Homeopathic Products Market By Product (Dilutions, Tincture, Tablets, Others), By Application (Analgesic and Antipyretic, Respiratory, Neurology, Others), By Source (Plants, Animals, Minerals), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47195

-

Feb 2025

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

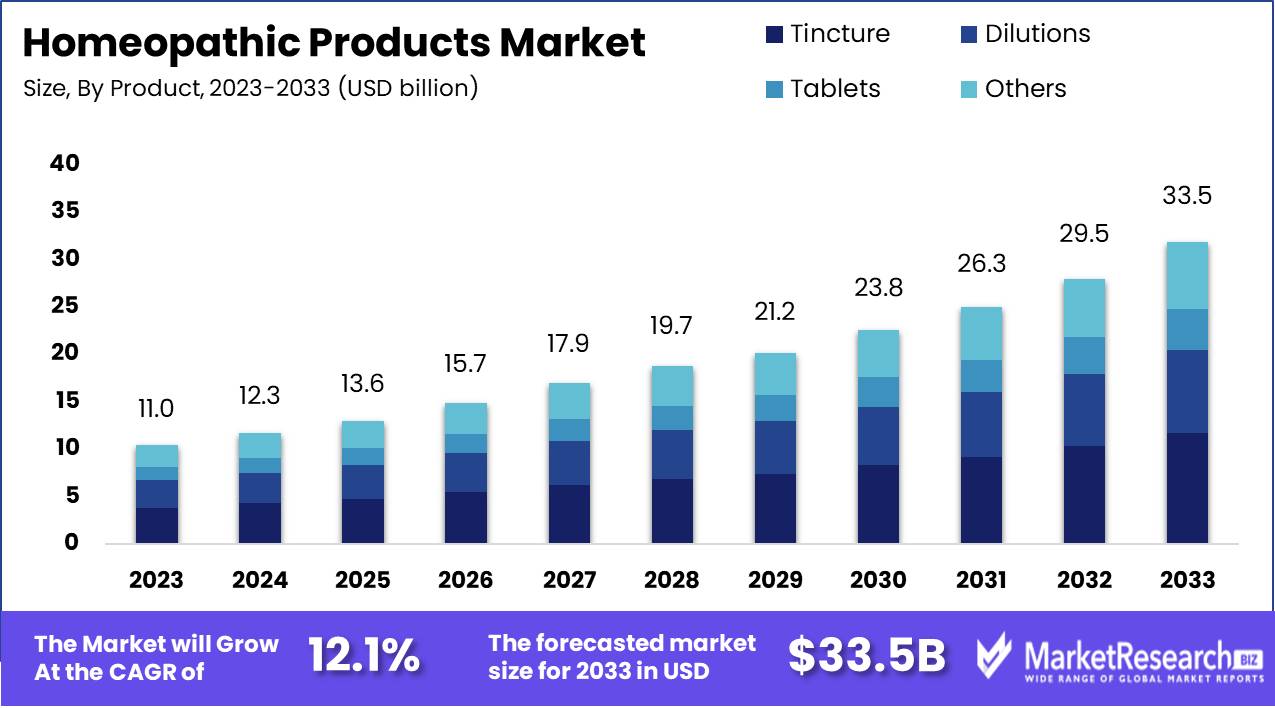

The Homeopathic Products Market was valued at USD 11.0 Billion in 2023. It is expected to reach USD 33.5 Billion by 2033, with a CAGR of 12.1% during the forecast period from 2024 to 2033.

The Homeopathic Products Market encompasses the production, distribution, and retail of remedies formulated based on homeopathic principles, which involve highly diluted substances aimed at triggering the body's natural healing processes. This market includes a range of products such as tablets, liquids, and topical applications, used for treating various health conditions.

The homeopathic products market is poised for significant growth, driven by rising health awareness and increasing consumer preference for natural treatments over conventional allopathic medicines. As consumers become more informed about the potential side effects of allopathic treatments, there is a marked shift towards homeopathy, which is perceived as a safer and more holistic approach to health and wellness. This trend is further amplified by a growing inclination towards preventive healthcare and wellness, particularly among the aging population and individuals with chronic ailments. The market is also benefiting from heightened consumer interest in personalized medicine, which aligns well with the homeopathic principle of tailored treatments.

However, the sector faces notable challenges, including the lack of standardization and variability in product quality, which undermine consumer confidence and hinder broader market adoption. Addressing these issues through regulatory frameworks and quality assurance measures will be crucial for sustained market expansion.

Despite these challenges, the future of the homeopathic products market appears promising. Companies operating in this space must prioritize rigorous quality control and standardization to build trust and credibility with consumers. Furthermore, leveraging digital health platforms and e-commerce can enhance market reach and accessibility, tapping into the growing digital-savvy consumer base. Strategic partnerships with healthcare providers and continuous investment in R&D for innovative product formulations will also be pivotal.

As health awareness continues to rise globally, the homeopathic products market is well-positioned to capitalize on these trends, provided that the industry can address its quality and standardization hurdles effectively. This dual focus on innovation and quality assurance will be essential for capturing a larger share of the expanding market and achieving long-term growth.

Key Takeaways

- Market Growth: The Homeopathic Products Market was valued at USD 11.0 Billion in 2023. It is expected to reach USD 33.5 Billion by 2033, with a CAGR of 12.1% during the forecast period from 2024 to 2033.

- By Product: Tinctures dominated the homeopathic market due to their versatility.

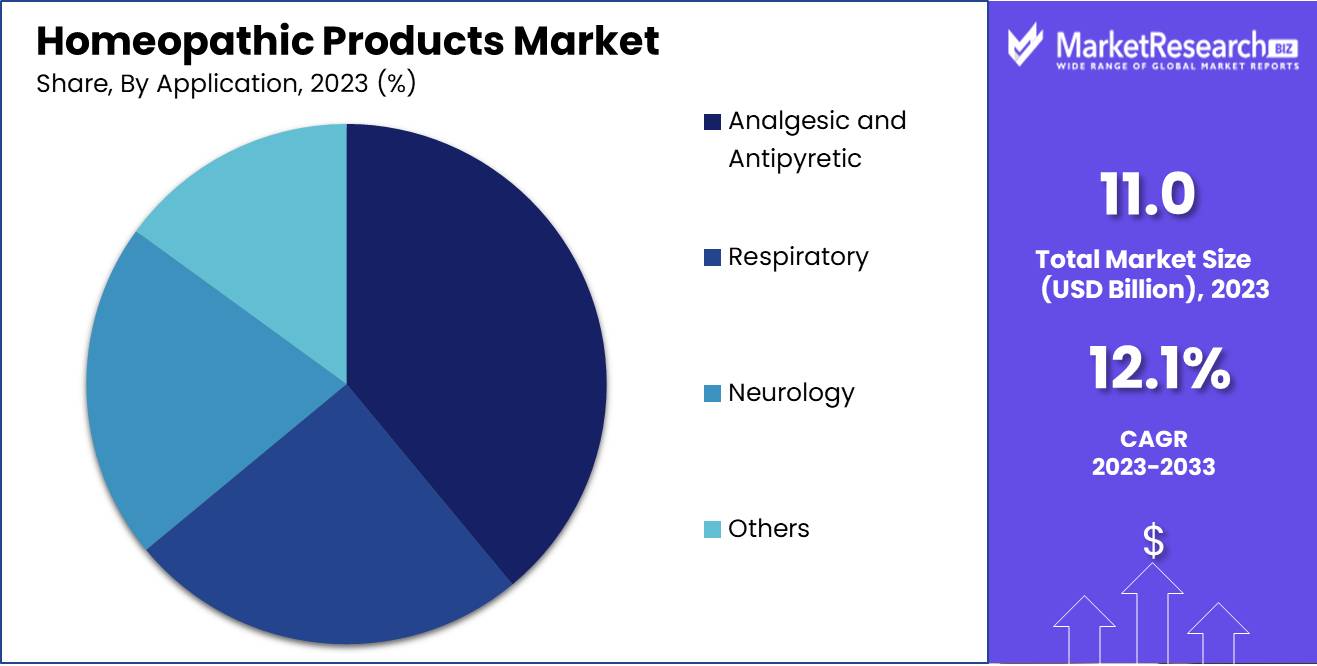

- By Application: The Analgesic and Antipyretic segment dominated the homeopathic products market.

- By Source: Plant-based homeopathic products dominate due to natural preference and effectiveness.

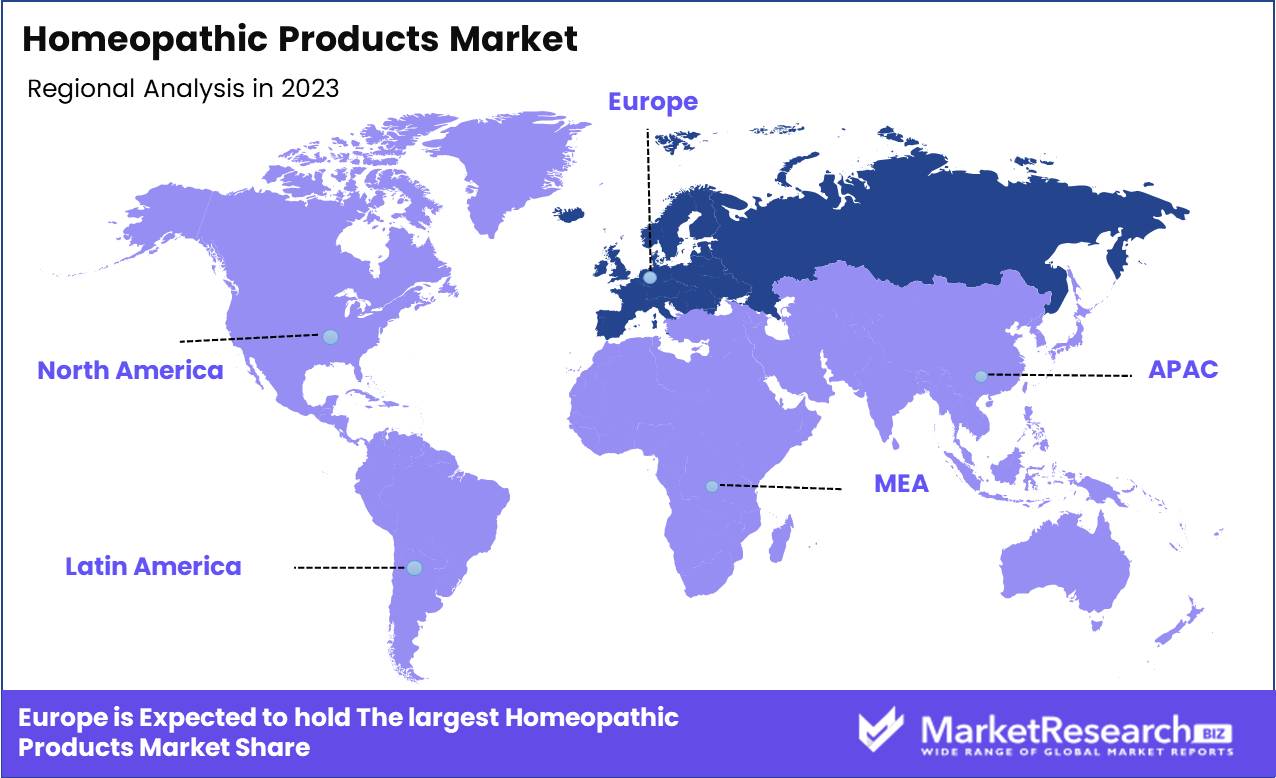

- Regional Dominance: Europe dominates the homeopathic products market with a 40% share.

- Growth Opportunity: The homeopathic products market will grow due to rising plant-based supplement adoption and innovation.

Driving factors

Rise in Prevalence of Lifestyle-Associated Diseases: Catalyzing Demand for Homeopathic Interventions

The increasing prevalence of lifestyle-associated diseases such as diabetes, obesity, hypertension, and chronic stress-related disorders is significantly driving the demand for homeopathic products. These conditions, often resulting from sedentary lifestyles and poor dietary habits, have led consumers to seek alternative and complementary therapies that promise fewer side effects and more holistic benefits.

Homeopathy, known for its individualized approach and natural ingredients, is perceived as a viable option to address the underlying causes rather than merely alleviating symptoms. According to recent market analyses, the rising incidence of these diseases correlates strongly with increased sales of homeopathic remedies, suggesting a direct relationship between the two.

Growing Awareness and Acceptance of Homeopathy: Broadening the Market Base

Awareness and acceptance of homeopathy are expanding, propelled by educational initiatives, endorsements from healthcare professionals, and positive patient testimonials. As consumers become more informed about the principles and benefits of homeopathic treatments, there is a notable shift in healthcare preferences. This trend is supported by numerous studies and reports indicating that homeopathy is gaining traction not only in traditional markets but also in regions where it was previously less popular. Increased media coverage and the proliferation of digital health platforms have further amplified the visibility of homeopathic products, contributing to their mainstream acceptance.

Growing Consumer Desire for Natural and Holistic Healthcare: Aligning with Wellness Trends

The consumer shift towards natural and holistic healthcare solutions is a pivotal driver of the homeopathic products market. Modern consumers are increasingly skeptical of synthetic chemicals and are looking for treatment options that align with their values of sustainability and natural living. This trend is evident in the rising popularity of organic food, natural cosmetics, and holistic wellness practices, with homeopathy fitting seamlessly into this broader lifestyle choice. The global wellness industry, valued at over $4.2 trillion, underscores the significant market potential for natural healthcare products.

Homeopathy's emphasis on treating the individual as a whole rather than isolated symptoms resonates well with this consumer base, fostering robust market growth.

Restraining Factors

Strict Regulation and Compliance Challenges: Impeding Market Expansion

The stringent regulatory environment surrounding homeopathic products significantly hampers market growth. Regulatory bodies such as the FDA in the United States and the European Medicines Agency (EMA) in Europe impose rigorous standards on the manufacturing, marketing, and distribution of homeopathic remedies. These regulations often require extensive documentation and evidence of safety and efficacy, which can be resource-intensive for producers.

According to recent industry reports, compliance costs have surged by approximately 20% annually over the past five years, as manufacturers strive to meet these stringent requirements. This financial burden disproportionately affects smaller companies, limiting their ability to innovate and expand their product lines. Additionally, the variability in regulatory frameworks across different regions creates further complications for international market players, leading to delays and increased operational costs.

Limited Availability of Homeopathic Practitioners: Constraining Market Reach

The limited availability of qualified homeopathic practitioners also serves as a significant restraining factor for the homeopathic products market. The efficacy and adoption of homeopathic treatments heavily rely on the expertise and availability of trained practitioners who can prescribe and administer these remedies effectively.

Statistics indicate a significant shortfall in the number of homeopathic practitioners relative to demand. For example, in the United States, there are approximately only 5,000 certified homeopaths, which is inadequate to serve the growing interest among consumers. This gap is even more pronounced in rural and underserved areas, where access to homeopathic care is minimal or nonexistent.

By Product Analysis

In 2023, Tinctures dominated the homeopathic market due to their versatility.

In 2023, Tincture held a dominant market position in the "By Product" segment of the Homeopathic Products Market. This segment, encompassing dilutions, tinctures, tablets, and others, showcased distinct growth patterns driven by consumer preferences and therapeutic efficacy. Tinctures, known for their rapid absorption and potent concentration, emerged as the leading product, capitalizing on their ease of use and versatility in treating various ailments.

Dilutions, the traditional backbone of homeopathy, continued to garner significant demand due to their personalized treatment approach and minimal side effects. Tablets, offering convenience and precise dosage, saw steady growth, particularly appealing to those new to homeopathic remedies. The "Others" category, comprising ointments, gels, and creams, experienced moderate expansion, driven by niche applications and specialized treatments. Collectively, these sub-segments highlighted a robust market dynamic, with tinctures at the forefront due to their broad application spectrum and consumer trust.

By Application Analysis

In 2023, The Analgesic and Antipyretic segment dominated the homeopathic products market.

In 2023, The Analgesic and Antipyretic segment held a dominant market position in the By Application segment of the Homeopathic Products Market. This leadership is attributed to the rising consumer preference for natural pain relief and fever management solutions, driven by increasing awareness of the potential side effects associated with conventional medications. Furthermore, the growing prevalence of chronic diseases and pain conditions, coupled with an aging population, has spurred demand for homeopathic analgesics.

Conversely, the Respiratory segment witnessed significant growth due to heightened concerns about respiratory health, exacerbated by recent global health crises. Products targeting common ailments such as colds, coughs, and asthma have seen increased adoption.

The Neurology segment, focusing on the treatment of neurological disorders like migraines, insomnia, and stress-related conditions, also experienced notable expansion. This is driven by an escalating incidence of neurological issues, often linked to modern lifestyle factors.

Other applications, encompassing a diverse range of conditions from digestive disorders to dermatological issues, continue to contribute substantially to the market. This diversity underscores the broad applicability and consumer trust in homeopathic remedies, reinforcing their market presence across various health concerns.

By Source Analysis

Plant-based homeopathic products dominate due to natural preference and effectiveness.

In 2023, Plants held a dominant market position in the "By Source" segment of the homeopathic products market. This dominance is attributed to the widespread availability and diversity of plant-based homeopathic remedies, which cater to a broad spectrum of health conditions. The growing consumer preference for natural and sustainable healthcare solutions has significantly boosted the demand for plant-derived homeopathic products. Additionally, the extensive historical use and documented efficacy of botanical ingredients in traditional medicine further underpin their market leadership.

Animal-based homeopathic products, while less prevalent, continue to hold a niche market share. These products are particularly valued for their unique therapeutic benefits and are often used in treatments where plant-based remedies are less effective. However, ethical concerns and regulatory challenges regarding the use of animal derivatives constrain their growth potential.

Mineral-based homeopathic products represent a stable yet smaller segment. Their therapeutic applications, particularly in addressing chronic disease conditions and deficiencies, are well-recognized. Nonetheless, their market expansion is tempered by the slower adoption rate compared to plant-based alternatives. Overall, plant-based homeopathic products are poised to maintain their leading position, driven by ongoing consumer trends and advancements in botanical research.

Key Market Segments

By Product

- Dilutions

- Tincture

- Tablets

- Others

By Application

- Analgesic and Antipyretic

- Respiratory

- Neurology

- Others

By Source

- Plants

- Animals

- Minerals

Growth Opportunity

Increased Adoption of Plant-Based Supplements

The global homeopathic products market is poised for significant growth in 2024, driven primarily by the increased adoption of plant-based supplements. As consumers become more health-conscious and environmentally aware, there is a notable shift towards natural and organic health solutions. Plant-based supplements, known for their minimal side effects and holistic benefits, align perfectly with these consumer preferences. This trend is anticipated to boost the demand for homeopathic products, which often incorporate plant-derived ingredients.

Launches of Innovative Homeopathic Remedies

Innovation remains a cornerstone for growth within the homeopathic market. Recent years have seen an influx of novel homeopathic remedies, designed to address a wider array of health concerns more effectively. These innovative products are not only enhancing the efficacy of treatments but also expanding the market reach. For instance, advanced formulations targeting chronic ailments and lifestyle-related diseases have gained traction, reflecting a broader acceptance of homeopathy in mainstream healthcare. In 2024, the launch of such cutting-edge remedies is expected to further stimulate market expansion, attracting new customer segments and reinforcing the credibility of homeopathic solutions.

Latest Trends

Growing Demand for Alternative Healthcare Options

In 2024, the homeopathic products market is poised for significant growth, driven by an increasing demand for alternative healthcare options. Consumers are progressively seeking holistic and natural remedies as concerns about the side effects of conventional pharmaceuticals rise. This shift is especially notable in regions where traditional medicine has faced scrutiny over long-term safety. The global wellness movement, emphasizing preventive healthcare and natural therapies, further propels this trend. As a result, homeopathic products, known for their gentle and individualized approach, are gaining traction among health-conscious consumers. Companies are responding by expanding their portfolios to include a diverse range of homeopathic remedies, from over-the-counter solutions to personalized treatments.

Increased Awareness of Homeopathy

Awareness and acceptance of homeopathy have been bolstered by concerted efforts from both advocacy groups and regulatory bodies. Educational campaigns and endorsements from influential health practitioners are demystifying homeopathy, highlighting its efficacy and safety. This increased awareness is not only drawing new users but also strengthening loyalty among existing ones. Additionally, digital platforms and social media are playing pivotal roles in disseminating information, enabling consumers to make informed choices about homeopathic treatments. Market players are capitalizing on this trend by leveraging online channels to engage with their audience, provide educational content, and offer convenient purchasing options.

Regional Analysis

Europe dominates the homeopathic products market with a 40% share.

The homeopathic products market demonstrates significant regional variation, driven by differing regulatory frameworks, cultural acceptance, and healthcare paradigms. Europe stands as the dominant region, commanding approximately 40% of the market share. This leadership is attributed to strong consumer trust in natural and alternative therapies, coupled with supportive regulatory environments in countries such as Germany and France. In North America, the market is growing, particularly in the United States and Canada, where the rising preference for holistic health approaches fuels demand. However, regulatory scrutiny remains stringent, affecting growth rates.

In the Asia Pacific region, the market is expanding rapidly due to increasing healthcare expenditures and a growing inclination towards traditional and natural medicine. Countries like India and China are at the forefront, leveraging their rich heritage in alternative therapies. The Middle East & Africa show moderate growth, driven by rising awareness and gradual acceptance of homeopathic treatments. Latin America also exhibits a positive trajectory, with Brazil and Mexico emerging as key markets, supported by a growing middle class and increasing healthcare awareness.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global homeopathic products market, projected for robust growth in 2024, is driven by key players that leverage extensive product portfolios, innovation, and strategic market positioning.

BoironUSA remains a dominant force, capitalizing on its extensive distribution network and strong brand recognition. Their focus on research and development (R&D) ensures a continuous pipeline of innovative products, catering to the growing consumer demand for natural remedies.

Biologische Heilmittel Heel GmbH and A Nelson & Co Ltd excel through their deep-rooted heritage and extensive expertise in homeopathy. Heel's integration of scientific research with traditional practices bolsters its market presence, while Nelson's diversified product range and robust retail partnerships solidify its competitive edge. Homeocan Inc. and SBL demonstrate strong market penetration in North America and Asia, respectively. SBL's aggressive marketing strategies and extensive practitioner network enhance its visibility, driving consumer trust and market share.

Hahnemann Laboratories and Mediral International Inc. focus on quality and purity, appealing to a niche market of discerning consumers. Their commitment to rigorous manufacturing standards fosters brand loyalty and premium positioning. Ainsworths Ltd. and Hevert-Arzneimittel GmbH & Co. KG emphasize their holistic approach, integrating sustainability and ethical sourcing into their value propositions. This alignment with consumer values supports their long-term market relevance.

BioIndia Pharma, Bioforce, and Schwabe Group leverage their international footprints to drive growth through geographical diversification. Schwabe's advanced R&D capabilities and comprehensive product offerings position it as a leader in herbal and homeopathic remedies. Lord’s Homeopathic Laboratory (P) Ltd., Hyland’s Homeopathic, Arogya, Bakson, Helios Homeopathy, and Rxhomeo continue to innovate within their local markets, driving growth through tailored solutions and consumer education. These companies' ability to adapt to regional preferences and regulatory landscapes is crucial for sustaining competitive advantage.

Market Key Players

- Boiron USA

- BiologischeHeilmittel Heel GmbH

- A Nelson & Co Ltd

- Homeocaninc.

- SBL

- Hahnemann Laboratories

- Mediral International Inc

- AinsworthsLtd.

- Hevert - Arzneimittel GmbH & Co. KG

- BioIndiaPharma

- Bioforce

- SchwabeGroup

- Lord’s Homeopathic Laboratory (P) Ltd.

- Hyland’s Homeopathic

- Arogya

- Bakson

- Helios Homeopathy

- Rxhomeo

Recent Development

- In March 2024, Heel GmbH announced a significant expansion of its product line to include new formulations targeting dermatological and gastroenterological conditions. This development is part of the company's strategy to diversify its offerings and tap into emerging segments within the homeopathic market.

- In February 2024, SBL Pvt. Ltd. introduced an innovative range of homeopathic products focused on pediatric care. This initiative reflects SBL's commitment to broadening its market reach and addressing specific health concerns in children, an area with growing consumer interest.

- In January 2024, Boiron, a leading player in the homeopathy market, launched a new range of homeopathic remedies specifically designed to address common cold and flu symptoms. This launch is aimed at reinforcing their market position by meeting seasonal demand and expanding their product portfolio.

Report Scope

Report Features Description Market Value (2023) USD 11.0 Billion Forecast Revenue (2033) USD 33.5 Billion CAGR (2024-2032) 12.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Dilutions, Tincture, Tablets, Others), By Application (Analgesic and Antipyretic, Respiratory, Neurology, Others), By Source (Plants, Animals, Minerals) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BoironUSA, BiologischeHeilmittel Heel GmbH, A Nelson & Co Ltd, Homeocaninc., SBL, Hahnemann Laboratories, Mediral International Inc, AinsworthsLtd., Hevert - Arzneimittel GmbH & Co. KG, BioIndiaPharma, Bioforce, SchwabeGroup, Lord’S Homeopathic Laboratory (P) Ltd., Hyland’s Homeopathic, Arogya, Bakson, Helios Homeopathy, Rxhomeo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Boiron USA

- BiologischeHeilmittel Heel GmbH

- A Nelson & Co Ltd

- Homeocaninc.

- SBL

- Hahnemann Laboratories

- Mediral International Inc

- AinsworthsLtd.

- Hevert - Arzneimittel GmbH & Co. KG

- BioIndiaPharma

- Bioforce

- SchwabeGroup

- Lord’s Homeopathic Laboratory (P) Ltd.

- Hyland’s Homeopathic

- Arogya

- Bakson

- Helios Homeopathy

- Rxhomeo