Guacamole Market By Form(Frozen, Dried and others), By Packaging (Stand-up pouches, Glass Bottles and others), By End-User(Food Service, Households and others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

15286

-

Oct 2023

-

292

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

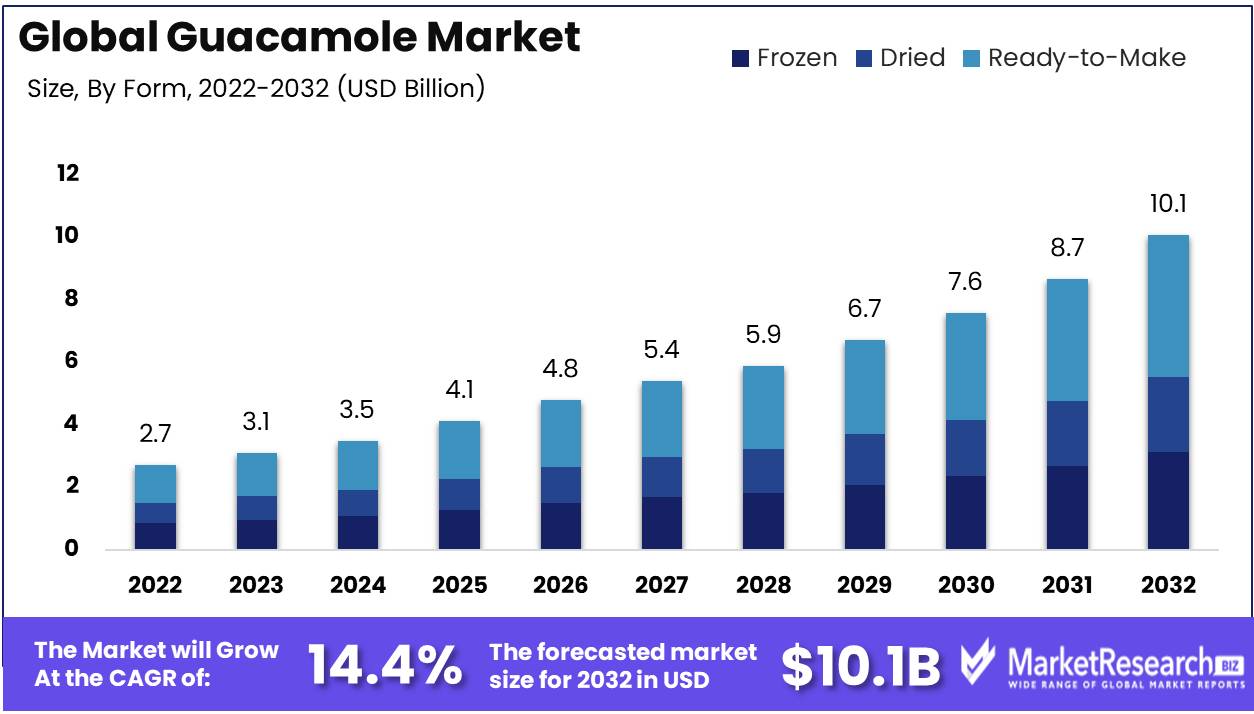

Guacamole Market size is expected to be worth around USD 10.1 Bn by 2032 from USD 2.7 Bn in 2022, growing at a CAGR of 14.4% during the forecast period from 2023 to 2032.

Guacamole's extraordinary popularity can be attributed not only to its delectable flavor but also to its numerous health benefits. As a veritable cornucopia of healthy lipids, fiber, and a wide variety of vitamins and minerals, avocados have captured the attention of an increasing number of health-conscious consumers. Consequently, guacamole has become a resoundingly satisfying and nutrient-rich option.

While the traditional rendition of guacamole remains an undeniable mainstay, the guacamole landscape has recently witnessed a veritable deluge of remarkable innovations. Notably, the introduction of personalized guacamole cups and snack packets has met the urgent demand for convenient on-the-go indulgence.

Moreover, companies with foresight have begun an ambitious effort to incorporate guacamole essence into a variety of products. The tang of guacamole has infiltrated a variety of culinary domains, from crisps and cookies to dressings and hummus. Unbelievably, some restaurants have even ventured to create cocktails and desserts inspired by guacamole.

Clearly, the guacamole market has expanded beyond the traditional boundaries of dips and appetizers. Massive corporations such as PepsiCo, Coca-Cola, and Nestle have invested in guacamole-based products after recognizing their potential.

Guacamole market growth is driven by consumers' perceptions of it as a healthy food, making it attractive to those concerned with their height and body fat levels. Guacamole is prepared using avocados which provide essential healthy fats, fiber, vitamins, and anti-inflammatories - benefits that have been documented including reduced cholesterol levels, improved heart health, reduced inflammation levels, healthy body weight management benefits as well as strengthened immunity systems.

Driving factors

Health Consciousness

The growing awareness and emphasis on health and wellness among consumers has been a significant consumer driving factor in the guacamole market. Due to its assimilation of avocados with healthy fats, fiber, and essential vitamins and minerals, guacamole's reputation as a nutritious and wholesome option has resonated with health-conscious individuals seeking flavorful yet nutritious food options.

Innovation and Diversification

The market for guacamole has seen remarkable innovations and diversification, driving its expansion. From individual guacamole cups and snack packs for on-the-go consumption to the incorporation of guacamole flavors into a wide variety of products such as chips, crackers, dressings, and hummus, companies have consistently pushed the envelope to cater to changing consumer preferences and expand the guacamole market.

Corporate Investments

The participation of prominent corporations in the guacamole market has contributed significantly to its growth. Large companies like PepsiCo, Coca-Cola, and Nestle have invested in developing and promoting guacamole-inspired offerings, lending credibility and resources to the market, in response to the increasing popularity and consumer demand for guacamole-based products.

Restraining Factors

Avocado Price and Availability

Avocados are one of the main components of guacamole, and their availability and price have a direct impact on the guacamole market. However, avocados are too costly for middle-income consumers to purchase. This alone can make guacamole a luxury item that is only accessible to those with greater purchasing power.

Guacamole producers can overcome this challenge by substituting cheaper ingredients for avocados, such as peas or edamame. This allows producers to cater to the middle-income consumer segment by providing them with a more affordable guacamole option.

Perishability Difficulties

Avocados are perishable, meaning they will rapidly spoil if improperly stored. Due to consumer preferences for fresh and high-quality ingredients, producers must ensure that their avocado supply is always fresh and of the highest quality. Guacamole producers must be cognizant of the shelf life of the avocados they purchase and use; this is a significant challenge.

Guacamole producers can collaborate with suppliers to ensure that the avocados delivered are fresh and the supply chain is efficient to overcome this challenge. Avocados can also be preserved by using innovative packaging and preservation techniques. By doing so, they can ensure that consumers receive guacamole of the highest quality and freshness.

Avocado Supply Management and Food Waste Reduction

The brief shelf life of avocados presents another challenge for guacamole producers: food waste. Once mature, avocados have a maximum shelf life of three days, limiting the opportunities for producers to distribute their products. If demand for guacamole decreases, producers may be left with unsold inventory that will be discarded.

To overcome this challenge, producers can utilize technology and marketing to precisely gauge consumer demand. By doing so, they are able to better manage their inventory and produce only as much guacamole as they believe will sell, thereby reducing the likelihood of food waste.

Form Analysis

The Ready to Make guacamole segment, which is acquiring immense popularity among consumers, is the market leader in guacamole. Because of its convenience and ease of preparation, demand for Ready to Make guacamole is rising. This segment is predominantly aimed at consumers who prefer to prepare guacamole from fresh ingredients at home.

Emerging economies are expected to experience significant growth in the Ready to Make Segment of the Guacamole market. Rapid urbanization and rising disposable incomes in developing nations are fueling the demand for ready-made guacamole products. Because of their busy lifestyles, consumers in these regions are more inclined to use products that are easy to use and require less time in the kitchen.

Consumer trends indicate that the younger generation is more inclined to purchase products that are wholesome and fresh. However, their hectic lifestyles and packed schedules have prompted a shift toward convenience. The Ready to Make guacamole segment offers fresh and nutritious ingredients in a format that is convenient and readily available.

Packaging Analysis

The dominant packaging type in the guacamole market is the stand-up pouch Segment. The lightweight, flexible, and easy-to-store nature of stand-up purses increases their convenience for consumers. Due to their indestructibility, these pouches are preferred over glass containers or jars, reducing the risk of injury during transportation or storage.

As they provide a cost-effective and efficient packaging solution, the popularity of the stand-up pouches Segment in the Guacamole Market is expected to increase in emerging economies. This segment also caters to consumers who prefer to transport their snacks and food items while on the go.

In recent years, consumers' attitudes toward packaging have undergone a significant shift. Consumers prefer products that are convenient and compatible with their always-on lifestyles. The stand-up pouches provide resealable, durable, and readily transportable packaging, making them an ideal solution in this regard.

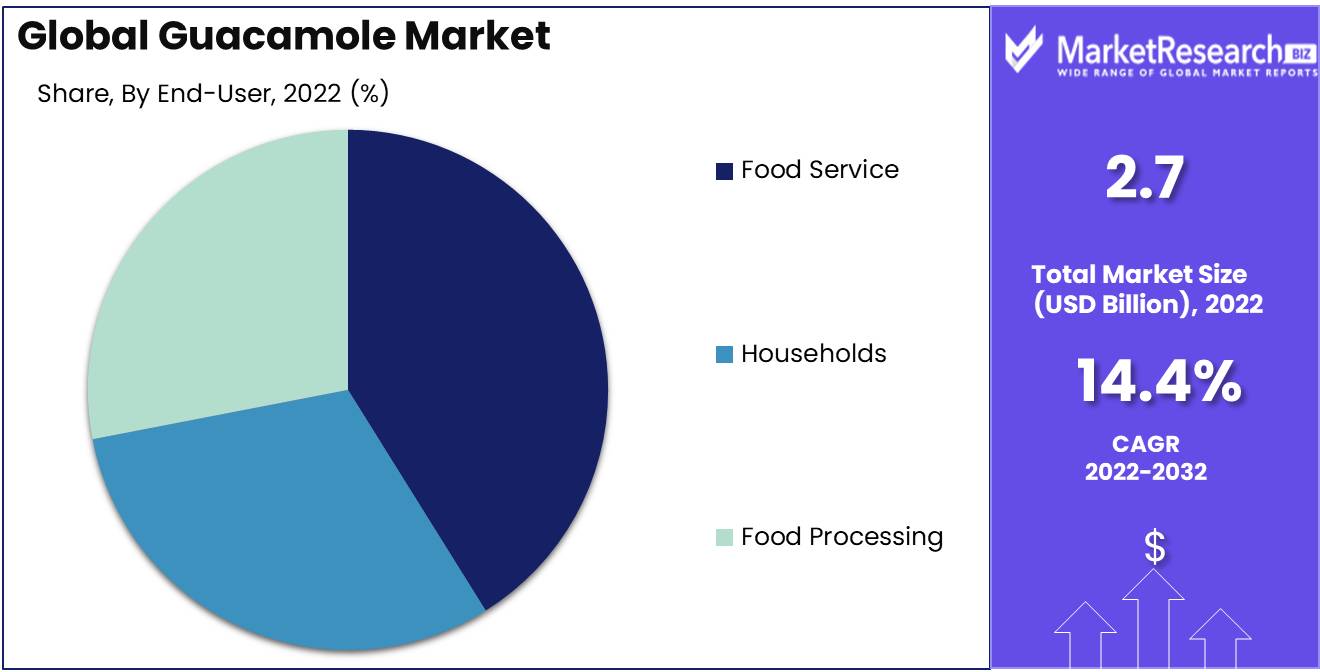

End-Use Analysis

The Guacamole Market Is Dominated By the Food Service Segment. The increased demand for fast food and rapid-service restaurants has led to an increase in guacamole consumption in the food service industry. The high demand is also evident in the hotel industry, where guacamole is used as a condiment or side dish for a variety of courses.

Due to the expanding popularity of eating out, the Food Service Segment is expected to experience significant growth in emerging economies. Guacamole consumption has increased in various food outlets as a result of the growth in the hotel and restaurant industries.

Consumers are adopting current market trends, particularly in the food service industry, which requires innovation and the ability to cater to a variety of preferences. Guacamole as a garnish or side dish complements a variety of Mexican and non-Mexican dishes, leading to an increase in its popularity. As consumers become more aware of the health benefits of avocados, the demand for guacamole as a healthful alternative increases.

Key Market Segments

By Form

- Frozen

- Dried

- Ready-to-Make

By Packaging

- Stand-up pouches

- Glass Bottles

- Plastic Containers

By End-User

- Food Service

- Households

- Food Processing

Growth Opportunity

Health and Wellness Industry Driving the Guacamole Market

The health and wellness industry is experiencing significant growth, and with it comes an increasing demand for healthier food options. One condiment that has seen a surge in popularity is guacamole. Consumers are turning to this delicious and nutrient-packed choice to enhance their meals and promote a healthier lifestyle.

Guacamole: A Nutrient-Packed and Flavorful Option

The awareness of balanced diets has played a crucial role in driving guacamole consumption. Health-conscious individuals are now prioritizing nutrition and actively seeking out healthy and flavorful food options. Guacamole fits the bill perfectly, as it is not only rich in nutrients but also packed with healthy fats and antioxidants.

Contributing Factors: Vegan and Vegetarian Diets and Online Retail

The rise of vegan and vegetarian diets has further contributed to the growth of the guacamole market. Avocados, a key ingredient in guacamole, are an excellent source of plant-based fats, making them a perfect addition to meatless diets. Additionally, the increasing popularity of online retail channels has made it easier for consumers to access a wide range of guacamole products, including organic and vegan options.

Latest Trends

Urbanization and Working Population

In recent years, the guacamole market has exhibited encouraging growth, primarily due to rapid urbanization and an expanding labor force. This growth can be attributed to a number of factors, including the altering dietary habits of consumers, the increasing demand for Chinese cuisine, and international cuisines, and the soaring trend of health consciousness, especially in North America and Europe.

Convenience and Health Consciousness

Convenience and natural food products, particularly meals that are simple to prepare and consume on the go, are becoming more and more popular among consumers worldwide. According to a recent report, consumers are shifting away from traditional meals and towards healthy, delicious, and convenient snacks as a result of their hectic lifestyles and time constraints. Due to its versatility as a dip, spread, and condiment, the guacamole market has experienced robust growth. To enhance the flavor and nutritional value of sandwiches, burgers, salads, and wraps, consumers can swiftly and easily add guacamole.

Fast-food restaurants Increase Demand for Guacamole in Sandwiches and Salads

Fast-food chains and quick-service restaurants have also significantly contributed to the increase in guacamole market demand. Many of the world's leading food chains have incorporated guacamole into their products, resulting in an increase in demand among consumers. Guacamole has been introduced as a key ingredient for sandwiches, burritos, and salads by major chains such as Subway, Chipotle, and Taco Bell, leading to higher industry sales.

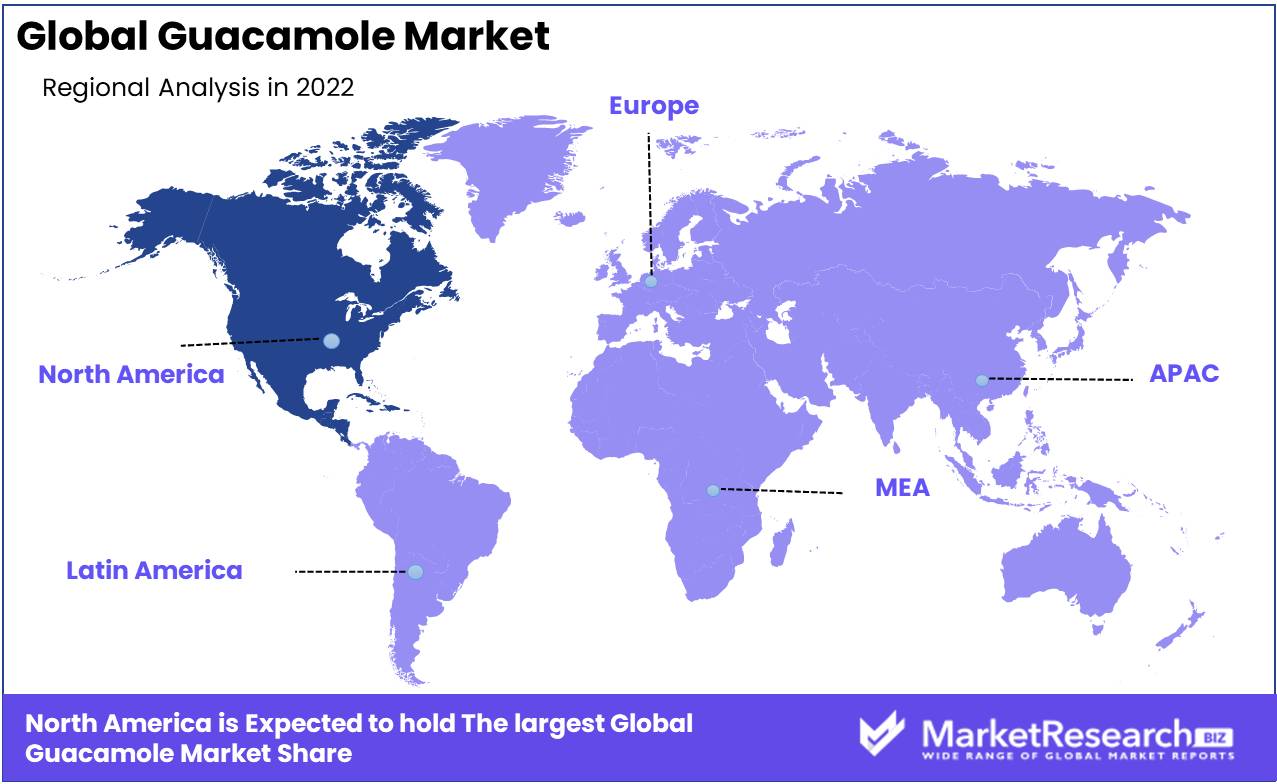

Regional Analysis

In North America, the Guacamole market generated the most revenue on the basis of region.

In recent years, the Guacamole market in North America has experienced tremendous growth due to the rising demand for healthful foods and the consumption of avocados. Guacamole market growth factors include the rising popularity of Mexican cuisine and the increasing awareness of the health benefits of avocados.

Guacamole is becoming increasingly popular as a nutritious dip for chips and a topping for burgers and sandwiches. In addition, the increasing prevalence of veganism has increased the demand for avocado-based products, such as guacamole.

The primary issue facing the Guacamole market is the volatility of avocado prices brought on by a variety of factors, including the weather, labor disputes, and trade regulations. Guacamole prices are directly influenced by the extreme volatility of avocado prices. In addition, the limited availability of the produce during certain seasons contributes to a supply shortage that drives up prices.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Players Analysis

Sabra is a well-known brand that offers different varieties of hummus, salsa, and guacamole. They take pride in using fresh ingredients to create distinctive flavors. Sabra is well-known for its delectable and creamy guacamole dips.

Yucatan is a brand that has existed for over two decades. They are known for their authentic guacamole made in a Mexican manner. The brand specializes in producing and disseminating high-quality guacamole to supermarkets and retailers.

The brand Garden of Eatin provides organic guacamole products. They take pride in making their guacamole using sustainable and organic ingredients. The brand is well-known for its guacamole that is thick, creamy, and brimming with bold flavors.

Fresh Made is a small-scale market participant known for its handcrafted, non-preservative guacamole. They offer a variety of guacamole flavors and sizes, ranging from classic to extra piquant. The brand is committed to creating exceptional guacamole using only natural and fresh ingredients.

Top Key Players in the Guacamole Market

- Yucatana

- Garden of Eatin

- Hormel Foods Corporation

- Ventura foods

- Fresh Made

- Calavo Growers, Inc.

- Salud Food Group Europe B.V.

- Frontier Natural Products Co-Op

- Avo-King International Inc.

- Chosen Foods

- Curation Foods Inc.

- Verfruco Foods Inc.

- Conagra Brands Inc.

- B&G Foods Inc.

- MegaMex Foods LLC

- Landec Corporation

Recent Development

- In April 2023, Calavo Growers Inc., a major producers of fresh avocados and avocado products, announced that it would restructure its operations in order to carry out Project Uno integration initiatives, improve consumer service, and increase efficiency and cost savings.

- In March 2023, CaboFresh, a manufacturer and marketer of fresh and prepared avocado products, announced the addition of a new line of organic guacamole to its product line.

- In January 2023, A global food company, Hormel Foods, announced that it was launching a new line of guacamole products under its Wholly Guacamole brand. The new products consist of a guacamole single-serve cup and a guacamole spread.

- In December 2022, Lakeview Farms Inc., a manufacturer and marketer of dips and spreads, announced that new product launch of guacamole under its Simply Delish brand. The new products feature both traditional and chipotle guacamole.

- In November 2022, San Amvrosia Health Foods Ltd., a manufacturer, and marketer of organic food products, announced that it was launching a new line of guacamole products under the Naked Guacamole brand. The new products are produced with organic avocados and lack artificial preservatives and flavors.

Report Scope

Report Features Description Market Value (2022) USD 2.7 Bn Forecast Revenue (2032) USD 10.1 Bn CAGR (2023-2032) 14.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form(Frozen, Dried, Ready-to-Make), By Packaging(Stand-up pouches, Glass Bottles, Plastic Containers), By End-User(Food Service, Households, Food Processing) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Yucatana, Garden of Eatin, Fresh Made, Calavo Growers, Inc., Salud Food Group Europe B.V., Frontier Natural Products Co-Op, Avo-King International Inc., Curation Foods Inc., Conagra Brands Inc., B&G Foods Inc., MegaMex Foods LLC, Landec Corporation, Sabra Dipping Company LLC, ventura foods, Verfruco Foods Inc., Hormel Foods Corporation, chosen foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Yucatana

- Garden of Eatin

- Fresh Made

- Calavo Growers Inc.

- Salud Food Group Europe B.V.

- Frontier Natural Products Co-Op

- Avo-King International Inc.

- Curation Foods Inc.

- Conagra Brands Inc.

- B&G Foods Inc.

- MegaMex Foods LLC

- Landec Corporation

- Sabra Dipping Company LLC