Horizontal Directional Drilling Market By Technique (Conventional, Rotary steerable system), By Parts (Pipes, Rigs, Reamers, Bits), By Application(Onshore, Offshore), By End-User (Telecommunication, Oil & Gas Excavation, Utility, Other End-Users), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

10464

-

August 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

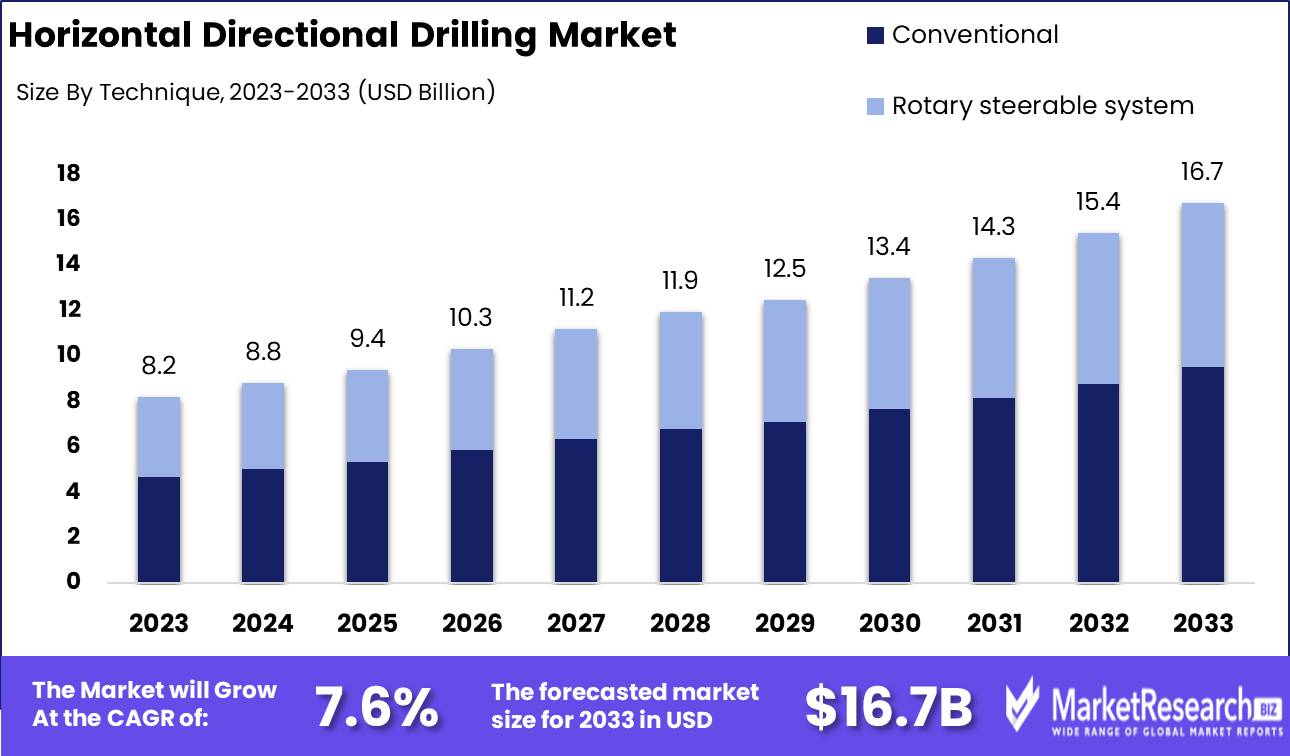

The Horizontal Directional Drilling Market was valued at USD 8.2 billion in 2023. It is expected to reach USD 16.7 billion by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

The Horizontal Directional Drilling (HDD) Market encompasses the industry involved in trenchless technology for installing pipelines, cables, and conduits underground with minimal surface disruption. HDD is a crucial method for crossing obstacles such as rivers, roads, and urban areas, driving significant demand across utilities, telecommunications, and oil and gas sectors. This market is characterized by advancements in drilling equipment, steering techniques, and automation, enabling precise and efficient installations.

The Horizontal Directional Drilling (HDD) market is poised for robust growth, driven by several key factors that underscore its strategic importance in contemporary infrastructure development. Urbanization and industrialization are primary catalysts, significantly increasing the demand for efficient and minimally invasive underground installation techniques. The rapid expansion of urban landscapes necessitates the deployment of utilities such as water, gas, and telecommunications, positioning HDD as a critical technology for enabling reckless and sustainable infrastructure growth.

Moreover, the high initial investment associated with HDD is mitigated by its long-term benefits, including reduced surface disruption, lower reinstatement costs, and enhanced project timelines. These attributes contribute to the sustained growth of the HDD market, as stakeholders recognize the technology's value proposition in achieving cost-effective and environmentally sustainable solutions.

Environmental sustainability is another pivotal driver, as HDD minimizes ecological disruption compared to traditional trenching methods. This alignment with global sustainability goals enhances the market's attractiveness, particularly in regions with stringent environmental regulations. Despite the high initial investment, the total cost of ownership favors HDD due to its efficiency and reduced need for post-installation remediation. The market's trajectory is further bolstered by ongoing advancements in drilling technologies and materials, which enhance operational efficiency and project viability. In summary, the HDD market is on an upward trajectory, supported by the confluence of urbanization, industrialization, environmental sustainability, and technological innovation, making it a cornerstone of modern infrastructure development strategies.

Key Takeaways

- Market Growth: The Horizontal Directional Drilling Market was valued at USD 8.2 billion in 2023. It is expected to reach USD 16.7 billion by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

- By Technique: Conventional HDD dominated the market due to cost-effectiveness.

- By Parts: Pipes dominate due to their crucial role and advanced materials.

- By Application: The Onshore segment dominated the HDD market applications.

- By End-User: Telecommunication dominated HDD usage for efficient underground installations.

- Regional Dominance: North America dominates the HDD Market, driving global growth at 40% largest market share.

- Growth Opportunity: The global HDD market's growth is driven by urbanization and technological advancements, enhancing infrastructure development efficiency.

Driving factors

Environmental Considerations: Pushing for Eco-Friendly Drilling Solutions

The growing emphasis on environmental sustainability is significantly driving the Horizontal Directional Drilling (HDD) market. Governments and regulatory bodies worldwide are enforcing stricter environmental regulations to minimize ecological damage caused by traditional trenching methods. HDD is considered an environmentally friendly alternative, as it causes minimal surface disruption and preserves natural habitats. This method reduces the need for extensive excavation, thereby lowering emissions and preventing soil erosion. The increasing adoption of HDD as a sustainable solution aligns with global environmental goals, fostering market growth. For instance, the European Union's stringent environmental regulations have led to a surge in HDD projects, contributing to the market's expansion in the region.

Infrastructure Development: Catalyzing HDD Market Expansion

Infrastructure development is a major catalyst for the growth of the Horizontal Directional Drilling market. As urbanization and population growth spur the need for improved infrastructure, HDD has emerged as a preferred method for installing underground utilities. Governments and private entities are investing heavily in the construction of pipelines, telecommunications, and electrical grids, which require efficient and minimally invasive drilling techniques. According to a recent report, global infrastructure investments are expected to reach $94 trillion by 2040, with a significant portion allocated to underground utilities. This surge in infrastructure projects is driving the demand for HDD technology, facilitating the installation of essential services with minimal disruption to existing structures and landscapes.

Oil and Gas Sector Growth: Fueling Demand for Advanced Drilling Techniques

The expansion of the oil and gas sector is a key driver for the Horizontal Directional Drilling market. With the increasing global demand for energy, there is a parallel rise in the need for advanced drilling techniques to access hard-to-reach reserves. HDD is particularly advantageous for the oil and gas industry due to its ability to drill under obstacles such as rivers, roads, and urban areas without extensive surface disruption. This method enhances the efficiency and safety of pipeline installations, contributing to operational cost savings. The International Energy Agency (IEA) projects that global oil demand will increase by 1.4 million barrels per day by 2025, further boosting the need for HDD technology to support the sector's infrastructure requirements. The oil and gas sector's reliance on HDD for pipeline projects is a significant factor propelling the market's growth.

Restraining Factors

High Initial Investment Costs Impeding Market Expansion

High initial investment costs represent a significant barrier to the growth of the Horizontal Directional Drilling (HDD) market. The technology requires substantial capital expenditure for equipment, technology acquisition, and skilled labor. For example, the cost of HDD rigs, which can range from hundreds of thousands to several million dollars, poses a challenge for smaller companies or new entrants attempting to enter the market. This high capital requirement limits the accessibility of HDD technology to only those with substantial financial resources, constraining market growth.

The impact of these high costs is twofold: it restricts market entry and limits the frequency of technology adoption. Organizations that do invest may experience extended payback periods due to the high upfront costs, potentially delaying or inhibiting further investment in new projects. Consequently, the overall market expansion is moderated as fewer companies engage in HDD projects, impacting the rate of industry growth.

Regulatory Challenges Affecting Market Dynamics

Regulatory challenges constitute another critical restraint for the Horizontal Directional Drilling market. The HDD industry is subject to a complex framework of regulations and environmental standards that vary by region and country. These regulations often include stringent environmental assessments, permitting processes, and operational restrictions designed to minimize environmental impact. Compliance with these regulations necessitates additional investments in monitoring and reporting systems, further increasing the operational costs for HDD projects.

In particular, stringent regulations can lead to project delays as companies navigate through lengthy approval processes. This can result in increased project timelines and costs, reducing the attractiveness of HDD as an option compared to alternative drilling methods that may face less regulatory scrutiny. The burden of regulatory compliance can also deter new entrants and slow down the overall adoption rate of HDD technology, thereby affecting market growth.

By Technique Analysis

In 2023, Conventional HDD dominated the market due to cost-effectiveness.

In 2023, The Conventional segment held a dominant market position in the Horizontal Directional Drilling (HDD) market. This technique has been widely adopted due to its cost-effectiveness and simplicity in various drilling applications. Conventional HDD methods utilize a drilling rig to steer the drill bit through the earth, with the trajectory controlled manually. This approach remains favored for its reliability and lower operational costs, making it particularly appealing for projects with standard requirements and limited complexity.

In contrast, the Rotary Steerable System (RSS) segment has seen increased adoption due to its advanced capabilities and precision. The RSS technique employs a system that rotates the drill bit continuously while steering it with high accuracy. This technology enables better control of the drill path and improves wellbore quality, making it suitable for complex and challenging drilling environments. Although more expensive than conventional methods, RSS offers enhanced efficiency and reduced operational risks, which are critical for deep and directional drilling projects.

By Parts Analysis

Pipes dominate due to their crucial role and advanced materials.

In 2023, Pipes held a dominant market position in the "By Parts" segment of the Horizontal Directional Drilling (HDD) market. This dominance can be attributed to the critical role pipes play in the HDD process, providing the necessary pathway for drilling fluid, supporting the drill string, and serving as conduits for the utilities being installed. The advancements in pipe materials, such as high-density polyethylene (HDPE) and steel, have enhanced durability and flexibility, further driving their adoption.

Rigs are the second most crucial component, responsible for the power and control required to execute the drilling operations. The increasing demand for robust and efficient rigs to handle complex drilling projects has fueled their market growth.

Reamers, which are essential for enlarging the borehole to the desired diameter, have seen significant advancements in design and technology, contributing to their vital role in the HDD market. Innovations aimed at improving cutting efficiency and reducing operational time have enhanced their market share.

Bits, the cutting elements at the forefront of the drilling process, are indispensable for penetrating various soil and rock formations. The development of bits with advanced materials and designs has ensured their essential status in HDD operations.

By Application Analysis

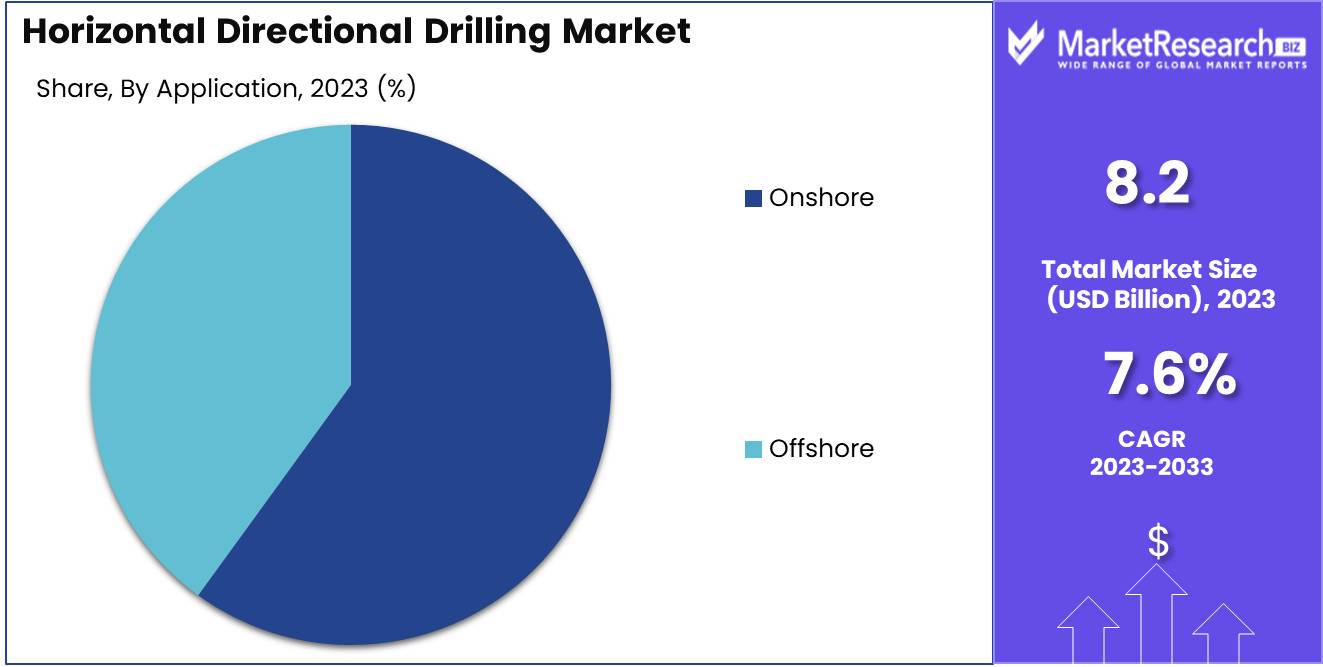

In 2023, The Onshore segment dominated the HDD market applications.

In 2023, The Onshore segment held a dominant market position in the By Application segment of the Horizontal Directional Drilling (HDD) Market. The onshore application is primarily driven by the growing demand for infrastructure development and utility installations such as water, gas, and telecommunications. The expansion of urban areas necessitates efficient underground installation technologies, propelling the growth of the onshore HDD market.

In contrast, the Offshore segment of the Horizontal Directional Drilling Market also exhibited significant growth in 2023, driven by the increasing demand for submarine cable installations and offshore oil and gas pipeline projects. The offshore HDD applications are crucial for establishing reliable connections between offshore platforms and onshore facilities. The need for high-capacity data transmission and power supply to offshore installations underpins the market expansion in this segment. Additionally, the rising investments in offshore wind farms and other marine renewable energy projects are expected to drive the offshore HDD market further.

By End-User Analysis

In 2023, Telecommunication dominated HDD usage for efficient underground installations.

In 2023, The Telecommunication sector held a dominant market position in the horizontal directional drilling (HDD) market. The telecommunication industry's reliance on HDD is driven by the need for efficient and minimally invasive methods to install underground cables. As the demand for high-speed internet and advanced communication networks surges, HDD offers a cost-effective and reliable solution to lay extensive fiber-optic networks without disrupting surface activities. This technique is particularly advantageous in urban areas where traditional excavation methods would cause significant disruption. HDD's precision and ability to navigate obstacles further cement its importance in the telecommunication sector.

The oil & gas excavation segment also significantly utilizes HDD for installing pipelines across challenging terrains and environmentally sensitive areas. HDD allows for the installation of pipelines beneath rivers, highways, and other obstacles, reducing environmental impact and project timelines.

The utility segment, including water and sewage systems, leverages HDD for infrastructure upgrades and expansions. The method's minimal surface disruption is crucial for maintaining service continuity in densely populated regions.

Other end-users, such as renewable energy sectors, also employ HDD for installing cables and pipelines for offshore wind farms and other projects, underscoring its versatility across various industries.

Key Market Segments

By Technique

- Conventional

- Rotary steerable system

By Parts

- Pipes

- Rigs

- Reamers

- Bits

By Application

- Onshore

- Offshore

By End-User

- Telecommunication

- Oil & Gas Excavation

- Utility

- Other End-Users

Growth Opportunity

Urbanization and Industrialization: Driving Demand for Horizontal Directional Drilling

The global Horizontal Directional Drilling (HDD) market is poised for significant growth, driven by rapid urbanization and industrialization across the globe. As cities expand and new industrial projects emerge, the need for efficient and minimally invasive drilling technologies becomes paramount. HDD offers a cost-effective and less disruptive solution for laying underground utilities, such as water, gas, and telecommunications lines, which are essential for supporting urban infrastructure. The increasing focus on sustainable development and the necessity to upgrade aging infrastructure in developed regions further amplify the demand for HDD. Emerging economies, experiencing accelerated urban growth, also present vast opportunities for market expansion.

Technological Advancements: Enhancing Efficiency and Precision in HDD Operations

Technological advancements in the HDD market are another critical factor contributing to its growth. Innovations in drilling techniques, equipment, and materials have significantly improved the efficiency, accuracy, and safety of HDD operations. For instance, advancements in drill bit technology, real-time monitoring systems, and automated drilling rigs have revolutionized the HDD process, making it more precise and less labor-intensive. The integration of digital technologies, such as artificial intelligence and machine learning, is also expected to optimize drilling operations and reduce operational costs. These technological improvements not only enhance the overall performance of HDD but also open new avenues for its application in complex geological conditions and remote locations.

Latest Trends

Increasing Demand in Telecommunications

The Horizontal Directional Drilling (HDD) market is poised for significant growth, driven by a surge in demand from the telecommunications sector. As the world continues to embrace digital transformation, the need for robust and extensive telecommunications infrastructure is paramount. HDD technology offers a non-invasive solution for laying fiber optic cables and other telecommunications conduits, ensuring minimal disruption to existing landscapes and urban settings. This technology's ability to install underground cables without extensive excavation is particularly beneficial in densely populated areas, making it the preferred method for modern telecommunications projects.

Government Investments in Infrastructure Development

Government investments in infrastructure development are another critical factor propelling the HDD market forward. Across the globe, governments are prioritizing infrastructure upgrades and expansions to support economic growth and development. In particular, the United States and several European countries have announced substantial funding allocations for infrastructure projects, including roadways, water supply systems, and energy pipelines. HDD technology's efficiency and environmental benefits make it a suitable choice for these large-scale projects, where minimizing environmental impact is increasingly important.

Regional Analysis

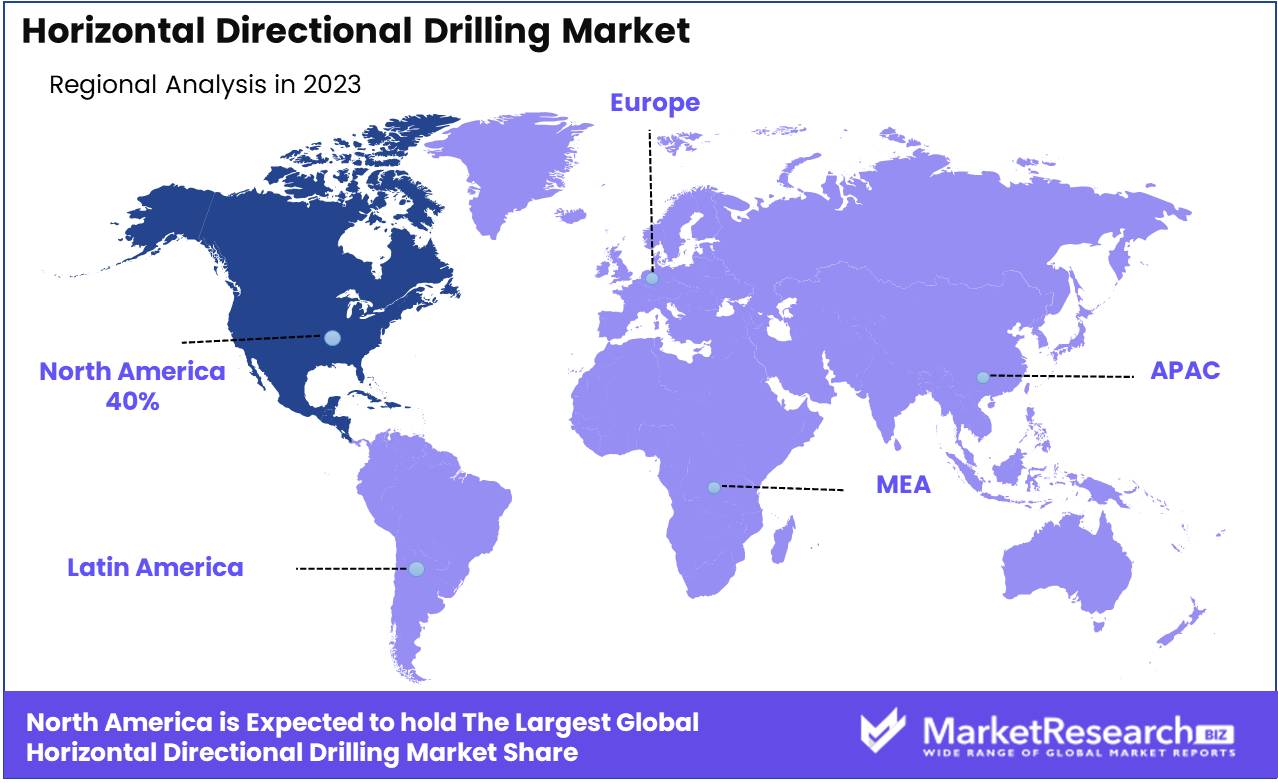

North America dominates the HDD Market, driving global growth at 40% largest market share.

The Horizontal Directional Drilling (HDD) Market demonstrates significant regional disparities, each driven by unique factors. North America emerges as the dominant region, accounting for approximately 40% of the market share. This dominance is primarily attributed to the extensive oil and gas infrastructure and the ongoing investments in upgrading and expanding utilities. The United States and Canada lead this growth, propelled by technological advancements and favorable regulatory frameworks.

In Europe, the HDD market is bolstered by substantial investments in renewable energy projects and utility infrastructure modernization. Countries like Germany, the UK, and France are at the forefront, contributing to around 25% of the market share, driven by stringent environmental regulations and the push for sustainable development.

Asia Pacific, with a market share of approximately 20%, is experiencing rapid growth due to increasing urbanization and infrastructural developments in countries such as China, India, and Japan. The demand for efficient and minimally invasive drilling techniques to support extensive telecommunications and energy projects fuels this regional market.

The Middle East & Africa, capturing about 10% of the market share, shows steady growth driven by oil and gas exploration activities and the need for advanced drilling technologies. Latin America, holding the remaining 5%, is gradually expanding its HDD market, particularly in Brazil and Mexico, due to burgeoning infrastructural projects and investments in utility networks. Overall, North America's dominance underscores the region's pivotal role in shaping the global HDD market landscape.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Horizontal Directional Drilling (HDD) market is poised for substantial growth, driven by advancements in technology and increasing demand for efficient drilling solutions. Key players such as Nabors Industries Ltd., American Augers, Inc., and Nawtek GmbH are at the forefront, leveraging cutting-edge technologies to enhance operational efficiency and reduce environmental impact. Nabors Industries Ltd. continues to innovate with its robust portfolio of automated drilling solutions, which are anticipated to drive significant market share.

American Augers, Inc. is capitalizing on its extensive product range and strong industry presence, focusing on expanding its customer base through strategic partnerships and continuous product enhancements. Nawtek GmbH is emphasizing sustainability, integrating eco-friendly technologies into its HDD systems to meet the rising demand for environmentally conscious solutions.

Prime Drilling GmbH and Herrenknecht AG are making notable strides in R&D, enhancing their drilling capabilities to cater to complex geological conditions. Meanwhile, The Toro Company and Vermeer Corporation are strengthening their market positions by offering versatile and reliable HDD equipment tailored to diverse project requirements.

Emerging players like Ferguson Michiana Inc. and Vmt Gmbh Gesellschaft Für Vermessungstechnik are gaining traction by addressing niche market needs and providing specialized solutions. Overall, the competitive landscape of the HDD market in 2024 is characterized by technological innovation, strategic collaborations, and a strong emphasis on sustainability, positioning key players for sustained growth and market leadership.

Market Key Players

- Nabors Industries Ltd.

- American Augers, Inc.

- Nawtek GmbH

- Barbco, Inc.

- Ellingson Companies

- Prime Drilling GmbH

- Ferguson Michiana Inc.

- Herrenknecht AG

- National Oilwell Varco, Inc.

- The Toro Company

- The Charles Machines Works, Inc. (Ditch Witch)

- Vermeer Corporation

- Vmt Gmbh Gesellschaft Für Vermessungstechnik

- Laney Directional Drilling Co.

- Inrock Drilling Systems, Incorporated

- Laney Directional Drilling Co.

- Mclaughlin Group, Inc.

Recent Development

- In June 2024, Global HDD Inc. secured a $100 million contract for a large-scale infrastructure project in Southeast Asia. The project involves the installation of underground pipelines using advanced HDD techniques to minimize environmental impact and disruption to urban areas.

- In May 2024, Ditch Witch launched a comprehensive training program aimed at improving the skills of HDD operators. The program, which includes both virtual and hands-on training modules, aims to address the skill gap in the industry and ensure operators are proficient with the latest HDD technologies and best practices.

- In March 2024, Vermeer Corporation announced the expansion of its horizontal directional drilling product line to include the new D60x90 S3 Navigator® HDD. This model is designed to offer enhanced performance and versatility, addressing the growing demand for mid-sized drilling projects in urban and suburban areas.

Report Scope

Report Features Description Market Value (2023) USD 8.2 Billion Forecast Revenue (2033) USD 16.7 Billion CAGR (2024-2032) 7.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technique (Conventional, Rotary steerable system), By Parts (Pipes, Rigs, Reamers, Bits), By Application(Onshore, Offshore), By End-User (Telecommunication, Oil & Gas Excavation, Utility, Other End-Users) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Nabors Industries Ltd., American Augers, Inc., Nawtek GmbH, Barbco, Inc., Ellingson Companies, Prime Drilling GmbH, Ferguson Michiana Inc., Herrenknecht AG, National Oilwell Varco, Inc., The Toro Company, The Charles Machines Works, Inc. (Ditch Witch), Vermeer Corporation, Vmt Gmbh Gesellschaft Für Vermessungstechnik, Laney Directional Drilling Co., Inrock Drilling Systems, Incorporated, Laney Directional Drilling Co., Mclaughlin Group, Inc. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Nabors Industries Ltd.

- American Augers, Inc.

- Nawtek GmbH

- Barbco, Inc.

- Ellingson Companies

- Prime Drilling GmbH

- Ferguson Michiana Inc.

- Herrenknecht AG

- National Oilwell Varco, Inc.

- The Toro Company

- The Charles Machines Works, Inc. (Ditch Witch)

- Vermeer Corporation

- Vmt Gmbh Gesellschaft Für Vermessungstechnik

- Laney Directional Drilling Co.

- Inrock Drilling Systems, Incorporated

- Laney Directional Drilling Co.

- Mclaughlin Group, Inc.