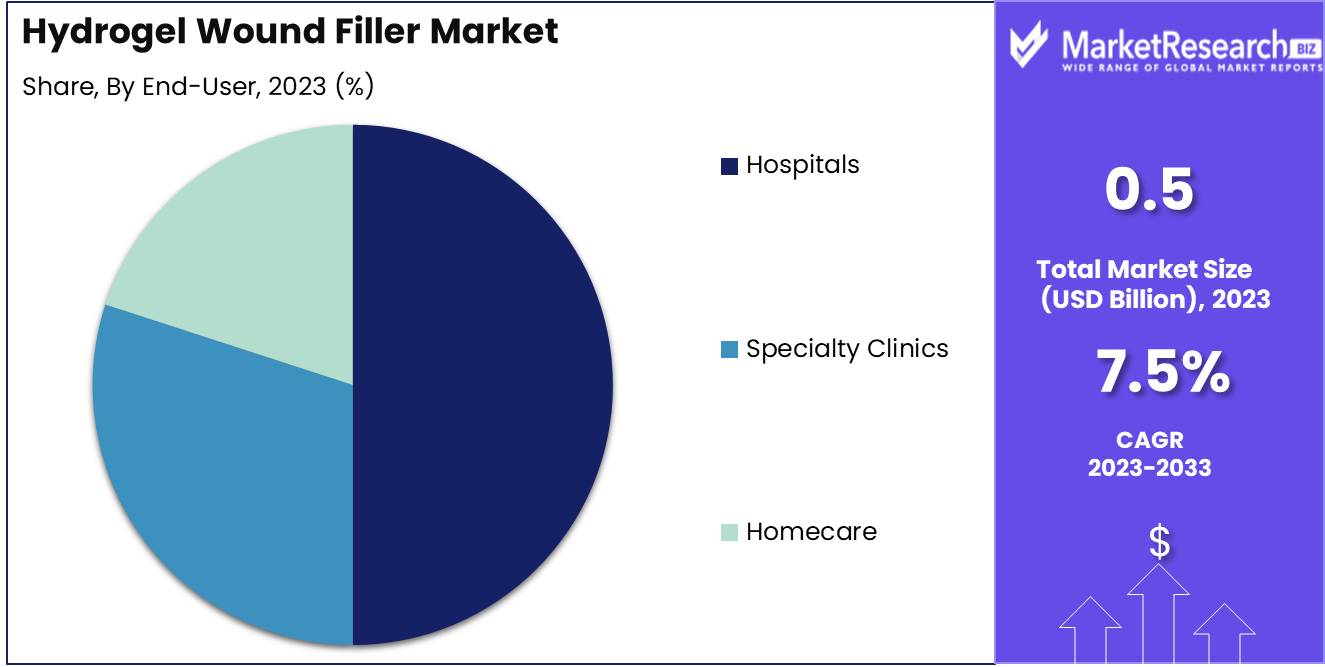

- By End-User: Hospitals account for 50%, relying on hydrogel fillers for treating complex wounds.

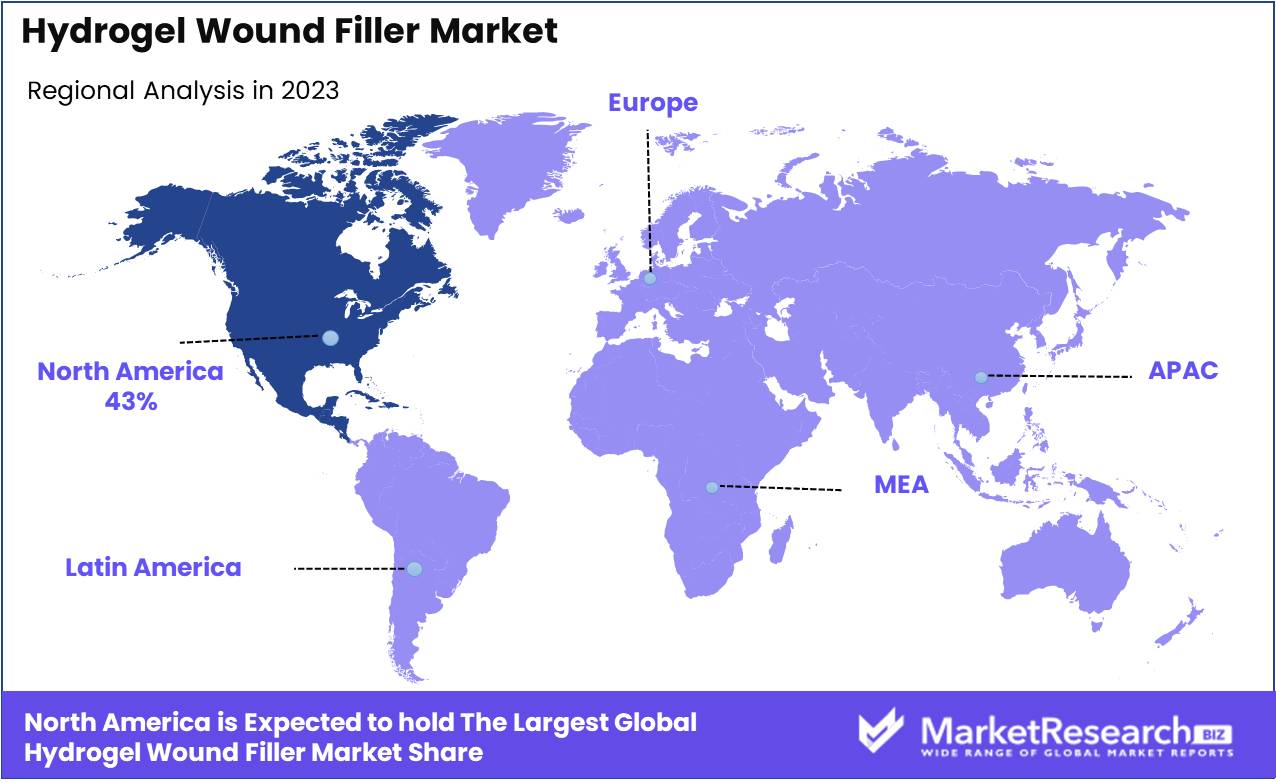

- Regional Dominance: North America holds a 43% market share, driven by a high prevalence of chronic wounds and advanced healthcare infrastructure.

- Growth Opportunity: Developing hydrogels with enhanced antimicrobial properties can improve wound healing outcomes and expand market adoption.

Driving factors

Increasing Incidence of Chronic Wounds and Ulcers

The rising incidence of chronic wounds and ulcers, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is a significant driver of growth in the Hydrogel Wound Filler Market. Chronic wounds are a major healthcare challenge, affecting millions of people worldwide and leading to extended hospital stays, increased healthcare costs, and reduced quality of life for patients. As the global population ages and the prevalence of diabetes and vascular diseases rises, the incidence of chronic wounds is expected to continue growing.

Hydrogel wound fillers, which provide a moist environment that promotes faster healing and reduces the risk of infection, are increasingly being recognized as an essential component of wound care. The increasing need for effective treatment options for chronic wounds is fueling the demand for hydrogel wound fillers, driving market growth as healthcare providers seek advanced solutions to manage these complex conditions.

Advancements in Wound Care Technologies

Advancements in wound care technologies have significantly contributed to the growth of the Hydrogel Wound Filler Market. Innovations in materials science and biotechnology have led to the development of next-generation hydrogel wound fillers that offer improved properties, such as enhanced moisture retention, better biocompatibility, and the ability to deliver therapeutic agents directly to the wound site. These technological advancements have made hydrogel wound fillers more effective in managing a wide range of wounds, from minor abrasions to severe chronic ulcers.

New formulations and delivery systems are making hydrogel wound fillers easier to apply and more adaptable to different wound types, further increasing their adoption in clinical practice. As these technologies continue to evolve, they are expected to drive further innovation in the market, offering healthcare providers and patients more effective and convenient wound care options.

Growing Demand for Moisture-Retentive Wound Care Products

The growing demand for moisture-retentive wound care products is another key factor contributing to the expansion of the Hydrogel Wound Filler Market. Moisture-retentive dressings, such as hydrogel wound fillers, are increasingly preferred in wound care because they create an optimal healing environment by maintaining a moist wound bed. This not only accelerates the healing process but also reduces pain and discomfort for the patient, as well as the risk of infection.

The shift towards moisture-retentive wound care is driven by a growing body of clinical evidence supporting the benefits of maintaining a moist wound environment, particularly in the treatment of chronic wounds and ulcers. As healthcare professionals and patients alike become more aware of these benefits, the demand for hydrogel wound fillers is expected to rise, supporting market growth.

Restraining Factors

High Cost of Advanced Wound Care Products

One of the primary restraining factors in the Hydrogel Wound Filler Market is the high cost associated with advanced wound care products. Hydrogel wound fillers, while highly effective, are generally more expensive than traditional wound care options such as gauze or basic dressings. This cost premium can be a significant barrier to adoption, particularly in healthcare systems with limited budgets or in regions where cost containment is a priority. The high cost can also deter patients from choosing these products, especially when out-of-pocket expenses are involved.

The uptake of hydrogel wound fillers may be slower than expected, limiting their impact on the broader wound care market. To overcome this challenge, manufacturers and healthcare providers will need to focus on demonstrating the long-term cost-effectiveness of hydrogel wound fillers, emphasizing their potential to reduce healing times, minimize complications, and lower overall healthcare costs.

Limited Awareness in Developing Regions

Limited awareness of hydrogel wound fillers in developing regions presents another significant restraint on market growth. In many low- and middle-income countries, healthcare providers and patients may not be familiar with advanced wound care products, including hydrogel wound fillers. This lack of awareness can be attributed to several factors, including limited access to healthcare information, insufficient training for medical professionals, and a lack of marketing and distribution efforts by manufacturers in these regions.

The adoption of hydrogel wound fillers in developing markets remains low, with traditional wound care methods still prevalent. Overcoming this barrier will require targeted education and outreach initiatives, as well as partnerships with local healthcare providers and organizations to increase awareness and accessibility. Expanding market penetration in these regions is crucial for unlocking the full potential of the Hydrogel Wound Filler Market and driving global growth.

By Type Analysis

In 2023, Amorphous Hydrogels held a dominant market position in the By Type segment of the Hydrogel Wound Filler Market, capturing more than a 40% share.

Amorphous Hydrogels have become the leading type of hydrogel wound fillers due to their versatility and effectiveness in managing a wide range of wound types. These hydrogels are primarily water-based, making them ideal for maintaining a moist wound environment, which is crucial for accelerating the healing process. Their ability to conform to various wound shapes and sizes, combined with their ease of application, has made them the preferred choice among healthcare providers. The increasing adoption of Amorphous Hydrogels in both acute and chronic wound care settings, due to their effectiveness in pain relief and autolytic debridement, contributes significantly to their market dominance.

Impregnated Gauze and Gel Sheets are also integral components of the hydrogel wound filler market. Impregnated Gauze is widely used for its ability to provide both moisture and support to wounds, particularly in burn care. Gel Sheets, on the other hand, are favored in situations requiring more precise application, such as post-operative wound care and burns. Despite these alternatives, the flexibility and broad applicability of Amorphous Hydrogels keep them at the forefront of the market.

By Application Analysis

In 2023, Chronic Wounds held a dominant market position in the By Application segment of the Hydrogel Wound Filler Market, capturing more than a 35% share.

Chronic Wounds, including diabetic ulcers, pressure ulcers, and venous ulcers, represent a significant burden in healthcare, driving the demand for effective wound care solutions like hydrogel wound fillers. The ability of hydrogels to maintain a moist environment, promote autolytic debridement, and reduce pain makes them particularly suitable for managing chronic wounds. The rising prevalence of diabetes and other chronic conditions globally has led to an increase in chronic wound cases, further fueling the demand for hydrogel wound fillers in this application segment.

Burns and Surgical Wounds are other key application areas for hydrogel wound fillers. In burn care, the cooling effect of hydrogels provides immediate pain relief and supports healing. For surgical wounds, hydrogels are used to manage exudate and prevent infection, promoting faster recovery. However, the higher incidence and longer healing time associated with chronic wounds ensure that this application segment maintains a leading position in the market.

By End-User Analysis

In 2023, Hospitals held a dominant market position in the By End-User segment of the Hydrogel Wound Filler Market, capturing more than a 50% share.

Hospitals are the primary end-users of hydrogel wound fillers, driven by the increasing number of surgeries, trauma cases, and chronic wound patients requiring advanced wound care. Hospitals are equipped with the necessary infrastructure and medical expertise to administer hydrogel wound fillers effectively, particularly in complex cases that require intensive care and monitoring. The growing adoption of advanced wound care technologies in hospital settings, coupled with the rising number of hospital admissions for chronic wounds, contributes to their dominant market position.

Specialty Clinics and Homecare settings also play significant roles in the hydrogel wound filler market. Specialty Clinics focus on specific types of wound care, such as burn centers and diabetic foot clinics, where hydrogel wound fillers are commonly used. Homecare settings are becoming increasingly important as patients seek convenient and cost-effective wound care solutions. However, the comprehensive care offered by hospitals, along with their ability to handle a high volume of patients, solidifies their leading position in the market.

Key Market Segments

By Type

- Amorphous Hydrogels

- Impregnated Gauze

- Gel Sheets

By Application

- Chronic Wounds

- Burns

- Surgical Wounds

- Others

By End-User

- Hospitals

- Specialty Clinics

- Homecare

Growth Opportunity

Development of Bioactive and Antimicrobial Hydrogel Fillers

The development of bioactive and antimicrobial hydrogel fillers presents a significant opportunity for the Hydrogel Wound Filler Market in 2024. Traditional hydrogel fillers are highly effective in maintaining a moist wound environment, but the integration of bioactive compounds and antimicrobial agents represents a new frontier in wound care. Bioactive hydrogel fillers can promote faster healing by releasing growth factors, peptides, or other therapeutic agents directly into the wound site.

Antimicrobial hydrogel fillers can help prevent infections, a critical concern in wound management, particularly in chronic wounds and ulcers. These innovations are expected to drive market growth by offering enhanced efficacy and addressing unmet needs in wound care, making these advanced hydrogel fillers a preferred choice for healthcare providers and patients alike.

Expansion in Home Healthcare and Outpatient Settings

The expansion of hydrogel wound fillers in home healthcare and outpatient settings is another key growth opportunity in 2024. As healthcare systems worldwide shift towards more cost-effective and patient-centered care models, there is increasing demand for wound care products that are easy to use and suitable for non-hospital environments. Hydrogel wound fillers, known for their ease of application and ability to maintain moisture, are well-suited for use in home healthcare and outpatient settings.

This trend is particularly important as the global population ages, leading to a rise in chronic wounds that require long-term management. The growing acceptance of hydrogel wound fillers in these settings is expected to drive significant market growth, as more patients and healthcare providers recognize the benefits of these products for managing wounds outside of traditional hospital settings.

Latest Trends

Use of Hydrogel Fillers in Combination with Growth Factors and Stem Cells

In 2024, one of the most transformative trends in the Hydrogel Wound Filler Market is the increasing use of hydrogel fillers in combination with growth factors and stem cells. This trend is driven by the growing focus on regenerative medicine and the need for more effective treatments for chronic and non-healing wounds. By incorporating growth factors and stem cells into hydrogel fillers, researchers and clinicians can enhance the body’s natural healing processes, promoting tissue regeneration and accelerating wound closure.

This combination approach is particularly promising for treating complex wounds, such as diabetic ulcers and severe burns, where traditional wound care methods may fall short. The ability of hydrogel fillers to act as a delivery system for these biologically active substances is expected to drive their adoption in advanced wound care, offering significant potential for improved patient outcomes and fueling market growth.

Adoption of Smart Hydrogels with Controlled Release Properties

Another key trend in 2024 is the adoption of smart hydrogels with controlled release properties. These innovative hydrogels are designed to release therapeutic agents, such as antibiotics, anti-inflammatory drugs, or growth factors, in a controlled manner over time, responding to specific wound conditions. The ability to provide sustained and targeted therapy directly at the wound site reduces the need for frequent dressing changes and minimizes the risk of infection, making smart hydrogels an attractive option for both patients and healthcare providers.

This trend is expected to revolutionize wound treatment by offering more efficient and effective care, particularly for chronic wounds that require long-term management. As research and development in this area continue, the adoption of smart hydrogels is anticipated to expand, driving significant advancements in the hydrogel wound filler market.

Regional Analysis

North America is the dominating region in the Hydrogel Wound Filler Market, holding a significant 43% share.

The Hydrogel Wound Filler Market in North America is experiencing robust growth, supported by the region's advanced healthcare infrastructure, high healthcare spending, and increasing prevalence of chronic wounds, such as diabetic ulcers and pressure ulcers. The United States, in particular, plays a leading role, with a well-established medical device industry and strong demand for advanced wound care solutions. The region's dominance is further reinforced by the presence of key market players and continuous innovation in hydrogel technologies, contributing to North America's 43% market share.

Europe follows closely, with significant market activity driven by the growing elderly population and the rising incidence of chronic wounds. Countries like Germany, the United Kingdom, and France are at the forefront of the market, benefiting from strong healthcare systems and government support for advanced wound care products. The European market is also characterized by increasing adoption of hydrogel wound fillers in both hospital settings and home care, as awareness of their benefits continues to grow among healthcare professionals.

The Asia Pacific region is emerging as a fast-growing market for hydrogel wound fillers, fueled by increasing healthcare investments and the rising prevalence of chronic wounds. Countries such as China, Japan, and India are key contributors to this growth, driven by a growing aging population and improving healthcare infrastructure. The region's expanding middle class and increasing access to advanced wound care products are also supporting market growth.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Hydrogel Wound Filler Market is prominently influenced by leading companies such as Smith & Nephew plc, ConvaTec Group plc, 3M Healthcare, Medline Industries Inc., Derma Sciences Inc., B. Braun Melsungen AG, Johnson & Johnson, Coloplast A/S, Cardinal Health Inc., and Integra LifeSciences Corporation.

Smith & Nephew plc and ConvaTec Group plc are key players, offering advanced hydrogel wound care products that enhance wound healing and patient comfort. Their established market presence and innovative hydrogel formulations drive significant market activity.

3M Healthcare and Medline Industries Inc. contribute with their extensive portfolios of hydrogel wound fillers, providing solutions that address various wound types and clinical needs. Derma Sciences Inc. and B. Braun Melsungen AG offer specialized hydrogel products that support effective wound management.

Johnson & Johnson and Coloplast A/S are notable for their advanced hydrogel technologies and extensive distribution networks, enhancing market reach and product accessibility. Cardinal Health Inc. and Integra LifeSciences Corporation provide a range of hydrogel wound fillers designed for optimal performance in clinical settings.

These companies collectively shape the hydrogel wound filler market by driving innovation, expanding product offerings, and improving wound care solutions globally.

Market Key Players

- Smith & Nephew plc

- ConvaTec Group plc

- 3M Healthcare

- Medline Industries Inc.

- Derma Sciences Inc.

- B. Braun Melsungen AG

- Johnson & Johnson

- Coloplast A/S

- Cardinal Health Inc.

- Integra LifeSciences Corporation

Recent Development

- In April 2024, 3M Healthcare expanded its wound care product line with an advanced hydrogel filler that features enhanced moisture retention properties. This product is expected to improve patient outcomes by 30%.

- In February 2024, Smith & Nephew plc introduced a new hydrogel wound filler designed to accelerate healing in chronic wounds. This product aims to reduce healing time by 20%, offering significant benefits to patients with long-term wounds.

Report Scope

Report Features Description Market Value (2023) USD 0.5 Bn Forecast Revenue (2033) USD 1.0 Bn CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Amorphous Hydrogels, Impregnated Gauze, Gel Sheets), By Application (Chronic Wounds, Burns, Surgical Wounds, Others), By End-User (Hospitals, Specialty Clinics, Homecare) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smith & Nephew plc, ConvaTec Group plc, 3M Healthcare, Medline Industries Inc., Derma Sciences Inc., B. Braun Melsungen AG, Johnson & Johnson, Coloplast A/S, Cardinal Health Inc., Integra LifeSciences Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Smith & Nephew plc

- ConvaTec Group plc

- 3M Healthcare

- Medline Industries Inc.

- Derma Sciences Inc.

- B. Braun Melsungen AG

- Johnson & Johnson

- Coloplast A/S

- Cardinal Health Inc.

- Integra LifeSciences Corporation