Hormone Replacement Therapy Market By Product(Estrogen & Progesterone Replacement Therapy, HGH replacement therapy, Thyroid hormone replacement therapy), By Route of Administration(Oral, Parenteral, Others), By Disease Type(Menopause, Hypothyroidism, Male hypogonadism), By Distribution Channel(Hospital Pharmacies, Retail Pharmacies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

41456

-

Jan 2024

-

160

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Hormone Replacement Therapy Market Size, Share, Trends Analysis

- Hormone Replacement Therapy Market Dynamics

- Hormone Replacement Therapy Market Segmentation Analysis

- Hormone Replacement Therapy Industry Segments

- Hormone Replacement Therapy Market Growth Opportunity

- Hormone Replacement Therapy Market Regional Analysis

- Hormone Replacement Therapy Industry By Region

- Hormone Replacement Therapy Market Share Analysis

- Hormone Replacement Therapy Industry Key Players

- Hormone Replacement Therapy Market Recent Development

- Report Scope

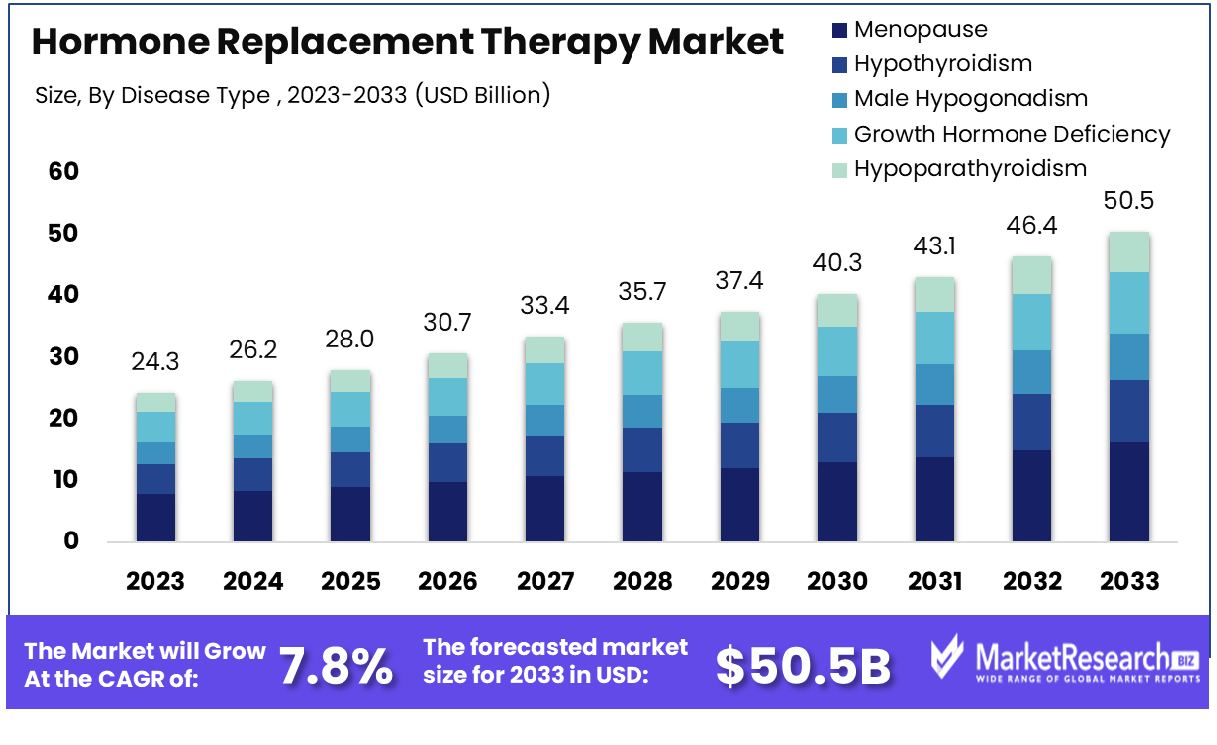

The hormone replacement therapy market was valued at USD 24.3 billion in 2023. It is expected to reach USD 50.5 billion by 2033, with a CAGR of 7.8% during the forecast period from 2024 to 2033.

The surge in demand for new advanced technologies and the rise in hormonal disorders are some of the main key driving factors for the hormone replacement therapy market. Hormone replacement therapy is also known as HRT, used for treating women who have low hormone levels such as women undergoing menopause. Hormone replacement therapy has another name also known as estrogen replacement therapy. With HRT, a woman can take estrogen, and generally progestin to help the symptoms which is caused by low hormone levels in her body.

According to a report published by June 2023, PCOS affects a projected 8 to 13% of reproductive-aged women. More than 70% of affected women are still undiagnosed globally. Moreover, a report published by the National Library of Medicine in February 2023, highlights that the global occurrence of PCOS ranges from 6% to 21% which is associated with different diagnostic categories, ethnicities, and regions.

There are almost 1.55 million new examples of PCOS in women of reproductive age globally and 17.23% of such cases were women between the age of 21 to 30 years. It is characterized by high risks of concurrent metabolic instabilities. More than 50% of PCOS patients have obesity and 31.1% have impaired glucose regulation as well as 7.5% have type 2 diabetes.

Hormone replacement therapy is generally utilized to treat the symptoms of menopausal changes, however, it is useful for treating PCOS. HRT helps to control and regulate menstrual cycles, decreases acne and hirsutism, and enhances fertility. There are many types of HRT for treating PCOS. Some of the most common HRTs are progesterone and estrogen. In HRT, progesterone is used to control menstrual cycles and decreases the risk of endometrial cancer.

Whereas, in estrogen, HRT diminution the seriousness of signs like hot flashes and night sweats. There are several other advantages of using HRT for treating PCOS such as it regulates the menstrual flow and cycle, decreases the risk of endometrial cancer, and enhances the chance of fertility. The demand for hormone replacement therapy will increase due to its requirement to control many women's hormonal disorders which will help in market expansion during the forecasted period.

Hormone Replacement Therapy Market Dynamics

Aging Population Fuels Hormone Replacement Therapy Market

The expanding demographic of postmenopausal women is a key driver for the hormone replacement therapy (HRT) market. In 2021, women aged 50 and over comprised 26% of the global female population, and this figure is set to rise. By 2030, the number of menopausal and postmenopausal women is projected to reach 1.2 billion. This surge parallels an increased demand for HRT, which addresses the decrease in estrogen and progesterone during menopause, alleviating related symptoms. The market is adapting to this demographic shift, anticipating a higher demand for HRT solutions.

Increased Awareness and Acceptance Propels HRT Adoption

Awareness and acceptance of hormone replacement therapy have significantly grown. Previously, over 60% of postmenopausal women sought information only after experiencing symptoms, but this trend is changing. Educational efforts have reduced the stigma around HRT, enlightening women about its benefits in managing menopausal symptoms. This shift in perception is crucial for the market growth rate, as more women are now open to considering HRT as a viable treatment option.

Government Funding Enhances HRT Accessibility

Government initiatives, like the scheme launched in England in 2023 offering affordable HRT prescription prepayment certificates, significantly impact the market. These subsidies make HRT more accessible and affordable, removing cost barriers for around 400,000 women. Such governmental support ensures that HRT reaches a wider audience, increasing its market presence and addressing the healthcare needs of menopausal women.

New Delivery Methods Broaden HRT Market Appeal

Innovation in HRT formulations and delivery methods, such as patches, gels, and vaginal inserts, has opened new avenues for adoption. These advancements provide women with more convenient and personalized options, catering to diverse preferences and medical requirements. This development not only enhances the user experience but also broadens the market by accommodating different needs and preferences in hormone replacement therapy.

Safety Concerns Restrict Hormone Replacement Therapy Adoption

The safety concerns surrounding Hormone Replacement Therapy (HRT) significantly limit its market-positive growth. Ongoing worries about potential risks such as breast cancer, heart disease, and stroke make many women hesitant to use HRT. Despite the introduction of safer and new formulations, these concerns continue to overshadow the benefits for a substantial portion of the potential patient base. As a result, the uptake of HRT remains hindered, as patients and healthcare providers alike weigh these risks against the therapeutic benefits, leading to a cautious approach towards prescribing and using HRT.

Availability of Non-Hormonal Alternatives Challenges HRT Market Expansion

The wide range of non-hormonal treatments presents an obstacle to the expansion of the Hormone Replacement Therapy market. Alternatives like Selective Serotonin Reuptake Inhibitors (SSRIs), gabapentin, and natural therapeutics like yoga and massage are increasingly appealing to women who are averse to taking hormones. These alternatives, offering different mechanisms of action and perceived safety profiles, provide patients with choices outside of traditional HRT. This diversification in treatment options naturally limits the size of the HRT market, as patients explore and adopt these alternative therapies for managing their symptoms.

Hormone Replacement Therapy Market Segmentation Analysis

By Product Analysis

Estrogen & Progesterone Replacement Therapy is the dominant segment in the hormone replacement therapy market, holding a 52.6% share. This dominance is primarily due to the widespread prevalence of menopausal symptoms among women, where estrogen and progesterone therapies are key treatments. These therapies effectively manage symptoms such as hot flashes, night sweats, and vaginal dryness. The growing acceptance and awareness of the use of hormonal replacement therapies in improving the quality of life for women going through menopausal changes are a significant factor in the sector's development.

Other segments like HGH replacement therapy, Thyroid hormone replacement therapy, Testosterone Replacement Therapy, and Parathyroid Hormone Replacement also contribute to the market. HGH therapy is used for growth hormone deficiencies, while Thyroid hormone therapy addresses hypothyroidism. Testosterone replacement is significant for treating male hypogonadism. Despite the significance of these treatments their importance, the incidence of menopausal-related illnesses, and the efficacy of treatments based on estrogen and progesterone in addressing these issues underscore their dominance in the market.

By Route of Administration Analysis

Oral administration is the dominant route in hormone replacement therapy, with a 40.6% market share. Oral hormone therapies are widely preferred due to their ease of administration, dosage control, and patient compliance. The availability of a wide range of oral formulations, including tablets and capsules, allows for flexibility and convenience in treatment.

Parenteral, Transdermal, and Other routes also play significant roles. Parenteral administration is chosen for conditions requiring rapid onset or where oral administration is not feasible. Transdermal patches are popular for their steady hormone release and lower risk of certain side effects compared to oral forms. Despite these alternatives, the convenience and patient preference for oral administration makes it the leading route in hormone replacement therapy.

By Disease Type Analysis

Menopause is the leading disease type in the hormone replacement therapy market, accounting for 43.5%. This dominance is due to the high number of women undergoing menopause worldwide and seeking treatment for its symptoms. Hormone replacement therapy is a primary treatment for menopausal symptoms, helping to alleviate discomfort and improve overall quality of life during this transition.

Hypothyroidism, Male hypogonadism, Growth hormone deficiency, and Hypoparathyroidism are other important disease types addressed by hormone replacement therapy. Each of these conditions requires specific hormone treatments to manage symptoms and maintain hormonal balance. However, the huge size of menopausal women and the efficacy of treatment with hormones to manage menopausal symptoms make Menopausal the predominant type of disease in the marketplace.

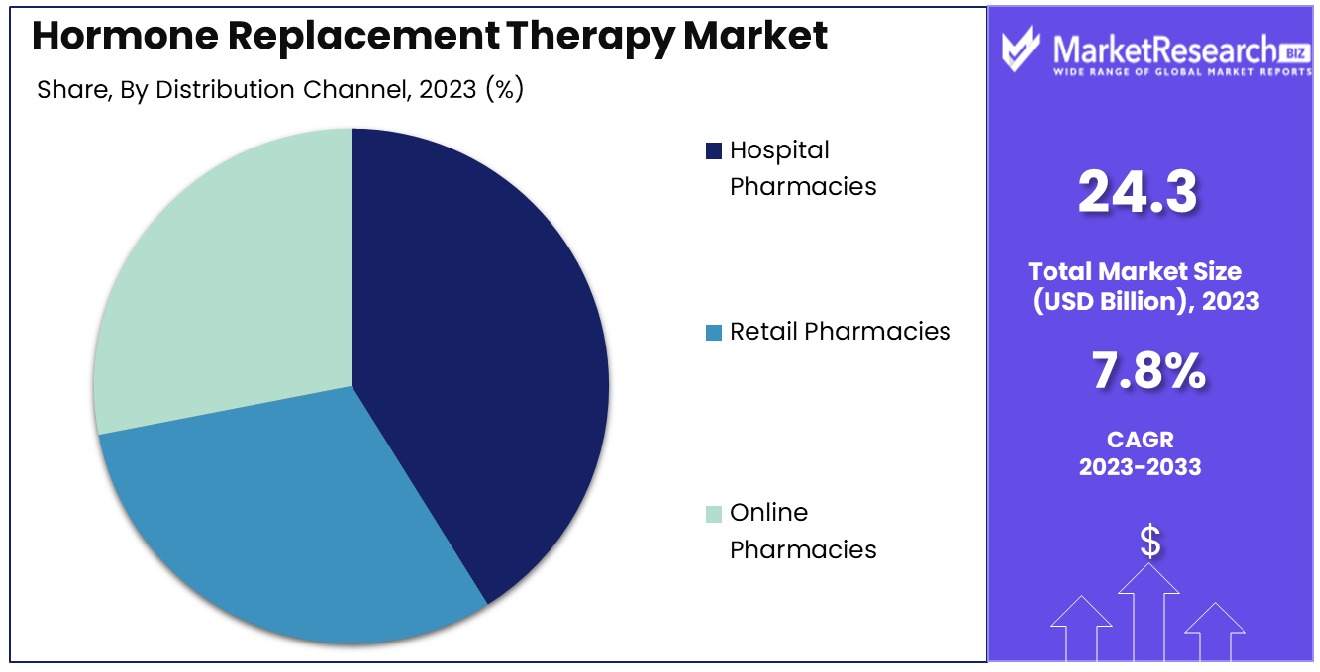

By Distribution Channel Analysis

Hospital Pharmacies are the dominant distribution channel in the hormone replacement therapy market, with a 54.9% share. Hospital pharmacies play a crucial role in dispensing hormone therapies, often for conditions requiring close medical supervision. The presence of in-house pharmacies in hospitals ensures the immediate availability of prescribed hormone therapies, especially for newly diagnosed patients or those requiring adjustments in their treatment regimens.

Retail Pharmacies and Online Pharmacies are also significant distribution channels. Retail pharmacies offer accessibility and convenience for patients, while online pharmacies provide the benefit of home delivery and often lower prices. However, the requirement for professional advice and the complexity of certain hormone replacement therapies further strengthen the dominant position of Hospital Pharmacies in this market.

Hormone Replacement Therapy Industry Segments

By Product

- Estrogen & Progesterone Replacement Therapy

- HGH replacement therapy

- Thyroid hormone replacement therapy

- Testosterone Replacement Therapy

- Parathyroid Hormone Replacement

By Route of Administration

- Oral

- Parenteral

- Transdermal

- Others

By Disease Type

- Menopause

- Hypothyroidism

- Male hypogonadism

- Growth hormone deficiency

- Hypoparathyroidism

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Hormone Replacement Therapy Market Growth Opportunity

Personalized Therapy in Hormone Replacement: A Key Driver for Market Expansion

Personalization in hormone replacement therapy (HRT) represents a significant growth opportunity in the market. Tailoring HRT products to individual patients' genetic backgrounds or specific symptom profiles can greatly enhance treatment effectiveness and patient compliance. This personalized approach addresses the unique hormonal needs and health conditions of each patient, leading to better outcomes and increased patient satisfaction. As the demand for personalized medicine continues to rise, the development of customized HRT solutions based on genetic testing or individual symptomatology could see increased adoption, driving growth in this sector of the healthcare market.

Over-the-Counter Availability of HRT Boosts Market Accessibility and Uptake

The potential shift of lower-dose hormone replacement therapy (HRT) products to over-the-counter (OTC) availability presents a substantial opportunity for market growth. By making HRT more accessible without the need for a prescription, this move could significantly increase uptake among women seeking relief from menopausal symptoms. Removing prescriber barriers and associated costs not only makes HRT more accessible but also empowers women to take greater control of their health. This increased accessibility is likely to lead to broader adoption of HRT, particularly among those who may have been hesitant or unable to consult healthcare providers for prescriptions, thus expanding the market reach.

Hormone Replacement Therapy Market Regional Analysis

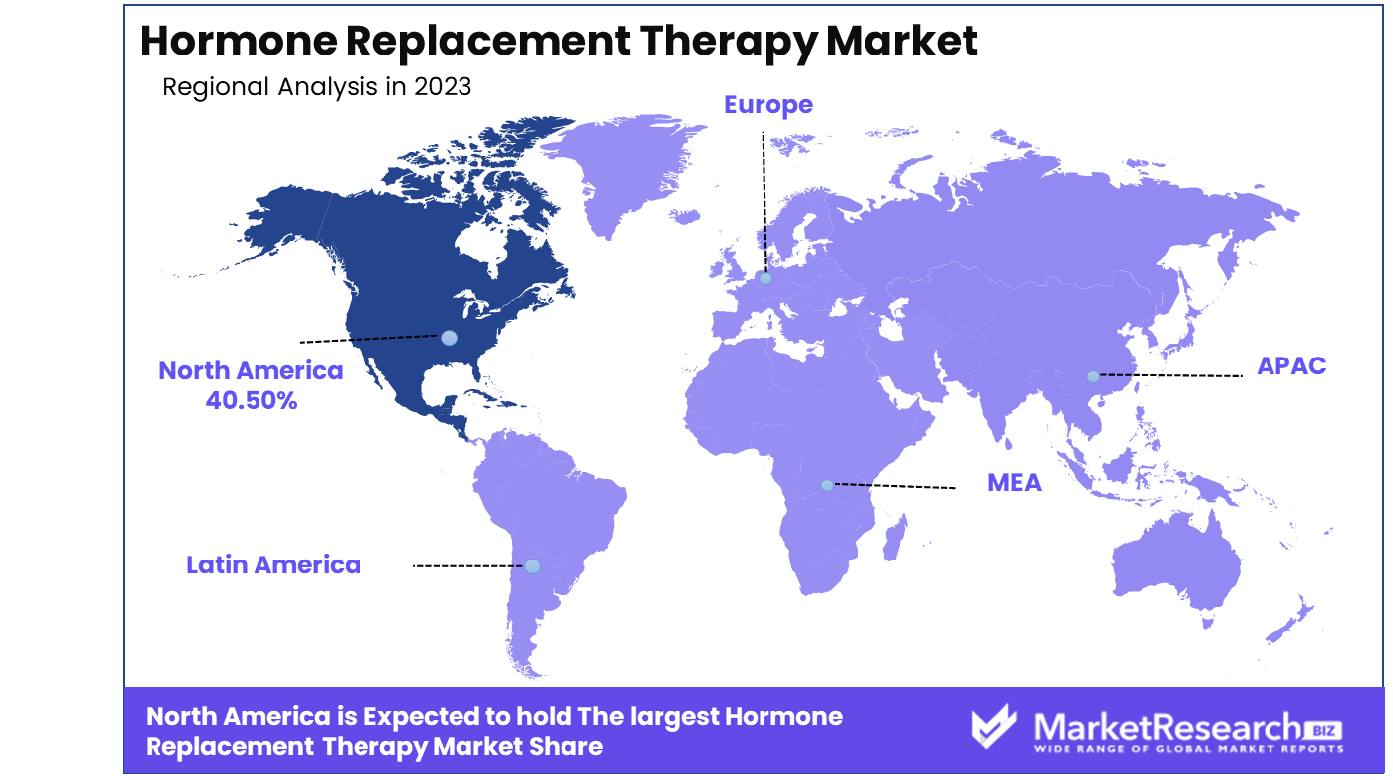

North America Dominates with 40.50% Market Share in the Hormone Replacement Therapy Market

North America's commanding 40.50% share in the hormone replacement therapy (HRT) market is largely attributed to the region's advanced healthcare infrastructure, heightened awareness regarding menopause management, and the increasing prevalence of hormone-related disorders. The United States plays a significant role in this dominance, with its robust healthcare spending and the presence of leading pharmaceutical companies like Pfizer and Merck, which are key players in the HRT market. The region's market is also driven by the growing acceptance and normalization of menopause-related conversations and treatments.

The HRT market in North America is characterized by innovative treatment solutions and a strong focus on research and development. The market benefits from the FDA's approval of new and effective HRT drugs, making advanced therapies accessible to patients. Furthermore, the growing life expectancy as well as the ageing population of women are a major reason for the demand for hormone replacement therapy. Educational campaigns and initiatives by healthcare providers also play a crucial role in increasing awareness and reducing the stigma associated with HRT.

Europe: Growing Awareness and Healthcare Access

Europe’s hormone replacement therapy market is driven by growing awareness of menopausal health and improved access to healthcare services. Countries like Germany, the UK, and France are significant contributors, with a focus on women's health and wellness. It is also affected by the growing use of bioidentical hormone therapy.

Asia-Pacific: Emerging Market with Increasing Demand

In Asia-Pacific, the HRT market is emerging, driven by an increasing focus on women's health and the rising prevalence of hormonal disorders. Countries like Japan, China, and India are witnessing a growing demand for hormone replacement therapies, supported by improving healthcare infrastructure and rising healthcare awareness. The potential for market growth in the region is substantial due to the substantial population and the growing urbanization.

Hormone Replacement Therapy Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

In the Hormone Replacement Therapy (HRT) Market, a critical sector for managing hormonal imbalances, the companies listed play a vital role in driving innovation and patient care. Pfizer Inc. and Bayer AG are significant players, known for their wide range of HRT products. Their strategic positioning emphasizes research and development in hormone therapies, significantly influencing treatment options for conditions like menopause and hypothyroidism.

Abbott Laboratories and Novartis AG offer a broad portfolio of HRT medications, catering to a global market. Their commitment to quality and patient safety reflects the industry's focus on effective and reliable hormone replacement solutions.

Hormone Replacement Therapy Industry Key Players

- Abbott Laboratories

- Bayer AG

- Eli Lilly and Company

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Viatris Inc.

- Novo Nordisk A/S

- F. Hoffmann-La Roche Ltd.

- ASCEND Therapeutics US, LLC.

- Mylan NV

- Braeburn Inc.

- Allergen Plc

- Perrigo Company Plc

- Johnsons & Johnsons Services Inc

- Hikma Pharmaceuticals PLC

- Sun Pharmaceuticals Industries Ltd.

Hormone Replacement Therapy Market Recent Development

- In October 2023, Henry Ford Health announced Wednesday that it has signed an agreement to join with Ascension Michigan and Genesys to create a $10.5 billion health system based in Detroit with 13 acute-care hospitals, roughly 50,000 employees, and more than 550 sites for regional health care.

- In October 2023, IBD's 756-company Medical-Biomed/Biotech industry group pulled back more than 60%. The SPDR S&P Biotech (XBI) exchange-traded fund has trended along the same line. After topping out at 174.79 in February 2021, XBI pulled back 63% through the end of October. From that low, shares of the IBD biotech group and the ETF bounded 31% and 40% higher, respectively, in November and December.

- In March 2023, A former executive for healthcare giant Johnson & Johnson had numerous contacts in the sector. So able to raise $1.5m (£1.3m) in investment, she worked with a team of engineers, scientists, and doctors to produce a wristband and connected app called Thermaband.

Report Scope

Report Features Description Market Value (2023) USD 24.3 Billion Forecast Revenue (2033) USD 50.5 Billion CAGR (2024-2032) 7.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Estrogen & Progesterone Replacement Therapy, HGH replacement therapy, Thyroid hormone replacement therapy, Testosterone Replacement Therapy, Parathyroid Hormone Replacement), By Route of Administration(Oral, Parenteral, Transdermal, Others), By Disease Type(Menopause, Hypothyroidism, Male hypogonadism, Growth hormone deficiency, Hypoparathyroidism), By Distribution Channel(Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Abbott Laboratories, Bayer AG, Eli Lilly and Company, Merck KGaA, Novartis AG, Pfizer Inc., Viatris Inc., Novo Nordisk A/S , F. Hoffmann-La Roche Ltd., ASCEND Therapeutics US, LLC., Mylan NV, Braeburn Inc., Allergen Plc, Perrigo Company Plc, Johnsons & Johnsons Services Inc, Hikma Pharmaceuticals PLC, Sun Pharmaceuticals Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbott Laboratories

- Bayer AG

- Eli Lilly and Company

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Viatris Inc.

- Novo Nordisk A/S

- F. Hoffmann-La Roche Ltd.

- ASCEND Therapeutics US, LLC.

- Mylan NV

- Braeburn Inc.

- Allergen Plc

- Perrigo Company Plc

- Johnsons & Johnsons Services Inc

- Hikma Pharmaceuticals PLC

- Sun Pharmaceuticals Industries Ltd.