Helicopters Market By Type(civil & commercial, military helicopters), By Weight(Lightweight, Medium Weight, Heavy Weight), By Number of Engines(Twin Engine, Single Engine), By Application(Emergency Medical Service, Oil and Gas, , Homeland Security), by Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

6804

-

May 2023

-

161

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

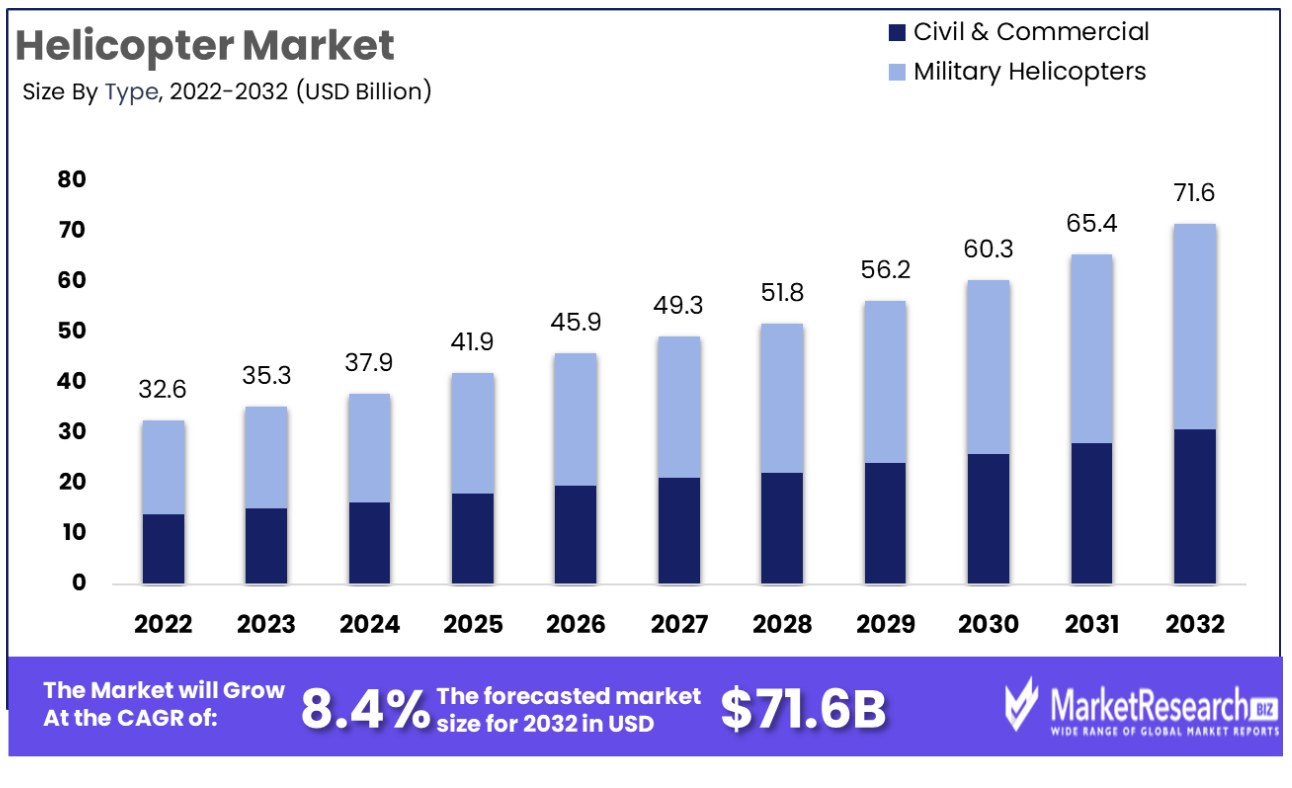

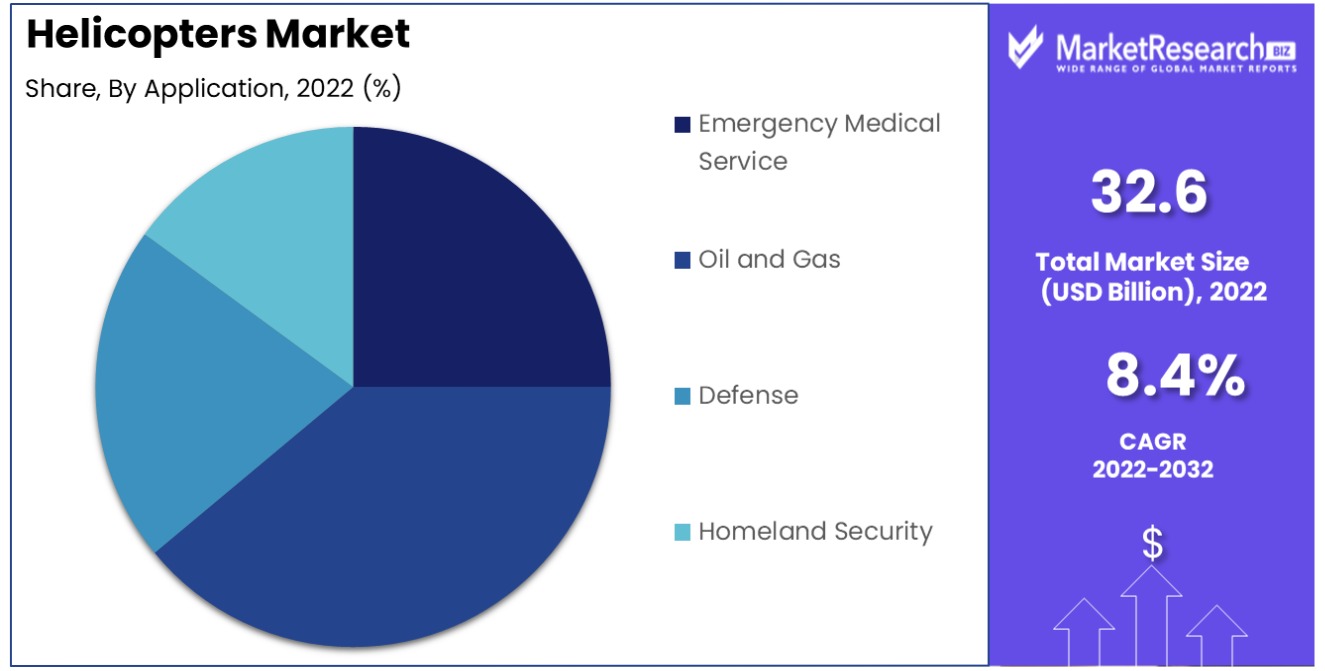

The helicopter market was valued at USD 32.6 Billion in 2022. It is estimated to reach USD 71.6 Billion by 2032, with a CAGR of 8.4% during the forecast period.

The surge of requirements in military forces and air ambulance services are some of the main factors for the helicopter market expansion. The primary function of a helicopter is to shift the patients toward medical centers and keep them safe and away from accidental sites or areas.

Air ambulance helicopters provide special care and support at the accidental sites and transfer the victims and patients to the nearest medical hubs, especially for cases of serious traumas.

The equipment and the safety of the patients are the most vital factors to take into attention whenever deciding to shift a patient through the helicopter. Air ambulance operations are an important part of society as it is expanding their reach to many urban areas and just not limited to remote areas.

As per the Aero time hub article, in April 2022, metropolitan police and London ambulance services took the help of an air ambulance to rescue an 81-year-old man who was severely hit by a vehicle in the middle of Trafalgar Square. Moreover, at the time of the pandemic, air ambulances were embedded with modern medical technology to handle the severity of COVID-19.

Financial and insurance firm Allianz stated that from March to August 2020, air transport services have been boosted by 25% as compared to the same period in 2019. Additionally, EpiGuard, a Norwegian medical maker witnessed an increase of sales by 2,000% during the period of 2020 to 2021 for its Epishuttle isolation pods to shift the COVID patients.

Helicopters are widely used by military forces. It has a wide range of usages that make it an important asset in different military operations. Some of the main roles of helicopters are troop transport, medical evacuation, fire support, disaster rescue missions, logistics and transportation, search and rescue operations, and other military operations. The demand for helicopters will increase in the coming years which will contribute to market expansion.

Driving Factors

Fleet Modernization Accelerates Helicopter Market Growth

The need for the replacement of old helicopter fleets with modern, advanced rotorcraft is a significant factor driving the helicopter market's growth. As aging fleets reach the end of their service life, there is a heightened demand for newer models that offer enhanced safety, efficiency, and technological capabilities.

This trend not only reflects the ongoing renewal cycles within the industry but also indicates a shift towards more sophisticated, multi-role helicopters. The long-term implication is a market increasingly oriented towards innovation, with manufacturers focusing on advanced designs and features to meet the evolving demands of operators.

Advanced Technology Integration Boosts Market Revenue

The increased use of advanced technologies, such as electronic thrust in helicopters, is a key driver of market revenue growth. These technological advancements enhance the performance, control, and efficiency of helicopters, making them more appealing to a wide range of users, from the military to civilian sectors.

The integration of cutting-edge technologies signifies a market that is becoming increasingly sophisticated, with a strong focus on innovation and technological excellence. In the long run, this trend is expected to lead to a market characterized by high-tech, versatile rotorcraft catering to a variety of needs and applications.

Joint Ventures and Combat Helicopter Demand Propel Market Dynamics

Growing joint ventures between global manufacturers and the increased demand for technologically advanced combat helicopters are reshaping the helicopter market. These partnerships enable the pooling of resources, expertise, and technology, leading to the development of superior combat helicopters.

The growing demand for these helicopters, especially for close air support and attack operations, further stimulates market growth. This synergy between joint ventures and military needs creates a robust environment for innovation and development in the market. The anticipated long-term effect is a more collaborative and technologically advanced market, capable of producing cutting-edge military rotorcraft.

Combat Helicopters' Rising Demand Underlines Market Expansion

The increased demand for combat helicopters for close air support and attack operations is a pivotal factor in the market's growth. With global security concerns and military modernization initiatives, the requirement for combat helicopters equipped with advanced capabilities is on the rise.

This demand is not just driving sales but also encouraging advancements in technology, design, and multi-role functionality. The long-term implications include a sustained focus on developing combat helicopters that are more efficient, capable, and versatile, meeting the complex requirements of modern warfare and defense strategies.

Restraining Factors

High Acquisition and Maintenance Costs Restrain Helicopters Market Growth

The high cost of acquiring and maintaining helicopters significantly limits the growth of the market. The initial purchase price of helicopters, particularly those with advanced technology and capabilities, is prohibitively high for many potential buyers.

Additionally, the ongoing maintenance and operational costs, including parts replacement and labor, add to the financial burden. These expenses make helicopter ownership less feasible for smaller operators or organizations with limited budgets. The high-cost barrier restricts the customer base to a relatively small segment of affluent buyers or large corporations, thereby hindering broader market growth.

Rising Fuel Prices Adversely Impact Helicopters Market Growth Globally

Rising fuel prices pose a substantial challenge to the global helicopter market, affecting both commercial and private operators. Helicopters, being fuel-intensive vehicles, are significantly impacted by fluctuations in fuel costs.

The increase in fuel prices leads to higher operational costs, which can result in reduced usage and lower purchases of helicopters, as operators and potential buyers reassess their budgets and operational efficiencies. This issue is particularly pressing in regions with volatile fuel pricing, where budgeting for helicopter operations becomes increasingly challenging. The consequent reduction in demand due to high fuel costs adversely affects the global market growth for helicopters.

Segmentation Analysis

By Type

Military helicopters are the predominant segment in the helicopter market. This dominance is driven by their critical role in defense operations, including transportation, reconnaissance, and combat missions. The demand for military helicopters is fueled by global security concerns, technological advancements, and the need for modernized fleet replacements. The trend towards multi-role helicopters, capable of performing various missions, is a significant driver of this segment's growth.

The civil and commercial segment, while smaller than the military sector, plays a vital role in the helicopter market. This segment includes corporate transport, emergency medical services, and tourism. The growth in this segment is driven by the increasing demand for air ambulance services and the rising use of helicopters in urban mobility solutions.

By Weight

In the helicopter market, weight categories play a pivotal role in determining the suitability of helicopters for various applications. Lightweight helicopters, known for their agility and economical operation, are often the preferred choice for tasks that demand maneuverability and cost-efficiency, such as pilot training, aerial surveillance, and light transport duties. These helicopters are particularly valued in sectors where speed and flexibility are more critical than payload capacity or range.

Medium-weight helicopters strike an optimal balance between performance capabilities and operational costs. This category is versatile, making these helicopters well-suited for a diverse range of applications, both in civilian and military contexts. They are commonly used for passenger transport, emergency medical services, and medium-lift tasks, offering a good compromise between the lightweight and heavyweight categories.

By Number of Engines

The helicopter market is segmented by the number of engines, with twin-engine helicopters being the preferred choice for safety-critical missions. These include offshore oil and gas operations and emergency medical services, where the added reliability of two engines is crucial for safe operations in challenging environments.

Conversely, single-engine helicopters are favored in less demanding applications, such as training, private transport, and light commercial use. Their popularity in these sectors is driven by their lower operating and maintenance costs, making them a cost-effective solution for operators who do not require the added safety and performance features of twin-engine models. This segmentation reflects the diverse needs and priorities of different users in the helicopter market.

By Application

In the helicopter market, the application segments play a critical role in shaping demand and technological advancements. Emergency medical services (EMS) heavily rely on helicopters for their unrivaled speed and agility, which are essential for providing rapid medical assistance in remote or inaccessible locations.

Additionally, Emergency Medical Services (EMS) benefit from the advanced onboard medical equipment that helicopters can carry, transforming them into airborne ambulances capable of providing critical care in transit. This capability significantly enhances survival rates in emergencies, making helicopters an invaluable asset in the healthcare and emergency response infrastructure.

Defense and homeland security represent another substantial market segment, utilizing helicopters for a wide range of national security tasks, including surveillance, search and rescue, and combat missions.

These sectors value helicopters for their ability to provide exclusive, efficient transport and unique aerial experiences, thereby contributing to the overall growth and dynamism of the helicopter market.

Helicopter Industry Segments

By Type

- civil & commercial

- military helicopters

By Weight

- Lightweight

- Medium Weight

- Heavy Weight

By Number of Engines

- Twin Engine

- Single Engine

By Application

- Emergency Medical Service

- Oil and Gas

- Defense

- Homeland Security

- Others

Growth Opportunities

Replacement of Aging Commercial Helicopters Offers Growth Opportunity

The need to replace aging commercial helicopters is a significant driver for market growth, opening avenues for new opportunities. As older models become obsolete or fail to meet current efficiency and safety standards, there's an increased demand for newer, more advanced helicopters.

This replacement cycle is supported by recent trends showing heightened investment in next-generation helicopters by commercial operators. These investments are not only motivated by the need for modernization but also by regulatory pressures and the pursuit of operational efficiency. Consequently, this key trend is likely to stimulate growth and innovation in the helicopter manufacturing sector.

Increased Demand for Lightweight Helicopters in Medical Applications Offers Growth Opportunity

The escalating demand for lightweight helicopters, particularly for air ambulances and medical purposes, propels market growth and innovation. Lightweight helicopters offer advantages like greater maneuverability and fuel efficiency, making them ideal for emergency medical services.

The recent spike in healthcare emergencies and the need for rapid medical response have highlighted the importance of these helicopters. This demand is driving manufacturers to innovate and produce helicopters that are not only lighter but also equipped with advanced medical facilities, thereby expanding the market's scope and potential.

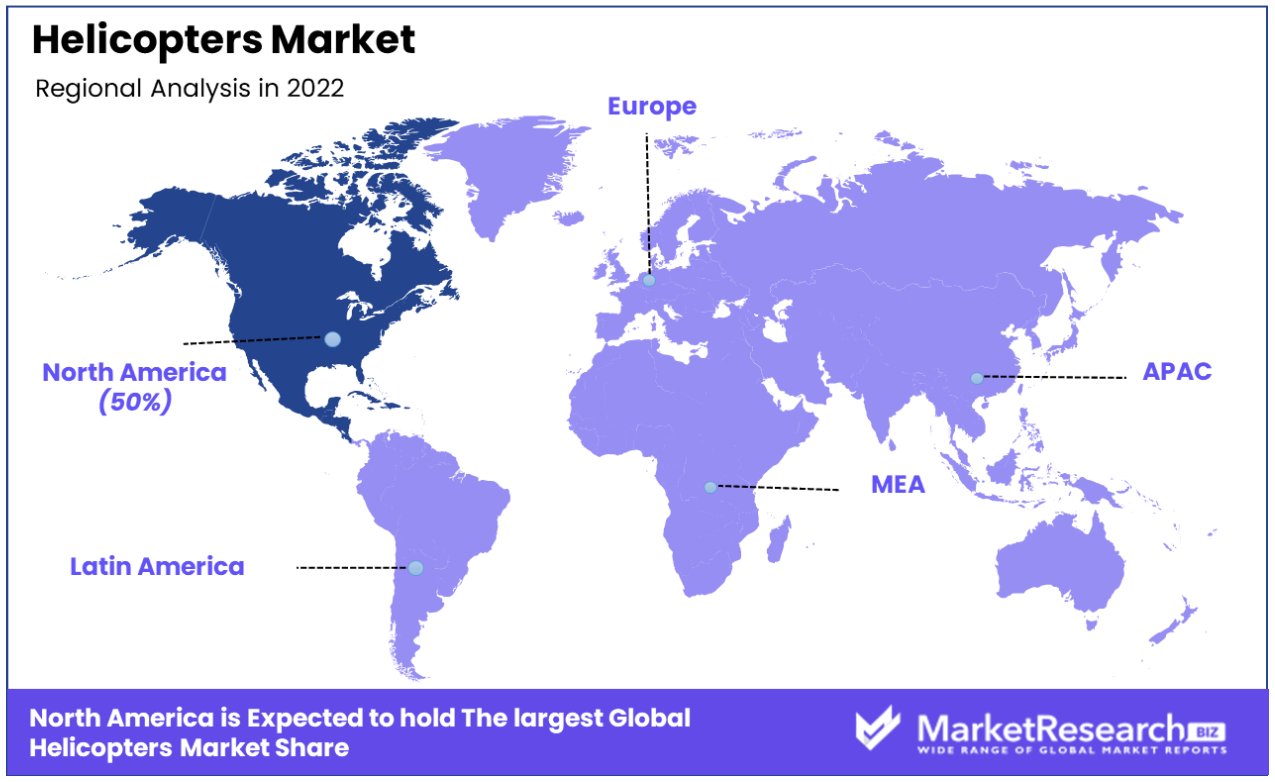

Regional Analysis

North America Dominates with a 50% Market Share

North America's commanding 50% share in the global helicopter market can be attributed to several key factors. The region is home to some of the world's leading helicopter manufacturers, such as Bell and Sikorsky, driving innovation and production. Additionally, there is a high demand for helicopters in both civilian and military sectors, spurred by vast geographical expanses requiring efficient aerial transportation and a strong defense budget supporting advanced helicopters In military rotorcraft development.

The dynamics of the helicopter market in North America are influenced by diverse applications, including emergency medical services, law enforcement, and corporate travel, alongside military usage. The region's advanced technological ecosystem fosters continuous innovation in helicopter design, including the integration of new navigation systems and an emphasis on safety and efficiency. The robust economic conditions further support market growth, allowing for substantial investments in helicopter infrastructure and services.

Looking ahead, the future influence of North America's market presence in the global helicopter industry remains strong. Initiatives in sustainable aviation and the exploration of electric vertical take-off and landing (VTOL) aircraft may further revolutionize the market, maintaining North America's leadership position.

Europe: A Focus on Innovation and Safety

Europe’s helicopter market is characterized by a strong emphasis on safety standards and technological innovations. The region benefits from the presence of key players like Airbus Helicopters, driving market competitiveness. Europe's strict regulatory environment ensures high safety and environmental standards, fostering trust and reliability in the market. The region's focus on incorporating advanced technologies such as AI and IoT in helicopter systems is set to bolster its position in the global market.

Asia-Pacific: Rapid Growth and Expansion

Asia-Pacific region helicopter market is experiencing rapid growth, driven by increasing demand in emerging economies like China and India. The region's expanding tourism industry, along with growing investments in infrastructure and defense, significantly contributes to this surge. The increasing need for helicopters in disaster management, medical evacuation, and urban air mobility in densely populated cities is also propelling market growth. Asia-Pacific's strategic focus on expanding its helicopter fleet and services indicates a significant potential for increased share in the future.

Key Player Analysis

The helicopter market, characterized by the companies listed, represents a diverse array of strategic approaches and influences. Airbus and Bell Textron Inc., with their broad portfolios, lead in innovation and versatility, catering to both commercial and military sectors. Their expansive global presence underscores the importance of adaptability and breadth in product offerings.

Helicopters Guimbal and MD Helicopters Inc., though smaller in scale, make significant contributions through specialized designs, appealing to niche markets such as training and light utility services. Kaman Corporation and Kawasaki Heavy Industries Ltd, known for their technological advancements, highlight the industry's focus on enhancing performance and safety.

Leonardo SpA, with its strong European presence, and Mitsubishi Heavy Industries Ltd, a key player in the Asian market, illustrate the importance of regional expertise and strategic positioning in global competitiveness. Robinson Helicopter Company, renowned for its cost-effective and popular light helicopters, underscores the market's demand for accessible and reliable civilian helicopters.

The Boeing Company and Lockheed Martin Corporation, giants in aerospace, demonstrate their prowess in the military helicopter segment, emphasizing advanced technology and defense contracts' significance. Rostec and Hindustan Aeronautics Limited, with their state-backed operations, reflect the role of national defense agendas and indigenous manufacturing capabilities in shaping market dynamics.

Collectively, these companies not only influence the global helicopter market size but also showcase a spectrum of strategies - from focusing on niche segments to leading in comprehensive offerings and technological innovations - vital in steering this multifaceted industry.

Key Players

- Airbus Helicopters Inc.

- Bell Textron Inc

- Helicopters Guimbal

- Kaman Corporation

- Kawasaki Heavy Industries Ltd

- Leonardo SpA

- MD Helicopters Inc

- Mitsubishi Heavy Industries Ltd

- Robinson Helicopter Company

- The Boeing Company

- Lockheed Martin Corporation

- Rostec

- Hindustan Aeronautics Limited

Recent Development

February 2023 Hindustan Aeronautics Limited (HAL), an India-based state-owned aerospace and defense company, unveiled a new manufacturing unit in Karnataka, India. HAL intends to manufacture more than 1,000 rotary-wing aircraft with different load capacities, generating a total revenue of over USD 4 billion over the next two decades.

December 2022 Bell Textron Inc. has been awarded a contract by the U.S. Army to construct a new long-range assault aircraft. Valued at up to USD 1.3 billion, the contract was won against a joint team from Lockheed Martin Corp. and Boeing Co. and will involve the replacement of the famous Black Hawk helicopters by 2030

In July 2021, MD Helicopters Inc. signed new contracts with Unitech Composites and ACT Aerospace to improve production and spare parts availability for the MD 902, MD 520N, and MD 600N aircraft.

In April 2021, Airbus announced that New Zealand VIP and charter operator Advanced Flight had become the launch customer for the new Airbus ACH145 with five rotor blades. It has also taken delivery of the first five-bladed ACH145 helicopter.

Recent Development

- In 2022, a team of researchers from the University of California, Berkeley developed a new method for producing aniline from biomass. The method uses a catalytic process to convert sugars from biomass into aniline in high yields.

- In January 2022, Maire Tecnimont's subsidiary, Tecnimont, has secured a €250 million EPC contract from Covestro to build a new aniline plant in Antwerp, Belgium. The project will boost aniline production at Covestro's Antwerp site, focusing on high-tech polymer materials and sustainable solutions. Completion is expected by 2024, featuring cutting-edge technologies for safety and energy efficiency.

- In 2022, A team of researchers at the Chinese Academy of Sciences discovered how to use lithium hydride to facilitate the hydrogenolysis of anilines to arenes.This work provides a new strategy for C-N bond activation and may help the design and development of new materials or catalysts for HDN as well as other important chemical transformations.

Report Scope

Report Features Description Market Value (2022) USD 32.6 Billion Forecast Revenue (2032) USD 71.6 Billion CAGR (2023-2032) 8.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(civil & commercial, military helicopters), By Weight(Lightweight, Medium Weight, Heavy Weight), By Number of Engines(Twin Engine, Single Engine), By Application(Emergency Medical Service, Oil and Gas, , Homeland Security) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Airbus, Bell Textron Inc, Helicopters Guimbal, Kawasaki Heavy Industries Ltd, Mitsubishi Heavy Industries Ltd, Lockheed Martin Corporation, Hindustan Aeronautics Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Helicopters Market Overview

- 2.1. Helicopters Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Helicopters Market Dynamics

- 3. Global Helicopters Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Helicopters Market Analysis, 2016-2021

- 3.2. Global Helicopters Market Opportunity and Forecast, 2023-2032

- 3.3. Global Helicopters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 3.3.1. Global Helicopters Market Analysis by By Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 3.3.3. Civil & Commercial

- 3.3.4. Military

- 3.4. Global Helicopters Market Analysis, Opportunity and Forecast, By By Range, 2016-2032

- 3.4.1. Global Helicopters Market Analysis by By Range: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Range, 2016-2032

- 3.4.3. Light

- 3.4.4. Medium Lift

- 3.4.5. Heavy Lift

- 3.5. Global Helicopters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.5.1. Global Helicopters Market Analysis by By Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.5.3. Rescue and Medical Support

- 3.5.4. Corporate Service

- 3.5.5. Medical

- 3.5.6. Training

- 3.5.7. Oil & Gas

- 3.5.8. Defense

- 3.5.9. Homeland Security

- 3.5.10. Others

- 4. North America Helicopters Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Helicopters Market Analysis, 2016-2021

- 4.2. North America Helicopters Market Opportunity and Forecast, 2023-2032

- 4.3. North America Helicopters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 4.3.1. North America Helicopters Market Analysis by By Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 4.3.3. Civil & Commercial

- 4.3.4. Military

- 4.4. North America Helicopters Market Analysis, Opportunity and Forecast, By By Range, 2016-2032

- 4.4.1. North America Helicopters Market Analysis by By Range: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Range, 2016-2032

- 4.4.3. Light

- 4.4.4. Medium Lift

- 4.4.5. Heavy Lift

- 4.5. North America Helicopters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.5.1. North America Helicopters Market Analysis by By Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.5.3. Rescue and Medical Support

- 4.5.4. Corporate Service

- 4.5.5. Medical

- 4.5.6. Training

- 4.5.7. Oil & Gas

- 4.5.8. Defense

- 4.5.9. Homeland Security

- 4.5.10. Others

- 4.6. North America Helicopters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Helicopters Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Helicopters Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Helicopters Market Analysis, 2016-2021

- 5.2. Western Europe Helicopters Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Helicopters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 5.3.1. Western Europe Helicopters Market Analysis by By Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 5.3.3. Civil & Commercial

- 5.3.4. Military

- 5.4. Western Europe Helicopters Market Analysis, Opportunity and Forecast, By By Range, 2016-2032

- 5.4.1. Western Europe Helicopters Market Analysis by By Range: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Range, 2016-2032

- 5.4.3. Light

- 5.4.4. Medium Lift

- 5.4.5. Heavy Lift

- 5.5. Western Europe Helicopters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.5.1. Western Europe Helicopters Market Analysis by By Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.5.3. Rescue and Medical Support

- 5.5.4. Corporate Service

- 5.5.5. Medical

- 5.5.6. Training

- 5.5.7. Oil & Gas

- 5.5.8. Defense

- 5.5.9. Homeland Security

- 5.5.10. Others

- 5.6. Western Europe Helicopters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Helicopters Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Helicopters Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Helicopters Market Analysis, 2016-2021

- 6.2. Eastern Europe Helicopters Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Helicopters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 6.3.1. Eastern Europe Helicopters Market Analysis by By Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 6.3.3. Civil & Commercial

- 6.3.4. Military

- 6.4. Eastern Europe Helicopters Market Analysis, Opportunity and Forecast, By By Range, 2016-2032

- 6.4.1. Eastern Europe Helicopters Market Analysis by By Range: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Range, 2016-2032

- 6.4.3. Light

- 6.4.4. Medium Lift

- 6.4.5. Heavy Lift

- 6.5. Eastern Europe Helicopters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.5.1. Eastern Europe Helicopters Market Analysis by By Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.5.3. Rescue and Medical Support

- 6.5.4. Corporate Service

- 6.5.5. Medical

- 6.5.6. Training

- 6.5.7. Oil & Gas

- 6.5.8. Defense

- 6.5.9. Homeland Security

- 6.5.10. Others

- 6.6. Eastern Europe Helicopters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Helicopters Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Helicopters Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Helicopters Market Analysis, 2016-2021

- 7.2. APAC Helicopters Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Helicopters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 7.3.1. APAC Helicopters Market Analysis by By Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 7.3.3. Civil & Commercial

- 7.3.4. Military

- 7.4. APAC Helicopters Market Analysis, Opportunity and Forecast, By By Range, 2016-2032

- 7.4.1. APAC Helicopters Market Analysis by By Range: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Range, 2016-2032

- 7.4.3. Light

- 7.4.4. Medium Lift

- 7.4.5. Heavy Lift

- 7.5. APAC Helicopters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.5.1. APAC Helicopters Market Analysis by By Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.5.3. Rescue and Medical Support

- 7.5.4. Corporate Service

- 7.5.5. Medical

- 7.5.6. Training

- 7.5.7. Oil & Gas

- 7.5.8. Defense

- 7.5.9. Homeland Security

- 7.5.10. Others

- 7.6. APAC Helicopters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Helicopters Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Helicopters Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Helicopters Market Analysis, 2016-2021

- 8.2. Latin America Helicopters Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Helicopters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 8.3.1. Latin America Helicopters Market Analysis by By Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 8.3.3. Civil & Commercial

- 8.3.4. Military

- 8.4. Latin America Helicopters Market Analysis, Opportunity and Forecast, By By Range, 2016-2032

- 8.4.1. Latin America Helicopters Market Analysis by By Range: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Range, 2016-2032

- 8.4.3. Light

- 8.4.4. Medium Lift

- 8.4.5. Heavy Lift

- 8.5. Latin America Helicopters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.5.1. Latin America Helicopters Market Analysis by By Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.5.3. Rescue and Medical Support

- 8.5.4. Corporate Service

- 8.5.5. Medical

- 8.5.6. Training

- 8.5.7. Oil & Gas

- 8.5.8. Defense

- 8.5.9. Homeland Security

- 8.5.10. Others

- 8.6. Latin America Helicopters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Helicopters Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Helicopters Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Helicopters Market Analysis, 2016-2021

- 9.2. Middle East & Africa Helicopters Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Helicopters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 9.3.1. Middle East & Africa Helicopters Market Analysis by By Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 9.3.3. Civil & Commercial

- 9.3.4. Military

- 9.4. Middle East & Africa Helicopters Market Analysis, Opportunity and Forecast, By By Range, 2016-2032

- 9.4.1. Middle East & Africa Helicopters Market Analysis by By Range: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Range, 2016-2032

- 9.4.3. Light

- 9.4.4. Medium Lift

- 9.4.5. Heavy Lift

- 9.5. Middle East & Africa Helicopters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.5.1. Middle East & Africa Helicopters Market Analysis by By Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.5.3. Rescue and Medical Support

- 9.5.4. Corporate Service

- 9.5.5. Medical

- 9.5.6. Training

- 9.5.7. Oil & Gas

- 9.5.8. Defense

- 9.5.9. Homeland Security

- 9.5.10. Others

- 9.6. Middle East & Africa Helicopters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Helicopters Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Helicopters Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Helicopters Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Helicopters Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Airbus Helicopters Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Bell Helicopter Textron Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Russian Helicopters JSC

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Leonardo S.p.A.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Lockheed Martin Corporation - Sikorsky

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Kawasaki Heavy Industries, Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Columbia Helicopters, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. The Boeing Company

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. MD Helicopters, Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Korea Aerospace Industries, Ltd.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Helicopters Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 2: Global Helicopters Market Attractiveness Analysis by By Type, 2016-2032

- Figure 3: Global Helicopters Market Revenue (US$ Mn) Market Share by By Rangein 2022

- Figure 4: Global Helicopters Market Attractiveness Analysis by By Range, 2016-2032

- Figure 5: Global Helicopters Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 6: Global Helicopters Market Attractiveness Analysis by By Application, 2016-2032

- Figure 7: Global Helicopters Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Helicopters Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Helicopters Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Helicopters Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 12: Global Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Figure 13: Global Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 14: Global Helicopters Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 16: Global Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Figure 17: Global Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 18: Global Helicopters Market Share Comparison by Region (2016-2032)

- Figure 19: Global Helicopters Market Share Comparison by By Type (2016-2032)

- Figure 20: Global Helicopters Market Share Comparison by By Range (2016-2032)

- Figure 21: Global Helicopters Market Share Comparison by By Application (2016-2032)

- Figure 22: North America Helicopters Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 23: North America Helicopters Market Attractiveness Analysis by By Type, 2016-2032

- Figure 24: North America Helicopters Market Revenue (US$ Mn) Market Share by By Rangein 2022

- Figure 25: North America Helicopters Market Attractiveness Analysis by By Range, 2016-2032

- Figure 26: North America Helicopters Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 27: North America Helicopters Market Attractiveness Analysis by By Application, 2016-2032

- Figure 28: North America Helicopters Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Helicopters Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Helicopters Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 33: North America Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Figure 34: North America Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 35: North America Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 37: North America Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Figure 38: North America Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 39: North America Helicopters Market Share Comparison by Country (2016-2032)

- Figure 40: North America Helicopters Market Share Comparison by By Type (2016-2032)

- Figure 41: North America Helicopters Market Share Comparison by By Range (2016-2032)

- Figure 42: North America Helicopters Market Share Comparison by By Application (2016-2032)

- Figure 43: Western Europe Helicopters Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 44: Western Europe Helicopters Market Attractiveness Analysis by By Type, 2016-2032

- Figure 45: Western Europe Helicopters Market Revenue (US$ Mn) Market Share by By Rangein 2022

- Figure 46: Western Europe Helicopters Market Attractiveness Analysis by By Range, 2016-2032

- Figure 47: Western Europe Helicopters Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 48: Western Europe Helicopters Market Attractiveness Analysis by By Application, 2016-2032

- Figure 49: Western Europe Helicopters Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Helicopters Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Helicopters Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 54: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Figure 55: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 56: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 58: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Figure 59: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 60: Western Europe Helicopters Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Helicopters Market Share Comparison by By Type (2016-2032)

- Figure 62: Western Europe Helicopters Market Share Comparison by By Range (2016-2032)

- Figure 63: Western Europe Helicopters Market Share Comparison by By Application (2016-2032)

- Figure 64: Eastern Europe Helicopters Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 65: Eastern Europe Helicopters Market Attractiveness Analysis by By Type, 2016-2032

- Figure 66: Eastern Europe Helicopters Market Revenue (US$ Mn) Market Share by By Rangein 2022

- Figure 67: Eastern Europe Helicopters Market Attractiveness Analysis by By Range, 2016-2032

- Figure 68: Eastern Europe Helicopters Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 69: Eastern Europe Helicopters Market Attractiveness Analysis by By Application, 2016-2032

- Figure 70: Eastern Europe Helicopters Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Helicopters Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Helicopters Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 75: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Figure 76: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 77: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 79: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Figure 80: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 81: Eastern Europe Helicopters Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Helicopters Market Share Comparison by By Type (2016-2032)

- Figure 83: Eastern Europe Helicopters Market Share Comparison by By Range (2016-2032)

- Figure 84: Eastern Europe Helicopters Market Share Comparison by By Application (2016-2032)

- Figure 85: APAC Helicopters Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 86: APAC Helicopters Market Attractiveness Analysis by By Type, 2016-2032

- Figure 87: APAC Helicopters Market Revenue (US$ Mn) Market Share by By Rangein 2022

- Figure 88: APAC Helicopters Market Attractiveness Analysis by By Range, 2016-2032

- Figure 89: APAC Helicopters Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 90: APAC Helicopters Market Attractiveness Analysis by By Application, 2016-2032

- Figure 91: APAC Helicopters Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Helicopters Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Helicopters Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 96: APAC Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Figure 97: APAC Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 98: APAC Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 100: APAC Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Figure 101: APAC Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 102: APAC Helicopters Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Helicopters Market Share Comparison by By Type (2016-2032)

- Figure 104: APAC Helicopters Market Share Comparison by By Range (2016-2032)

- Figure 105: APAC Helicopters Market Share Comparison by By Application (2016-2032)

- Figure 106: Latin America Helicopters Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 107: Latin America Helicopters Market Attractiveness Analysis by By Type, 2016-2032

- Figure 108: Latin America Helicopters Market Revenue (US$ Mn) Market Share by By Rangein 2022

- Figure 109: Latin America Helicopters Market Attractiveness Analysis by By Range, 2016-2032

- Figure 110: Latin America Helicopters Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 111: Latin America Helicopters Market Attractiveness Analysis by By Application, 2016-2032

- Figure 112: Latin America Helicopters Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Helicopters Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Helicopters Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 117: Latin America Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Figure 118: Latin America Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 119: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 121: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Figure 122: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 123: Latin America Helicopters Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Helicopters Market Share Comparison by By Type (2016-2032)

- Figure 125: Latin America Helicopters Market Share Comparison by By Range (2016-2032)

- Figure 126: Latin America Helicopters Market Share Comparison by By Application (2016-2032)

- Figure 127: Middle East & Africa Helicopters Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 128: Middle East & Africa Helicopters Market Attractiveness Analysis by By Type, 2016-2032

- Figure 129: Middle East & Africa Helicopters Market Revenue (US$ Mn) Market Share by By Rangein 2022

- Figure 130: Middle East & Africa Helicopters Market Attractiveness Analysis by By Range, 2016-2032

- Figure 131: Middle East & Africa Helicopters Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 132: Middle East & Africa Helicopters Market Attractiveness Analysis by By Application, 2016-2032

- Figure 133: Middle East & Africa Helicopters Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Helicopters Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Helicopters Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 138: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Figure 139: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 140: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 142: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Figure 143: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 144: Middle East & Africa Helicopters Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Helicopters Market Share Comparison by By Type (2016-2032)

- Figure 146: Middle East & Africa Helicopters Market Share Comparison by By Range (2016-2032)

- Figure 147: Middle East & Africa Helicopters Market Share Comparison by By Application (2016-2032)

- List of Tables

- Table 1: Global Helicopters Market Comparison by By Type (2016-2032)

- Table 2: Global Helicopters Market Comparison by By Range (2016-2032)

- Table 3: Global Helicopters Market Comparison by By Application (2016-2032)

- Table 4: Global Helicopters Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Helicopters Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Helicopters Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 8: Global Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Table 9: Global Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 10: Global Helicopters Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 12: Global Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Table 13: Global Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 14: Global Helicopters Market Share Comparison by Region (2016-2032)

- Table 15: Global Helicopters Market Share Comparison by By Type (2016-2032)

- Table 16: Global Helicopters Market Share Comparison by By Range (2016-2032)

- Table 17: Global Helicopters Market Share Comparison by By Application (2016-2032)

- Table 18: North America Helicopters Market Comparison by By Range (2016-2032)

- Table 19: North America Helicopters Market Comparison by By Application (2016-2032)

- Table 20: North America Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Helicopters Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 24: North America Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Table 25: North America Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 26: North America Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 28: North America Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Table 29: North America Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 30: North America Helicopters Market Share Comparison by Country (2016-2032)

- Table 31: North America Helicopters Market Share Comparison by By Type (2016-2032)

- Table 32: North America Helicopters Market Share Comparison by By Range (2016-2032)

- Table 33: North America Helicopters Market Share Comparison by By Application (2016-2032)

- Table 34: Western Europe Helicopters Market Comparison by By Type (2016-2032)

- Table 35: Western Europe Helicopters Market Comparison by By Range (2016-2032)

- Table 36: Western Europe Helicopters Market Comparison by By Application (2016-2032)

- Table 37: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Helicopters Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 41: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Table 42: Western Europe Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 43: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 45: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Table 46: Western Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 47: Western Europe Helicopters Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Helicopters Market Share Comparison by By Type (2016-2032)

- Table 49: Western Europe Helicopters Market Share Comparison by By Range (2016-2032)

- Table 50: Western Europe Helicopters Market Share Comparison by By Application (2016-2032)

- Table 51: Eastern Europe Helicopters Market Comparison by By Type (2016-2032)

- Table 52: Eastern Europe Helicopters Market Comparison by By Range (2016-2032)

- Table 53: Eastern Europe Helicopters Market Comparison by By Application (2016-2032)

- Table 54: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Helicopters Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 58: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Table 59: Eastern Europe Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 60: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 62: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Table 63: Eastern Europe Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 64: Eastern Europe Helicopters Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Helicopters Market Share Comparison by By Type (2016-2032)

- Table 66: Eastern Europe Helicopters Market Share Comparison by By Range (2016-2032)

- Table 67: Eastern Europe Helicopters Market Share Comparison by By Application (2016-2032)

- Table 68: APAC Helicopters Market Comparison by By Type (2016-2032)

- Table 69: APAC Helicopters Market Comparison by By Range (2016-2032)

- Table 70: APAC Helicopters Market Comparison by By Application (2016-2032)

- Table 71: APAC Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Helicopters Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 75: APAC Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Table 76: APAC Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 77: APAC Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 79: APAC Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Table 80: APAC Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 81: APAC Helicopters Market Share Comparison by Country (2016-2032)

- Table 82: APAC Helicopters Market Share Comparison by By Type (2016-2032)

- Table 83: APAC Helicopters Market Share Comparison by By Range (2016-2032)

- Table 84: APAC Helicopters Market Share Comparison by By Application (2016-2032)

- Table 85: Latin America Helicopters Market Comparison by By Type (2016-2032)

- Table 86: Latin America Helicopters Market Comparison by By Range (2016-2032)

- Table 87: Latin America Helicopters Market Comparison by By Application (2016-2032)

- Table 88: Latin America Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Helicopters Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 92: Latin America Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Table 93: Latin America Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 94: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 96: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Table 97: Latin America Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 98: Latin America Helicopters Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Helicopters Market Share Comparison by By Type (2016-2032)

- Table 100: Latin America Helicopters Market Share Comparison by By Range (2016-2032)

- Table 101: Latin America Helicopters Market Share Comparison by By Application (2016-2032)

- Table 102: Middle East & Africa Helicopters Market Comparison by By Type (2016-2032)

- Table 103: Middle East & Africa Helicopters Market Comparison by By Range (2016-2032)

- Table 104: Middle East & Africa Helicopters Market Comparison by By Application (2016-2032)

- Table 105: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Helicopters Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 109: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by By Range (2016-2032)

- Table 110: Middle East & Africa Helicopters Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 111: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 113: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by By Range (2016-2032)

- Table 114: Middle East & Africa Helicopters Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 115: Middle East & Africa Helicopters Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Helicopters Market Share Comparison by By Type (2016-2032)

- Table 117: Middle East & Africa Helicopters Market Share Comparison by By Range (2016-2032)

- Table 118: Middle East & Africa Helicopters Market Share Comparison by By Application (2016-2032)

- 1. Executive Summary

-

- Airbus Helicopters Inc.

- Bell Helicopter Textron Inc.

- Russian Helicopters JSC

- Leonardo S.p.A.

- Lockheed Martin Corporation - Sikorsky

- Kawasaki Heavy Industries, Ltd.

- Columbia Helicopters, Inc.

- The Boeing Company

- MD Helicopters, Inc.

- Korea Aerospace Industries, Ltd.