Global Halal Meat Market By Type (Poultry, Sheep & Goat, Beef, Others), By Certification Type (Halal Certification, Non-Certified), By Packaging Type (Fresh meat, Frozen meat), By End-User (Household Consumers, Retailers, Food Service Sector, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51469

-

February 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Certification Type Analysis

- By Packaging Type Analysis

- By End-User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

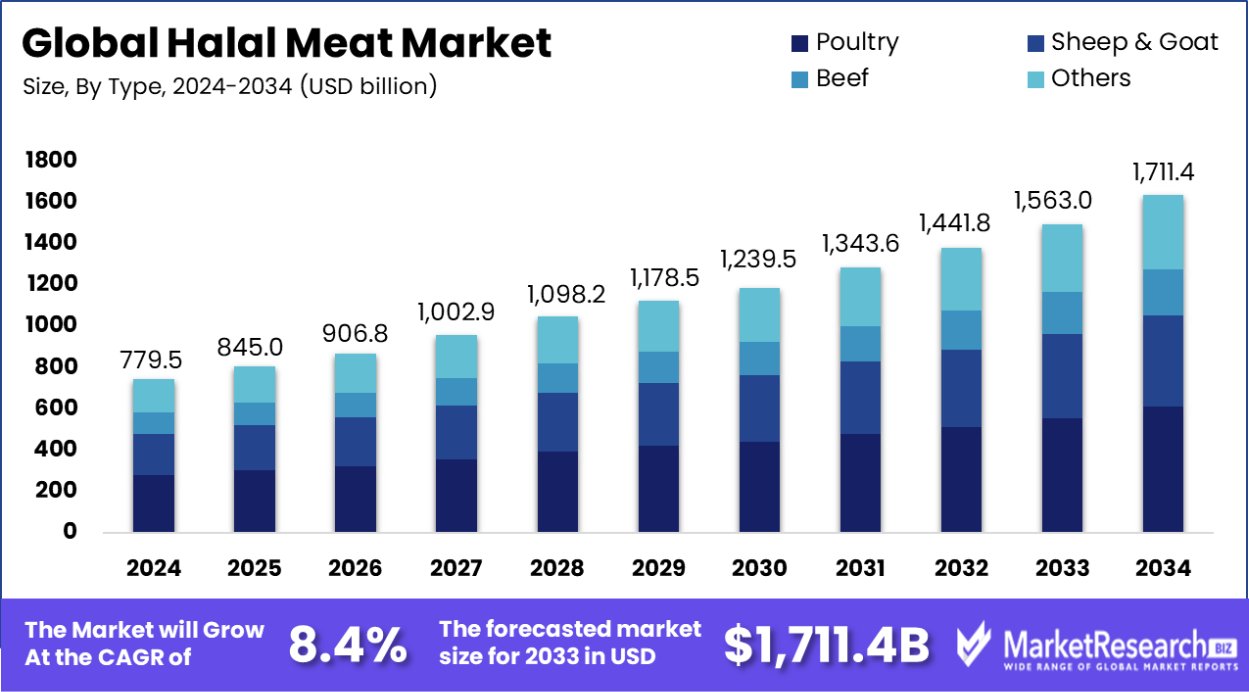

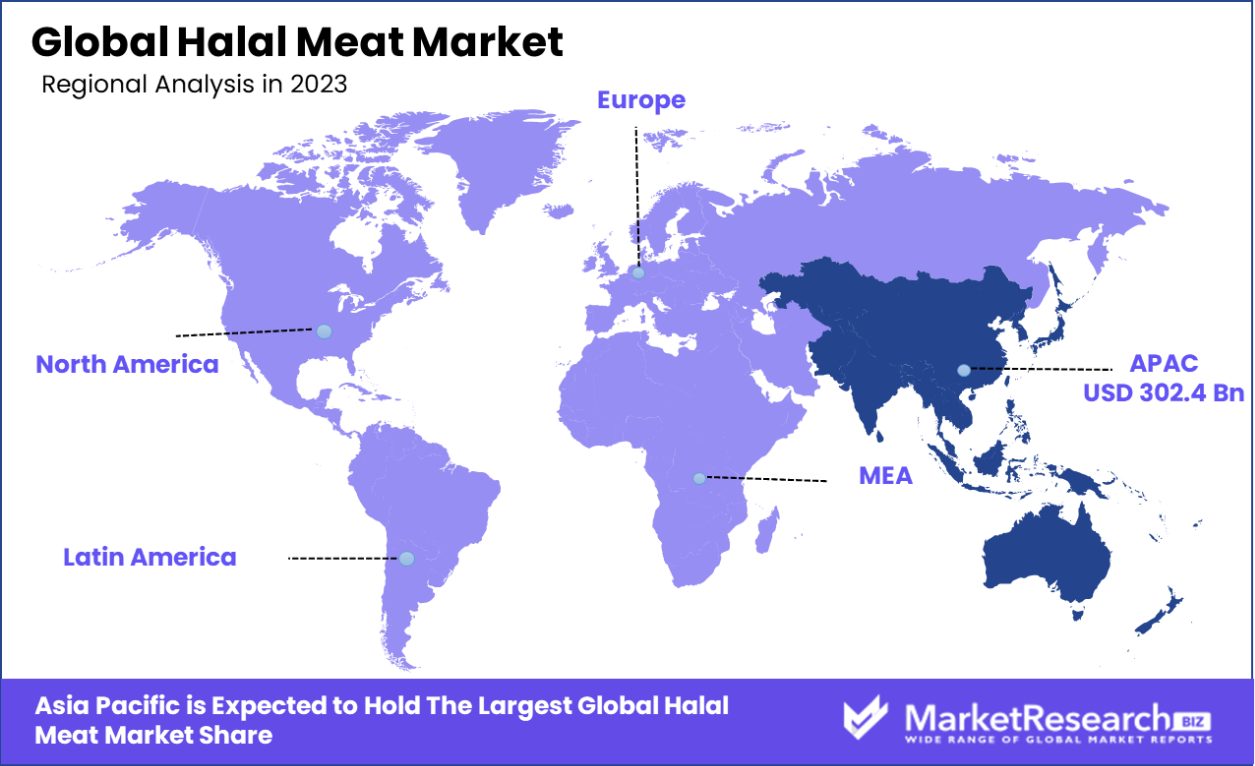

Global Halal Meat Market was valued at USD 779.5 billion in 2024. It is expected to reach USD 1,711.4 billion by 2034, with a CAGR of 8.4% during the forecast period from 2025 to 2034. Asia Pacific dominates the Halal Meat Market with 38.8%, USD 302.4 Bn.

Halal meat refers to meat that is prepared according to Islamic law, as outlined in the Quran. The term "halal" means "permissible" in Arabic. For meat to be considered halal, the animal must be slaughtered by a Muslim who follows specific rituals. This includes invoking the name of Allah during slaughter, ensuring the animal is healthy, and the meat is free from forbidden substances such as pork or alcohol.

The halal meat market is a segment of the global food industry that caters to the dietary needs of Muslim consumers. With a large and growing Muslim population worldwide, particularly in regions like the Middle East, Southeast Asia, and parts of Europe and North America, the demand for halal meat has surged. The market includes fresh, frozen, and processed meat products, such as beef, chicken, lamb, and goat, all produced in compliance with halal guidelines.

One of the key growth factors in the halal meat market is the increasing global Muslim population, which is expected to rise significantly over the next decade. Additionally, heightened awareness of ethical and sustainable meat production is driving non-Muslim consumers to explore halal meat options, as these products often align with concerns about animal welfare.

Technological advancements in halal slaughtering processes and distribution systems have also contributed to the market’s growth, ensuring the meat meets international standards and reaches broader markets.

Demand for halal meat is rising due to growing awareness among Muslim populations regarding the health, hygiene, and ethical standards associated with halal practices. Increased disposable incomes, urbanization, and a more diverse consumer base are also influencing demand. As more countries implement halal certification and halal-friendly environments, accessibility to halal meat products has expanded, further fueling consumption.

The halal meat market presents significant opportunities for both local and international players. The expanding halal tourism and increasing interest in ethically produced food offer avenues for growth. Emerging markets, particularly in Asia and Africa, hold strong potential as they experience population growth, urbanization, and rising incomes, all contributing to the growing demand for halal meat products.

Key Takeaways

- Global Halal Meat Market was valued at USD 779.5 billion in 2024. It is expected to reach USD 1,711.4 billion by 2034, with a CAGR of 8.4% during the forecast period from 2025 to 2034.

- Poultry represents 35.7% of the halal meat market, reflecting significant consumer preference for chicken products.

- Halal certification accounts for 64.6% of the market, ensuring meat meets Islamic dietary standards worldwide.

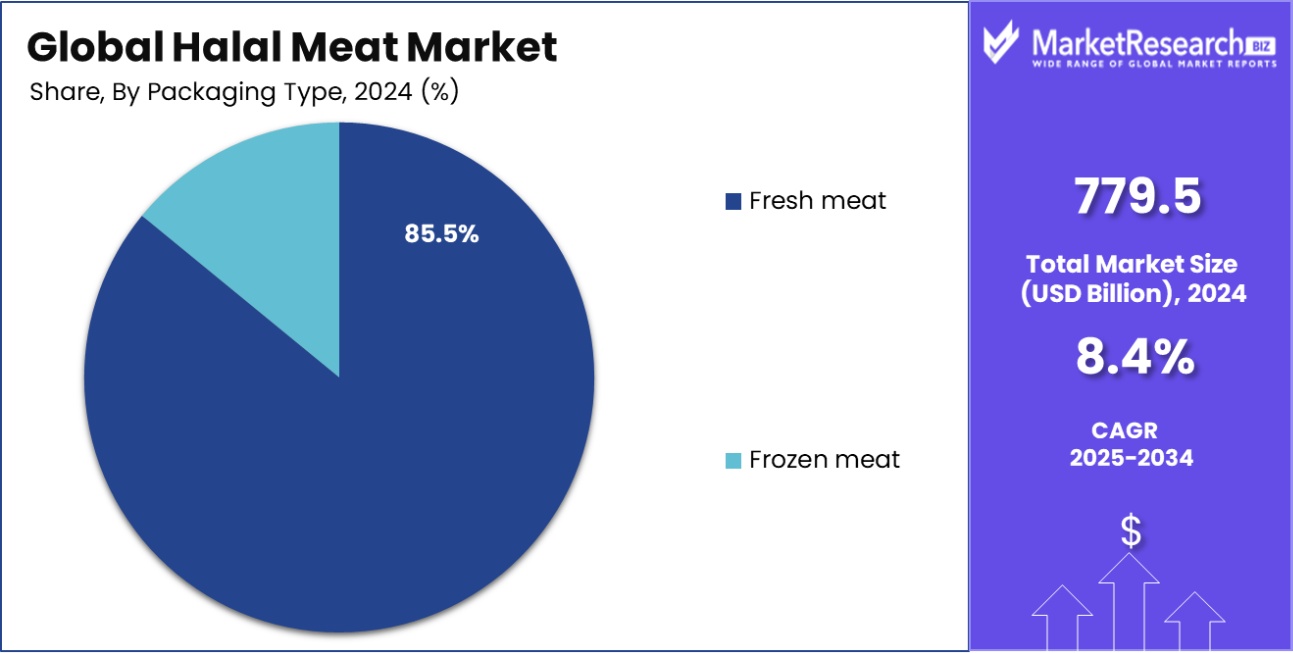

- Fresh meat dominates packaging types, comprising 85.5% of the halal meat market due to consumer preference.

- Household consumers account for 34.6% of the halal meat market, indicating strong demand in everyday consumption.

- Convenience stores are the leading distribution channel, contributing 72.2% of halal meat market sales globally.

- In 2024, the Asia Pacific Halal Meat Market held a 38.8% share, valued at USD 302.4 billion.

By Type Analysis

Poultry dominates the Halal meat market, accounting for 35.7% of sales.

In 2024, Poultry held a dominant market position in the By Type segment of the Halal Meat Market, with a 35.7% share. This category has consistently attracted a larger share due to its widespread consumption across various demographics, including both Muslim and non-Muslim consumers. Poultry’s relatively lower cost and versatility in food preparation have also contributed to its leading position.

Sheep & Goat, another significant type of halal meat, continues to maintain a notable presence in the market, although it does not hold the same share as poultry. These meats are traditionally favored in specific regions and cultural practices, with strong demand in areas such as the Middle East and parts of Southeast Asia. Their market share remains substantial, owing to their importance in religious and cultural festivities.

Beef, while a significant category in the Halal Meat Market, holds a smaller portion compared to poultry and sheep & goat. Despite being an essential part of halal diets, beef's market share is comparatively lower, as the production and consumption of beef are more region-specific and less versatile than poultry.

By Certification Type Analysis

Halal certification leads the market, representing 64.6% of overall certification types.

In 2024, Halal Certification held a dominant market position in the By Certification Type segment of the Halal Meat Market, with a 64.6% share. The increasing global demand for verified halal products, driven by growing Muslim populations and heightened consumer awareness, has significantly contributed to the rise of certified halal meat.

The presence of trusted halal certification bodies ensures compliance with Islamic dietary laws, offering transparency and reassurance to consumers, which has led to its widespread adoption.

Non-Certified halal meat, while present in the market, holds a smaller share compared to certified options. Despite this, non-certified meat products are still available in regions with less stringent certification regulations or where the halal market is less structured.

While some consumers may purchase non-certified products based on local traditions or familiarity, the demand for halal-certified meat continues to surpass that of non-certified alternatives, especially in regions with higher religious observance and stricter adherence to Islamic guidelines.

By Packaging Type Analysis

Fresh meat packaging takes the largest share, comprising 85.5% of packaging types.

In 2024, Fresh meat held a dominant market position in the Packaging Type segment of the Halal Meat Market, with an 85.5% share. The preference for fresh meat can be attributed to its perceived higher quality, flavor, and texture, which aligns with consumer expectations for halal products.

Fresh meat is widely favored in regions where local slaughtering practices are prominent, ensuring rapid access to fresh halal-certified meat. Its dominant share reflects the consumer demand for fresh, locally sourced products, with minimal preservatives, which are often preferred in traditional dietary practices.

Frozen meat, while a smaller segment in comparison, continues to cater to specific consumer needs and regional demands. Holding a much smaller share of the market, frozen meat provides the advantage of longer shelf life and easier transportation, making it an attractive option for consumers in areas with limited access to fresh halal meat.

Frozen meat also serves the growing demand for convenience and bulk purchases, often seen in supermarkets or large retail chains.

By End-User Analysis

Household consumers are a significant segment, representing 34.6% of Halal meat demand.

In 2024, Household Consumers held a dominant market position in the By End-User segment of the Halal Meat Market, with a 34.6% share. This significant share can be attributed to the growing number of Muslim households, where halal meat is a dietary staple.

Additionally, rising disposable incomes, increased urbanization, and greater access to halal meat products in local supermarkets and grocery stores have bolstered household consumption. Consumers in this segment tend to favor fresh and certified halal meat options for everyday cooking, contributing to the segment's strong presence in the market.

Retailers represent another important segment within the market, although their share is smaller compared to household consumers. Retailers play a crucial role in making halal meat more accessible to consumers, offering a wide range of products that cater to different demographics. This segment is growing as more supermarkets and specialty stores expand their halal meat offerings to meet the demand from Muslim and non-Muslim consumers alike.

The Food Service Sector, while a key end-user of halal meat, holds a smaller market share compared to household consumers and retailers. However, it is still a valuable segment, particularly in regions with a high concentration of halal food establishments, such as restaurants and catering services.

The demand from this sector continues to grow as more consumers seek halal dining options in diverse food service environments.

By Distribution Channel Analysis

Convenience stores are a major distribution channel, accounting for 72.2% of sales.

In 2024, Convenience Stores held a dominant market position in the By Distribution Channel segment of the Halal Meat Market, with a 72.2% share. The widespread availability of halal meat in convenience stores, coupled with the convenience of quick access for everyday consumers, has contributed to its leading position.

These stores often offer a variety of halal meat options, including fresh and packaged products, catering to local communities. Their strategic locations in urban and suburban areas, along with extended operating hours, make convenience stores a popular choice for consumers seeking ready-to-use halal meat.

Supermarkets/Hypermarkets represent a key distribution channel but hold a smaller share compared to convenience stores. These outlets often stock larger volumes of halal meat, targeting both regular consumers and bulk buyers. Despite their size and range, supermarkets face more competition and logistical challenges compared to convenience stores, which are more agile and focused on local demand.

Online Retail is an emerging segment in the Halal Meat Market, yet it holds a smaller share compared to brick-and-mortar stores. The growing popularity of e-commerce has driven increased demand for halal meat through online platforms, especially in regions with limited access to physical halal stores.

Key Market Segments

By Type

- Poultry

- Sheep & Goat

- Beef

- Others

By Certification Type

- Halal Certification

- Non-Certified

By Packaging Type

- Fresh meat

- Frozen meat

By End-User

- Household Consumers

- Retailers

- Food Service Sector

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail

- Convenience Stores

- Others

Driving Factors

Rising Muslim Population Globally

The increasing global Muslim population is one of the key drivers of the Halal Meat Market. As the Muslim population continues to grow, particularly in regions such as the Middle East, Southeast Asia, and parts of Africa, the demand for halal-certified meat products is also expanding. This trend is further supported by rising disposable incomes and changing lifestyles, increasing access to halal meat in both urban and rural areas.

Increased Awareness of Ethical Consumption

There is a growing global shift toward ethical consumption, with more consumers becoming concerned about the source and quality of their food. Halal meat, known for its ethical slaughter practices, is increasingly seen as a preferred choice for those seeking humane and ethical treatment of animals. This trend is driving both Muslim and non-Muslim consumers to opt for halal-certified products, thereby expanding the market beyond traditional boundaries.

Expanding Halal Meat Availability in Retail

The expansion of halal meat offerings in supermarkets, convenience stores, and online platforms is playing a significant role in market growth. As retailers increasingly stock halal meat products to cater to diverse consumer bases, the accessibility and convenience of purchasing halal meat have greatly improved. With greater distribution networks and a broader product range, halal meat is becoming more readily available, driving increased consumer demand across various regions.

Restraining Factors

High Production and Processing Costs

The production and processing of halal meat often involve higher costs compared to conventional meat. Strict halal slaughtering practices, certification processes, and the need for specialized handling facilities contribute to the increased expenses.

These higher costs can result in price premiums for consumers, which may limit market growth, especially in regions with price-sensitive populations. Balancing quality and affordability remains a challenge for producers and suppliers in the halal meat industry.

Limited Halal Meat Availability in Some Regions

While the demand for halal meat is rising globally, its availability remains limited in certain regions. Areas with low Muslim populations or limited halal certification infrastructure often face challenges in accessing halal products.

This lack of distribution channels and certified suppliers can restrict market growth, making it difficult for halal meat to reach all potential consumers, particularly in non-Muslim-majority countries or regions with lower awareness of halal practices.

Regulatory and Certification Challenges

Halal certification and regulatory requirements vary by country and certification body, leading to inconsistencies in product offerings. These variations can create confusion for consumers and complicate the supply chain for producers, especially those trying to enter new markets.

Ensuring compliance with diverse halal certification standards can be time-consuming and costly, further restricting market growth and creating barriers to international expansion within the halal meat sector.

Growth Opportunity

Growth in Non-Muslim Consumer Base

One of the most promising growth opportunities in the halal meat market is the increasing interest from non-Muslim consumers. With growing awareness about ethical sourcing and health benefits, non-Muslim consumers are choosing halal meat due to its humane slaughtering practices and perceived higher quality. This shift offers a significant opportunity for producers to expand their customer base beyond traditional Muslim populations, driving market growth in diverse regions.

Expansion of Halal Meat in Online Retail

E-commerce offers a substantial growth opportunity for the halal meat market. As more consumers prefer the convenience of online shopping, the demand for halal meat through online platforms is on the rise.

E-retailers can tap into this opportunity by offering a wide range of halal-certified products, coupled with home delivery services. This could help make halal meat more accessible, particularly in areas where physical retail options are limited.

Development of Halal Processed Foods

The halal meat market is experiencing growth in processed halal food products, such as ready-to-eat meals, sausages, and frozen options. As consumer demand for convenience continues to rise, there is a significant opportunity for the development of halal-ready meals and packaged products that cater to busy lifestyles. Companies focusing on this segment can tap into the growing demand for convenient, halal-certified meal solutions in both retail and food service channels.

Latest Trends

Rise of Halal Meat Substitutes

A notable trend in the halal meat market is the growing popularity of halal-certified plant-based and lab-grown meat alternatives. With increasing concerns about health and sustainability, more consumers are looking for halal meat substitutes that offer similar taste and texture without using animal products.

This trend aligns with broader plant-based eating habits and presents an opportunity for innovation and diversification within the halal food sector.

Halal Certification Across Global Markets

The trend of expanding halal certification in global markets is accelerating. As international trade in halal products increases, more companies are seeking certification to tap into the lucrative halal meat market. Countries outside traditional halal markets, such as parts of Europe and North America, are seeing an increasing number of halal-certified meat offerings to meet the needs of both Muslim and ethically-minded consumers, expanding market reach.

Technological Advancements in Halal Processing

Advancements in processing technology are becoming a key trend in the halal meat industry. Companies are investing in automation, improving slaughtering techniques, and ensuring greater consistency in halal certification across production facilities.

These innovations not only help reduce production costs but also ensure that halal meat products meet international quality standards, increasing consumer trust. This trend helps the market grow by making halal meat production more efficient and scalable.

Regional Analysis

The Asia Pacific region holds 38.8% of the Halal Meat Market, valued at USD 302.4 billion.

In 2024, Asia Pacific held the dominant position in the Halal Meat Market, accounting for 38.8% of the global market share, valued at USD 302.4 billion. This region's strong market presence is driven by the large and growing Muslim population across countries like Indonesia, Pakistan, India, and Malaysia.

Additionally, the increasing urbanization, rising disposable incomes, and cultural preferences for halal-certified products further fuel the demand for halal meat. In countries such as Indonesia and India, halal meat is not only a dietary requirement but also part of the social and cultural fabric, resulting in significant market growth.

The Middle East & Africa region also plays a crucial role, with a high percentage of its population following halal dietary laws. The demand for halal meat in this region is driven by religious and cultural factors, supported by the well-established halal certification infrastructure. As a result, the Middle East & Africa continues to experience stable demand growth.

North America and Europe are emerging markets for halal meat, primarily driven by an increasing number of Muslim immigrants and growing awareness of ethical food sourcing. Retail chains in these regions are expanding their halal meat offerings to cater to both Muslim and non-Muslim consumers seeking certified products. However, the market share in these regions remains smaller compared to Asia Pacific, where halal meat consumption is a deep-rooted cultural norm.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Halal Meat Market in 2024 is characterized by a diverse range of companies catering to the growing demand for halal-certified products. Leading players, such as BRF Global and Amana Foods, have established strong presences, leveraging their extensive distribution networks and product variety to meet the increasing demand from both Muslim and non-Muslim consumers.

BRF Global, with its expansive portfolio of halal meat products, is well-positioned to tap into emerging markets while reinforcing its footprint in established regions like the Middle East and Southeast Asia. Similarly, Amana Foods continues to innovate with high-quality, ethically produced halal meat products, ensuring compliance with global halal standards, which enhances its competitive edge.

Tariq Halal and Tahira Foods Ltd are also notable players, excelling in the UK and European markets by focusing on premium halal meat offerings. These companies have benefited from their strong local market knowledge and growing awareness of halal meat among non-Muslim consumers seeking ethically sourced options.

In the Middle East, Al Islami Foods and Al Kabeer Group ME dominate with a rich legacy of halal food production. These brands leverage strong cultural ties and trust in their products, driving consistent demand. SIS Company, Thomas International, and Nema Halal are key players in the North American and European markets, focusing on high-quality products and expanding their reach through both retail and online channels.

Top Key Players in the Market

- BRF Global

- Amana Foods

- Tariq Halal

- Tahira Foods Ltd

- SIS Company

- Thomas International

- DOUX

- Al Kabeer Group ME

- Prairie Halal Foods

- Nema Halal

- Herd & Grace

- Al-Aqsa

- Al Islami Foods

- Other Key Players

Recent Developments

- In 2024, Launched new halal-certified organic food lines, integrating traditional processing methods with modern food technology to meet diverse consumer demands.

- In 2024, Al Kabeer Group ME Expanded its halal product portfolio, including ready-to-cook and frozen meals, with a focus on regional preferences and product quality.

Report Scope

Report Features Description Market Value (2024) USD 779.5 Billion Forecast Revenue (2034) USD 1,711.4 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Poultry, Sheep & Goat, Beef, Others), By Certification Type (Halal Certification, Non-Certified), By Packaging Type (Fresh meat, Frozen meat), By End-User (Household Consumers, Retailers, Food Service Sector, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BRF Global, Amana Foods, Tariq Halal, Tahira Foods Ltd, SIS Company, Thomas International, DOUX, Al Kabeer Group ME, Prairie Halal Foods, Nema Halal, Herd & Grace, Al-Aqsa, Al Islami Foods, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BRF Global

- Amana Foods

- Tariq Halal

- Tahira Foods Ltd

- SIS Company

- Thomas International

- DOUX

- Al Kabeer Group ME

- Prairie Halal Foods

- Nema Halal

- Herd & Grace

- Al-Aqsa

- Al Islami Foods

- Other Key Players