Harbor Deepening Market By Type (Underwater Deepening and Partially Underwater Deepening), By Application (Government Organizations, Private Organizations, Mining & Energy Companies, Oil & Gas Companies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48051

-

June 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

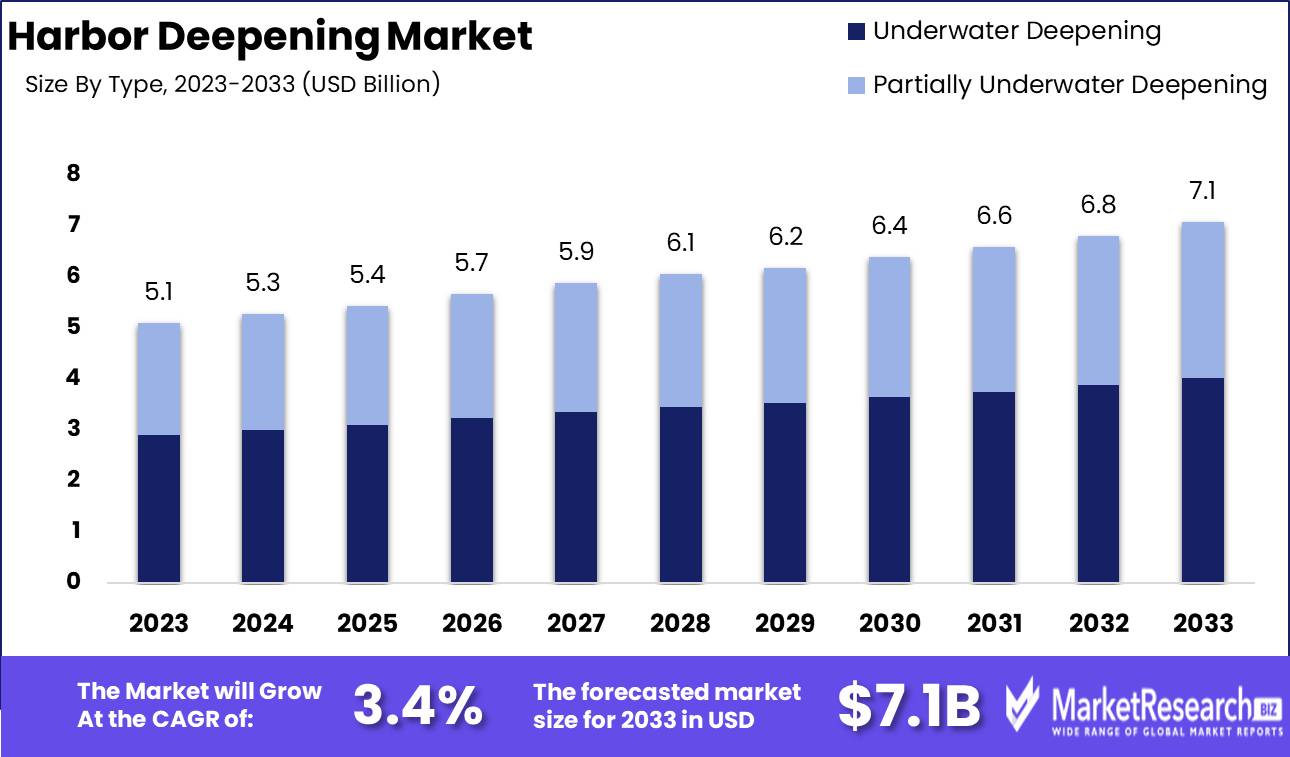

The Harbor Deepening Market was valued at USD 5.1 billion in 2023. It is expected to reach USD 7.1 billion by 2033, with a CAGR of 3.4% during the forecast period from 2024 to 2033.

The Harbor Deepening Market encompasses activities related to the dredging and deepening of harbors, channels, and ports to accommodate larger vessels, enhance shipping efficiency, and support global trade expansion.

The Harbor Deepening Market involves advanced engineering services, specialized dredging equipment, and environmental management practices. Driven by the surge in global maritime trade, increasing vessel sizes, and port modernization initiatives, the harbor deepening sector is critical for maintaining competitive port operations and ensuring maritime safety. Key stakeholders include port authorities, shipping companies, and construction firms, with a focus on sustainable practices to mitigate environmental impact while boosting economic growth.

The harbor deepening market is poised for significant growth driven by several critical factors, reflecting the broader trends in global trade and sustainability. Firstly, the rise in global trade volumes necessitates the expansion and deepening of ports to accommodate larger vessels. This trend is underscored by the increasing size of container ships, which demand deeper ports to facilitate efficient and cost-effective operations. As international trade continues to expand, the strategic importance of deep-water ports will become increasingly pronounced, necessitating substantial investments in dredging and port infrastructure.

Furthermore, there is a growing emphasis on environmentally sustainable dredging practices to minimize ecological impact. Regulatory pressures and corporate social responsibility initiatives are driving the adoption of greener technologies and methods in harbor deepening projects. Advances in dredging technology are pivotal in this context, offering enhanced efficiency while reducing environmental footprint. Additionally, increased investment in port infrastructure by governments and private stakeholders is anticipated to bolster market growth. These investments are crucial not only for maintaining a competitive edge in global trade but also for ensuring compliance with environmental regulations.

Collectively, these factors position the harbor-deepening market for robust expansion, underscoring the need for a balanced approach that integrates economic, technological, and environmental considerations.

Key Takeaways

- Market Growth: The Harbor Deepening Market was valued at USD 5.1 billion in 2023. It is expected to reach USD 7.1 billion by 2033, with a CAGR of 3.4% during the forecast period from 2024 to 2033.

- By Type: Underwater Deepening dominated the harbor deepening market by type.

- By Application: Mining & Energy Companies dominated harbor deepening investments for global trade.

- Regional Dominance: Asia Pacific dominates the Harbor Deepening Market with a 40% share.

- Growth Opportunity: The harbor deepening market offers significant growth opportunities driven by increasing global trade and effective public-private partnerships.

Driving factors

Growing Demand for Larger Vessels: A Catalyst for Harbor Deepening Investments

The global shipping industry has experienced a significant upsurge in the construction and deployment of larger vessels, including mega container ships and bulk carriers. These vessels, driven by economies of scale and the need to optimize logistics costs, require deeper harbors to accommodate their increased draft requirements. As a result, ports worldwide are investing heavily in deepening their harbors to remain competitive and capable of handling these larger ships.

According to industry statistics, the average size of container ships has nearly doubled over the past decade, with the largest vessels now exceeding 23,000 TEU (Twenty-Foot Equivalent Units). This trend is expected to continue, prompting port authorities to undertake extensive dredging projects to deepen their harbors. For instance, the Port of Rotterdam and the Port of Los Angeles have both announced multi-billion dollar investments in harbor deepening to support the influx of larger vessels.

The growing demand for larger vessels not only drives the need for harbor deepening but also stimulates ancillary industries such as dredging equipment manufacturing and maritime infrastructure development. This dynamic creates a positive feedback loop, further accelerating market growth.

Rising Demand for Coastal Protection: Enhancing Harbor Resilience and Sustainability

As coastal areas face increasing threats from climate change, including rising sea levels and more frequent severe weather events, the demand for coastal protection measures has surged. Harbor deepening projects often integrate coastal protection initiatives, such as the construction of seawalls, breakwaters, and other protective barriers, to safeguard ports from erosion and flooding.

This dual-purpose approach not only ensures the operational continuity of harbors but also aligns with broader environmental sustainability goals. Investments in coastal protection enhance the resilience of harbor infrastructure, making them more attractive to shipping lines and logistics companies that prioritize reliability and environmental stewardship.

Statistics indicate that global spending on coastal protection measures is projected to exceed $50 billion annually by 2025, reflecting a robust growth trajectory. This substantial investment in coastal protection directly benefits the harbor deepening market, as integrated projects become more common and necessary to mitigate the risks associated with climate change.

Urbanization and Population Growth: Driving Port Capacity Expansion

The rapid urbanization and population growth in coastal regions around the world have significantly increased the demand for port capacity expansion. As urban centers grow, so does the need for efficient maritime logistics to support the influx of goods and materials required for urban development and consumption.

Harbor deepening plays a crucial role in expanding port capacity, enabling ports to handle larger volumes of cargo and accommodate the increased traffic from burgeoning urban populations. For example, Asia-Pacific, home to some of the fastest-growing urban areas, has seen significant investments in harbor deepening to support economic growth and international trade. The region accounts for nearly 40% of the global harbor deepening projects, driven by countries like China, India, and Indonesia.

Urbanization not only demands larger and more efficient ports but also necessitates the development of adjacent infrastructure, such as roads, railways, and logistics hubs. This holistic development approach further propels the harbor deepening market, as it becomes integral to regional and national economic strategies aimed at sustaining growth and competitiveness.

Restraining Factors

High Cost and Complexity of Harbor Deepening Projects: A Major Restraint on Market Expansion

The harbor deepening market is significantly constrained by the high costs and complexities associated with these projects. Harbor deepening involves substantial financial investments in dredging equipment, labor, and technology. For instance, the average cost of a large-scale harbor deepening project can range from $500 million to over $1 billion, depending on the scope and geographic location. This financial burden is a major deterrent for port authorities and private investors, particularly in regions where funding is limited or economic conditions are unstable.

Additionally, the complexity of these projects exacerbates the financial challenges. Harbor deepening requires precise engineering and planning to ensure the stability and sustainability of the expanded waterways. The intricacy of the work demands specialized skills and advanced technologies, leading to increased project durations and a higher risk of cost overruns. For example, unforeseen geological conditions or technical issues can significantly escalate costs and delay project completion. This complexity not only inflates initial expenses but also raises the risk profile of these investments, making it difficult to secure necessary funding and insurance.

Regulatory Hurdles and Environmental Concerns: Significant Barriers to Market Development

The harbor deepening market faces substantial regulatory hurdles and environmental concerns that further constrain its growth. Regulatory frameworks governing harbor deepening are often stringent and multifaceted, requiring extensive compliance with local, national, and international laws. These regulations are designed to protect marine ecosystems, coastal regions, and water quality, which can be severely impacted by dredging activities.

Obtaining the necessary permits and approvals for harbor deepening projects can be a protracted and complex process. Environmental impact assessments (EIAs) are mandatory in most jurisdictions, involving detailed studies and consultations with multiple stakeholders, including government agencies, environmental groups, and the public. These assessments aim to evaluate the potential adverse effects on marine habitats, biodiversity, and water quality. For instance, dredging operations can disrupt sediment layers, release harmful substances, and threaten marine life, leading to stringent regulatory scrutiny and potential project delays.

Environmental concerns also play a pivotal role in shaping public opinion and regulatory policies. Advocacy from environmental organizations and community groups can lead to increased regulatory oversight and more stringent environmental standards. This, in turn, can result in higher compliance costs and longer approval timelines for harbor-deepening projects.

By Type Analysis

In 2023, Underwater Deepening dominated the harbor deepening market by type.

In 2023, Underwater Deepening held a dominant market position in the By Type segment of the Harbor Deepening Market. This sub-segment encompasses the full-scale excavation and removal of underwater sediments to achieve the desired depth for harbors, which is critical for accommodating larger vessels and enhancing port efficiency. The increasing global maritime trade, coupled with the necessity to upgrade existing port infrastructure to handle larger container ships, significantly drove demand for underwater deepening. This process involves advanced dredging technologies and techniques, ensuring precise and efficient deepening operations, minimizing environmental impact, and optimizing port operations.

On the other hand, Partially Underwater Deepening, which involves a combination of underwater and above-water excavation activities, also saw considerable growth. This method is often employed in scenarios where only specific sections of the harbor require deepening, allowing for targeted and cost-effective dredging operations. The flexibility and reduced operational costs associated with partially underwater deepening make it an attractive option for ports with budget constraints or those requiring incremental deepening projects. Overall, both sub-segments contribute to enhancing harbor capabilities, though underwater deepening remains the preferred choice for comprehensive port modernization efforts.

By Application Analysis

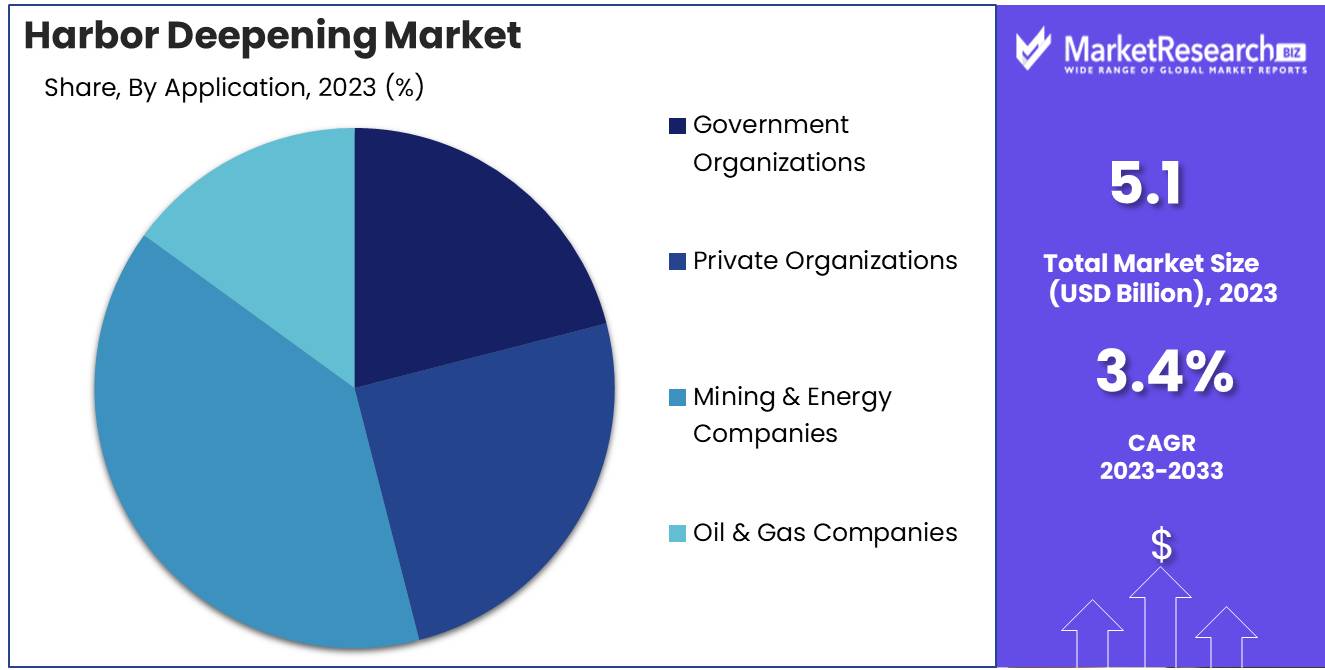

In 2023, Mining & Energy Companies dominated the harbor deepening investments for global trade.

In 2023, Mining & Energy Companies held a dominant market position in the "By Application" segment of the Harbor Deepening Market. The strategic imperative to ensure efficient and reliable access to global trade routes has driven substantial investments by these companies. As demand for minerals and energy resources continues to grow, the need for deep-water harbors capable of accommodating larger vessels becomes critical. This demand is propelled by the expansion of global trade and the necessity to streamline logistics and reduce transportation costs.

Government Organizations also play a significant role, often partnering with private entities to fund and facilitate harbor-deepening projects. These collaborations aim to enhance national infrastructure, support economic growth, and ensure the sustainability of maritime operations.

Private Organizations are increasingly involved, seeking to capitalize on the commercial opportunities presented by improved port accessibility. Their investments focus on boosting operational efficiency and competitiveness in the global market.

Oil & Gas Companies, similar to Mining & Energy Companies, require deeper harbors to handle large oil tankers and gas carriers. Their investments in harbor deepening projects are driven by the need to optimize supply chains, reduce delivery times, and enhance the safety and reliability of transport operations.

Key Market Segments

By Type

- Underwater Deepening

- Partially Underwater Deepening

By Application

- Government Organizations

- Private Organizations

- Mining & Energy Companies

- Oil & Gas Companies

Growth Opportunity

Increasing Global Trade and the Need for Larger Ships

The surge in global trade and the growing demand for larger vessels present substantial opportunities for the harbor-deepening market. As international commerce continues to expand, ports worldwide must accommodate mega-ships that require deeper and wider harbors. This trend is driven by the efficiency and cost-effectiveness of larger ships, which can transport more goods per voyage, thereby reducing shipping costs.

Consequently, ports that can support these vessels stand to gain a competitive edge, fostering regional economic growth and attracting more shipping lines. According to industry forecasts, global container traffic is expected to grow by 4.5% annually, further underscoring the urgent need for harbor-deepening projects to meet this demand.

Public-Private Partnerships

The rise of public-private partnerships (PPPs) is another significant driver of growth in the harbor-deepening market. Governments increasingly recognize the necessity of modernizing port infrastructure but often lack the financial resources to undertake such capital-intensive projects independently. PPPs offer a viable solution by leveraging private sector investment and expertise to achieve public infrastructure goals. These partnerships can expedite project timelines, improve efficiency, and ensure high standards of construction and maintenance.

In recent years, notable PPP initiatives in port development have demonstrated their effectiveness, with successful projects yielding enhanced port capacities and significant economic benefits. For instance, the collaborative efforts in expanding the Port of Rotterdam and the Suez Canal have proven the transformative potential of PPPs in harbor deepening.

Latest Trends

Advancements in Dredging Equipment and Techniques

The harbor deepening market is set to experience significant advancements in dredging equipment and techniques. Modern dredging technologies are evolving to become more efficient, environmentally friendly, and cost-effective. Innovations such as hybrid and electric dredgers are reducing fuel consumption and emissions, aligning with global sustainability goals.

Additionally, the integration of real-time monitoring systems enhances the precision of dredging operations, minimizing environmental impact and optimizing resource utilization. These technological improvements are crucial for accommodating larger vessels and increasing port capacities, thereby supporting global trade growth.

Increasing Use of Automation and AI in Project Planning and Execution

Automation and artificial intelligence (AI) are revolutionizing project planning and execution within the harbor-deepening market. We anticipate a surge in the adoption of AI-driven analytics for project management, enabling more accurate forecasting and risk assessment. Automated systems are being deployed to manage dredging operations, enhancing efficiency and safety. These systems can continuously monitor and adjust operations, ensuring optimal performance and reducing human error.

Furthermore, AI algorithms are being used to analyze vast amounts of data, providing insights that inform decision-making processes and improve project outcomes. This shift towards digitalization not only streamlines operations but also reduces costs and enhances project timelines, making harbor-deepening projects more economically viable.

Regional Analysis

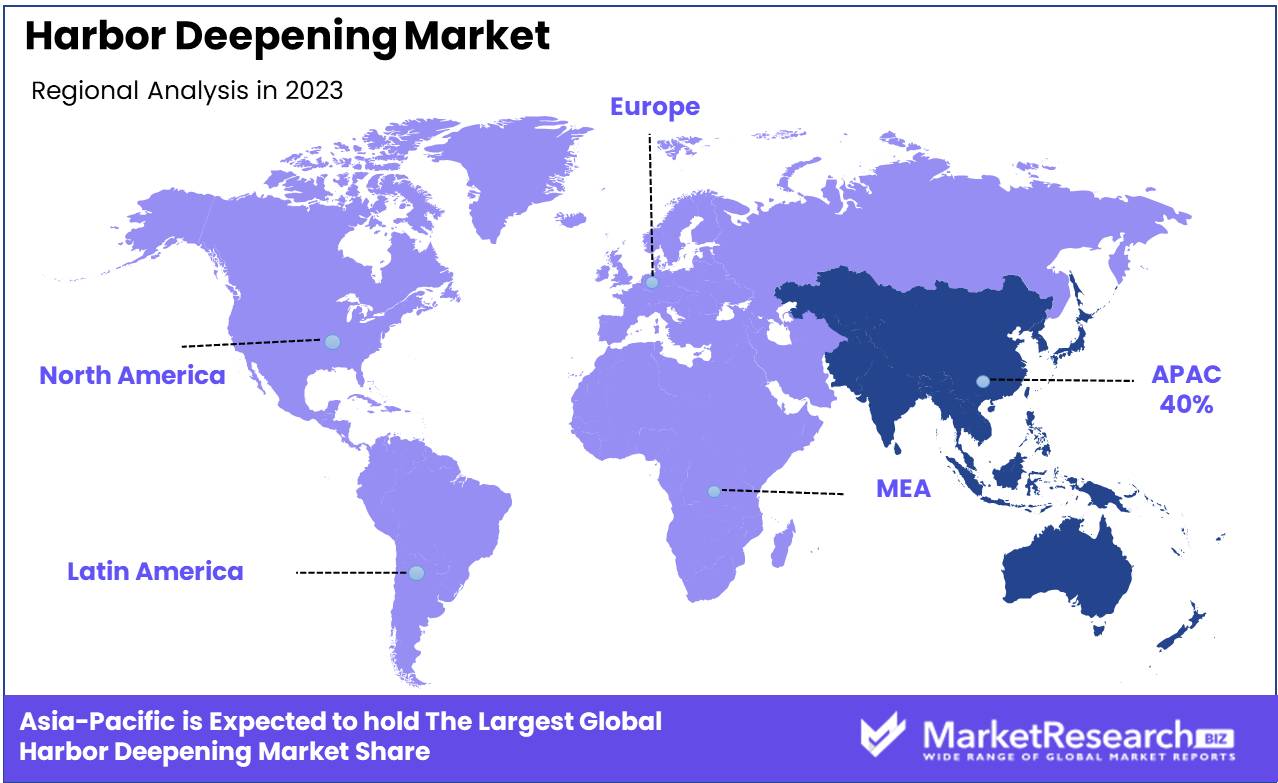

Asia Pacific dominates the Harbor Deepening Market with a 40% share.

The Harbor Deepening Market exhibits significant regional variations, with Asia Pacific emerging as the dominant force, holding approximately 40% of the global market share. This region's supremacy is driven by rapid economic growth, extensive maritime trade activities, and substantial investments in port infrastructure across countries such as China, India, and Japan. China, for instance, has been aggressively deepening its ports to accommodate larger vessels, supporting its role as a global trade hub.

North America follows, accounting for around 25% of the market. The United States, with its expansive coastline and major ports like Los Angeles and Long Beach, leads in harbor-deepening projects to maintain competitiveness and manage increasing cargo volumes. Europe, with a 20% market share, emphasizes modernizing its ports in response to growing maritime trade and environmental regulations, with notable projects in the Netherlands and Germany.

The Middle East & Africa region holds about 10% of the market, driven by strategic initiatives to enhance port capabilities, particularly in the UAE and Saudi Arabia, aiming to bolster their positions as key global logistics centers. Latin America, contributing around 5%, is seeing incremental growth, with countries like Brazil and Panama investing in harbor deepening to support burgeoning trade routes.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global harbor deepening market in 2024 is characterized by robust competition among several key players, each leveraging their unique capabilities and regional strengths to drive market dynamics.

DEME and Jan De Nul, both based in Belgium, continue to be front-runners due to their advanced technological solutions and significant project portfolios across Europe, Africa, and Asia. These companies are well-positioned to capitalize on the increasing demand for harbor deepening in emerging markets.

Great Lakes Dredge & Dock Company, a dominant player in the U.S., is expected to maintain its leadership through substantial investments in new dredging technologies and a strong focus on the North American market, supported by government infrastructure initiatives.

Royal Boskalis Westminster and Van Oord Dredging & Marine Contractors, both headquartered in the Netherlands, are likely to strengthen their market positions through strategic acquisitions and expanding their project capabilities in the Middle East and Asia-Pacific regions.

Asian firms such as CHEC, Hyundai E&C, and TOA Corporation are anticipated to experience growth driven by the escalating infrastructure projects in Asia, particularly in China and Southeast Asia. Their competitive pricing and extensive local knowledge give them an edge in these rapidly developing markets.

The Indian market is primarily dominated by the Dredging Corporation of India, which is expected to benefit from the Indian government's emphasis on port modernization and capacity expansion.

Other notable players like National Marine Dredging, Cashman Dredging, and Inai Kiara are strategically enhancing their operational efficiencies and expanding their geographic reach to capture a larger market share.

Market Key Players

- DEME

- Jan De Nul

- Great Lakes Dredge & Dock Company

- Royal Boskalis Westmister

- Van Oord Dredging & Marine Contractors

- CHEC

- Penta Ocean

- Hyundai E&C

- TOA Corporation

- Dredging Corporation of India

- National Marine Dredging

- Cashman Dredging

- Inai Kiara

- Rohde Nielsen

- Norfolk Dredging

- Starhigh Asia Pacific Pte Ltd

- Weeks Marine Inc.

- Orion Marine Group

- J.F. Brennan

- Salmons Dredging Corporations

- BEAN

- Ellicott Dredges

- CCCC Tianjin Dredging Co., Ltd.

Recent Development

- In May 2024, The Port of Rotterdam Authority completed the Maasvlakte 2 expansion project, which included significant harbor deepening efforts. Finished in May 2024, this project has deepened the port’s access channel to 24 meters (approximately 79 feet), positioning Rotterdam as a key transshipment hub in Europe capable of handling the largest container ships in the world.

- In April 2024, The Port of Long Beach initiated a new $1 billion harbor deepening project. The plan, approved in April 2024, aims to deepen the port’s main channel to 55 feet by 2028. This project is part of the port’s long-term strategy to accommodate the next generation of ultra-large container vessels, ensuring the port remains a pivotal hub in the global supply chain.

- In March 2024, The U.S. Army Corps of Engineers announced the completion of the Charleston Harbor Deepening Project. This $550 million initiative, which began in 2016, has deepened the harbor to 52 feet, making it the deepest harbor on the East Coast. This development is expected to significantly enhance the port’s capacity to accommodate larger container ships and improve the overall competitiveness of the port.

Report Scope

Report Features Description Market Value (2023) USD 5.1 Billion Forecast Revenue (2033) USD 7.1 Billion CAGR (2024-2032) 3.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Underwater Deepening and Partially Underwater Deepening), By Application (Government Organizations, Private Organizations, Mining & Energy Companies, Oil & Gas Companies) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape DEME, Jan De Nul, Great Lakes Dredge & Dock Company, Royal Boskalis Westmister, Van Oord Dredging & Marine Contractors, CHEC, Penta Ocean, Hyundai E&C, TOA Corporation, Dredging Corporation of India, National Marine Dredging, Cashman Dredging, Inai Kiara, Rohde Nielsen, Norfolk Dredging, Starhigh Asia Pacific Pte Ltd, Weeks Marine Inc., Orion Marine Group, J.F. Brennan, Salmons Dredging Corporations, BEAN, Ellicott Dredges, CCCC Tianjin Dredging Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DEME

- Jan De Nul

- Great Lakes Dredge & Dock Company

- Royal Boskalis Westmister

- Van Oord Dredging & Marine Contractors

- CHEC

- Penta Ocean

- Hyundai E&C

- TOA Corporation

- Dredging Corporation of India

- National Marine Dredging

- Cashman Dredging

- Inai Kiara

- Rohde Nielsen

- Norfolk Dredging

- Starhigh Asia Pacific Pte Ltd

- Weeks Marine Inc.

- Orion Marine Group

- J.F. Brennan

- Salmons Dredging Corporations

- BEAN

- Ellicott Dredges

- CCCC Tianjin Dredging Co., Ltd.