Global Graphite Electrodes Market By Grade(Ultra High Powered (UHP), High Powered (HP), Regular Powered (RP)), By Application(Electric Arc Furnace (EAF), Basic Oxygen Furnace (BOF), Non-steel Application), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46835

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

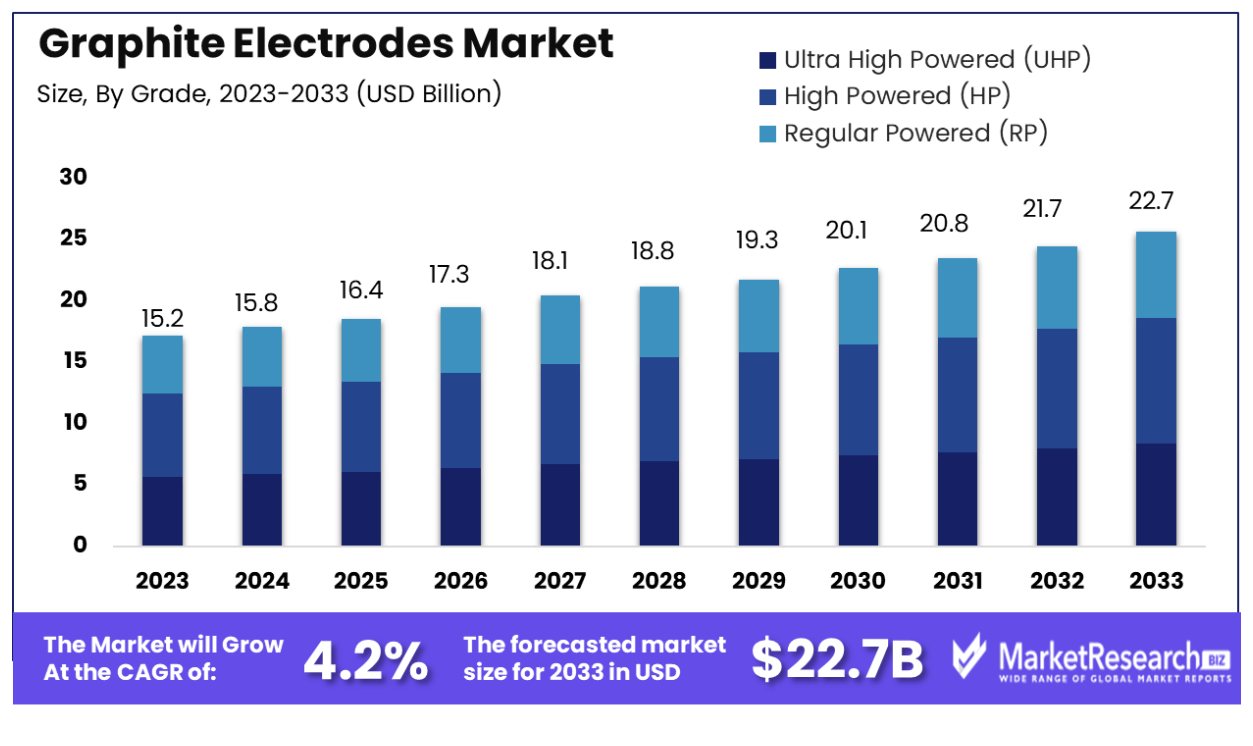

The Global Graphite Electrodes Market was valued at USD 15.2 billion in 2023. It is expected to reach USD 22.7 billion by 2033, with a CAGR of 4.2% during the forecast period from 2024 to 2033.

The Graphite Electrodes Market encompasses the global trade and production of graphite electrodes, essential components predominantly used in electric arc furnaces for steel production. These electrodes, known for their ability to withstand high temperatures and electrical conductivity, are crucial in the melting of scrap steel.

The market's relevance extends as it aligns with industrial manufacturing demands and evolving technological advancements in steel-making processes. Executives in this sector monitor market trends to optimize procurement strategies and enhance operational efficiencies, ensuring competitive positioning in a resource-intensive industry.

The Graphite Electrodes Market is undergoing significant transformations, driven by evolving industrial demands and technological advancements. As of 2022, the global graphite mine production totaled approximately 1.3 million tonnes, reflecting robust production capacities worldwide.

Notably, Canada emerged as the sixth-largest producer, contributing 13,000 tonnes to the global output. This substantial production underscores the crucial role of graphite electrodes in various applications, particularly in electric arc furnaces where they are indispensable for steel recycling processes.

Moreover, the broader context of the market can be appreciated by examining adjacent sectors such as the medical device market, which is poised to reach a global revenue of $595 billion by 2024. This growth is propelled by innovative trends including digital therapeutics and wearable technology, alongside a heightened focus on sustainability.

These trends not only indicate a dynamic market environment but also suggest potential cross-sectoral opportunities for graphite applications, particularly in high-tech medical devices where material properties like conductivity and durability are prized.

Overall, the Graphite Electrodes Market is positioned for growth, influenced by both direct industrial demand and potential new applications spurred by technological advancements in related fields. Stakeholders should monitor these developments closely, as they could open new avenues for market expansion and technological integration.

Key Takeaways

- Market Growth: The Global Graphite Electrodes Market was valued at USD 15.2 billion in 2023. It is expected to reach USD 22.7 billion by 2033, with a CAGR of 4.2% during the forecast period from 2024 to 2033.

- By Grade: High Powered (HP) dominated 52.5% of the market.

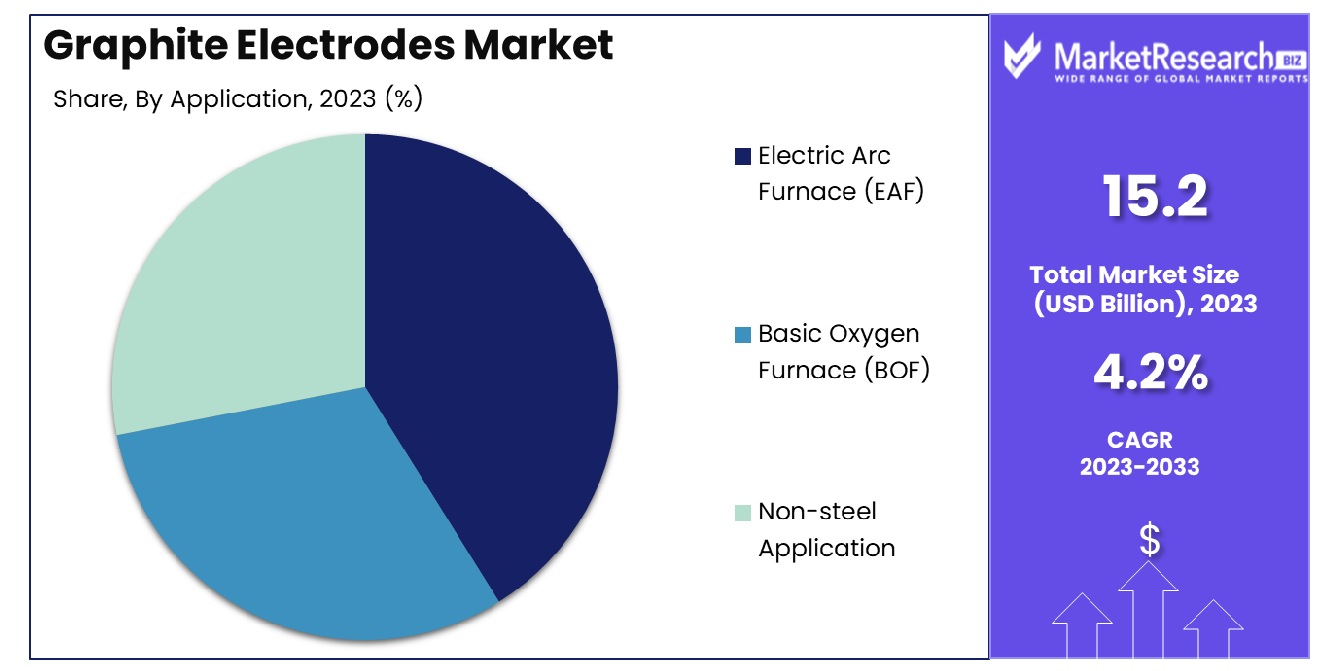

- By Application: Electric Arc Furnace (EAF) led with 73.2%.

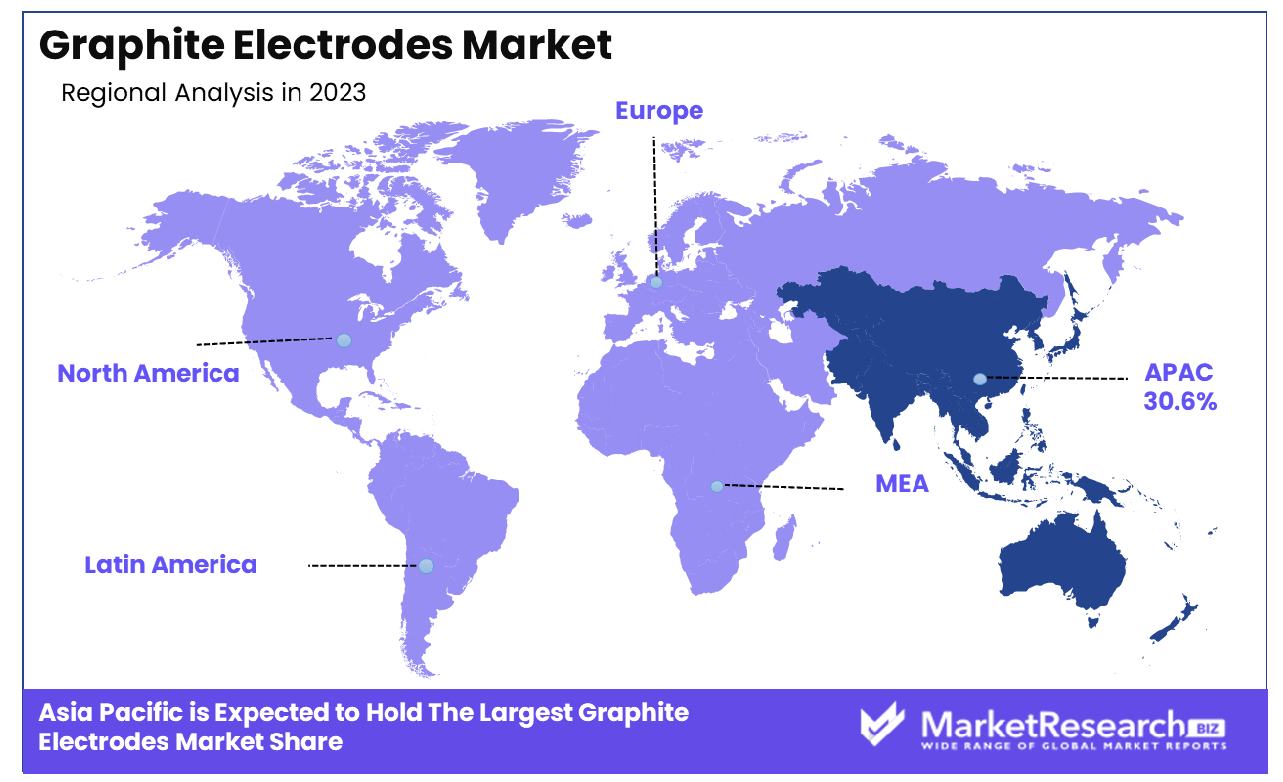

- Regional Dominance: The Asia Pacific holds a 30.6% share in the Graphite Electrodes Market.

- Growth Opportunity: The global Graphite Electrodes Market is expected to grow significantly in 2023 due to increased demand for electric vehicles and stringent regulations aimed at reducing air pollution.

Driving factors

Growing Adoption of Electric Arc Furnace (EAF)

The expanding usage of Electric Arc Furnaces (EAF) in steel production significantly propels the demand for graphite electrodes. As steelmakers shift from traditional blast furnace methods to EAF, driven by energy efficiency and reduced greenhouse gas emissions, the graphite electrodes market experiences robust growth. Graphite electrodes, essential for the steel recycling process in EAFs, benefit directly from this transition.

The growth in EAF adoption, which now accounts for approximately 25% of global steel production, underscores a direct correlation with the escalating demand for graphite electrodes. This shift not only highlights the environmental pivot in steel manufacturing but also marks a sustainable pathway promoting recycled steel, further enhancing market prospects for graphite electrodes.

Strategic Partnerships and Investments by Market Participants

Strategic partnerships and substantial investments characterize the competitive landscape of the graphite electrodes market. Companies are actively engaging in alliances and expanding their production capacities to meet the surging demand linked to EAF proliferation. These collaborations often aim to enhance production efficiencies and expand geographical reach, providing a strategic edge in a competitive market.

For instance, investments in technologically advanced production facilities have enabled manufacturers to produce higher-quality electrodes, which are critical for the efficient operation of EAFs. This strategy not only supports the existing market demand but also prepares the infrastructure for future growth expectations.

R&D Initiatives for Novel Formulations and Tactics

Research and development (R&D) in novel graphite electrode formulations and manufacturing techniques play a crucial role in market evolution. Companies investing in R&D are paving the way for innovations that offer superior performance characteristics such as increased conductivity, higher heat resistance, and longer service life.

These enhancements are vital as they significantly reduce operational costs and improve the efficiency of EAF operations. The continuous improvement in product quality through R&D initiatives ensures that the graphite electrodes not only meet the current demands of steel manufacturers but also adapt to evolving technological advancements, thereby sustaining market growth and innovation.

Restraining Factors

Limited Availability of High-Grade Needle Coke

The scarcity of high-grade needle coke, a crucial raw material in the production of graphite electrodes, significantly impacts market dynamics by restricting production capabilities and increasing costs. High-grade needle coke is essential for producing high-quality graphite electrodes, which are required for efficient and stable performance in electric arc furnace operations.

The limited availability of this material not only constrains the supply of graphite electrodes but also elevates production costs, reflected in the final product prices. This shortage is exacerbated by the competing demand from the lithium-ion battery industry, which also relies heavily on high-grade needle coke for manufacturing battery anodes. The tight supply scenario can lead to prolonged delivery schedules and potential production delays, affecting the overall market growth and stability.

Overcapacity in the Market Leading to Price Wars

Overcapacity in the graphite electrodes market has led to intense price wars among manufacturers, eroding profit margins and creating a challenging economic environment. This overcapacity is partly a result of previous market expansions during periods of high demand, which have since normalized, leading to an imbalance between supply and demand. As manufacturers struggle to maintain market share and utilize existing capacities, prices are driven down, further complicating the market's financial health.

This situation is particularly challenging for smaller players who might lack the financial resilience to withstand prolonged periods of low prices, potentially leading to market consolidation or exits, thereby impacting the market structure and future investment in innovation and quality enhancements.

By Grade Analysis

High Powered (HP) graphite electrodes dominated, holding 52.5% of the market share.

In 2023, the Graphite Electrodes Market was distinctly segmented by grade into Ultra High Powered (UHP), High Powered (HP), and Regular Powered (RP). Among these, High Powered (HP) electrodes held a dominant market position, capturing more than 52.5% of the market share. This significant dominance can be attributed to the robust demand in steel production through Electric Arc Furnaces (EAF), where HP graphite electrodes are preferred for their efficiency and cost-effectiveness.

Ultra High Powered (UHP) graphite electrodes, which are typically used in high-capacity EAFs due to their superior heat and electrical conductivity, also represented a substantial portion of the market. These electrodes are essential for manufacturers requiring high levels of productivity and lower specific electricity consumption. Regular Powered (RP) electrodes, while less efficient than their HP and UHP counterparts, continued to find applications in smaller EAFs and ladle furnaces, catering to markets with less intensive usage requirements.

The market dynamics of graphite electrodes are heavily influenced by the global steel industry's shift towards more sustainable and energy-efficient production methods. This shift is particularly visible in the increased adoption of EAF technology, which relies extensively on the performance characteristics of graphite electrodes.

The market's growth trajectory is expected to be sustained by ongoing technological advancements in electrode manufacturing and the expanding production capacities of steel manufacturers globally. As these trends continue, the market for HP and UHP graphite electrodes, in particular, is projected to see robust growth, driven by both capacity expansions and technological innovations in the steel industry.

By Application Analysis

Electric Arc Furnace (EAF) usage led significantly, representing 73.2% of applications.

In 2023, the Graphite Electrodes Market was segmented by application into Electric Arc Furnace (EAF), Basic Oxygen Furnace (BOF), and Non-steel Applications. Dominating the market, Electric Arc Furnace (EAF) held a significant market share of over 73.2%. This predominance is primarily due to the extensive use of EAF in steel production, which heavily relies on graphite electrodes for their electrical conductivity and heat resistance capabilities.

Basic Oxygen Furnace (BOF), another critical application segment, utilizes graphite electrodes for refining steel. Although less dependent on electrodes than EAFs, BOFs still contribute considerably to the demand within the market. Meanwhile, non-steel applications of graphite electrodes, such as in silicon metal production and smelting processes, though smaller, are gradually expanding as industries seek more efficient and cost-effective methods of high-temperature processing.

The substantial market share of EAF can be attributed to the shift in steel production techniques, with a growing preference for recycling scrap metal over traditional steelmaking methods. This trend not only supports sustainability initiatives but also aligns with global efforts to reduce carbon emissions, where EAFs play a pivotal role due to their lower energy consumption and reduced environmental impact compared to traditional steelmaking processes.

Moving forward, the market is anticipated to witness sustained growth, driven by innovations in electrode manufacturing and the increasing adoption of EAF technology. As the global steel industry continues to evolve, the demand for high-quality graphite electrodes in EAF applications is expected to remain robust, supporting the overall growth of the market.

Key Market Segments

By Grade

- Ultra High Powered (UHP)

- High Powered (HP)

- Regular Powered (RP)

By Application

- Electric Arc Furnace (EAF)

- Basic Oxygen Furnace (BOF)

- Non-steel Application

Growth Opportunity

Increasing Demand for Electric Vehicles

The global Graphite Electrodes Market is poised for substantial growth in 2023, primarily driven by the escalating demand for electric vehicles (EVs). As nations worldwide intensify efforts to reduce carbon footprints, the shift towards sustainable transportation becomes imperative. Graphite electrodes, crucial for producing steel via electric arc furnaces, are integral in manufacturing various EV components.

The market's expansion is bolstered by increasing investments in EV infrastructure and technological advancements in battery production, which rely heavily on high-quality steel. This surge in demand reflects a broader industrial commitment to environmentally friendly solutions and positions the graphite electrodes market at the center of a significant industrial evolution.

Growing Concerns Regarding Air Pollution

Parallelly, the global push towards electric vehicle adoption is significantly fueled by intensifying concerns over air pollution. Many governments are setting ambitious targets for EV adoption, incorporating stringent regulations to curtail vehicular emissions. These policy-driven initiatives directly influence the graphite electrodes market, as they increase the production of electric arc furnace-based steel, known for its lower environmental impact compared to traditional steelmaking processes.

The market is expected to benefit from these regulatory frameworks, as they not only encourage cleaner industrial practices but also ensure sustained demand for graphite electrodes in the burgeoning EV sector. This alignment with global sustainability goals further enhances the market's growth prospects, making it a critical area for investment and development in 2023.

Latest Trends

Continuing Research and Development Operations

In 2023, the global Graphite Electrodes Market is witnessing a significant uptrend in research and development (R&D) activities, focusing on enhancing product efficiency and environmental sustainability. This trend is driven by the need for high-performance graphite electrodes that can withstand increasing temperatures and electrical loads in steel production. Innovations in electrode design and material composition are pivotal in reducing electrode consumption rates and operational costs, thereby increasing the overall efficiency of electric arc furnaces.

Moreover, the development of less porous, more durable electrodes is critical in minimizing electrode breakage, a common issue that impacts production continuity and steel quality. As manufacturers invest more in these technological advancements, the market is set to offer more advanced solutions that align with the industry's evolving requirements.

Issues Linked to Raw Material Availability and Pricing

Another prominent trend in the global Graphite Electrodes Market is the challenges associated with the availability and pricing of crucial raw materials, such as petroleum coke and pitch. The volatility in raw material costs, largely influenced by geopolitical tensions and trade policies, poses a significant risk to stable market growth. These materials are essential for producing graphite electrodes, and their fluctuating availability can lead to production delays and increased costs.

Additionally, the imposition of tariffs and export restrictions on these raw materials exacerbates the situation, compelling manufacturers to seek alternative sources or develop more cost-effective production methods. This ongoing issue remains a critical focus for stakeholders within the graphite electrodes industry, as it directly affects production capabilities and market stability.

Regional Analysis

The Graphite Electrodes Market in Asia Pacific holds a substantial 30.6% market share.

The Graphite Electrodes Market exhibits diverse dynamics across different regions, influenced by local industrial activities and regulatory landscapes. In the Asia Pacific region, which dominates the market with a 30.6% share, rapid industrialization and the expansion of steel manufacturing capacities, particularly in China and India, drive substantial demand for graphite electrodes. This region benefits from the availability of raw materials and competitive manufacturing costs, which bolster its leading position in the global market.

In North America, the market is characterized by advanced manufacturing technologies and stringent environmental regulations, which promote the use of electric arc furnace (EAF) methods for steel production. The emphasis on recycling steel scrap in the U.S. and Canada further supports the demand for graphite electrodes, enhancing the region's market stability and growth.

Europe follows a similar pattern, with an increasing shift towards sustainable production methods. The region's focus on reducing carbon emissions and the circular economy contributes to the steady demand for graphite electrodes, particularly in countries like Germany and Italy, which have robust automotive and manufacturing sectors.

The Middle East & Africa region, although smaller in market share, is experiencing gradual growth due to the development of local steel industries and infrastructure projects. The market in this region is expected to expand as more countries invest in building their manufacturing capabilities.

Lastly, Latin America shows potential for growth with rising industrial activities in countries like Brazil and Argentina. The region's market is primarily driven by the demand for steel in the construction and automotive sectors, which in turn fuels the need for graphite electrodes.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the 2023 Global Graphite Electrodes Market, several key players have distinguished themselves through strategic market maneuvers and technological advancements. Among these, GrafTech International remains a leader, benefiting from vertically integrated operations that secure a stable supply of raw materials and competitive pricing. Their expertise in the ultra-high-power (UHP) graphite electrode segment is particularly noteworthy.

Zhongze Group and Dan Carbon also command significant attention, primarily driven by their expansive production capacities and the adoption of advanced manufacturing technologies. These companies have focused on increasing efficiency and reducing the environmental impact of their production processes, aligning with global sustainability trends.

Showa Denko and Tokai Carbon, both based in Japan, continue to leverage their robust R&D capabilities to enhance product quality. These companies are pioneers in developing electrodes that offer higher electrical conductivity and durability, crucial for demanding applications like electric arc furnaces.

Graphite India and Fangda Carbon New Material Co., Ltd. capitalize on their geographical advantage and scale of operations to meet the growing demand, especially in emerging markets. Their aggressive expansion strategies and improvements in supply chain logistics have improved their market position.

Resonac Holdings Corporation, Sangraf International, SEC Carbon, Ltd., and Nippon Carbon are recognized for their specialized products and customer-centric approaches. They focus on niche markets and have developed unique graphite electrode solutions tailored to specific industry needs, which helps them maintain a strong presence in the market.

Market Key Players

- GrafTech International

- Zhongze Group

- Dan Carbon

- Showa Denko

- Tokai Carbon

- Graphite India

- Resonac Holdings Corporation

- Fangda Carbon New Material Co., Ltd.

- Sangraf International

- SEC Carbon, Ltd.

- Nippon Carbon.

Recent Development

- In April 2024, Researchers from Ningbo University and the University of Puerto Rico-Rio Piedras Campus developed an ultralow-concentration electrolyte for lithium-ion batteries, promising economical and sustainable energy storage solutions

- In December 2023, Graphite India acquired a 31% stake in Godi India, a Hyderabad-based battery manufacturer specializing in lithium-ion, sodium-ion, and solid-state batteries for EVs and consumer electronics.

Report Scope

Report Features Description Market Value (2023) USD 15.2 Billion Forecast Revenue (2033) USD 22.7 Billion CAGR (2024-2032) 4.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Ultra High Powered (UHP), High Powered (HP), Regular Powered (RP)), By Application(Electric Arc Furnace (EAF), Basic Oxygen Furnace (BOF), Non-steel Application) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape GrafTech International, Zhongze Group, Dan Carbon, Showa Denko, Tokai Carbon, Graphite India, Resonac Holdings Corporation, Fangda Carbon New Material Co., Ltd., Sangraf International, SEC Carbon, Ltd., Nippon Carbon. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- GrafTech International

- Zhongze Group

- Dan Carbon

- Showa Denko

- Tokai Carbon

- Graphite India

- Resonac Holdings Corporation

- Fangda Carbon New Material Co., Ltd.

- Sangraf International

- SEC Carbon, Ltd.

- Nippon Carbon.