High Voltage Switchgear Market Type(Air insulated, Gas-insulated, Other Types), Application(Power Generation, Power Transmission, Power Distribution, Industrial, Oil and Gas, Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

22998

-

March 2023

-

185

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- High Voltage Switchgear Market Size, Share, Trends Analysis

- Driving Factors

- Restraining Factors

- High Voltage Switchgear Market Segmentation Analysis

- High Voltage Switchgear Industry Segments

- Growth Opportunities

- High Voltage Switchgear Market Regional Analysis

- High Voltage Switchgear Industry By Region

- High Voltage Switchgear Market Key Player Analysis

- Market Key Players

- High Voltage Switchgear Market Recent Development

- Report Scope

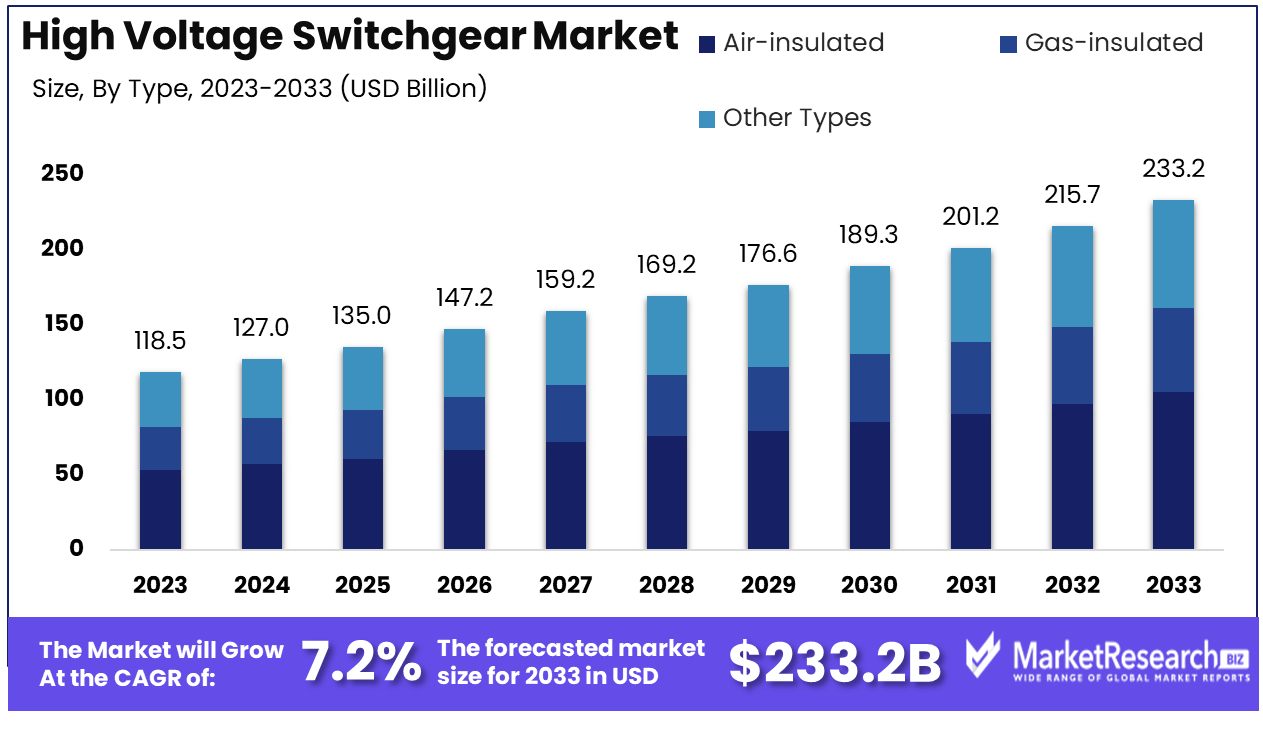

The high-voltage switchgear market was valued at USD 118.54 billion in 2023. It is expected to reach USD 233.2 billion in 2033, with a CAGR of 7.19% during the forecast period from 2024 to 2033.

The surge in demand for electricity in remote areas and reconciliation across transmission and supply networks are some of the main driving factors for the high-voltage switchgear market expansion. High-voltage switchgear is an important part of electrical grids for power supply networks. It makes sure that it is the safe, efficacious, and dependable transmission of electrical energy by offering a means to safely separate and detach electrical equipment from the power distribution.

Switchgear is the most vital part of power supply systems. When it is utilized with high voltage systems, this equipment should be able to match the voltage needs. High voltage switchgear is an integration of electrical elements that includes switches, fuses, transformers, and disconnectors, these are used in power supply networks that handle high voltages above 36Kv. This equipment is used for the carriage and supply of load while upholding the electrical connectors. It helps to know the faults and loss of connections so that it can decrease the damage.

As the high voltage switchgear can hold more and above 36Kv, when the level of the electricity voltage surges then the arcing will be produced as the switching load is exceptionally high. Due to this, at the time of designing this kind of equipment, there should be special care and attention needs to be taken.

High-voltage switchgear relies on an HV circuit breaker as its core component. This is the reason why the HV circuit breaker should have safe and reliable work features. The switching work of the HV circuits is very occasional. These CBs remain in the ON state and can be operated after some time. There must be dependability to enable safe operations when it is needed.

The high voltage switchgear enhances the application in power supply systems oriented towards commerce and industry. These HV switchgear are responsible for the distribution of power or electricity in a given area, normally one that extends a border distance and has several individual structures such as university campuses.

According to the IEA in 2023, there will be more than 760 million people who do not have any access to electricity. The covid-19 and recent war between Russia and Ukraine have upsurged the number of people without access to power supply back to 2019 levels. This rise is majorly seen in sub-Saharan Africa, which accounts for 80% of the people who lack electricity access.

Moreover, according to the IEA Data and Analysis's report, electricity supplies will resume in 2023 in remote areas that have been without access for at least seven years or more. High-voltage switchgear installations in these remote areas will facilitate access to electricity supplies; their installation is essential due to high requirements in these rural communities which will contribute to market expansion over time.

Driving Factors

Smart Grid Evolution Sparks Switchgear Demand

The high-voltage switchgear market is gaining momentum from the transformative shifts in the power generation industry, notably the burgeoning focus on smart grids and technological innovation. As power networks evolve to become more intelligent and interconnected, the role of high-voltage switchgear becomes increasingly vital in managing power flow and ensuring grid stability.

This innovation-driven demand is not just a response to current energy needs but a forward-looking strategy to future-proof power systems against surging energy demands and complexity. The long-term market trajectory is set to align with advancements in smart grid technologies, positioning high-voltage switchgear as a key component in the next generation of power distribution systems.

Transmission Network Growth Energizes Switchgear Market

As the world grapples with rising power consumption, the development and enhancement of transmission infrastructure become pivotal. High-voltage switchgear plays an instrumental role in this expansion, ensuring efficient, safe, and reliable power distribution across vast networks. This trend reflects a broader market movement towards reinforcing and modernizing power transmission systems, in which high-voltage switchgear is indispensable. The anticipated long-term effect is a steady rise in switchgear demand, correlating directly with the ongoing expansion of global transmission networks.

Renewable Energy Integration Boosts Switchgear Market

Renewable energy investments have seen rapid growth, significantly increasing demand for high-voltage switchgear. As more people turn towards sustainable sources such as wind, solar, and hydroelectric power as an energy solution, integrating them safely and efficiently into existing power grids is becoming a formidable task - high voltage switchgear plays an essential role in providing safe and efficient incorporation of renewables into these networks.

This trend is not merely a response to current environmental imperatives but a strategic alignment with the global transition towards green energy. The long-term implications for the high-voltage switchgear market include sustained growth, driven by the relentless global pursuit of renewable energy generation and integration.

Restraining Factors

Volatility in Raw Material Prices Hinders High Voltage Switchgear Market Growth

The volatility in raw material prices, such as copper and aluminum, can significantly hinder the growth of the high-voltage switchgear market. These materials are essential components in the manufacturing of switchgear, and their prices can fluctuate widely due to market dynamics, trade policies, and global supply chain issues.

Such unpredictability can lead to inconsistent manufacturing costs, affecting the pricing and profitability of switchgear products. Companies may struggle to plan and budget effectively, potentially leading to reduced investment in new technologies and hindering market growth as manufacturers and consumers navigate these financial uncertainties.

Impact of Russia-Ukraine War on Global High Voltage Switchgear Market Dynamics

The Russia-Ukraine conflict has had a devastating impact on the global high-voltage switchgear market, altering market dynamics and growth significantly. The conflict has led to geopolitical tensions, trade sanctions, and supply chain disruptions, affecting the availability and cost of raw materials and components. These challenges can increase production costs, delay manufacturing processes, and create uncertainty in the market.

Additionally, the war can lead to reduced investments in infrastructure projects due to economic and political uncertainties, directly impacting the demand for high-voltage switchgear. Navigating these complex geopolitical issues is crucial for market stability and growth.

High Voltage Switchgear Market Segmentation Analysis

Type Analysis:

In the high-voltage switchgear market, Air-insulated switchgear (AIS) is recognized as the dominant segment. The preference for AIS stems from its reliability, cost-effectiveness, and ease of maintenance. Air-insulated switchgear is widely used in power systems due to its ability to handle high voltages effectively, making it a crucial component in electrical distribution networks. Its dominance is further reinforced by the extensive application in both new power generation projects and aging infrastructure upgrades.

While AIS leads the market, Gas-insulated switchgear (GIS) is also significant, particularly favored for its compact design and suitability for space-constrained environments. GIS is increasingly popular in urban substations and other areas where space is at a premium. Other types of switchgear, such as solid and hybrid systems, are evolving to address specific needs and offer alternative solutions in the high voltage switchgear market.

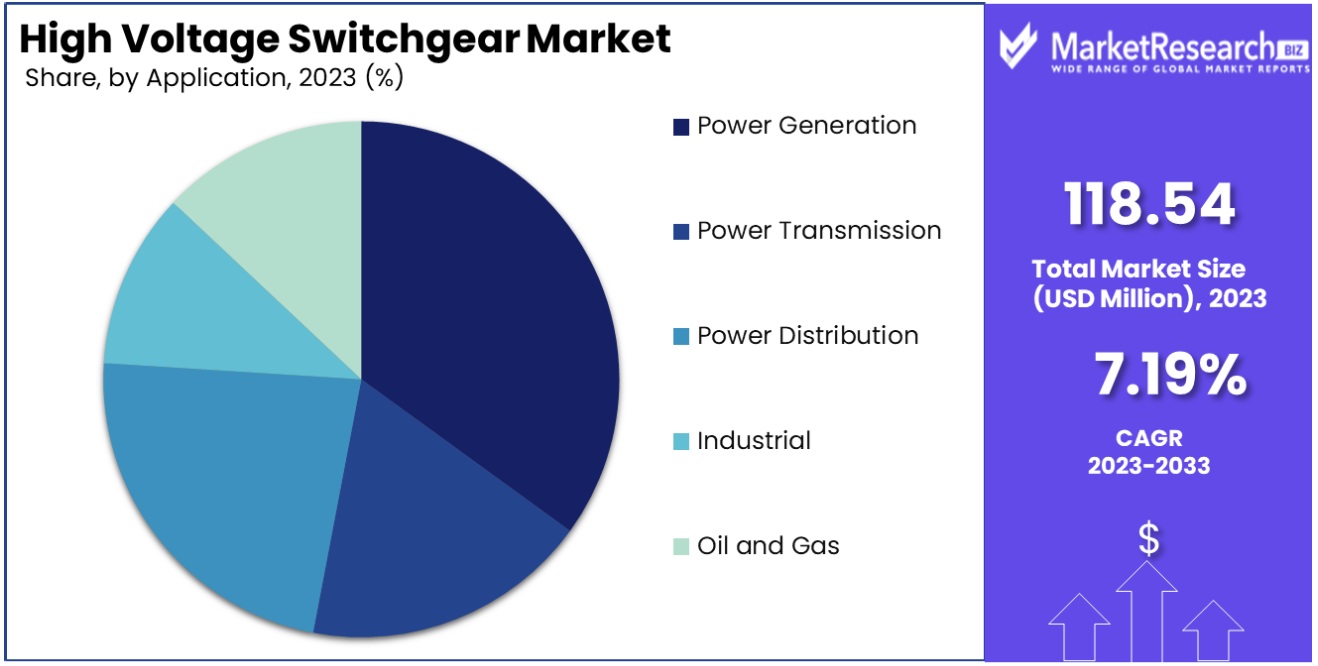

Application Analysis:

The Power Generation sector emerges as the dominant application in the high voltage switchgear market. As global energy demands rise and renewable energy sources become more prevalent, the need for efficient, reliable high voltage switchgear for power generation facilities has become critical. Switchgear in power generation plants is vital for controlling and protecting electrical equipment and ensuring uninterrupted power supply.

While Power Generation leads, Power Transmission and Power Distribution are also key applications. These segments rely on high voltage switchgear to manage the flow of electricity over long distances and distribute it safely and efficiently. Industrial applications, along with Oil and Gas sectors, also significantly utilize high voltage switchgear for their large-scale power requirements and complex electrical systems.

High Voltage Switchgear Industry Segments

Type

- Air-insulated

- Gas-insulated

- Other Types

Application

- Power Generation

- Power Transmission

- Power Distribution

- Industrial

- Oil and Gas

- Others

Growth Opportunities

Urbanization Spurs Demand for High Voltage Switchgear in Power Infrastructure

Urbanization has led to an exponentially rising electricity demand, necessitating reliable and cost-effective high voltage switchgear solutions. As cities expand and become denser, so does their need for stable power infrastructure; high voltage switchgear plays an essential role in providing safe transmission and distribution of electricity in these urban settings. As new infrastructure is developed and upgraded to meet these growing needs, so too does its market expand accordingly.

Smart Grids and Energy Efficiency Drive Advanced High Voltage Switchgear Demand

The emphasis on smart grid technologies and energy efficiency is driving the demand for advanced high voltage switchgear solutions. Smart grids require sophisticated switchgear capable of handling complex operations, integrating renewable energy sources, and improving grid reliability and efficiency.

As governments and utilities invest in upgrading grid infrastructure to meet future energy needs and sustainability goals, the market for high voltage switchgear that supports these advanced systems is expanding. The shift towards smarter, more efficient power networks presents a significant growth opportunity for high voltage switchgear manufacturers, particularly those offering innovative, technology-driven solutions.

High Voltage Switchgear Market Regional Analysis

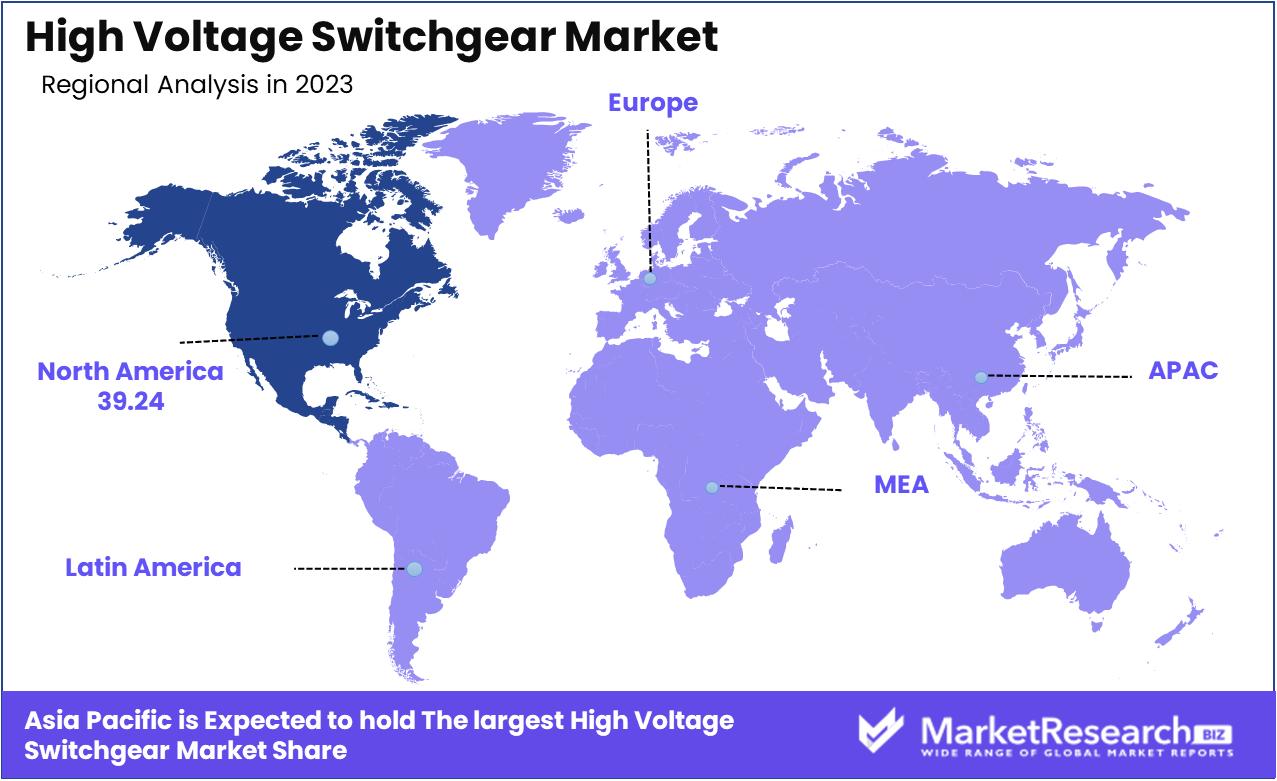

Asia Pacific Dominates with 39.24% Market Share in High Voltage Switchgear Market

Asia-Pacific's significant 39.24% share of the high voltage switchgear market is driven by the region's rapid industrialization and urbanization, particularly in countries like China, India, and Japan. The increasing demand for electricity and the ongoing investments in power infrastructure development significantly contribute to this market dominance. Additionally, the region's commitment to enhancing grid reliability and the integration of renewable energy sources fuels the need for advanced switchgear systems. The presence of several key electrical equipment manufacturers in Asia-Pacific, along with the rising focus on energy efficiency and grid modernization, further bolsters the market.

The market dynamics in Asia-Pacific are influenced by the growing construction of new power generation plants and the refurbishment of old ones. The expanding industrial sector and the increasing power consumption in residential and commercial sectors drive the demand for high voltage switchgear. Moreover, the region's emphasis on reducing power losses and improving the stability of electricity supply propels the adoption of advanced switchgear technologies. The ongoing rural electrification projects and the rising investments in smart grid initiatives also contribute to market growth.

North America: Advanced Power Infrastructure and Technological Innovation

North America's high voltage switchgear market is driven by advanced power infrastructure and a strong focus on technological innovation. The region's emphasis on grid reliability and the integration of renewable energy sources contribute to market growth. Major technology companies and investments in smart grid technologies fuel demand for high voltage switchgear.

Europe: Stringent Regulations and Focus on Renewable Energy

Europe’s high voltage switchgear market is characterized by stringent regulations regarding energy efficiency and emissions. The region's commitment to reducing its carbon footprint and the increasing adoption of renewable energy sources drive the demand for advanced switchgear solutions. Europe's well-established industrial sector and the growing emphasis on grid modernization provide substantial opportunities for the high voltage switchgear market.

High Voltage Switchgear Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

High Voltage Switchgear Market Key Player Analysis

High Voltage Switchgear Market companies play an essential role in driving technology and market development. ABB and Siemens AG are industry leaders, known for their advanced and reliable high voltage switchgear solutions. Their strategic positioning emphasizes innovation, sustainability, and global reach, significantly influencing market trends and technological standards.

General Electric Company and Mitsubishi Electric Corporation are key players with a broad range of switchgear products, reflecting the industry's focus on versatility and adaptability to different power systems. Toshiba International Corporation and Hitachi Ltd., with their strong emphasis on research and development, contribute to the market with cutting-edge technologies that enhance grid reliability and performance.

Market Key Players

- ABB

- General Electric Company

- Siemens AG

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Kirloskar Electric Co. Ltd

- L&T

- Larson & Turbo

- Hitachi Ltd.

- Crompton Greaves

- Hubbell

- Powell Industries

- BHEL

- Hyosung

- Rittal

High Voltage Switchgear Market Recent Development

- In November 2022, Hitachi, Ltd. announced to provide its SF6-free 420 kV gas-insulated switchgear technology for TenneT's grid connection in Germany to support the European grid operator in achieving its carbon neutrality goals

- In November 2022, GE Renewable announced that its Grid Solutions business developed a new 123kV, 16.7Hz HYpact switchgear for DB Energie GmbH’s 60-year-old Amstetten train station located in Lonsee between Stuttgart and Ulm in Germany

Report Scope

Report Features Description Market Value (2023) USD 118.54 billion Forecast Revenue (2033) USD 233.2 billion CAGR (2024-2032) 7.19% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type(Air insulated, Gas-insulated, Other Types), Application(Power Generation, Power Transmission, Power Distribution, Industrial, Oil and Gas, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ABB, General Electric Company, Siemens AG, Toshiba International Corporation, Mitsubishi Electric Corporation, Kirloskar Electric Co. Ltd, L&T, Larson & Turbo, Hitachi Ltd., Crompton Greaves, Hubbell, Powell Industries, BHEL, Hyosung, Rittal Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ABB

- General Electric Company

- Siemens AG

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Kirloskar Electric Co. Ltd

- L&T

- Larson & Turbo

- Hitachi Ltd.

- Crompton Greaves

- Hubbell

- Powell Industries

- BHEL

- Hyosung

- Rittal