Heat Transfer Fluids Market By Product Type (Silicones & Aromatics, Glycols, Mineral Oils, Others), By End-use (Chemical Processing, Oil and Gas, Renewable Energy, Food Processing & Packaging, Pharmaceuticals, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48308

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

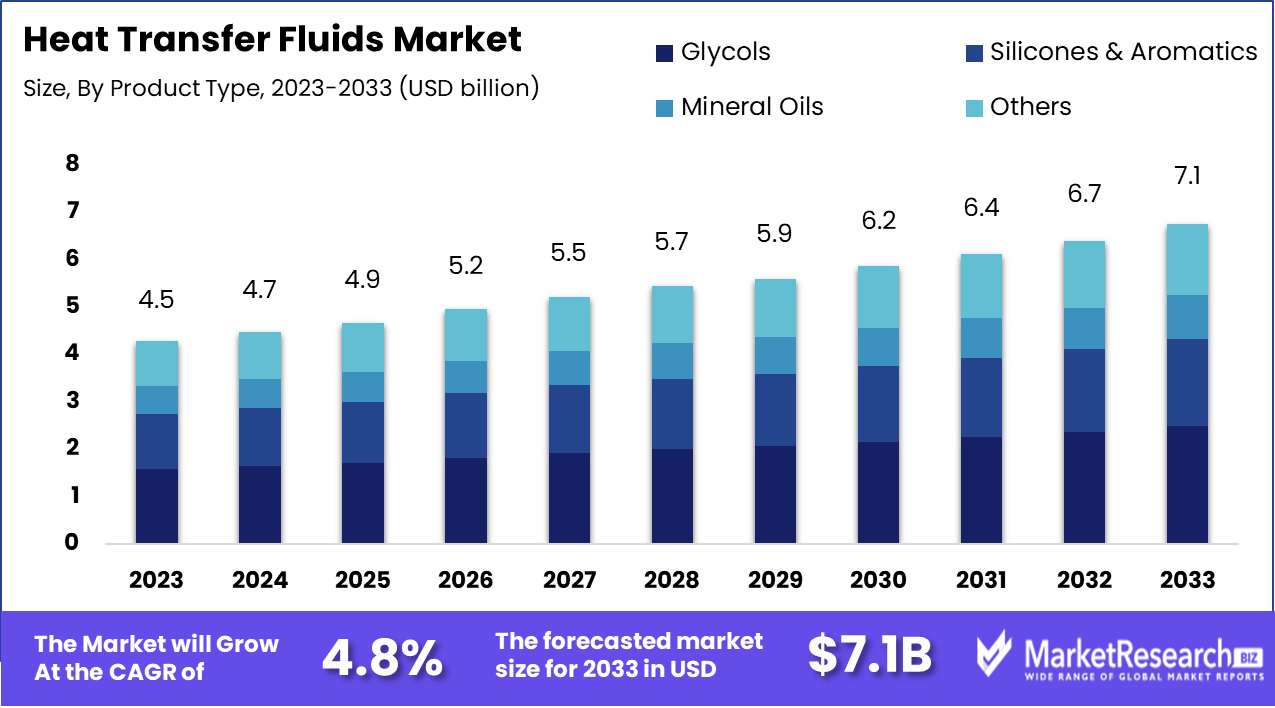

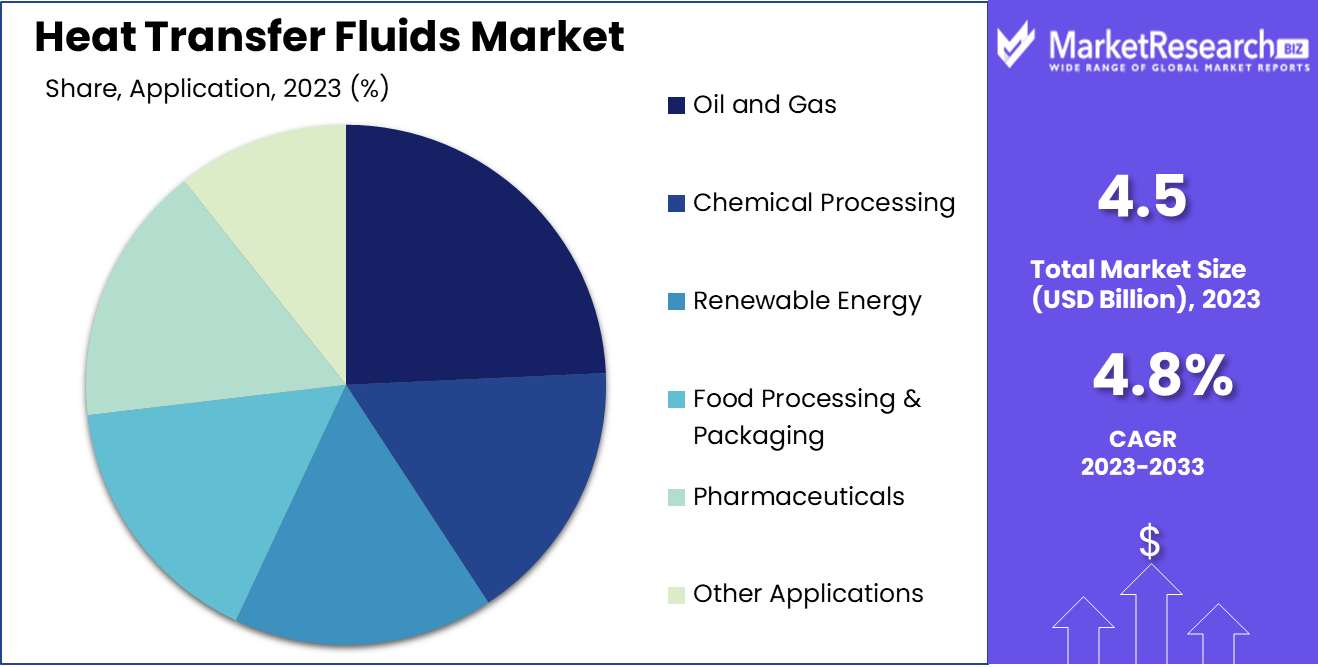

The Heat Transfer Fluids Market was valued at USD 4.5 billion in 2023. It is expected to reach USD 7.1 billion by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Heat Transfer Fluids Market encompasses the production, distribution, and utilization of specialized fluids designed to transfer heat efficiently within various industrial processes. These fluids, essential in applications such as chemical processing, HVAC, and renewable energy systems, enhance thermal management and operational efficiency. The market is driven by advancements in manufacturing technologies, increasing energy efficiency mandates, and the growth of high-temperature operations.

The heat transfer fluids (HTFs) market is poised for robust growth driven by a confluence of factors. The increasing focus on energy-efficient systems is catalyzing demand for advanced HTFs capable of operating at higher temperatures with greater stability. This trend is particularly pronounced in industries such as chemical, automotive, and oil & gas, which are rapidly expanding in emerging economies. The adoption of energy-efficient solutions in these sectors underscores a broader shift towards sustainability and operational efficiency, further propelling market expansion. Additionally, technological advancements in HTF formulations are enhancing thermal efficiency and reducing the environmental footprint, addressing key industry needs for innovation and compliance with stringent regulatory standards.

However, the market landscape is not without challenges. Price volatility in raw materials poses a significant risk to the cost structure of HTF manufacturers. Fluctuations in the prices of key inputs, such as synthetic and mineral oils, can lead to unpredictable manufacturing costs and impact profit margins. Despite these challenges, the continuous drive for technological innovation offers a pathway to mitigate these risks. Companies that can develop more resilient and cost-effective HTF solutions are likely to gain a competitive edge.

Overall, the HTF market is set for substantial growth, driven by advancements in technology, expanding industrial applications, and a global shift towards energy efficiency, albeit tempered by the inherent volatility in raw material prices.

Key Takeaways

- Market Growth: The Heat Transfer Fluids Market was valued at USD 4.5 billion in 2023. It is expected to reach USD 7.1 billion by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

- By Product Type: Glycols dominated the Heat Transfer Fluids market segment.

- By End-use: Oil and gas dominated the heat transfer fluids market.

- Regional Dominance: Asia Pacific leads the heat transfer fluids market with a 40% share.

- Growth Opportunity: The global heat transfer fluids market is set for robust growth, driven by geothermal energy adoption and automotive thermal management advancements.

Driving factors

Rising Demand for Energy-Efficient Solutions

The rising demand for energy-efficient solutions significantly propels the growth of the heat transfer fluids market. Industries are increasingly prioritizing energy efficiency to reduce operational costs and comply with stringent environmental regulations. This trend drives the adoption of advanced heat transfer fluids that offer superior thermal stability and lower viscosity, enhancing system efficiency.

According to industry reports, energy efficiency measures can reduce energy consumption by up to 20-30% in industrial processes. This significant potential for cost savings and environmental benefits incentivizes businesses to invest in high-performance heat transfer fluids. Furthermore, government incentives and regulations promoting energy conservation bolster the market, as companies seek to capitalize on these programs by upgrading their thermal management systems.

Increasing Adoption of Concentrated Solar Power (CSP) Globally

The increasing adoption of concentrated solar power (CSP) globally is a major driver for the heat transfer fluids market. CSP technology relies heavily on heat transfer fluids to absorb and transfer heat generated by solar energy to power turbines. The growth of CSP installations, particularly in sun-rich regions like the Middle East, North Africa, and parts of the United States, creates substantial demand for specialized heat transfer fluids.

For instance, the global CSP capacity is expected to grow at a compound annual growth rate (CAGR) of 10.1% from 2021 to 2028. This expansion directly correlates with increased demand for heat transfer fluids, which are critical for efficient energy conversion in CSP plants. The high thermal stability and specific heat properties required for CSP operations push manufacturers to develop and supply innovative fluid solutions, further stimulating market growth.

Technological Advancements in Heat Transfer Fluid Formulations

Technological advancements in heat transfer fluid formulations are pivotal in driving market growth. Continuous research and development efforts focus on enhancing the thermal properties, stability, and environmental safety of these fluids. Innovations such as nano-fluids, which incorporate nanoparticles to improve thermal conductivity, represent a significant leap forward in heat transfer technology.

Moreover, advancements in synthetic and bio-based heat transfer fluids cater to the growing demand for environmentally friendly and high-performance solutions. These innovations not only improve efficiency but also reduce the ecological footprint of industrial operations. For example, the introduction of high-performance glycol-based fluids with enhanced thermal stability has expanded their application across various industries, from HVAC systems to chemical processing.

Restraining Factors

Volatility in Raw Material Prices: A Significant Impediment to Market Stability

The heat transfer fluids (HTFs) market is highly sensitive to fluctuations in raw material prices, which primarily include petroleum-based products such as ethylene and propylene. Price volatility in these raw materials can be attributed to several factors including geopolitical tensions, fluctuations in crude oil prices, and supply chain disruptions.

Such instability directly impacts the cost structure of heat transfer fluids, leading to unpredictable pricing strategies for end consumers. For instance, a sharp increase in crude oil prices can elevate production costs, compelling manufacturers to pass these costs onto consumers, thereby reducing demand. Conversely, periods of price drops may temporarily boost demand but also create uncertainty and hesitation among manufacturers to invest in long-term production capabilities.

This price volatility not only strains the profitability margins of manufacturers but also hampers the market’s ability to sustain consistent growth. It affects the planning and forecasting capabilities of businesses reliant on HTFs, creating a ripple effect of inefficiencies and potentially slowing market expansion. According to market analysis, raw material costs account for approximately 40-50% of the total production cost of heat transfer fluids, underscoring the profound impact price fluctuations can have on the market.

Availability of Substitutes: Competing Solutions Curtailing Market Penetration

The availability of substitutes represents another formidable challenge to the growth of the heat transfer fluids market. Alternatives such as water-glycol mixtures, synthetic oils, and solid-state heat transfer technologies offer competitive advantages in various applications, particularly where cost-effectiveness and environmental sustainability are paramount.

Water-glycol mixtures, for example, are commonly used in applications requiring non-flammable, low-toxicity fluids, particularly in HVAC systems and automotive applications. Synthetic oils, while more expensive, offer superior thermal stability and longevity, making them attractive for high-temperature applications.

The development and adoption of these substitutes are often driven by advancements in technology and shifts in regulatory landscapes aimed at promoting environmental sustainability. As industries increasingly prioritize eco-friendly and cost-effective solutions, the heat transfer fluids market faces growing competition. This competition is further intensified by the stringent environmental regulations targeting the reduction of volatile organic compounds (VOCs) and other hazardous emissions associated with certain HTFs.

By Product Type Analysis

In 2023, Glycols dominated the Heat Transfer Fluids market segment.

In 2023, The Glycols-Based Segment held a dominant market position in the By Product Type segment of the Heat Transfer Fluids Market. The market for heat transfer fluids is segmented into Silicones & Aromatics, Glycols, Mineral Oils, and Others. Glycols, particularly ethylene and propylene glycol, are favored due to their high thermal conductivity, low viscosity at various temperatures, and excellent antifreeze properties, making them indispensable in a wide range of industrial applications, including HVAC systems, automotive cooling, and industrial heat exchangers.

Silicones & Aromatics, known for their stability at extreme temperatures, cater to niche applications requiring superior thermal performance, such as in chemical processing and solar power plants. Despite their higher cost, their reliability in demanding environments underpins their consistent demand.

Mineral Oils are valued for their cost-effectiveness and are widely used in applications where temperature fluctuations are moderate. Their market share is bolstered by their compatibility with a broad range of equipment and operational settings.

The Others category encompasses bio-based heat transfer fluids and other synthetic fluids, which are gaining traction due to the increasing focus on sustainability and stringent environmental regulations. As industries seek greener alternatives, these fluids are poised for growth despite their current lower market share.

By End-use Analysis

Oil and Gas dominated the heat transfer fluids market in 2023.

In 2023, The Oil and Gas segment held a dominant market position in the heat transfer fluids market, underscoring the critical role of these fluids in maintaining operational efficiency and safety. This sector's demand is driven by the need for precise temperature control in various processes, including drilling, refining, and petrochemical production. The heat transfer fluids are essential for ensuring that operations remain within the desired temperature ranges, thereby preventing equipment failures and optimizing performance.

Chemical Processing follows closely, leveraging heat transfer fluids to maintain consistent temperatures during chemical reactions, which is vital for product quality and safety. The growing complexity and scale of chemical processes further fuel demand in this segment.

Renewable Energy is emerging as a significant market, particularly in concentrated solar power (CSP) plants, where heat transfer fluids are used to store and transfer solar energy. This segment is set for rapid growth due to increasing investments in sustainable energy solutions.

In Food Processing & Packaging, heat transfer fluids ensure the safe and efficient heating and cooling of products, maintaining food safety standards and extending shelf life. The sector's expansion is driven by the rising global demand for processed foods.

Pharmaceuticals utilize these fluids in the precise temperature management required during the manufacturing of drugs, ensuring product efficacy and compliance with stringent regulations.

Lastly, the Others category encompasses diverse applications such as electronics cooling and HVAC systems, reflecting the broad utility of heat transfer fluids across various industries. Each segment's growth trajectory is influenced by technological advancements, regulatory frameworks, and economic trends, making the heat transfer fluids market a dynamic and integral component of industrial operations.

Key Market Segments

By Product Type

- Silicones & Aromatics

- Glycols

- Mineral Oils

- Others

By End-use

- Chemical Processing

- Oil and Gas

- Renewable Energy

- Food Processing & Packaging

- Pharmaceuticals

- Others

Growth Opportunity

Increasing Adoption of Geothermal Energy

The global heat transfer fluids market is poised for significant growth, driven primarily by the increasing adoption of geothermal energy. Geothermal energy, a renewable and sustainable source, is becoming more attractive due to its low environmental impact and reliability. The market for geothermal energy is projected to expand at a CAGR of over 6% through 2024, fueling demand for efficient heat transfer fluids essential for optimizing energy transfer and storage. With governments and private sectors investing heavily in renewable energy projects, the heat transfer fluids market is set to benefit from the enhanced focus on sustainable energy solutions.

Advancements in Automotive Thermal Management

Advancements in automotive thermal management technologies present another substantial growth opportunity for the heat transfer fluids market. The automotive industry is undergoing a transformation with the shift towards electric and hybrid vehicles, which require sophisticated thermal management systems to ensure optimal performance and safety. The global market for automotive thermal management systems is expected to grow significantly, driven by the increasing production of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which are anticipated to account for 30% of global vehicle sales by 2030. This surge in demand for advanced thermal management solutions directly correlates with a rising need for high-performance heat transfer fluids, which are critical in managing the temperatures of batteries and other components.

Latest Trends

Eco-friendly and Non-toxic Options

The heat transfer fluids (HTF) market is witnessing a significant shift towards eco-friendly and non-toxic options. This transition is driven by stringent environmental regulations and increasing awareness of sustainable practices. Manufacturers are focusing on developing biodegradable and low-toxicity fluids, such as glycols derived from renewable sources and silicone-based fluids with low environmental impact. These innovations are not only aligning with global sustainability goals but also meeting consumer demand for safer and more environmentally responsible products. This trend is expected to continue, with further advancements in formulation and wider adoption across industries.

Suitability for Renewable Energy Applications

The suitability of HTFs for renewable energy applications is another critical trend shaping the market. As the world accelerates its shift towards renewable energy sources, the demand for efficient and reliable heat transfer solutions in solar thermal and geothermal systems is rising. HTFs play a crucial role in these applications, ensuring optimal thermal management and energy efficiency. Innovations in this area include the development of high-temperature stable fluids and those with enhanced thermal conductivity, which are essential for improving the performance and longevity of renewable energy systems. This trend highlights the growing intersection between the HTF market and the renewable energy sector, driving technological advancements and market growth.

Regional Analysis

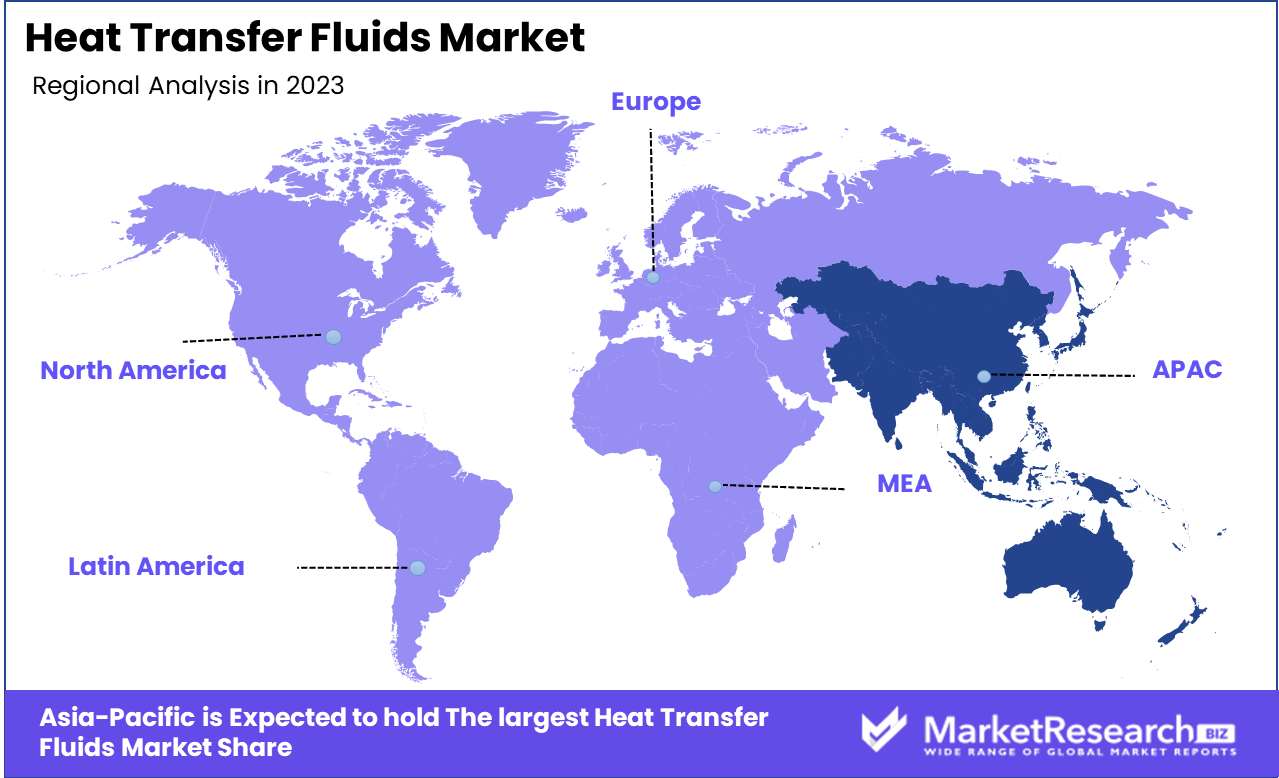

Asia Pacific leads the heat transfer fluids market with a 40% largest share.

The heat transfer fluids market exhibits varied growth dynamics across different regions, with Asia Pacific emerging as the dominant force. In North America, the market is bolstered by the significant presence of the chemical and pharmaceutical industries, with the U.S. leading in innovation and adoption of advanced thermal management solutions. Europe follows closely, driven by stringent regulatory standards and a robust automotive sector, with Germany and France being key contributors.

The Asia Pacific region, however, stands out as the largest and fastest-growing market, accounting for approximately 40% of the global share. This growth is primarily fueled by rapid industrialization, expanding manufacturing sectors, and increasing demand for energy-efficient solutions in countries like China and India.

The Middle East & Africa region is witnessing steady growth, underpinned by the oil & gas industry and infrastructural development, particularly in the UAE and Saudi Arabia. Meanwhile, Latin America shows promising potential with Brazil and Mexico driving demand through their burgeoning industrial activities and improving economic conditions. Collectively, these regional trends underscore the critical role of localized factors in shaping the global heat transfer fluids market, with Asia Pacific at the forefront due to its substantial industrial base and favorable economic landscape.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Heat Transfer Fluids (HTF) market in 2024 is shaped by several key players, each bringing distinct strengths to the industry.

Arkema and Eastman Chemical Company are leading innovators, leveraging extensive research and development to enhance product performance and sustainability. Their diversified portfolios and strong global presence position them as market leaders.

Dow Chemicals and Exxon Mobil Corporation are notable for their robust supply chains and vast manufacturing capacities, enabling them to meet high demand and ensure consistent product availability. These companies also benefit from significant economies of scale, driving competitive pricing strategies.

Indian Oil and Bharat Petroleum, key players in the Indian market, capitalize on the region's growing industrial sector. Their extensive distribution networks and strong governmental ties facilitate market penetration and expansion in Asia.

Specialty players like Dynalene, Inc., and Paratherm focus on niche applications, offering customized solutions that cater to specific industry needs. Their agility in innovation and customer-centric approach allow them to capture market segments that require specialized products.

Phillips 66 and Therminol are renowned for their high-performance HTFs, which are critical in demanding applications such as chemical processing and energy production. Their commitment to quality and reliability ensures sustained demand from high-stakes industries.

Collectively, these companies drive the HTF market through innovation, strategic expansions, and customer-focused solutions, ensuring robust growth and a dynamic competitive landscape in 2024.

Market Key Players

- Arkema

- Bharat Petroleum

- Castrol

- Dalian Richfortune Chemicals

- Dow Chemicals

- Dynalene, Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Fernox

- Hindustan Petroleum Corporation Ltd.

- Honeywell International

- Indian Oil

- Lytron Inc.

- Paratherm, Schultz Chemicals

- Phillips 66

- Radco Industries

- Therminol

Recent Development

- In April 2024, Eastman Chemical Company launched its "GreenStream™" initiative, focusing on the development of eco-friendly heat transfer fluids derived from renewable resources. The initiative aligns with Eastman's commitment to sustainability and aims to reduce the environmental impact of industrial heating and cooling processes.

- In March 2024, BASF SE announced a strategic partnership with Siemens Energy to develop and commercialize innovative heat transfer fluid solutions for industrial heating and cooling systems. This collaboration aims to leverage BASF's advanced chemical expertise and Siemens Energy's engineering prowess to deliver high-performance, sustainable heat transfer fluids.

- In January 2024, Dow Inc. introduced a new line of silicone-based heat transfer fluids designed for high-temperature applications in the chemical processing and solar power industries. The new product, named "DOWTHERM™ HTP," is formulated to enhance thermal stability and efficiency, promising longer operational life and reduced maintenance costs.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Billion Forecast Revenue (2033) USD 7.1 Billion CAGR (2024-2032) 4.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Silicones & Aromatics, Glycols, Mineral Oils, Others), By End-use (Chemical Processing, Oil and Gas, Renewable Energy, Food Processing & Packaging, Pharmaceuticals, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Arkema, Bharat Petroleum, Castrol, Dalian Richfortune Chemicals, Dow Chemicals, Dynalene, Inc., Eastman Chemical Company, Exxon Mobil Corporation, Fernox, Hindustan Petroleum Corporation Ltd., Honeywell International, Indian Oil, Lytron Inc., Paratherm, Schultz Chemicals, Phillips 66, Radco Industries, Therminol Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Arkema

- Bharat Petroleum

- Castrol

- Dalian Richfortune Chemicals

- Dow Chemicals

- Dynalene, Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Fernox

- Hindustan Petroleum Corporation Ltd.

- Honeywell International

- Indian Oil

- Lytron Inc.

- Paratherm, Schultz Chemicals

- Phillips 66

- Radco Industries

- Therminol